How to retire early in Switzerland?

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Many people want to retire early! The Financial Independence and Retire Early (FIRE) movement is taking in a lot of momentum. But, few people want to retire early in Switzerland. So, is it even possible to retire early in Switzerland?

I believe it is possible to retire early in Switzerland. But you need to know the differences between Switzerland and other countries. Since most FIRE people are in the United States, we must know what changes here. It is necessary to see if it is possible and how to adapt.

Even though it is possible, it is more difficult to retire early in Switzerland than in the United States. But some people, including me, could not retire in another country than Switzerland. I would prefer to continue working my whole life than have to move.

In this article, we see whether it is possible to retire early in Switzerland. And also, how can we retire early in Switzerland?

Financial Independence in Switzerland

Becoming Financially Independent in Switzerland is not much different from becoming FI in any other country. The concepts remain the same:

- You choose a withdrawal rate. It is how much you will withdraw each year based on your initial portfolio. You must select a withdrawal rate according to your situation (portfolio and life expectancy). You can base this on your current expenses if you are far from retirement.

- You compute your target net worth (FI Number). It is your annual expenses multiple by 1/WR.

- You accumulate this amount in your portfolio. Every month, you save money in your portfolio. And ideally, you invest it to make it grow faster than inflation.

- Once your actual FI net worth reaches your target net worth, you are Financially Independent.

Now, Financial Independence is mostly discussed in the United States. It makes sense since the movement started in the U.S., the only country where the math has been down regarding whether this FIRE will work. To start at its roots, you can read about the Trinity Study.

Now, there is no reason to believe that this is not possible in Switzerland. Financial Independence is just pure mathematics.

But, you need to account for the differences between Switzerland and countries where FI is known to work. The same is true for any country. And actually, you should even consider your local region in big countries. Some things will change based on which country you want to retire in.

The retirement system

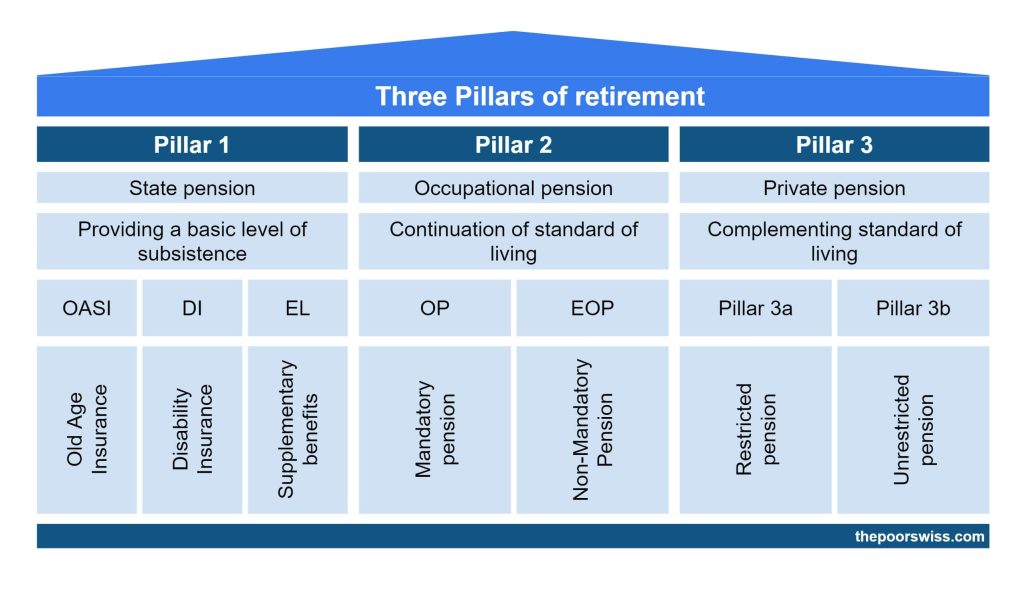

The retirement system of Switzerland is based on three pillars. All of them are solely useful for official retirement. You must wait until the official retirement age to get any of that money. You can also use it to buy a house or start a business. But that is a story for another article.

Once you retire early, you will stop contributing to the second and third pillars. You need a salary to do both these things. It means that you cannot deduct it anymore from your taxes. At this time, you will not receive any money. On the other hand, if you still have a side income, you may continue contributing.

Once you reach retirement age (65 for men and 64 for women at the time of this writing), you will receive money from the three pillars:

- The first pillar will give you a pension.

- The second pillar will give you a pension or a lump sum, depending on your choice.

- The third pillar will give you a lump sum. Since it is optional, not everybody will have a third pillar account.

The good thing is that once you reach retirement age if you worked many years, you will receive a very nice pension or a very nice lump sum. For most people, what they receive from the three pillars is enough to live forever. For this, we have a good retirement system in Switzerland. However, if you have a higher lifestyle, you will need more than the retirement system.

So, the biggest challenge for retiring early in Switzerland is to cover for the years between early retirement and official retirement.

During these years, you will not receive any help from the government. So, you will need to rely solely on your withdrawals from your portfolio. You can only have cash and bonds, and stocks in your broker account. Or you could rely on some income from real estate properties to lower your effective withdrawal rate.

The difficulties of retiring early in Switzerland

There are quite a few difficulties in retiring early in Switzerland. These difficulties must be considered when planning to retire early in this country.

High Cost of Living

The main difficulty in retiring early in Switzerland is the high cost of living. If you want to become financially independent and live from your portfolio, you must accumulate a substantial net worth.

The high cost of living also has the disadvantage that real estate is costly. Many people that retire early in the U.S. own their houses. And for most of these people, their home is paid in full. In Switzerland, it is more efficient to keep a mortgage than to pay it off. Otherwise, you will significantly increase your expenses. And most people rent in Switzerland. If you want a beautiful house in retirement, you may have to pay a substantial amount each month. Your rent will increase how much you need to accumulate.

Net Worth Taxes

Compared to some other countries, another disadvantage is that we pay net worth taxes.

Therefore, the more money you accumulate, the more taxes you pay. Once again, you must account for quite some taxes, even in retirement. In some countries, you will almost not pay any taxes in retirement.

Taxes on dividends

Another thing that is not great about retiring early in Switzerland is paying taxes on dividends.

Once you are in retirement, you will receive a significant amount of money in dividends. And this will be counted as income. You will pay taxes on these dividends as if it was income. It means we will pay more taxes in Switzerland than in other countries for retirement.

These taxes are also why dividend investing is not as good in Switzerland as in the U.S.

The retirement system

The retirement system in Switzerland is for people working until the official retirement age. So, after you retire early, you cannot contribute any more to your second and third pillars.

On the other hand, you will have to continue paying for the first pillar based on your net worth. Once you reach retirement age, you will receive your second and third pillars. If you retire 20 years before this age, you need to make sure that your primary net worth will not be exhausted before you receive this money.

Small stock market

Most people in the U.S. invest mostly in U.S. securities and bonds. Some also have a small allocation to international stocks. If we try to do the same in Switzerland, we have a significant allocation to Swiss stocks, some Swiss bonds, and a small allocation to international stocks. There are a few issues with that approach.

First, historically, Swiss stocks have not performed as well as American stocks. They performed well, but not great.

Also, Switzerland is about 2.5% of the world’s stock market. Our stock market is tiny. It is not great diversification to own, such as a large allocation to Swiss stocks. So, we need more international allocation.

That means we will have much of our portfolio in foreign currencies, most likely U.S. dollars. We need to take exchange risks into account in our planning.

Health System

I think that the health system in Switzerland is a burden for early retirees. In some countries, health insurance is included in taxes. And once you retire, you will pay fewer taxes. In Switzerland, however, you must pay for your health insurance until you die.

And health insurance is not cheap. On the contrary, it is costly, and its price increases year after year. Also, as you age, you pay more for it. And even though it is really expensive, it does not cover everything.

And it includes a large deductible (2500 CHF) that you must be ready to pay. Even though you spend much money on your insurance, you may never get anything back.

So, you need to account for a large amount of money to be spent on health insurance in retirement.

Real Estate

There are two primary schools of thought for retiring early: the house haters and the fully paid house people. I have nothing against houses. Ultimately, it is always up to you to decide which way you want to go. And this decision should not be driven only by your finances!

If you want to retire early in Switzerland, there are some advantages to owning your house. Given the current interest rate, you probably will pay less each month by having a house. We still have to consider the opportunity cost, of course. But over the long term, you will have to accumulate less money for retirement.

But the houses are very expensive in Switzerland. You cannot hope to find a house below 500’000 CHF. And most houses will be more costly than that. These high prices make it challenging to accumulate the money for the 20% downpayment.

Moreover, it is generally more efficient to keep a mortgage in Switzerland than to pay it off like in most countries. You can keep 65% of the mortgage for a very long time. You can pay it off, of course. But in that case, you will increase your taxes since the mortgage will not balance your taxes anymore.

The advantages of retiring early in Switzerland

Even though there are many disadvantages if we retire early in Switzerland, there are also a few advantages.

Low inflation

One of the advantages of Switzerland is that, historically, inflation has been quite stable. Lower inflation can significantly help when you want to retire. It will substantially increase the chance of your portfolio sustaining your lifestyle for extended periods.

No capital gains tax

Another advantage is that we do not pay capital gains tax. Now, this is only true if you are not considered a professional investor. But for ordinary investors like you and me, this is very helpful. Since we will sell shares in retirement, it is terrific not to pay capital tax gains on it.

Low Income Taxes

If you get some income in retirement from your side hustles, the taxes on that income will be lower in most other countries.

We are lucky in Switzerland to have quite reasonable taxes. The tax system in Switzerland is fair. If you get a small income in retirement, you do not want to pay much taxes on it. If you get a large income in retirement, it may be different, but that is another story.

Stable country

Generally speaking, Switzerland is less impacted by recessions than in other countries. So, the country’s economy and inflation will be more stable during recessions.

Of course, the Swiss stock market is highly correlated with the rest of the world. So even though it may be less impactful, it will still be impactful.

Safe country

Switzerland is currently a very safe country. Most places in the country are incredibly safe to live in, even at night. Safety is one of the things I love about Switzerland.

Of course, there are some exceptions. There are some places I would not go to. But these places are well-known and still relatively safe compared with some dangerous places in other countries.

When you want to retire, you want to do so in a safe country. You want to be able to live in peace for a long time.

Why retire in Switzerland?

Retiring early in Switzerland is more complicated than retiring early in the United States or most European countries.

So, why retire in Switzerland?

Honestly, I could not imagine my life outside of Switzerland. I love this country. It is wonderful with its magnificent countryside. And it is a very safe and stable country. We have a lovely quality of life in this country. I really would not trade it for any other country.

Retiring in Switzerland will make it more difficult for me to retire early. But I would rather continue working for more years and retire in a country I love than in another one. I am ready to pay the premiums for that. I also have the advantage of liking my job for now. So, it is not a big deal to imagine working for more years. But of course, this could change in the future.

How much do you need to retire early in Switzerland?

A simple guide you through all the basics to your own Financial Independence and if you want it, your own early retirement.

Start your journey to financial freedom now!

How much you need to retire in Switzerland is not an easy question.

As I said, your needs before official retirement will be higher than yours. Moreover, your net worth will be different. You cannot count your third and second pillars into your FI net worth. This net worth is only for computing what will happen before retirement age.

Keep in mind that this section only reflects my plan. I do not know anyone who retired early in Switzerland. This information is based on math and the current status of the economy and the country. It may well be different in five years. But hopefully, by that time, I will have updated this post!

So, you must make two simulations: one before the retirement age and one after. Unless you plan to retire early, you will probably have a longer time in the second part.

Before Retirement Age

We have to rely solely on withdrawals before the retirement age. Your expenses will be precisely what they are now. And this also means that your income will only be your income, which is not your primary salary.

The first basic idea would be to use the 4% rule or any other withdrawal for that period. But if you choose a correct withdrawal rate, you would ideally never exhaust your principal. So if you use twice the withdrawal rule, you will end up with too much money.

You could use a higher withdrawal rate for the period before the official retirement age. For instance, 5% would not be a bad idea for 15 or 20 years. But then, you must compute a second period with a lower withdrawal rate for the official retirement. And if you double both numbers, your effective total withdrawal rate will be very low, and it will be challenging to accumulate such an amount of money.

The important thing is that you should only consider the part of your net worth that is available. This part should be everything but your second and third pillar. It would be wrong to run your numbers with these two components.

From that, we can get that you will need a large portion of your net worth in cash and investment accounts. This amount will have to get you through these years.

For me, I would estimate that I would need a minimum of about ten years of living expenses ready for the years between 50 and 65. During that time, my second and third pillars will continue to grow, and I will not make a withdrawal from them.

And, of course, my net worth should be higher than my FI Number!

After Retirement Age

After retirement age, we can use the withdrawal rule.

You can now consider your entire net worth. You will have access to your second and third pillars at this stage.

You will need to choose a withdrawal rate for your situation. It will depend on how many years you plan to live (impossible to predict) and your portfolio returns (only possible to estimate). Since it is difficult to determine these two, it is better to be on the safe side. I am aiming for a withdrawal rate between 3.5% and 3.75%.

Unfortunately, I cannot give you a formula for your withdrawal rate. You will have to run simulations. I am currently working on a withdrawal rate calculator that should be useful for that. In the meantime, you can look at the Trinity Study Results. Your withdrawal rate will mainly depend on your risk tolerance.

Since you are officially retired, you will receive a pension from the first pillar. If you have a large enough salary and have paid every year, you will receive 2350 per month — this is 28’200 CHF per year. A married couple could receive up to 3525 CHF per month. (42’300 CHF per year).

It is essential to know that this could change before you retire. It could even disappear. If you believe you will receive this when you retire, you can remove it from your yearly expenses. You must also consider that you may not get this amount if you retire in another country. If you are Swiss, you will always get this amount regardless of where you retire. However, if you are not Swiss, it will come from where you are and where you are retiring (Source).

Once you know your withdrawal rate and your yearly expenses, it is straightforward to know how much you need. You need to divide your yearly expenses by your withdrawal rate in percent (0.04 for 4%).

With the first pillar, we would need about 20’000 CHF to cover our expenses. With a 3.5% withdrawal rate, this would give us 560’000 CHF to accumulate. Without the first pillar, this would give us 1’736’000 CHF. As you can see, the first pillar can make a huge difference.

This computation is not entirely exact since you need to account for taxes on the pension you will get. And your retirement expenses are likely to be different from now. But it is already a good estimation.

I think we will still have a first pillar pension when I retire. However, I think it could be lower than now. Moreover, I would like to account for some more risks. I would only account for half of the first pillar. The closer you are to retirement, the more confident you can be about whether you will receive it.

With half of the first pillar, we would need about 1’148’000 CHF net worth. It seems reasonable to be able to retire at about 50 years old.

The Complete Picture

Now, we will consider the big picture. There are several essential things you need to think about if you want to retire early in Switzerland.

First, you will need a significant amount of available money for the years before the official retirement age. These are the years when you cannot count on any of the three pillars of retirement.

Then, in official retirement, the first pillar should cover a good part of your expenses. It means the expenses you must cover from your net worth will be significantly lower. In practice, this means you need to accumulate less money. And starting from that point, you can also account for the second and third pillars.

Finally, you need to be careful with the usual withdrawal simulation. These simulations are based on the U.S. stock market and inflation numbers. They could be different in Switzerland. I would simply use a lower withdrawal rate in Switzerland.

In the end, we can simply use the withdrawal rule. We just need to ensure not to rely too much on the second and third pillars. And we need to account for the local returns.

Conclusion

You are looking for financial independence or just achieved it, or living it?

Make the most of each phase with support from Dror, a certified professional coach (having been through all the phases).

I think it is entirely possible to retire early in Switzerland. It is probably not the country where you can retire the earliest. But, you may have a great retirement in this country.

As you saw, there are many things you need to take into account. But once you do, the principle remains to retire early in Switzerland. It is not rocket science!

And if you live a frugal life and have a good salary, it should not be too difficult to reach these numbers. It will take some dedication, of course. But most people do not realize how much they could save by cleaning up their budget.

This article shows well that retiring early is simple but not easy. The concepts are simple, but it takes effort and dedication to reach that goal.

For example, I have interviewed an early retiree in Switzerland.

What about you? Do you think it is possible to retire early in Switzerland? Did I forget anything?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-book

Save tons of money in Switzerland and retire early in Spain.

Seriously, saving around 40K€ yearly in Switzerland, it would allow you to live 4 years in Spain without working and with a small rent or owning a property. Moreover, with that money, you could buy a newly decent house in a Spanish countryside village.

Healthcare is 100% free in Spain (swiss citizens only need residence permission after demonstrating economic means for living), as long as highways, TV, radios, etc. As a disadvantage, you will pay more taxes as fiscal resident…but you are not going to inform of your abroad investments to Spanish authorities, aren’t you?

No mention to clima and ultra-cheap daily expenses, in the South you will only wear gross coats a few days on November and December, maybe January too…for the price of a bear in Geneva, you could take 7 beers and pass the afternoon in a typical bar. Forget about Swiss meat…in the South of Spain you could launch meat and dinner fresh fish all days!!!!

Think about that, it’s an interesting alternative.

Hi LCM,

That’s a good strategy. And there are many people planning to do it. Even Italy and France would be good options.

Are you planning to do that?

However, I don’t like the tax evasion that you suggest. If people were to move to another country, I would strongly encourage them to declare their abroad investments as well.

Thanks for sharing.

Out of curiosity, which areas in Switzerland you do not deem safe?

Hi Robert,

Some small areas of Lausanne and Genève, at night. And I am sure there are some areas of Zurich at night where it is not that safe. I guess it is the same for each city that grows enough.

These are small areas. Overall, I feel very safe in Switzerland.

Do you have other areas at night or do you feel safe everywhere?

Thanks for stopping by!

Great overview. I think it’s not clear to many that early retirement depends heavily on the place you work and plan to live in.

I suggest you include more tables and graphs in your blogs. In this case a table listing all expected expenses and income after retirement but before the official retirement age.

In my opinion there will be expenses for covering the time after the official retirement age. And not just for the time before it. Depending on your retirement age the three pillars will not be able to sustain your lifestyle alone. It seems you are suggesting that. Paying 1st pillar contributions is one of those expenses. And then you have the expenses which don’t go away because you have no job like health insurance contributions or housing taxes (Eigenmietwert) as you mentioned.

You could also turn it around and calculate the difference in accumulated pension between retirement age and official retirement age. Including all those employer contributions and tax deductions.

You don’t pay income taxes on dividends if they are part of your pension money. You can even delay 2nd pillar pension money payout until you are 70 avoiding wealth tax too. Basically we have two pots of money which can be invested. Arguably with different rules and investment percentages.

By the way there was a recent article in the Handelszeitung interviewing a person who has retired with 46 and lives in Switzerland.

Hi capmac,

That’s a good idea for graphs and tables :) I will try to improve this on my next blog posts and when I update older blog posts.

It’s true, you don’t pay taxes on dividends in your second and third pillar. However, if you want to retire early, your second and third pillar is not the largest part of your assets. So it won’t help a lot.

I should have mentioned that you can delay the first and second pillar if you want. This is a bit of a gamble on life. But this could be helpful.

Unfortunately, I don’t read German so I didn’t see this article. And Google translate of german is still not as good as it should :(

Thanks for stopping by!

Hy

I think too, thats much more difficult to retire in switzerland, than in other countries, but you have the Advantage, that the incomes are higher, than elsewhere.

One issue is interresting, when thinking of early retirement in switzerland. The second pillar. When you stop working early, you don’t have much contributed in your 2nd pillar. In most cases your employer contributes at least the same percentage every month, in some cases even much more. When you quit, it wont grow over the years because of the lack of yield caused by the strict regulations, unlike a third pillar. So the earlier you quit, the less Pension you will have and the more FI Money you Need after 65.

“You also need to consider that you will only get that amount if you retire in Switzerland!” I think you can get your 1st pillar when you move in an other Country. See https://www.ch.ch/de/pensionierung-ausland/

Hi KM Finanzen,

Yes, the income is high enough that it’s easy to retire in other countries if you are in a high-paying job. But it’s not high enough to make it very easy to retire in Switzerland.

That’s a good point for the second pillar. And the worst is that you are generally paying more when you are older than when you are young. This makes it even more difficult to have a large second pillar when you retire early. That’s why I only accounting for the current value of the second pillar for retirement. Not as a pension, but as a lump sum. And I am probably going to use it for a house anyway.

I am only accounting for the first pillar as a pension.

You are right, if you are Swiss you can always get the AVS outside of Switzerland. If you are from another country, there are some exceptions. But generally, you can indeed receive it. Thanks!

Thanks for stopping by!

“Now, this is only true if you are not considered a professional investor.”

FYI: if your realized capital gain income exceeds 50% of your salary, you are considered professional investor. (plus other conditions..). This could be an issue.

Hi Lexandro,

As you said, there are other conditions. Including not holding funds for more than six months. I think we are safe as long as the other conditions are fine. But I do not have a definitive answer on that. I guess we would have to ask the tax office on that one.

Another way to fight this is to use your dividends to represent more than 50% of the income. I think it is doable to get enough dividends to cover half of your expenses.

Thanks for stopping by!