Your retirement benefits after your death

| Updated: |(Disclosure: Some of the links below may be affiliate links)

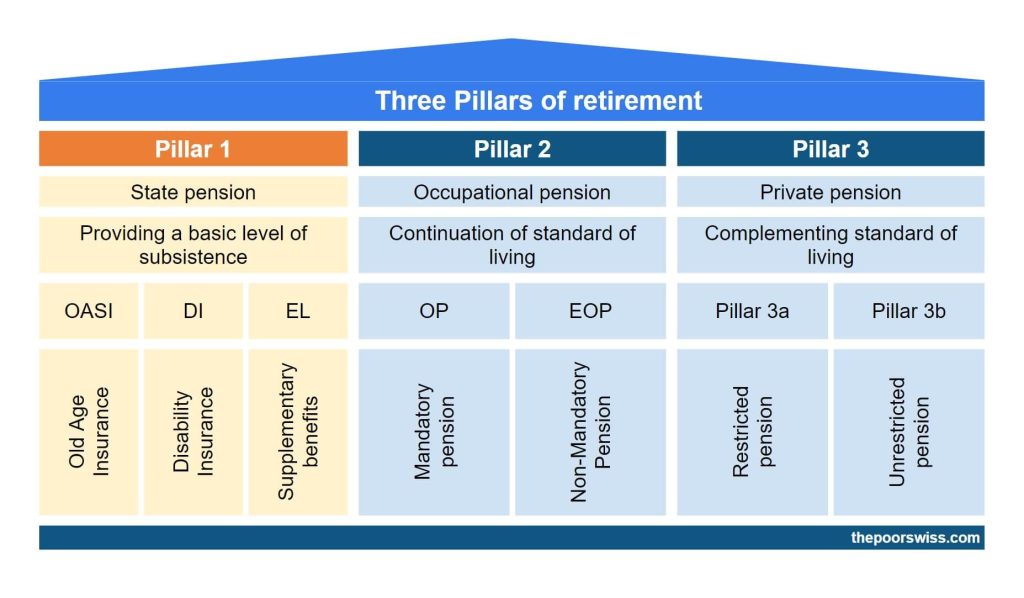

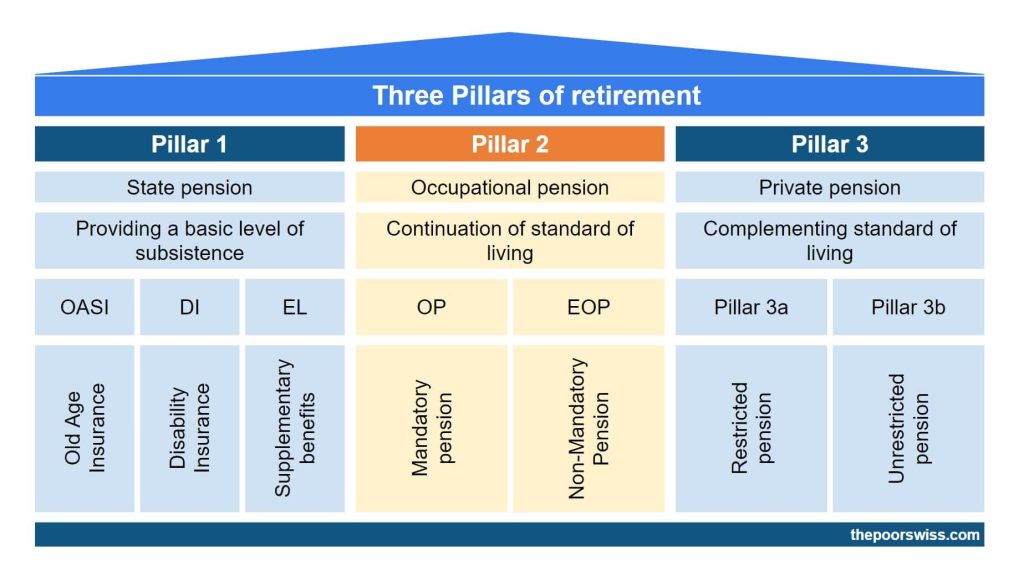

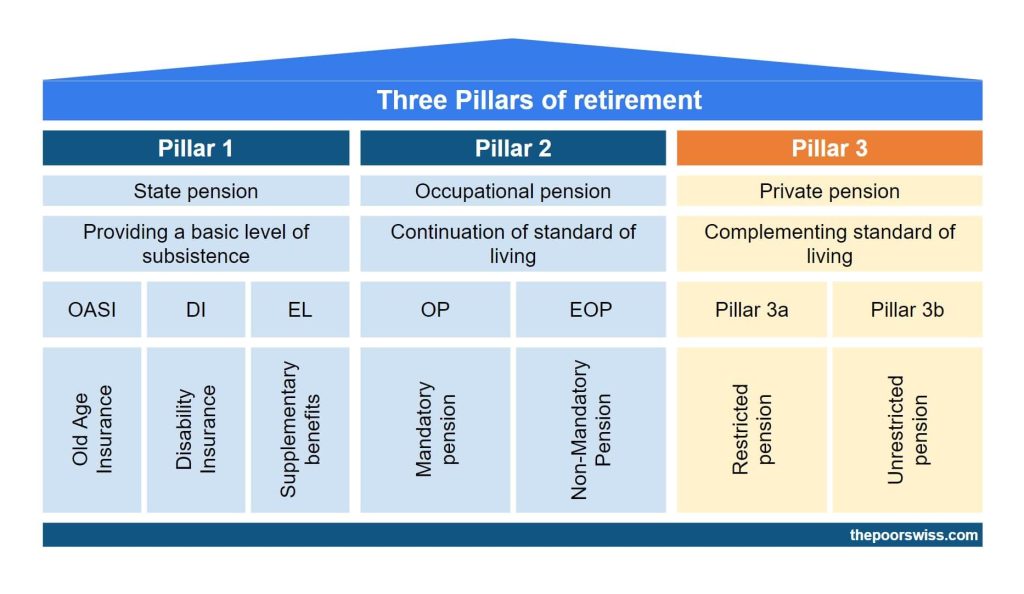

In this blog, I have talked at length about the retirement system of Switzerland, the so-called three pillars. However, I have not covered what would happen to these different parts in the event of your death.

Even though this is a subject that most people prefer to avoid, it is an important subject. Indeed, you want to be sure that people who depend on you will be covered if this happens. And it is also essential to know about that in some special situations.

And it is also important to cover what happens before retirement age and after retirement since this will vary.

So, in this article, we will cover what will happen to each of the three pillars in the event of your death.

First Pillar

The first pillar will pay you a pension after your retirement age. This pension will depend on how many years you have contributed and how much money you have contributed.

Part of your pension could go to your surviving spouse and children if you die. The conditions for each are different, so we must see them all.

With the first pillar, it does not matter whether you die before or after retirement. The same conditions for the pensions will apply.

Widow pension

A married woman (or registered partner) is entitled to a widow pension from her husband if:

- They have children, or

- She is 45 or older, and the marriage lasted for at least five years.

A divorced woman is entitled to a widow pension from her ex-husband if:

- They have children, and the marriage lasted for at least ten years, or

- She was more than 45 years old at the time of divorce, and the marriage lasted for at least ten years, or

- The youngest of their children is younger than 18 years old when she reaches 45 years old

If none of these conditions are met, the divorced woman will get a widow pension until the youngest of their children is younger than 18 years old.

The conditions for a man are simpler. A man is entitled to a widow pension from his spouse (or ex-spouse) if he has children younger than 18.

It is important to note that you cannot be entitled to two pensions. So, if you are getting a widow pension and retire, you will only receive the highest of the two pensions you would receive, not the sum.

The pension will be added to your taxable income. Therefore, you will pay income taxes on it.

How much the widow will receive depends on many things. Unfortunately, this is not as simple as it should be. As for January 2022, the minimum full widow pension is 956 CHF per month, and the maximum full widow pension is 1912 CHF per month.

The pension is full if the deceased person contributed to the second pillar from the 1st of January following its 20th birthday to its death. Otherwise, a partial pension will be calculated based on the years of contribution.

The decision between the minimum and the maximum is based on the average revenue of the deceased. Below 14’340 CHF average annual revenue, the minimum pension is due. After 86’040 CHF average yearly revenue, the maximum pension is due. Between these two points, the pension will vary from the minimum to the maximum.

If the deceased was younger than 45 years, the average annual revenue would be increased based on his age. This compensates for the fact that younger people earn less.

People who earned money before 1983 will also see increased revenue for these years based on some factors. For instance, revenue in 1974 will be multiplied by 1.108. This compensates for years of low wages.

Finally, if the deceased took care of children below 16 or ill parents, his revenue for these years will also be increased.

As you can see, it is rather complicated to know how much you will receive. If you want to know the exact number, you can ask the first pillar office in your region.

Orphan pension

An orphan gets an orphan pension until their 18 years birthday. If they are studying, they get a pension until the end of their studies, but no longer than their 25 years birthday. Moreover, a student with a revenue of more than 28’680 CHF will not get a pension.

The amount of an orphan pension is based on the same calculation as a widow pension but with different limits. The minimum pension for an orphan is 478 CHF per month, while the maximum is 956 CHF per month.

If an orphan gets two orphan pensions, the total amount cannot exceed 1434 CHF per month (50% of the first pillar maximum pension).

It is important to note that until the majority of the child, the surviving parent or legal tutor will have to declare the pension in its taxable income.

The calculation for the pension amount is the same as for the widow pension but with a different minimum and maximum.

Second Pillar

With the second pillar, you will choose between a pension and a lump sum at retirement age. And you can have a standard second pillar account or a vested benefits account. The main difference is that a vested benefits account never pays a pension.

Employee Second pillar

The rules for a pension fund are the most confusing. Indeed, they depend on each pension fund. The law sets some minimum rules, but many pensions provide better conditions. And some things are left to the pension funds to decide.

If you die before retirement age, your spouse or registered partner is entitled to a widow pension if you have a child together or if they are 45 years old and you were together at least five years. The minimum widow pension is 60% of the old-age pension.

Divorced spouses or partners are also entitled to a pension if the marriage lasted at least ten years and if the deceased was paying them a pension as per the divorce.

Children below 18 or children in education below 25 can receive an orphan pension. The minimum pension is 20% of the invalid children’s pension. It is more complicated and entirely up to the pension fund for unmarried and unregistered partners. In this case, most pension funds will give a surviving pension, but you must announce the beneficiary in advance.

Other people are not entitled to a pension by law. But some pension funds consider other inheritors, but they must be announced in advance.

If no pension is due, the capital is inherited. This is generally going first to the spouse or partner, then to the children, and then to the person that depends on the deceased. However, the capital itself depends highly on each pension fund. Some pension funds also give capital if the capital is higher than necessary to pay the pension.

Usually, the country will not get the money without inheritors. In that case, the money will go back to the pension fund.

If you get a lump and die after having received it, standard inheritance rules will apply since your second pillar money will not be different from your standard assets at this point.

Again, these conditions will vary for each pension fund. If you want to ensure, you must ask your second pillar foundation to see their conditions.

One important difference between pension funds is how they handle buy-backs (voluntary contributions). Many pension funds exclude this from what they will give back if you die.

Another important difference is that some pension funds will allow pensions to be withdrawn as a lump sum based on the receiver’s age.

Vested Benefits Account

If you have a vested benefits account and die before retirement age, the account will be liquidated, and your inheritors will share the lump sum. The law defines four groups of inheritors. If there is nobody in a group, the next group will inherit. If nobody is in the four groups, the money will return to the country.

With a will, you can make a few changes. You can promote people from one group to a higher priority group. And you can choose within a group how much each people get. But you cannot exclude a person from one group.

The surviving spouse or partner is part of the first group. The surviving divorced spouse or partner is also part of the first group if the marriage lasted ten years at least and he or she was receiving a pension since the divorce. Finally, children that are not yet 18 or children in education below 25 are also in this group.

The unmarried and unregistered life partners would be part of group 2 if they lived with the deceased for at least five years. In this group are also present persons who substantially depend on the deceased. Unfortunately, the law does not say what it substantially means, so it is often up to the court to decide. Finally, the persons raising the children of the deceased fall into this group.

Independent children (not part of group 1 or 2) are part of group 3. Parents and blood-related siblings are also part of the third group.

All other legal inheritors will fall into group 4, except for the country. The country can only inherit when all the groups are empty.

By default, assets are evenly distributed between inheritors of each group.

Inheritors will have to pay taxes on the inheritance. These will depend on each canton.

If you die after having received the lump sum from your vested benefits account, standard inheritance rules will apply since, at this point, you do not have a second pillar any more.

Third Pillar

The rules for the third pillar are the simplest.

First, whether you have bank 3a or life insurance, the rules are the same. In the case of a bank third pillar, the amount will be what you have contributed. But for life insurance, the amount the beneficiary will get is the insured amount.

If you have a surviving spouse, he or she will get the entire amount. If not, the children will be in a second lot of beneficiaries. If you have a non-married concubine, he or she can also (on your request) be included in this lot. In this second lot, you are free to choose how will the money be shared. However, over total succession, you still have to respect the law’s limits. For instance, you cannot fully disinherit any of your children. Finally, if there is nobody in the second lot, the third lot is formed by your parents, your siblings, and other people you have explicitly named.

If you have 3b life insurance, you can name anybody in the contract, which will work like standard life insurance.

In all these cases, the inheritors must pay taxes on the capital received. And these taxes depend on each canton.

If you die after the retirement age, you will not have a third pillar anymore, its value will be mixed into your assets. So, the standard inheritance rules will apply to it.

Conclusion

While this is not a subject many people like to discuss, it remains an important subject. I want to know what will happen to my retirement benefits after my death. Especially, I want to be sure that people depending on me will be safe.

If you are living alone without children, it is essential to know that there is a good chance for some of the assets to fall into the country or back into the pension fund if you die. Some people prefer to avoid this, so they could optimize their strategy to prevent this case.

If your inheritors live abroad, the situation could get even more complicated. Indeed, they could have to consider both countries’ tax systems. This goes out of the scope of this article.

I hope I have covered all cases. It should help you know where the money will go in case of death.

Did I miss any cases?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Retire in Switzerland

- More articles about Retirement

- How many years until you can retire?

- Disaster File – A Simple Way to Prepare for Your Death

- Switzerland is unfair to married couples

That’s an interesting topic. Do you know what happens with your capital if let’s say you retire at 65 and die one year latter. Is there any capital to be inherited by your family?

Do you mean the third and second pillars capital? In that case, it follows the usual rules of inheritance. It’s simply integrated in your cash, it’s not a retirement capital anymore.

I mean the case where you are retired and get a pension from your second pillar. Let’s say for a short period. I think that if you start getting the pension you might lose the “rest” of your capital upon your death. But I might be wrong.

That’s correct. If you get the pension and day after one month, you will only have gotten one month out of the entire capital and the rest goes back into the pension fund.

Hello Baptiste, I would like to know if, considering all this, it is worth it, for a family with children, to have disability or death insurance and which one would you recommend? Thanks

Hi Itziar,

I would think that in most cases, it’s not worth it. We are well covered in Switzerland for both disability and death.

Hi Baptiste,

Thanks for your answer. I had doubts and by chance I had received a proposal from Viac in relation to insurance: VIAC Life Plus. That’s why I asked you. Thank you very much for your help.

Now, keep in mind that my advice was general, not particular. I would say that most people don’t need it, but not that it’s useless. If you are in a situation where you would not need life or disability benefits, that could be interesting. But most people would receive enough such benefits to not need extra coverage.

Great and thorough analysis!

One point worth mentioning IMHO, is the fact that some pension plans exclude the plan buy-backs from what gets distributed to spouse and dependants. For those that do not exclude them, they need to be made aware of them if the buy-backs have been made in previous pension plans.

The other one is, again probably pension plan regulations dependent, the possibility of capitalizing a widow’s (not sure it can be made for dependants also) rent.

Example: I die and my wife is 53 and she is entitled to a 50K CHF annual rent.

If at the time the women’s life expectancy is 83, a lump sum of 30 (83-53) times 50K = 1.5M CHF can be paid right away.

Hope this contributes to the general knowledge about these complex matters! :-)

Hi Pedro,

Thanks for sharing!

I had no idea that buy-back could be excluded. I will mention that in the article!

I should also talk about lump sum. Do you know if there are many pension funds that allow this?

Buy-backs exclusions seem to be more frequent than the opposite in my experience.

I’ve had one with the lump sum possibility in pension plan with Helvetia. I have no idea about how common that is, but I have it highlighted in my 3 pillars XLS dashboard so that my wife would ask for it if and when.

Thanks! That can make a very big difference for buy-backs.

Hi Baptiste,

it’s indeed a very interesting article. I tried to calculate once for our family situation but didn’t finish to take everything into account.

But looking at what you describe, I did a quick calculation and I end up with higher income that what I’m earning now! And not even taking into account the family allowance (between 200 and 400CHF/month depending on the canton and number of kids, e.g. in Vaud and Geneva it’s 300 for the first 2 kids and 400 from the third, so with 3 kids it’s 1000CHF per month).

But is the family allowance still fully due if the widow doesn’t work (as he/she has to take care of the kids).

For my 2nd pillar I check the annual yearly statement, there is a yearly allowance for the widow and another one (that is a third of the widow allowance) for the kid (I assume it’s per kid but I should double check with my company). Then there is death capital (not that much, about a year of salary). I assumed it was on top of the yearly allowance but from what you wrote it might be one or the other, I should also check this point.

Regarding AVS/AI (1st pillar), are these figure the same for all Switzerland?

You mention that the person must have contributed to 2nd pillar from 20th birthday but I guess you mean 1st pillard (AVS/AHV) right?

Maybe it would be good to do a couple of example to see what we are talking about.

For the calculation you mention an average yearly income of 86’400CHF to reach the maximum pension. So someone that die at 40 and earn a total of 1’000’000CHF between is 20 and 40, it’s an average of 50’000CHF/year, right? Then is it’s proportional between 14’340 and 86’400CHF, it’s about 70% right? So the widow will get about 1625CHF/month and each kids about half of it. For a family with 2 kids, it will be 3250CHF/month or 39’000CHF/year. +12’000CHF of family allowance + 2nd pillar. In my case 2nd pillar would be more generous than 1st+family allowance in VD/GE. And this will increase each year as the average yearly income will increase obviously. By the way how does it count if there was a period without income that was covered by unemployment? Is it added to the total for calculation of the yearly average or not? This could make a huge difference for some situation, fortunately it’s not my case.

In our case we have 3 kids, so until they are 18 (or end of study up top 25, not sure if it’s the same rule in 2nd pillar), so if I add the 1st and 2nd pillar for the third kid, it’s now even more than what I earn. Not sure if I should tell my wife or not, ahaha.

Then you add 3rd pillar and all invested money that will also bring some safety net and additional revenue if needed until kids are on there own and the widow can work 100% again (or retire if enough money is left compare to the expenses).

In any case it mean that most extra life insurance might be really unnecessary for typical family I guess.

I didn’t do the calculation in the other direction, if I get widow with 3 kids on my own, my wife average salary would be quite low as she didn’t work much until we have the third kid and stopped then. I will calculate another time, I don’t want to get depress.

Hi Eluc,

On the yearly statement, it should be per kid, I believe. But these statements are not always clear.

AVS should not change per canton, yes.

Yes, that’s a typo. The pension is full if you contributed to the first pillar since your 20th birthday.

Your example looks right to me. I am not entirely sure about family allocations, but I would assume they stay the same.

Good question about years with unemployment. I have no idea how it would work. I would expect it depends on whether you pay contributions to the first/second pillar on your benefits. I would expect you do.

I should do the math in your case, it seems indeed surprising to end up with more income than current income.

And if that is true (and seems to be the case), you are right about life insurance not being very useful, in most cases.

On the other way around, it would also depend if you continue working or not. That depends on the age of the children.

Thanks for sharing your examples!

It’s definitely per kid!

The death capital (very often 1,2 or more yearly salaries) is a lump sum that is paid right after the death on top of a widow rent.

Unemployment, you’ll pay AVS/1st pillar for as long as you receive unemployment benefits.

2nd pillar/LPP will depend on if you decided (pension plan regulations allowing) to stay in the plan, hence paying your part, the employer’s part plus the admin fees of the plan!

HTH ;-)

Good article, I learned some things.

Only have 3 points to add.

1) vested benefits (Pillar 2) can be left invested until 5 years after official retirement age or taken out as cash at earliest 5 years before official retirement age. The actual birthday month of your 70th or 60th birthday (in the case of a man) is the determining month for withdrawal in the cases above, not the calendar yearend.

2) 3rd pillar accounts can be withdrawn as cash at earliest 5 years before retirement age and latest on 65th birthday (in case of a man)

3) You mention there is a withdrawal tax; important to realise this tax is based on the Gemeinde where you live, not the location of the fund

Hi ian

Thanks for your comments. 1) and 2) are not really related to death and I mention them in the articles

3) is a good point, I will update the article to make it clearer

Ian,

1) I think it may be dependant on the specific pension plan regulation.

Regarding 2) and depending on the cantons they MAY be withdrawn after the year of your 65th birthday if and only if you’re still working, which is the case in the Vaud canton.

Thanks. For your comment on 1), you may be correct. My info comes from UBS and Pictet 2nd pillars. However even they couldn’t advise me on last date for withdrawing the second pillar. I had to go to the government dept and ask them. It’s the day of your 70th birthday (for a man)

For 2), you are correct, thanks

Great article. Thank you for your effort

Thanks :)

2 typos:

1) that the marriage *lasted* for at least five years.

2) the marriage *lasted* for at least ten years.

Great analysis , thanks a lot!

Two cases I haven’t seen:

– pillar 1: you only mention the married situation. Any difference if it’s an unmarried partnership?

– residence of the inheritors: if any of the inheritors are abroad, what changes? I understand it can be a super-complex situation. I’m just wondering if the Swiss law applies first (as the place of origin of the assets to be inherited), then the local laws second (e.g. for local taxation on the receiving end)

Great work as usual

Hi MF,

Good questions!

1) It looks like it’s exactly the same as marriage. I will update the article.

2) That’s a good question. Then, in that case, I would guess that the residence country inheritance law will apply. But I am definitely not an expert there.