How to Open an Interactive Brokers Account in 2024?

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Interactive Brokers is an excellent broker from the United States. It is known for its cheap fees and unique investment product range. It is being used by many personal finance bloggers, for instance.

It is currently the best broker that allows access to U.S. ETFs. And U.S. ETFs are the most efficient ETFs for Swiss investors.

In this guide, I review how to open an Interactive Brokers account. It is not very difficult, but there are a few things you need to know before you start your application. And I also teach you how to optimize your account to save money!

Interactive Brokers

The broker you need to buy stocks and ETFs reliably and at extremely affordable prices. Trade U.S. stocks for as little as 0.5 USD!

- Extremely affordable

- Wide range of investing instruments

So what is Interactive Brokers (IB)?

IB is a brokerage firm from the United States. It was created in 1978 in New York, more than 40 years ago! IB is the largest brokerage firm in the United States and the leading foreign exchange (forex) broker. Interactive Brokers offers access to many instruments, such as stocks, bonds, options, futures, and more.

Interactive Brokers is a very well-known broker with an excellent reputation. It is known to be cheap compared to its competitors. I have already compared IB and DEGIRO in the past. This comparison showed that it is even less expensive than DEGIRO, the broker I used before.

An essential thing with IB is that, by default, they do not lend your shares to other people, such as DEGIRO does by default. But you have the choice, which is good! Indeed, you also can lend shares, and you will get some of the money from the lending.

If you want more information on IB, read my review of Interactive Brokers.

Why open an IB account?

So, why did I open an IB account? It is currently the best broker available to Swiss investors.

There are many reasons to prefer Interactive Brokers over other brokers.

- IB offers access to U.S. ETFs to Swiss investors, while many brokers are not.

- IB has excellent prices.

- IB offers access to many investing instruments.

- IB offers foreign exchanges at an excellent price.

- IB has an excellent reputation.

- IB has good financial strength.

So, we will see how one can create an account on IB.

Create an Interactive Brokers account

First, prepare some time in front of you. The account creation process on Interactive Brokers is not difficult, but it will take some time. You will need to answer a few questions, and you will need to wait a day for your account to be funded.

Interactive Brokers has several entities in Europe. The primary entity is IB UK, but one is in Luxembourg, and one is in Ireland, for instance. For Swiss investors, the best entity is IB UK because they offer access to a Swiss IBAN and give you access to US ETFs. For European investors, it does not make much of a difference.

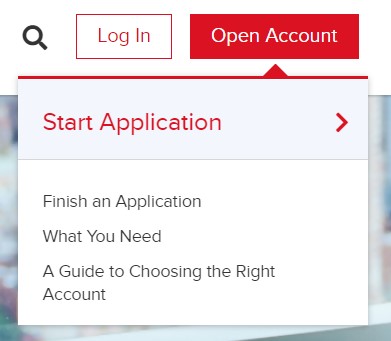

First, go to the account creation page and click “Open account”.

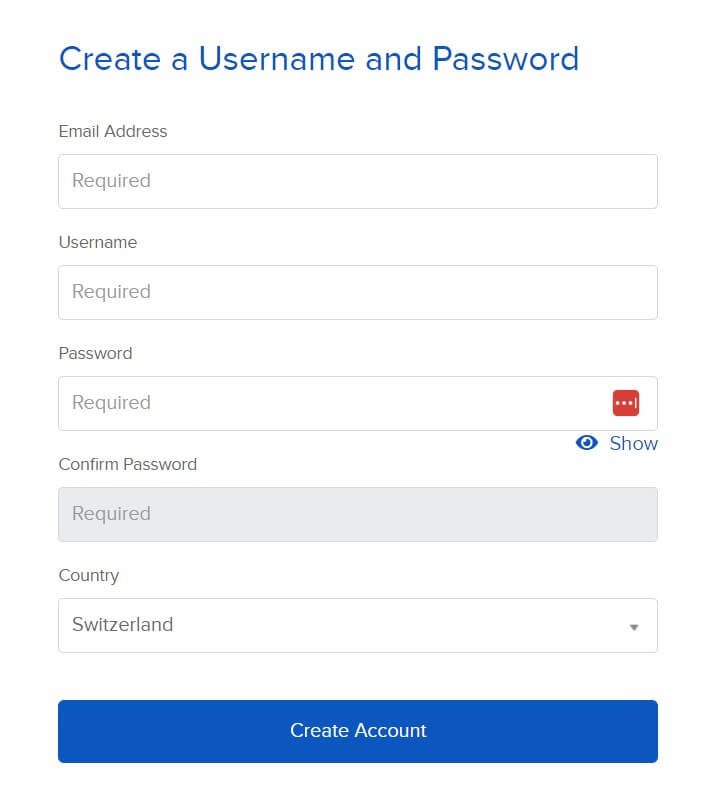

On the first page, you must enter your email, user name, and password for the account. Make sure to choose a good password and user name.

I would recommend making your password at least 20 characters long. A long password is essential to secure your online accounts! Make sure to remember it correctly as well!

You also need to enter your country of residence. If your country of legal residence differs, you must also enter it. You can then confirm the first page.

At this point, they will email you to confirm your email address. Just check your mail and choose to continue the application.

Personal information

On the second page, you will have to set your account type. I put it to Individual for this example. You can check the kinds of accounts to ensure you choose the one according to your needs. But most people will want either an Individual or a Joint account.

Then, you will have to enter the general kind of personal information. Nothing is special here, only what you are used to entering on each website. You will have to set your addresses as well.

Since this will be related to your taxes, it is essential to enter them correctly. You will also need to enter a valid phone number. IB will use this phone number authentication, so once again, enter it correctly.

IB has several types of accounts. You will need to select the type you want. The primary type of account is a Cash account, which is the type you probably need. A cash account means you need to have the money before each trade.

There are also Margin accounts (IB has some good information about margin accounts). Margin means you can use leverage for investing with money you do not have. Unless you know what you are doing, I recommend a Cash account.

Another thing you need to configure when you create an IB account is the base currency. Since I make most of my payments in Swiss Francs (CHF) and live in Switzerland, I chose CHF as my base currency.

You can always convert money from your base currency to any other currency. The base currency only matters for the interface’s display. If you choose CHF, you can still transfer USD and buy shares in EUR, for instance.

Currently, the CHF balance has a positive interest rate. If it becomes negative again, you will see a warning about the negative interest rate on CHF balances. You can get the current negative interest rate and limit here.

Now, you will also have to set up three security questions. You will need these questions if you ever need to recover your account. Make sure you choose questions from which the answer is not ambiguous (but not easy to find)! This procedure is, once again, a standard procedure.

Investment Questions

After this, you need to answer questions about your finances.

You need to tell how much your net worth is and how much income you have. You also need to say what your objectives are for your investments. For instance, you may want to invest for capital appreciation or fixed income.

All this information is here for regulatory reasons. I would advise you to answer them with honesty.

You also need to set which instruments you need to invest in. For instance, if you want to invest in stocks and bonds, you must select these options. I only chose stocks.

Stocks, bonds, options, and futures are among many other choices. You must also select which country (stock market exchange) you want to invest in.

You also need to confirm your phone number with a code.

Confirmations

At this point, you must agree to all the rules IB has for trading. Ideally, you may want to read them. But you probably will not!

If you want, you can also join the Stock Yield Enhancement Program. This program will allow IB to lend your shares to other people. With that, you will receive half of the profits.

Of course, there is a slight risk to that, and you may also be unable to sell your shares when you want or need to. I am not using that feature now. But I have tested this feature recently, and it works well.

At this point, Interactive Brokers will want proof of your identification. For this, you can upload a driving license, an ID card, a passport, or an alien ID card for IB to confirm your identity. You will also have to enter information about your tax status on the same page.

You will also have to fill in information about your employer and job. Usually, you also need to submit something as proof of address.

Fund your IBKR account

IB will fully activate your account once they receive funding.

You need to deposit the first amount for IB to validate your account. First, you need to declare how much money you will deposit. Then, IB will give you all the information necessary for the payment.

Make sure you correctly copy the IBAN. With banking transactions, you should always double-check all banking information before transferring. The transfer will be free since they have a bank account in Switzerland!

And do not forget to include the “Further Benefit to XXX” line! Otherwise, the money will not go directly to your account, and you must contact them to fix the issue. You must do that for all future deposits to your Interactive Brokers account.

Finalize your account

After you have funded your account, you can still do a few more things.

First of all, you can configure the market data. You should set your market data status to non-professional. And you should check that you are not buying any market data. Unless you plan to day trade, you do not need this data. You do not want to pay for it.

One great thing is that you have to use two-factor authentication (2FA). You have no choice. You must configure your mobile phone to use it as 2FA.

2FA is an essential part of online security. First, you need to install IBRK Mobile on your phone. This application is available for Android and iOS.

Once you have installed the application, you can register it as a two-factor authentication for your account. You will have to log in with your username and password, and you need to enter the code you received by SMS.

Finally, you can then choose a PIN for your future two-factor authentication. Remember that PIN since you must use it for each connection to Interactive Brokers.

If you do not know about 2FA and why it is necessary, read my article about online personal finance and security.

Wait for your account

At this point, you only need to wait for IB to create and fund your account.

It should not take too long. It only took one day for my account to be created and funded. It is pretty fast. The next day, I could directly make my first trade.

Optimize your IBKR account

Now that you have access to your account, there are two more things to finalize in your account.

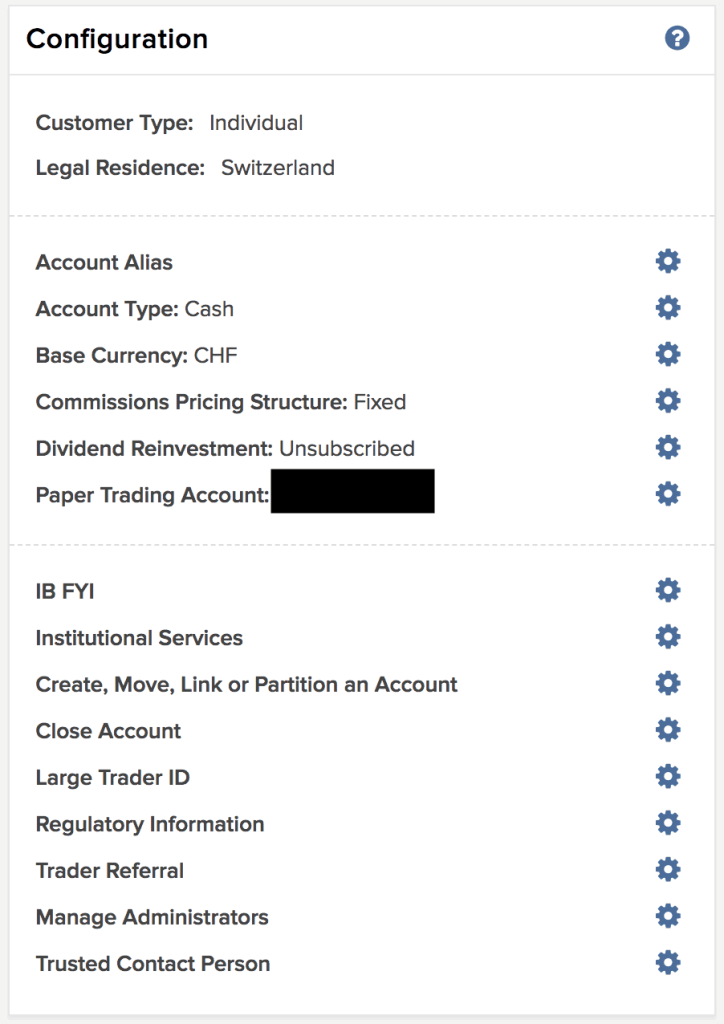

The first thing remaining at this point is configuring the Pricing System. I recommend you use the Tiered Pricing system. IB is cheaper than DEGIRO when you use the Tiered Pricing system.

You can make the change in your Account Settings. If you prefer the more predictable Fixed Pricing, you can also opt for it. There are some cases where fixed pricing is cheaper than tiered pricing.

Here are my settings just before I made the change to Tiered pricing:

The second thing applies if you are a Swiss investor and will invest in U.S. ETFs. In that case, you need to fill out the W-8BEN form. That is pretty simple. You can go into your Account Settings. Then, you must click the (i) blue button next to your name below Profiles. Then, you can click on “Update Tax Forms”.

They will then take you through the process, and you can fill out the W-8BEN tax form. This form will halve the dividend withholding from your American stocks and ETFs. This step is essential if you want to profit from the great tax efficiency of U.S. ETFs.

Some people have told me that it sometimes takes about one day for the account currency to be changed on the interface. You have to wait one day, and the issue should disappear. In the meantime, you may see some numbers in other currencies (likely GBP).

Another thing you can choose to do is to allow IB to lend your shares. By doing so, you will get 50% of the profits. This feature is called the Stock Yield Enhancement Program. However, there are some risks. I have tried it on and off over the last few years, but whether you think it is worth it is up to you.

Conclusion

The broker you need to buy stocks and ETFs reliably and at extremely affordable prices. Trade U.S. stocks for as little as 0.5 USD!

- Extremely affordable

- Wide range of investing instruments

The procedure is now complete! If you followed this guide, you now have an Interactive Brokers account.

With this great broker, we have access to U.S. Exchange Traded Funds such as VT, which makes the most significant part of my portfolio.

I have now been using IB for more than two years. And I am delighted with IB. Interactive Brokers is the best broker available to Swiss investors.

The next step is now to buy an ETF from Interactive Brokers. It is also relatively simple and only takes a little time.

What do you think about Interactive Brokers? Do you already have an account? If not, which broker are you using?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Best Brokers

- More articles about Investing

- How to Open a DEGIRO account and start trading

- Cornèrtrader Review 2024 – Cheapest Swiss broker

- Should you use IB Fixed or Tiered pricing in 2024?

Hi Baptiste

Thank you very much for your blog. I’m following it for quite some time and optimized a couple of things following your blogs.

I plan to invest around 150k with IBKR later this year. Are there any advices you can give me? Do suggest investing the hole amount? Or rather to average-in monthly (how much monthly)? Are there any limitations?

Thanks in advance

P

Hi P

Thanks :)

If you are investing for the long term, you should invest at once if you have the risk capacity to pull it out.

I have an article about dollar cost averaging: Dollar Cost Averaging is more risky than you think

Hi Baptiste

What should I set as my base currency if I’m planning on funding my IB account from bank accounts in different countries? Should I just set it to the currency of the country in which I’m living?

I will most probably stick to US stocks & ETF’s. Will I need to convert whatever currencies I have funded my account with, into USD before transacting?

Hi Steven

Don’t worry about it; this simply changes the currency the web interface uses. If you want to look at your net worth in CHF, use CHF. You can still transfer different currencies to the account regardless of the base currency.

Unless you can transfer USD directly to IB, you will indeed have to convert your currencies to USD before buying US stocks & ETFs.

Hi Baptiste

So if I wish to view my account in USD, I should set my base currency to USD, even if I intend funding my account in currencies other than USD?

Assuming that’s correct and I make a transfer to my IB account in GBP, will that amount continue to reflect in GBP or will it automatically be converted to USD to match up with my chosen base currency?

Thanks

Steve

Correct, it’s only for showing your balances.

No, IB will never convert automatically (unless instructed by recurring investments). The total will be reflected in GBP, but you will still be able to see each balances individually. FOr instance, my base currency is CHF. I can see the total in CHF but I can also the amount of each positions in their currencies and the amount of each of my cash balance (USD and CHF).

Hi Baptiste,

Thank you so much for all the valuable information on your blog. Do you have an IB affiliate link with which we could open an account and also support you in the same time?

Thank you and kind regards,

Bence

Hi Bence

You are welcome!

The IB links on this page are affiliates and suport me if you open an account from them.

However, there is no advantage for you :(

Hi, thanks again for your great and very useful info . Now , 🙄😅 I have tried to open an account at IBKR PRO. Now the thing is , it is asking me to do a Stock Teaching Exam , and the same with Bonds .

I mean … yea but I am not an expert and I wouldn’t know all the answers.

It this new / normal or am I doing something wrong ? 🙄

Thanks

Hi Carla

Indeed, they do a small “exam” when onboarding. You do not need to know all the answers. In general, this should not restrict your use of stocks, but is more geared towards limiting options and margin usage.

It is normal.

Bonjour Baptiste,

Regarding interest rates on cash deposits on IB, I am tempted by the high rates paid on USD and EUR cash deposits, still quite confused on the following points:

1. “Accounts with a Net Asset Value (NAV) of USD 100,000 (or equivalent) or more are paid interest at the full rate for which they are eligible. Accounts with NAV of less than USD 100,000 (or equivalent) receive interest at rates proportional to the size of the account.”

Could you please explain what is NAV and how it is calculated on IB? e.g. what is my NAV if I only have a cash deposit of 100k USD on my IB account?

2. I live in Switzerland, so I guess the risk of depositing cash in a currency which is different from CHF is related to the exchange rate between CHF and the currency used for the cash deposit, right?

Meaning: let’s say I deposit 50k USD in cash and I get an amazing 4.347% interest on my deposit. I need the USD-CHF exchange rate to hold in order for me to realize a net profit if I decide to cash-out in CHF, is that correct?

3. In their interest rate calculator form, IB states that “The interest calculator is based on information that we believe to be accurate and correct, but neither Interactive Brokers LLC nor its affiliates warrant its accuracy or adequacy and it should not be relied upon as such. Neither IBKR nor its affiliates are responsible for any errors or omissions or for results obtained from the use of this calculator.”

Not very reassuring…I mean, what could be delta between the calculated value and the actual interest?

Thank you for your time and for your blog. Amazing content.

Steph

Hi Steph

1) NAV is the sum of all your assets, minus your liabilities (margin). If you only have cash, your NAV is your cash.

2) Correct. If you do 5% per year on USD but the USD lose 10% against CHF, you will have lost money.

3) This is just a way of protecting themselves, standard legalese wording. In practice, there is no delta. But keep in mind that the the interest rate can change at any moments.

Cheers

Hi Baptiste, would like to ask you when opening IB account now when living and working in Switzerland and long term 5 – 10 years moving back to home EU country:

– as I want to invest in U.S. ETFs so I do fill out the W-8BEN form. After moving to EU country do I have to sell US ETSs?

– is there possibility to update phone number due to two-factor authentication (2FA)?

In order to fill out the W-8BEN form, is it necessary that you have already submitted tax declaration by yourself? What data are they asking for in this part?

Bests

Hi Miro

You need indeed to fill a W8BEN and this is independent of the tax declaration.

In theory, you should not have to sell your US ETFs but won’t be able to buy more.

There should be a way to change your phone number normally, but I have never tried. I would be extremely surprised if this was not possible as long as you do it while you have the two phones (old and new).

Hi Baptiste,

I have one additional question.

On IBKR you can set in the settings (Dividend Election) how dividends are either paid out or reinvested directly.

Default is paid out (cash). I guess it also makes more sense to keep it that way (paid out), since otherwise it could generate much more fees when a small dividend is paid out and they immediately buy small number of shares with this, rather than e.g. use the dividend together with the next/bigger monthly investment orders, right?

Hi Peter,

Indeed, this would trigger a small 0.35 fee on each reinvestment in a US ETF. If you are investing monthly, you can simply use the cash available to buy more shares and save a little.

For non-US ETFs, the fees would be expensive unless you get very dividends.

Hi Baptiste,

One thing that confused me is that there is a IBKR Pro and Lite version on IBKR.

After some research I found out that IBKR Pro is the only option available for non-US-residents.

But also in the US, the default is Pro whereas Lite has to be requested.

We can’t profit from other rates anyway here in CH, but I guess even with the “Pro” version IBKR currently mostly outcompetes other brokers available to Swiss citizens, right?

Hi Peter

You are correct :)

IBKR Lite is currently only for IBKR US customers.

Since you can open an IBKR US account as a Swiss customer, it may be possible to get a IBKR Lite account directly by doing so, but not through IBKR UK.

And for us, the difference would be tiny. We pay about 0.35 USD for a US ETF, so we would save 0.35 on each US ETF (or stock) transaction, which is negligible. And we would be forced into fixed pricing for non-US ETFs, which may make it more expensive.

That makes sense, thanks! :)

Dear Baptiste,

Thanks a lot for the info. Do you think it is better setting the account in USD, because IB is giving > 10,000 4.830% (BM – 0.5%) 3.830% (BM – 1.5%) and for CHF is around 1%

Thanks for your help

Hi Juan

The base currency of your account makes no difference other than changing the default display.

If you set it to CHF, you can still hold USD and CHF in your account.