Swiss Stock Market Indexes – SMI, SPI and SLI

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Even in the small Switzerland stock market, many Swiss Stock Market Indexes exist.

Indeed, the Swiss Stock Market is small (about 2% of the world capitalization). But it is considered quite stable. Therefore, there is quite more interest in this stock market than the small market capitalization would make us think.

If you are a Swiss investor, you will probably want to invest in one of these indexes. So, it is essential to know these different Swiss Stock Market indexes to choose the best for your portfolio.

In this article, I go over all the indexes from the Swiss Stock Market. If you prefer visuals over texts, head to the end and discover a helpful infographic I made for the Swiss Stock Market Indexes.

The Swiss Stock Market

In Switzerland, we have two different exchanges:

- The SIX Stock Exchange, formerly SWX Stock Exchange, was founded in 1850.

- The BX Stock Exchange, formerly Berne Exchange, was founded in 1880

The first one is much larger and more well-known than the second one. It is interesting to note that several exchanges (Basel, Geneva, and Zurich exchanges) merged into SIX in 1995. Berne Exchange (BX) had the option of merging as well. But they decided not to take part in the merger.

There are about 270 shares in the entire SIX stock exchange. When we compare that to the approximately 2800 shares of the New York Stock Exchange (NYSE), this shows that Switzerland is small!

Another interesting fact about the SIX Stock Exchange is that this is the first exchange in the world to have a fully automated system for trading and clearing. This system is pretty cool for such a small exchange!

In this article, we will focus on the SIX Stock Exchange since almost everybody trades on this exchange for Swiss securities. Therefore, the Swiss Stock Market Indexes presented in this article will all be about the SIX exchange only.

I will focus primarily on the official Swiss Stock market Indexes provided by SIX directly. The SIX Group is providing the data for these indexes. I will also present a few other indices, but I believe it makes more sense to invest in official indexes when there are some.

If you want to invest in the Swiss Stock Market, the best way is to invest through an index. That way, you will replicate the performance of the entire Swiss Market. If you want to integrate some Swiss shares in your index ETF portfolio, you have a lot of choices.

Swiss Market Index (SMI)

The most well-known Swiss Stock Market Index is the Swiss Market Index (SMI).

It contains the stocks of 20 of the largest Swiss companies. The SIX Stock Exchange directly operates this index. SIX introduced the SMI in 1988.

For inclusion into the index, a company has to pass a few conditions based on trading volume and liquidity. And then, out of this list, they take the 20 largest companies by market capitalization. However, it is generally always the 20 largest companies in the entire Swiss Stock Market. SIX chooses the constituents of the index once a year.

Before 2007, there were 25 companies in the index. After that, SIX changed the index to only 20 companies and removed five companies.

Even though it only has 20 companies, the SMI represents about 80% of the Swiss Stock Market. We have a few giant companies in Switzerland, such as Nestlé, Roche, and Novartis. These companies are dwarfing most of the other companies.

Initially, the index was fully market-capitalization-weighted. However, in 2017, SIX added a new rule to the index. No single company can be more than 18% of the index. I talked before of the three giants. In terms of market capitalization, they represent more than 60% of the index.

Therefore, SIX introduced this capped weighting to reduce their impact on the index to 18% each. SIX is updating the weightings every quarter.

The biggest company on the index is Nestlé. It is almost at the same level as Roche because of the 18% rule.

If we want to invest in the index, we must choose an Exchange Traded Fund (ETF). There are two primary ETFs for the SMI index:

- iShares SMI: 2.1B of assets and a TER of 0.35%

- UBS SMI A-Dis: 1.7B of assets and a TER of 0.21%

Out of these two, I would invest in the UBS SMI ETF. It is a bit smaller, but not too much, and TER is about 40% cheaper! I do not know why the iShares ETF has such a large TER. They have a lot of funds that are significantly cheaper than that.

Swiss Performance Index (SPI)

The Swiss Performance Index (SPI) is probably the second most used Swiss Stock Market index. And the SPI is the index I recommend to most Swiss investors.

It contains about 230 shares, almost all from the entire market. There are only two rules for inclusion in the SPI:

- At least 20% of free float shares. This rule means that at least 20% of the shares should be publicly available.

- Not an investment company.

SIX chooses the constituents of the index every quarter. SIX introduced the SPI index in 1987, one year before the SMI.

The biggest company is again Nestlé, with a significant advance over the second two, Roche and Novartis. These three companies make up 50% of the market.

Here are the available ETFs for the entire SPI:

- ComStage SPI TR UCITS: 10 million CHF of assets and a TER of 0.40%

- iShares Core SPI (CHSPI). 1415 million CHF of assets and a TER of 0.10%

- UBS ETF SPI A-dis: 766 million CHF of assets and a TER of 0.17%

Between these three ETFs, the choice should be obvious. The iShares Core SPI ETF is the biggest and the cheapest of the three ETFs. The UBS ETF is not bad but a bit too expensive. I do not see any reason anyone would want to invest in the ComStage ETF. It is both too small and too costly.

Swiss Market Index Mid (SMIM)

The SMI MID (SMIM) index contains the 30 largest companies from the Swiss stock market index that are not in the SMI index.

If you take the 50 largest companies from the SPI, you can put the 20 largest into the SMI and the 30 others into the SMIM. Considering these 50 companies together, you get the SMI Expanded index. Since there is no available ETF for the SMI Expanded, I will not cover it in detail.

SIX manages this index in the same way it manages the SMI one. They update the index once a year. On the other hand, there is no maximum on a company’s weight. A maximum is unnecessary since the biggest company is less than 10% of the index.

SIX made this index available in 2004, but its price reference dates to 1999. It is a much recent index than the SMI.

This time, the largest company is Partners Group Holding AG, a company from the financial sector.

I have found two ETFs for this index:

- iShares SMIM. 1289 million CHF of assets and a TER of 0.45%

- UBS ETF SMIM. 864 million CHF of assets and a TER of 0.28%

This case is another example where the iShares ETF is much more expensive than the UBS one for some obscure reason. Here, I would invest in the UBS ETF.

Swiss Leader Index (SLI)

The Swiss Leader Index (SLI) is an alternative to the SMI.

The SLI Index comprises the 20 companies from the SMI and the ten largest companies of the SMIM. Simply put, the SLI is the index representing the 30 largest companies on the Swiss Stock Exchange. The SLI is quite recent. It was introduced only in 2007. But for consistency, its pricing was normalized back to 1999.

Not only does this index has ten more shares than the SMI, but there is also another big difference. They put a strong upper limit on the weight of each company. The four largest companies have a maximum of 9%. And the other 26 companies have a limit of 4.5%. It is the only time I have seen limits like this! SIX introduced this special rule to reduce the weight of the three Swiss giants. I think this rule makes this index too complicated.

As a Swiss Stock Market Index, I prefer the simplicity of the SMI. But if you want to lower the allocation of the giant companies, this could make sense.

Logically, the biggest company in the index is Nestlé. But this time, the weighting is less than 9%.

There are three ETFs available for the SLI index:

- iShares SLI: 405 million CHF of assets and 0.35% TER

- UBS ETF SLI: 327 million CHF of assets and 0.21% TER

- Xtrackers SLI UCITS: 32 million CHF and a TER of 0.35%

Given the almost same size and the lower TER, I would choose the UBS ETF SLI and not the iShares SLI ETF. The Xtrackers SLI fund is simply too small for my taste. And 0.35% TER is too high for me.

Other SPI Indexes

There are also a few more Swiss Stock Market Indexes from the SPI Family.

We can start with the SPI Large Index. This index comprises the 20 largest companies from the SPI with the same rule as the SMI. SIX deprecated this index when they reduced the number of shares in the SMI from 30 to 20. Therefore, the SPI Large is now entirely equivalent to the SMI.

Since they changed the weightings of the SMI in 2017 to a maximum of 18% per company, they introduced the SPI 20 Index. The SPI 20 is the equivalent of what the SMI was before 2017. The SMI and the SPI 20 contain the same list of stocks. But the SPI 20 has no upper limit on a company’s weight.

We can split the rest of the SPI into the SPI Mid Index and the SPI Small Index. The SPI Mid Index has 80 companies. These are the largest 80 companies from the SPI that are not in the SPI Large. The SPI Small index contains all the companies not in SPI Large and SPI Mid.

Finally, there is one more index. The SPI Mid and SPI Small together form the SPI Extra Index. Another way to put it is that SPI Extra is all SPI but SPI Large.

Of these indexes, only the SPI Mid Index has an available ETF: UBS SPI Mid A-Dis, with 159 million CHF of assets under management and a TER of 0.29%. Overall, investors should stick to the main indexes.

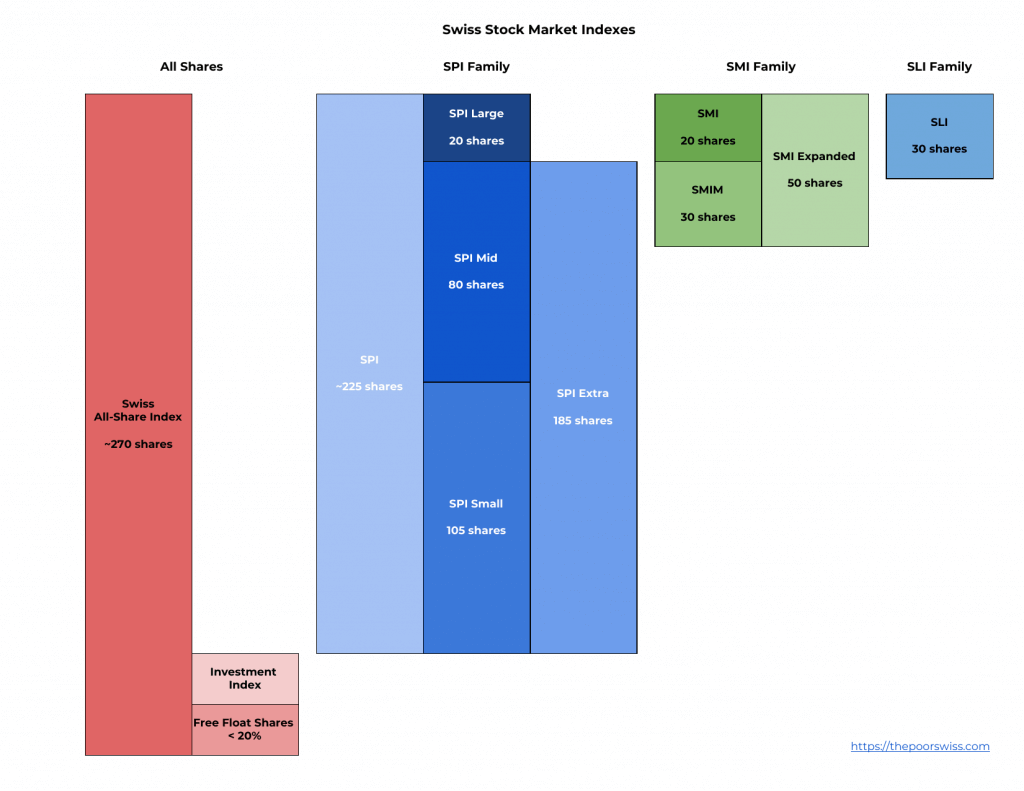

Visual Swiss Stock Market Indexes

Since most of the Swiss Stock Market indexes are linked, and some are simply a combination of other indexes, we can visualize them quite nicely. It will probably make sense to the visual readers. Since I did not find a recent infographic that is free to use, I decided to do it myself.

I am pretty happy with the result. It is probably not much for you. But I am terrible at any graphics task. So without further ado, here is my fancy infographic:

I think it is straightforward to visualize the different indexes using this infographic. You can see the size of the indexes, and you can also see the relations between the various indexes.

If you want to reuse this infographic, feel free, but I would ask that you cite this article as the source.

What do you think of my not-so-fancy infographic?

Indexes from other providers

I went over all the SPI, SMI, and SLI families first because they are provided directly by the SIX Stock Exchange. For me, it makes more sense to have an index that comes from the same country as the shares themselves. Therefore, I will not go into the details of all these indexes. But it is good to know that the SIX indexes are not the only ones out there.

The first index to consider is the Dow Jones Switzerland Titans 30. Cool name, right? This index contains the 30 largest and most liquid companies in the Swiss Stock Market index. This index is almost the same as the SLI index but without the upper limit on the weights. I would rather use the SLI instead of this done, even though its name sounds less cool!

Another one is the NASDAQ Alphadex Switzerland index. This one is really weird. It only contains 41 companies. Instead of using a simple market-capitalization weighting, it uses the Alphadex methodology. The idea is that they are trying to beat the market by using a smarter selection instead of replicating the market performance. For this single reason, I would not invest in this index. We know that we cannot beat the market in the long term.

MSCI offers several Switzerland indexes:

- MSCI Switzerland. It tracks the 38 largest companies of the Swiss Stock Market.

- MSCI Switzerland 20/35. It is the same as the previous one except that the largest stock is limited to 35%. Also, all the other companies are limited to 20 of the index.

- MSCI Switzerland IMI. It contains the 118 largest companies from the Swiss Stock Market.

And MSCI has currency-hedged versions of all these indexes. Hedging leads to many ETFs and indexes available.

I am not fond of all these indexes. They do not offer any advantage compared to the indexes from SIX. And some are simply the same as existing SIX indexes. Also, there are not many ETFs available for these indexes. So it is difficult to invest in these indexes. But of course, as usual, feel free to choose the index that suits you best!

The Best Swiss Stock Market Index and ETF

To invest in Swiss stocks, you must pick a Swiss Stock Market Index. The one you will choose will depend on your needs.

If you want to invest in the Swiss Stock market, the best index is the Swiss Performance Index (SPI). It is the most diversified index of the Swiss Stock Market with 270 companies. And the best ETF for the SPI index is the CHSPI ETF from iShares. This ETF has a 0.1% TER and manages 1.5B CHF of assets.

Now, if you do not like that three giant companies (Nestle, Roche, and Novartis) are dominating the SPI index, you can opt for something different. In that case, the best option is to use the SLI index, which has maximums for large companies. And the best ETF for the SLI index is the UBS SLI ETF. This ETF has a 0.21% TER and manages 520M million CHF.

Finally, if you only want to invest in medium or small companies, you also have your choice of Swiss Stock Market indexes. For medium companies, you could invest in the SMIM index. And for small companies, you could invest in SPI Small.

Overall, the best Swiss Stock Market index is the SPI Index. The only reason to use another is if you do not want too much allocation to large companies. In this case, you can weigh in with other indexes to obtain your desired allocation. But I prefer to trust the indexes rather than make my own. In investing, I always try to keep it simple.

Conclusion

Even for the small Swiss Stock Market, there are many available Swiss Stock Market indexes.

All sizes of companies are present. Since some indexes changed over the year, there are also some duplicates. And since there are three giants in the Swiss Stock Market (Nestlé, Novartis, and Roche), they had to do some fancy things with a limit on the weights of each company to have a better representation of more companies.

For me, the best Swiss Stock Market Index is the SPI index. The SPI is the Swiss Index I currently recommend, and I am investing myself in this index with the iShares SPI ETF (CHSPI).

Overall, some indexes make more sense than others. The SPI, SMI, and SLI indexes make the most sense. If you do not know what to invest in, you should probably invest in the SPI. It is the wider available index. And it is also the one with the cheapest ETF.

As for the ETFs for these indexes, there are good ETFs available for the most important indexes. It plays out between iShares and UBS. Sometimes, the UBS ETFs are cheaper. Sometimes the iShares ETFs are cheaper. For each index, it is necessary to choose the best ETF to invest in.

If you do not know how to choose an index, I have a guide on choosing the best index to invest in.

Do you know other Swiss Stock Market indexes? Do you invest in any of them?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Investing Fundamentals

- More articles about Investing

- Who Is John Bogle? Founder of Vanguard

- Sustainable Investing in Switzerland in 2024

- The Little Book of Common Sense Investing – Book Review

Be careful!

The UBS SPI ETF (SPISI) has now a 0.15% TER. Plus there is no dividend distribution. It means no taxes for private investors!

The CHSPI (ishares) still has a 0.1% TER but it offers dividends which will taxed (between 20% and 40% depending on you other incomes and where you live).

The TER is not the only cost! And the difference between a 0.1% and a 0.15% TER is exactly 5 CHF for a 10’000 CHF investment!

Hi Dan

You are wrong about taxes! An accumulating ETF has exactly the same taxes as a distributing ETFs in Switzerland.