Save taxes with staggered withdrawals in 2024

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Most cantons use a progressive tax system for taxing retirement withdrawals. These withdrawals are coming from the second and third pillars.

This progressive tax system makes it more interesting to stagger your withdrawal over multiple years to save on taxes. This technique is called staggered withdrawals.

I want to discuss this in detail in this article and how you can use staggered withdrawals to save taxes on your second and third pillars.

Withdrawal taxes

When you withdraw your retirement assets, you must pay a tax on this withdrawal. This applies to assets from the second and third pillars.

These taxes are based on the amount you are withdrawing. As usual in Switzerland, you will pay taxes at three levels:

- The canton

- The municipality

- The country

For this, most cantons use a progressive tax system. Such a system means you pay a lower percentage for smaller amounts than larger ones.

The country (federal taxes) also has a progressive tax system, with the percentage increasing with the amounts. The municipality is a percentage of the cantonal taxes. So, if the cantonal tax is progressive, the municipality tax will also be progressive.

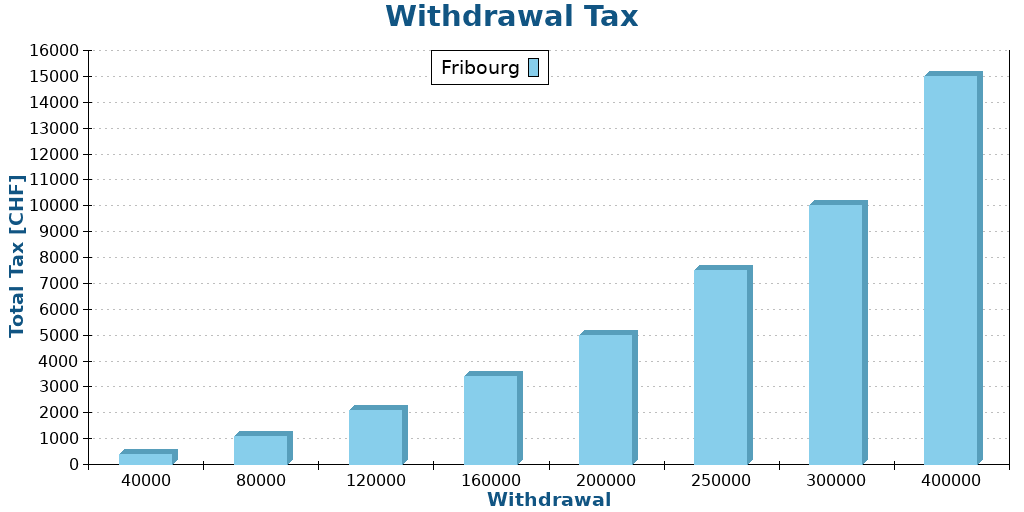

Here is the example of the canton of Fribourg:

- 1% for the first 50’000 CHF

- 2% for the next 50’000 CHF

- 3% for the next 50’000 CHF

- 4% for the next 50’000 CHF

- 5% for any amount higher

With this system, we can run a few examples:

- If you withdraw 40’000 CHF, you will pay 400 CHF.

- If you withdraw 80’000 CHF, you will pay 1100 CHF.

- If you withdraw 120’000 CHF, you will pay 2100 CHF.

- If you withdraw 160’000 CHF, you will pay 3400 CHF.

Here are more examples in a graph:

So, we can see that this is not a linear system. What is very important to realize is that withdrawing multiple times small amounts is cheaper than withdrawing a large amount. If you withdraw 4 times 40’000 CHF, you will pay 1600 CHF in taxes. But if you withdraw 160’000 CHF at once, you will pay 3400 CHF. This is more than double!

Since the amounts are calculated yearly, you will need to stagger your withdrawals over multiple years.

Some cantons are worse, and some cantons are better than Fribourg. Since this can vary for each canton and municipality, I cannot show all results here. However, since the federal tax is progressive, it will always be important to stagger your withdrawals.

Staggered withdrawals

So, now that we know that we need to withdraw over multiple years, how can we achieve it? First, we need to see the rules for withdrawing the second and third pillars.

For the second pillar, if you have a pension fund, you must withdraw it at retirement age. If you have a vested benefits account, you can withdraw it up to 5 years before retirement and up to 5 years after. Up to 2030, you do not need proof of employment to withdraw after retirement. However, since 2030, you will need proof of employment.

We can withdraw our third pillar five years before the official retirement age. And we can postpone the withdrawal up to five years after the official retirement age. However, postponing the third pillar withdrawal requires proof of employment. This means that we will need to postpone retirement as well.

So, in a perfect world, you could spread your withdrawal over 11 years. However, this requires working after the retirement age since you need proof of employment. Therefore, in most cases, we should consider that most people can stagger their withdrawals over 6 years.

Theoretically, you could also use advance withdrawal before buying a house or starting a company. However, this is not applicable in most cases. Regardless, this could be another way of staggerring withdrawals.

So, let’s see how we can increase the number of withdrawals for the second and third pillars.

Get five third pillars

Unfortunately, you cannot do a partial withdrawal of a third pillar. You must withdraw an account all at once. So, you need multiple accounts if you want to stagger your withdrawals.

Fortunately, you can open multiple accounts. You should open five third pillar accounts. You may wonder why five since we can generally spread over 6 years. The reason is that most people also have a pension fund or a vested benefits account to withdraw, taking a year.

If you are married, taxes will be computed together. If you are the same age, you will have to withdraw following the same pattern. But if you have some age difference, this means you will be able to withdraw over more years. So, make sure you take that into account.

A good thing about this system is that you can open multiple accounts with the same provider. A good third pillar provider will allow you to create up to five accounts. If you need a good third pillar, you can look at the best third pillar for Switzerland.

And unfortunately, you cannot split a third pillar account. So, this is something you must plan.

Get two vested benefits accounts

If you are employed until your withdrawal, you must withdraw from your pension fund at once (unless you have two employers and two pension funds, but this is rare).

However, if you are not employed, you could have several vested benefits accounts. For this, when leaving your pension fund, you could ask them to send the money to two different vested benefits foundations. It is important that you need two different foundations. You cannot have multiple accounts with the same foundation.

However, some providers have two foundations. So, you can have two accounts at the same provider if it has two foundations. If you do not know where to start, look at the best vested benefits account.

Once again, you cannot split a vested benefits account, so you must plan.

How much can you save?

While you could, in theory, split your withdrawals up to 11 years, most people will only achieve up to 6 years since most people will work until the reference retirement age and will not be able to postpone withdrawals since they will not be employed.

So, in theory, you could split up your withdrawals in equal chunks of 1/6 of the total. However, this ignores that most people will have significantly more in their second pillar than in their third pillar. Since the contribution percentage increases over time, the contributions to the second pillar will quickly outpace the contribution to the third.

On average, we can imagine that most people will have double the money in their second than in their third pillar. This is an average, of course, but it makes sense.

So, if you have 200’000 CHF in your second pillar and 100’000 CHF in your third pillar, you will still have to do a single 200’000 CHF withdrawal and five 20’000 CHF smaller withdrawals. This will still result in very nice tax savings, but significantly less than if you could split the second pillar.

In that case, you would pay 5600 CHF in cantonal taxes instead of 10’000 CHF. This is a very good improvement in favor of staggered withdrawals.

If you split your second pillar withdrawals, you could optimize it further by withdrawing four times 25’000 CHF and twice 100’000 CHF. With that extra step, you would only pay 3’250 CHF in cantonal taxes. In this case, staggering your withdrawals divides your taxes by three.

From that, we can draw a few conclusions:

- Staggering your withdrawals is very effective!

- In practice, most people will only be able to split their withdrawals over six years.

- The strategy becomes more and more effective the more money you have.

- Splitting vested benefits can be very effective if you can achieve that.

Is it legal?

One question you may ask yourselves is whether this is legal. Currently, it is legal, but there are some limitations.

Many people feel this is tax evasion and want to pass new laws to limit it. Already, with the OASI 21 reform, staggered vested benefits are more difficult than before.

Also, some cantons are stricter than others. For instance, the canton of Vaud only allows staggering for 3 years, and the canton of Neuchatel only allows 2. After these points, they will consider this tax evasion.

We will likely see stronger regulations to avoid this in the future. However, we should not stop trying to have 5 third pillars and, ideally, two vested benefits accounts. Since this is currently possible, we should still try to do it. And even if it is not possible in the future, you can always withdraw multiple accounts per year to abide by the law.

The important point is that since you cannot split them later, it is important to be prepared. You never know in which canton you will retire. So it is better to be prepared. Having multiple accounts is never an issue. Staggering over too many years can be an issue in some cantons.

Conclusion

Staggering your retirement withdrawals can save you a significant amount of taxes. However, you must plan for it since you cannot split a third pillar or a vested benefits account. Therefore, you should always consider this when managing your retirement assets.

I recommend anybody open five third pillar accounts and try to balance them over time. You can simply send the money into the account with the lowest amount over time, which will be more or less balanced.

If you have the opportunity, it is also a good idea to split your pension fund into two vested benefits accounts before the official retirement age. But I realize this is an optimization that is only doable for people retiring before the reference retirement age and able to live without these funds for some years.

I plan to reach ten third pillar accounts (5 for me and 5 for my wife) by the age of retirement, more or less balanced. If my plan to retire early works, I will split my pension fund into two vested benefits accounts. Then, we will spread all these accounts for 6 years.

What about you? Are you planning to stagger your withdrawals?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Retire in Switzerland

- More articles about Retirement

- The truth about 3b pillar accounts

- Should You Contribute to Your Second Pillar in 2024?

- Disaster File – A Simple Way to Prepare for Your Death

I want to offer an even better option to minimizing tax upon withdrawal: tax-free withdrawal abroad.

For this, you have to become a tax resident in a country that does not tax withdrawals from retirement accounts (e.g. income exclusions for foreign unremitted income in non dom countries).

E.g. Cyprus, Spain under Beckham law, Malta non dom, UK non dom, IR non dom, Portugual under NHR, Georgia, AUS on temporary permit, NZ in first 5 years, etc.

Then Switzerland as the source country must have waived its taxing rights to the residence country according the respective double tax county. This depends on the following factors: retirement account type (piller 2 versus pillar 3a), classification of pension fund (private or public), citizenship (CH versus residence country versus both versus neither). Generally, withdrawing money tax-free is always possible if you are flexible to move. You can find a lot of tax-free withdrawal countries for pillar 3a. For pillar 2, it is more difficult as Switzerland retains taxing rights more often under double tax treaties.

Unfortunately, swiss pension schemes charge fees for account closures or withdrawals abroad. Therefore, I try to have fewer accounts because I assume this is cheaper for my plan to retire taxfree abroad.

Moving abroad also removes Swiss wealth taxes, removes Swiss dividend/interest taxes, retains the favorable 15% residual US withholding tax rate (as most countries have a similar double tax treaty like CH), and substantially lowers cost of living.

Hi Stefan

Thanks for sharing your strategy!

Geoarbitrage can definitely help you reduce your tax burden and optimize your burden. And it’s definitely great to plan that ahead and optimize.

But for most people, moving out of Switzerland is not an option they would consider.

Having more than 5 3rd pillar accounts also make sense if like you did use one for a house purchase along your life.

Good point. In some cases, you can plan ahead and see whether you would need more than 5 portfolios.