Should you use IB Fixed or Tiered pricing in 2024?

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Until recently, I thought Interactive Brokers Tiered pricing was always better for most investors. But after doing some more simulations, this may not be the case!

So, I made more tests to see exactly when we should use Fixed or Tiered pricing. This article shows the differences between these two pricing structures and whether you should use Fixed or Tiered pricing.

Interactive Brokers Pricing

The broker you need to buy stocks and ETFs reliably and at extremely affordable prices. Trade U.S. stocks for as little as 0.5 USD!

- Extremely affordable

- Wide range of investing instruments

Interactive Brokers is the broker I am using and recommending. It is a great broker with very affordable prices and excellent execution.

Contrary to many brokers, Interactive Brokers (IB) has two different pricing models:

- Fixed pricing

- Tiered pricing

And many people are asking me whether they should use fixed or tiered pricing. So, we will compare these two in detail and find out!

Fixed pricing is the simplest model, you pay a fixed percentage fee, with a minimum and maximum, and that is generally it. This model is standard with most brokers.

On the other hand, tiered pricing is made of several sub fees:

- Regulatory fees

- Exchange Fees

- Trading fees

- Clearing fees

Some of these fees are per share, while others are flat, and still, others are based on the total value. And tiered pricing is very different from one exchange to the other.

So the main difference between those two is that fixed pricing is straightforward and predictable, while tiered pricing is complex and changes heavily from one exchange to the other.

Note that when you change the pricing method, it generally takes one day to apply.

The price they will pay for each transaction matters most to each investor. So, we will compare Fixed and Tiered pricing schemes for several stock exchanges.

I selected several stock exchanges: the Swiss Stock Exchange (SIX), the European Stock Exchange (Euronext Paris), and the New York Stock Exchange (NYSE). These are the most used stock exchanges for a Swiss or European investor.

In some cases, there are some slight differences between buying stocks and ETFs. When this happens, the following results will use the ETF pricing.

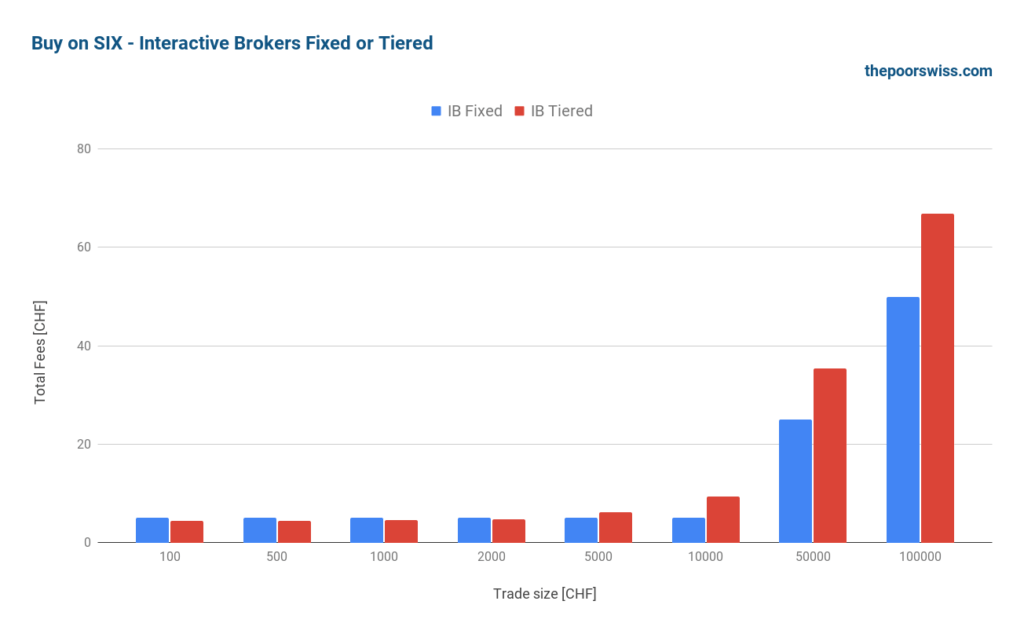

Swiss Stock Exchange (SIX)

We start with operations on the Swiss Stock Exchange and see if fixed or tiered pricing differs.

With fixed pricing, you will pay 0.05% of the trade value on SIX, with a minimum of 5 CHF and no maximum.

With tiered pricing, you will pay 0.05% of the trade value on SIX, with a minimum of 1.50 CHF and a maximum of 49 CHF. On top of that, you will pay a trade reporting fee of 1 CHF and a clearing fee of 0.38 CHF. Finally, you will pay an exchange fee of 0.015% of the trade value plus 1.50 CHF.

With tiered pricing, you will pay even lower fees if you have a substantial monthly volume. Indeed, starting from 50 million EUR monthly volume, the fees are going down, and several thresholds exist. But we will ignore that because this does not concern most people.

So, here are the total fees for a few order sizes:

These results are pretty interesting. We can see that for small operations, the tiered pricing is slightly cheaper than fixed pricing. But once we reach 5000 CHF orders, fixed pricing becomes cheaper. And as order sizes increase, the gap between both pricing schemes grows.

So, to buy on SIX, you should use tiered pricing for small operations and fixed pricing once you start doing large options.

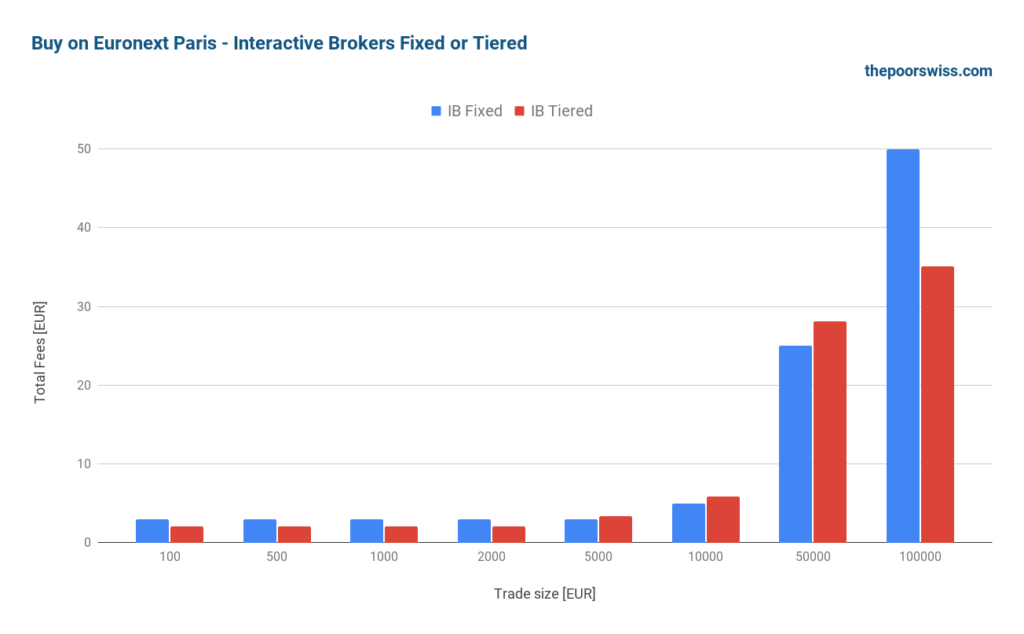

European Stock Exchange (Euronext)

Next, we look at the Euronext Paris stock exchange, one of the most used stock exchanges for European investors.

With fixed pricing, you will pay 0.05% of the trade value on Euronext Paris, with a minimum of 3 EUR and no maximum.

With tiered pricing, you will pay 0.05% of the trade value on SIX, with a minimum of 1.25 EUR and a maximum of 29 EUR. After that, you must pay exchange fees of 0.006% of the trade value, with a minimum of 0.75 EUR and no maximum. You also have to pay a clearing fee of 0.10 EUR.

Once again, here are the total fees for a few order sizes:

These results are very interesting. Below 5000 EUR, the tiered pricing is cheaper than the fixed pricing. Indeed, the tiered pricing minimum is smaller. Then, between 5000 and 50’000 EUR, fixed pricing is slightly more affordable. Finally, for 100’000 EUR, tiered pricing is cheaper again. Indeed, there is a maximum for the commissions, while fixed pricing has no maximum for the commissions.

So, to buy on Euronext Paris, you should start using tiered pricing for small operations, Fixed pricing for medium operations, and, once again, tiered pricing for large operations.

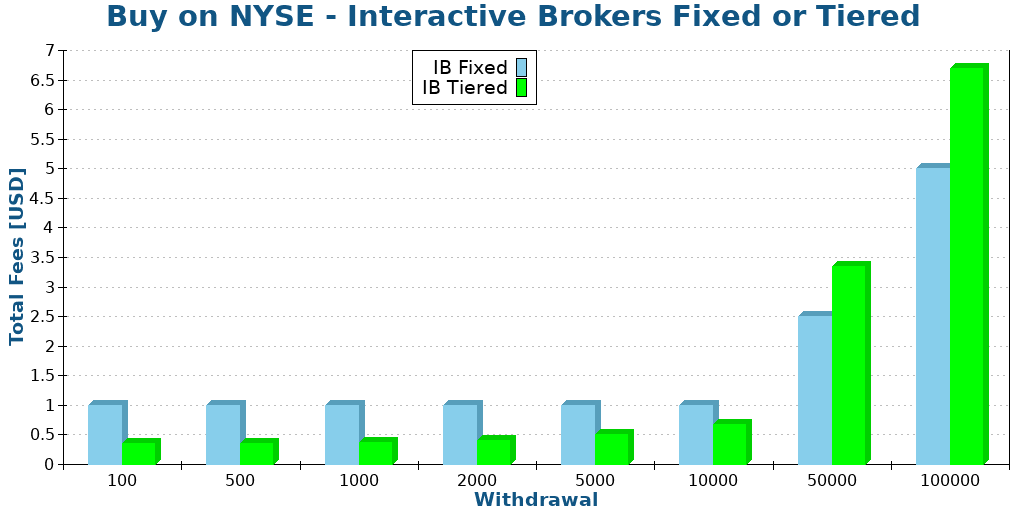

New York Stock Exchange (NYSE)

Finally, we should look at the New York Stock Exchange (NYSE), the stock exchange of the best ETFs available.

Interestingly, the commissions on NYSE are expressed per share. For this, I will assume that we buy an ETF with shares worth 100 USD. So, if we buy 1000 USD, we buy ten shares.

Also interesting is that this time, the fees differ between buying and selling. So, we first cover the buying fees.

With fixed pricing, you will pay 0.005 USD per share, with a minimum fee of 1 USD and a maximum fee of 1% of the trade value.

With tiered pricing, you will pay 0.0035 USD per share on NYSE, with a minimum fee of 0.35 USD and a maximum fee of 1% of the trade value. Additionally, you have to pay a clearing fee of 0.0002 per share. You will also pay an NYSE exchange fee of 0.003 per share. Finally, you will pay some pass-through fees. For NYSE, these pass-through fees are 0.000175 times the total of the other fees.

Putting it together, this gives us these fees for buying on NYSE:

Interestingly, Interactive Brokers’ tiered pricing is cheaper for all operations below 50’000 USD but start to be slightly more expensive for larger operations. For small operations, tiered pricing is almost three times cheaper. However, it is worth mentioning that both pricing models are extremely cheap for US ETFs.

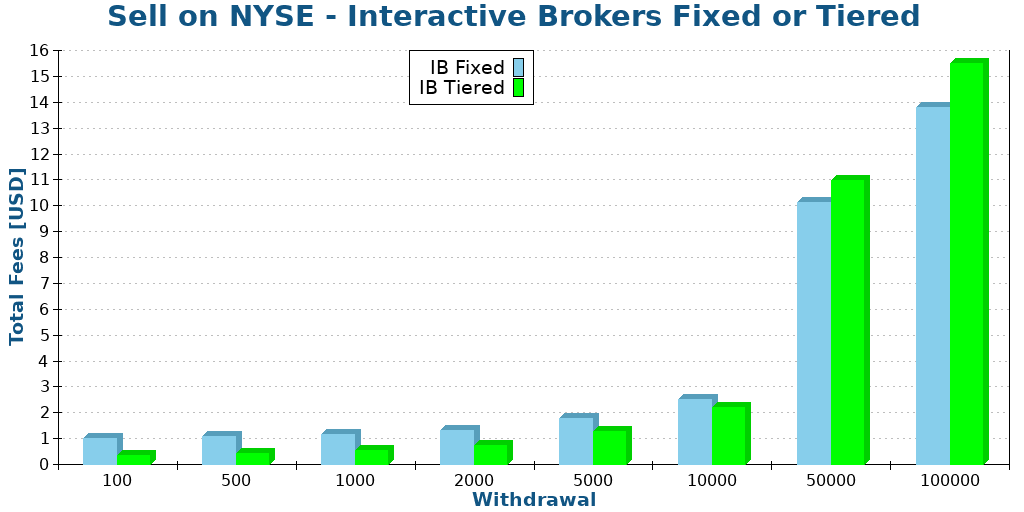

For sale operations, there are two additional regulatory fees:

- The SEC regulatory fee of 0.0000229 per share

- The FINRA regulatory fee of 0.00013 per share, with a maximum of 6.49 USD

These two regulatory fees apply to both fixed and tiered pricing. So, this will not change which model is cheaper, but it is still interesting to realize the prices.

So, here is how this translates to selling on NYSE:

The tiered pricing model is generally the cheapest, up to very large operations. The gap is slightly smaller than for buy operations. However, the selling fees weigh heavily on large operations that are now several times more expensive.

For most passive investors, having more expensive sales should not be an issue. Indeed, we should buy more often than we sell.

For a small conclusion on US stock exchanges: Tiered pricing is cheaper than fixed pricing to buy US ETFs on NYSE.

Conclusion

The broker you need to buy stocks and ETFs reliably and at extremely affordable prices. Trade U.S. stocks for as little as 0.5 USD!

- Extremely affordable

- Wide range of investing instruments

We can see that neither fixed nor tiered pricing is always the cheapest option. It depends on which stock exchange you use and on the size of your transactions.

If you mainly buy US ETFs, you should use tiered pricing to save money. If you do small operations, tiered pricing is also great. Fixed pricing is excellent for medium to large operations on Swiss and European stock exchanges.

We must mention one more thing: fixed and tiered pricing models are affordable. Interactive Brokers has excellent pricing! Given these results, I plan to keep tiered pricing because I mostly use US ETFs.

What about you? Are you using Fixed or Tiered pricing?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-book

Do I get it right: If I invest 60k CHF in CHSPI and 240k CHF in VT, in both cases fixed pricing is better. After initial payment I should switch to tired pricing for monthly payment (switch at least 1 day before)

Thank you so much for your blog 🙏🏻

Hi,

Yes, you are right. For such investments, fixed will be cheaper. And then you can switch to tiered for your smaller monthly payments.

Hi Baptiste,

The high minimum fee for the Swiss index are a bit concerning to me for recurring investments. Let’s say one follows a 80% VT, 20% CHSPI plan, and invests 1000k/month, it would surely make sense to invest 4 months in a row in VT and 1 month in CHSPI, or even better 8 months in VT, 1 month break and then 2k into CHSPI, right?

You miss out on exposure on Swiss home market for a while, but with the last option you actually save ~45 CHF of fees which saves 2.3% of your investment (45/2000).

A similar thought would be to invest only every 2 months (but then 2000k), to save 50% of currency conversion fees (0.2% when doing 1000chf to 1000usd). But that is probably not worth it when you expect a (conservative) 5% yearly gain which comes at a ~ 0.4% gain/month.

With that calculation you would loose more money being out of the market than you save for optimizing currency conversions.

Generally speaking, any fee optimization that would take you out of the market is not worth it. Investing in one ETF per month generally works well.

Hi Peter

I have always recommended to buy a single ETF per month. As long as all your money is in the market, I think it’s fine to have a slightly out of balance portfolio for a few months.

Buying 4 months VT then one month CHSPI makes a lot of sense in my opinion.

And I agree that fees for CH ETFs are expensive but that’s the same at most brokers unfortunately.

How some SIX Tiered is more expensive for 100k? It’s capped at 49 CHF. To it should be similar Euronext’s graph, i.e. cheaper than Fixed

Hi Foo,

The 49 CHF cap only applies to IB fees. Then, you have the exchange fees on top of that maximum. And same with Euronext, you can go above the maximum of 29 EUR.

That’s the issue with tiered fees, you need to consider all fees independently.

Hello Baptiste, thank you for the great content as usual! Checking for US ETF and seems the fixed pricing is now $4 minimum. Could you please update your recommendations with this update? thank you so much!

Hi Vi,

Where did you see that? Looking at their commissions here, I still see 1 USd minimum for US Stocks and ETF with fixed pricing.

Hi Baptiste, I assume Vi is looking here: https://www.interactivebrokers.co.uk/en/index.php?f=1590&p=stocks2#pills-switzerland-usd

In the link above, do the USD fees for Switzerland only apply to USD stocks on the SIX exchange (if there are such things)? Or are the USD fees applied to all USD transactions originating from Switzerland?

Oh, thanks Ben, I get it now.

Yes, this is only for USD stocks and ETFs on the SIX stock exchange (and there are such things).

That’s a good point, I never dug so deep since I only buy CHF stocks on SIX.

This will not apply to US ETFs fortunately.

I think you have a mistake nuse exchange fee is 0.0030

It’s not a mistake, they have changed their fees recently. I will need to update the article, thanks for letting me know.

Hi! Please, do you know whether there is a way to preview how much would one pay under either Fixed or Tiered? I downloaded the Impact cost for Fixed (above the Preview button), changed to Tiered but it shows the same Impact cost. Do I have to wait for a day for the change to take effect? Thanks!

Hi Peter,

What’s the Impact cost?

Normally, you have to wait until the change is applied, which may take indeed one day to apply. I don’t think you can see both prices without switching and waiting first.

Sorry, I meant “Cost Impact”. It is a link above “Preview” next to “Submit Buy Order”, I was thinking it is used to see the cost in advance.

Yes, you can see the fees in advance with that but only with the current cost model, not changing frequently.