What should you do with a life insurance 3a?

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Recently, I have talked about life insurance 3a policies and how bad they were. We have established that they have almost only disadvantages compared to an invested 3a.

So, people should not take new life insurance 3a. But what should you do if you already have one?

There are a few options about what to do with life insurance 3a. We will explore them all in this article and compare them. By the end of this article, you should know what to do about your life insurance 3a.

Life Insurance 3a

We have already established that life insurance 3a has significant disadvantages:

- Their returns are low.

- Their fees are high.

- They are very inflexible for deposits, locking you into this monthly expense.

- They are very inflexible for withdrawals, making you lose money in taxes.

- They are not transparent.

- They are heavily advertised.

The only advantage they have over an invested 3a (like finpension 3a) is that they have a guaranteed amount of money. However, life insurance 3a only guarantees a 0% interest rate, and the guaranteed amount is less than what you paid. If you want guaranteed 3a, you should take a bank 3a.

Life insurance 3a also has insurance in case of disability and death. This extra insurance may sound like a significant advantage. However, most people will not need insurance. On top of that, you can get pure risk life insurance for a fraction of the fees of life insurance 3a.

If you need more convincing, I have an entire article explaining why nobody should fall into the trap of life insurance 3a.

What to do with existing life insurance 3a?

It is essential to know that life insurance 3a is a terrible instrument. But what should you do if you already have one?

First, you should not feel bad about it. Many people in Switzerland are falling for life insurance 3a. I have a life insurance 3a. I am not proud of it, but I consider it a learning opportunity.

Why did I take life insurance 3a? An insurance advisor convinced me, and I did not know any better. Most people in Switzerland do not have the necessary financial education to understand how bad these products are. And most people in Switzerland trust advisors, banks, and insurance companies.

Banks, advisors, and insurance companies push these products because life insurance 3a is very lucrative. But life insurance 3a is not lucrative for its users.

We now go to the main question: What should we do with life insurance 3a?

There are three main ways to deal with life insurance 3a:

- Do nothing

- Reduce or stop the payments

- Cease the contract

We will see these three ways in detail in this article.

1. Do nothing

The first and simplest option is to do nothing. You continue contributing your monthly premiums, which stay in your life insurance 3a until your retirement age.

While this option is the simplest, it is also the most costly. Indeed, we have seen that life insurance 3a has abysmal returns and is very expensive. These low returns and high fees result in low performance for life insurance 3a in the long term.

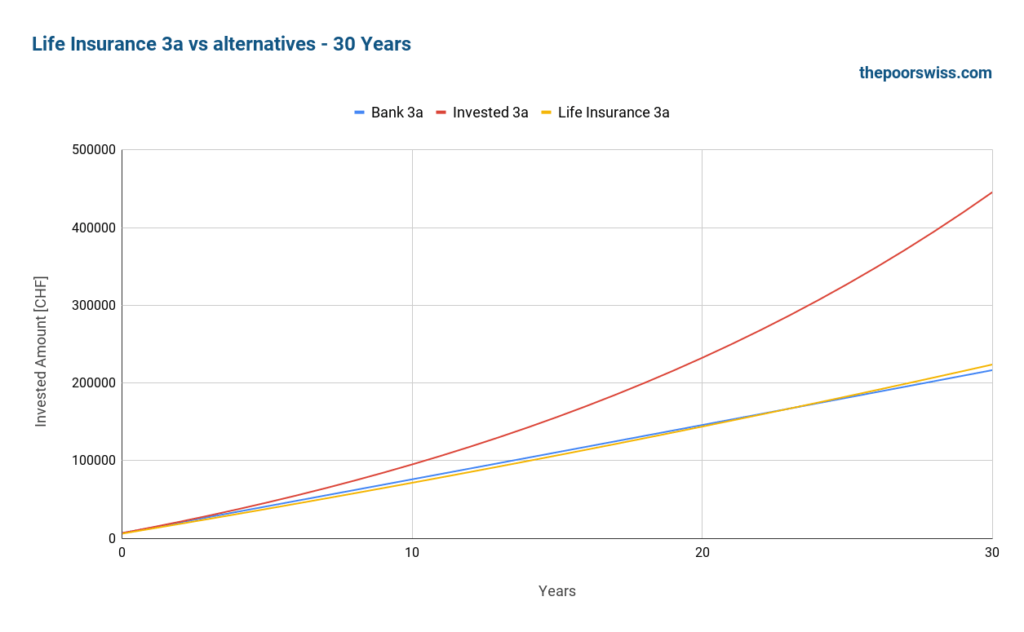

In the previous article, I ran a comparison and got these results after 30 years:

We can see that doing nothing can be extremely costly. Over 30 years, investing in a good 3a could easily yield twice more money by the time you retire.

Overall, I would strongly advise against doing nothing!

2. Release the premiums

The second option is to stop paying the premiums either fully or partially. Most life insurance 3a allows you to be released from the premiums. Once you release the premiums, you will not have to contribute anymore, and the money will stay with the life insurance until the original policy termination date.

From what I know, all life insurance 3a include such a clause in their conditions. So, it is generally not a huge deal to do that.

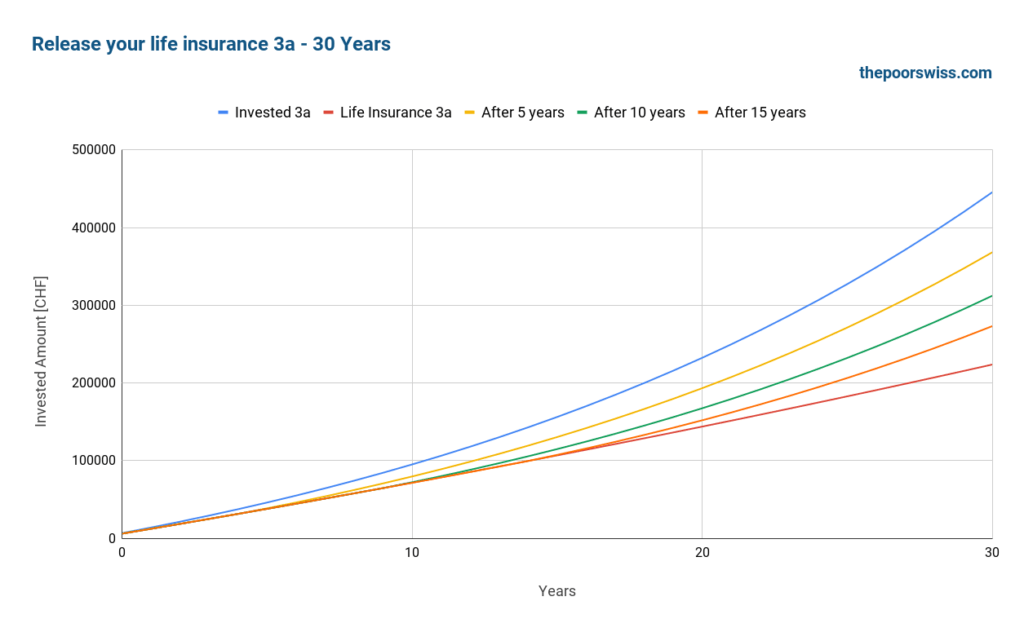

Here is what would happen to the money by stopping paying the premiums, simulated for 30 years.

We can see that the earlier we stop, the better results we get. It is logical since we get better compounding in the invested 3a, with much better returns. The part invested in the life insurance 3a will continue growing slowly over the years, but you could see it as bonds in your portfolio since this money (minus the fees) is guaranteed.

If you stop the premiums very early, in the first few years of the life insurance 3a, you may incur a penalty. Indeed, in the first few years, the life insurance company takes more in premiums for the risk premiums than in the following years. However, the earlier you stop, the better you will end up in retirement.

This strategy always makes sense unless you are extremely close to retirement. Even a few years without fees could help.

You must remember that the stock market returns are great in the long term but not necessarily in the short term. So, if you are close to retirement, below five years, you could stop the premiums and switch to a bank 3a instead. Or, you could be more conservative, depending on your asset allocation.

It is probably worth mentioning that doing that may prevent you from taking on another life insurance 3a. But that is probably a good thing.

3. Break the contract

The third option is to go a little further and entirely break the contract. With that, you stop paying, and you get back the money from the insurance company.

With this option, you will get back the buyback value. This value is based on the current value minus some cancelation fees. Usually, this value is zero in the first few years of the contract. You have no choice but to transfer this value to another 3a account.

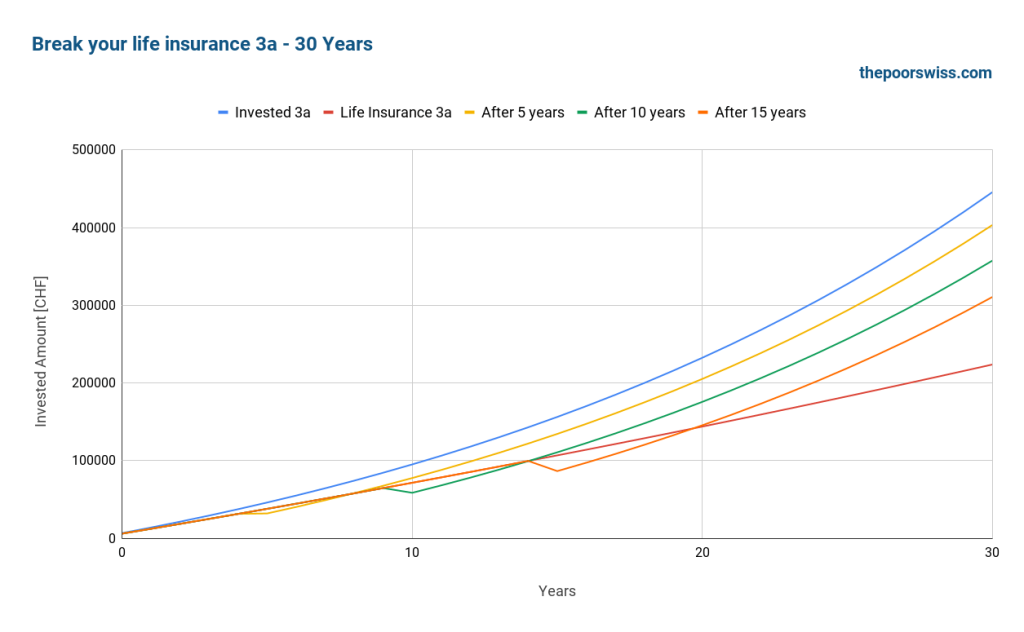

Once again, we can simulate this. I will assume that by canceling the contract, you will lose an extra 20% of the value compared to what you would have in life insurance 3a. This assumption is not precise since, in theory, you would lose more during the first few years and less during the following years. However, this allows us to make a simple simulation.

You may lose more than 20% or less than that based on your life insurance company. Unfortunately, they are not very transparent about these fees.

Here is what would happen if we were to break the contract after 5, 10, and 15 years.

We can see that the penalties can make a significant dent, but the returns of a good 3a easily recover this.

Again, the earlier you break the contract, the better the results will be in retirement. This effect is due to the compounding of the invested 3a.

I should repeat the disclaimer for the previous strategy: if you have only a few years, the stock market’s returns may not be great, depending on the timing. Therefore, breaking your contract a few years before retirement is not a great idea.

Comparing the three strategy

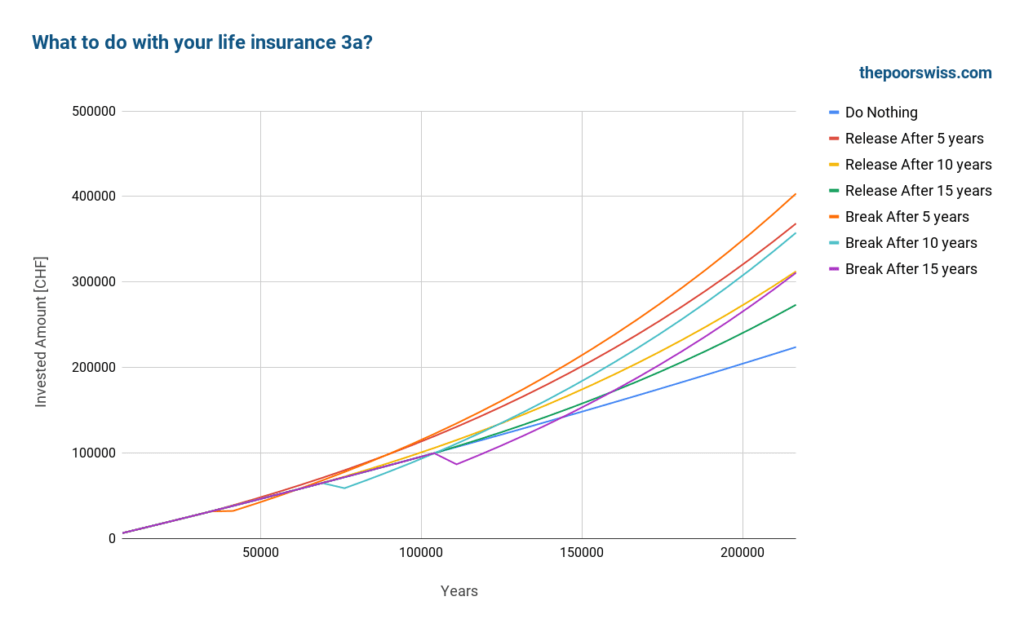

Here are all three strategies together on our graph to summarize them.

The difference between the worst and best strategies is almost 200’000 CHF! Such an amount of money can make a very significant difference in your life in retirement.

Unless you are very close to retirement, you should do something about your life insurance 3a. And doing something means either releasing your premiums or entirely breaking the contract.

The earlier you can do something, the better your returns will be in the long term. And generally, it should only take a few years to recover the loss from breaking the contract.

So, what makes the most sense is to break the contract and move the little money you get back into a good 3a and then invest regularly into that 3a. Releasing the premiums is also an excellent strategy that can make a lot of difference.

Life insurance 3a and mortgage

If you have tied your life insurance 3a with a mortgage for indirect optimization, you may be unable to change your life insurance.

Indeed, if you are using it for indirect amortization, your life insurance 3a policy belongs to the bank. Therefore, you will not be able to make any changes to the contract without changing the mortgage contract.

In these cases, the best option is to wait until the next contractual deadline for your mortgage. Then, you can either switch to direct amortization or use another third pillar for indirect amortization.

Of course, you can also ask your bank to see if there is a quicker way out.

What will I do with our life insurance 3a?

By now, you may know that I also have a life insurance 3a. And if you have read my previous article on life insurance third pillar, you will know that my life insurance policy is really bad.

Before writing these two articles, I thought I would keep them as a reminder of my error. Then, I was thinking of lowering the premium from 300 CHF per month to 100 CHF since it seemed possible. Since I had to wait a few more years because of my mortgage, I wrote these articles to support my evidence.

At this point, I have realized that my life insurance 3a needs to stop. Before, I did not know it was possible to stop paying the premiums completely.

Finpension 3a is the best third pillar in Switzerland.

Use the FEYKV5 code to get a fee credit of 25 CHF*!

*(if you deposit 1000 CHF in the first 12 months)

- Invest 99% in stocks

So, I plan to break the contract in 2024, when I can renegotiate my mortgage. At this point, I will remove the life insurance 3a from my mortgage, switch to direct amortization, and start to invest in finpension 3a fully.

I will then move the leftover money from the contract into Finpension 3a. At first, I was thinking of keeping it and considering it a bond. However, life insurance 3a is much more than a bond. Therefore, it does not make sense to keep some money with these people.

Conclusion

If you are trapped with a bad life insurance 3a, I strongly encourage you to do something about it. At least you should learn more about how they deliver very poor returns, have high fees, and are not transparent.

The results of this article show that doing nothing may cost you a lot of money in retirement. Before doing this analysis, I considered doing nothing. However, I now realize it does not make sense.

Once I can renegotiate my mortgage, I will free my life insurance 3a from the bank. Then, I will break the contract and invest everything in finpension 3a.

If you need to find a good 3a after reading this article, you should read about the best third pillars in Switzerland.

What about you? What will you do with your life insurance 3a?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Retire in Switzerland

- More articles about Retirement

- Early retiree in Switzerland – Dror’s Story

- Should you contribute to your third pillar in 2024?

- The 4 Stages of Wealth

Hello, I have a question.

I’ve made several contracts with AXA SmartFlex ( one 3a and two 3b) I’ve been paying 300.- per month since I made them and today I have around 500.- on my 3a and my 3b and 1500 in my other 3b account.

I want to quit AXA because I want to invest my money better into finpension, and also because they’ve been making a lot of mistakes and not assuming their responsibility.

For example, I lost my job last year and instead of pausing my 3b monthly payments as I asked them, they stopped my 3a, and I just discovered that when I was filling my taxes. Ont of my 3b was made for my nephew, and I wanted it to be able to cash out at his 20’s but the contract goes until 2060 etc…

I already sent them the form to transfer my 3a money into Finpension, but concerning the 3b’s if I try to “buy them back” 3b the total goes to 0. So I’m loosing 2000.- what should I do in this case ?

Hi Jorge

Good decision!

Sorry to hear about your troubles, seems very unprofessional of them.

The only other thing you can do is release the premiums (stop paying, by sending them a letter). This will keep the money in the 3b and you won’t have to pay more.

Thank you, Baptiste, for such an “eye-opener” article. I’m also one who has fallen into the trap of life insurance 3a!

I’m an employee and have a 3a insurance policy with Zurich with a high “capital guarantee”. I have paid CHF 588 per month from Jan 2023 until now.

On top, in March 2023 I transferred CHF 13776 from my bank 3a account into this life insurance…all with the support of my “independent” financial advisor!!!

All in all, I have paid CHF 22k up to now.

Zurich sucks when it comes to reporting as they don’t have any online service. However, based on a document I received from them, it seems that before 31-Dec-2024 the surrender value is CHF 0. By that time the surrender will be CFH 20k.

In this case, it would be better to stop paying premiums (i.e. releasing the premiums or reducing them to the minimum) now?

Or should I continue paying premiums until December 2024 to get back CHF 20k in surrender value?

The other question I have is if releasing the premiums is the same as converting this to a “paid-up policy”?

Hi Juan

Sorry to hear about that!

Normally, whether you release the premiums or not, you should be able to get back some money since th surrender value is set to increase soon. Ideally, you should ask them what is the surrender value in January 2025 if you release the premiums now, but they will resist and try to trick you…

If you are sure that the surrender value will be 20k in January 2025, then paying the premiums until the end of the year and then breaking the contract would be a good way to get a significant part of what you put into.

I do not know what is a “paid-up policy”.

Thank you, Baptiste,

I’ve extracted this from a document containing the general conditions of my life insurance:

“Can this insurance be converted to paid-up insurance or

surrendered?

Conversion into a paid-up policy

The policyholder is entitled to request that the insurance be converted

to a paid-up policy at any time with correspondingly reduced benefits.

All supplementary insurance policies will lapse. The effective date for

conversion is the end of the period for which a premium was last paid.

The future administration costs and any risk premiums will be financed

from the contractual capital.”

It seems that converting to a “paid-up” policy is the same as releasing the premiums…

I have requested Zurich to confirm what would be the surrender values in both cases: releasing or reducing the premiums. I’ll keep you posted!

Interesting way to put it, it’s not very clear.

I think it’s indeed the same as releasing the premiums. And surrendered policy would mean breaking the contract.

Hello everyone,

It seems I felt in the same trap with life 3a life insurance.

Did anyone experienced issues getting a separate pure life insurance not tied to 3a or 3b from a different company? (after canceling the 3a contract)

By issues I mean price increase for new life insurance or refusal for the new life insurance?

Thanks for the blog post Baptiste,

Cheers

Hi Vladimir,

Sorry to hear that!

I have never heard that, but I know it’s possible because they consider that a client that canceled once can cancel multiple times in the future.

What you could do is take pure life insurance before canceling your tied life insurance.

Hi All,

I believe this article is missing a 4th option to reduce the scam value of a 3a with life insurance: buy an apartment using the surrender value and then wait until the end of contract to recover the last portion of the “costs” (20%). This way one would utilise immediately 80% (surrender value) and then get the rest at the end. What does PS think about it?

Cheers

Hi Al,

Keep in mind that you can’t recovered everything. It’s true that the last few years is where a lot of the money is “vesting”, but the risks costs are lost.

You could take out some money early for a house or pledge it and then run the insurance to the end.

I am not sure this would be much better but this would avoid breaking the contract. The most important is to release the premiums as to stop paying more into the scam.

Thus option does not exist. Once the capital is reduced there won’t be any recovery of the 20% since the interests money simply won’t be there. Basically they stole 20% of your money, full stop. That’s the ugly truth. What is unacceptable is that the government backs those scams without intervening supporting consumers and legally blocking the scams. Peiple like us trust our brokers and the fact those are known options labeled 3a so one wouldn’t think of a scam. The other crazy stuff is those big companies are still able to hide contractual terms and costs without giving and indications, this is all legal!