Is indirect amortization really better for you?

| Updated: |(Disclosure: Some of the links below may be affiliate links)

When you take a mortgage in Switzerland, you must amortize some of the debt in the following years. For amortization, you have the choice between direct and indirect amortization.

Financial institutions will generally heavily recommend indirect amortization. But do they have your interest at heart?

How can you choose between these two? Both amortization methods have pros and cons, as seen in this article. By the end of the article, you should know whether you should use direct or indirect amortization for your situation.

Swiss mortgages and amortization

We should start with something that is not obvious to many people. In Switzerland, you do not have to repay the entire principal. Indeed, you are legally bound to have at least 35% repaid in the next 15 years after you take the mortgage (or before you are 50). But you do not need to repay the loan any further.

As a result, many people keep their mortgages forever in Switzerland. This fact is hard to believe for most expatriates coming to Switzerland.

Usually, people take a loan with 20% money down and repay the next 15% over the next 15 years. It means you have to amortize 1% per year.

You could also put more money down at the beginning to avoid amortization. Or you could amortize quicker or even more than necessary. Whether this is interesting or not depends on the interest rate of your debt. But this is a discussion for another article.

Banks give you two choices for this 1% amortization:

- Direct amortization

- Indirect amortization

We will see both of these options in detail.

Direct amortization

Direct amortization is very simple. If you are amortizing directly, you are directly paying money to the bank, which is deducted from the principal you own.

If you have a loan of 1’000’000 CHF and amortize 10’000 CHF, your loan is now 990’000 CHF. Direct amortization is straightforward.

Since your loan is getting lower, you will also pay lower interest after you have amortized.

You can see direct amortization as an investment that returns the interest rate of your debt. If your debt is a 1% mortgage, amortizing this debt has a 1% return.

However, since you can deduct your interest payments from your taxes, by amortizing, you will increase your taxes (lower deductions = more taxes). So, your marginal tax rate impacts the returns of direct amortization.

For instance, if you amortize 10’000 CHF out of a 1% loan, you will save 100 CHF annually. If your marginal tax rate is 30%, your taxes will increase by about 30 CHF per year. So, you have only saved 70 CHF per year.

And direct amortization has a second effect on your taxes: it will increase your net worth. Since we pay wealth tax in Switzerland, it is better to have a lower taxable wealth. Since you can deduct your loan from your net worth, reducing your debt will increase your wealth. And increasing your wealth will increase your wealth tax.

In general, the wealth tax effect is minimal for most people. Indeed, wealth tax is relatively low and very progressive. So, unless you are very wealthy, you will not pay a significant tax rate on your wealth. As such, the difference in the wealth tax is much smaller than in the income tax.

Indirect amortization

Indirect amortization is slightly more complex. When amortizing indirectly, you are not putting money in the debt directly but inside a retirement account. When you retire, the bank will use some of this money to amortize as if you had contributed all these years.

Banks allow indirect amortization through their third pillar accounts or life insurance 3a. In the case of life insurance 3a, you will pledge the life insurance policy to the bank.

Why would we do such a thing? Indirect amortization lets you save taxes. Since you are not reducing your interest payments, you are not increasing your income taxes. And since you are not reducing your debt, you are not growing your wealth tax. Money in a 3a is not taxable. Therefore, you are also not increasing your wealth tax.

During the years until your retirement, your debt and, therefore, your taxes will not change. Lower taxes is the advantage of indirect amortization.

Contributions to the third pillar are tax deductible. At retirement, you will pay some withdrawal taxes, which will be lower than what you saved during contributions. However, we can mostly ignore that since you should contribute to your third pillar regardless of your mortgage.

Direct or indirect amortization

We can now compare the two methods.

The first important difference is that indirect amortization will reduce your taxes. You will pay lower income taxes and wealth taxes when amortizing indirectly.

Most people will stop there and tell you that indirect amortization is better for everybody. But it has some significant issues as well.

First, when amortizing indirectly, you are tying a large amount of your retirement money into your mortgage. Once you retire, you will owe the bank a lot of money to amortize. If you had amortized directly and filled up your third pillar, you would have more money at retirement.

This point is important because many people are in financial trouble in Switzerland when they retire. And if you cannot amortize and fill up your third pillar, I would argue that you cannot afford that mortgage.

Second, when amortizing indirectly, you are often investing in sub-par products. Indeed, many banks will insist that you take on a life insurance 3a for indirect amortization.

If you have been reading my blog, you will know that life insurance 3a products are terrible investment products. You should avoid them at all costs. I would say that any indirect amortization with a life insurance 3a is worse than direct amortization.

Banks will also generally give you the choice of investing in their third pillar accounts. Unfortunately, the best third pillar accounts are not from banks. Indeed, banks have a relatively poor selection of third pillars, with high fees and conservative investing.

Finally, there is a significant conflict of interest with indirect amortization. Banks will advertise heavily for indirect amortization because there are two advantages for them:

- You will pay more interest (since your debt will not go down)

- You will invest in their products, which will return them money

So, they have a double interest in selling you indirect amortization. Banks recommend you what is best for them and not what is best for you.

As with everything, not everything is evident when choosing between direct and indirect amortization.

Comparison in numbers

Until now, we have seen the pros and cons of each option. But in the end, how much money will you save or lose with these options? We will run some small simulations to see how both options fare.

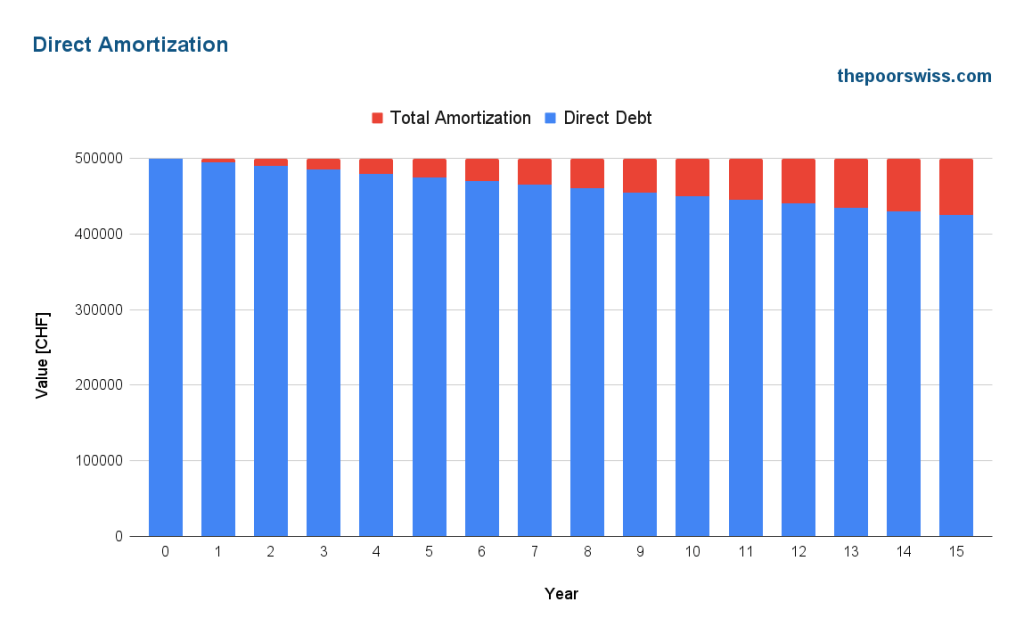

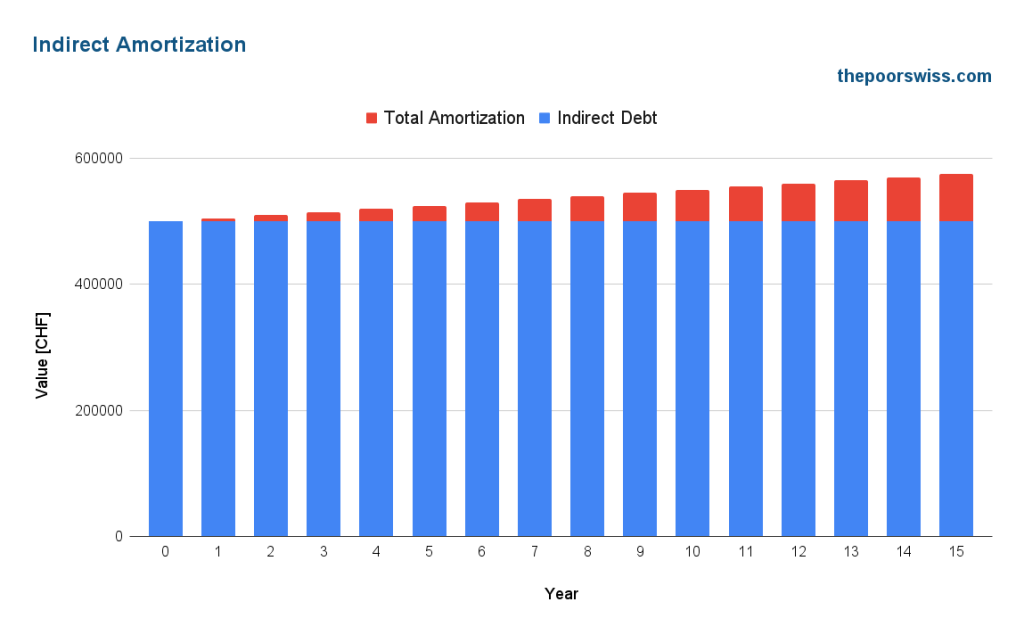

In all scenarios, we will use a house with 625’000 CHF value and a 500’000 mortgage. To simplify, we will fix the maximum 3a contribution to 5000 CHF. All available first goes to pay the interest, then to fund the 3a, and finally to the free assets. We will test different returns.

I will also ignore the wealth tax. The wealth tax will not matter for most people since it is tiny. The wealth tax will not represent a significant expense unless you have a large estate.

1% interest rate

We start with a scenario with a 1% interest rate. Until 2021, a 1% interest rate was prevalent.

We imagine a scenario with a person having 15’000 CHF available per year and a 30% marginal tax rate. In the direct case, this person will pay the amortization, the interest, and finally, the 3a. As his debt goes down, he will contribute a little to its free assets. His taxes will increase each year.

In the indirect case, this person will pay the interest first, then the 3a for amortization, and the rest into the free assets. Taxes will not change throughout the scenario.

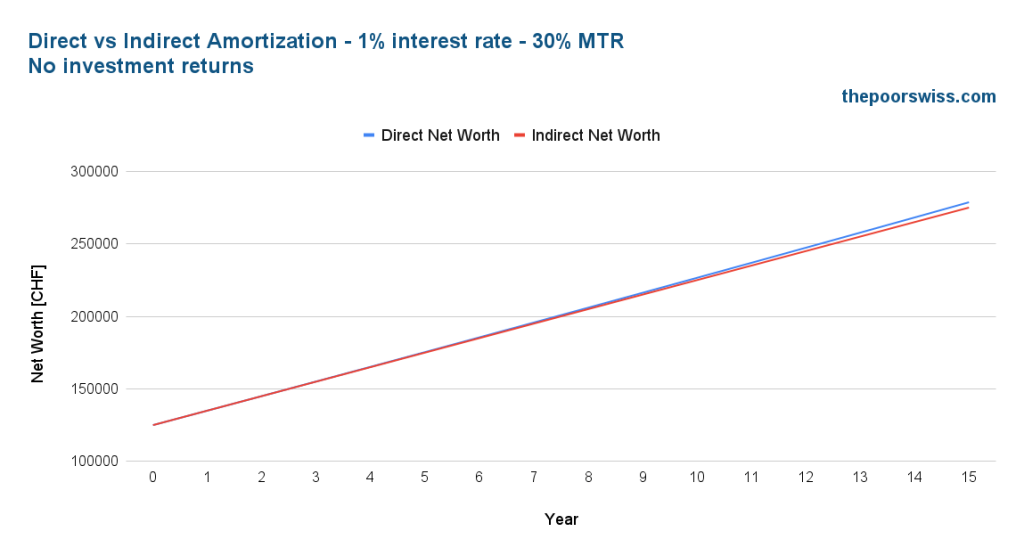

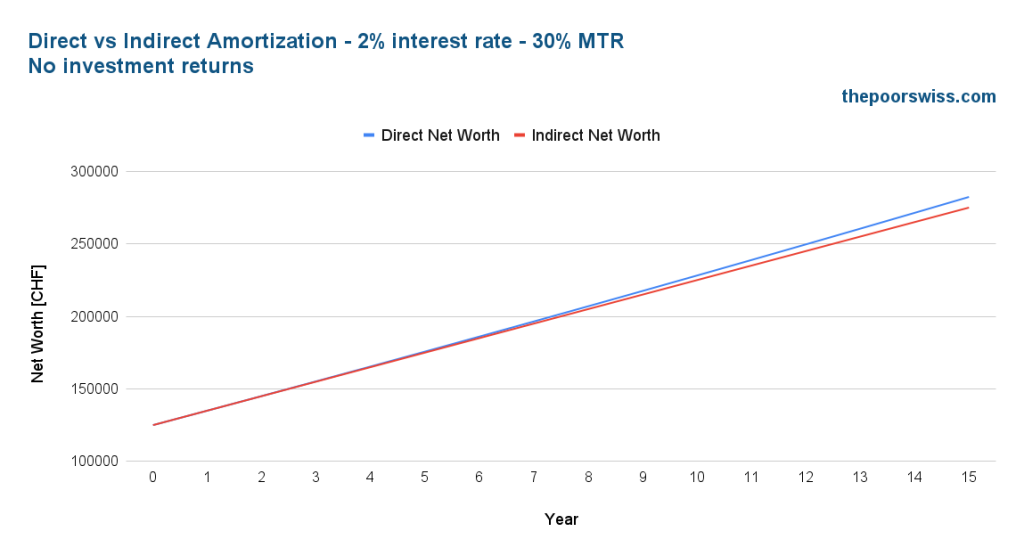

First, we will see what happens when no money is invested. Returns are zero on each asset class.

We can see that the difference is very small, but direct amortization would win. The person with direct amortization would end up with 3675 CHF more than the person with indirect amortization.

Even though direct amortization means more taxes, it also means saving on interest payments. Direct amortization is the same as a 0.7% return in this case.

So, if you are not investing, you should opt for direct amortization.

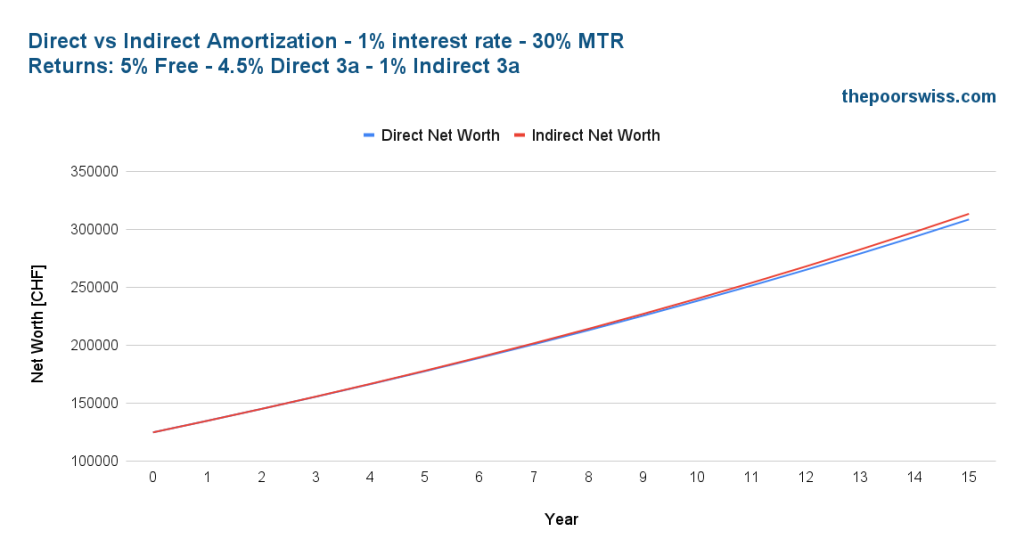

Then, we will see what happens when the money is invested. We will assume 5% returns per year on the free assets, 4.5% on the direct 3a, and 1% on the indirect 3a. If you are wondering why the indirect 3a returns are worse, it is because the investment options are much worse. Banks are very conservative in the stock allocation they will allow.

Interestingly, indirect amortization wins this time, but not by a long shot. In that case, the person with indirect amortization has built more money into his free assets that return more than paying into the debt. But the difference is not huge because the direct 3a returned significantly more than the indirect 3a.

2% interest rate

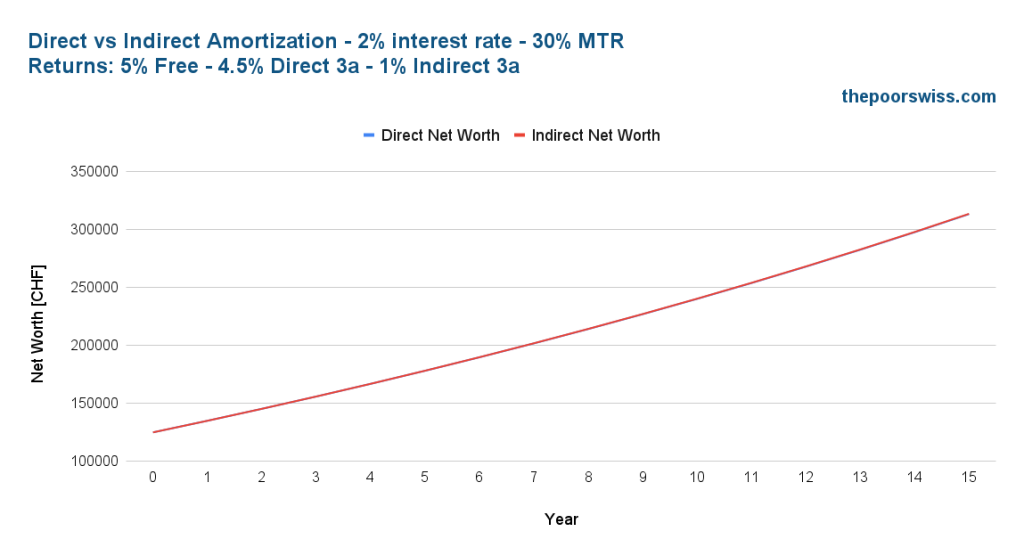

In the next scenario, we use a slightly higher interest rate of 2%. In 2022, such an interest rate is very common. Our investor now has 20’000 CHF available per year to simplify things.

We start without investing again.

We can see that the difference is now higher than before. Direct amortization now has 7350 CHF more than indirect amortization. This increased difference makes sense since the returns of amortizing are higher than the returns of not investing.

Here is what happens to an investor that invests his money.

This time, both methods are almost on the same level. The difference is negligible, only 247 CHF more for indirect amortization. This increasing difference makes sense once again. Indeed the returns of amortization are higher than the returns on the bad third pillar.

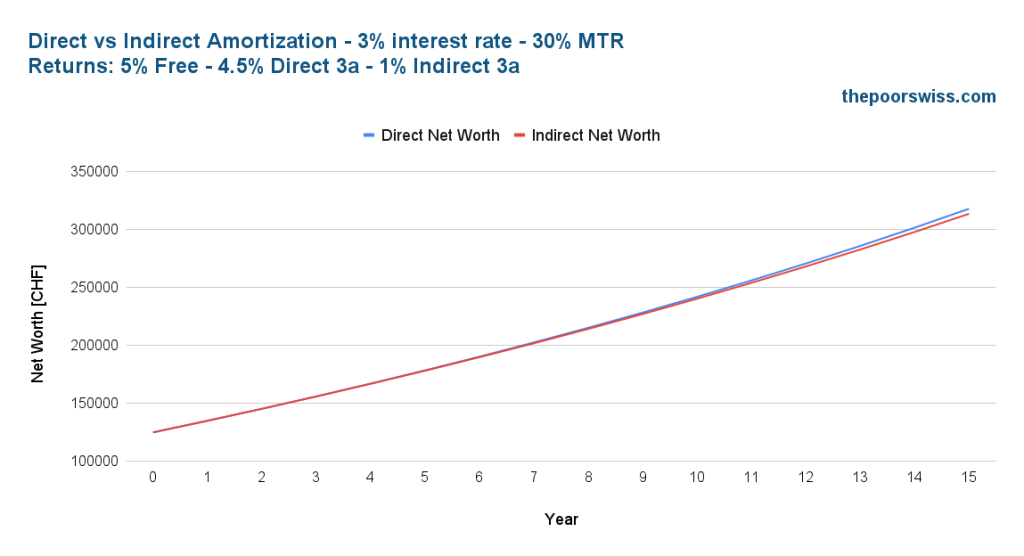

3% interest rate

The last scenario uses a higher interest rate of 3%. Our investor now has 25’000 CHF available per year to simplify things. We can imagine having such an interest rate shortly.

In this scenario, indirect amortization is now worse than direct amortization. The investor would lose 4357 CHF by using indirect amortization.

We can conclude that the higher the interest, the best direct amortization gets. Of course, taxes will increase significantly, but the returns will still be higher than what a bad third pillar (or worse, a life insurance 3a) will get you.

We can also conclude that indirect amortization worsens with a high difference between free asset returns and the indirect 3a options.

So, you should only use indirect amortization if you get access to an excellent third pillar, with yearly returns higher than your debt interest rate.

Why is indirect amortization so recommended?

In these scenarios, we have seen that indirect is not much better than direct amortization, and in some cases, it can be significantly worse.

However, in most places, you will read that indirect amortization is much better than direct amortization. Why?

The reason is simple: banks are financially interested in recommending indirect amortization! They recommend it because you will invest in their retirement products or their partner’s life insurance 3a. This limitation results in a massive conflict of interest.

This conflict is very similar to the conflict of interest of financial advisors. Indeed, both banks and financial advisors are interested in recommending products that are good for them but not for you.

I am not saying that indirect amortization is bad. It is not. In some cases, as we have seen, indirect amortization can be better than direct amortization. But in many cases, it can also be worse, and banks will not tell you that.

Conclusion

The pros and cons of direct and indirect amortization should be appropriately considered when choosing how to amortize. Contrary to what banks will tell you, indirect amortization can be significantly worse than direct amortization.

The main problem with indirect amortization is investing in a bad third pillar. If the returns of this bad third pillar are significantly lower than the returns of free assets and your interest rate, indirect amortization is not interesting.

A few recommendations:

- You should never use life insurance 3a for indirect amortization (more information about these bad products).

- You should not use indirect amortization if you get a third pillar in which you cannot invest.

- You should always get information about the investment options for indirect amortization. And if the banks do not disclose that well, you should look for a new bank.

Again, I am not saying that indirect amortization is necessarily bad. I am just saying that it is not always better than direct amortization. And you should not take what bankers and financial advisors say at face value.

That being said, the only way I would use indirect amortization in the future is if a bank lets me amortize indirectly in a third pillar as good as finpension 3a.

What about you? Do you prefer direct or indirect amortization?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Alternative Investments

- More articles about Investing

- Cryptocurrencies in nutshell – How do they work?

- The 6 Biggest Problems of Investing in Cryptocurrencies

- A short history of Cryptocurrencies

Nice article! It is clear to me that the banks push indirect amortization because it is in their interest as you say!

“And if you cannot amortize and fill up your third pillar, I would argue that you cannot afford that mortgage.”

Absolutely agree with that!

I have a mortgage contract which only amortizes the minimum required 1% a year for the next five years. I am seriously considering that, when it is time to renegotiate the mortgage at the end of the five year period, 1. we pay down a big lumpsum payment to reduce my mortgage, and 2. we arrange a bigger rate of amortization, such that we reduce our interest payments substantially and ‘own’ our home faster.

I think direct amortization is better than indirect amortization in most cases. However, you should be careful about reducing it too much. Unless you have a very expensive mortgage interest rate, it’s generally more interesting to invest money rather than to lock it in the mortgage. Make sure you take opportunity cost into account.

I understand that “opportunity cost” is real, but just consider if you owned your home without a mortgage, would you borrow money on your home to invest it somewhere. Some would, many wouldn’t. I wouldn’t.

For example. when you say

“So, you should only use indirect amortization if you get access to an excellent third pillar, with yearly returns higher than your debt interest rate.”

you have skipped the point that yearly returns have market risk associated with it while the debt interest rate does not.

Yes, each person is different. I would personally borrow money on my home if it was mortgage free, but I completely agree that many people would not.

The debt interest rate actually has a market risk in that it needs to be renegotiated every X years and go up or down at this point. But definitely less than the stock market.

Also very much agree with this phrase “And if you cannot amortize and fill up your third pillar, I would argue that you cannot afford that mortgage.”

But what about using 2nd pillar for down payment ? Let’s say I have 15% of the property price in cash (10% down payment, 5% notary fees) and plan to get another 10% from pledging/withdrawing 2nd pillar?

Would you also say that in such case I can’t afford the mortgage?

If you are in Canton Zurich (like I am), I would say that you need nowhere close to 5% for your notary fees. The notary fees is 0.2%, and even with all of the other expenses such as closing fees for mortgage, fees for withdrawing from Pillar 2 and the capital taxes on withdrawal of Pillar 2 and Pillar 3 funds, we hardly got to 1% of the property value.

So if you have 15% of the property value in cash, I would say that you can very much afford the mortgage (considering also other parameters such as a good income relative to the property value etc). And my opinion does not matter anyway, what matters is if you feel confident and secure about the mortgage amount depending on all your personal circumstances. Best of luck!

The 5% is also for the land register payment.

In our case, for a 715K purchase, we paid about 3K to the notary (less than 0.5%) but we paid 23k to the land register (that’s a good 3%). 5% is probably a safe measure to have some margin.

Note that I am not saying using your 3a is bad for the down payment. I am saying it’s bad for further amortization, which are two different concepts.

I think using your 2nd (and even 3a) is great because in general it helps you stagger withdrawals between now and retirement.

However, you should be careful about one thing: if you want to do some voluntary contributions to your second pillar in the future, using your second pillar will block your strategy. But that’s the only downside.

Hi Baptiste,

Many thanks for your answer!

It might be that I misunderstood something – that’s why I sent an email to the advisor to double check. My wife understood the same.

However I wouldn’t go for it before having a bank confirmation – even if he confirms this could be only a selling story.

Coming back to your point – even if a bank takes my death coverage insurance to get their reimbursement from my potential insurance company – this amount is equal to a guaranteed amount (and we know that their returns are not so great, so in any case if someone takes a life insurance would not get much more than a guaranteed amount)

3rd pillar life insurance is not attractive for me at all, but if this is really possible then it might be a game changer. My simple calculation on the UBS calculator showed me that monthly costs saving is cca 1’500 (simulation interest rate 2.4%, 1’000’000 vs. 640’000 full purchase price). If you put this savings on stock market it’s a lot of money for 30 years. Don’t you think? Of course if this scenario is possible :) – but this I am going to check.

Cheers

Hi MD,

Let us know what the bank and the advisor tell you. If this works that way, it would be a game changer. But I would likely have heard about that.

Hi Baptiste,

Great review again!

I was offered a 3rd pillar life insurance which I think is a horrible opportunity to invest compared to the other 3rd pillars – and I didn’t hide my disappointment.

Then I was told something interesting – in case that you want to buy a property (which is one of my goals) – then you can reduce your mortgage and interest by providing your 3rd pillar life insurance ->in example – value is 1’000’000, you have to pay a down payment 20%, so your mortgage is 800’000+interest. But if you offer to a bank your guaranteed amount at death that is ,let’s say, 180’000, you would owe to a bank 620’000+interest. The guy told me that we can even do it as a couple – so if we take that a guaranteed amount of my wife’s life insurance is also 180’000- we would owe 440’000+interest that sounded attractive at first glance – as per both – less amortisation and less interest. On a monthly level this could be a nice cost saving. I am not sure that I understood this correctly as we discussed a lot of things. Have you heard that? In case that this is true you could invest this monthly savings into stock market in order to compensate losses that you would have investing in 3rd pillar life insurance vs. Finpension / some other normal 3rd pillar.

On the other side he mentioned that if we go through direct amortisation usually a bank will require to get a life insurance in any case – I don’t know what would be a cost of that?

Cheers

Hi MD,

I don’t think that’s correct. You can indeed use life insurance as indirect amortization. And if necessary, the bank will use the money in your policy to amortize.

But the money in the policy does not reduce the money of the loan.

At least, I have never heard of such a way. And in that case, the money in your policy would be entirely lost since it would be going to your bank.

Without knowing the details, I think this is just a way for them to sell you life insurance. I would try to get more information and have it in writing. And you should get confirmation from your bank, not the seller of insurance.

I know this article is about the direct and indirect amortization but you touched briefly on it at the start about how some or most Swiss will never own their home having only paid it down to 65%.

How exactly does that work? Do they just not have a loan after 15 years and debt?(no more payments?) my wife and I were looking to buy and I easily came to this conclusion that if we followed the banks advice we would never own the home and to me (an American) this sounds crazy.

What happens when someone passes and kids inherit it? Or so they?

As someone who invests in property I am always for increasing my net worth and gaining assets (especially ones that provide cash flow). However this wealth tax is a bit cumbersome as I don’t understand it completely. I just understand it goes up as Wealth increases.

Thanks,

Evan

Of course you need to renew your mortgage after it expires. Even 15 years is rarely seen here the longest most banks do is 10 years I think. This allows you to renegotiate the terms possibly even with a different bank.

Currently in the process of discussing a mortgage with ZKB and it looks promising if they allow me to indirectly amortize using their Frankly app, if they allow the maximum stock allocation with it, too.

Hi Julian,

Indeed, having a relatively good 3a for indirect amortization, like Frankly makes indirect amortization look better.

Did they allow you to do that, i see the OP is against (quite fairly) the insurance 3a but so far it seems that insurance 3a is the “only” option for indirect amortization (their selling point) and in which case, apps like finpension and frankly, cannot be pledged, although they may be products of the same banks that you may take mortgage from… this may be because you may go for an aggressive investment strategy which they do not allow (99 stock vs. 40Stock or lower).

However, I am still not able to find the answer to the question, is there any other way to do indirect amortization instead of a insurance 3a? if not, then i think the OP should analyze that scenario.

I think the OP did hint towards it, saying “if the bank would allow him to pledge FinPension account ” which means that is not an option at the moment….

You can amortize indirectly with non-insurance products, but each bank will limit you to their own products. For instance, you can amortize indirectly an UBS mortage with an UBS 3a, but their 3a options are not optimal.

You forget one thing. If i sell my home with the direct variant. Ill get all my direct amortisation money back in cash and ready to reinvest in whatever i wish. With indirect it will be locked in the 3a pillar till im 60+.

I don’t think that matters since in both cases you should invest in the 3a.

Great research, thanks!

They variables are quite a lot, and not easy to mach all of them exactly (especially the returns with invested 3a or free investments).

With UBS you can get something really close to SPX and with no crazy fees (of course not as good as 0.39% with Finpension)

Hi wavemotion,

Yes, there are many variables, and it will highly depend on each situation. The main point is that indirect amortization is not always better, contrary to what most bankers will tell you :)

Returns with free investments and a good 3a are fairly easy to estimate if you invest in index funds in the long term.

Hello,

interesting article. In general it is well agreed why life insurance 3a is so bad.

However checking your numbers, the max difference between direct and indirect amortization is 7350 CHF in the span of 15 years which amounts to ~500 CHF per year or 40 CHF/month.

Given the small difference, do you consider it makes sense as a form of hedging?

If we assume that a person who would take indirect amortization by investing in insurance 3a, they would invest the rest of their disposable income in ETFs, then they would be much less exposed to the market than someone who is just investing in ETFs. Of course in the long term investing in ETFs always is better than life insurance but in this case given the small difference in future potential earnings, doing both can give a better peace of mind. Plus all the other benefits in peace of mind that life insurance gives like… life insurance.

One more question. I think that banks are much more eager to provide mortgage at lower rate if you invest your 3rd pillar at them, so could this be considered an additional benefit?

thanks,

Nice

Hi Nick,

It’s true that the difference is not huge.

But I would never recommend a life insurance 3a. If you want a safer investment, just put your money in a bank 3a. The cash in the bank 3a will balance out the risks of your investments.

I don’t know if that’s really the case. At least, with Migros Bank, they did not offer any benefit of using their products.

> If you want a safer investment, just put your money in a bank 3a. The cash in the bank 3a will balance out the risks of your investments.

the point is that I can not get indirect amortization with bank cash 3a. I can get it though with life insurance 3a.

Life insurance 3a as standalone always underperforms compared to invested 3a however when combined with indirect amortization they can be compared with the additional benefit of security.

> At least, with Migros Bank, they did not offer any benefit of using their products.

point taken.

If you only can get it through life insurance, I would not recommend it. Whichever life insurance you have, just do direct amortization. But again, this is just what I would do :)