How to Choose an ETF or an Index Fund

| Updated: |(Disclosure: Some of the links below may be affiliate links)

If you have decided to invest passively in the stock market, you must first choose the stock market index. And then, you will have to decide through which index fund you will invest in this index. For this, you can choose either a mutual fund or an Exchange Traded Fund (ETF). For popular indexes, there will be a wide choice of index funds replicating the performance of this index.

Even if you only choose popular funds for a precise index, it will still be challenging to decide. As you will see in this article, there are many things you can take into account when you compare two index funds. The most important remains the price, as most people know. But there are other points you can use to compare two index funds. And some of these points are not obvious.

In this guide, we see everything you can look at when choosing an index fund, whether a mutual fund or an Exchange Traded Fund (ETF).

Total Expense Ratio (TER)

The Total Expense Ratio (TER) of an index fund is probably the most important metric you need to look at! Sometimes, it is simply called the Expense Ratio (ER). Since you are comparing two funds that follow the same index, the difference in returns will depend on how much fee they are charging you.

The TER is the total fees removed from the fund each year to pay for the fund’s management. These fees include paying for the employees and advertisements, for instance. The TER is expressed as a percentage. This percentage is removed from the fund around the year.

When you invest passively, the only control you have over future returns is the total amount of fees you will pay. Therefore, you must choose an index fund with a very low TER.

For instance, we can look at two index funds following the S&P 500 index:

- Vanguard S&P500 ETF (VOO): The TER is 0.04%

- SPDR S&P 500 ETF (SPY): The TER is 0.09%

If you have 100’000 USD invested and choose VOO over SPY, you will “save” 50 USD per year. 50 USD per year may not sound like much. But after 20 years at 8% yearly returns, this is more than 4000 USD that you will have saved. Therefore, based only on the TER, you should choose VOO over SPY.

In my opinion, the TER is the most important metric for comparing two different index funds. However, this is not the only metric! You need to consider many other things as well.

Assets under Management (AUM)

Many index funds are tracking the same index. Some of them are managing a lot of money, and some of them are much smaller. The amount of money one fund manages is called the Assets Under Management (AUM). This metric gives you how much money people invested in the fund. It is an important metric to see if a fund is popular. However, it is a bit more difficult to evaluate than the TER.

Generally, a very large fund is a better choice than a tiny one. If the fund is very small, there is a risk it may end up being closed. It may also indicate that it is not popular for some other reasons. A very large fund is also probably more liquid than a smaller one.

Now, there is an exception here. If you want to track the performance of an index with small-cap companies, you may want to choose a smaller fund. The reason is that if a fund is too big, large investments in small companies may have a significant effect on its stock price. Moreover, some small-cap funds have been known to start investing in medium-cap companies when they grew. It means you are not investing in the same thing anymore.

In any case, you should not consider absolute values. For instance, a fund managing 400 million dollars is not necessarily better than one managing 350 million dollars. However, something must be said when you compare a fund managing two billion dollars and one managing ten million dollars.

Now, there is a slight twist here. For many funds, you will find two numbers. For instance, if you look at VOO on Vanguard, you will find these two numbers:

- Fund total net assets: 400.7 billion USD

- Share class total net assets: 90.6 billion USD

The reason is that this fund, like many others, is available in several different share classes (ETF, Admiral shares, and Investor Shares). Therefore, the first number is the amount of all the shares of the stock. And the second number is the amount of all assets under management only for shares of the ETF itself. The total net assets is the number you are interested in.

We can take an example again with the Russel 3000 Index:

- iShares Russell 3000 ETF (IWV): 9.6 billion USD AUM

- Vanguard Russell 3000 ETF (VTHR): 420 million USD AUM

IWV is more than twenty times larger than VTHR. Based on only the AUM, you are better off with the IWV.

Number of stocks

Even though you may think two index funds following the same index should have the same number of stocks, it is not always true. Therefore, an important thing to consider when comparing two index funds is the number of stocks (or holdings) of both funds.

At the time of this writing, Vanguard S&P500 ETF (VOO) has 509 stocks. It is quite counter-intuitive since it follows an index of 500 companies! It gets even worse because the S&P500 index has, in fact, 505 stocks. The reason is that some companies, such as Alphabet (Google), have several classes of shares, and the index comprises them all.

Several reasons may make an index have more or fewer stocks than its index. For instance, if the fund is too small and there are many stocks in the index, it may not yet have the opportunity to buy the smallest companies.

Since most funds are market-capitalization-weighted, there are more shares of the big companies than of the small ones. The fund will acquire the shares of the smallest companies as it grows. Another reason is that for saving money on transactions, some funds do not buy and sell all the time. Therefore, there may be some differences between the index and the fund. Finally, the fund managers can add or remove companies from the index.

Generally, you should prefer funds with a number of holdings as close as possible to the number of stocks in the index. For most indexes, there will not be much difference between funds. But if you look at large indexes, you may want to pay attention to that.

Trading Volume

Another interesting thing to consider is the trading volume of each index fund you are comparing. The trading volume is the number of transactions done for the fund. Each time one share is sold or bought, the volume is increased by one. It is a pretty straightforward notion. Generally, a bigger fund has a bigger trading volume. However, some similar funds have a much higher volume than others.

It is important because it tells you how liquid a fund is. A large trading volume indicates that shares are easy to buy and sell for this fund. But it also tells you that the difference between the ask price and the bid price is small. This difference is often called the bid-ask spread. The smaller the spread is, the better prices you will get when you buy and sell.

If you hold for the long term, it is not that important. But it could be good to know that you can liquidate your shares at the best price.

For instance, we can look at the average trading for three S&P 500 funds:

- SPDR S&P 500 ETF (SPY): This fund has a trading volume of 122 million shares per day.

- iShares Core S&P 500 ETF (IVV): This fund only has 6.3 million trades average daily trading volume.

- Vanguard S&P 500 ETF (VOO): This last fund only has 4.4 million trades per day on average.

Interestingly, even though SPY is less than three times larger than VOO, it has thirty times more trading volume. Thus, it is consistently one of the highest trading volume instruments on the stock market.

Fund Domicile

If you are in the United States, you will likely only invest in the United States. That is not to say you should not invest in indexes outside the U.S., but you can find U.S. funds with international exposure.

In Europe, it is a bit more challenging to choose between index funds coming from different countries. If all other things are equal, the fund domicile should be considered. Of course, there are some cases where you will not find funds from different countries. But for popular indexes such as The S&P 500 index, there are many funds from many different countries.

For European investors, U.S. funds are generally the best. The reason is related to taxes on dividends. Investing in U.S. funds is more tax-efficient than investing in Swiss funds in Switzerland. It is only true for funds containing U.S. equities. But since half of the world stock market is in the U.S., it is more than likely that you have many U.S. equities in your portfolio.

If you invest in an S&P500 fund from the U.S., 30% of the dividends will be withheld. However, you can reclaim the entirety of these dividends. It makes an effective 0% withholding tax. The next best thing is to invest in an Ireland fund where only 15% will be effectively withheld. For other countries, it will vary from 15% to 35% for Swiss investors. So if you can, you should invest in U.S. funds, and if you cannot, you should invest in Ireland funds.

There is just one caveat with U.S. funds: the U.S. estate tax. If you still hold these funds and pass away, you must declare your funds to the Internal Revenue Service (IRS) from the U.S. This will likely burden your heirs. However, unless you have more than 11 million dollars, they should not have to pay a tax on it.

If you are opting for any non-Swiss ETFs (including U.S. ETFs), read my article on how to file your taxes with foreign ETFs.

Dividend Distribution

When you hold an index fund, you own shares from many companies. Some of these companies will pay a dividend. First, the fund managers are receiving these dividends. However, in the end, the dividends are for you. Therefore, at some point, the fund’s shareholders, you, will receive these accumulated dividends.

There are two ways to do that. First, the fund can distribute the money as a dividend from the fund. Generally, funds do that quarterly. The other way is to accumulate dividends directly into the funds. That way, the fund share price will grow the same amount of dividends you would have gotten per share. Interestingly, European fund providers use this a lot. But U.S. fund providers only use it very rarely.

In some countries, there are some tax advantages to accumulating funds. It is not the case in Switzerland. Here, they have the same tax efficiency. Another advantage of accumulating funds is that you can save a bit on transactions because you do not have to buy shares with dividends. If you plan always to reinvest the dividends, accumulating funds may make sense.

On the other hand, distributing funds may give you some more flexibility. You will have some extra cash to invest in whichever fund you want. You could use that to rebalance your portfolio. This extra useful cash is the main reason why I prefer distributing funds. To learn more, this article compares accumulating funds and distributing funds.

Replication Technique

I have already talked at length about index replication in the past. First, there are two main families of replication: physical replication and synthetic replication.

Physical replication is simple. It means that the fund will hold shares of the companies in the index. Synthetic replication means they will use some derivatives to replicate the market performance. I do not want to go into detail about synthetic replication. I recommend you do not invest in synthetic ETFs! You should keep it simple with physical ETFs.

There are two main ways of physically replicating the index: Full Replication or sampling.

Full Replication means that the fund will hold shares from all the companies from the index. Full Replication is a simple strategy to replicate the index’s performance correctly. However, this is not always possible. For example, if the index has too many companies, it may not be efficient to hold shares of all the companies.

When it is not possible, or not efficient, to do Full Replication, index funds use sampling. In that case, they own only a part of the shares of the index companies. For instance, they could hold shares of 90% of the companies on the index. Sampling is not bad and is very close to what we discussed in the “Number of Stocks” section.

However, there is something different in that funds can also hold other things. Sampling funds can also contain some derivatives such as futures, contracts, and options to replicate the performance of the market. Thus, the fund managers have more freedom to do what they want.

I much prefer a Full Replication fund rather than a Sampling fund. However, if the index is large, you may not have the choice. In that case, it is better to prefer Sampling funds with the highest number of equities from the index. That way, you will know better what the fund holds!

Tracking Difference and Tracking Error

If you want to go deep into your analysis of an Exchange Traded Fund or an index fund, consider the Tracking Difference and the Tracking Error as metrics to compare two different funds.

The Tracking Difference is the difference between the performance of the ETF and the index’s performance. For instance, if the index returned 10% in one year and the fund returned 8.9%, the tracking difference is 1.1%.

Many things influence the Tracking Difference. The most obvious factor is the TER. Indeed, all the fees of the fund are removing some returns. But this is not the only thing. To reduce fees, funds will only buy and sell shares a few times yearly. That means that they do not always perfectly replicate the market. This can make a big difference. And the number of shares the fund holds can also make a difference.

The Tracking Error is directly related to the Tracking Difference. The Tracking Error measures the variability of the differences in returns. It is measured as the standard deviation of the daily Tracking Differences over one year.

Generally, you want the lowest Tracking Difference and Tracking Error for an ETF. Unfortunately, it is difficult to find these metrics. I have not found a website that gives me the tracking errors and tracking differences for all ETFs. If you know one, please let me know! If you want this data, you must look at the documents provided by the fund provider. They are generally updated every quarter with this information.

However, this is an advanced comparison. You probably will not have to go that deep in your analysis of an ETF!

Historical Fund Returns

Something that some people want to compare is the historical returns of the funds. In itself, it is not useful because this is the past, and we have no way of predicting the future.

Past Performance Is No Guarantee of Future Results

However, it is interesting to see if there is a significant difference between different funds. The past performance is highly related to the Tracking Difference of the funds. If there is a significant difference in Tracking Difference between two funds, there will also be a significant difference in returns. Most of the time, you will see a large correlation with the TER of the funds.

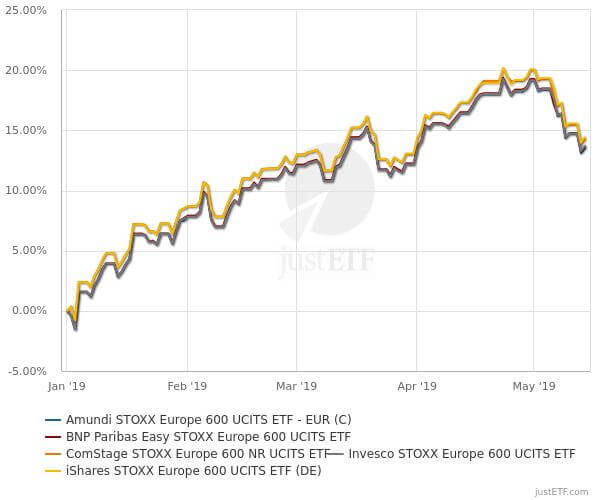

For instance, here is the graph of the performance of five ETFs for the Euro STOXX 600 index:

Two of the funds are performing significantly better than the other three. The five funds have very comparable TERs, so it is different in how they follow the index. In general, you will not have such a difference! I had to look for a while to find a good example. In the long term, these five funds do not differ much.

It could be useful to compare the historical returns if you are hesitant between several funds. They should be as close as possible to the index performance.

Currency Hedging

The last thing I want to mention is currency hedging. But first, you need to consider that not all funds are in the same currency. Generally, each fund is in the currency of the country the fund is from. Most S&P 500 funds are in USD, for instance. However, if you take an S&P 500 fund provided by a European fund provider, it could be in EUR. In any case, the underlying currency would always be in dollars. It is just traded in a different currency.

We can get back to currency hedging now. Owning a fund in foreign currency implies a currency risk. If your base currency becomes stronger, your investments in foreign currencies will lose value. And if they become weaker, you will get more. This risk is called currency risk.

In the short term, there can be a lot of variations. Some people do not want to take that risk. Therefore, they buy a fund hedged against their currency. If you buy a USD-denominated fund hedged to CHF, it will not matter if the USD or the CHF becomes stronger. Currency-hedged funds always have more fees than the equivalent unhedged fund. The hedge fee is a premium you pay to eliminate the currency risk.

There is something fundamental to know. It is not because you have an S&P 500 fund denominated in CHF that you do not have any currency risk. If the dollars go up or down, the value in CHF will vary greatly! But, as said before, the underlying currency of the S&P 500 is always the dollar. And all the companies in this index trade in dollars!

I do not invest in currency-hedged funds. I am investing in the long-term. As such, I do not believe the fees are worth it. If you invest consistently, the variations in the foreign currencies will also be averaged over time.

If you want more information, read my in-depth article about currency hedging.

Conclusion

As you can see, even after you selected an index, it remains a difficult task to pick a mutual fund or an Exchange Traded Fund (ETF) for this index. You can take many parameters into account when you compare two funds.

You do not have to use all these parameters. Depending on the situation, you may only need to look at a few. Although it is a critical parameter, the TER is not the only thing you should look for in a fund. Sometimes, the cheapest fund is not the best. It may be too small or hold too many derivatives. And even if you do not need these parameters to make your choice, it is essential to know them for the funds you are investing in. It is essential to understand your investments!

Now that you know how to choose an index fund, you may want to know how to design an entire ETF Portfolio!

If you do not have a broker account yet, I recommend you try Interactive Brokers. IB is a very cheap broker with a lot of great features.

What about you? How do you choose between two funds?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Investing Fundamentals

- More articles about Investing

- Swiss Stamp Tax Duty – All you need to know

- You should invest every month not every quarter

- The Complete Guide to Asset Allocation

Hi Baptiste,

Do you know why some institutional funds, such as the “UBS (CH) Institutional Fund 2 – Equities Global Small Cap Passive II I-X” (https://www.ubs.com/ch/de/assetmanagement/funds/asset-class/ch0209675195-ubs-ch-institutional-fund-2-equities-global-small-cap-passive-ii-i-x-pd001.html) can have incredibly low TERs compared to the ETF funds normal people have access to?

For example Finpension 3a is investing in this fund, which raises the question, how can they possibly have a ~0.39 annual fee, when the funds are basically for free? In any case, it doesn’t make sense in my eyes how UBS can provide this fund for 0.00% TER.

Hi Peter,

These are funds for financial institutions only. THey have low TER, but generally buy and sell fees. On top of that, they are making money on volumes.

As for Finpension, the 0.39% is mostly to pay Finpension:

* The employees

* The IT system

* The real estate

As far as I know, this is still the cheapest 3a in Switzerland. And other 3a like VIAC, are using the same funds. So you can ask this of every 3a. I don’t think this is prohibitive, but you would need to access their budget to know exactly what they do with this money.

Hi Baptiste,

Amazing guide! I just have a question and cannot seem to find it in this post or on the blog.

Suppose I already chose an index/ETF to invest in, let’s say VUSA. Searching over DEGIRO, I still get multiple options that differ in their exchange market/currency. I know internally they would all have USD, but how can I choose which one is best to choose for me as a Swiss investor to buy VUSA shares?

Would I benefit by choosing the option that is using the Swiss stock market (SWX) to buy VUSA shares since by doing that, I wouldn’t need to convert my CHF to EUR/GBP/USD/…?

Thanks so much!

Hi Aydin,

It depends on a few factors. Personally, I prefer to hold a USD-ETF in USD because I then have a better idea of its worth. And I prefer to hold it in the stock exchange with the highest volume. These two criteria would each discourage the use of SWX.

However, it is true that DEGIRO is not the cheapest for currency conversion (0.25%), so it’s up to you to weigh this in the balance, especially thinking that at some point you will have to sell your stocks and this will likely yield large fees.

Thanks so much for the reply!

Yeah I’d also rather have it in USD but unfortunately I don’t have access to IB (and hence US ETFs).

Do you mean that if I would go for SWX, when selling the shares, I’d have higher fees compared to EAM?

And also, for saving on withholding tax, the entity of the ETF is important, not the market you buy from, right? Because the Vanguard entity is in Ireland (and as you mentioned I’d save 15% withholding tax), but if I buy it from SWX, will I lose this saving?

Thanks a lot!

Hi

It’s possible, but it’s difficult to assess in advance. However, with DEGIRO 0.25% fee, you are likely better off with the ETF from SWX in CHF. This may cost you slightly more to sell since the spread will be higher, but very unlikely to be 0.25%.

For your second question, you are fine the domicile matters, not the exchange.

Perfect! Thanks so much for the great insights!

And thank you again for taking the time to go through comments, I seriously don’t know how you have the energy to do it so thoroughly, haha!

Best of luck to you!

I am glad you appreciate this :) It does take a lot of time, but the goal of this blog is to help people and answering questions is part of that :)

Hi Baptiste,

thanks a lot for all these super precious information. Starting from zero into this world, I’m really taking a lot of benefit and starting to have an idea on how things work here..

I have a curiosity I want to ask you (and apologize if my question will look similar to the last one you received in Oct):

looking at VOO and VT, on which basis have you decided to go for VT?

If I only look at the markets’ weighted exposures, VT has 61% of US, whereas VOO has 100%. For me this means that even if VT is more diversified from a geographical point of view, it still has a huge component of the US. That means to me that it doesn’t matter if the US part performs well or not, it will always highly influence VT, moving its behavior to look quite the same to VOO. Therefore if one would like to diversify his portfolio, from a market point of view, the two ETF will not be that different..The only difference I can notice is that VOO seems to have better TER and better historical data in general (even if we know, historical data are not a good indicator to analyze future performance).

Thanks in advance for showing your point of view :)

and all the best for this new year!

andrea

Hi Andrea

I am glad my content is helping you!

You are right that the US has a huge influence on the world stock market because it’s always been between 50 and 60% of it. A 40% difference is still very significant, it will matter.

On top of that, VT will automatically adapt the % of US stocks based on market cap. So, if the US does poorly this next decade, the % would decrease to 50% or even 40%, in which cases, you would be “diversified away” from the US. On the other hand, if you had VOO, you would be stuck with only 100% of poorly performing stocks.

Many people invest solely in the US. I don’t think it’s a very bad thing, but I would not want this for my portfolio, this is why I don’t recommend it.

thanks a lot Baptiste, you’re really kind.

all clear!

cheers

a

Dear Baptiste,

First, let me thank you so much for this great blog and for taking the time to answer all the questions. You help a lot to everyone wanting to educate themselves in the field of finance.

I`m about to start investing in a US ETF on IB and I`m kind of torn between VT and VOO.

I know the importance of international diversification and the fact that you and many other amateur and professional investors with a lot of knowledge and experience choose VT for their base ETF should be enough for me, a beginner, to do so as well.

However, I can`t get over the fact that the annual returns of VOO (13,76%) outperformed VT (6,82%) by double since their inception (official data from the website of Vanguard). I know that the strong performance of the US market in the last 10-15 years doesn`t mean it will stay like that and another cycle might soon come like in the 80s or 2000s when the US was outperformed, but is this speculation without clear signs enough for choosing VT over VOO? In other words, is it worth betting on a changing world market already even though it may not even happen? Wouldn`t it be enough to start investing in the emerging markets once they start to rise? I`m curious what your take is on that.

Hi Balint,

Thanks for your kind words! I am glad my content is useful.

For me, this is enough. But again, there are people using only the S&P500 in their portfolio.

One thing you could do is get a bias on VOO. For instance, 30% VOO, 50% VT and 20% home bias or something of the sort based on your bias towards the US. There is nothing wrong with such a portfolio.

It’s true the performance of the US stock market may always outperform the rest of the world, but again it also may not. We could see the rise of India or China or even another country. For me, this warrants international diversification. However, I do not really believe in Europe, so this is a bit wasted. But I’d rather keep it simple.

Thank you so much for your answer. I will consider this option.

Dear Baptiste,

Thank you very much for making available all this information. You are able to put all these complex subjects on a simple and easy way of understanding. I’m sure it took a lot of work and time. For that thank you so much.

I have a question regarding ETF funds details. You mentioned things like AUM, number of stocks, Trading Volume, etc. But for some reason in CSX online that information is not available. As a CS (Credit Suisse) employee i must do my investments through their services. So i dont understand if that information is not available on purpose or for other reason.

Is there a way to gather that information somehow, for instance using ISIN? How can i make sure i am investing on something “safe” (that will not desapear). Here is an example of 1 ETFs i am looking on:

Vanguard S&P 500 ETF; ISIN US9229083632; Valor 22423967

Thank you so much for your attention and for sharing this valuable information

Thanks for your kind words, I am glad this is helpful.

You can simply paste the ISIN in google and you will get all the information you need from multiple sites. Personally, I like getting information from justetf, you can easily search for a ISIN. For instance, for yours: https://www.justetf.com/en/etf-profile.html?isin=IE00B3XXRP09

Normally, the broker should not matter much for the fund.

Hello Baptiste,

Great article! May I ask if it makes sense to buy an US-listed ETF for non-US shares, eg Asia-Pacific or Eurozone, or would it be preferable to buy an ETF domiciled say in Ireland? I understand a withholding tax may apply in both cases, ie only part of the dividends paid out by a company reach the ETF. But in the US case, there would be an additional withholding tax once the ETF transfers dividends to its shareholders (I understand this can be claimed back later on when filing Swiss taxes). So unless the TER is notably lower for the US-domiciled ETF, I wonder whether the Irish-domiciled ETF is actually a better option for non-US stocks as it saves the hassle with taxes. Many thanks!

Hi Johannes,

For ETFs that do not have US shares, it makes very little difference generally. There could be some countries that have a better tax treaty with Ireland or US, and in that case, we should choose accordingly. But since the US represents 50% of the world stock market, it’s more important to optimize for them.

I would say US ETFs for anything that has US shares. Then, the lowest TER (and other fundamentals like big enough funds and volume) for other markets. Ireland is great for all European stocks for instance.

Dear Baptiste,

Many thanks again, your explanations are very helpful indeed.

One question that came to my mind was whether it makes a difference in terms of withholding tax if an ETF invests in US stocks vs US bonds? Put differently, would interest/coupon payments to ETFs outside the US (say in Ireland or Luxembourg) also be subject to 15% withholding tax or does it only apply to dividends paid to non-resident aliens? Looking at annual reports of some US bond ETFs domiciled in Ireland, I had the impression that they don’t pay 15% withholding tax but I was not sure whether my understanding is correct.

Many thanks!

Hi Johannes,

Good question and I am really not sure. Looking at the IRS website, I would think that bonds are taxed the same way as stocks. But it may be that this only applies to bonds from US companies, not bonds from the government.

Hello Baptiste,

Thank you very much for your blog- it helped me to finally start investing :)

Could you please explain the process how TER is paid? Should I keep some cash on my IB account for that? Is it reflected in any reports?

All the best wishes and happy New Year! Have a great 2023!

Veronika

Hi Veronika,

Good question. The TER is directly removed from the fund by the fund manager, so this is very transparent and you don’t have anything to do.

Happy new year to you too.