Second Pillar: All you need to know to retire in Switzerland

| Updated: |(Disclosure: Some of the links below may be affiliate links)

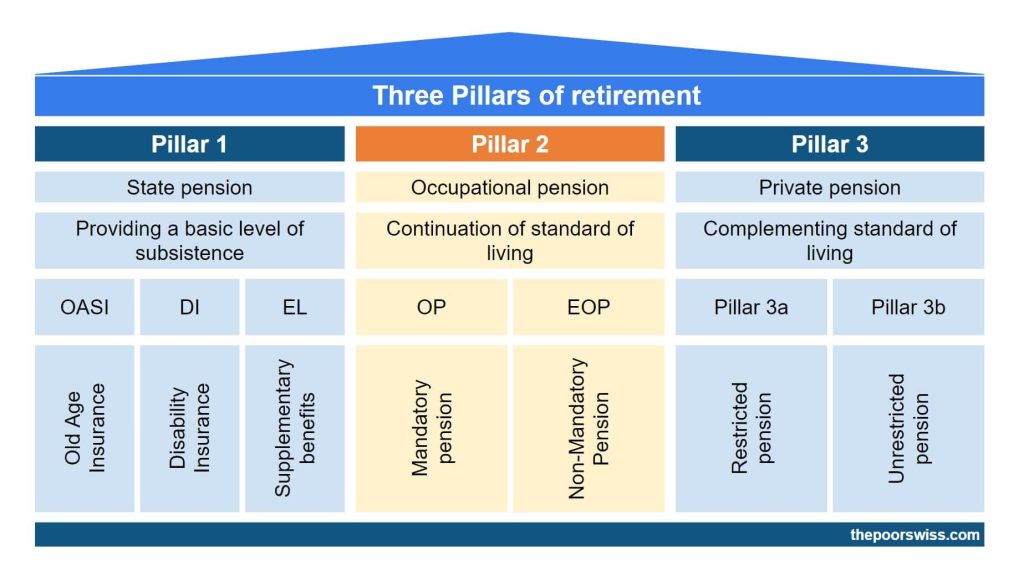

We have studied the first pillar in the previous post in the series. Now, it is time to study the second pillar. The second pillar is an occupational pension for people working in Switzerland.

While the first pillar covers everybody’s basic needs, the second pillar covers a larger part of your salary. It is an occupational pension. If you never worked, you will never pay anything for this, and you will never receive anything from this. It is significantly more complicated than the first pillar.

In this article, I give you all the important details on the second pillar. I will also help you understand what you can do to improve it.

The Second Pillar

The second pillar is your work pension.

In French, it is called Loi fédérale sur la prévoyance professionnelle vieillesse, survivants et invalidité (LPP). In German, it is Bundesgesetz über die berufliche Alters-, Hinterlassenen- und Invalidenvorsorge (BVG). As you can see, the Swiss government is very good to make short names… But, we will simply call it second pillar in this article.

This second pillar is a pension for every people who worked in Switzerland and paid into the LPP. Every Swiss employee of at least 24 years with an annual salary of more than 21’150 CHF contributes to the second pillar. It is directly deducted from your salary and transferred to your pension fund. The contribution is a percentage of your salary.

Interestingly, your employer will at least match your contribution. Some employers contribute more than this. As an independent, you must pay both the employee and employee parts.

How much you pay for the second pillar depends on your age:

- 25 to 34 years old: 7%

- 35 to 44 years old: 10%

- 45 to 54 years old: 15%

- 55 to 65 (64 for women) years old: 18%

The percentage deducted from your salary depends on the part your employer is paying. All the contributions to the second pillar are pre-tax. It is an essential fact. You will pay the taxes when you withdraw your second pillar.

As you get older, you put more and more into your second pillar. It means that the last years matter a lot in the calculations of your second pillar pension. It is a bit dumb because the first years are the ones that are the most important for compound interest. So, we should actually contribute more in the early years.

The first pillar was global insurance. You are paying for other people. But the second pillar is a physical account, in your pension fund, with your name. So this is your money.

There is another big difference. Your pension fund is related to your current employer. Each employer chooses its pension fund provider. It means that when you change company, you will likely change pension fund as well.

Some companies will have a better option for the second pillar than others. Most second pillar providers are extremely conservative. But there are a few good ones that allow investing your money in stocks.

Vested Benefits

If you change employer, you must transfer your contributions to the new pension fund. But if you do not directly switch to a new job, you will transfer the funds into a vested benefits account.

If you lose or quit your job, you must transfer the funds into a vested benefits account. This account will be locked until you get a new job (and a new pension fund) or reach retirement age. Even if it is in your name, there is not much you can do with it. In some cases, you can choose how the money is invested. But, you cannot move money in or out.

If you become unemployed, you can also choose to continue contributing to the pension fund. In that case, you can transfer your assets to the Substitute Occupational Benefit Institution. This could be an option to avoid a gap in your pension fund.

If you retire early, you will keep the money in a vested benefits account as soon as you quit your job. It will stay there until the official retirement age. Vested benefits accounts can be withdrawn up to five years before retirement age.

If you leave Switzerland, you will have the choice to withdraw the money or keep it until retirement. Depending on the country you are leaving to, different conditions may apply.

Vested benefits accounts are generally much better than pension funds. For instance, you can take a look at finpension. They offer excellent vested benefits accounts.

If you want to know more, I have an article about all you should know about vested benefits.

Mandatory vs. Extra Mandatory

Now starts the complicated part about the second pillar. We have to distinguish between the mandatory insured salary and the extra-mandatory salary.

We will only be talking about the yearly salary here. The mandatory insured salary is the salary between MIN and MAX.

- MIN is 7/8 of the maximum of the first pillar, 24’675 CHF.

- MAX is three times the maximum of the first pillar, 84’600 CHF.

If your salary is between 21’151 CHF and 28’200 CHF, your mandatory insured salary will be 3’525 CHF. Everything higher than MAX is the extra-mandatory salary. So, the maximum mandatory insured salary is 59’925 CHF (MAX-MIN).

Here are a few examples with different yearly salaries:

- 20’000 CHF: Not eligible for the second pillar (less than 21’150 CHF)

- 25’000 CHF: Mandatory insured salary of 3’525 CHF (less than 28’200 CHF)

- 30’000 CHF: Mandatory insured salary of 5’325 CHF

- 50’000 CHF: Mandatory insured salary of 25’325 CHF

- 84’600 CHF: Mandatory insured salary of 59’925 CHF

- 100’000 CHF: Mandatory insured salary of 59’925 CHF and Extra-mandatory salary of 15’400.

So what is the difference between these two parts?

I mentioned the contribution rate for the second pillar. These were the contributions to the mandatory part. The contributions for the extra-mandatory part depend on your pension fund and your company.

Another difference is the interest rate. The law sets a minimum interest rate of 1% on your mandatory contributions. But there is no minimum for the extra-mandatory portion. Your pension fund can offer better (or worse) interest on it. It is generally a bit better on the extra-mandatory portion. This interest is the only way your second pillar account money will grow. It is not a great interest rate. But there is nothing you can do about it. It still beats Swiss banks currently.

The last difference is the conversion rate. This rate will define how much pension you can get from the capital. The law sets a minimum conversion rate of 6.8% for the mandatory portion of your capital. Again, there is no minimum for the extra-mandatory part. Your pension fund will set the conversion rate. Generally, it is significantly worse than the conversion rate on the mandatory part.

1e pension plans

There is a third component for the second pillar, the 1e pension plan. This plan offers better investments for persons with very large salaries. It is not well-known because very few employers have such a plan.

If you want to know more, read my article about the 1e pension plan.

Insurance for death and disability

The second pillar also acts as insurance in two cases.

In the case of disability, the insured person will get a disability pension. The basis for the pension is all the assets accumulated and the sum of all the future credits. But they will not take interest into account for future credits. It is great insurance in case of a serious accident.

In the case of death, the surviving spouse will get 60% of the deceased’s full disability pension. However, there are some conditions for eligibility. There should be either the duty to provide for children or be at least 45 years old and the marriage lasted at least five years. If these conditions are not met, the surviving spouse will only get three years of pension.

In both cases, the government will review the pension every two or three years based on the beneficiary’s cost of living.

If you want more details, I have an entire article explaining what would happen to your retirement benefits if you died.

How much will I get from the second pillar?

Once you reach retirement age (65 for men, 64 for women), you can get your second pillar. You have three options:

- An annuity

- A lump sum

- A lump and an annuity

Here is where the conversion rate becomes important. The annuity will be computed using the conversion rate. If you convert 200’000 CHF with a conversion rate of 6.8%, you will get a 13’200 CHF pension each year.

If you take a lump sum, you will pay capital taxes, and if you take an annuity, you will pay income tax on top of it. For the extra-mandatory part, the conversion rate will depend on your pension fund.

Whether you should choose between these options is discussed below.

Should I take an annuity or a lump sum?

There is no definite answer to this question.

It will depend on the conversion rate at the age of your retirement. And how much you expect to get out of the capital each year if you manage it yourself. Generally, if you were to invest the amount into stocks, you would do, on average, better than the current conversion rates. However, there is a risk with stocks, whereas the conversion rate is guaranteed. In the end, you will have to do the math yourself, depending on your situation.

If you do not invest your money or get lower returns than the conversion rate, you should probably opt for the annuity. It also depends on how much you need that money. Maybe you have planned to use that large sum for something specific. But be careful about considering the taxes.

Inheritance and second pillar

Now, I said that the second pillar was your money. This is true. But there is a case where you could lose this money. Or, at least, your family could lose this money.

If you die before retirement, the inheritance of the second pillar depends on whether you have it in a vested benefits account or pension account.

First, if you have it in a standard pension account and if you die, this money can be passed to your spouse or your legal heirs. This is the standard way of inheritance.

However, if you do not have heirs or a spouse, this will not be distributed according to the inheritance law. For instance, your parents will not be eligible. And this money will get back to the canton. So, if you have no heir or spouse, you may consider your second pillar differently.

For a vested benefits account, it is simpler. It is based on the standard inheritance procedure.

How to optimize your second pillar?

Compared to the first pillar, there are a few things you can do to optimize your second pillar.

Voluntary contributions to the second pillar

You can make voluntary contributions to the second pillar to fill contribution gaps.

Like for the first pillar, you can have holes in your second pillar. Contribution holes (or gaps) can happen in several cases. For instance, if you started contributing late due to your studies or were unemployed for some years. If you leave Switzerland, you will stop contributing too. Finally, it generally happens because your salary is higher now than before. Therefore, you could contribute more now because your salary would have allowed you to contribute more.

You can fill these holes (or contribution gaps) by voluntary contributions. These contributions are pre-tax, too, so this will reduce your taxes. However, your employer will not match them. Moreover, voluntary contributions are always extra-mandatory. Finally, these contributions are locked for three years. It means there is no way to withdraw them before. You can ask your pension fund how much you can contribute to filling the gaps. There is an annual limit on how much you can contribute. They will also give you directions on how to perform these voluntary contributions.

If you can do it, I think it is a good way to increase your pension and lower your taxes. However, you need to be sure whether you should contribute to your second pillar or not. Be sure of your actions because this money will be locked for years. It is also money that will not return a lot of interest. But it is a safe investment. You can think of it as a long-term bond investment.

If you compare the second pillar to investing in the stock market, the second pillar will only be interesting in the short term. It will provide nice tax savings, but the interests are so low it will not return much after that.

If you want more details on the subject, you can read whether you should contribute to your second pillar or not.

Taxes

When you withdraw the second pillar, you will pay taxes on the withdrawal. This is at a better rate than if you had been taxed in the first place. But this is still a non-negligible part.

One essential thing is where you live when you withdraw your second pillar. This is what will matter for the second pillar. There can be a huge difference between different cantons. Moreover, you will also pay a wealth tax that can vary from canton to canton.

If you want to compare the implications of where you live on your second pillar withdrawal, you can try to look at this calculator. It will tell you how much you will pay taxes on your second pillar if you take a lump sum.

When you do the calculation, you need to take taxes into account. This could help you decide between a lump sum and a pension. And you may want to consider this when you move to a new place.

Change employer

Another thing you can do is choose a company with a better pension fund.

Of course, this is impractical, and the pension fund should probably not be the main argument for choosing a company over another. But this could make a significant difference in your retirement. You can also ask your company if there is an option for investing more in the second pillar. Indeed, at some companies, they give you the choice of how much to invest in it. And some companies can even match your extra contributions.

Increase your income

As for the first pillar, increasing your salary will increase your contributions to the second pillar.

Then, it will increase your final pension. Do not forget that contributions to the second pillar are pre-tax. But of course, increasing the salary is not always possible or even what you want. And increasing your salary is an obvious choice if you can do it in good condition.

Withdraw the second pillar before retirement

You can withdraw money from your second pillar before retirement (early withdrawal).

The main reason for early withdrawal is to buy a house. Indeed, you can withdraw your second pillar money to build or buy a house. It will reduce your pension accordingly. But it can help you to have the funds for the downpayment on your house.

However, this will only work for your primary residence and the place where you live! You cannot use your second pillar for a secondary residence. If you work in Switzerland and live in a neighboring country, you can use this money to buy a house abroad. But again, you will have to live on this property.

The same applies if you want to start your own company. You can also withdraw the money if you are leaving Switzerland. The other reason is early retirement. You can withdraw your second pillar five years before retirement age.

The case of leaving Switzerland is the most complicated. It will depend on where you are going. If you leave for an EU country, you will only be able to withdraw the extra-mandatory part of your second pillar. But that will depend on exactly the country where you are going.

There are some limitations and rules to these early withdrawals. The minimum withdrawal is 20’000 CHF. If you sell the house you bought with the second pillar, you must repay what you withdrew.

Voluntary contributions into your second pillar after early withdrawal will not be tax-free. After you have reached the same amount as before the withdrawal, they will be tax-free again.

Be careful that after 50 years old, you are limited in what you can withdraw. After 50, you can only withdraw the amount when you are 50 or half of what is available. The limit is the maximum of these two numbers. Finally, withdrawals are only possible every five years.

Reporting

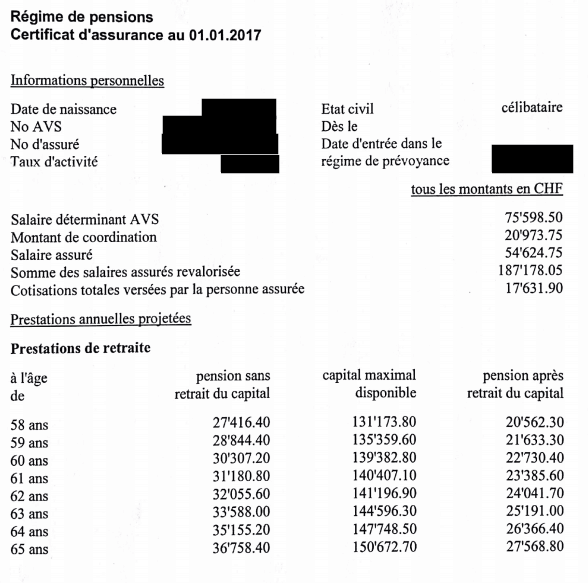

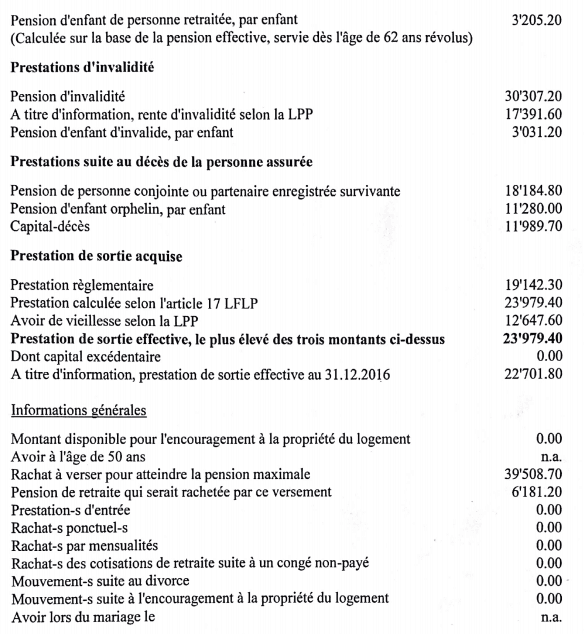

Every year, you should receive a report from your pension fund telling you many things. It will give you information about how much you contributed, the mandatory and extra-mandatory parts… It also predicts how much you will have by retirement. You should not bother too much about the predictions. But it is interesting, nonetheless.

This report differs for each pension fund, but most information will be the same. For instance, here is my redacted report from 2017:

As you can see, there are tons of numbers here. It will also cover things like death or pension in case of handicaps. If you are married or divorced, you will have more information than me.

If you are lucky, you will receive reports more often. And if you are fortunate, your pension fund will have a web portal where you can see this information online. It will depend on your pension fund. My new second pillar company updates its online portal monthly. I can track it much better now.

You should always keep these reports if you receive them in the mail (I scan them). They contain important information for your financial future.

Accounting for your Second Pillar

If you are tracking your net worth (and you should!), you may consider the second pillar inside it.

I integrate my second pillar in my net worth and count it as bonds. Since it is a very safe and conservative investment, counting it as bonds in my net worth makes sense. Adding your second pillar to your net worth will give you a better picture of your assets.

FAQ

What is the second pillar in Switzerland?

The second pillar is an occupational pension. Every person who works in Switzerland and receives a salary of more than 21000 CHF per year is eligible for this pension.

How much will I receive from the second pillar?

How much you will receive will depend on how much you contributed. It will also depend on your last salary. Finally, some second pillars have better conditions than others. You can ask your second pillar provider to estimate how much you will receive at retirement.

How can I optimize my second pillar?

You can make some voluntary contributions to your second pillar. But remember that these contributions will be locked in your second pillar until you can withdraw them. You can also increase your salary to increase your second pillar contributions.

Conclusion

The second pillar is the second part of the retirement system in Switzerland. It will cover a larger portion of your salary in retirement than the first pillar. While the first pillar is for everybody, the second pillar is only for employed people.

How much you get at retirement will mostly depend on your salary. Under normal circumstances, with your first and second pillars together, you should gain a pension of about 70 to 80 percent of your salary. If you want to complete this, you must use the third pillar. I will cover the third pillar in the next post of this series. It is an optional part of the retirement system but has many advantages.

To continue learning about the retirement system in Switzerland, read about The Third and Final Pillar.

What do you think about the second pillar? Do you have tips to optimize it? Do you have any questions regarding the second pillar?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-book

“If you do not invest your money or get lower returns than the conversion rate, you should probably opt for the annuity.”

The main issue with keeping the money in the pension fund is that if you die and your children are grown-ups, they’ll get nothing. However, if you take out the money at the retirement, you can invest them conservatively (e.g. high grade bonds), get a return and keep the whole amount. It’s a no brainer what to do.

Hi PG,

I agree that you should consider the inheritance point.

However, I don’t agree that it’s a no-brainer. If you are get a high-quality bond these days, you will maybe get 2%. So, you are trading 6.8% returns for 2% returns, that’s not a good deal unless you are in bad health and will not last long.

Hello Baptiste

I work in the restaurant sector and I was approached by an agency recommending to invest my 2nd pillar into an account which is more profitable than the existing one . Is it risky to transfer to another caisse? Do you recommend any for better returns ?

Thank you

Hi Heiden,

Are you employed or self-employed? As an employee, there is nothing you can do.

As an employer, you could indeed move it. I don’t know them from the point of view of employers, but I would be careful with someone cold-contacting you about that.

Even though there are some advantages for you and your employees, it may be risky and complicated to do so.

Hi Baptise,

WOW! I owe you a beer (or 5), your blog has been exceptionally helpful for me! Do you have a donation button somewhere? Thank you so much for all your wonderful work, it’s deeply appreciated!

May I bother you for just a little bit more of your wisdom? I am starting my own GmbH and I’m assuming that means I need to soon choose a Pillar 2 pension option for the company. I know you say most return 1%, some really good ones at times return 5%. I’ll chat with my accountant on setting something up in the coming weeks, but I’d like to already know what’s a good Pillar 2 to choose as the company owner is, so he doesn’t sell me something questionable with 1% returns.

Do you know of good Pillar 2 options? (I’m not finding much online about this as I guess it’s often not spoken about because most people are employees and don’t need to make these decisions, but as I’m the business owner, I get to pick and I definitely want low fees and as high of an exposure to stocks as possible!)

I also note in the comments above you said if you’re self-employed you can choose a vested benefits account which is preferable… though I’m assuming as I’ll be employed by my own GmbH, I’m technically “employed” and the director of the company, not simply “self-employed” and therefore just allowed to choose the best vested benefits account (which I see is clearly Finpension!) Though if I’m wrong and I’m able to just sign my GmbH for a vested benefits account, I totally will!

Cheers!

Paige

Hi Paige,

No, I don’t have a donation button, but if my content helped you, the blog achieved its goal, no need for more :)

Honestly, if you are going to setup a tiny company (a few employees), you won’t have a great second pillar. Great second pillar are second pillar that are run by a company entirely, for instance, some large tech companies do that.

I have good experience with AXA, with decent returns (about 3% average in the last 5 years).

In the case of this blog, since we draw a tiny income, we had to use the Substitute Institution. They do not have great returns, but there is not much we can do with the salary we draw.

Indeed, if you are employed by your own company, you are not really self-employed and you will get a second pillar, not a vested benefits account. There may be ways if you are the only employee, but I am not sure about that.

Dear Baptiste

I should have paid attention earlier! I am still sitting on a fairly sizeable vested benefits account. In retrospect, I should have opened two of them to minimise the tax burden. But I didn’t.

My question: Is it still possible to open a second account with another provider? I don’t think so. But wanted her (highly informed!) take on this.

Also, I’m 68 and understand that I’ll have to withdraw the funds before I turn 70. Any other suggestions for minimising the taxes? (Note that buying property doesn’t appeal to me. And I don’t have a mortgage.)

Thanks a lot!

Veloman

Hi Andrew,

You can’t split it at this point unfortunately. If you are still working and still have a pension fund, you could transfer it to a second vested benefits, but your existing account must stay.

The thing you should do is start withdrawing your 3a accounts if you have not done so already so that they will not be withdrawn the same year as your second pillar. Other than that, I don’t see what you could do, unless you are willing to move to a cheap withdrawal tax canton.

Hey,

I’ve recently become self-employed and have the opportunity to withdraw the entirety of my 2nd pillar funds. I don’t need these funds for my company’s operations, but I’m contemplating investing them independently. This way, I could access the money later if necessary, without any restrictions etc.

Have you ever analyzed the pros and cons of an early withdrawal in the context of self-employment?

Hi Ivo

No, I have not analyzed this in detail.

You need to be careful about multiple things before doing that:

* Can you invest them and generate better returns than a vested benefits account?

* Can you trust yourself not to spend that money and make sure you won’t risk your retirement?

* Are you going to create a sole proprietorship? LLCs for instance wont’ let you use your second pillar.

Hi Baptiste,

I’ve been considering opening a separate account on IB, possibly investing in VT + bonds (80% stocks + 20% bonds) or a similar option. I believe this could be more interesting and “aggressive” compared to a standard vested benefits account + the amount isn’t substantial enough to significantly impact my retirement (about 90k), and considering I’m 39 years old, I still have a long time before retirement.

I’ve started a sole proprietorship 5 months ago, and I’ll be eligible to withdraw 2nd pillar funds within a year.

Thank you for for any input.

I learned recently that leaving Switzerland to an EU country (not sure if it applies to all of them) actually allows you to withdraw the whole investment in your Pillar 2, as long as you are not registered in the country’s social security system for 90 days (meaning, you don’t have a job).

Hi Tomas,

I believe that’s wrong. If you leave to an EU country, you will have to wait until you are of retirement age to get access to your second pillar. At this age, you will then be able to withdraw everything.

I have never heard about this specific rule of being unemployed.

Hi, really enjoy these articles thx. Most readable articles on pensions I have read tbh. You touch on it often but would really love you to cover options for someone leaving country permanently. (Expat e.g.).

I know e.g. you would have to pay for bank account as non swiss resident. Could I take a pension payment in chf without having to cash out. If I take the cash what capital fees etc. Etc.

Hopefully you could cover that some day.

Hi Mike,

Thanks for your kind words :)

That’s a good idea. I touch on that on several articles, but never as a whole article!

Hi Baptiste,

I have a more system understanding question.

When one changes jobs, if there’s a period of unemployment, then the 2nd pillar can be transferred to Finpension, right?

What happens then later when I get a new job?

Can I keep the money in the finpension / vested benefits account or is it mandatory to transfer it to the new 2nd pillar company ?

Yes, you need to transfer the money to the new 2nd pillar.