Vested benefits accounts: All you need to know!

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Vested benefits accounts play an essential role in the retirement system of Switzerland. You can transfer your pension fund money to a vested benefits account when you are unemployed.

You then keep your vested benefits until your retirement or until you work again.

These accounts are not well known, and there are many interesting things to learn about them. So, this article will go in-depth into everything you should know about vested benefits.

What is a vested benefits account?

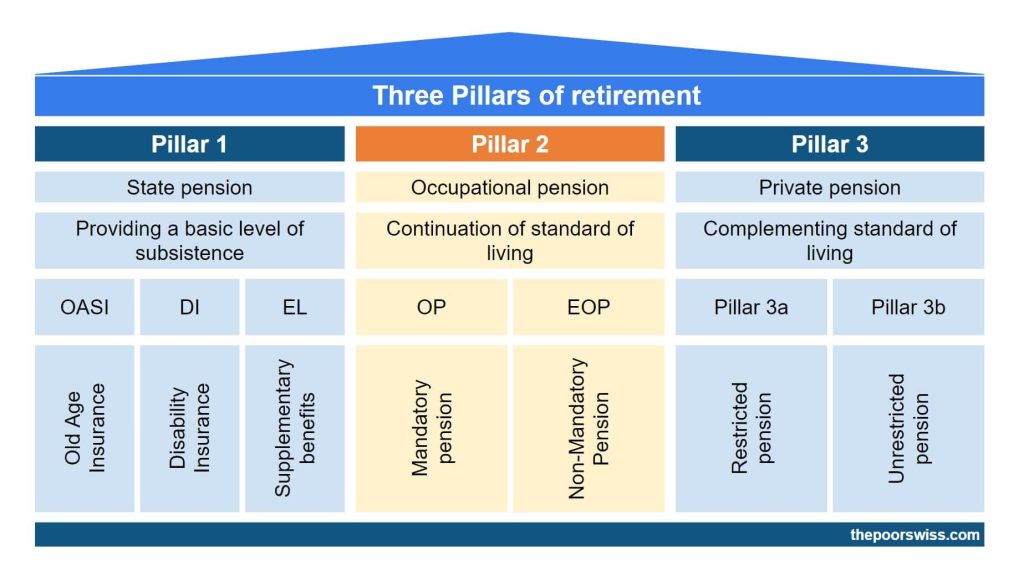

A vested benefits account is a particular account where you can keep your pension fund money when you are not working. It is part of the second pillar system.

When you are working, you are enrolled in a pension fund. But if you leave your company and do not join another, you will not be part of a pension fund. In that case, you must move your pension fund capital to a vested benefits account.

An exception to that is that if you are becoming unemployed, you could choose to still contribute yourself to the pension fund. In this case, you would generally go to the Substitute Occupational Benefit Institution. But this is a rare case.

This also applies if you move out of the pension fund system while still working, for instance, if you are moving abroad.

Just like a third pillar account must belong to a third pillar foundation, a vested benefits account belongs to a vested benefits foundation. These foundations are heavily regulated and must follow strict rules.

While not everybody can profit from vested benefits, they remain an important part of the retirement system. This article will cover everything there is to know about vested benefits.

Vested benefits and retirement

The usual way to use vested benefits is at retirement. It makes sense since it is part of the second pillar.

You can withdraw your vested benefits at retirement age or up to five years before normal retirement.

Also, it is currently possible to delay the withdrawal up to five years after retirement. However, this will not be possible after January 2024 unless you are still working.

Contrary to the second pillar in a pension fund, you cannot choose between a pension and a lump sum withdrawal. Indeed, you cannot draw a pension from a vested benefits account. You will need to withdraw the capital as a lump sum.

A few vested benefits foundations allow you to draw a pension, but this is extremely rare.

We must note that you cannot partially withdraw vested benefits accounts. At retirement, you have to withdraw it entirely.

Optimize for taxes

There is one thing very few people know: you can have two vested benefits accounts. Two accounts allow you to optimize your taxes when withdrawing from them.

You will pay a withdrawal tax when you withdraw your vested benefits. This tax is lower than the taxes you have saved using the second pillar, but it is not negligible either. Therefore, it is essential to try to optimize these taxes.

Withdrawal taxes are using a progressive system. This means you will pay a different tax rate on each tranche of your withdrawal. For instance, a progressive tax system may look like this (entirely made up for the example):

- 2% on the first 10’000 CHF

- 3% on the next 20’000 CHF

- 4% on the next 20 ‘000 CHF

- 5% on the rest

So, if you withdraw 60’000 CHF, you will pay 2100 CHF in taxes. So, higher amounts are taxed at higher rates.

Imagine you can withdraw 30’000 CHF the first year and 30’000 CHF the second. In that case, you will pay 1600 CHF in taxes. You have saved 500 CHF on your taxes, more than 25%!

Therefore, you should always try to have two vested benefits accounts. When you leave a pension fund, you can tell them to split your second pillar and send it to two vested benefits accounts.

It is also important to note that you cannot have two accounts with the same foundation. You need to have accounts with different vested benefits foundations.

Vested benefits and employment

As discussed before, you use a vested benefits account when you are not part of a pension fund, namely unemployed.

But it is important to know that when you are employed again in Switzerland, you must transfer your vested benefits to a pension fund. This is a rule of the retirement system.

Many people will say it is a grey area because pension funds cannot verify your vested benefits assets. And indeed, many people do not transfer their retirement benefits when working again. But this is against the rules. Therefore I would not recommend doing it. I recommend following the rule and transferring your vested benefits to a pension fund.

Vested benefits and death

In the event of death, the vested benefits go to the beneficiaries. The foundation determines the beneficiaries based on four different groups.

In most cases, the vested benefits will go to the members of the first group: the surviving spouse or partner, the surviving divorced spouse of partner (under some conditions), and dependent children.

If there is nobody in the first group, this will go down to group 2, group 3, and then group 4. If all the groups are empty, the vested benefits will return to the state.

In most cases, you will not have to do anything, but if you are living with an unregistered life partner, you should declare it to the foundation to ensure they can inherit (if you wish to).

If you want to learn all the details, read my article about retirement benefits and death.

Vested benefits and divorce

Finally, we cover the event of divorce.

If you get divorced or your registered same-sex partnership is dissolved, each spouse or partner is entitled to half of the vested benefits of the other party earned during the period of marriage or partnership. This is done regardless of your marital property regime.

Only the part earned during the official relationship will be shared, not the entire sum. And both parties will see their earned vested benefits cut in half and transferred to the other person.

If only one person worked, this could significantly reduce their retirement benefits. This is one reason divorce makes couples much poorer.

Withdraw vested benefits without retiring

There are several other ways to withdraw your vested benefits without retiring.

The most used way is to use your vested benefits assets to finance a mortgage. You can use your retirement benefits to cover 10% of the property value.

You can also use your vested benefits to pay off an existing mortgage. This is not something really interesting, but that is an option nonetheless.

If you become self-employed, you can use your vested benefits to start your own company.

Finally, if you leave switzeralnd permanently, you can get some or all of your assets. If you leave for a country outside the EU/EFTA countries, you can withdraw the entire vested benefits. If you leave for a country part of the EU/EFTA, you will only be able to withdraw the extra-mandatory benefits.

The Substitute Occupational Benefit Institution

Many people have vested benefits assets in the Substitute Occupational Benefit Institution and may not even know it.

Indeed, many people forget to transfer their second pillar benefits when they switch employers or stop working. In that case, pension funds must transfer the assets automatically to the Substitute Occupational Benefit Institution.

How to choose vested benefits accounts?

When transferring your pension fund money to a vested benefits account, you must choose a vested benefits account. And as with every financial service, there are many options out there. And unfortunately, many of these options are pretty bad. So, how do we choose vested benefits accounts?

If you are close to withdrawing the money, your choice is simple. You only need to find a provider that allows you to keep the money in cash and charges as low fees (ideally zero) as possible.

However, if you are not close to retirement, you want to look for a provider that lets you invest your money.

There are several critical criteria for choosing a vested benefits provider.

First, you must look at the fees. You do not want to lose your hard-earned money in fees to a greedy banking institution. They usually charge a management fee in percent of your assets. This can eat your returns very quickly. And be careful that many companies are not transparent, and you have to look hard to find the total fees, not only the first fees they present.

Then, you need to look at the investment strategy of the company. You should prefer companies that offer passive funds. Ideally, you want to be able to invest as much as possible in stocks.

Finally, you should look at the domicile of the vested benefits foundation. This domicile is essential if you withdraw your vested benefits while abroad. Indeed, if you are abroad, the domicile of the foundation will determine which canton will tax you. And there are some major differences in withdrawal taxes between Swiss cantons.

You can also at other small things like:

- Customization of portfolio

- Foreign exposure limits

- Sustainability options

The best vested benefits account

Finpension Vested Benefits is the best account in Switzerland.

Use the FEYKV5 code to get 25 CHF in your account!

- Invest 99% in stocks

Currently, the best vested benefits provider is Finpension. This service has many advantages:

- You can invest up to 99% in stocks

- You only pay a 0.49% yearly fee (the lowest available!)

- Finpension is only using passive funds

- You can customize your portfolio in detail

- You can heavily invest in foreign currency instruments (without hedging)

- Excellent tax domicile for withdrawing abroad

- They have two foundations, ideal for splitting your assets

Finpension is significantly better than other alternatives if you want to invest aggressively. If I had to use a vested benefits account, I would use finpension.

You can read my review of Finpension vested benefits if you want more information.

However, keep in mind that if you look for a short term vested benefits account, Finpension may not be the best. Indeed, for the long-term, you want to invest it aggressively. But in the short term, you want to be more careful. In general, for the short term, you will want a good interest rate on cash and avoid exit fees.

Conclusion

There are many important notions regarding vested benefits. If you are serious about the retirement system of Switzerland, you should learn about this important subject too.

Choosing a good account is essential if you use vested benefits. Currently, finpension is the best option for aggressive investors.

If you want to learn more about the retirement subject, I encourage you to read my article about the Substitute Occupational Benefit Institution, another little-known part of the retirement system.

What about you? Are you using a vested benefits account? Did I miss anything about these accounts?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Retire in Switzerland

- More articles about Retirement

- How many years until you can retire?

- What Would I Do If I Retired?

- How Much Will You Spend in Retirement?

Thanks for the article.

I will be leaving Switzerland later this year and have concerns that even if I split my pillar 2 into two vested accounts and withdraw each in two tranches then the tax I will pay in my home country will be almost 50% under a progressive tax system.

Therefore is it possible to withdraw the lump sum into another bank account in Switzerland and withdraw money annually in order to reduce tax in my home country?

Hi Mark

I am unaware of any canton where the tax would rise to 50%. Are you talking about the taxes from the country you are moving to? Otherwise, it should not reach such heights.

Hi Baptiste

Thanks for your quick reply.

Yes, I’m talking about the progressive tax rates in the EU country that I’m moving to.

This is why I need to understand if there is an option to transfer the funds from a vested account into another bank account in Switzerland and then transfer the money to the EU country over several years (in order to pay a lower progressive tax rates)?

I am unaware of any way you could spread the withdrawals more than 2 ways.

Hi Baptiste,

What would be the best vested-benefits account for the short term (i.e., 12-18 months, offering the highest interest rate on cash and fewer exit fees?

Hi Juan

I don’t know if it’s the best, but VIAC is quite decent for the short-term. They have a good interest rate and a no exit fees (unless you use it to buy a house).

What about https://cbt.clientis.ch/de/

https://www.moneyland.ch/en/vested-benefits-accounts-costs Says they are the best with 1.7%.

What do you think?

Hi Ata

They may be the one with the highest interest rate, but I don’t think that makes them the best. For people wanting to invest, they are not good, but for people only wanting to keep their vested benefits in cash, this is indeed a good option.

The only issue is that the provider with the highest interest rate changes regularly, so it may not be the best in a few months.

You mention that some vested benefits would allow to withdraw a pension from them. Do you have some examples?

I unfortunately don’t . I have read that multiple times, but I could not find an example.

Pillar 2 pension funds are notorious for low interest (1-2%), but they provide a good tax saving when paying in. I plan to stop working in 2-3 years (at 40), so does it make sense to shove as much as possible into pillar 2 now, and then transfer to a vested benefits account once I am no longer employed? This would seem that it would let you benefit both from the tax saving and the higher interest rate of the vested benefit account (apart for a few transition years in between).

Hi Venora,

While most second pillars are indeed returning very little, there are also some good ones returning more than 4% per year. But they are rare unfortunately.

Yes, I think it makes total sense to maximize your second pillar contributions the last few years of your work life if you are going to retire early. That will only be very interesting if you have a very significant taxable income of course.

Dear Baptiste,

Thanks for the information, very helpful.

What accounts would you recommend or know of in case I don’t want to aggressively invest the retirement funds in stocks? Is there one that has 0 fees, or very low costs, that lets you keep the money without risk of losing it, and perhaps guarantee some % per year until employment?

Or one does manages the funds passively without a high risk, maybe more secure?

Thanks for the help!

Hi Julia,

If you don’t want to invest aggressively, Finpension is not the best. In that case, I think that VIAC is the ideal solution. They have a solution without any investment, which currently stands at 0.65% interest per year.

Hello! Thank you again for your articles and information. It is a great place to start.

But in this particular one I have few queries, first of all, there are no comparisons or mention of any other product… For example, Viac, Swisslife, etc…

Also, from my understanding the statement bellow is wrong… You state:

“Vested benefits and employment

As discussed before, you use a vested benefits account when you are not part of a pension fund, namely unemployed.

But it is important to know that when you are employed again in Switzerland, you must transfer your vested benefits to a pension fund. This is a rule of the retirement system.

Many people will say it is a grey area because pension funds cannot verify your vested benefits assets. And indeed, many people do not transfer their retirement benefits when working again. But this is against the rules. Therefore I would not recommend doing it. I recommend following the rule and transferring your vested benefits to a pension fund.”

My understanding is that, there is no law that mandates an employee to transfer the 2d pillar money to the new employers pension Fund… You can chose to keep it in your Vested account, or you can transfer… I can see multiple scenarios where it would be more advantagous to keep it in a Vested account rather than in the pension fund(specially depending on the pension funds… You need to look into their condition, fees, etc… when you change employer). Can you double check it?

I am not going to list every single service in each of my article. If you clicked on the Finpension article, you would have found a comparison with VIAC: https://thepoorswiss.com/viac-vs-finpension-vested-benefits/

Even though it’s definitely advantageous to keep it, you are obliged to transfer, every single vested benefits provider says that. For instance, on VIAC: “Yes, under the law on vested benefits, you are obliged to transfer all your vested benefits to the pension fund of your new employer.”. Unfortunately, I do not find this in the “vested benefits law”. But again, being a grey area, I will not advertise this nor do it myself.

Hi Baptiste

So as long as you are working, you cannot take advantage of tax reduction by investing into the vested benefits account, right?

Cheers

Maciej

Hi,

There is no tax reduction advantage to a vested benefits account.

But you cannot indeed have a vested benefits account when you are working, you can only have a standard second pillar account. And when you are working, you could contribute to your second pillar which would give you tax advantages.