Investing Fees could cost you your early retirement!

| Updated: |(Disclosure: Some of the links below may be affiliate links)

When you are investing, you want to minimize your investing fees. It is something most people already realize. But what most people do not realize is how expensive fees can be in the long term.

In this article, we see precisely how much investing fees are hurting you! Not only will we see that they are more expensive than they seem. We will also see that investing fees have a significant impact on your retirement!

And of course, we cover different kinds of fees there are (there are more than you think!). Finally, I will give you a few pointers on how to reduce all these fees.

Types of investing fees

When you are investing, there are many different types of investing fees. It is essential to know about them to avoid them.

Of course, there are some fees that you cannot avoid. But you can still minimize them. And some fees are more important than others so you will need to consider them first.

Management Fees

The most important investing fee is the management fee.

Management fees are something you will pay every year on the stock market funds you are investing in. In funds, this is called the Total Expense Ratio (TER).

The reason this fee is very important is that it is set in % of your invested money. It means that you will lose some percentage of your money year after year. The more money you have, the more fees you will pay!

While there are some mutual funds and ETFs with 0% TER, it is still very rare. Therefore, you cannot entirely avoid this tax. But you can minimize it.

Unfortunately, there are some considerable discrepancies between funds and ETFs. For instance, my primary ETF is Vanguard Total World (VT), with a TER of 0.08%. If you take the PostFinance Fonds Global A that invests similarly, it has a TER of 0.80%. This ETF is ten times more expensive!

And you can find even more expensive funds. For instance, another similar fund, the Raiffeisen Global Invest Equity A, with 1.32% TER! And the UBS Vitainvest 100 World U is coming at 1.61% TER! This ETF is 20 times more expensive than VT!

By choosing the fund with the lowest TER, you can divide your management fee by twenty! It is a lot of money!

We can take a simple example. If you have 100’000 CHF invested in this fund, VT will cost you 80 CHF per year. But with UBS, you will lose 1610 CHF per year! And this is only for one year. The long-term costs are much higher, as we will see shortly. We will see in the next section that this could mean the difference between early and late retirement.

So, you need to minimize management fees! And you need to check these fees. When you choose a fund, a financial service, or a broker, you need to read well about all the fees they may have. Sometimes, they are not transparent, and some fees are hidden. You want to do your research correctly.

Issuance and redemption fees

There is another fee you must be very careful about, issuance and redemption fees!

An issuance fee is a fee that is paid when you buy shares of a mutual fund (or another investment). And a redemption fee is a fee that is paid when you sell shares of a mutual fund (or another investment).

These two fees are generally expressed in percentages. For instance, if you have an issuance fee of 0.2% and a redemption fee of 0.3%, you will pay 2 CHF to buy 1000 CHF of shares and pay 3 CHF to sell 1000 CHF of shares.

Many believe these fees are less critical since they are only paid once. This fee indeed has less impact than the management fees. However, they can have a significant impact.

What is essential to know is that there are many funds without any issuance and redemption fees! It means that you can avoid this fee entirely! So, there is no reason to pay an issuance and redemption fee.

Secondly, even a 0.1% fee will weigh you down long-term. If you invest 10’000 CHF right now and you directly lose 10 CHF, this means your investment is in negative territory directly. And the issuance fee will also take a cut of your returns. If you sell after ten years and double your investments, you do not want to give away even 0.2% of this!

The great news is: if you invest in ETFs, there are no such things as redemption and issuance fees! And some good mutual funds like Vanguard do not have such fees either.

So, you should only choose ETFs or mutual funds with no issuance and redemption fee. And when you are presented with an investment, make sure to check these fees.

In 2023, there is no reason to pay issuance and redemption fees

Transaction fees

When you invest in the stock market, you must use a broker. And broker will introduce a new set of fees: the transaction fees.

Every time you do a transaction on the stock market, you will pay some fees. You will generally pay the same transaction costs when you buy and sell.

The differences between brokers can be huge. You can easily find brokers ten times more expensive than others when you invest. For instance, buying 100 shares of Novartis will cost you 5 CHF with Interactive Brokers and 40 CHF with Migros.

And on the U.S. Stock market, the difference is much more significant. Buying 100 shares of Microsoft will cost you 0.36 USD with Interactive Brokers and 80 USD with Swissquote! Swissquote is 200 times more expensive for this trade!

If you invest monthly, like me, these fees can quickly add up to several hundred CHF per year. So, you need to be careful.

Custody fees

Sometimes, some brokers will make you pay custody fees. And more likely, some financial services will also make you pay a custody fee.

There are two kinds of custody fees:

- The custody fees with a fixed amount. While you want to minimize them, they are not so bad unless you are starting up.

- The custody fees with a percentage. These fees are the same as management fees and should be minimized or avoided.

When you choose a broker, you want to avoid custody fees in percentage. If there is a maximum per year or quarter, it is not that bad. But without a maximum, you can pay a lot of your fees. For instance, Migros Bank has a custody fee of 0.23% per year without a maximum. I would never invest with a broker with a percent-based custody fee and no maximum. The problem is that most people will not even verify this!

When you choose a financial service like a Robo-advisor, you want to select the cheapest one for your needs. These services always have a custody fee. You will not be able to avoid it. But you need to find the one with the lowest fee that fits your needs.

So make sure you are avoiding brokers with custody fees and choosing financial services with low custody fees.

Never invest with a broker with a percent-based custody fee and no maximum

Taxes

Now, in some countries, you must pay taxes on your portfolio. They are not directly investing fees. But they will have the same effect. Two kinds of taxes could be important here.

The first important tax is a wealth tax. This kind of tax is based on a percentage of your net wealth. So, the wealth tax has the same effect as a management fee except that you will pay it in cash, and it will not be removed from your portfolio. And Switzerland has a wealth tax, so you need not forget that.

The other important tax is the dividend tax. Since the dividends are a percentage of your net worth, any tax on dividends will also be a percent of your net worth! Once again, this acts in the same way as a management fee. For instance, if you pay 10% taxes on your 2% dividends, this is a 0.2% tax over your entire portfolio. A 0.2% tax is very significant, as we will see shortly.

The long-term cost of investing fees

Now that we have seen the different fees there is, we can take a look at the long-term impact of the investing fees.

You may think a few hundred in fees here and there is not so bad. But over the long term, it can make a very significant difference. And you need to be aware of that to motivate you to minimize these fees.

For this, we will make a few simple simulations with different management fees. If you have a custody fee in % of your net worth (Robo-advisors, for instance), you can treat it as a management fee. It is important to consider everything together.

I will not make simulations with transaction fees and issuance fees because there are too many factors going on. But it will still make a significant difference in the long term! Unless you invest with a stupidly expensive broker, transaction costs do not matter much in the long term.

And the impact of redemption fees is pretty easy to understand. If you have a redemption fee of 0.3%, you must increase your net worth by 0.31% to be financially independent. When looking at a 2 million net worth, this is an extra 6200 CHF that you need! But this is not nearly as bad as a 0.3% management fee!

For each period, I will do two simulations. For the first one, I will simply take a 5% yearly return for the simulation. These are somehow reasonable returns to expect.

And in a second time, I will compute the historical chances of successful retirement with different investing fees. For this, I use the 4% Rule. If you do not know about this, I encourage you to read my article about Trinity Study results. In this article, you will find the details of my simulations.

Impact over 10 years

We start with the impact of fees over ten years. Ten years is a short time for investing.

Here is the evolution of a portfolio starting at 100’000 CHF from 0 to 10 years with different levels of fees.

![Value of investments with investing fees [5% Returns] - 10 years](https://thepoorswiss.com/wp-content/uploads/2020/05/Value-of-investments-with-investing-fees-5-Returns-10-years-1024x762.png)

Most people think they will pay the same amount of fee every year. But if the portfolio gets bigger, so do the fees. So fees also compound if your portfolio compounds! And you lose more money to fees than only the fees you pay. There is also the lost opportunity of having these fees compound into your portfolio.

Here is how much money you will lose with fees:

![Money Lost to Investing Fees [5% Returns, $100'000 portfolio] - 10 years](https://thepoorswiss.com/wp-content/uploads/2020/05/Money-Lost-to-Investing-Fees-5-Returns-100000-portfolio-10-years-1024x724.png)

Even a 1.0% fee per year will cost you 14’000 CHF! If you can reduce to a 0.5% fee, you will save more than 7’000 CHF! And this is only for ten years and only for a 100’000 CHF portfolio!

Even over ten years, we can see that investing fees matter! You cannot ignore fees when you are investing in the long term! You need to think of investing fees like you are thinking of bills.

The analysis of retirement success rate for ten years is not very interesting. Indeed even with 2% fees, you still have a 100% chance of success, so we keep that for 20 years.

Impact over 20 years

Ideally, you want to invest a long time. So, here is what happens with these investing fees over 20 years.

![Value of investments with investing fees [5% Returns] - 20 years](https://thepoorswiss.com/wp-content/uploads/2020/05/Value-of-investments-with-investing-fees-5-Returns-20-years-1024x762.png)

So, here is exactly how much we are losing to fees:

![Money Lost to Investing Fees [5% Returns, $100'000 portfolio] - 20 years](https://thepoorswiss.com/wp-content/uploads/2020/05/Money-Lost-to-Investing-Fees-5-Returns-100000-portfolio-20-years-1024x724.png)

Over 20 years, the difference between 0.2% and 1.0% fee is already more than 36’000! You do not want to pay anything more than a 1.0% fee!

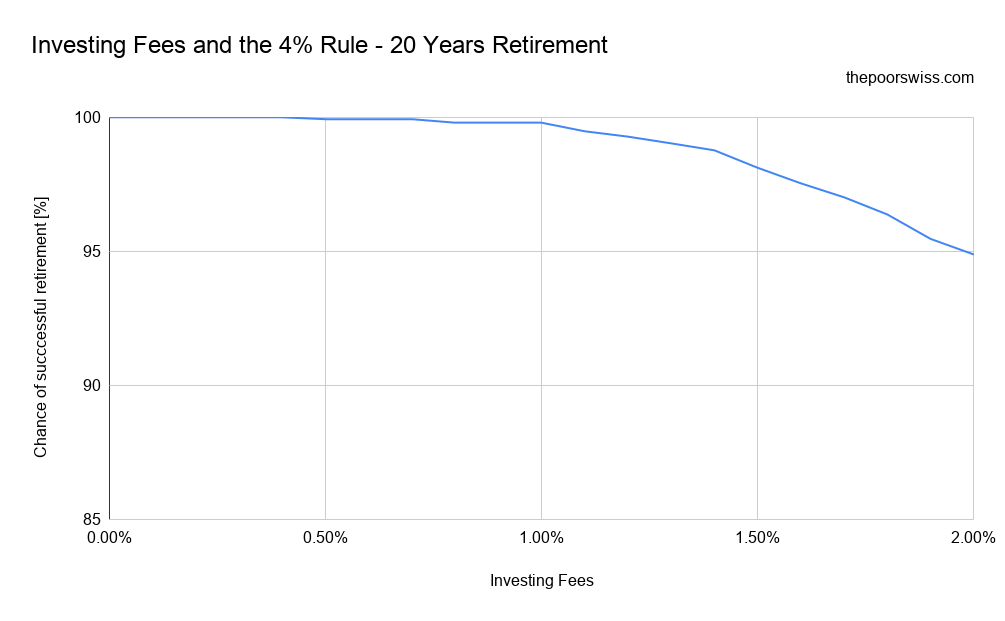

If you plan to retire early using the 4% rule (or any other withdrawal rate), you may be interested in knowing how much investing fees could impact your chances of a successful retirement (not running out of money).

I did the simulation for an 80% U.S. stock portfolio and a 4% withdrawal rate. I am using U.S. inflation here as a reference. Here are the results with different levels of investing fees:

Interestingly, investing fees will not have a substantial effect on your chances of success. However, a 2.0% fee will reduce your chances by 5%. A 95% chance of success is still a good result. But we must keep in mind that this is only for 20 years. Twenty years is still a short retirement by any means.

Impact over 30 years

Then, we look at the impact of investing fees over 30 years. 30 years is a period that is already more reasonable for early retirement.

Here is directly how much money we lose to fees:

![Money Lost to Investing Fees [5% Returns, $100'000 portfolio] - 30 years](https://thepoorswiss.com/wp-content/uploads/2020/05/Money-Lost-to-Investing-Fees-5-Returns-100000-portfolio-30-years-1024x724.png)

By going from a 1.0% fee to a 0.2% fee, you can save over 80’000 CHF! We are talking about a huge amount of money that can make a significant difference! If you had a portfolio of 1’000’000 to start with, you would get a difference of 800’000 CHF after 30 years!

It is very interesting to note that after 30 years, the lost compounding value is higher than the fees paid. And this gets even more true for a higher number of years!

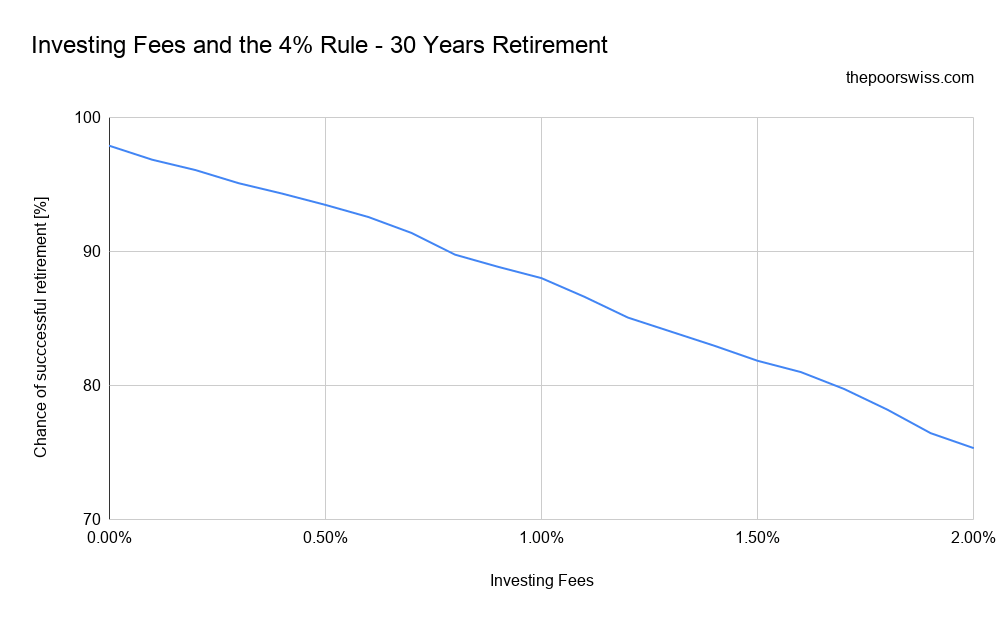

We can check our retirement simulation again for 30 years.

This time the impact of investing fees is significant! A 1.0% fee will cost you more than a 10% chance of success. And a 2.0% fee will cost you more than 20% chances!

If you pay a 1.0% fee or more, you will likely have to use a lower withdrawal rate than 4.0%. When you are planning for the future, it is essential to take this into account. Reducing your chances of success by 10% is already very dangerous. Some people can plan for a 90% chance of success. But many fewer people can accept an 80% chance of success.

Impact on 40 years of retirement

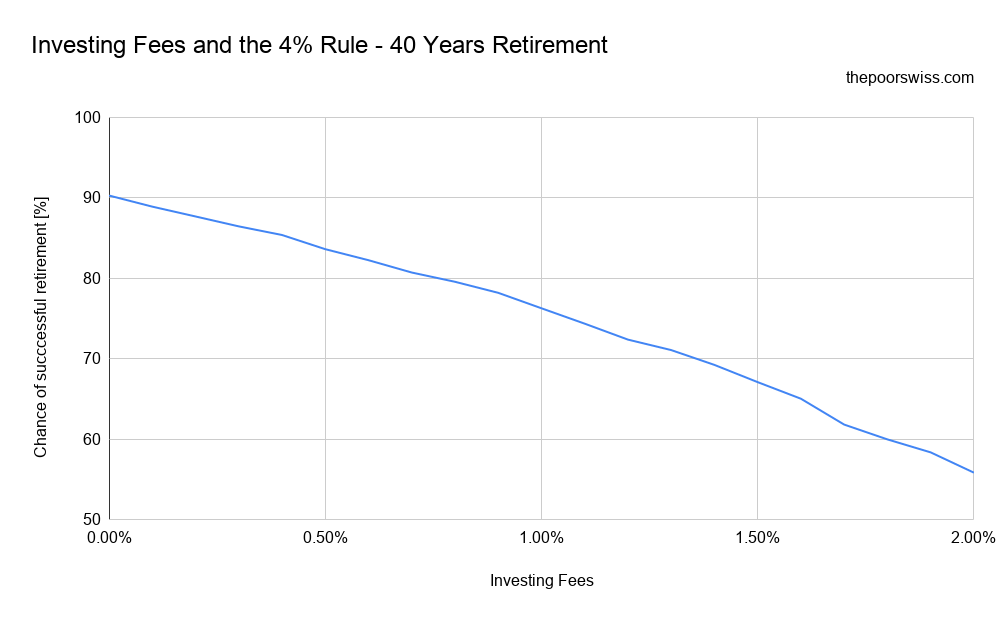

We will repeat our retirement simulation for 40 years now. I will not repeat the first experiment since, by now, you should have seen the significant impact of these investing fees.

Over 40 years, investing fees have a devastating impact! Even a 1.0% fee reduces your chances of success to less than 80%! It means that with such a fee, the 4% rule fails! And with 2.0%, your chances of success are even below 60%.

If you are investing in ETFs yourself, it is likely that your investment fees are significantly lower than 1.0%. But even a 0.2% fee diminishes your chance of success by 2.5%. So going from a 0.5% fee to a 0.2% fee will increase your chances of success by 4%. If you are investing with an expensive Robo-advisor, you will have to take this into account if you plan for early retirement.

We can conclude two things at this point:

- Investing fees have a significant impact on your chances of success in retirement if you follow the 4% rule.

- Over a long retirement period, even a small change in fee can have a significant impact.

How to reduce investing fees

We have now seen that investing fees have a significant impact in the long term. So, here are a few practical things we can do to reduce them.

Only use ETFs with low TER

The first thing you should do is invest only in cheap ETFs and mutual funds.

If you are in Switzerland, like us, you want to choose only Exchange Traded Funds. Indeed, there are no good mutual funds available in Switzerland. If you are in another country with access to good mutual funds like the ones from Vanguard, you can also consider them!

When you choose ETFs (or mutual funds), you want to focus on those with a very low Total Expense Ratio (TER). The TER is the management fee per year of the funds. And this will be removed from your net worth year after year. Doing so is the most important thing you can do to reduce your investing fees.

These days, there is never any reason to pay more than 0.4 %TER for a fund. And ideally, you want to focus on ETFs with significantly less than that.

Now, the TER should not be the only factor your use to compare ETFs, but it is an important one. I have a guide on choosing Exchange Traded Funds if you need more information.

Use the best broker

Transaction costs are less important than management because they do not represent a portion of your assets.

But this does not mean they are not important either. If every time you invest something, you lose 50 CHF. It is not ideal. And you need to remember that you will also pay transaction costs when you sell your assets.

You especially want to avoid all significant fees proportional to the amount invested. But generally, with good brokers, these are so small they almost do not matter.

When you choose a broker, you need to avoid choosing one with a percentage custody fee. Fortunately, there are plenty of good brokers without such fees, so you will never have to pay for it.

But there are other factors at play here. For instance, if you are using a Swiss broker, you will pay up to 0.15% stamp tax duty on each buy and sell operations. This fee is not as bad as a management fee. But this is still something that you want to avoid.

You do not have all the research yourself. I have an article on the best brokers for Swiss investors.

Use the best third pillar

Another place where you will have to pay investing fees is in your third pillar. And again, you want to minimize these fees.

The first thing you want in a third pillar is to invest it in stocks. Most people do not invest the money in their third pillar. But there are now several good third pillars with a large amount invested into stocks.

To choose between these few good third pillar providers, you need to look at their fees. You will not find something as cheap as a Vanguard ETF. But you can now find third pillars with a 0.5% fee or less, which is reasonable compared to other alternatives.

If you do not know where to start, read my article about the best third pillar in Switzerland.

Use the cheapest Robo-Advisor

If you are not investing by yourself, you will probably want to use a Robo-Advisor. For this, you will pay a management fee each year.

The price of a Robo-advisor is not the only criterion you should use. However, it is a very important one. As we saw before, the difference in returns is quite significant.

So make sure you are choosing a Robo-advisor with reasonable fees. I have talked about several Robo-advisors in Switzerland. They are not cheap by any means. But there are some more reasonable than others.

Optimize your taxes

We have also seen that taxes can weigh heavily on your fees. There are a few things we can do to reduce this part of the fees.

If you want to reduce your wealth tax, the only thing you can do is move to another state. There are some very significant differences in taxes between the different states. For more information, you can read my post about Geo-Arbitrage in Switzerland. Of course, this is only doable if you are not too attached to your place or live near a border.

There are two ways to reduce your dividend taxes. First, you need to invest in efficient ETFs. Currently, the best ETFs for Swiss investors are U.S. ETFs. It is because you can reclaim 15% of the dividends withheld in the United States.

Secondly, you can avoid investing in companies with high dividend yields and focus on growth. If you want to be diversified, it is impossible to avoid all dividends. But you can avoid investing in funds focused on dividends.

Conclusion

By now, you should understand that investing fees are essential. You cannot ignore investing fees if you are serious about investing!

In the long term, even a 0.1% extra investing fee will cost you much money. And extreme fees also diminish your chances of retiring early. Reducing your investing fees should be a priority!

If you realize this, you also need to minimize fees as much as possible to get the most out of your investments. There is no point in investing if most of your earnings go to your bank, broker, or advisor.

One problem with investing fees is that people do not pay them as bills. If people received a 10’000 CHF bill for a 1.0% fee on a one-million portfolio, they would be more eager to optimize it. But investing fees are vicious in that they are almost invisible. So people tend to forget about them.

If you are investing directly by yourself with a broker, the most important thing you should do is invest in ETFs that have a low Total Expense Ratio (TER). Then, you also need to minimize your transaction costs by choosing an affordable broker.

If you are not investing by yourself and you prefer Robo-advisors, you need to make sure you are using the cheapest one that fits your needs. You will pay more in fees than when DIY investing. But investing with a Robo-advisor is much better than not investing at all!

If you do not know where to start, you can start by looking at the best ETF portfolio for Swiss investors.

Did you realize investing fees were so important? Do you know how much fees you are paying?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Investing Fundamentals

- More articles about Investing

- Distributing Funds vs Accumulating Funds: Which is better?

- Margin Loans – Borrow money from your broker

- How do stock options work?

Hello,

Thank you very much for your article, it’s very useful.

I have a question. I am not quite sure I understood the difference between management and custody fees. I have the feeling they work in a similar way, the only difference being their justification.

Also I have the same question for transaction fees VS issuance and redemption fees. What’s the difference between the two ? Are they paid to different entities ?

Hi Tanguy

In most cases, custody fees and management fees are indeed exactly the same thing. Some services charge both because they say that management fees are their costs while custody fees are the fees of the third-party custody bank.

Transaction and issuance/redemption fees are more different.

* Transaction are charged by the broker to buy shares, this will go away directly from your account, taken from the cash. This apply to stocks, etfs, bonds and more.

* Issuance and redemption fees only apply to mutual funds (not ETFs). This fee is taken by the fund manager out of the money inside the fund. No money will be taken by your broker, but your investment will automatically diminish.

Thank you very much for the (really fast) answer :)

Hi there.

Just wondering all the fees etc if I pick swiss bank account for my crypto currency exchange.

And open a bank account. Does anyone have any experience in this field?

What do you think of it??

I don’t get your question. Do you want to create your own exchange and use a bank for that corporate entity?

Could you share your thoughts in investing in USD? I have been investing in IB, however I see a decline in my assets because of the USD/CHF conversion. If I am retiring in Switzerland, does it make sense to continue investing in IB in USD considering how the USD keeps declining, my CHF net worth is decreasing substantially and the gains are not really felt.

my five cents: we have CHF income, but invest mostly in USD (bonds and equity), EUR (equity and kind of bonds) and INR (bonds).

In general, in IBKR you also can hold and invest in CHF.

When it comes to equities: Given that the majority of equities are in the US, you would lose a lot of diversification and performance if you don’t invest in US equities.

You could hedge (a part) of the currency, but the costs tend to be higher than the benefit from what i have seen/heard.

When it comes to fixed income: I think important to diversify across currencies. And to make sure that you get sufficiently compensated for the additional risk. Eg. USD historically is loosing value against CHF, but it also compensates better, eg. 4-5% government bonds, up to 9% high-yield bonds. INR is depreciating guaranteed vs. the CHF, but short-term deposits pay 7-8%.

From my point of view, I don’t understand the recommendation that you tend to get from Swiss bankers, or the impression you get from 3a deposits, that Swiss people should not be exposed to foreign currencies, of that you should hedge. But it is important to understand the risk, diversify, track the performance, and learn.

Hi Zuger,

On the long-term, I believe it makes sense to invest in USD rather than hedge. If you are still investing, you can buy stocks cheaper.

When in retirement, it becomes more difficult. It could be interesting to hedge in retirement or to hold more Swiss stocks.

But this is a very difficult question.

Great article, this is really helpful.

May I ask if the TER has to be paid on the invested money “only” or does it take into account unrealized P/L? For example, one invests 10k each year. That would mean TER of e.g., 0.05% on 10k in the first year, 0.05% on 20k in the second year, and 0.05% on 30k in the third year?

What if the value goes up by 10% each year (incl. dividends reinvested), despite not selling the stock, in reality those 10, 20, and 30k could be worth 33,100 (assuming 10% each year). I assume in a broker account that value would be written as net worth (or portfolio worth) would the TER have to be paid on this or only on what was actually invested (incl. dividends if they are being reinvested)?

Hi Donald

The TER is an average of all the fees paid during one year over the entire assets of an ETF.

So, you should expect to pay the TER over all the invested money, including all gains.

Thanks a lot. Much appreciated :)

…by the way, I think IBKR just waived the fee of 10USD for not maintaining the balance: “Effective July 1, 2021, you will no longer be charged USD 10 for not maintaining a minimum balance or transaction activity for account”. Nice! :)

That’s correct, they announced this yesterday. This makes it even better!

Hi!

Is it true that IBKR will charge anegative interest rate on CHF deposits? Well this is what I see under my IBKR account. Thanks!

Hi,

That’s correct, but only on balances of more than 100’000 CHF.

If you have less than that, you won’t have to pay negative interest rate.

“Never invest with a broker with a percent-based custody fee” is one of the worst advice you can ever find …

Did you ever wonder why Swiss banks bill custody fee but not foreign brokers ? What’s the catch ? The broker has to pay custody fees to their own custodian, how are they going to pay it if they don’t bill their clients ?

The reason is simple, Swiss banks are not allowed to brings customer shares to their balance sheet while foreign brokers are allowed. In case of bankruptcy with the foreign broker bye bye your shares, their are part of the bankruptcy process since they are on the balance sheet. With Swiss banks, you are protected from the debtors of the bank since they can consider only what is on the balance sheet of the bank.

You might say “What about segregation ?” Sure, your Swiss cash bank account is also segregated, but in case of bankruptcy only 100k is guarantee. Why ? Because cash is on the balance sheet of the bank.

Also wonder why so easy to have a margin load with foreign broker while is Switzerland it is a complicated “Lombard loan contract” ? Same reason, balance sheet rules.

With a foreign broker such as IB, you pay the custody fees by taking more risk, while with a Swiss banks you pay custody with hard cash.

Ever wonder why half billionaire of the world are trading with UBS ? Why not a discount broker ? Well, they don’t want to take the risk of losing it all … That make sense.

Thanks for sharing your opinion.

I do not agree with it. What about Swiss brokers? They have maximums to the custody fees and they seem to be doing just fine.

Interactive Brokers is not allowed to have client assets on their balance sheets either.

Billionaires invest with UBS because they can get better deals than us and because they do not care nearly as much as we do about a small percentage fee given the amount of money and leverage they have.

I would encourage you to question everything, not because it “looks fine” it is fine. Madoff was looking fine as well … Madoff Securities enjoyed better reputation than IB. (That do not mean IB is a scam, nothing against IB, IB is great!)

If IB is not allowed to have client assets on their balance sheet how can they provide margin loan ? share lending ? Short Selling ? They do have to bring them to their balance sheet to provide these services

Swiss brokers are regulated as bank.

Only small banks have maximum custody fees because they don’t have clients that hold billions. Billionaires use big banks: UBS, Credit Swiss, BNYM, State Street, etc …

As example, Warren Buffet use Citi Bank.

Yes, UBS have better deals with big amount, but still higher than discount brokers and they still pay custody fees.

You can read about differences of balance sheet between brokers and banks

https://www.usbank.com/financialiq/plan-your-growth/find-partners/Bank-vs-brokerage-custody.html

or

https://www.pilotagepo.ch/publications/brokerage-vs-custody-wf796-58geb

Or even the book “The intelligent investor” from Benjamin Graham who recommends local bank custodian instead of brokers for this reason.

I used to use IB in the past. They are great for small accounts (few hundred thousands) or frequent trading, but now I use UBS since they look better suited for holding bigger amount over long term.

Transaction and custody are very different things that involve different risks.

thanks for bringing the topic up, john young. until recently, the scenario of bank wipe outs seemed marginally interesting. under these new circumstances (svb, credit suisse), seems a very interesting topic! Since I put more and more share of assets on IBKR, this is indeed a topic of interest, should i diversify on level broker? what would be the impact of a broker bankrupcy? just no liquidity and trading for a few days or weeks or months? Or would the assets be affected somehow?

Hi Hannes,

That’s a good point, we need to be careful about the financial strength of our brokers.

I have written an article about broker bankruptcy: Broker Bankruptcy: What happens to your investments?

I plan to write another article on whether we should diversify across brokers as well.

This is an excellent article and exactly the reason why any expat reading this should be aware of the outrageous fees charged by companies offering expat savings plans. Anyone contacted by DeVeers, Utmost, Generali etc should hang up the phone immdeiately!

Thanks for the kind words Mr. B!

Hi, TPS. This is a good post.

If you didn’t invest every month, but immediately with a large amount, then through which broker?

Thank.

Hi Mikhail,

I would still go with IB :)

It’s just too cheap to pass and they still allow access to U.S. ETFs.

Thanks for stopping by!

Hello Mr. The Poor Swiss,

You mention that Vanguard Total World (VT) is a bit piece of your portfolio. I am just starting investing, but from what I understand, it is know impossible to invest in US based ETFs. How did you buy VT? as a proffesional investor?

Best,

Andrei

Hi Andrei,

It’s still possible to invest in U.S. ETFs, but not from every broker. I am using Interactive Brokers for this. But it’s unknown for how long this will be possible.

Thanks for stopping by!