The Trap of Life Insurance Third Pillar

| Updated: |(Disclosure: Some of the links below may be affiliate links)

For your third pillar, you can choose between an account at a third pillar provider or a life insurance policy. Many people (often advisors) recommend using a life insurance policy.

However, in practice, these third pillars have many disadvantages. There is no reason to use a life insurance 3a for your third pillar.

In this article, I detail the differences between a third pillar with a bank or an independent provider and a life insurance third pillar (life insurance 3a).

Life Insurance Third Pillar

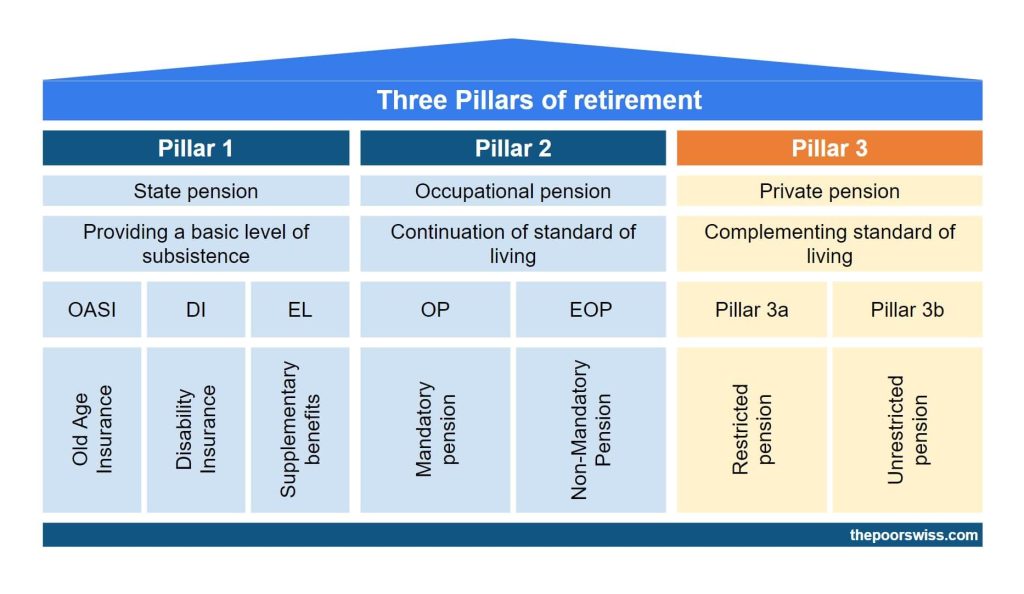

The third pillar is open to workers who pay into the second and independent people who own companies. The idea of the third pillar is simple: save money while you work and get it back when you retire.

The main advantage of the third pillar is that you can deduct your contributions from your taxable income. The third pillar is an excellent way to reduce your taxes. However, employees are limited to 7056 CHF annually (as of 2023). Generally, I recommend most people contribute to their third pillar. I contribute the maximum every year.

For your third pillar, you have two choices:

- An account with a bank or an independent provider (Finpension 3a or VIAC, for instance). I call these standard 3a accounts.

- Life insurance third pillar with most insurance providers in Switzerland. I call this life insurance 3a.

Both options have the same basics:

- You can deduct the contributions from your taxable income

- The money is locked until retirement

- Or until some specific conditions, as seen later

Both standard 3a and life insurance 3a can be invested. In both cases, there are some special retirement funds available. So, your money can be invested in stocks, bonds, or other alternative investments. Since the third pillar is a long-term account, it is excellent to invest this money.

However, they have some significant differences. And as we will see in this article, most of these differences are disadvantages of the life insurance version.

Life Insurance 3a is not flexible

Lets’s start with the first difference: flexibility.

With a standard third-pillar account, you can deposit money whenever you want. But with life insurance 3a, you must pay your premium regularly. For most providers, you will pay for months. But sometimes, you may have to pay quarterly, semi-annully or even annually. This limitation leads to several disadvantages.

First, if you want to max out your third pillar in January and forget about it, you can do it with a third pillar in a bank. With life insurance, you have no choice but to pay when the insurance tells you to.

More importantly, if you are having a bad year and do not want to contribute to your third pillar, you cannot stop paying your life insurance (without penalty). On the other hand, you can stop paying your 3a account for several years if you want. This lack of flexibility is important because it means your life insurance 3a can put you in trouble.

Finally, the maximum amount for the 3a changes every few years. If you start your life insurance 3a with a full contribution, this contribution will not follow the increase over the year.

For instance, in 2019, the maximum contribution was 6826 CHF. But in 2021, the maximum increased to 6883 CHF. If you got your life insurance 3a in 2020, you already lose 57 CHF per year in potential tax deductions. And this will increase every few years.

Of course, you could take out a standard 3a on the side to reach the maximum contribution, but most people will simply not. Usually, this limit will increase every two years. In 2023, it went up 7056 CHF.

With life insurance 3a, you are also not flexible on withdrawal. With a standard 3a account, you can withdraw money early or late. But with insurance, you can only withdraw it on the date set on the contract. So, you are stuck if you want to withdraw later or sooner than your retirement date. A standard 3a account allows you to withdraw up to 5 years in advance or up to 5 years late.

Life Insurance is not tax-efficient

While you contribute to them, both a standard 3a and a life insurance 3a are equally efficient. However, when it comes to withdrawing them, standard 3a has the potential to save you a very significant amount of money.

The reason is simple: you cannot stagger withdrawals of the life insurance 3a. Usually, you want five different third pillars. Then, you can withdraw a single third pillar account annually to save on taxes.

Indeed, the taxes in most cantons are progressive. You pay a fixed percentage on each bracket. For instance, you would pay a 5% fee on the first 30K, then a 10% fee on the next 30K, and so on.

So, if you can withdraw over several years, you can save significant money. We talk about up to 50% tax savings in the best cases. With staggered withdrawals, you could easily save more than 10’000 CHF!

And with a life insurance 3a, you are wasting money on taxes.

One may argue that you could have several insurance policies, and in theory, you could. However, most life insurance will run to your retirement date, not earlier or later. In practice, it will be tough to plan this properly. And you have to get it right the first time since you cannot change it afterward.

Life Insurance 3a fees are expensive

Many people do not realize that when you invest in life insurance 3a, a significant percentage of your contributions feed the risk premiums. Since this is life insurance, it can pay out in case of death or disability.

And this does not come from the principal but from the risk premiums. Each contribution is split into two parts. Some percentage goes into the capital and stays there until retirement. Another portion goes to the risk premium. This percentage is lost to you and goes to the insurance company.

There is nothing wrong with the principle. Insurances need risk premiums to cover the risks for their customers. However, there are a few things wrong when related to your 3a:

- The risk premium percentage is very significant

- A significant part of your retirement money is lost

- Advisors are not forthcoming with this

In practice, life insurance will take anything from 10% to 25% of your contributions. Every time you contribute to your life insurance 3a, you lose 10% to 25%!

For many people, it is already challenging to contribute a significant amount of money to their third pillar. And seeing such a large percentage disappear is not comfortable!

Not only that, but the fees of the funds available are also very high. I have looked into the funds from Generali, where I have my life insurance, and the fees of funds are all about 1%. And some insurance companies invest in funds with more than 2% yearly fees. And the advisors telling you that these active funds will outperform the market are either lying or delusional.

On top of that, many of these funds have load fees. You will lose even more of your money before it is invested. It is not uncommon to see 5% load fees. Again, whenever your money is invested into the funds, you lose 5% of the value!

So, these high fees will reduce your performance even more.

Life Insurance 3a returns are bad

The advisors will tell you you can get good returns on your life insurance 3a. But in practice, this is far from correct.

You can indeed invest your money from your life insurance 3a. However, the money is invested in expensive active funds that will significantly underperform the market in the long term.

On top of that, these investments are generally very conservative. It is rare to go higher than 35% in stocks. Since this money is locked away for several decades, a high stock allocation would make more sense.

We can take my Generali life insurance 3a as an example. I started to invest in August 2016. At the end of 2019, I asked them about the performance of my money. On average, I got 0.4% returns per year. During that same, the US stock market returned 45%, and the Swiss stock market returned 30%.

And the finpension Global 40 fund would have returned about 19%! Again, finpension 3a would have 45 times more returns during the same period!

The two funds for my life insurance invest 35% in stocks. So, having 0.4% returns yearly during a bull market is a joke!

We can compare one of the funds from Generali, GENERAL INVEST – Risk Control 5, with some other investment options from February 2015 to September 2022:

- Generali INVEST: -10%

- Swiss Stock Market (SPI) ETF: +29%

- US Stock Market (S&P 500) ETF: +87%

- finpension global 40: +23%

- finpension global 100: +69%

With a conservative portfolio at finpension, you would have gained 29% of your money. But with a conservative fund at Generali, you would have lost 10% of your money!

Before making that comparison, I knew that Generali funds were bad, but I had no idea how bad they were. This performance is atrocious.

You likely do not need the insurance

One advantage of life insurance 3a is that you get some insurance benefits.

If you die before retirement, your spouse will get the capital you would have gotten at retirement. And if you are incapacitated and unable to pay your premiums, the insurance will pay for you.

Insurance is all good, but do you need insurance coverage? Advisors will tell you everybody needs this insurance coverage, which is dumb. Insurance that is always worthwhile has not been invented.

First, you do not need death life insurance without dependents or heirs. If nobody depends on you and you die, the capital will return to the insurance company. This could still go to your heirs even if you have no dependents. But you must ask yourself whether they need that insurance if they are not depending on you.

Then, we have good insurance coverage already in Switzerland in many cases.

And if you are a double-income earner household, chances are that your spouse could handle the financial side without you. On top of that, the first and second pillars have benefits for your spouse if you die.

If you lose your job, you will get up to 80% of your income for up to 3 years. You would still be able to pay your life insurance premiums and are unlikely to be in financial trouble.

If you are disabled, you will get disability insurance and receive assistance to return to work if possible.

The need for life insurance is reserved for very few cases. In which cases, better options exist, like pure risk term life insurance.

Life insurance 3a has guaranteed value

We now go over the last difference. A life insurance 3a has some guaranteed value. On the other hand, a standard invested 3a account has no guaranteed value.

Now, we need to relativize that guarantee. First, no interest is guaranteed. So what is guaranteed is the amount without any performance. The performance cannot be negative.

However, you should know that the guaranteed value differs from what you contributed. We have seen that fees are expensive before. These overall fees include the risk premiums. At least 10% of your contributions will be lost to the risk premiums and direct fees.

Since we have seen that returns are very low for life insurance and that you will lose at least 10% to risk, the guaranteed value is not that interesting anymore.

If you invest that money long-term, you can expect significantly more money. While there have been some 20-year bad periods in the stock market, they are very rare. And over 30 years, the stock market has historically been great.

Life Insurance 3a vs invested 3a

Finally, we can make a small comparison of some products. We will have to assume a few things:

- The bank 3a account will return 0.1% per year, and there are no fees

- The life insurance 3a will return 1% per year after fees, and 10% of the investments will go to the risk premiums

- The invested 3a will return 4.5% per year after fees, and there are no extra fees

Each year of the simulation, 6883 gets invested into the product. There are no adjustments for this amount over time. In practice, this amount would rise for the bank 3a and the invested 3a.

You may think the invested 3a has an advantage in my assumptions. But my numbers are pretty conservative in both senses. A 3a invested 99% in stocks could return significantly more than 4.5% per year. And on the other hand, many life insurance 3a will return less than 1% per year (mine returned 0.4% on average during a bull market for three years).

And on top of that, some insurance will charge more than 20% for the risk premiums. So, these assumptions are being nice to life insurance 3a.

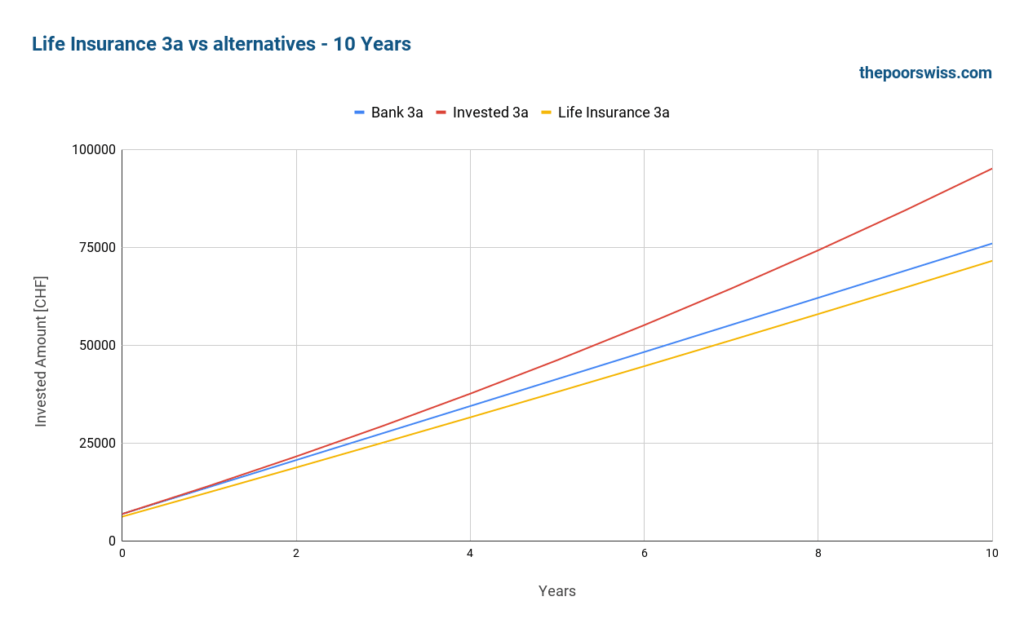

So, here is how these three products would result after ten years:

The result is quite surprising. After ten years, you would be better off with a bank 3a with a 0.1% interest rate than a life insurance 3a. Losing 10% of the premiums makes a huge difference, and poor returns make compensating difficult. Even over ten years, a bank 3a would leave you with 5000 CHF more than the life insurance 3a. With a good 3a, you would have about 23K CHF. Such an amount of money can make a very significant difference in your retirement.

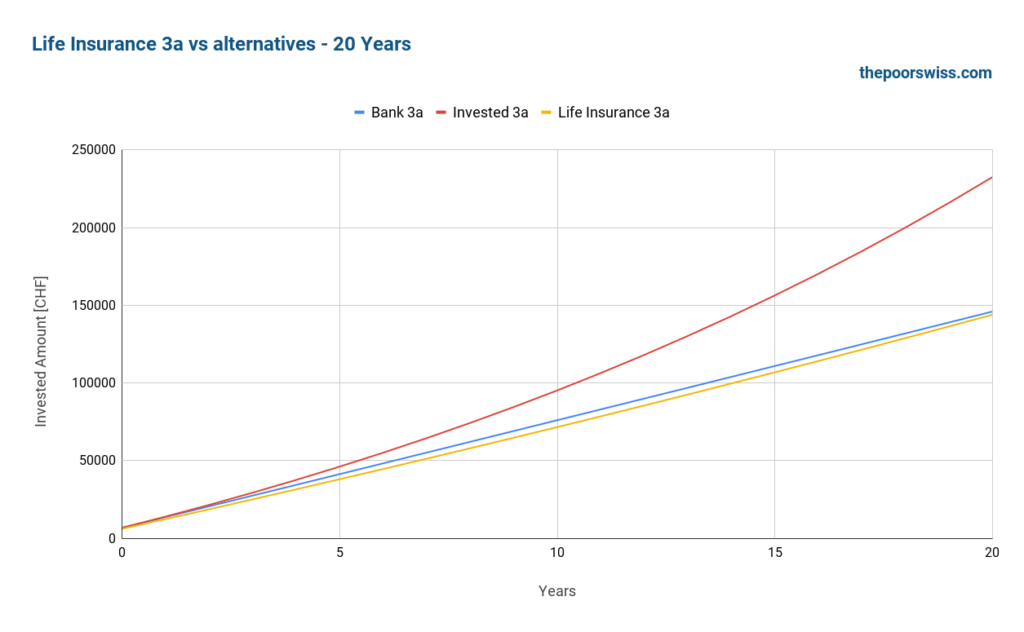

Here is what happens after twenty years.

After twenty years, life insurance 3a still is worse than bank 3a. This result is bad. The difference is only 2000 CHF, but it still shows the extremely poor returns of life insurance 3a.

After twenty years, the difference with a good 3a becomes extremely impressive. Indeed, in that simulation, the invested 3a has 88K CHF more than the life insurance 3a. Put another way, the person with an invested 3a has 61% more money in retirement than the person with a life insurance 3a.

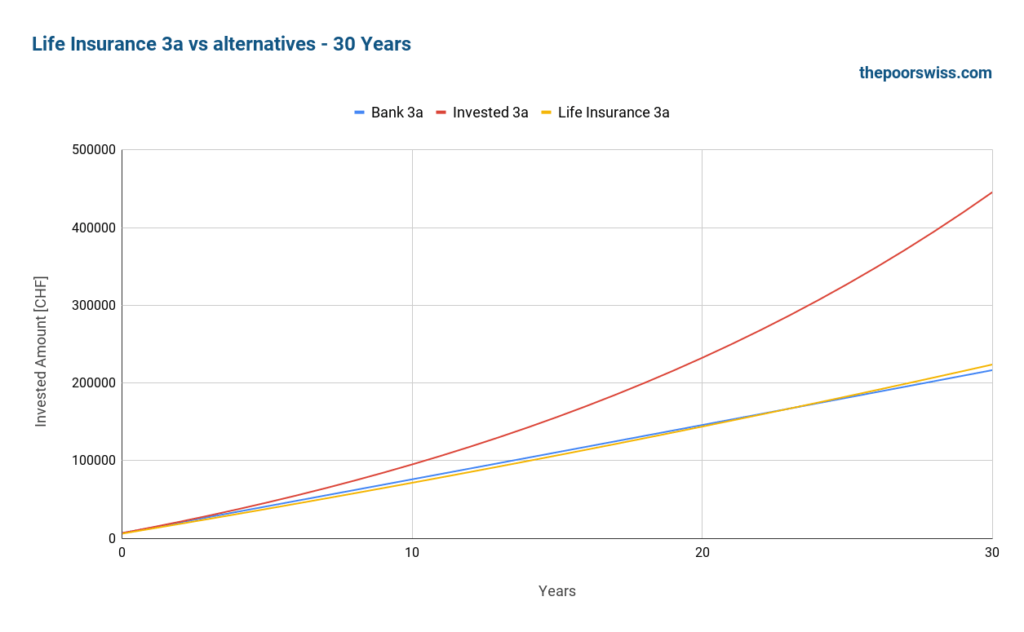

Finally, we look at thirty years.

Finally, life insurance 3a is at the same level as bank 3a. However, the difference is only 7000 CHF.

After thirty years, the invested 3a now has twice more money as the life insurance 3a. We are talking about a difference of more than 220’000 CHF after thirty years. Such an amount of money could change your life in retirement.

This result comes from only a single simulation. In practice, there are some cases where life insurance would do better than this one. But there are also cases where the invested 3a does much better. And there are some much worse insurance policies out there. I strongly doubt any insurance 3a comes close to a good invested 3a.

Why does life insurance 3a exist?

With all these disadvantages, we may wonder why these products exist. And it is a fair question.

After doing all this research, I believe life insurance 3a should not exist! They are horrible investments and will likely result in much lower retirement money than if you had used a proper third pillar account.

The reason life insurance 3a exists is simple: They are highly profitable to insurance companies and insurance advisors. I think there is no good reason for their existence.

Advisors make large commissions on these products. So, they push these products quite hard. Unfortunately, most Swiss people are not educated enough about investment and retirement to understand these products. And most people trust advisors.

What to do instead?

Finpension 3a is the best third pillar in Switzerland.

Use the FEYKV5 code to get a fee credit of 25 CHF*!

*(if you deposit 1000 CHF in the first 12 months)

- Invest 99% in stocks

The third pillar in Switzerland is great for investing money and saving taxes. Life insurance 3a being bad should not stop you from investing in the third pillar.

If we eliminate life insurance 3a, there are two options for your third pillar. Either you invest with a bank, or you invest with an independent provider. In practice, I highly recommend using an independent provider like Finpension 3a.

Finpension (and other independent providers) have many advantages over a life insurance 3a:

- You will get more returns on average

- All your contributions will go to the capital

- You will pay lower fees on the invested capital

- You will get a more transparent third pillar

- You are flexible as to when you contribute

- You can save taxes with staggered withdrawals

And if you are afraid of investing and want guaranteed capital, you can invest in a bank and get a tiny interest rate. In my opinion, a bank 3a is already better than a life insurance 3a.

If you need help choosing the third pillar, read my articles about the best third pillar in Switzerland.

And if you need life insurance, you should get a pure-risk term life insurance policy. There are many of them. I have never delved into them, so I do not know which is best, but I am sure there are some good ones.

For a simple example, I have looked at the calculator for Allianz for 30 years and 120’000 CHF coverage, comparable to my insurance policy. This pure risk life insurance includes paying your premiums if incapacitated. So, this is very close to a life insurance 3a.

Such insurance would cost me 379 CHF per year. Over 30 years, this pure risk life insurance would cost 11’370 CHF. If you remember the results two sections before, the life insurance 3a will result in 220’000 CHF less money than the invested 3a. For the cost of 11’370 CHF, you can get a great 3a and separate life insurance.

Note that I do not particularly endorse Allianz. Their calculator is the simplest I found.

This simple comparison shows how bad life insurance 3a is. You can get good life insurance for cheap and good 3a with much higher returns and transparency.

Conclusion

When I started this article, I knew life insurance 3a was a bad investment. But after going through the research, I now realize life insurance 3a is a horrible investment!

There are much better alternatives out there. I would not recommend life insurance 3a to anyone. Instead, use a great third pillar like finpension (my review here). And if you need life insurance, take pure risk insurance instead and continue investing in a good 3a.

Now, there is one question I have not answered in this article: What should you do if you already have a bad life insurance 3a? First, do not be ashamed. Many people fell into the life insurance 3a trap, including me. That is right! I fell into this trap!

There are a few options to get out of a life insurance 3a. I encourage you to at least look at them if you have life insurance 3a.

To start investing with an excellent third pillar, you should read about the best third pillar from Switzerland or my review of Finpension 3a.

What about you? What do you think of life insurance 3a? Did you fall into this trap?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Retire in Switzerland

- More articles about Retirement

- Vested benefits accounts: All you need to know!

- What should you do with a life insurance 3a?

- Disaster File – A Simple Way to Prepare for Your Death

Hi Baptiste,

Thanks for your website and blog, I found it very useful.

Do you know about the life insurance policies that invest in EFT? I have two contracts with Generali Multi Index 100 (https://www.generali.ch/en/privatkunden/vorsorge-vermoegen/kapital-aufbauen/sparen-mit-risikoschutz/anlageplaene/anlageplan-223) that expire in different years. What do you think of these solutions, especially in terms of fees?

Three years after opening, I am thinking of closing one of them and keeping only one 3a with Generali. The rest of the savings I would like to invest in the stock market with a bank account with a higher return.

Thanks again and kind regards,

Gio

Hi Gio

I don’t have a high opinion about this product:

* 2% issuance commission is money wasted

* 0.24% management fee on top of the ETFs

* The allocation to ETFs is weird. 20% in Europe and 10% in US simply does not make sense.

* The performance is not too bad on paper (52.6% since inception) but VT returned 75% in the same period

I still believe that life insurance should never be mixed up with investments.

Hello Baptiste,

Many thanks for your feedback and the work you’re doing on your website.

All the best,

Gio

You’re much welcome :)

Hi, I guess it’s (hopefully) not the same, but I have a Vorsorgekonto 3a at Zurich Insurance. As far as I know there are around 4 CHF fees for every 200 CHF I transfer.

Beside of the (I guess high) fees, is there anything else bad about this model?

I probably get the amount of fees back through discount on other insurances at Zurich, so probably it’s not too bad if it’s just that.

Or would you still recommend to transfer the money to another 3a?

Do you know if there will be a (big) loss if I would do so?

Hi Luca

Without any details, it’s difficult to know because Zurich Insurance does have 3a in fonds and 3a in insurance apparently.

If you are invested in fonds, there is nothing really bad about except, except for the very high (2%!) fees.

If it’s in fonds, there should not be huge loss by moving to another 3a. And in the long term switching from 2% fees to 0.5% or less should be worth it.

Hi Mr. PS, nice article, but I have some doubts. Say that I’m in the market for a pure lisk life insurance because I recently got married and had 2 kids (no mortgage). Let’s also say that I deposit every year the maximum deductible for pillar 3a at some institute (my bank, VIAC, FP, whatever) and that I’m confident I will not change this behavior.

The advantage of putting life insurance is 3a is that: 1) I am not adding yearly expenses, I am reducing my deposit in my traditional 3a but I’m keeping the yearly sum constant, and 2) most importantly, when I reach retirement age, I am withdrawing less money from my 3a, so I get taxed less.

But wait, you might say, if I put less in my 3a I also have less return from a 3a investment perspective (funds, stocks, etc). True, but if I really want to compensate that loss of return I might as well invest that difference in traditional stocks/funds/whatever completely disconnected from pillar 3a/3b regime. The final return would likely be higher, the taxation at retirement age lower, plus, added bonus, it would not be bound to usual 3a cashout limitations. The only disadvantage is that it’s not tax-deductible, but also your idea of putting life insurance outside 3a would not be.

Am I missing something? Thanks for any clarification!

Hi TG,

I do not understand your logic, sorry.

1) You are not adding a real expense to your budget true, but you are adding a significant hidden cost and opportunity which is just as important.

2) You are saying you are withdrawing less money from your 3a, but your life insurance is a 3a, and taxed as such. Once your withdraw your life insurance 3a, you will get taxed as well, just like a bank 3a.

But maybe I did not understand your point.

Thanks for your reply. Mind you, I’m not an expert, just questioning. Here is an example: say that the maximum deductible for pillar 3a is 7000 CHF/year that I deposit, e.g., on a VIAC account, and that my fixed-premium life insurance costs me 1000 CHF/year.

SCENARIO 1: I open this life insurance as a pillar 3b account, or even as some other private account disconnected from pillar 3a/3b. My yearly investment+premium is now 8000 CHF. This is what your post suggests if I understand correctly.

SCENARIO 2: I open my life insurance as a pillar 3a, meaning that now I only deposit 6000 CHF/year on VIAC, the other 1000 CHF are the insurance premium. If we want to compare apples with apples, let’s say that I also invest 1000 CHF/year on some ETF, so my total yearly investment+premium is still 8000 CHF.

Advantages of scenario 2:

1) I have 1000 CHF/year *in investment* which are not bound to pillar 3a withdrawal limitations. In scenario 1, instead, those “unbounded” 1000 CHF are insurance premiums, that I (hopefully) never cash out. Remember we’re talking of pure risk insurance, not mixed/endowment insurance.

2) At retirement age, vested benefits 3a in scenario 2 are less than in scenario 1. This means that I cash out less – and hence I pay less taxes on that cashout.

3) That ETF is likely to overperform the VIAC portfolio.

The only serious advantage of non-3a life insurance in a situation like this, AFAICS, is that with 3a you have zero control on the beneficiaries in case of your death: the money goes to your married partner and kids. Which might or not be 100% what you want depending on your situation.

Amirite?

Hi TG,

What I don’t understand in your scenario is that you talk about pure risk insurance. Pure risk cannot be put into the 3a. You can only use a “retirement-life-insurance” with a part of risk and a part of retirement assets as part of the 3a schema.

A pure risk life insurance at 1000 CHF per year is wildly different from a life insurance 3a at 1000 CHF per year.

Indeed, I recommend usig a pure risk life insurance, completely unrelated to 3a/3b for people needing life insurance. A pure risk insurance will only pay out in the case of death, nothing is left in retirement. But a 3a life insurance is a combination of risk and assets.

But one thing I can tell for sure requires correction on your post is that it’s not true that you MUST pay premiums monthly in a life insurance 3a. For me it’s the opposite: I *wanted* to pay monthly, but I got only yearly, 6-months or 3-months options.

Good point, I have amended this part of the article.

“Pure risk cannot be put into the 3a.” Ah, I think this is the root of misunderstanding. I have been offered indeed a pure risk life insurance under 3a with Zurich, maybe it’s a new product you were not aware about?

I am a 40-yo non-smoker male with no particular risk factors. The proposal I got (I didn’t sign yet) is s fixed premium ~1600 CHF/year at 25 years term for 500k CHF coverage and exoneration from premium payment in case of inability to work > 360 days. It also has a partial coverage feature in case of contract termination: If I keep paying the premium for at least 7 years and then I stop paying but then I die, then Zurich still pays back something to my survors, ranging from 10k CHF (year 7) to 220k CHF (24 years). This is on par with the Generali offer I find on safeside.life (which is a tad cheaper but does not offer partial coverage in case of contract termination).

The interesting part is indeed the possibility of paying the premiums on a Zurich 3a account. The idea is that I pay the premiums in that account, but I will never cash out those money at retirement, they will just sit there and be invested and collected by the insurance, so it’s not “mixing insurance and investment together”, it’s still a pure risk life insurance, there is no investment at all, the only advantage for me is that I can deduct those premiums from taxes. If the 3a performs well, they will give me a super-minuscule discount on the premiums which I don’t even consider because it’s laughable. If the 3a performs bad… not sure, I haven’t found it mentioned anywhere on the contract, but I don’t think they can ask me to cover the negative difference because the premium is fixed. If I decide to rescind the policy before the end of the contract, I get no refund.

Interestingly, they offered me the option to do it on 3b instead of 3a, but the advisor recommended 3a, for the reasons in my post above (tax deduction). I admit I found this model strange, and the advisor of course must have his own interest, but his reasoning of why depositing on 3a is convenient compared to non-3a sounded convincing to me, it looks to me that in this particular case paying in 3a has only advantages.

Does it make sense? Thanks!

I indeed have never heard of such products. I did not find the Zurich product you are talking about, but I found the Generali prevista offer online and that seems to be on the same idea with a pure risk life insurance linked to 3a.

If that’s really the case, your math checks out. If you are going to buy this policy anyway (as an expense), then it makes to put it in the 3a to get tax savings on it. And then, you invest this 1600 CHF per year in your broker account (or else).

You should just be sure you don’t need the money for your retirement.

Thanks for a great article and comparison and atleast there exists something out there that compares, i havent seen these analysis for switzerland by anyone! so thanks for atleast giving a different perspective. I partially agree with the comparison point made by ahmed in terms of apples to apples but even if you do that, it would still be a loss making vehicle so whats the point? to know how less worse it is compared to others…

However, one aspect that you havent covered and would be great to read is the aspect of pledging this insurance 3a against your 2nd rank Mortgage, this is something is recently found and sounds interesting because you will only be paying interest on your whole mortgage and instead putting 3a but ofcourse, with my limited knowledge i am unable to crack the fineprint – is there any other option to pledge a 3a account against 2nd rank mortgage, as my advisor is advising me there isnt.

Hi ATS,

Pledging is interesting, but pledging through a very bad investment product does not make sense. You can also pledge the assets of your 3a (not only insurance products), which would be much better. But many banks will focus on pledging through insurance products because they are safer (for them!).

Hi Baptiste,

Thanks for an(other!) excellent article.

I have recently had to take out pillar 3 life insurance as a condition for receiving a mortgage. This was supposedly mandatory since the house I am buying is in France. I was somewhat reluctant after reading your article but had no choice to sign, since the number of Swiss banks offering cross-border mortgages is extremely limited.

Looking at the funds in the product basket of the Swiss Life product (https://www.swisslife.ch/en/individuals/products/pension-and-asset-accumulation/save/dynamic-elements-uno.html) I was pleasantly surprised relative to your analysis. It’s a basket of five equity ETFs giving exposure to US (40%), UK (7%), EU (14%), CH (34%), JP (5%). Major market indices for these countries returned 12.6%, 5.2%, 7.6%, 6.2% and 12.4% respectively on an annualised basis over the last 10 years – or 9.2% on a rough weighted average basis. The product start with 95/5 split in equity and cash. I can change the allocation as my risk sensitivity decreases. Given I’m 38 that will be soon-ish…

All the above being said, it doesn’t look like the worst long-term investment option for someone who is less risk sensitive. I am also less concerned (for now) about my ability to meet annual payment requirements. Would you say the key danger with these life insurance products is in the production selection itself?

I’m hoping I have done my due diligence correctly but your article prompted me to put the question out there in case others are in the same situation as me.

Thanks,

MW

Yes, unfortunately, some banks will force you into that for special investments or if you are near retirement. These policies are really good for banks.

The key danger is not only on the products. Because a portion of what you put inside will go towards the risk premium (can be as much as 20%), this is what drives the prices down.

It is also true that for somebody that does not want to be extremely aggressive will have better results with life insurance since they don’t expect too much.

On paper, it’s not the worst indeed, but I have not done a full research. I would not expected anything like 9.2% returns on your stock exposure. If you can get 3-4% per year until you are retired, I think it’s good enough. But it’s much better than my own life insurance for which I expect 0% at best annualized…

Hi PS, your article is absolutely spon-on! I wish I had read it 10 years ago when the shark of my advisor lured me in this horrible and absolutely nonsense life insurance 3a product from Swisslife!

After 10 years I found myself having lost 20% of my money without having any advantages whatsoever! I could have easily used the 2nd pillar voluntary contributions to lower taxes or any other 3rd pillar option that works without losing money! IMO these products are simply “legalised scams”!, I see no other words to described them. Both the government and insurance companies are into this together. The worst part is that the costs (20%) is written nowhere, neither on the initial contract, nor in the yearly certificate, it’s purposely hidden! How can a country like Switzerland allow something like this? I think we should make our voice louder and ask for compensation from these giant insurance scams. Individually there is no chance, they are too big and any lawyer will not work on a such case for unfair contract terms, but as a group of say 20000 people scammed, perhaps there is a chance.

In summary, if I read your article earlier I would have saved 36k and the possibility to be able to use my money whenever I wanted instead of locking them until retirement.

The “funniest” part: I have no kids so don’t need one and my life insurance is paying exactly the money I pay in up to that year, so I was surprised to see on your article that the life insurance product pays the money at retirement, mine does not! at least that’s what it shows on the certificate. I will double check this as otherwise I have to say this product is a scam even more.

Sorry to hear about your experience. It’s unfortunately very common.

I also think this is a legalised scam. The insurance are pushing to keep this system because it serves them.

If it’s a 3a life insurance, there is a surrender value at retirement. Otherwise, it’s a pure life insurance where you only get money back if you die.

Hi Baptiste,

Thanks for your reply. I captured one important aspect from your articles, that is 3a and 3a with insurance differs since the second (which I have) should have an insurance product in it.

However, when I see the conditions in my contract I am (now) shocked to see that there is almost no life insurance on it!

The condition quotes:

– From the 1st year 9623 Fr

– From 2nd until one year before end: Increasing by 6535 Fr per year

– Final year 153000 Fr

I am now on the 11th year, on my certificate it show the current insured capital as of 2023 that is 76000 Fr!

I calculated how much I paid so far into this scam, it totals to 74650 Fr! as you can see, they would just give me extra ~2.500 Fr on the so called “insurance product”! what kind of insurance is that?

Seems to me clear that the contract is fraudolent from the beginning, since it does not include a proper life insurance product.

The second part is about the 20% risk costs (~10k). So in order to pay extra 2.5k they calculate a risk of extra 10k? absolutely insane.

I need to talk to a lawyer to see if I can sue these scammers and get my money back.

IMO Finma should care, since they regulate the whole 3a insurance market and provide rules for companies to follow. If I bring the case to their attention maybe they will listen to me.

I also found this article which is interesting:

https://www.finma.ch/FinmaArchiv/bpv/e/themen/00501/00563/00734/index.html?lang=en

It basically talks about fair surrender values that should be validated by FOPI in case of termination of the insurance contract (art. 127 of the ordinance).

I’m not sure if I am wasting my time, but probably worth trying with such unfair conditions.

As you mentioned, those brokers use the naivity of newcomers and the fact that this market is regulated to make you sign such fraud contract.

If you have any further comment let me know.

Have a good day! :)

Hi Alfonso,

The life insurance is when you die, that’s why there is risk. If you die after 10 years, they should pay out a final amoutn, not what you have paid. That’s why there is a high amount of risk cost.

If you have the time and the means, it may be interesting indeed to pursue that route, but you should not expect to much. The 3a life insurance industry has been doing that for a very long time, I am not sure anything will change.

Hi Baptiste,

That is exactly my point, the insurance should pay the entire amount of the contract in case of death. However that’s not the case in my contract, they won’t do this since the condition of insurance they set-out are stating they will pay just slighly more than what I paid-in up until that point, that’s it! This why I am saying it is a complete rip-off, since the insurance product does not even configure as one. It’s a non-sense to get a life insurance that pays a little more than what you paid-in until that point, but that’s what they made me sign in the contract :(

This is also the reason why, in my case, I would perhaps have better changes to file a lawsuit and have more chances to win it.

I also checked the services that FINMA provides, among them there is one that is free for anyone to ask for correctness of rules applied in their conduct of business, see here at section 2.3: https://www.finma.ch/en/finma-public/fragen-und-antworten/

I will keep you posted in case I get extra info, so people will also know what they can do against those sharks.

Have a great day!

Indeed, that’s weird!

Keep us posted!

Your article is non sense, and obviously you are working with Finpension which invests in CS fonds and obligations which are not even regulated with the CISA.

I don’t think my article is as much non-sense as your comment :)

There is nothing wrong with CS funds, many good 3a providers are using them. And you can choose Swisscanto or UBS instead.

Dear Baptiste

How are you able to compare an investment strategy from Generali Invest which is in fact a fund that is made out of 86% Bonds with a strategy that is invested in shares FinPension Global 100?

You are not comparing apples with apples. Please update so people can make a more informed decision. Furthermore please elaborate on the premium waiver. The fact that people can keep an investment in the Swiss asset even if they leave Switzerland and that the Pillar 3a should not be regarded as an investment vehicle but as a pension savings vessel. Thank you. KR, Ahmed

Did you read that I also compare against finpension 40 which has only 40% stocks.

As for the premium waiver, it’s well elaborated in the next article: What should you do with a life insurance 3a?

Dear Baptiste

You should not compare it with the 40% share fund as the Generali Invest holds 5% shares. This is misleading to the average person. The only reasonable comparison that can be made would be to compare it to the Finpension 0. To compare a Bond Fund to a 40 or even 100 Equity fund is “not reasonable”. Thank you for your understanding. Alternatively, please use products that can be compared. SmartFlex Global Equity Fund from AXA or Swiss Life Dynamic Elements Global Equity Fund. Please compare similar strategies. “Income” with “Income” and “Balanced” with “Balanced”.

Kind Regards, Ahmed

I’m sorry, but I have to say your comment is nonsense. Mr. PS is exposing to public this big scam from insurances 3a products and people are entitled to know this is a trap, nothing else

Hi Mr. PS,

Thx again for your awesome content!

Have you heard about AXA’s Life Insurance 3a? It can invest up to 90% into a passively managed Global fund (MSCI ACWI).

It addresses a lot of your critique points incl. invest flexibility. May even be worth a full review from you 😉

Source: https://www.axa.ch/en/private-customers/offers/pensions-assets/pillar3-private-pension-provision/smartflex-pension-plan.html

Best,

Marc

Hi Marc

This solution may address my flexibility point, but as long as this product is tied to a life insurance (seems optional in this case), it won’t address most of them.

I do not see how a life insurance 3a can have any advantage over a 3a + a separated life insurance. These combinations are simply not good products.

Great article!

I also felt into the SwissLife 3a via a “Financial advisor” (never go for a non fee advisor, lesson learned).

So is it a possibility to keep the Insurance 3a, reduce the amout of monthly contribution and open another this time with Finpension 3a?

Hi Allan,

Sorry to hear that!

Yes, it’s a possibility to reduce it lower (or even to zero). If you read the second article about life insurance 3a, you will see the different strategies.

Hi Mr. PS, amazing as always. I unfortunately was one of the ones who believe a financial advisor 3 years ago and ended up signing in for a Pillar 3B (not A, B) with SwissLife. After the last months reading all over your blog, I see that it was a stupid decision. And I also noticed I signed it without even understanding exactly what I was investing on, Swiss Life doesn’t even share how the money invested is performing (even though there was some tax savings since I was in Geneva at that point). I am currently very confused on the way forward and don’t understand exactly how much money I would lose if I stop it now. They use terms like surrender value, paid up value, premium which I really struggle to understand. I also don’t trust my financial advisor anymore to explain it. What do you suggest?

Hi Edna,

Normally, Swiss Life should share the value of your insurance. You should be able to ask them. I got this in the past for Generali, my life insurance provider. If you don’t trust your advisor, you can contact Swiss Life directly to have these numbers.

I would imagine that the surrender value is what you would get if you stop the contract right now.

I would recommend getting a status report from Swiss Life and then taking an informed decision on this product.

I also have a 3a life insurance with Swisslife. After 10 years I realised they have “stolen” more than 11k from me (surrender value).

I was asking to provide a written document where they clearly state those “costs”, I was informed by my layer that it should be possible to have the costs reviewed by Finma, they would check if they are really compliant with regulations.

Unfortunately they rejected my request and refused to provide the paper.

Normally, they should state these costs properly. You could lawyer up and force them to, but then it’s expensive and there is very little to gain.

I don’t think that Finma cares. As long as insurance providers follow regulations, they can provide very bad products to their clients.

Hi! What is the best life insurance based on your research?

Hi Maria,

I have another article about choosing a life insurance: How to choose life insurance?