Should you contribute to your third pillar in 2024?

| Updated: |(Disclosure: Some of the links below may be affiliate links)

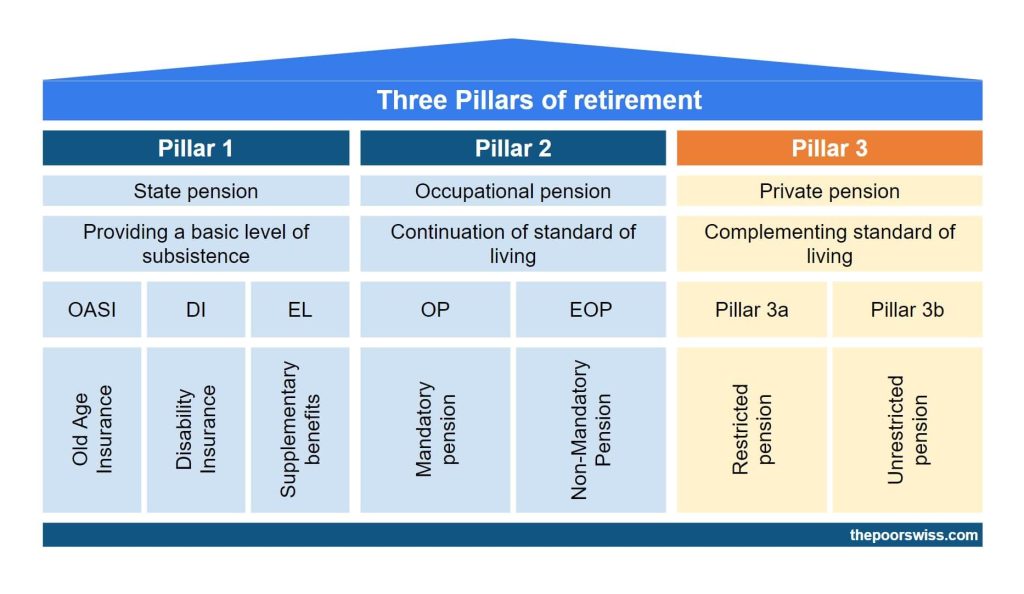

The third pillar of retirement in Switzerland is entirely optional. Your contributions will be locked until retirement. But you will get a significant tax cut from your contributions.

So, should you contribute to your third pillar every year? Before, it was obvious to me. I have always contributed as much as I could to my third pillar. But recently, several people have asked me if they should invest the maximum yearly.

Even though there is a large tax advantage to the third pillar, there are also some disadvantages to the third pillar. Do the benefits outweigh the disadvantages?

I answer this question in detail in this article.

Third pillar Advantages

If you are not yet familiar with the third pillar, I have an entire guide on the third pillar.

All contributions to the third pillar are voluntary. They are entirely optional.

So, why contribute to your third pillar? Contributions to the third pillar can be deducted from your income. These deductions will make a significant difference to your taxes.

You can contribute a maximum of 7056 (in 2023) per year in your third pillar. This amount is the maximum that will be tax-deductible. And there is no advantage in contributing past this point.

How much exactly you will save in taxes, depend on your marginal tax rate. This rate is the tax rate at which extra income is taxed. It will depend on how much income you have. Generally speaking, the higher your income is, the higher your marginal tax rate. For many people, this will be between 20% and 40%.

So, if your tax rate is 20% and you contribute 7056 to your third pillar, you will save 1411 CHF the year of the contribution. If your tax rate is 40%, you will save 2822 CHF.

You can view third pillar contributions as an investment with a return based on your marginal tax rate.

When you withdraw the money, you will still pay taxes on it. But this will be at a reduced rate. How much you will be taxed will depend mainly on two things: the amount of the withdrawal and the place where you live.

There is a second tax advantage for your third pillar contributions. You will not pay any wealth tax on the amount accumulated in your third pillar. If you were to keep this money in a bank account, you would pay a wealth tax.

If you have significant wealth, this can save you some money. It will depend on where you live. Indeed, in Switzerland, the wealth tax is different from canton to canton.

Overall, this could be savings from 0.1% to 1.0%. For most people, this will be on the low side of things. However, compared to the first advantage, this second advantage works every year. So, if you are investing for your retirement in 40 years, this could make a significant difference!

So, the advantages of the third pillar are in the tax advantages it provides.

Third Pillar Disadvantages

Now, there are some disadvantages to contributing to your third pillar.

First, all your contributions will be locked in the third pillar account until you can legally get this money. Generally, you will not get it before retirement age. But this money can also be used to buy a house or start a business (only if you become self-employed). And if you leave Switzerland, you can also withdraw this money under some conditions. But in general, we should assume that this money is not made to be used.

The second disadvantage is that the returns on the third pillar are not as high as when investing directly in the stock market. We have access to pretty good third pillar providers in Switzerland (here are the best third pillar accounts). But still, some rules limit the allocation of stocks you can have. And it also limits the allocation of international stocks you can invest in.

Nevertheless, this is much better than the second pillar, where you can expect very low returns. Overall, you probably lose between 5% and 10% in returns. But this is only true if you are aggressive in both your broker account and third pillar. If you compare cash and your third pillar invested in stocks, the third pillar will get much better returns. We need to compare similar investing strategies.

Now, the most significant disadvantage is the higher fees! It is where the second pillar loses to DIY investing. The best third pillar accounts have about 0.50% Total Expense Ratio (TER). This TER is significantly higher than a DIY portfolio with between 0.10% and 0.20% TER.

On top of these fees, we will probably lose on the tax efficiency of U.S. Exchange Traded Funds (ETFs). Most third pillars in Switzerland do not invest in U.S. ETFs. They will probably invest in fee-efficient Swiss funds. It means that they are losing on dividend withholding.

This also means they get even better TER (sometimes 0%) using pension funds. Depending on your allocation to U.S. funds, this could account for another 0.05% to 0.1% loss compared to your ETF portfolio with U.S. Funds.

Since 2020, third pillar providers have been allowed to get back this source withholding of the dividends by the U.S. For now, not every third pillar has taken advantage of this. But Finpension 3a and VIAC already implemented this optimization! So, by using them, you will get more returns than other equivalent third pillars!

Finally, contrary to DIY investing, your capital gains will be taxed. Indeed, when you pay the withdrawal tax, you will pay it on the entire capital, not only the money invested.

So, the disadvantages of the third pillar are mostly its slightly lower returns and significantly higher fees. It should not matter too much since you will need money for retirement.

Comparison with DIY Investing

So, with these disadvantages and advantages, we can see if you should contribute to your third pillar.

First, I compare it with DIY Investing. It is what I am doing with my invested money. And this is what I recommend.

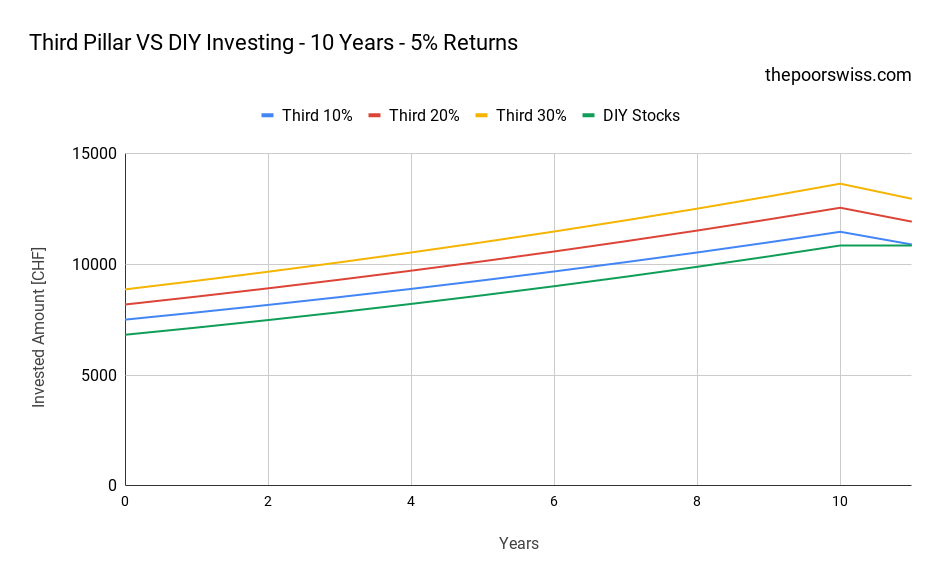

For this, I will assume a 5% return per year on the stock market. And the DIY Investing portfolio will have a 0.20% TER. You could go lower than that, but it is a reasonable average for many people. In both cases, I will consider aggressive portfolios fully invested in stocks. I consider a yearly 0.05% wealth tax.

As for the third pillar, I take Finpension 3a into account. It is currently the best third pillar available to acknowledge. The fees will be 0.44% with the most aggressive strategy. The money saved with the tax relief is invested in stocks in the DIY Portfolio. I assume 4.8% yearly returns for the Finpension 3a portfolio.

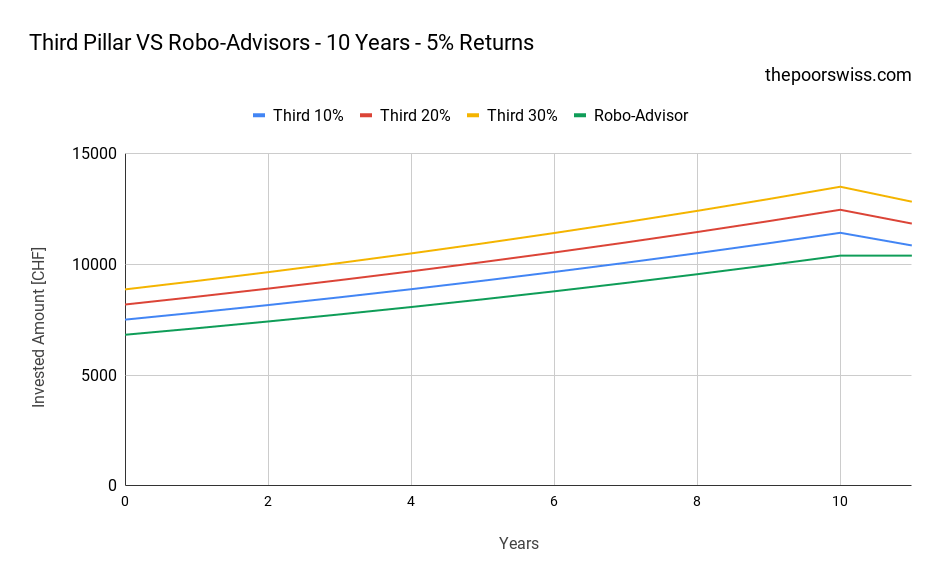

Here is what happens if you have ten years in front of you with different tax rates.

So, with ten years in front of you, it is quite interesting to invest in your third pillar. The direct returns of the first year make a significant difference.

Now, we can see that after ten years, the third pillar with 10% tax returns is at the same level as the DIY stock portfolio. However, 10% is a very tiny marginal tax rate. You would need to earn a tiny income to have such a low tax rate. For instance, even with one salary, we have more than 30% savings from the third pillar. And some people can go all the way to 40%. So, we should not be concerned.

If you have more than a 10% tax rate, invest in the third pillar!

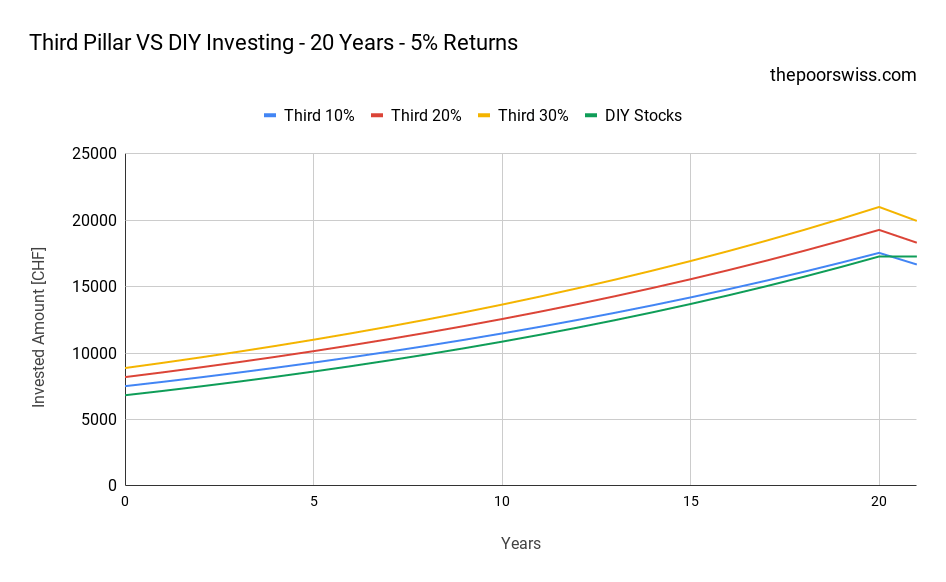

But what happens with a longer period? Here is what happens for 20 years.

After 20 years, the DIY stocks pass the 10% tax rate significantly. But the third pillar is still better if you have about a 15% tax rate. And this is still low.

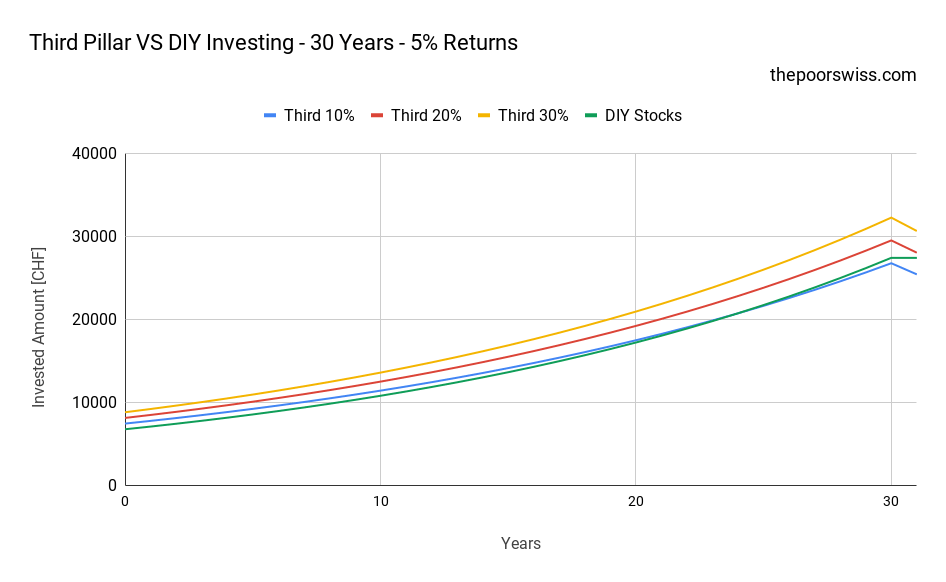

Finally, here are the results after 30 years:

It is interesting that even after 30 years, the third pillar with a 20% tax rate still beats a DIY Stocks Portfolio.

So, even if you invest in your own cheap index ETF portfolio, the third pillar is still very interesting because of the tax returns. But, indeed, the difference is not huge because of the lower yields and higher fees of the third pillar.

Nevertheless, it is still significant. After 20 years, you would still have about 2’600 CHF extra with the third pillar with a 30% tax rate. So, in the end, it will depend on your tax rate, wealth tax rate, and the returns of your portfolio compared to your third pillar.

Comparison with a Robo-Advisor

Now, if you invest with a Robo-Advisor, should you still contribute to your third pillar?

We keep the same parameters for the third pillar as the previous example. However, the money saved by the tax returns is invested in the Robo-Advisor.

For the comparison, I assume you use a very good Robo-Advisor from Switzerland, True Wealth. With an aggressive portfolio at True Wealth, you will have around 0.65% yearly fees. I am expecting the returns of the portfolio to be the same as the stocks (5% per year). And I am expecting Finpension to be at 4.8% per year. If you are using a more expensive Robo-Advisor account, the results will be lower for Robo-Advisor.

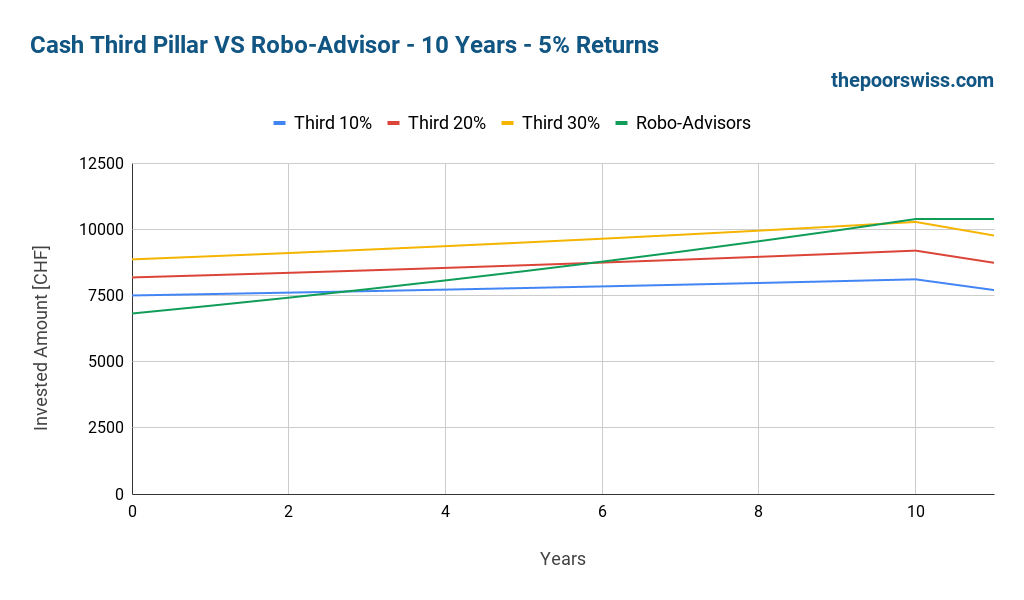

Again, here are the results for ten years:

Even with the lowest tax rate (10%), you still have a benefit over the Robo-Advisors outside of the third pillar. So, if you use one of the cheapest Robo-Advisors in Switzerland, you have a good reason to invest in the third pillar.

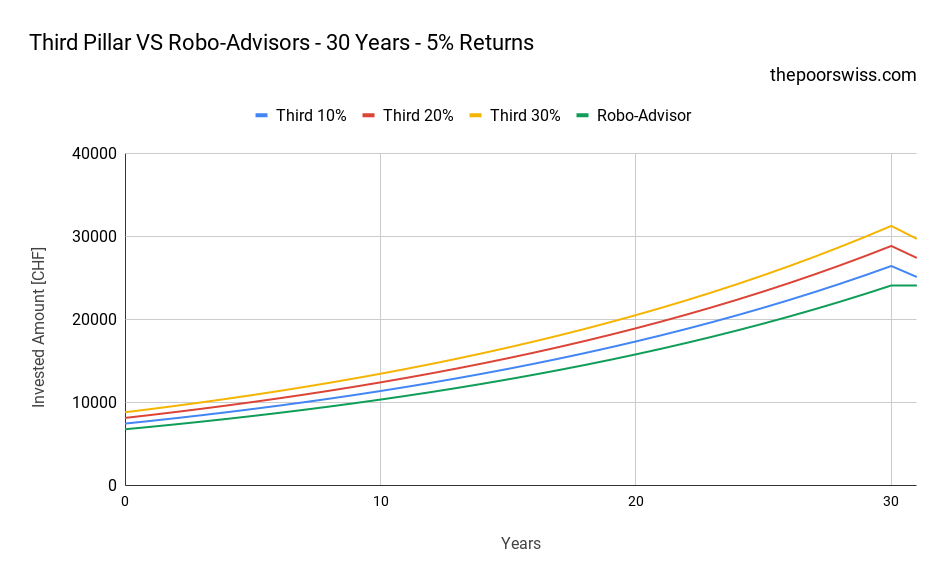

Can directly skip over to 30 years period:

Over 30 years, the differences are more significant. After 30 years, you have gained 5500 CHF more with the third pillar than with a Robo-advisor.

The results are quite logical. An excellent third pillar has very few disadvantages compared to a Robo-Advisor. The returns may be slightly lower. But the fees of Finpension 3a are better than the fees of the best Robo-Advisor! So, the initial tax advantage is better than the difference in returns.

So, if you are investing with a Robo-Advisor, you should contribute to your third pillar! The difference is significant. The best third pillar is better than the best Robo-Advisor.

Comparison with savings account

Finally, we can compare it with keeping money in a savings account, uninvested.

It means the money you do not invest in your third pillar is left in a savings account. For this savings account, we consider 0% returns and 0% fees. You may have a fee on your bank account these days.

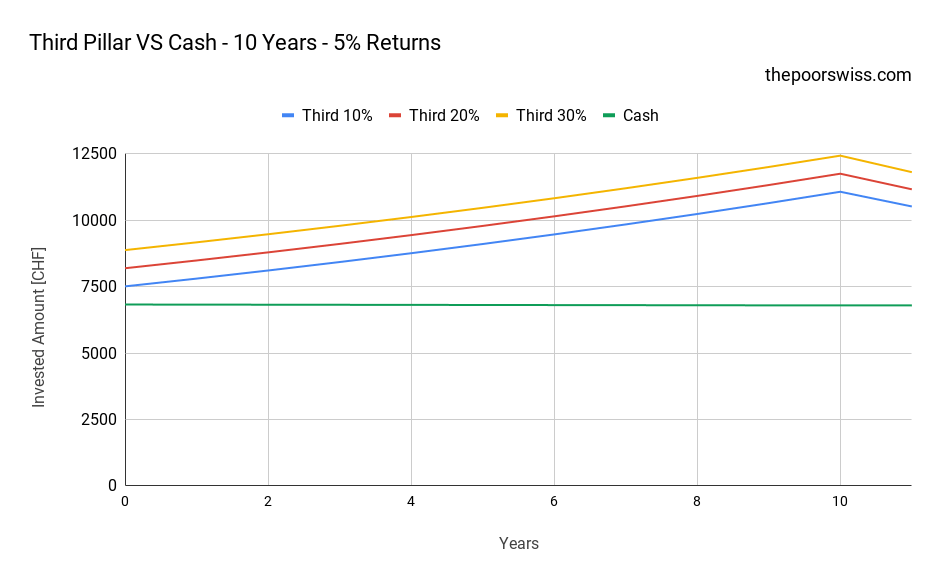

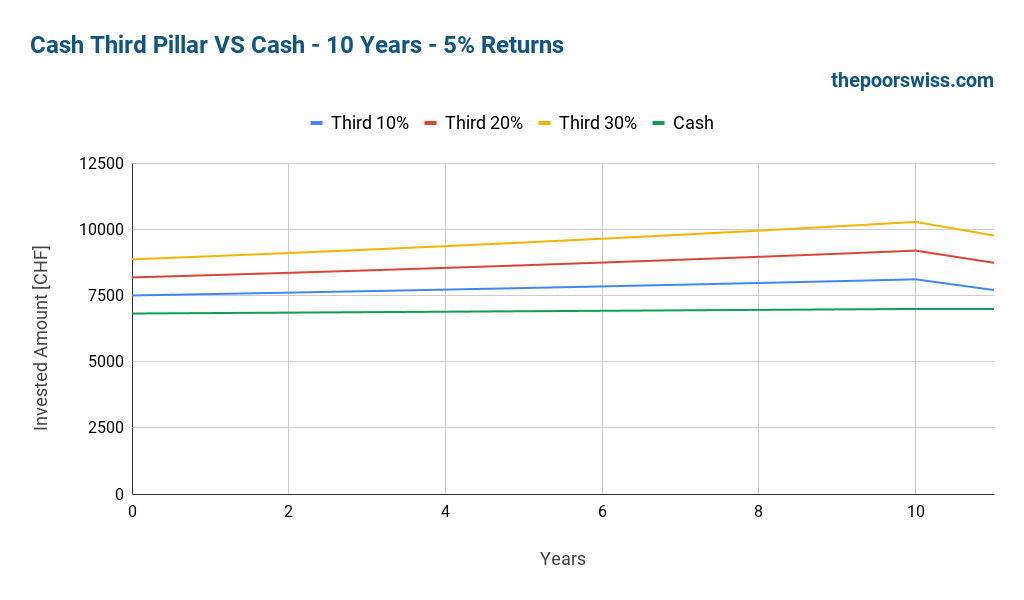

Here is what would happen after ten years:

The results are pretty obvious! If your money is uninvested, invest what you can in the third pillar. Contributing to your third pillar will make a huge difference!

What if you have a third pillar in cash?

Some people have a third pillar in cash. These accounts have very low returns but usually have no fees. So, how do they compare with the other means of investing?

Before comparing, I emphasize that I do not recommend these third pillars. The only time it would be adequate is when your retirement is very close.

So, we can take a third pillar account with 0.3% interest as an example of this analysis.

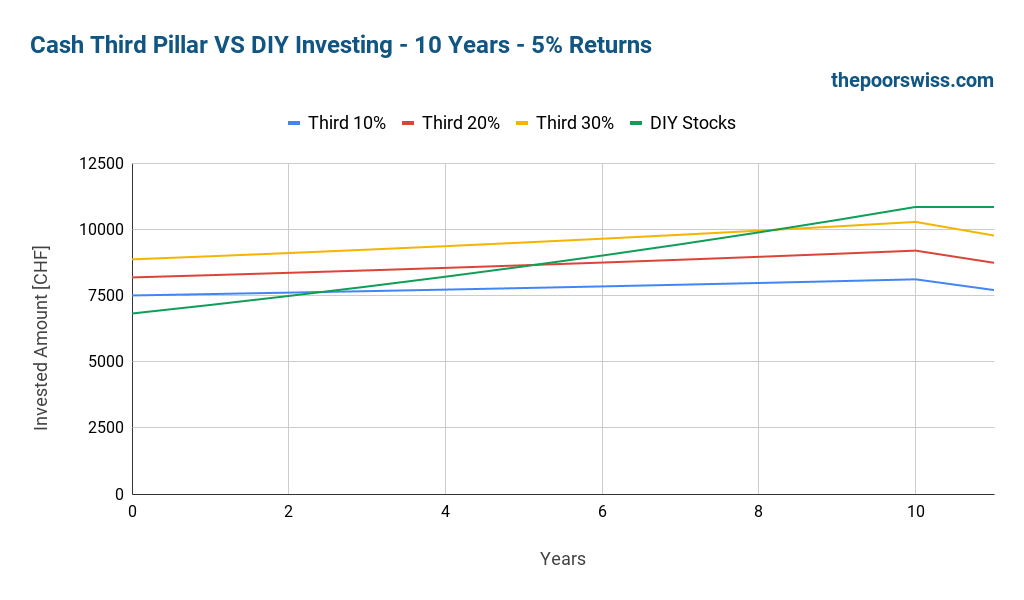

First, we compare it with a DIY Stocks Portfolio:

In less than ten years, the DIY Stocks portfolio will outperform the third pillar, even with large tax returns. This result is expected because of the much larger performance of a DIY Stocks portfolio compared to a cash third pillar.

So, if you only have access to a cash third pillar account and are a DIY Stocks Investor, you should not contribute to the third pillar! The exception would be in the last few years before your retirement. But I do not see how an investor would invest in such a third pillar.

We can see if the same holds when compared with Robo-Advisors:

We get almost the same results as with the DIY stocks portfolio. If you invest in stocks in a Robo-Advisor, you should not invest in a third pillar in cash.

Finally, we see what happens if you invest in cash:

In that case, we still have enough advantages with the original tax returns to make it worthwhile.

Now, I must repeat: you should invest in stocks in your third pillar if your risk tolerance allows it. And ideally, you should invest in stocks in your primary portfolio.

Conclusion

So, now we can answer the question: should you contribute to your third pillar? Yes!

Finpension 3a is the best third pillar in Switzerland.

Use the FEYKV5 code to get a fee credit of 25 CHF*!

*(if you deposit 1000 CHF in the first 12 months)

- Invest 99% in stocks

If you contribute to a good third pillar with low fees and high returns (Finpension 3a probably), the tax advantages of the third pillar will outperform even your DIY Stocks Portfolio.

And the third pillar gets better as your income grows. If you have a substantial income, you have no excuses not to contribute to the third pillar.

With an aggressive DIY portfolio, the difference is not huge, but it is still significant. But if you are investing with a Robo-Advisor, the third pillar will be even more investing. And if you are uninvested, the third pillar will be your best investment!

And in some cases, indeed, the third pillar is not worth it. If you are in a canton where withdrawals are heavily taxed, the tax on capital gains may outweigh the benefits of the tax benefits. But that is unlikely, for most people, it is still interesting to contribute to the third pillar.

Now, of course, you will not gain much by investing in a third pillar in cash. You need to invest in a good third pillar for the long term.

If you do not know where to start, check out my guide on how to start investing. And if you want to save money from taxes, you can read my article about the best tax deductions in Switzerland.

What about you? Are you contributing to your third pillar?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Retire in Switzerland

- More articles about Retirement

- Early retiree in Switzerland – Dror’s Story

- Third Pillar: All you need to know to retire in Switzerland

- The Trap of Life Insurance Third Pillar

Hey! But what about the tax that you will get once you withdraw this money? That can be a lot more that the extra growth vs investing in your own portfolio (where you do not have capital gains).

Hi,

This is taken into account in each of the graphs. You can see that the last year in the graphs there is a drop for the third pillar.

Dear Baptiste, I am not required to submit a tax return as my gross income is lower than 120k and I’m not a swiss citizen. Do you think it still makes sense to invest on a pillar 3a? I thought about submitting the tax return voluntarily, but most of my friends didn’t recommend it as in their experience most of the times I’ll be required to pay more taxes.

Hi Cesare

I think the general consensus is indeed to avoid 3a if you are not submitting a tax return. As your friends said, it could increase your taxes, even taking the 3a into account. If you have available money, invest it in a broker or robo-advisor for the time being.

Hi Baptiste

I have a question regarding the advantages of the Pillar 3a. Isn’t there another advantage: when I invest into Pillar 3a I do not pay income tax on the dividends. While if I would invest into an ETF DIY I would need to declare the dividend and then would need to pay my marginal income tax rate on them.

Thanks for the answer!

Hi HHP,

Yes, that’s a good point. On the other hand, they are not tax-free because you will pay a withdrawal tax on them withdrawing, but that should be lower than your tax rate.

I did not talk about it because dividends are not really efficient in Switzerland so only few people are optimizing for dividends. And as far as I know, there is no way to optimize for dividends inside a 3a either. But it’s a good bonus indeed.

Hi Baptiste,

Thanks a lot for all the good work :) you cannot imagine how much your knowledge sharing helps us (at least newcomers)

First time for me opening a 3rd pillar and I am wondering if I can open a cash uninvested 3rd pillar (at BCGE bank for example) and also Finpension and then transfer the cash to Finpension ?

Reasoning behind is that, I feel the market is too inflated at the moment and do not want to put all my money in stocks right now.

So let’s consider I put 3K in BCGE and 3K in Finpension… could I transfer 1K out of BCGE to finpension whenever I want ? (or worst case completely transfer BCGE to Finpension)

From what I read, I can trasnfer a 3rd pillar account from 1 bank to another, completely and not partially. Is this correct ?

Also, can I transfer a bank 3rd pillar to Finpension in like 12 or 18 months ?

What would be your recommendation for what I am trying to do ? any precautions I need to take ?

thanks a lot again !

Hi Mohit

Thanks for your kind words :)

You are correct in that you can only transfer fully and not partially.

One thing you could do is use a portfolio with only bonds at Finpension and then switch to stocks.

One thing you need to be careful is that some services have fees if you transfer out during the first year.

What I would recommend is think again about your investing strategy. You are trying to time the market and this does not work in the immense majority of cases. If you are a long term investor, just invest now and don’t think about the current valuations. The current valuations are not so high, several indexes are lower than they used to be one year ago. What will you do if the indexes never go down to this level again?

Thanks a lot Baptiste for the prompt response.

Enjoy the end of the year and do drop a message if you happen to be in Geneva, would love to grab a coffee or a drink or a fondue ;)

Cheers !

Thanks, will take a note of that!