Interactive Brokers Review 2024: Pros & Cons

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Are you looking for a great broker? Look no further!

Interactive Brokers (IB) has all the features you need as a passive investor. Plus, their fees are almost unbeatable in the industry.

I have been using IB for several years and could not be more satisfied. They offer a wide range of products at excellent prices.

In this review, you will find all you need to know about Interactive Brokers, what you can do with IB, how much IB will cost you, and much more!

By the end of this review, you will know whether IB is a good broker for you!

| Custody Fees | 0% per year |

|---|---|

| Inactivity Fees | 0 CHF |

| Buy Swiss ETF | 5-15 CHF |

| Buy American Stock | 0.50 – 1 USD |

| Currency Exchange Fee | 2 USD |

| Languages | English, French, German, and Italian |

| Mobile Application | Yes |

| Web Application | Yes |

| Custodian Bank | 8 different US banks |

| Established | 1978 |

| Headquarters | United States |

What is Interactive Brokers?

The broker you need to buy stocks and ETFs reliably and at extremely affordable prices. Trade U.S. stocks for as little as 0.5 USD!

- Extremely affordable

- Wide range of investing instruments

Interactive Brokers (IB) is a well-established brokerage firm (a broker) from the United States. IB was founded in 1978 already.

Today, Interactive Brokers is a huge brokerage company. They are the largest electronic brokerage firm in the United States. They are also leading the forex broker market. IB is also profitable, with over one billion US dollars in yearly revenue. IB employs more than 1500 employees worldwide.

IB offers access to stocks, bonds, options, futures, and other financial instruments on the leading stock exchange in the world. You will have access to all the investing instruments you will ever need.

If you are going to trade US bonds, it is worth mentioning that IB offers access to the US bond market 22 hours a day, 5 days a week. This makes it very available to buy US bonds during European hours.

So, here is precisely what IB offers as a broker.

Interactive Brokers Account Types

Interactive Brokers offers two types of accounts.

The default account type is the Cash account. With this account, you can only trade with the money you have in it. I am using this account type, which is good for most people.

The other account type is the Margin account. With this account, you can trade on margin, which means that you can buy stocks with money you do not have. So, IB will lend you money to trade on the stock market, and you will pay interest on the money loaned to you.

Generally, with margin, you have a certain level of margin. For instance, if you have 10K cash and a 4:1 margin, you will have 40K available.

If you are interested in margin accounts, you should first read IB’s page on Margin accounts. You should also be careful about the risks of trading on margin.

For most people, a Cash account will be the best choice. If you do not know about margin accounts, do not consider getting a Margin account. You could lose a lot of money if you do not know what you are doing. On the other hand, if you know what you are doing and want to use leverage, you can choose a Margin account.

Interactive Brokers Fees

In the long term, you need to reduce your fees. Investing fees are extremely important.

Interactive Brokers has two fee systems:

- Fixed Fee System

- Tiered Fee System

The fixed fee system is straightforward. You will pay a fixed fee for each exchange. For instance, you will pay 0.10% on transactions on the Swiss Stock Exchange (with a minimum of 10 CHF).

The tiered fee system is much more complicated. You pay individual fees, such as clearing fees, trade reporting fees, and transaction fees. The rules are different for each stock exchange.

The complexity of the tiered fee system turns many people away. However, for simple investors, the tiered system is often significantly cheaper. In most of my calculations, the tiered fee system was less expensive than the fixed system. So, if you want the lowest fees possible, you should generally opt for the tiered system.

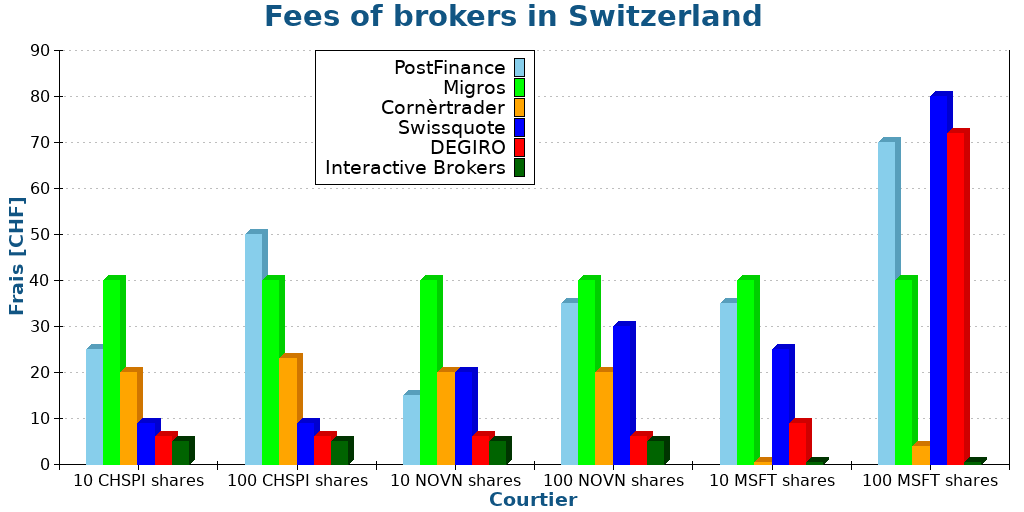

I will not go into details about all the fees of Interactive Brokers because they are complex. But overall, the fees of IB are really low. For instance, here is a comparison I did for the best brokers in Switzerland:

When you compare IB with other brokers available in Switzerland, we can see that the fees of Interactive Brokers are excellent. If you trade a few times per month, your costs will be really low!

If you want to register your Swiss shares in the share register, you will have to pay 150 CHF. This is relatively expensive, even compared to Swiss brokers. However, this is something not everybody needs and is not necessary for each position. But if you are planning to register your shares, it is important to know this fee.

Custody / Inactivity Fee

Fortunately, there are no custody fees or inactivity fees at IB!

IB’s no custody fee advantage over most other brokers is fantastic! Not only do they have outstanding transaction fees, but having no custody fees is fantastic!

Cash Interest Rates

The interest rate on CHF cash was negative in the past. However, it has been growing steadily since 2023.

In August 2023, the interest is now 0% up to 10’000 CHF and 0.726% on cash more than 10’000 CHF. This is a good interest rate. And the interest rate in USD is now 4.830% simultaneously. This is very high interest.

You can get the current interest rate on this page.

Opening an account with Interactive Brokers

Opening an account with Interactive Brokers is not complicated, but it will take some time. The procedure asks many questions and has many steps.

First, they will ask for general information about you (name, address, and such). You will also need to select the type of account you want. This choice is essential. This step is also where you will choose the base currency of your account.

The second step of the procedure is to provide financial information. IB will ask you how much money you have and how much experience you have with stocks. And you will have to choose which instruments you want to invest in. Do not worry too much since you can register for new investing instruments later.

The next step is about accepting the terms and conditions of Interactive Brokers. I would recommend at least skimming through them. After this, they will ask for proof of your identity and extra tax-related information.

Finally, you only need to fund your account for it to be complete. While this is not the most straightforward procedure, it is not too complicated.

If you want more information on the process, I have a guide on creating an Interactive Brokers account.

Subaccounts

It is worth mentioning that you can have subaccounts in your Interactive Brokers account. It means that you can manage several accounts in the same primary account.

The best usage of subaccounts is if you want to invest for your children and easily separate your stocks from theirs. Legally, the stocks are still yours since you cannot create accounts for minors. Nevertheless, it is good to see them separate. I have bought a share of VT every month for my son.

If you want further information, I have an article about investing in stocks for your children.

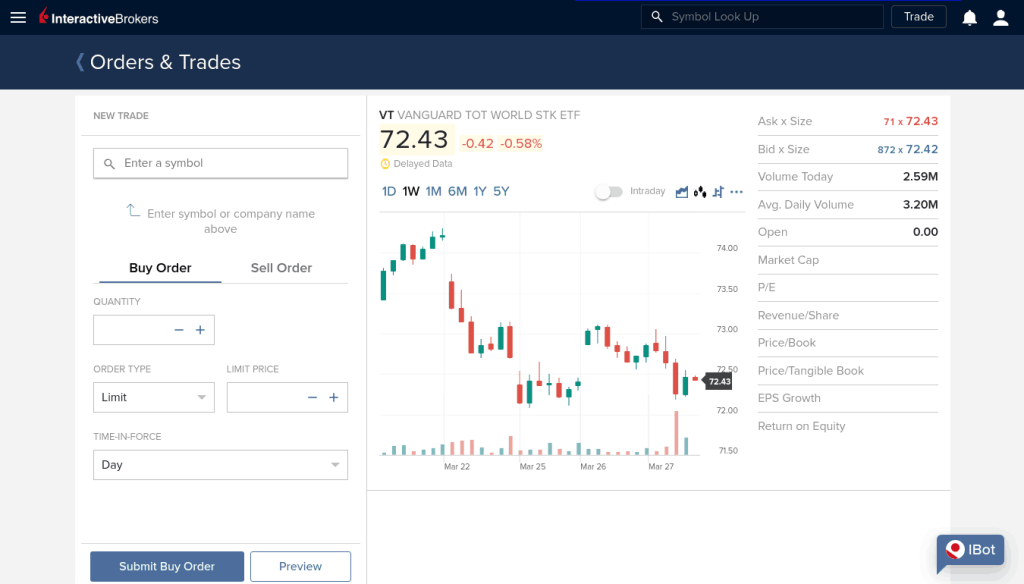

Using IB to trade

Interestingly, IB has many user interfaces:

- The standard web application

- The mobile application (IBKR Mobile)

- The WebTrader web interface

- The IBKR Desktop application, for Windows and Mac

- The Trading Workstation (TWS) desktop application

So, there should be an interface for everybody!

You can do most things from all interfaces. For instance, you can trade stocks from each of these interfaces. The problem with IB is that many people have been discussing the TWS interface. So, many beginners believe they should use it. However, the TWS interface is the most complicated of these interfaces by far.

I have never used the TWS application for trading. It is just too complicated for most investors. You only need the Account Management interface if you are a simple investor and invest in ETFs. If you prefer phones, you can also use the IBKR Mobile application to trade.

From account management, you can trade everything you want. And you can also transfer money to and from your account. All these operations are relatively simple.

You can fund your account for free with a bank transfer. First, you must declare your bank account in IB, and then you can make a deposit. Withdrawals work the same way. You can only send money to accounts in your name. I never had any issues with either deposits or withdrawals.

For currencies, you have multiple choices:

- You can do a forex trade directly. For instance, you could buy USD.CHF, which is buying USD with CHF.

- You can use the currency converter and let IB do the operation for you.

- Since April 2024, You can let IB do the currency conversion for you by buying shares in a currency you do not have. For instance, if you buy VT in USD and only have CHF, IB will do the conversion for you. This will only work on a cash account, since a margin account would go negative on the currency you do not have.

In any case, IB is outstanding at converting currencies. They use an excellent rate and have very low fees.

It is also worth noting that you can automate your investments with IB. You can set up standing orders starting weekly or monthly. If you use a recurring order for the transfer, you can entirely automate your investments. This feature is something some people are looking for.

If you want further instructions, I have a guide on how to fund your IB account and trade an ETF.

Other features

IBKR has some other interesting features.

I would especially like to mention the Stock Yield Enhancement Program. If you enable this option in the settings, IB can lend your shares to other investors.

I like that IB shares 50% of the profit with you if you use that option. This sharing starkly contrasts with other brokers that would lend your shares by default without giving you any profits.

I am not saying everybody should enable this option, but for me, this shows that IB is a great broker.

Another interesting feature is that you can trade fractional shares. This feature allows you to buy fractions of shares. This feature is helpful if you want to buy some expensive shares or if you want to purchase many different companies without having a large portfolio. You can read more about fractional trading at IB.

Is IB safe?

If you invest significant money, you want your broker to be safe. So, we must look at the safety and security of IB.

Regulations

First, we can take a look at regulations.

Interactive Brokers has seven legal entities depending on the customers’ country. For instance, Interactive Brokers LLC works in the US, while Interactive Brokers (UK) Limited works for European clients.

Each of these entities is regulated. For instance, the US Entity is regulated by the Security Exchange Commission (SEC), and the UK entity is regulated by the Financial Conduct Authority (FCA). So, overall, IB is extremely well-regulated.

Financial Strength

Currently, Interactive Brokers is considered very strong financially. They have a strong capital position and advanced risk controls.

The company manages over two million accounts and executes almost two million daily trades. These are substantial numbers showing that IB has many active users.

In April 2023, IB had over 7 billion USD above the regulatory capital they needed. The company invests mostly in the short term to ensure it has enough money to cover issues in the short term. So, IB’s money is not locked when it needs to be available.

Overall, Interactive Brokers’ financials are good. The company has not shown any signs of financial trouble.

Protections

On top of that, protection in case of bankruptcy is also critical. Even though IB is financially strong, we still want to know what would happen should it go bankrupt.

It is important to know that IB does not segregate each country. This means a Swiss investor using IB UK will use the same trading system as a US investor. This is great news for protection!

The SIPC will protect US Investors. It protects your assets up to 500K USD, but it will only protect your cash up to 250K USD. And since Swiss investors are protected like US customers, we also get SIPC protection!

Now, there is an exception for some instruments. For instance, Contracts for Difference (CFDs) are prohibited in the United States. But they are offered to other investors. If you use them, the protection for your CFDs will fall to the FCA protection, up to 85K GBP.

Again, you have excellent protection against bankruptcy with Interactive Brokers. We have higher protection with IB than with a Swiss broker.

It is important to note that since Brexit, European investors have been using other entities of IB. In that case, the protection is worse since you will not get SIPC protection on stocks, only FCA. But Swiss investors still have SIPC protection.

If you want to learn more, I have an entire article about broker bankruptcy.

Technical security

Finally, technical security is also essential.

With Interactive Brokers, you will have strong technical security. All communications with the server are encrypted, but all honest brokers use encrypted traffic.

Most importantly, you can use Two-Factor Authentication for your account. You will be able to use the IBKR Mobile Application for that. Every time you log in from the web interface, you must confirm the login and enter one more code on your phone. This second factor adds a great layer of security to your account.

So, Interactive Brokers has excellent security!

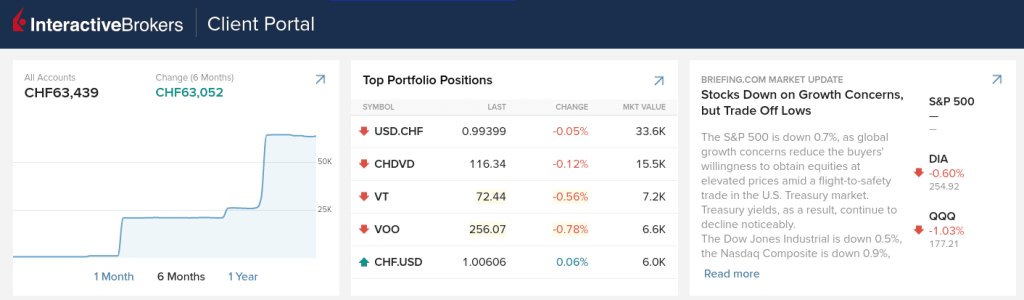

My Experience with IB

I started investing with Interactive Brokers when DEGIRO suddenly blocked access to US ETFs to Swiss Investors. Since then, I have been delighted with Interactive Brokers. I have been investing with IB for more than three years.

My entire stock portfolio is in my IB account. I buy new ETF shares every month from the default web interface, but I have also tried other interfaces. The IBKR Mobile application is very well done, but I generally prefer using my desktop computer rather than my phone.

I do everything from the Account Management interface, which suits all my needs. IB also fits my needs perfectly well. With time, I have learned to ignore most of the tool’s features. I only need a few features for my trading.

Since I sometimes get paid in USD, I can wire the money directly to my Interactive Brokers account. That way, I would not have to pay any currency exchange fees and could invest the money directly.

Overall, I am happy with my experience with IB. I never had an issue with the broker, and all my transfers reached IB very quickly. When I needed to withdraw money for the downpayment on our house, I had no problems. All my trades have been flawlessly executed. The reporting on the web interface is also precisely what I need. I can only recommend IB!

IB Reputation

It is essential to look at a broker’s reputation before using it to invest in the stock market.

As a source of review, I always use TrustPilot. So, we look at the reviews of IB on TrustPilot. On average, users rate IB at 3.3 stars. Before looking at this, I was expecting a higher score.

First, we look at what people do not like about IB. We can categorize most of the negative reviews into two categories:

- Poor user interfaces. It takes a while to get used to the IB user interface. But after some time, it is straightforward to use.

- Poor customer service. It seems that many people have issues getting help from customer service. I cannot comment on that since I have never used their customer service. But I know people in Switzerland who did and have never had issues with them.

Overall, I am not too worried about these negative comments. A lot of them do not seem serious. And many commenters seem pissed off at making mistakes with the platform. But of course, it would be better if they are fewer negative reviews.

One good thing is that most reviews (39%) rate IB at five stars. So, we should also look at what positive reviews are saying:

- Excellent customer service. It is interesting to note that there are both negative and positive reviews of IB’s customer service.

- Excellent fee system

- Excellent order execution

- Good platforms

So, we can see that overall the reviews are mixed for IB. I think it comes from the fact that it takes a while to get used to it. Once you get used to it and focus only on the things you need, IB is quite simple to use.

Interactive Brokers Awards

One way to see how a broker is doing is to check out the awards they got from external sources. Over the years, Interactive Brokers has received many awards.

They received seven awards only in the year 2022:

- Best Online Brokers of 2022, by Barron’s

- Three awards from Investopedia, including best broker for international investing

- Several award titles from stockbrokers.com

- Several award titles from forexbrokers.com

- Several award titles from brokerchooser

While this is not the only thing that matters, awards are a good sign for Interactive Brokers.

Alternatives to Interactive Brokers

There are many alternatives out there.

The one that is the most interesting for a Swiss investor is DEGIRO. However, we should also compare IB with Swiss brokers.

Interactive Brokers vs DEGIRO

|

5.0

|

4.0

|

|

No custody fees

|

Very affordable

|

|

|

|

|

- Great prices

- Many investing instruments

- Excellent execution

- Access to US ETFs

- A little intimidating at first

- Affordable

- Wide range of investing instruments

- Expensive currency conversions

- No access to US ETFs

- Lend your shares by default

For European investors, DEGIRO is another interesting alternative. So, it is interesting to compare these two brokers.

The first main difference between the two brokers is that only Interactive Brokers offers access to US ETFs to Swiss investors. This difference makes IB a much better choice than DEGIRO for Swiss investors. It will make a significant difference in the performance of your portfolio. If you invest with DEGIRO, you must invest in inferior European funds.

But we can also look at the fees of both brokers. There are a few differences between DEGIRO and IB:

- IB is much cheaper for the American Stock Market

- DEGIRO is very slightly cheaper for the European Stock Market

- IB is much cheaper for Foreign Exchange (FOREX)

There are a few differences in the features part as well. IB is also a FOREX broker, so you can hold many currencies in your account. And foreign currency exchanges are cheap. On the other hand, DEGIRO offers automatic currency exchanges when you buy and sell, but it is much more expensive than IB (unless you do small conversions).

You can also opt for manual currency conversions on DEGIRO, making currency conversions even more expensive. Overall, DEGIRO is not a great choice for trading currencies.

For the user interface, DEGIRO is slightly easier to use than IB. On the other hand, IB has many more features, but simple investors will likely not need many of these features.

Also, there is another difference in share lending. By default, DEGIRO will lend your shares to other investors. You, unfortunately, have no choice about that.

On the other hand, IB will not lend your shares by default. But with IB, you can choose to do that (it is called Stock Yield Enhancement Program), and then IB will give you some percentage of the profits. IB’s approach is much superior in that it does not lend your shares by default.

Finally, IB was established in 1978, while DEGIRO only started offering brokerage accounts to retail investors in 2013. So, IB has more extensive experience.

So, overall, Interactive Brokers is a much better broker than DEGIRO. You will be able to access US ETF if you are Swiss. And you will be able to get excellent service at very low prices.

If you want more details, you can read my DEGIRO Review.

Interactive Brokers vs Swissquote

|

5.0

|

4.5

|

|

Extremely cheap

|

Very affordable

|

|

|

|

|

- Outstanding prices

- Many investing instruments

- Excellent execution

- Access to US ETFs

- Good reputation

- A little intimidating at first

- Swiss broker

- Easy to use

- Many investing instruments

- Access to US ETFs

- Good reputation

- Expensive to trade US shares

- Expensive currency conversion

Many Swiss investors prefer to use a Swiss broker. So, we should compare Interactive Brokers vs Swissquote, a great Swiss broker.

Both brokers offer access to US ETFs and have roughly the same features. If you are a simple passive investor like me, both brokers will have more than enough features for you.

You can trade with both brokers from your computer and your mobile phone or tablet. Swissquote is slightly easier to use than Interactive Brokers, but not by a long shot.

The main difference between these two brokers is price. If you use a stock exchange other than the Swiss Stock Exchange, IB is much cheaper than Swissquote. In some cases, IB can be 100 times cheaper than SQ. This difference can be very significant.

In addition, SQ has some custody fees, while IB has zero account management fees. So, if you are looking to optimize the price, IB is the clear winner.

For many investors, Swissquote will have the advantage of being in Switzerland. It may make it easier to deal with them if you have issues, while it could be complicated with IB. So, if you are looking for an affordable (not cheap) Swiss broker, Swissquote is an interesting alternative.

For more information, read my review of Swissquote or my comparison of Swissquote vs Interactive Brokers.

Frequently Asked Questions

What is the minimum deposit for Interactive Brokers?

There is no minimum deposit at Interactive Brokers. You can open an account without any money inside. Since there are no inactivity fees, this is perfectly fine for a small amount.

Is Interactive Brokers safe?

Yes. Interactive Brokers has been around for more than 40 years and has a great reputation. On top of that, it is well regulated in several different countries. Finally, your money is insured at Interactive Brokers for up to 500’000 USD, thanks to SIPC.

Is Interactive Brokers good for beginners?

Yes. While it is not the simplest broker out there, IB allows you to get started with little money and very low fees. The basic interface is simple enough to use and will allow you to do everything you need to start investing in the stock market.

What Interactive Brokers entity should I use?

As a Swiss investor, I recommend using the Interactive Brokers UK entity that offers the best regulations, protection, and features.

Who is Interactive Brokers good for?

Interactive Brokers is great for all investors that want to trade themselves and do not mind a foreign broker.

Who is Interactive Brokers not good for?

Interactive Brokers is not the best if you want to keep it very simple. If you are afraid of using a foreign, there are some Swiss alternatives, but at higher fees.

Summary

Interactive Brokers is an excellent broker with everything you need to buy stocks and ETFs, reliably and at extremely affordable prices. With IB, you can trade U.S. stocks for as little as 0.5 USD!

Product Brand: Interactive Brokers

5

Interactive Brokers Pros

Let's summarize the main advantages of Interactive Brokers:

- A vast range of investments

- Very low fees

- No custody or inactivity fees

- Very professional service

- Offers US ETFs to Swiss Investors

- Good overall reputation

- Long experience

- Excellent security

Interactive Brokers Cons

Let's summarize the main disadvantages of Interactive Brokers:

- It can be intimidating at first

- Too many user interfaces

Conclusion

The broker you need to buy stocks and ETFs reliably and at extremely affordable prices. Trade U.S. stocks for as little as 0.5 USD!

- Extremely affordable

- Wide range of investing instruments

Overall, Interactive Brokers is an excellent broker. Their fees are incredible, and their service is top-notch. Interactive Brokers should be your choice if you want a professional broker at a very fair price.

Since they are still offering US ETFs to Swiss investors (why US ETFs are the best), Interactive Brokers is currently the best broker for Swiss investors. No other broker even comes close if you want to optimize your portfolio.

I have been using Interactive Brokers for more than two years now. IB is the broker I am currently recommending to Swiss investors. It is also an excellent choice for European investors. I am pleased about IB and plan to continue using it for a long time.

Many people argue that we should not pay fees for brokers since there are free brokers. However, you have to be careful. There are many downsides to commission-free brokers. I much prefer paying very little for a great broker than not paying for a bad broker.

If you are interested in IB, I have a guide on opening an IB account.

What about you? What do you think of Interactive Brokers?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-book

Hi Mr. The Poor Swiss,

First off, lemme congratulate with you for the excellent content of your blog!

I’m a very happy IB user since some time, and I mainly invest in US ETFs and high-value CH stocks.

So far, I only had the pleasure transfer CHF into IB, so far so good.

Now, since some time, I’ve got some (non-transferable) USD ESPP shares in Etrade that I want to sell and move the outcome to IB.

I’m thinking at opening an USD account at my bank and then transfer USD into my IB account, so to cut off all FX conversions.

Do you have any experience of funding IB with USD? I see that I can go with either ACH or Wire transfer, but I’m not sure what’s the most efficient and straightforward way.

Btw, I’m also living in the beautiful Kt. Freiburg!

Cheers,

Urs

Hi Urs,

Thank you for your kind words :)

Why don’t you do the transfer from trade to IB directly? That’s what I usely do for my own ESPP. That way you don’t pay any conversion fees or transaction fees except for IB wire fees.

Hi Mr. The Poor Swiss,

Thank you vm for replying!

Just to be on the safe side, you sell ESPP shares and deposit the outcome in the E*Trade Account and then, when it’s settled and ready to withdraw, you wire it to IB, ain’t you?

Hi Urs,

I have done both:

1) Sell ESPP and directly send the outcome by wire to IB

2) Sell ESPP, get the outcome on E*Trade and then wire everything to IB

They should both work, but option 2) has the advantage that you can group some wires together to save on the wire fee from E*Trade.

Hi Mr PoorSwiss,

I’m a new customer to IB, swiss resident, and content with IB’s services and options. My question will be a bit naive I guess, but I noticed IB charges interests – but what for? I’ve got a margin account and I only now realised there is a monthly interest notification sent, outlining interests accumulated during the previous month, even though I did no use my margin credit and always kept my account balance positive. This is the first broker where I have to pay interest on my holdings and I don’t know why. Any idea? Many thanks ahead!

Jürgen

Hi Jurgen,

Are you sure you did not use your margin? Many people with a margin account use balance by mistake, for instance by buying USD shares when they only have CHF.

If you do not have margin, you should not pay interest.

* Could this be the monthly custody fee?

* If you have more than 100’000 CHF, you will have to pay negative interests on your balance

* You will get positive interests on your USD cash

Hi Mr PoorSwiss

First of all thanks for your great blog!

I want to start investing and I’m wondering if I should directly start with IB and invest in US ETF’s or if I should start with Degiro bc of the lower fee’s for small investments and then switch to IB when I reach 100k..? If I start investing this year, I would say I’m able to reach 100k in 5years.

Another question that I have:

If I invest in US ETF and then they would ban it in Switzerland in about two years, do I need to sell the ones that I already have or can I keep them? If I need to sell them I’m wondering if it’s even worth start investing in US ETfs now.

Thanks a lot for your answers!

Cheers

Marc

I would not recommend starting with DEGIRO if you are going to move to IB later. This is what I did and moving the money from one to the other is not a good experience.

It’s only 120 USD fee per year and it’s a good motivation to reach 100k!

If the past is any indicator, we will be able to keep our U.S. ETFs shares, we just won’t be able to buy any more. Since we do not know for sure that we are going to lose access to these ETFs, I still recommend investing in them and I am still doing it.

Hi The Poor Swiss,

Thanks for the great content!

Except for the Trading 212, could you also compare IB with Webull, Futubull and Tiger Trade for those people who can open accounts for them in Switzerland?

Secondly, isn’t it cheaper to pre-exchange money from chf to usd or GP in revolut and then transfer to IB, instead of exchange currencies in IB?

Thirdly, what do you think about trading crypto currencies on IB?

Thanks a lot and keep up the great work. I am a huge fan.

Best,

Grace

Hi Grace,

1. I can’t compare IB to every possible broker, there are just too many of them. It does not seem like any of these brokers are available in Switzeralnd.

2. IB charges you 2 USD for a conversion, it is not worth optimizing this. And Revolut only lets you convert 1250 CHF per month for free

3. I do not think you can trade crypto on IB.

Hi The Poor Swiss,

Thanks for the great content!

I was wondering if you also knew the plateform “Trading 212” and what’s your thoughts about it?

Best,

Charles

Hi Mr. The Poor Swiss!

Excellent write up and just what I was looking for as these sort of reports are usually paid or very badly done. One thing I was missing for me personally, especially given the current “Gold Rush” in Pennyland: Do you have any experience in trading OTC stocks on IB? Can you comment on fees for OTC trades for Swiss residents?

Looking forward to your reply.

Kind regards,

Kevin

Hi Kevin,

I am afraid I have no experience in OTC stocks: I know IB lets us trade them, but no idea about their fees.

Thanks for stopping by!

Hi TIPS,

Thanks for this interesting info on your website.

But I am still a bit confused about buying US etf’s with IB as a German citizen, concerning the PRIIP regulations.

I am now with DEGIRO, but the choice of etf’s is quite limited, without the US etf’s. I was considering opening an account at IB, but

is your position being Swiss different than a German, or do I get the same trading possibilities as you with IB?

Or do I get limited in US etf’s trading being a member of EC?

Hi Peter,

Unfortunately, as a German resident, you will not have access to U.S. ETFs.

We only get them since we are not part of the EU.

I should try to make this clearer in the article.

Thanks for another great piece. I have two questions:

1. I earn in both USD and CHF – is it possible to have both base currencies in my account, or I must choose?

2. I am from the UK – do you know if it would be better to set up my account as a UK resident or a Swiss resident (as I am not sure how long I would stay in Switzerland)? Are you aware of any advantages either way?

Keep up the great work!

Hi John,

1) You have to select one, but it will only change how the values are displayed in the web interface. Even with CHF as base currency, you can still deposit and hold both CHF and USD. This is something I have been doing myself too.

2) I think you should simply choose the actual proper residence. My policy is simply to use the truth. So, if you are currently a Swiss resident, you should use that.

Thanks for stopping by!

Thanks for your answer – that’s very helpful. I see there are two options for IB – Lite and Pro, but I’m not sure Lite is available outside of the US. Which one did you go for and are recommending here?

Hi,

Unfortunately, Lite is only for the U.S.

No options but Pro in Switzerland. But Pro is already very cheap.

Thanks for stopping by!

Hi TPS – as always, thanks for your nice website! :)

I have a question on the Swiss tax declaration: Which documents/reports from IB do you usually add to your tax declaration?

I guess the office will want to see the end-of-year balance, as well as a dividend summary (with US withholding tax in case you fill DA-1). Do you join your annual activity statement? This seems too much info…

Thanks!

Hi Sam,

I am using the annual statement from IB and attach it to my tax declaration. They actually want to see all the dividends and when you sold and bought shares. I’d rather give them too much info than too little.

Thanks for stopping by!

Hi Mr. TPS,

Thanks for the tax information, very useful in the current period. It would be really great if you could publish a post with the tax declaration process and documents needed, even if it changes between cantons.

I have been checking the DA-1 form and the items in the table for the capital placements and revenues seem a bit confusing.

Thanks

Hi Henry,

I will soon publish an article on how to fill the DA-1 form, hopefully, it will clear out some issues.

Thank you, much appreciated

Hi The Poor Swiss,

Thanks for your insightful blogposts, you are doing an amazing job.

Regarding the inactivity fee of IB, you write “Also, when you have more than 100K USD in your account, the custody fee is waived.”

Does cash balances qualify towards the 100k waiver?

I am thinking to park part of my emergency money as cash with IB to waive the inactivity fee. Does that sound like a good idea?

Thanks!

Hi Anne,

Yes, the cash is counted towards this 100K.

So, you could definitely move some extra cash there to raise it to the limit. But this may make your emergency fund a little less liquid since you need one extra transaction to get it. But it is generally not an issue.

Also keep in mind that at IB, you get a negative interest rate on CHF starting at 100K, but I hope your emergency fund is not 100K :)

Hi Anne,

Also, the inactivity fee is waived in the first three calendar months since the first money deposit. However, pay attention to another extra fee of 10$ if your account balance is less than 2k$.

For the interest rates, you can check the calculator and the table on the IB website: https://www.interactivebrokers.com/en/index.php?f=46385

In some cases, if you have too much cash it might be reasonable to exchange some into other currency to avoid negative interest rates.

Warmly,

Emil