Wealth Tax in Switzerland in 2024

| Updated: |(Disclosure: Some of the links below may be affiliate links)

In Switzerland, we have something that very few countries have: a wealth tax. This means that we get taxed on the amount of our net worth. So, the more wealth we accumulate, the more we pay taxes.

This tax is often not properly considered when estimating taxes paid in retirement.

In this article, we see all there is to know about the wealth tax in Switzerland.

Wealth Tax

In our guide to Swiss taxes, we have briefly touched on wealth tax, but we have mostly focused on income tax. In this article, I will focus solely on the wealth tax.

In Switzerland, the wealth tax is levied by the cantons and municipalities. There is no federal wealth tax. This means you are entirely dependent on your canton for how much wealth you will pay.

The wealth tax is usually much lower than the income tax. Many people do not even pay wealth tax because their taxable net worth is lower than the deductions. However, as soon as you accumulate money (for retirement, for instance), you must pay significant wealth taxes.

Most cantons have a simple progressive system where you pay a higher tax rate on higher net worth. Since it is progressive, you pay different taxes on each tranche of your taxable net worth.

But some cantons have more complex systems with several wealth tax components. We will run a few examples later.

Taxable net worth

It is important to know that your wealth tax will be based on your taxable net worth, which is slightly different from your net worth.

The basis is the same as your net worth. The taxable net worth is the sum of all your taxable assets minus your deductible debts.

The main difference is that some of your assets are not included in the taxable net worth. The taxable net worth excludes assets tied to the second pillar, such as vested benefits accounts or funds in your pension fund. The taxable net worth excludes assets tied to the third pillar in a bank account or life insurance.

The second difference is how the value of some assets is calculated, especially real estate. The taxable value of your real estate is estimated by a basic value by the canton. For us, the taxable value of our house is about twice lower as what we paid. This is not the value you will have in your net worth.

Finally, depreciating assets like cars are also included in the taxable net worth. I generally do not recommend including them in your net worth because they will end up worth nothing. In the taxable net worth, they use formulas to compute the value of a vehicle based on its years. However, this should not contribute much to your taxable net worth.

Examples

We will take a few examples of cantons. I use single-person examples because this can vary slightly for couples. I also only consider the cantonal tax. In practice, you would have to pay a tax for the municipality (a percentage of the cantonal tax). You can expect to pay about double these numbers once you consider the canton and municipality.

Nidwald has the simplest system. They have a deduction of 35’000 CHF and a tax rate of 0.025% on the taxable net worth.

Neuchatel has a simple system. The first 50’000 CHF are free. Then, from 50’0001 to 200’000 CHF, you will pay 0.3% of your taxable net worth, 0.4% up to 350’000 CHF, and 0.5% up to 500’000 CHF. Anything above will be taxed at 0.36%.

Vaud has a more complex system. You also get the first 50’000 CHF for free. But then, the rate increases from 0.048% to 0.3082% from 50’001 CHF to 2’000’000 CHF. Anything above that will be taxed at 0.339%.

Fribourg has a relatively simple system but with complex deductions. The tax rate grows from 0.05% to 0.37% between 50’000 CHF and 1’200’000 CHF. And anything above will be taxed at 0.29%. Deductions are different for couples and singles. For instance, singles get a 55’000 CHF deduction for a net worth below 75’000 CHF. But the deduction is reduced by 10’000 CHF for each extra 25’000 CHF of net worth.

Zug has a very simple system. The first 168’000 CHF are taxed at 0.05%, the next 168’000 at 0.10%, and then at 0.15% for the third tranche. Anything above 504’000 CHF is taxed at 0.20%.

Geneva has a complex system. They are using two different progressive tax rates. The difference between the two rates is that the second tax rate is not counted for municipalities. Only the first is. In our case, we simply add the two values. Geneva is offering an 83398 CHF deduction on the taxable net worth.

Finally, Zurich has a slightly different system. You don’t pay taxes on wealth below 77’000 CHF. Then, from 77’000 you pay 0.50 CHF for each 1000 CHF extra. Starting from 308’000 CHF, you pay 1 CHF for each 1000 CHF. And this increases to 3 CHF for each 1000 CHF after 3’158’000 CHF.

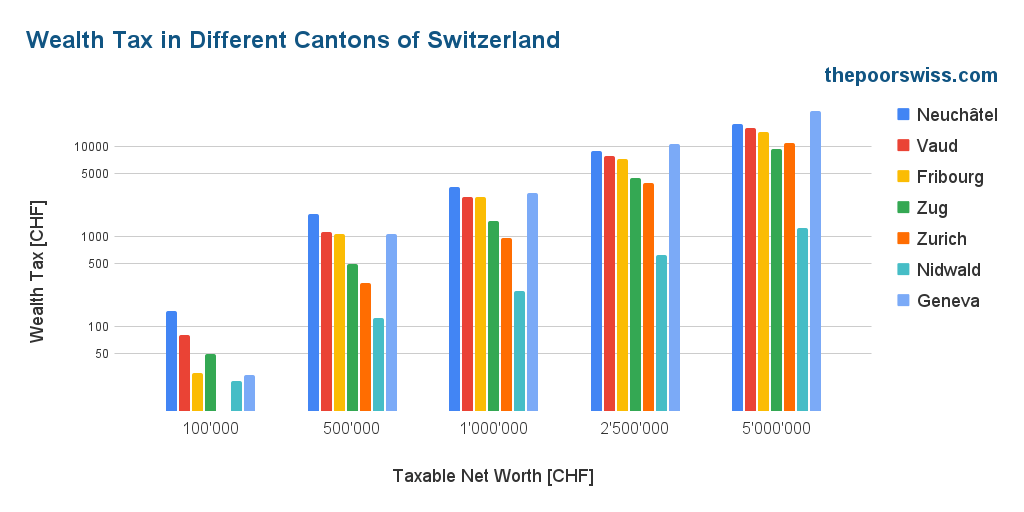

We can compare these seven cantons based on a few taxable net worths.

I used a logarithmic vertical axis to see the small numbers on the left. It is clear from this graph that there are huge differences between cantons.

Neuchâtel is always very expensive. Geneva is also very expensive, especially when we reach high numbers. Vaud and Fribourg are mostly the same, after Geneva and Neuchâtel. Zurich and Zug are quite good, much cheaper than the first four cantons. Finally, Nidwald is on a different plane with a very cheap wealth tax.

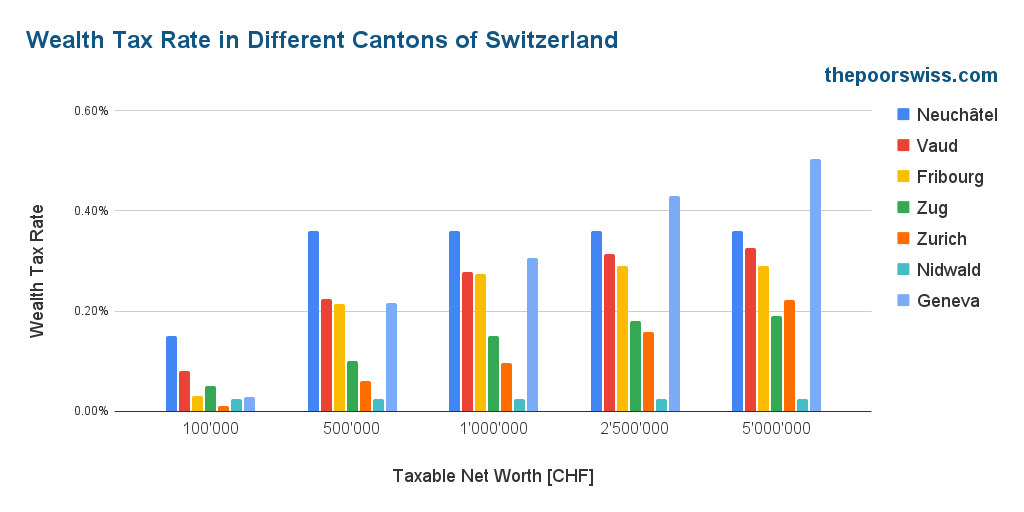

We can also present the results as the total wealth tax rate to compare better.

On this scale, it is easier to see the huge difference between the cantons.

When we think this number will be multiplied by the municipality tax rate, wealth tax can significantly affect your expenses.

Wealth tax and early retirement

If you plan to retire early, you must amass significant money. This amount of money means you will pay a significant wealth tax. So, how does this tax impact your retirement?

There are two ways to plan for wealth tax in early retirement.

The first way is simply to consider this as an extra expense. If your FI target is 2’500’000 CHF, you can estimate your wealth tax based on the canton you live in. For instance, for us, in Fribourg, it would be 7250 CHF for the canton and 6235 CHF for the municipality. But in Nidwald, it would be ten times cheaper.

Once you have estimated this number, you simply add it to your projected expenses in retirement. Since this will increase your FI number, you may have to do some math to get it right, but it is not very complicated.

The second way is to consider this wealth tax rate as a wealth management fee. When investing, we are trying to minimize investing fees. Any management fee will reduce your success rate in retirement if you follow Trinity Study withdrawal rates.

In that case, you will likely need to offset that extra fee with a reduced withdrawal rate. The result is again that this will increase your FI target.

Overall, planning for the wealth tax for early retirement is important. You will likely have to accumulate more money if you want t

Optimize your wealth tax

There are a few options to optimize our wealth tax. But these options are limited.

The first option is to move to a canton with a lower wealth tax. Since there are huge differences between cantons, geo arbitrage works well. Of course, this is not a simple solution, but this is likely the best way to optimize your taxes.

The second option is to decrease your taxable net worth. There are a few options to achieve that. The first option is real estate. In general, the taxable value of a real estate property is much lower than its real value. This means that your debt will often be higher than the taxable value, reducing the taxable net worth.

Another way to reduce your taxable net worth is to transfer money to non-taxable assets such as your second and third pillar.

Conclusion

The wealth tax is a relatively simple concept but with huge differences between the cantons. There is not much we can do to reduce this wealth tax.

The wealth tax is a form of double taxation. We are taxed on our income and then again on our savings when we accumulate money. I do not think this is a great way to tax people since this does not incentivize saving but spending.

For most people, the wealth tax will be negligible. It starts to matter when considering early retirement and the need to accumulate a lot of money.

In our case, we plan for the wealth tax as an extra expense for financial freedom. This wealth tax will increase over time until we can be financially free.

What about you? How do you account for the wealth tax?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Personal Finance in Switzerland

- More articles about Save

- 25 Money Statistics about Switzerland

- 5 Traps to avoid when moving to Switzerland

- All you need to know about Car Insurance in Switzerland

I was wondering if it’s really convenient minimize the second pillar or third pillar payments in favour of self investing money on the stock market, this because 2/3a pillars in general don’t offer good yelds compared to self investing but they let you save a bit of taxed, is there any simulation about that?

Hi GF,

I have done simulations for both cases:

* Should You Contribute to Your Second Pillar in 2023?

* Should you contribute to your third pillar in 2023?

Does anyone know – how is the taxable value estimated for wealth tax purposes for real estate that is located in a non-EU country?

I understand that purchase value can be used as a proxy. But if purchase was made many years back and now is part of inheritance, then purchase value might not make much sense.

With the same token, current market value might not be right number because in Switzerland, the tax value of real estate is not the same as market value

This is a bit too simplified a take in an early retirement case.

In several cantons (at least Bern, Geneva, Vaud and Valais as far as I know), there are “fiscal shield” (bouclier fiscal in French) mechanism that can theoretically reduce a good chunk of this wealth tax, depending on how low you can reduce your taxable income.

In Geneva for example (and Vaud I think), your total taxes (income + wealth) cannot be higher than 60% of your taxable income. That means that, if you don’t rely too much on taxable income yielding investments (RE, dividends), you end up being taxed a maximum of 60% of [residual income – deductions (health insurance etc)]. If you manage to get that number as close as possible to 0, that will leave the wealth tax limited to that 60%.

Hi,

That’s interesting, I did not know about these shields. I don’t think we have this in Fribourg. Obviously, I cannot know about all the details of all the cantons.

But if you retire early, you are going to have a large portfolio (at least a million in Switzerland). That is going to generate large dividends, so I am not sure the shield is going to be very effective.

I was aware of the Geneva one since I live here, however I just searched out of curiosity when writing my comment if something similar existed elsewhere and discovered that way that some other cantons also had a similar thing. Kind of a good surprise !

You’re right about the fact that having a large portfolio will yield revenue anyways. However, this will be reduced by all the deductions you can apply, thus ending up with a lower wealth tax.

Note that in Geneva at least, they consider your wealth to yield at least 1%, meaning that the retained yield of your wealth is min(realYield, 1%).

Assuming you can manage to keep it to 1% or less, this’ll give you a taxable revenue of 10k / 1M.

For 1M, you can expect about 6K in final wealth tax in GVA (after the communal “percentage” added to it), so 60% of 10k doesn’t change much. However, for higher wealth, the base percentage is way higher than the average for 1M.

For 2M, you’ll probably have a wealth tax somewhere between 15 and 18k at that point (hard to really compute as it depends on the commune) : so the shield mechanisms says that, since your taxable revenue is 20k (still assuming you stay below 1% of total yield), you cannot pay more than 60% of that, so 12k. From that 20k, you can still deduce things like your health insurance and other deductibles for the taxable revenue, so you’ll most likely end up paying less than 10k, instead of 15 to 18.

Not sure if it ends up being competitive with cantons with hugely lower rates, but that still helps :)

Hi Pastissad,

I am not sure you can manage to keep it to 1% or less with average dividend yield.

Thanks for the examples, this is very interesting. I would not have thought it could be so effective.

This is probably not enough for Geneva to be a good place for taxes, but it’s still a good feature.

Hello Baptiste,

Thanks for this interesting post.

When looking at your chart ‘Wealth Tax Rate in Different Cantons of Switzerland’, I thought, well, this is relatively low.

However as you stated, it will be increased by a factor, depending on the county you live in. So for instance in Lausanne you would make 1.785x since they have 78,5% local tax. Hence we are rather with 0.6-0.7% on the first million, which is already higher than our interest rate from the bank.

So moving to a lower tax county will also help saving taxes.

Kind regards,

Laurent

Hi laurent,

Yes, when you put canton and county together, this makes it a very expensive management fee.

And you are absolutely right that even a change in county makes a big difference.

Thanks Baptiste, this has been very informative. I haven’t been aware of these huge differences wealth taxes, because I’ve always been focused on income taxes. But as you correctly point out, in retirement wealth tax becomes way more important!

So I assume Nidwalden is the “cheapest” canton for early retirement in Switzerland?

I would not say it’s the best for retirement. In retirement, you also have income tax because of dividends. So you have to balance out everything. And of course, you need to take costs into account. I have not researched what would be the idea for early retirement.

When you retire you might not be bound to Switzerland anymore. If your total tax is too high and Switzerland is going to skin you alive, you can just move to one of the neighbouring countries or other country which will be happy with sensibly less. A lot of people do it. No need to support the state with your money.

That’s indeed a possible optimization for retirement. We currently plan to retire in Switzerland, but who can say what will happen in the next 15 yeras.

The system in Berne is quite complicated. Basically the wealth tax is high, but there is a kind of „brake“ intended for wealth which doesn‘t generate much income: In this case, you pay a minimum of 0.24% of the taxable wealth OR 25% of the revenue generated from the wealth (i.e. dividends). This means that revenue from stocks is much less interesting than capital gains, as you will easily pay more than 50% in taxes on each dividend CHF

(income tax around 25% and wealth tax 25%). The „valeur locative imputée“ is also considered as revenue from wealth.

Interesting, I did not know Bern had such a system. It’s entirely true that in Switzerland, capital gains are preferrable over dividends. So optimizing for dividens makes little sense.

Thanks a lot Baptiste for this article.

Are you aware of a webpage which lists the wealth tax of all cantons? Already great to see the comparison you did, much appreciated.

As for the comment for the double taxation and that it does not incentives savings, I agree. However, I feel like wealth tax might counter the fact that there are essentially no capital gains tax in Switzerland. At least I have the feeling most countries have capital gains of ca. 20% or higher but no wealth tax? Could be wrong of course, interested to hear your thoughts.

Hi Donald

No, I am not aware of any such page. The problem is that the formulas for net worth taxes are often complicated, so putting everything into a web page will be difficult, especially since they can change every year.

That’s a good point. We do indeed have no capital gains tax in most cases. And it’s also true that many countries like the US, have capital gains tax but no wealth tax. It’s difficult to know exactly which one is better, it likely depends on the canton.

There is another impact of owning one property in Switzerland and one in another country. The interest of the mortgage in Switzerland can be deducted from your income. However, if you own a property in Switzerland (with mortgage) and one in another country (without mortgage), for tax calculation purpose, the interest from the mortgage in Switzerland will be split between the 2 properties according to their value. This reduces the amount of interest you can deduct from you income.

So, you mean that the deductible interest on the Swiss property is reduced because you own a property abroad? That sounds weird.

Hi,

Does the taxable net worth include assets and loans outside Switzerland?

If so, how is the value of real estate calculated?

Best Regards

Hi Martin,

I believe it should include all assets.

But I have no idea how it works for real estate outside of Switzerland, I have never had one.

Hi,

Yes, you are taxed on your worlwide assests and you need to include everything in your Swiss Tax return. There is a difference between real estate and other assets. Real estate abroad is included in your total wealth and as such increases your tax bracket (%) but is not included in the actual wealth tax calculation base (so the % is applied on your assets excluding real estate abroad).

Loans etc. are included in your tax return as well and are treated the same way as if in Switzerland e.g. if you loan X $ to your friend abroad you need to declare this in your tax return and this amount is a part of your next wealth. Similarly for loans taken (deducted from your net worth).

Hope it is clear.

Thanks for all the details, T! This is very useful and clear.

Obviously I meant “a part of your net wealth” and not “part of your next wealth” :-)

Regarding your second question on real estate value calculation. You put the value of the foreign real estate in your tax return yourself. Assuming you bought it, it should be the purchase price. Otherwise (inheritance etc.) your estimated value.

I can confirm T comments on this, at least that’s how it is in the canton of Zurich.

Thanks for the confirmation!

Hi,

Yes, in canton Vaud they will ask for the contract of purchase and take the price you bought it by 80%. Then, you can deduct the interest as in Switzerland.

however, there is a caviar. They will calculate the valeur locatif from the asset. This is just taking the value of the asset x80%x6%. This 6% is totally arbitrary as they dont take care the same considerations of the quality of the construction as in Switzerland.