Geo Arbitrage in Switzerland – Improve your finances by moving

| Updated: |(Disclosure: Some of the links below may be affiliate links)

In Switzerland, there are many differences between the different cantons. Can you take advantage of these differences and do geo arbitrage inside Switzerland? We are talking about arbitrage for money advantages.

Most people using geo arbitrage are doing it in different countries. For instance, several people work in Switzerland but then plan to retire in a cheaper country. But I think there are opportunities within Switzerland.

So, we explore the different opportunities for geo arbitrage within Switzerland. We will see if people can get more money or reduce taxes by moving inside Switzerland.

What is geo arbitrage?

Geo arbitrage is a technique where you optimize where you work and where you will be retiring. The idea is to get the most out of each place. In this article, we focus on the financial implications of specific locations.

But you could use geo arbitrage to find the best schools for your children. Or you could choose a canton based on the best medical care. Some people are simply choosing a place to live based on the sights.

But we will focus on the money part. For instance, you could work in the city with the highest salary and then retire in the city with the cheapest capital taxes.

Or you can even optimize it further by working in a city and living in another city with lower taxes. And then, once you are Financially Independent, you could move to another city or country.

Geo arbitrage can happen at many levels, even in city districts. If you take a large city like Geneva, where you live will matter. However, most people are considering it for countries. But there is no limit to which you can apply it.

If you aim to achieve Financial Independence as fast as possible, geo arbitrage is a very powerful technique.

There are some disadvantages to geo arbitrage. The biggest is that you will have to move at some points. It means you will have to leave your friends and family. It also means you have to organize many things in advance. Doing that may be overwhelming. And in some cases, people end up not moving after a while because they have grown attached to the place they lived for a few years.

I would not move to another canton. I like the place where we live. And all my friends and family are still in the same canton. I have strong ties to this region. But I completely understand that some people have weaker ties. For those people, it makes sense to move around to optimize. It is even truer for people that pursue Financial Independence.

Increase your income

The main reason in Switzerland for people to move to another canton is to get a higher salary. There are some substantial differences in income between cantons and cities.

For instance, the canton of Zurich has the highest income average in Switzerland. And the canton of Ticino is the canton with the lowest income in Switzerland.

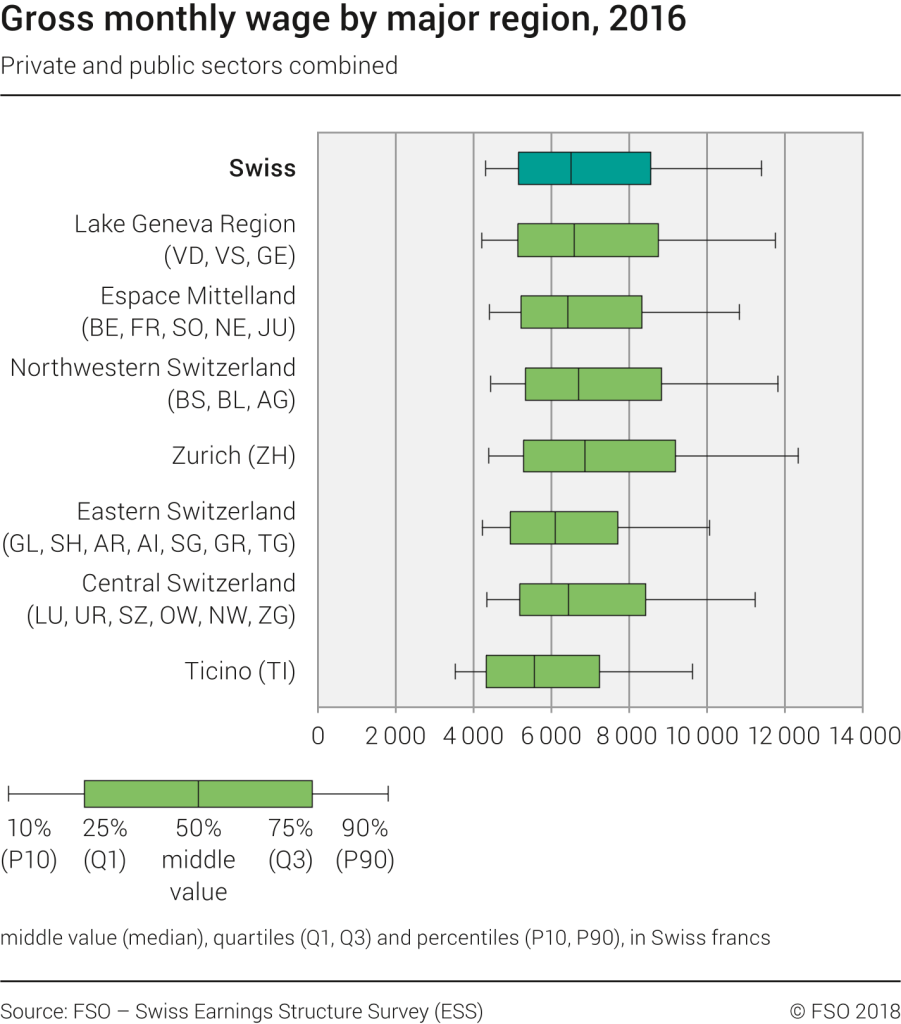

I found this great visual representation from the Federal Statistics Office (Source).

There is more than a 1000 CHF monthly difference between the highest paying and the lowest paying cantons.

There are also some significant differences inside the cantons. For instance, you may not be paid the same in small villages in Geneva as in Geneva City.

Consequently, the two cities with the highest income (Zurich and Geneva) are also the most expensive in Switzerland.

You could take advantage of this by moving to a high-income city when you work. And then you could move to a cheaper city when you retire. It can make a very significant difference.

Reduce your taxes

Optimizing taxes is an excellent reason to use geo arbitrage. In Switzerland, the taxes can be very different from one canton to another. If you are a high-income earner, you may want to move to another canton.

Income Taxes

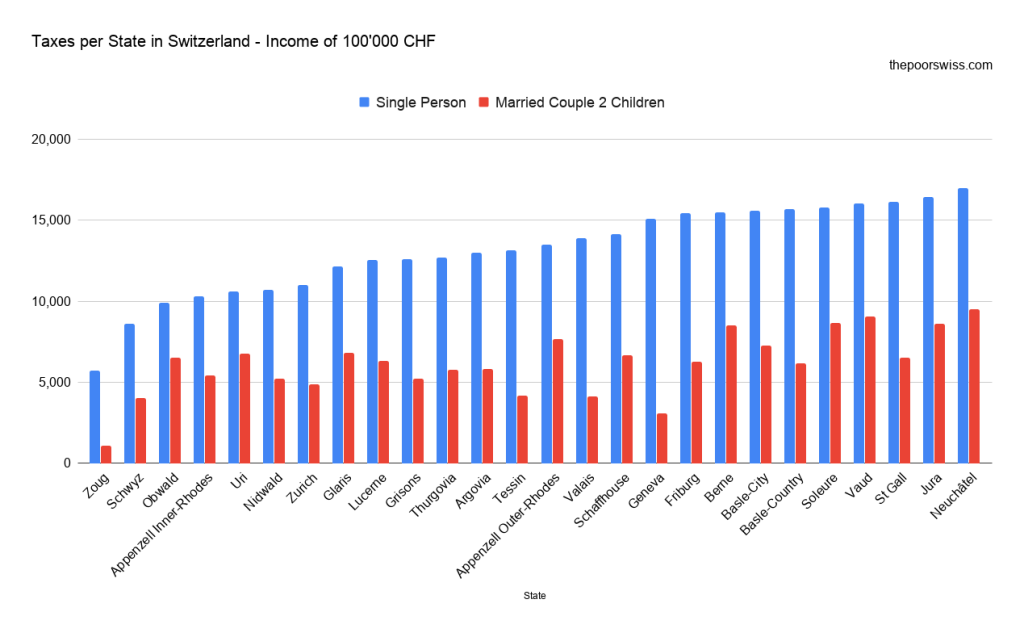

We can look at the taxation for an income of 100’000 CHF in different cantons. I found a list of taxes from 2014 on Wikipedia (Source).

For a single person, there is a factor three of difference between the lowest tax canton, Zug, and the highest tax canton, Neuchatel. It is interesting that for a married couple, there is almost a factor 8 difference! And it is also interesting to note that the cheapest and highest are the same for a single person than for married couples with children.

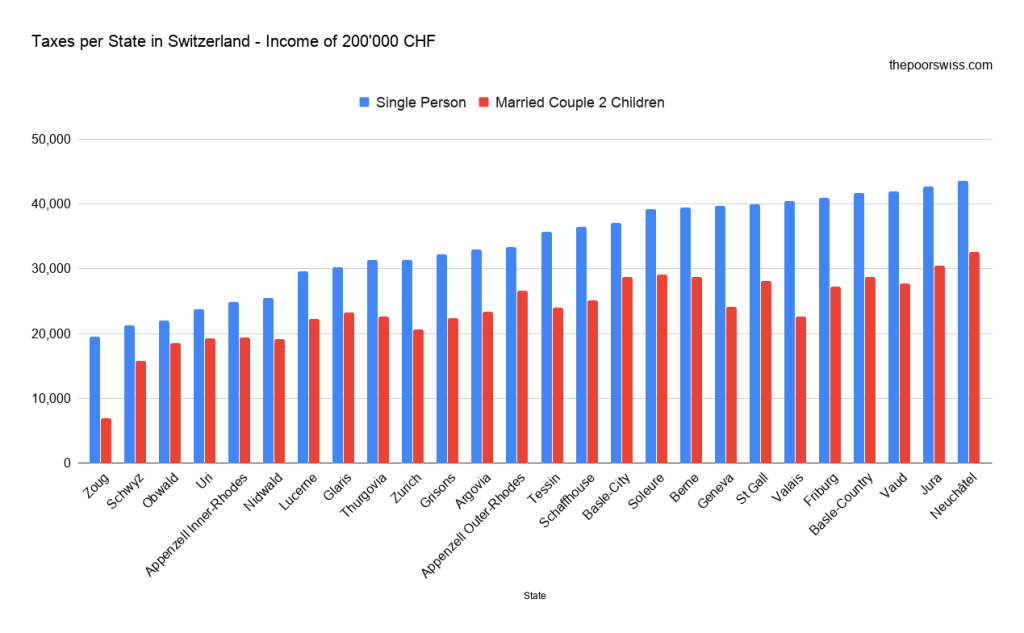

We can also look at what happens with an income of 200’000 CHF.

The same stats are the cheapest and the most expensive. But there is less difference between the top and the bottom. A single person pays 2.3 times fewer taxes in Zug than in Neuchatel. And a married couple with two children would pay 4.6 times cheaper.

Whether you have children or not, moving to another canton for taxes, reason can be an excellent geo arbitrage opportunity! If you can save 20’000 CHF per year on taxes, you can probably retire a few years earlier.

Wealth Taxes

If you have a large net worth, you will pay some wealth tax. This can become significant as your wealth increases.

Again, there are some huge discrepancies between different cantons. Zug is still very cheap, but it is not the cheapest canton for wealth taxes. Generally, the best cantons for wealth taxes are Nidwald and Obwald. And the worst is generally Neuchatel.

These differences can be a lot. For instance, for a wealth of one million CHF, you will pay about 0.015% in Nidwald and 0.07% in Neuchatel. This is almost five times more expensive!

This is very important when you plan to become financially independent. At this point, you should have a large wealth and a low income. In this stage of your life, it could be very beneficial to move to another canton. It could make a large difference in your yearly expenses.

Municipality Taxes

You can also consider moving to another municipality to save taxes. We also pay municipality taxes. These are generally a percentage of the cantonal taxes. And they can vary quite a lot. In the canton of Fribourg, it varies from 32% in Greng to 100% in Jaun. There is a factor three difference in your municipality taxes.

Generally, it is simpler to move from one municipality to the other than it is to move to another canton. It can make a significant difference to your financial situation if you want to optimize your finances.

Reduce your spending

We also have some significant differences in prices between cities. Some things have almost no differences, like appliances or groceries. But some things like services and rent can differ wildly. Some things are cheap in Switzerland.

I did not find sufficient data to compare each city in Switzerland or canton. However, Zurich is known to be one of the most expensive cities in the world, and so is Geneva. On the other hand, a small town in Ticino would probably be around 30% to 40% cheaper.

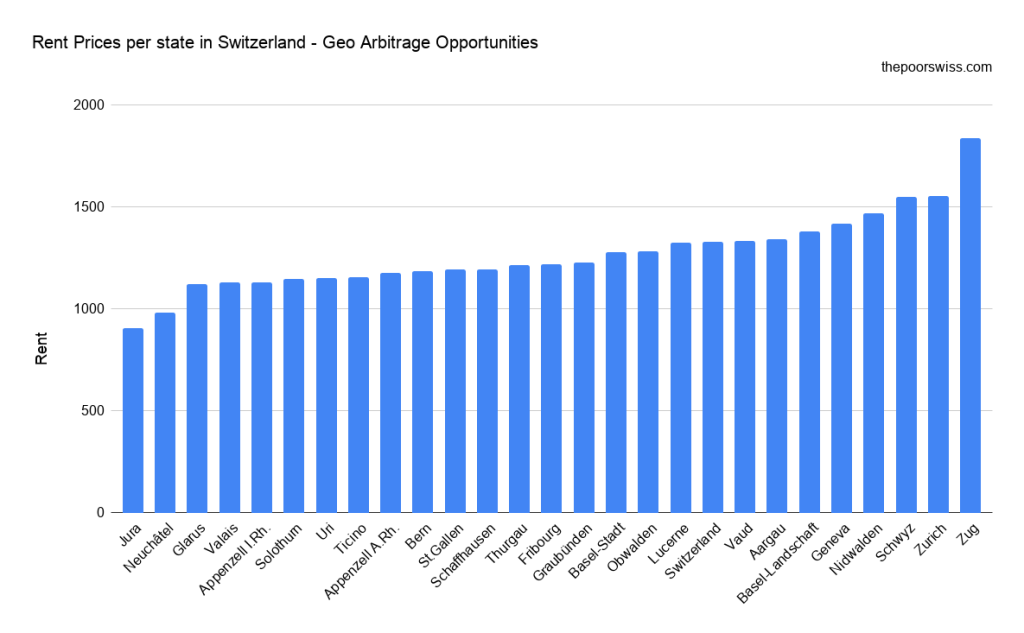

One good indicator is the price of rent in each canton.

We can see that there are some major differences between cantons. Between Jura and Zug, there is a factor two for the average rent price. Interestingly, the canton with the most expensive rent is also the canton with the cheapest taxes.

Considering the prices of the canton and cities is something good when you consider retiring in Switzerland. Now, it is not worth the trouble for a few percent. But it could be worth the trouble for 20% reduced expenses, for instance. Moving for retirement could mean you need to accumulate 20% less money to become Financially Independent.

Buy a cheaper house

If you aim to buy a house or an apartment in Switzerland, it will make a huge difference in where you plan to buy. There are immense discrepancies between cantons and cities.

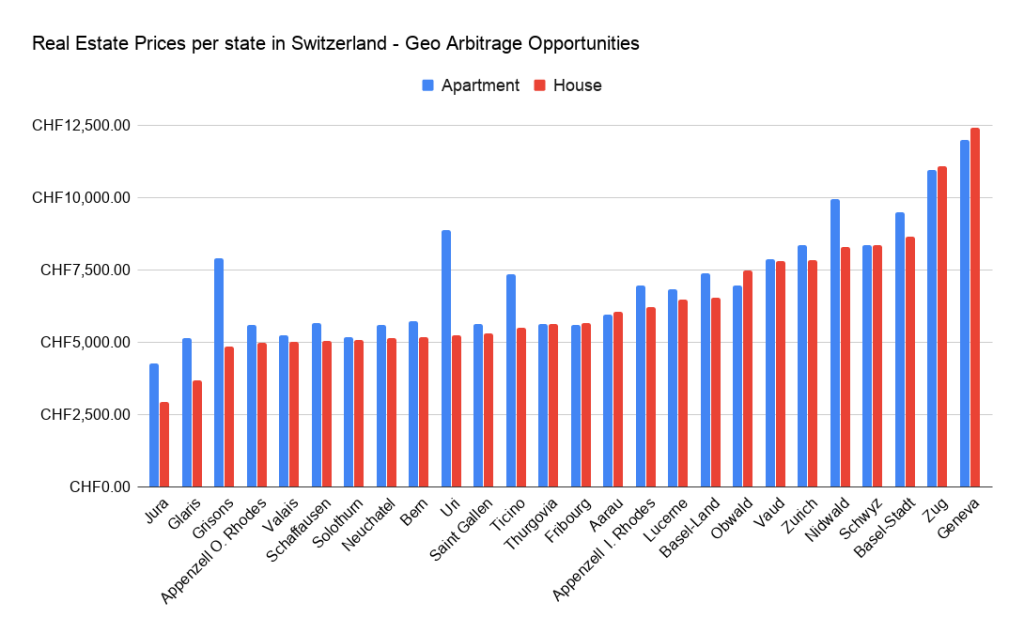

I am no expert in real estate, but I know that house prices are quite crazy these days. I found some statistics about house prices. We can look at the price per square meter for houses and apartments.

As you can see, there are considerable disparities in prices. The cheaper canton for houses (Jura) is 2.8 times less expensive than the most expensive canton (Geneva). For houses, the difference is 4.2 times more expensive.

If your goal is to buy a nice house, it could make sense to choose a canton based on the price of the real estate properties.

Pay less for health insurance

Another big difference between cantons in Switzerland is the price of health insurance.

Indeed, each insurance has a different plan for each canton. This is based on the demographics of each region and the prices of each region.

For instance, here are the three cantons with the most expensive average health insurance premiums:

- Basel-Town: 567 CHF

- Geneva: 554 CHF

- Vaud: 495 CHF

And here are the three cantons with the cheapest average health insurance premiums:

- Appenzell Inner Rhodes: 348 CHF

- Nidwald: 361 CHF

- Ury: 369 CHF

As we can observe, there are some very significant differences between the cantons. I do not think this is enough to make anybody move. But it could be interesting to consider this when you are moving around in Switzerland.

Conclusion

As you can see, there are tons of opportunities for geo arbitrage in Switzerland. There are so many differences between cantons, manucipalities, and even cities. It makes the financial situation between locations very different.

If you want to optimize your finances, there are many opportunities. Whether you can move will depend on your ability to move and on your job. But with some jobs, you could double your income. By moving to another town, you could divide your taxes by two. Or, if you want a house, you could get one four times cheaper by moving to a more affordable place.

Now, I am not recommending you to move around to optimize everything. I am not planning to move just for the sake of saving money. Geo arbitrage is not for everybody. But it is a very powerful tool. If you have strong goals and are very motivated, you can take advantage of geo arbitrage to reach your goals much faster.

If you want more details about Switzerland, I have collected a large set of statistics about Switzerland.

What do you think? Did you ever consider geo arbitrage inside Switzerland?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Money-Saving Tips

- More articles about Save

- 11 Tips to Save Money Sustainably

- The Best Internet Plans in Switzerland for 2024

- How to Build a Nice DIY Shoe Rack for 35$

Hello,

as usual very useful and well explained, thank you!

Could you give me a link to find out the % of wealth taxation according to the amount?

Hi francesca,

This will depend on each canton. You will have to find the information for the cantons you are interested in.

Unfortunately, I do not have a good reference with all cantons together.

Thank you for putting it together. That’s a topic that we have been considering a lot lately, as my wife’s family is from Bern and most of the jobs related to our careers are in Zürich. We would like to be closer to her family and commute (property prices are lower and enjoy life in the countryside), but taxes are crazy high!

One point that it would be interesting to add to your analysis: fortune taxes. The link that Tarik shared above has all the data ;). It is something that I always forget to look into, but it makes a difference as we start to accumulate more capital.

Thanks,

Vini

Hi Vini,

It’s really difficult to find the best place to live and work.

My income would be significantly higher in Zurich than in Fribourg, but I would have to move and I really do not want to move that far from friends and family.

That’s a good point, I mostly considered income taxes and not fortune taxes. I will try to add this to the article later on.

Thanks for stopping by!

We used geo-arbitrage ourselves in a few ways:

We’re in the US and started off in an expensive city (NYC). Even while there we moved to a more affordable neighborhood — there is wide variety in pricing.

Then we moved to a cheaper city altogether (we’re now in FL).

Finally we have vacation rentals in Costa Rica, which is a Plan B option that is even cheaper than the US.

Hi Caroline,

Thanks for sharing! This is very interesting to hear about people that did geo-arbitrage.

You can make huge savings by doing that if you are not attached too much locally!

Thanks for stopping by!

Very concise, the Swiss government has great graphs on tax attractivity

https://www.estv.admin.ch/estv/fr/home/allgemein/steuerstatistiken/fachinformationen/steuerbelastungen/steuerbelastung/karten-kantone-2018.html

Hi Tarik,

Yes, the Swiss official website is really good for information!

Thanks for stopping by!

Another great post, thanks!!

Any chance a post on Internet security cheap & best options + Cloud storage solutions (Microsoft vs Google vs ??)

Hi Doods,

Thanks :)

I think that’s a bit specific. I have a post on the cheapest internet plans but for security, I do not think you need to pay anything, a simple Firewall and Antivirus and a lot of common sense is enough for almost everybody.

And as for cloud storage, it would depend too much on the needs on people. I am using Google Drive on the free plan and it is enough for all my documents and all that I need to save online.

Thanks for stopping by!