Save taxes with staggered withdrawals in 2024

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Most cantons use a progressive tax system for taxing retirement withdrawals. These withdrawals are coming from the second and third pillars.

This progressive tax system makes it more interesting to stagger your withdrawal over multiple years to save on taxes. This technique is called staggered withdrawals.

I want to discuss this in detail in this article and how you can use staggered withdrawals to save taxes on your second and third pillars.

Withdrawal taxes

When you withdraw your retirement assets, you must pay a tax on this withdrawal. This applies to assets from the second and third pillars.

These taxes are based on the amount you are withdrawing. As usual in Switzerland, you will pay taxes at three levels:

- The canton

- The municipality

- The country

For this, most cantons use a progressive tax system. Such a system means you pay a lower percentage for smaller amounts than larger ones.

The country (federal taxes) also has a progressive tax system, with the percentage increasing with the amounts. The municipality is a percentage of the cantonal taxes. So, if the cantonal tax is progressive, the municipality tax will also be progressive.

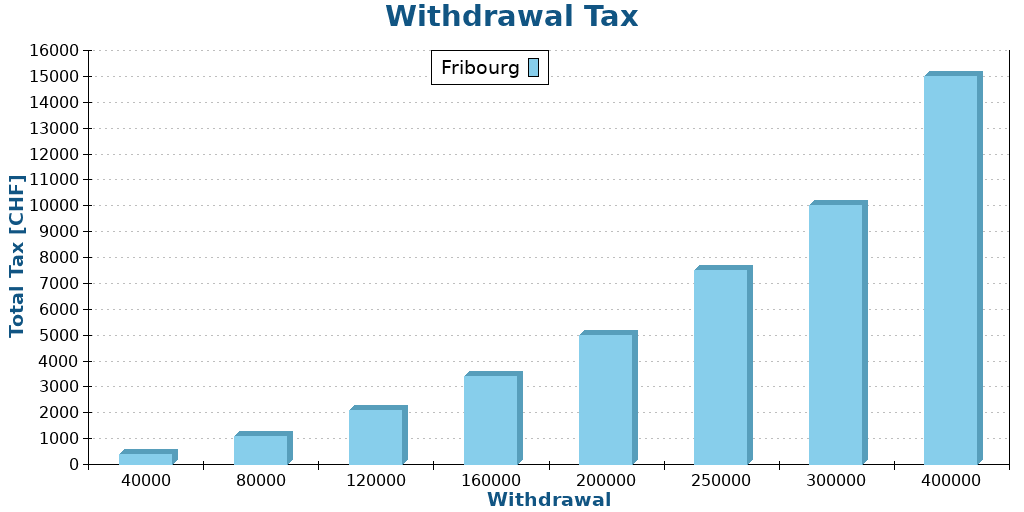

Here is the example of the canton of Fribourg:

- 1% for the first 50’000 CHF

- 2% for the next 50’000 CHF

- 3% for the next 50’000 CHF

- 4% for the next 50’000 CHF

- 5% for any amount higher

With this system, we can run a few examples:

- If you withdraw 40’000 CHF, you will pay 400 CHF.

- If you withdraw 80’000 CHF, you will pay 1100 CHF.

- If you withdraw 120’000 CHF, you will pay 2100 CHF.

- If you withdraw 160’000 CHF, you will pay 3400 CHF.

Here are more examples in a graph:

So, we can see that this is not a linear system. What is very important to realize is that withdrawing multiple times small amounts is cheaper than withdrawing a large amount. If you withdraw 4 times 40’000 CHF, you will pay 1600 CHF in taxes. But if you withdraw 160’000 CHF at once, you will pay 3400 CHF. This is more than double!

Since the amounts are calculated yearly, you will need to stagger your withdrawals over multiple years.

Some cantons are worse, and some cantons are better than Fribourg. Since this can vary for each canton and municipality, I cannot show all results here. However, since the federal tax is progressive, it will always be important to stagger your withdrawals.

Staggered withdrawals

So, now that we know that we need to withdraw over multiple years, how can we achieve it? First, we need to see the rules for withdrawing the second and third pillars.

For the second pillar, if you have a pension fund, you must withdraw it at retirement age. If you have a vested benefits account, you can withdraw it up to 5 years before retirement and up to 5 years after. Up to 2030, you do not need proof of employment to withdraw after retirement. However, since 2030, you will need proof of employment.

We can withdraw our third pillar five years before the official retirement age. And we can postpone the withdrawal up to five years after the official retirement age. However, postponing the third pillar withdrawal requires proof of employment. This means that we will need to postpone retirement as well.

So, in a perfect world, you could spread your withdrawal over 11 years. However, this requires working after the retirement age since you need proof of employment. Therefore, in most cases, we should consider that most people can stagger their withdrawals over 6 years.

Theoretically, you could also use advance withdrawal before buying a house or starting a company. However, this is not applicable in most cases. Regardless, this could be another way of staggerring withdrawals.

So, let’s see how we can increase the number of withdrawals for the second and third pillars.

Get five third pillars

Unfortunately, you cannot do a partial withdrawal of a third pillar. You must withdraw an account all at once. So, you need multiple accounts if you want to stagger your withdrawals.

Fortunately, you can open multiple accounts. You should open five third pillar accounts. You may wonder why five since we can generally spread over 6 years. The reason is that most people also have a pension fund or a vested benefits account to withdraw, taking a year.

If you are married, taxes will be computed together. If you are the same age, you will have to withdraw following the same pattern. But if you have some age difference, this means you will be able to withdraw over more years. So, make sure you take that into account.

A good thing about this system is that you can open multiple accounts with the same provider. A good third pillar provider will allow you to create up to five accounts. If you need a good third pillar, you can look at the best third pillar for Switzerland.

And unfortunately, you cannot split a third pillar account. So, this is something you must plan.

Get two vested benefits accounts

If you are employed until your withdrawal, you must withdraw from your pension fund at once (unless you have two employers and two pension funds, but this is rare).

However, if you are not employed, you could have several vested benefits accounts. For this, when leaving your pension fund, you could ask them to send the money to two different vested benefits foundations. It is important that you need two different foundations. You cannot have multiple accounts with the same foundation.

However, some providers have two foundations. So, you can have two accounts at the same provider if it has two foundations. If you do not know where to start, look at the best vested benefits account.

Once again, you cannot split a vested benefits account, so you must plan.

How much can you save?

While you could, in theory, split your withdrawals up to 11 years, most people will only achieve up to 6 years since most people will work until the reference retirement age and will not be able to postpone withdrawals since they will not be employed.

So, in theory, you could split up your withdrawals in equal chunks of 1/6 of the total. However, this ignores that most people will have significantly more in their second pillar than in their third pillar. Since the contribution percentage increases over time, the contributions to the second pillar will quickly outpace the contribution to the third.

On average, we can imagine that most people will have double the money in their second than in their third pillar. This is an average, of course, but it makes sense.

So, if you have 200’000 CHF in your second pillar and 100’000 CHF in your third pillar, you will still have to do a single 200’000 CHF withdrawal and five 20’000 CHF smaller withdrawals. This will still result in very nice tax savings, but significantly less than if you could split the second pillar.

In that case, you would pay 5600 CHF in cantonal taxes instead of 10’000 CHF. This is a very good improvement in favor of staggered withdrawals.

If you split your second pillar withdrawals, you could optimize it further by withdrawing four times 25’000 CHF and twice 100’000 CHF. With that extra step, you would only pay 3’250 CHF in cantonal taxes. In this case, staggering your withdrawals divides your taxes by three.

From that, we can draw a few conclusions:

- Staggering your withdrawals is very effective!

- In practice, most people will only be able to split their withdrawals over six years.

- The strategy becomes more and more effective the more money you have.

- Splitting vested benefits can be very effective if you can achieve that.

Is it legal?

One question you may ask yourselves is whether this is legal. Currently, it is legal, but there are some limitations.

Many people feel this is tax evasion and want to pass new laws to limit it. Already, with the OASI 21 reform, staggered vested benefits are more difficult than before.

Also, some cantons are stricter than others. For instance, the canton of Vaud only allows staggering for 3 years, and the canton of Neuchatel only allows 2. After these points, they will consider this tax evasion.

We will likely see stronger regulations to avoid this in the future. However, we should not stop trying to have 5 third pillars and, ideally, two vested benefits accounts. Since this is currently possible, we should still try to do it. And even if it is not possible in the future, you can always withdraw multiple accounts per year to abide by the law.

The important point is that since you cannot split them later, it is important to be prepared. You never know in which canton you will retire. So it is better to be prepared. Having multiple accounts is never an issue. Staggering over too many years can be an issue in some cantons.

Conclusion

Staggering your retirement withdrawals can save you a significant amount of taxes. However, you must plan for it since you cannot split a third pillar or a vested benefits account. Therefore, you should always consider this when managing your retirement assets.

I recommend anybody open five third pillar accounts and try to balance them over time. You can simply send the money into the account with the lowest amount over time, which will be more or less balanced.

If you have the opportunity, it is also a good idea to split your pension fund into two vested benefits accounts before the official retirement age. But I realize this is an optimization that is only doable for people retiring before the reference retirement age and able to live without these funds for some years.

I plan to reach ten third pillar accounts (5 for me and 5 for my wife) by the age of retirement, more or less balanced. If my plan to retire early works, I will split my pension fund into two vested benefits accounts. Then, we will spread all these accounts for 6 years.

What about you? Are you planning to stagger your withdrawals?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-book

If you postpone the distribution of 3rd pillar after age 65, do you have to keep the funds with the same provider, or could you theoretically move them to another 3rd pillar fund?

I don’t think there are any restrictions until withdrawal.

Note that you can only postpone if you are employed. This means that you can also still contribute. So as long as you can contribute, you should be able to choose your 3a provider.

But having a 3a pillar dont you need to withdraw all amount when reaching retirement age, or can you still keep those money for some years on this account?

Do you balance all your accounts (splitting maximum contribution amount in the current year between them all) or do you fill one account until 50 000 and then you open another one and start filling it etc.

Thank you for a knowlegable article.

Hi Natalia

If you have a single account, you need to withdraw it entirely. But having 5 accounts (the whole point of this article) allows you to withdraw each account on a different year.

I balance them each year by adding money into a different account.

Is there a limit of money you should have in one of the pillar accounts? Does it make sense to put maximum (7000chf) each year in one of the 5 accounts or at one point it stops making sense since withdrawing bigger amount of money will force you to pay higher taxes?

I think it always make senses to contribute if you have a high marginal tax rate. But it’s true that the more you have, the more you will be taxed. If you are in a canton where going from 10’000 CHF to 20’000 CHF multiplies the tax by 10 (I don’t think this case exists, just extreme example), then maybe, but in most cases, you should be good.

Thanks and I appreciate your opinion but here we are dealing with hard earned cache and someone’s life savings. No one should decide based on that. It would be nice to back that up with some numbers like you do in many of your postings.

Already covered in detail: Should you contribute to your third pillar in 2023?

I can’t do math for each situation. I provide the framework, people should back it up themselves.

Thank you very much. That was a really good read. I just spent hours reading that article and going through all the links you provided in it.

Here is another way of withdrawing pension capital:

When you move your (tax) residence from Switzerland to a non-EU country, you can withdraw your entire pension capital in pillar 2 and 3. In this case, the withdrawal is not taxed by your canton of residence but by the canton of the pension fund. You can move the capital to a fund in Schwyz, which is the lowest-tax canton for withdrawals. One fund with particularly low fees is “Liberty Freizügigkeitsstiftung”.

It is therefore a good strategy to leave Switzerland every 5-10 years and spend sometime abroad. You are free to come back and register your residence once again at the communal authorities. A job change is an ideal opportunity for this.

There are three advantages to this strategy: (1) By withdrawing smaller tranches, you lower the tax rate. (2) By moving the capital to the lowest-tax canton, you lower the tax rate further. (3) You can access your pension capital before retirement, and invest it in ETFs with lower fees.

This approach is compliant with Swiss law. Of course, you should not make any false claims. Your communal tax authority will most likely accept your relocation without any further questions. Most Swiss communities do not require any proof of your new residence abroad. The pension fund may require some proof before it makes the payout. Any documentation requirements will be explained on the websites of the community and the fund. If you are Swiss, the fund may accept an excerpt of the “Auslandschweizer-Register” which shows your new address and is easy to obtain.

Hi Karl,

It may be an interesting strategy, but that’s extremely advanced and 99.9% of people will never consider that.

Also, you are putting your retirement at risk unless you are really careful. And you wont’ be able to do voluntary contributions after you come back to Switzerland unless you reimburse your withdrawals.

Amazing how well you know people of what they will do to save taxes. Maybe relocate once to Zug, Schwyz or even Zurich to get a picture of what else is going on outside of Freiburg.

Are you saying there is more than 1 out of 1000 Swiss citizens that are ready to relocate outside Switzerland every decade to save on taxes? I don’t believe that.

And if you are married, you could have 5 accounts each, for 10 accounts

Yes, but for the withdrawal of the accounts (and the vested benefits too) the age difference with your spouse matters.

It feels like the worst case is being exactly the same age, which means twice the money / account to stagger during the same 5 years. Being 5+ years apart creates more years to stagger and avoids an overlap. But it makes harder to retire at the same time to enjoy retired life together.

Anyway, we’re here to optimize finances. I guess and hope that tuning the age difference between spouses for financial reasons is outside the scope of this blog. :-)

Hi Patrik,

Yes, you are correct. And excellent point about the age difference, I did not think about that!

You are asbolutely right that having 5+ years difference will optimize withdrawals.

It’s definitely outside the scope but I will mention the age difference in article, it’s important to plan together.

Thanks!

Also in case of overlap it might be optimal to not have 5 accounts with the same amount.

Lets say the couple is 1 year apart in age. This leads to 4 out 6 years withdrawing together. It would be optimal to each have one account with more in it and 4 accounts with less but equal amounts in it. That way you can smooth the withdrawal over all the years.

Yes, if you want to be optimal, you should have lower amounts for the overlap on each end and higher for the non-overlap years so that each year is more or less the same. However, that requires a lot of planning. Even for me, I am not willing to go that far :)

An important question for this is: Is the allowed withdrawal time window oriented around the official retirement age (65 currently) or the actual retirement time point? Because if it always possible to withdraw third pillar between 60 and 65, then a 5+ year age gap the younger person could retire early (share the time together) but withdraw regularly until 65. So both partners start withdrawing at 60 each but maybe the younger retires at 60 as well? If they can afford it…

It’s all centered around officlal retirement age. If you quit the workforce at 50, you still need to wait 15 years to get full social security.

Remember that you will still pay AHV till the official retirement age. And that amount is calculated based on the wealth you have. That amount can easily be more than 10,000 CHF per year and may offset your tax savings.

Hi Barbara,

It’s around the retirement age (60 to 65). Keep in mind it adds up with the Pillar 2 if the person retiring is also cashing in some / all of the pillar 2 money.

And yes, you can decide to withdraw as late as possible depending on whether you can afford it. It keeps the money out of the taxes but it also severely limits the investment options you have.

Hi Patrik

Well, once I retire I don’t really want to keep investing, I am looking to live off the money I have made until then. The longer you keep everything in investments the more you risk losing your retirement money in a new crash. It’s all good to say that the market recovers from any crash but if one happens when you’re 70, you can’t really afford to wait 10 years to recover your money. So if it’s at good value around retirement age I plan on cashing in to give myself security.

@Barbara: You think that cash is somehow safe, a good store of purchasing power without any risks. This is not true. By holding 100% cash, you are totally vulnerable to inflation. Inflation can easily destroy 20-50% of your capital over ten years. And you may have noticed that your individual expenses probably increase more than the officially reported inflation figures. Even when retired, the majority of your capital has an investment horizon of more than 10 years and should therefore be invested in equities. Your average investment horizon shortens as you get older. This may be a reason to gradually increase the fixed-income allocation from 0% to maybe 20%. It depends on your withdrawal plan. But cash is not a good choice.

It is not true what you write: “The longer you keep everything in investments the more you risk losing your retirement money in a new crash.”

It should really say: “The longer you keep investing according to a sensible plan, the more capital you have and the less you are affected by a temporary decrease in equity prices.”

I have a question regarding the five 3rd pillar accounts. Do I have to use the same provider for all 5, or can I use different providers?

For instance, I already have a 3a account with BCV, can I open a 3rd pillar account with Viac next year, one with Finpension the year after and with Yuh the year after that?

Or can I only open my other 4 accounts with BCV? Thanks.

You can have them with different providers if you prefer. Or you can have them all at the same provider, for simplicity. It does not make a difference for staggered withdrawals.

Thank you for your answer, that’s good to know!

Following up on this answer, to what I know, one needs to accumulate 50,000 CHF at one Pillar 3a account before being able to open another account. Does this correspond to your understanding?

Thank you.

Hi Annie,

No, that’s not correct. You can have 5 first pillars with each 100 CHF, that’s not a problem.

Depending on your canton, 50’000 CHF may be the amount to try to reach (by retirement!, not at the beginning). But the easiest way to save on taxes is to balance your 5 accounts as much as possible, don’t wait too long to create new ones.

Hello Baptiste,

Great reading.

What staggering options for the 2nd pillar would a person have, if she/he decided to leave CH before reaching the pensionable age?

Thank you.

Hi Annie,

I think this should be the same as any early retiree. Once you leave Switzerland, you can transfer your pension fund to two different vested benefits account. And then, you can withdraw them on two different years from abroad.

You have touched upon the situation where one could own a personal residence. This seems a very obvious way to reduce taxes. It is possible to withdraw Pillar 2 as well as Pillar 3A funds to pay down towards equity in personal residence once every five years. One could even withdraw from a spouse’s account in different tax years than oneself and thereby stagger the pension fund withdrawals over many more years. This has the added benefit of deleveraging oneself. For people who are more risk-tolerant, they could always lever more by buying and borrowing on rental real-estate for example.

Hi RV,

Yes, this is a way to use more of your second and third pillar before retirement.

But it’s complicated to know whether it’s worth it. You are going to save a little in taxes indeed, but you may be losing out on returns and on retirement benefits.

If you don’t rely on your third and second pillars to retire, you will be good, but otherwise, it’s dangerous. Also, the return of putting money into your mortgage is quite low and a good 3a could outperform this. So many factors at play here.

This is really interesting, though it’s not very clear to me how you would split the 2nd pillar? What I understand is that you can only go from a 2nd pillar to a vested benefits if unemployed, correct? So, if that is the case, one would need to be unemployed for the last 2 years before retirement? Sorry if these questions are quite silly.

Hi Andrei,

Yes, as mentioned in the article, if you work until retirement, you will not be able to split your second pillar.

It’s not a silly question! It gives a slight advantage to people retiring early or people switching to self-employement late in their carreer.

>You can open up 5 third pillar accounts.

Actually, one can open more than 5 third pillar accounts.

True, but there is no point in doing so.

Why not?

Because you cannot spread them over more than 5 years, so having more than 5 means you have to withdraw more than 1 per year. You can of course, but there is no advantage.

>Because you cannot spread them over more than 5 years.

In the blog post you write: “Therefore, in most cases, we should consider that most people can stagger their withdrawals over 6 years.”

Could you please explain how these statements match together?

Most people have a second pillar or a vested benefits account. This makes 5+1=6 total accounts to spread over 6 yeras.

Now I see, thank you! The recommended number of 3a accounts thus seems to depend on the withdrawal of the 2nd pillar (no working after reaching the retirement age assumed):

– no withdrawal of the 2nd pillar – 6 accounts

– withdrawal of the 2nd pillar in one chunk – 5 accounts

– withdrawal of the 2nd pillar in two chunks – 4 accounts

Do I understand it correctly?

Yes, you got it perfectly!

I will add such an example to the article to make it clearer.

>However, we should not stop trying to have 5 third pillars and, ideally, two vested benefits accounts.

Still one question: what is the point in having 2 vested benefits accounts and 5 third pillar accounts (not 4)?

Since your pension fund is likely larger than 1/5 of your 3a, it is best to split it since it can lead to significant tax. Even if you have to withdraw 1 vested benefits account and 1 3a the same year. And since you don’t really know in advance whether you will be able to split your pension fund / vested benefits before retirement, it is best to have 5 3a anyway. But it’s true that if you know you will have multiple vested benefits at retirement, you could do with only 4 3a.