What is the Substitute Occupational Benefit Institution?

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Have you ever heard of the Substitute Occupational Benefit Institution? Likely not. Most people have never heard of it. And yet, over half a million people have an account with this institution without knowing it!

This institution plays an important role in the retirement system in Switzerland. And it can help many people in different situations. So, we should see what the Substitute Occupational Benefit Institution is in detail!

Substitute Occupational Benefit Institution

The Substitute Occupational Benefit Institution is both a pension fund and a vested benefits foundation. It is a non-profit organization mandated by the government that anybody can use. Its role guarantees that employers and employees can access the professional pension.

As we will see in this article, this institution has several uses. And many people have accounts with it without even knowing about it.

Pension Fund

As of 2019, the Substitute Occupational Benefit Institution managed about 2 billion CHF in their pension fund (the second pillar). The institution manages these funds for about 38’000 people.

With very conservative conditions, this pension fund is not the best available. However, there are several cases where people would use this foundation. Indeed, this foundation, by contract, will accept anyone. So, many people will use this foundation if they cannot get another one.

This is often the case for small companies that still need a pension fund for their employees. Finding a good pension fund is difficult if you have very few employees and not necessarily high salaries. Therefore, small companies often turn to the Substitute Occupational Benefit Institution.

Some independent workers turn to this institution. Indeed, independent workers can choose to be insured with a pension fund, but since it is not mandatory, very few choose to do so. And since they are alone, it is once again difficult to find a good pension fund. Therefore, many turn to this institution.

If you are unemployed and receive unemployment benefits, you can also contribute to a pension fund via this institution. This could be an excellent way to avoid gaps in your pension.

The last case is probably the most interesting for people and the least known. To be included in a pension fund, your salary must be above the minimum of 21’510 CHF. Above that amount, you will contribute to a pension fund. But below that amount, you will not contribute.

However, if you work for two employers, each with a salary below the minimum and a total above the minimum, you can choose to affiliate yourself with the institution. This point is important because it means that many people working two small jobs can still contribute to the second pillar and have a better situation in retirement.

So, the Substitute Occupational Benefit Institution is a last resort choice as a pension fund. But the institution was made exactly for these cases. And it is good to have that choice to avoid even worse conditions.

Vested Benefits

The case of the Substitute Occupational Benefit Institution as a vested benefits provider is also very interesting.

Indeed, the Substitute Occupational Benefit Institution manages more than one million accounts, with more than 10 billion CHF in assets. And even more interesting, more than half of these accounts belong to people that lost their vested benefits.

It is a bit crazy, but many in Switzerland do not know they have assets with the Substitute Occupational Benefit Institution.

When you leave your employer, you must transfer the funds from your previous pension fund into the new employer’s pension fund. And if you are not working directly, you must transfer these assets to a vested benefits account.

If you do not transfer these assets, the previous pension fund must transfer them to the Substitute Occupational Benefit Institution after two years at most. So, many assets are transferred that way because either the person forgot to do it or because the person did not know.

When the institution receives assets that way, it will try to contact the person to get everything in order. But often, that person has moved, and the address or contact information is not current. In that case, they will wait until retirement and then work with the first pillar to find the owner.

You could also use the Substitute Occupational Benefit Institution as your vested benefits account. However, there are much better vested benefits accounts available.

How to know if you have lost assets?

If you have often changed employers, it could be interesting to know if you have lost some assets. In most cases, these assets will end up in the Substitute Occupational Benefit Institution.

If that is the case, you can use this form to ask the institution whether they have assets in your name.

If you have assets there, you can transfer them to your current pension fund or your current (or a new) vested benefits account.

If you prefer, there is another way to determine whether you have funds without knowing. You can use Kala for that. Kala is available as an app or an online form to get information about your funds. The process is a bit more involved because you must verify your identity, making it significantly longer to fill out. But then, they will search your assets in many pension funds.

Once they have the results, they will let you know. This could take up to 80 days.

Conclusion

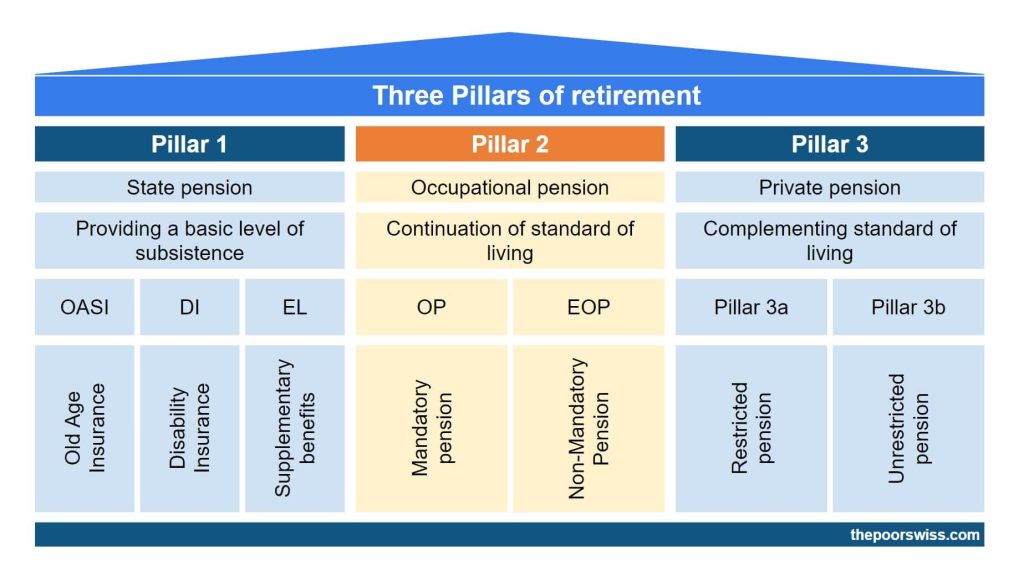

The Substitute Occupational Benefit Institution is an important part of the three pillars system in Switzerland. They provide an essential service to ensure everybody can access the second pillar system.

They also hold all the funds people forget in the second pillar system. You may have some funds in there without knowing about them.

To learn more, you should read about the second pillar and the vested benefits.

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Retire in Switzerland

- More articles about Retirement

- The Trap of Life Insurance Third Pillar

- Should You Contribute to Your Second Pillar in 2024?

- Should you contribute to your third pillar in 2024?

I am one of those people that some years ago didn’t know what pension benefits they had. I left benefits from previous employers unclaimed long enough that they “fell back” to the Substitute Occupational Benefit Institution. (Rendita is the name of it if I’m not mistaken). They managed to contact me and preserve the benefits. Even after two years abroad, I was able to reclaim them once I came back to Switzerland, and transfer them to a new employer. I really like that there is this solution, for people like me who needed a while to get their ducks in a row and understand how the pension system works. Thanks for the article!

Hi Karolina,

Thanks for sharing, this is very interesting! I only discovered this institution recently.

Regarding Rendita, I think it’s actually a vested benefits foundation that is standard, not the substitute one.

Every time you change jobs, you have an opportunity to transfer your pension capital to a Freizügigkeitsstiftung such as Viac. There you can control the asset allocation yourself and invest almost 100% in equities. If you transfer the capital to the pension fund of your new employer, the equity allocation will likely be only 45%. This leaves your capital vulnerable to inflation. In theory, you are required to transfer all pension capital to the pension fund of the new employer. In practise, it is not enforced and there is no legal consequence if you use a Freizügigkeitsstiftung instead. This was clearly and unambigously stated by Swiss lawyers quoted in business newspaper NZZ.

That’s a pretty interesting fact, thank you for sharing. I have some pension funds leftover from my previous job in another country and I am able to allocate it between any of the different funds available with the provider which I think is nice too. Wish it would be more the standard approach for those that want it.

Very correct. One should just note that you cannot turn it into a monthly pension then.