How to start investing in P2P Lending in 2024

| Updated: |(Disclosure: Some of the links below may be affiliate links)

You probably have heard of P2P Lending! It is the new trend of investing these days. A lot of people are investing, and some people are even using it as their sole investing instrument.

P2P Lending is much riskier than investing in stocks. And it is much less regulated. It is dangerous! I would never recommend anyone to invest a large amount of money in P2P Lending.

However, it never hurts to stay informed about the trends in investing. And while this is risky, it may be interesting for some small part of your net worth.

When I created my Investor Policy Statement, I stated that I could consider investing between 5% and 10% of my net worth outside of stocks. Therefore, I decided to start researching P2P Lending. And after a while, I decided to start to invest some money.

I have not invested a lot of money into it yet. And I do not plan to invest a lot of money at all. It is just some small diversification. I believe this could not replace stock investing.

In this article, we will see the basics of P2P Lending. And I detail my current investments.

P2P Lending

If you do not yet know what P2P Lending is, it is quite simple. The idea is to lend money to borrowers at a specific interest rate. While you could directly lend money to some people you know, some platforms are easing this.

Most P2P lending platforms act as intermediaries between lenders and borrowers. A borrower can ask for a loan on the platform. And lenders can participate in that loan. The great thing is that several lenders can participate in the same investment. It allows for small loans from lenders and high diversification. This simple model is called a three-party business model.

In the most prominent platforms, the loans are not coming directly from borrowers. They are coming from loan originators. These are companies that are issuing loans. They are then filling these loans into the P2P lending platform. And the platform is then matching lenders and borrowers. This more complex model is called a four-party business model.

Advantages of P2P Lending

We should discuss the benefits of P2P Lending. Why would we invest in it instead of stocks?

First of all, the returns can be quite high. It is not uncommon to find loans with more than 10% interest. In general, yearly returns of P2P Lending are higher than those of the stock market.

Another advantage is the added diversification. There is not a significant correlation between stocks and P2P Lending. Therefore, diversifying into a new uncorrelated asset could help your overall portfolio.

Also, fees are generally reasonably low for investors. And you can often invest with as little as 10 CHF. It is straightforward to start investing in P2P Lending. It is much easier than investing in stocks.

Risks of P2P Lending

As with every other investment, there are risks when investing in P2p Loans. There are several risks related to P2P Lending.

The first risk is that the borrower defaults. It means that the borrower cannot repay the loan. If you were lending the money directly to the borrower, you would lose your money. However, in most platforms, there is something called the Buyback Guarantee. It means that the loan originator will repay what you lent and cover the loss. If your loan has a buyback guarantee, you are safe from this risk.

The second risk is that the loan originator defaults. It means that the loan originator cannot pay back the buyback guarantee to you if too many of its borrowers are defaulting. In my opinion, this is the most significant risk in P2P Lending. However, it is more frequent for a borrower to default than for a loan originator. In this case, there is almost nothing you can do. You may get back some of your money after a lengthy legal procedure. But it will be difficult.

The third risk is that the platform itself goes bust. Usually, you should not lose money in this case. However, it may be complicated to get your money back. And it will also depend on how the platform protects you against this. In good platforms, the loans are directly related to you, and hence, if the platform goes bust, you are still entitled to the principal and the interests. Nevertheless, I expect it to take a very long time to get the money back.

The last risk is that the platform is a scam or a Ponzi scheme! In that case, once it goes, you will lose your money! You can read the next section to learn more about that.

As you can see, there are some risks when investing in P2P Lending. We can compare it to investing in single stocks. For me, it is much riskier than investing in low-cost index ETFs.

P2P Debacle in 2020 – Kuetzal and Envestio

In early 2020, Kuetzal announced they were shutting down. They said their bank was blocked. Initially, they tried to make investors believe they would get back their money, but people could not invest anymore. However, it turned out it was just a scam. They have shown projects with companies that did not even know about them.

Many people should have seen that investing in loans with 18% interest could not be sustained. Greed took the best part of people. It is often the case. Many people lost a lot of money from this scam.

A few days later, it was time for Envestio to shut down. At first, they claimed that their website had been under attack. But it turned out that they shut down the site. And they were trying to win some time.

There were also some strange things about Envestio. For instance, it was not clear who was running the platform. And they were trying to remove negative online reviews. These are also signs of bad company.

I think these two events are pretty sad because many people lost money. But I also think these events were necessary. They made some people realize that the P2P Lending market was riskier than people thought.

Even if some people can get some money back (I do not believe it will be the case), it will take a very long time. And some people invested more than they could afford. So they could be in trouble. These events are a good reminder never to invest more than you can afford.

Tips for investing in P2P Lending

Risks from the previous sections can be somewhat mitigated by diversifying your loans.

First, you should always diversify across borrowers. You should avoid lending a considerable sum of money to a few borrowers. You should try to lend very little money to many borrowers. And if you can, you should try to invest in loans with a buyback guarantee. It will protect you from a borrower defaulting.

Then, you should also try to diversify across loan originators. It is only possible if you invest in a four-party platform. If you only invest 10% of your money in each loan originator, you would only lose 10% if one loan originator goes bankrupt.

I also believe you should diversify across platforms. There are many possible P2P platforms available. There are several in each country. You need to do your research and make sure you can

Finally, you need to do your research. You should not invest in a platform without doing your research. You need to know the platform. You should also try to get reviews of this platform. It may not be enough since many people recommend Kuetzal and Envestio. But this could help.

And I still want to remind you to be careful. Since it is not well regulated, many platforms are not very trustworthy. You should never invest more than you can afford to lose. And you should not let your greed decide on your investment.

P2P Lending in Switzerland

At first, I wanted to invest in Switzerland. So, I checked the leading platforms available here. Even though Switzerland is quite small, there are still more than 15 platforms available. I have not checked them all out. I have only focused on the ones that seem the most popular.

cashare.ch is the oldest platform available in Switzerland. You can start to invest with 100 CHF. This minimum is also the minimum per loan. You will pay 0.75% fees on your loans. It has about 30’000 members. They have loans from 3.9% to 9.9%. They are managing more than 880 million CHF of loans.

creditgate24.ch is another younger alternative. You will pay a 1% fee on your loans. It has about 20’000 members. They are managing about 200 million CHF of loans. The minimum to invest per project is 500 CHF. Their loans are between 4% and 7.5%. The minimum is too high for me. It would be too difficult to diversify. However, they do have a system where risks are shared across many people. This system means that diversification becomes less critical.

Lend.ch is a serious alternative, backed by big banks such as PostFinance. They offer loans from 3.88% to 7.39%. They have fees of 1% per year you lend money. These fees are pretty bad for long-term loans. They already have 30’000 users and are managing more than 200 million CHF. Finally, the minimum investment is 1000 CHF. Such a large minimum investment is a big deal breaker!

crowd4cash.ch is another alternative. You will pay a 0.85% fee. The minimum per loan is also 500 CHF. They offer loans with interest rates between 3.5% and 8.5%. They have less than 2000 users and manage about 27 million CHF of loans. For me, this is too small.

Overall, Swiss options are not great.

For me, the best platform is cashare.ch. It is the only allowing investments of 100 CHF for diversification. But the fees of 0.75% are pretty bad on top of loans that do not have high-interest rates. And none of them have any buyback guarantee. However, this beats Swiss bank interest rates. Yet, P2P Lending platforms have a much higher risk.

After Cashare, another good candidate for me is creditgate24.ch. They are more expensive, but I like their risk-sharing system.

If I try Cashare and creditgate24 in the future, I will let you know how this goes.

If you know of any other better option in Switzerland, let me know!

P2P Lending in Europe

As we can see, the options in Switzerland are not great. However, there are also many options in Europe. I cannot list all of them because there are way too many. However, I will talk about the two I started investing in.

Fast Invest

FastInvest is the first platform I started investing in. It is the first platform I have heard of. However, I just started investing in it without proper research. It is not a great thing on my part!

FastInvest is a P2P Lending platform with a four-party business model. This model means you will be connected to loan originators and not directly to borrowers.

It is a Lithuanian company registered in the United Kingdom. They have about 30’000 users and manage approximately 15 million euros. You can invest without any fee.

You have access to rates between 9% and 16% interest. But I have not seen a loan with more than 13% in a long time. All the loans have a buyback guarantee. After being three days late only, you will be repaid for your loan. And you can sell your loans at any time. But in that case, you will lose your interest.

I have only invested 700 EUR since October 2018. In July 2018, it returned 36 EUR. This about 5.2% return or an annualized return of 8.93%. It is not bad, but not that great either. However, the low yields are also because I stopped investing for a while.

I have some doubts about FastInvest. The big problem I have with them is that they do not disclose the identity of all their loan originators. It means you do not know to which you are lending money. It is the reason I started investing in another platform for more diversification.

In the beginning, they did not share any information at all. Now, they have revealed the names of several of their loan originators. And several of their loan originators are the same as for Mintos.

However, since May 2020, they have stopped paying withdrawals! So, I would not recommend investing in this platform currently.

Mintos

To diversify, I started investing a little in Mintos.

Mintos is also using the same model as FastInvest, with four-party. However, Mintos has many loan originators and is disclosing information about all of them.

Mintos is a Latvian company. It is currently the largest P2P Lending platform in Europe. They have more than 140’000 users and manage more than two billion EUR.

There are many different rates. The overall yield is about 12%. It is slightly higher than FastInvest, but not by a long shot. You can choose in which loan originators you invest. Some of the originators have a buyback guarantee. You can choose to only invest in originators with a buyback guarantee. It is what I did. When a loan is late for more than 60 days, you will be refunded your investment.

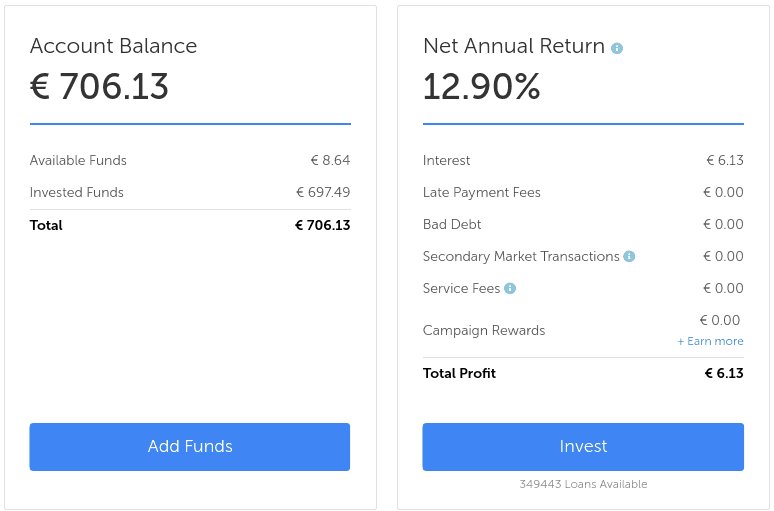

I started in mid-April 2018, and I have invested 700 EUR to match my investments at FastInvest. So far, it has returned 6.13 EUR. I am unsure how the 12.9% Net Annual Return from Mintos is calculated. I think I am more in the 10%.

Overall, I am pretty satisfied with Mintos. I think it is superior to FastInvest. I am not sure this is the best option. But this is the best I could come up with the little research I did.

For more information, you can read my complete review of Mintos.

My P2P Lending Strategy

I do not have a well designed P2P Lending strategy. I plan to invest no more than 2.5% of our net worth. And I will probably invest less than that.

What I am trying to do is to diversify as much as possible. I am only investing 10 EUR in each loan. And I am only investing in loans with a buyback guarantee. I am also diversifying over various loan originators.

I do not know yet if I will keep both platforms. For now, I plan to invest 100 EUR each month into Mintos. If I find a better platform, I will replace FastInvest or add a third platform to my portfolio.

I also plan to invest in P2P Swiss alternatives later on. But I do not want to have too many financial services at once. It is always better to keep it simple.

In any case, do not forget to secure your account! You want a long password, and you want to use Two-Factor Authentication (2FA), available for both services I mentioned.

Conclusion

I think that P2P Lending is interesting. However, it lacks regulation, and the risks are higher than passive stock investing. So I would not recommend investing a large part of your portfolio into it. I would recommend you invest a little as your fun money. And you need to do your research. There were many scams in this industry. And many people lost a lot of money!

I know some people invest everything into P2P Lending. But I think it is a terrible idea even if they diversify over several platforms. And some people are strongly against P2P Lending. I am probably in the middle.

But it is still interesting, and it offers some diversification over investing in the stock market. Diversification is a great thing. It is good to own uncorrelated assets.

If you do not know where to start, I would recommend investing a small amount of money in Mintos to try it. Remember that there are risks, even with a buyback guarantee. Be careful not to invest too much.

What about you? What do you think about P2P Lending?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Alternative Investments

- More articles about Investing

- 6 Good Reasons to Invest in Real Estate

- Mintos Review 2024 – My experience and results

- Is indirect amortization really better for you?

Does anyone have experience in Foxstone Crowdlending (not Crowdfunding) which is more like a loan to real estate company. The interests offered are quite good (5-6%).

What I am struggling to understand is that why the real estate companies are paying 5-6% for a crowdloan ? Why would they not get a bank loan?

I have no experience with them.

In general, I think these companies make money on the fees and transfer the risks to their investors. That way, they have guaranteed returns while the investors take most of the risks.

Very nice article. Do you know where Swiss (or EU) citizens can invest in P2P loans in USD to diverisify (all the US companies ask you to be a resident of the country).

Hi Lea,

I know that Mintos had some USD loans through GetBucks, but I don’t know if that’s still the case. Other than that, I don’t know since I don’t do P2P lending anymore.