First Pillar: All you need to know to retire in Switzerland

| Updated: |(Disclosure: Some of the links below may be affiliate links)

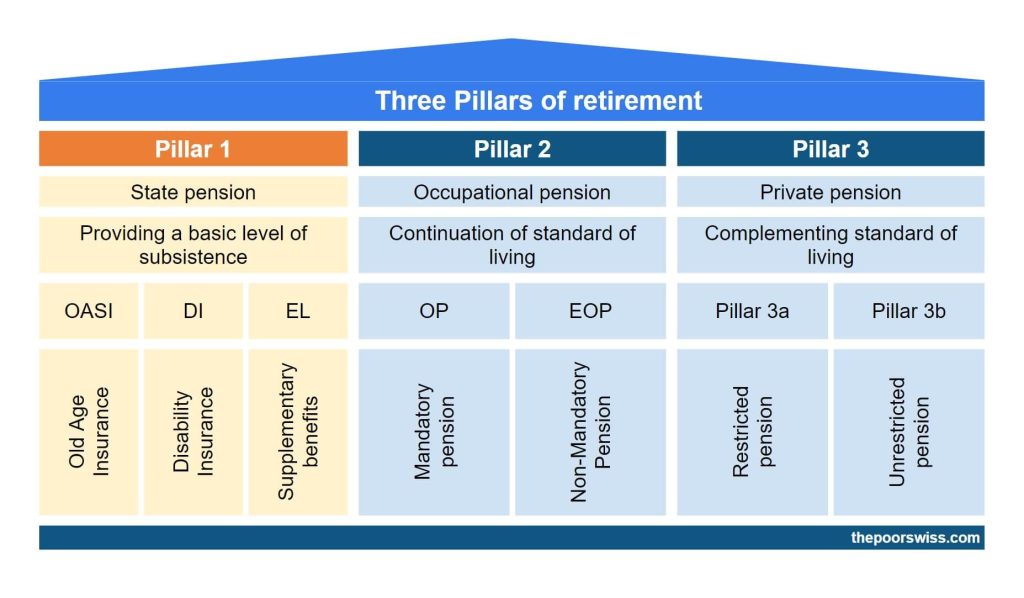

The retirement system of Switzerland is a system with three pillars. Each pillar is paid differently and will cover different needs. The first pillar is the state pension.

If you are working in Switzerland, it is essential to know these three pillars. Even if you do not plan to retire in Switzerland, understanding how they work will help you plan your retirement.

This article discusses the first pillar in detail. It should contain everything you need to know about the first pillar to retire in Switzerland.

I use the French acronyms in this article. But the figure at the top of this article has the acronyms in English as well.

Introduction to The three pillars

Here are the three pillars of retirement in Switzerland:

- The first pillar (state pension). This first pillar will grant a pension to every Swiss employee after retirement. It is a state pension between 1175 CHF and 2350 CHF per month if you have worked every year since you were 20. Each employee in Switzerland finances this pillar.

- The second pillar (occupational pension). The second pillar will grant a pension to every Swiss retired employee. You will only receive money from this pension if you work and have an annual salary of more than 21150 CHF (currently). You will pay for this pillar with a deduction of your salary each month.

- The third pillar (private pension). The third pillar is a personal saving system. While the first two pillars are mandatory, the third pillar is optional. You can only save a certain amount each year into the third pillar. The essential part is that the third pillar has tax advantages.

Every pillar will improve your quality of life after retirement. The first pillar is only there to cover your basic needs. With the first pillar, the second pillar should cover from 75% to 80% (on average) of your last salary. And the third pillar, which is optional, should help you cover the missing part of the second pillar.

The first pillar

The first pillar is a state pension.

Every Swiss person registered with this global insurance will receive this pension. The Assurance-Vieillesse et Survivants (AVS) insurance is what makes the first pillar. This insurance covers the basic needs of every person in Switzerland after retirement.

This pension is paid by every Swiss employee (and independent people) after 17 years old through a deduction from their salary.

You pay for the AVS insurance and two other insurances: the insurance for invalids (AI) and when you serve in the army (APG). Each month, 8.7% of your raw salary goes to the AVS, 1.4% to the AI insurance, and 0.45% to the APG insurance, for a total of 10.55%.

Employees pay half of the full contribution, and the employer pays the other half. Therefore, you should see a deduction of 5.275% each month for these three insurances together.

These contributions can change every year. For instance, in 2020, the contribution for AVS insurance (the first pillar) increased from 8.4% to 8.7%.

For completeness’ sake, we also need to talk about Unemployment Insurance. It is not directly related to the retirement system. But you will also pay for it monthly. You will also pay 1.1% of your salary for it. If you get more than 148’200 CHF per year, you will pay 0.5% of the part higher than this number. This insurance will cover the needs, for some time, of people who lose their jobs and cannot find a new one.

Unemployed people also have to pay this fee. People who do not have a salary have to pay the minimum fee of 478 CHF per year, starting from their 20-year birthday. An exception is if their spouse pays at least twice the minimum fee (956 CHF) per year. For instance, I have enough salary that my wife does not have to pay AVS.

If you have a significant net worth, the minimum fee will increase. For instance, with a one million net worth, you must pay 2054.60 CHF (as of 2020) as a minimum each year. There are exceptions if paying this fee would reduce your living standards too much. You can use this calculator to see how much the tax is for unemployed people.

How much will I get from the first pillar?

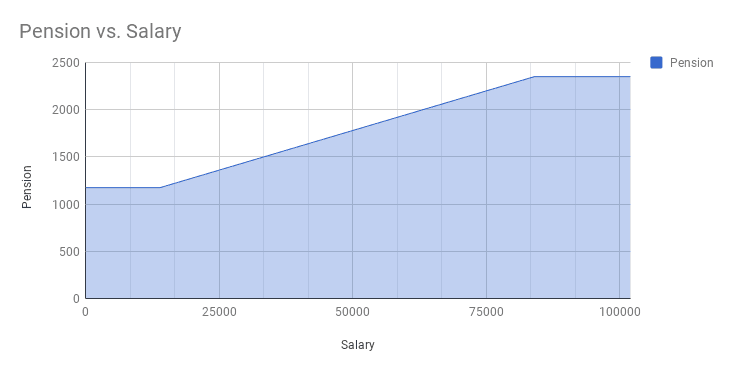

The full pension is a minimum of 1225 CHF per month, up to a maximum of 2450 CHF per month. How much you get depends on several factors:

- How much income you got during your working life.

- The number of years you have contributed to the first pillar.

- Contributions for caring for children or relatives.

First, the amount of your salary determines the amount of the full pension. The minimum pension is up to a salary of 14’100 CHF per year. To reach the maximum pension, you must have an average annual salary of 88’200 CHF. You can see in the previous image how that scales. Between those two milestones, the full pension scales linearly.

The second factor is how many years you paid the AVS insurance. To get the full pension, a man should pay for 44 years and a woman for 43. If you have missing years, you will receive a pension prorated for the years you have paid the insurance.

The third factor is when you care for children below the age of 16 or care for relatives. During the years when you are in this situation, you cannot have contribution gaps. Even if you did not pay during this time because you had no income, it would not count as a gap in your contributions.

The first pillar and marriage

Importantly, a married couple cannot receive two full pensions, only 150% of a full pension (3525 CHF per month).

Fortunately, the minimum is still 200% of the minimum pension (2350 CHF monthly). It is unfair to married couples with both a large income. But some things are unfair to married couples in Switzerland (taxes, for instance).

This first pillar of pension also covers the case of widowed people. If the dead spouse were eligible for a pension, the surviving spouse would receive this pension.

Several things need to be considered in the case of divorce. First, each spouse will get a pension based on half the combined income during the marriage. The care contribution credits are also divided in half. If one of the divorced spouses dies without retirement, the other spouse will get 80% of the deceased pension.

The first pillar and early retirement

The first pillar only covers official retirement, at 65 for men and 64 for women.

If you want to retire earlier, you can ask for a pension one or two years in advance. However, this means you will get a reduced pension of 6.8% per year of advance. You can also take it later, as seen in the next section.

If you want to retire earlier than two years before the official retirement age, you will only be eligible for the pension when you reach retirement age. Before that, you must rely on your net worth to cover your expenses.

Official calculator

If you want an official estimation, there is a cool official tool for estimating your pension.

Remember that this is only an estimation, not an official number. But in my experience, it seems pretty accurate. It can compute the results based on your income and marital status.

If you have not worked in Switzerland your entire life, you can enter your income for each year and get a good picture of what you will get based on the holes in contributions.

The first pillar and leaving Switzerland

If you leave Switzerland, you will usually still be entitled to the pension. So, once you reach retirement age, you will receive your pension.

However, there are a few exceptions. For instance, if you are not Swiss and move to a country without a social security treaty, you will lose the first pillar pension.

If you lose the right to the first pillar pension, you are generally entitled to reimbursements of your first pillar contributions.

In any case, it is mandatory to announce that you are leaving the country. If you want all the details, you can read about them on the official Switzerland website.

Optimize your first pillar

You cannot do much to optimize your pension from the first pillar. Since it is mandatory, you are already paying for it.

It is essential to avoid any years when you do not pay the AVS insurance. All these years will significantly reduce the amount you will receive. If you go to a foreign country for a long time, you should continue to pay the minimum each year to avoid penalties.

Even living abroad after retirement, you should receive your pension. But the country where you retire should have a social security agreement with Switzerland.

When you are studying, you should also pay the minimum to avoid any missing years. If you missed a year of contribution, you could pay for it in the next five years. After five years, you cannot compensate for it anymore.

If you are moving to Switzerland, you will not be able to fill your gaps. These gaps can be filled if you are in Switzerland and then living abroad for a few years for instance.

If you want to increase your pension, the biggest thing you can do is increase your salary. Although it may not be evident, you should probably try to increase your income regardless of the pension.

There is one other thing you can do to increase your pension. You can delay the time at which you start to receive the first pillar pension. If you delay the pension by one year, you will get a pension increase by 5.2%. It increases to 10.8% for two years, 17.1% for three years, 24% for four years, and 31.5% after five years (maximum delay). It is a gamble on your life expectancy. If you expect to live until 100 years old and can afford to delay the pension, you should delay it for five years.

Accounting

I do not account for the first pillar in my net worth. There are several reasons for this.

- You do not only pay this insurance for yourself. It is global social insurance. The people with more salary will pay more for people with a smaller salary.

- Then, since I plan to retire in Switzerland, I will never touch the capital, only the pension.

- I am not entirely confident it will still exist once I reach the official retirement age.

However, I should account for this in my computation of my Financial Independence (FI) ratio. Since it is a guaranteed pension after retirement age, you will need less money stashed for your needs. But it is a bit weird to account for it, and I still have not done it. Indeed, it is only starting at the official retirement age. And your retirement may begin early.

Another argument for not accounting for the first pillar is that it may not be solvent once I reach retirement age. It is a somewhat pessimistic point of view. But the population is rapidly aging, and Swiss couples have fewer and fewer children. I prefer to ignore it for now in my strategy, and I will rethink it when I am closer to retirement. If you are optimistic about it or close to retirement, you should account for the first pillar in your retirement strategy.

FAQ

What is the first pillar in Switzerland?

The first pillar of retirement in Switzerland is a state pension. Every person in Switzerland is eligible for this state pension.

How much will I receive from the first pillar?

This will depend on your salary. The minimum is 1175 CHF per month, and the maximum is 2350 CHF per month. The minimum is up to a salary of 14’100 CHF per year, and the maximum is 84’600 CHF per year.

How can I optimize my first pillar?

You cannot do much to optimize for your first pillar. You need to make sure you pay for it every year. Having holes in your contribution will lower the money you receive.

Conclusion

The first pillar is the first part of the Swiss retirement system. It should cover the basic needs of every retired Swiss person. Employees pay it from their salary, and unemployed people pay a minimal amount each year. The pension is quite low (2350 CHF per month at most).

Most people cannot live only on this pension after retirement. The other two pillars are here to complete your needs during retirement.

Next, I cover the second pillar, which is an occupational pension that should make up a significant part of your retirement income.

What about you? Do you have any tips regarding the first pillar? Do you have any questions about the first pillar?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-book

Great website !

I am unclear if the UK has a social security agreement or not and what it means for my pillar 1 pension. Can you advise please? Thanks

Hi Steph

Yes, Switzerland has a social security with the UK since October 2023. so you should be good.

Hello Baptiste,

Great website – very useful!

My son (26) was a student outside of Switzerland during which time he paid the min AVS contribution.

He is now living and working in London, and can now choose to make voluntary AVS contributions.

Although given that he would have to pay the full c10% AVS contribution based on his gross earnings, I am thinking that he would do better to invest this potential AVS contribution elsewhere given the actual amount he would need to pay, many years until retirement, and potential (limited) growth of first pillar c/w with equities.

Of course other benefits (eg disability, survivors) are included in the AVS payment, but on a “simple investment play”, am I missing something?

Hi GPD,

On a simple investment play if you have to pay the entire contribution, it may be better to not pay into the first pillar.

However, your son needs to be aware that this will mean a significant loss in pension once he reach retirement age. So, this money must be invested in the goal of sustaining retirement (not for buying a new car or a travel :) ). As long as he has the will to do that properly, I think it’s fine to avoid AVS.

Hi!

Thank you very much for your explanations and all the great articles on the website!

I have a question regarding gaps. I am French. Since 2020 I have been working (at least for some time) in Switzerland. I asked for a recap of my paying to AHV and it seems I paid enough since 2020. However before that, I was not in Switzerland, and my compensation fund told me that I couldn’t fill my gaps for 2019 (which I believe is still in the 5-year range).

Do you have any information about that? Or if not, sources where I could find the information? Since I am quite young, I would like to fill all the gaps.

Hi Tanguy,

I would indeed except that you could could pay 2019 at this time, it’s not yet too late.

Many sources online talk about this, for instance: https://finpension.ch/fr/tout-ce-que-vous-avez-toujours-voulu-savoir-sur-lavs/

However, it looks like it may not be possible if you were not insured in Switzerland at this point: https://www.allnews.ch/content/points-de-vue/avs-les-ann%C3%A9es-de-cotisations-manquantes-p%C3%A8sent-lourd

So, it may only work if you leave Switzerland for a few years and come back :(

I will research this more and update the article accordingly!

It’s been a year since I moved to Switzerland (time flies). I am 46 now, married with a kid, and just learned you can buy back up to five years in your first pillar. I have two questions about it:

1. Are those voluntary contributions to the first pillar tax-deductible?

2. Is it worthy? I feel like it’s throwing good money on a Ponzi scheme.

Forgot to mention our gross income is 120-125k/year, depending on bonuses.

Hi CM,

1) Good question. I am not sure. I would assume so, but I can’t find a good source on the subject, I will need to research more.

2) It’s indeed highly debatable. If you are far enough from retirement, it may not be great since the conditions of the first pillar will have likely deteriorated by the time you retire. It also depends on whether you will rely a lot on first pillar. You have to plan properly for your retirement, even 20 years in advance. I would personally not do that.

Hello thanks for this information, I have the following question.

I arrived in Switzerland July 2015. I have not worked until December 2021, as I was taking care of our child and was hard to find job. Accordingly, I have not had pension contributions.

My question is, since my husband was working during this period – he paid the 1st pillar and the 2nd pillar, do I also have contributions under the 1st pillar, as his wife, during the period in which I did not work?

And hypothetically, when I retire, will this period July 2015 to December 2021 somehow be included, as some kind of 1st pillar contribution from my side, even though I didn’t work, but treating us as a family unit?! If NO, what can i do now?

Hi Fazlo,

Normally, as long as your husband had a decent salary, he would have paid at least twice the minimum first pillar contribution. If that’s the case, the contribution will be valid for you since your marriage.

If that’s not the case, you should have paid the first pillar yourself. I am thinking that if you never had to pay, your husband paid enough for both of you and this should count towards a pension for you.

To be sure, you can ask the first pillar office of your canton to see if you have any holes in your contributions.

Hi and thank you for the great info.

One thing I didn’t get. If I have gaps of contribution (moved to Switzerland in later working age), can I still reach the maximum if I have big salary?

Without voluntary contributions, you won’t be able to fill out your gaps.

A similar situation is, let’s say someone moved to Switzerland at the age of 28, and kept working until retirement without any gaps. Do you say this person still has to pay for the initial 8 years (Age 20 to 28) that happened before moving to Switzerland to be able to have the full 1st pillar pension?

If yes, can this person pay for these initial 8 years at any time? or only within 5 years after moving to Switzerland?

Thanks!

Hi Ahmed,

Yes, that’s correct. 28 to 65 is still missing a few years.

In that case, you would be able to pay for the missing when you arrive, but after 5 years it would be too late I believe.

I think, my employer did not pay into the AHV. I see the deductions in my salary slip, but not in my AHV statement. Can you please point me to the place where I can issue a complaint, and make sure that employer pays?

Hi,

Are you sure you are not mixing the first and second pillar? What is your AHV statement? Normally, you receive a statement from your pension fund for the second pillar, and you should see there how much your employer pays. But I don’t think you should receive a statement from the first pillar.

Hello,

I am working in switzerland since last 5 years. If i leave switzerland in future (lets say in 2 years) and if i move to non-EU country where there is no treaty. in this case, what will be the reimbursement for my contribution to 1st pillar? How is this calculated?

Thanks

Hi mihir,

There is also a condition of being a citizen of the country you are moving to. You can read about the details here. I will improve the article to reflect that.

Thanks Baptiste for clarifying and the link helped it.

Also thanks much for the detailed blog on the pension plans in Switzerland.