Protect yourself from a recession – Be prepared for the worst!

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Due to the 2020 Coronavirus (Covid-19), the stock market entered a bear market. It has fallen more than 20% since its high. And we hear a lot of talk about recessions. We are currently not in a recession, but we may well be soon!

But do you even know what a recession is? And what does it have to do with the stock market?

In this article, I discuss what a recession is, what causes one, and what its consequences are. It is essential to know these things if you want to be prepared.

Once you know what is likely to happen during the next recession, there are several things you can do to prepare yourself better. We go over several things you could do for that! These are not magical things to avoid a recession, but they could help weather it.

What is a recession?

We should start with the definition of a recession. In short, it is a period of economic decline.

We can be more precise in identifying it as two consecutive quarters during which the Gross Domestic Product (GDB) declines. Other factors are being followed when people speak of a recession. It can be tied to employment rate, income, and sales. But following the GDP is the easiest way to know how a country is doing.

A recession can either be local or global. A local recession only affects a single country. And a global recession affects many countries at the same time. Sometimes, a global recession is more challenging to identify since different countries have different growth. But the rule of thumb of two declining GDP quarters is generally good enough!

And it is essential to know that countries do not enter recessions simultaneously. For instance, the U.S. could enter a recession in March, and France could follow six months later. So, it is sometimes difficult to find the exact dates of recessions.

What is a depression?

Another term you may have heard is depression. It is closely related to a recession. But it is not the same thing. Here, we are talking about depression in economics.

Simply put, depression is a stronger recession. It is a very long period of economic decline. The rules for distinguishing a recession and a depression are not very well defined. But generally speaking, a depression is a period during which either:

- The GDP declined by at least 10% from its peak.

- A recession lasted for two years or more.

The last depression in the United States is known as the Great Depression and started in 1929. Hopefully, we will not have another depression for a long time. However, if recessions have beneficial effects, depression is much more devastating. The Great Depression saw almost a third of the American people unemployed for a sustained period. It is not something anybody wants to experience.

The causes and consequences of depression are the same as a recession, but they are more devastating. And you can protect yourself in the same way.

History of Recessions in the United States

There have been many recessions in the past. It would take too long to list them all. Instead, I will focus on the ones in the United States and Switzerland later. And I will mention global recessions as well!

Recessions in the United States are significant. Indeed, the U.S. is currently the biggest economy in the world. It means that many companies will be impacted by a recession in the U.S. Countries doing business with the U.S. will also be impacted.

The National Bureau of Economic Research (NBER) refers to the dates of recessions in the United States. They do not use the GDP rule of thumb but evaluate monthly economic data.

Great Recession

The most recent one is the Great Recession. It started in the United States with the subprime market crisis and the real estate market collapse. Many banks failed, and the U.S. government had to bail out several. It is considered a global recession since many countries followed the U.S. into the crisis. However, many emerging markets, such as India and China, had less impact on their economies. The GDP declined by 5.1% from its peak.

This recession lasted from December 2007 to June 2009. It ended about six years of economic growth.

Early 2000s Recession

The first one of the 21st century was the Early 2000s Recession. Many people mistake this for the dot-com bubble. The dot-com bubble is a bear market in the U.S. stock market where a speculative bubble burst. And while the dot-com bubble affected the economy, it was not the only cause. There was also a significant fall in investments.

This recession ended ten years of growth from March 2001 to November 2001. The GDP only declined by 0.3% from its peak.

Recession of 1945

The end of the war did not only have good consequences. It caused the Recession of 1945.

This crisis is not well-known, but it is a strong one. The end of Government spending caused it at the end of the war. Once the war was over, the United States stopped investing so much in its military. It led to a significant drop in GDP as well as higher unemployment. During the war, people were either in the military or employed in the weapons industry.

The GDP declined by 12.7% from its peak, making it a significant recession. However, from an unemployment point of view, it was one of the softest. It only lasted eight months, from February to October 1945.

Great Depression

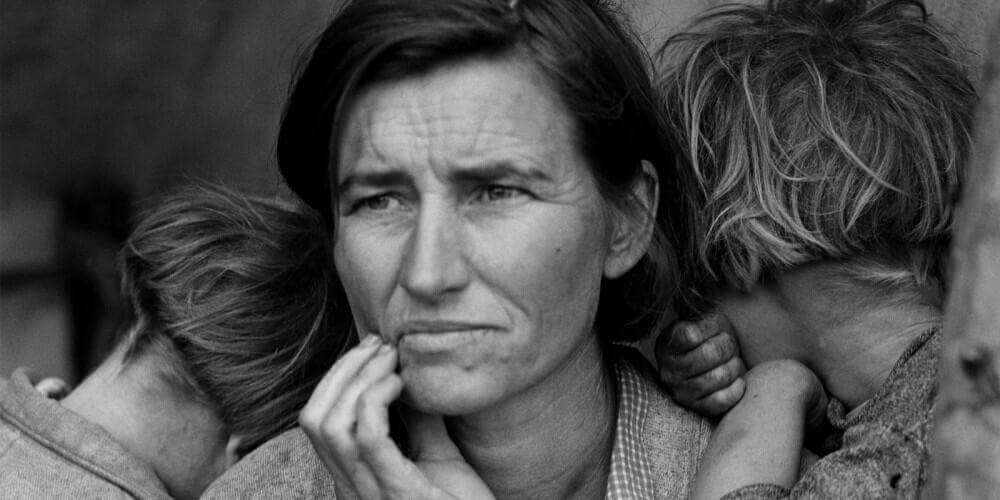

The Great Depression was the strongest in the 20th century in the United States.

Historians do not precisely agree on what exactly caused the Great Depression. But there were several factors. First, it started with a steady decline in stock prices and a few months later with the Wall Street Crash of 1929 (Black Tuesday). Before that, almost everyone was starting to invest. So the fall of the stock market had a massive impact on people.

But there was also a collapse in the money supply and problems with the gold standard. And protectionist acts also played a role.

It started in August 1929 and lasted until March 1933, three and a half years. The GDP declined 26.7% from the peak! And unemployment reached 24.9% in 1933! Compared to that, the Great Recession is almost insignificant.

History of Recessions in Switzerland

The economy in Switzerland is mostly following the same cycle as the United States and the European Union (EU).

When these two partners cut their spending during a crisis, the exports from Switzerland also fall. Many people and companies from Switzerland are investing in the U.S. and the EU. Once these investments start losing value, investors are less prone to invest and spend money, starting the cycle of recession.

However, they generally have a lower impact on Switzerland. Even though many crises impact Switzerland, unemployment and GDP, decline are often not as bad as in other countries.

For instance, during the Great Depression, the GDP only fell by about 1%, contrary to 26.7% in the United States. The worst decline was during the Oil Embargo of the 1970s. And it only declined by about 7%.

And the same can be said about unemployment. During the Great Recession, unemployment rose to 4.4%, while it was 10% in the United States.

That is not to say these crises do not impact us. Indeed, almost all global recessions affected the Swiss economy. But we have it better than in most countries.

What are the causes of a recession?

As we saw in the previous list, the causes can be multiple and very different. There are generally several factors that can explain why a recession started.

Economic uncertainty is a significant cause of trouble. When people and companies do not believe in the economy, they are spending less and investing less. As to why this starts, this could be simply because the economy is slowing down.

Things like tariffs and monetary reforms are also very significant factors. I would not be surprised if the current US-China trade war caused the next financial crisis.

Of course, wars are terrible factors for the economy. But it is a bit more complicated since sometimes wars are very good for export. And stopping the war could be worse for the economy. But generally speaking, wars are bad signs.

Sometimes, a large speculative bubble can also cause a recession. For instance, a stock market bubble or a real estate bubble could cause it.

As you can see, there are multiple possible causes. But, generally, there is growing pessimism about the economy in the months before a recession.

What are the consequences of a recession?

A recession has many consequences. And none of them are good!

The first consequence is that many companies will cut jobs. And many companies will also close down, causing even more job cuts. It will lead to a significant unemployment rate. All recessions see a rise in unemployment. And, of course, when people lose their job, they spend less, which contributes to the problem itself by making it worse. In addition, companies often reduce wages during prolonged crises for those that still have a job.

Companies will also cut their spending, such as research and buying new equipment. Once again, this will lead to even less global spending and will contribute to the recession itself.

The stock market generally falls sharply during a recession. Many people need to sell their stocks because they need the money. It will drive the prices down. And very few people will continue investing during a crisis.

Overall, these things are highly related to one another. Spending leads to economic decline, which leads to job losses and more spending reductions. It is a cycle that is difficult to break.

What about the stock market?

Many people confuse recessions and bear markets. Although they are often related, the stock market and the economy are not the same.

Recessions are related to the country’s economy. On the other hand, bear markets are only associated with the stock market. The definition of a bear market is when stocks fall 20% from their previous high. For reference, a correction in the stock market is when the stocks fall 10% from their peak.

Generally, bear markets happen around the same time as recessions. Sometimes, bear markets are one of the factors causing a recession. But often, it is the other way around. So if a recession starts, it is likely to start a bear market as well.

It is logical since, during a crisis, people are much less likely to invest. And when people lose their jobs, they may have to liquidate some of their investments. It is not good for the stock market.

What can the government do?

The government is always trying to avoid a recession. It is bad for the country, and so should be avoided. They have many tools to do so. But, there is no foolproof way to prevent a recession. There have always been cycles in the economy, and a government cannot stop it.

However, we can see that the economy has been much more stable in the last decades. There has not been any depression since the Great Depression. And recessions have been much better since then!

One thing a government can do is introduce tax cuts to promote spending. However, the government cannot do that all the time. Otherwise, the government would run out of money.

Another thing that the government can do is increase spending. It could spark some economic growth. But of course, it would have to be very significant spending. And they have to be careful not to ruin the government’s economy.

What about interest rates?

One of the strongest and most used tools of government is interest rate management.

First, governments can lower interest rates. It will have several effects. First of all, it will encourage spending by consumers. People with debts will have more disposable income since they will pay less interest. And people can borrow money to spend it at a lower interest rate. It will also encourage companies to spend rather than save since saving money will not be efficient enough.

Another way to lower interest rates is for the central bank to buy government bonds or mortgage securities. It should lower these rates and have the same effects as directly reducing them.

Quantitative Easing

If the interest rates are already very low, a central bank could resort to Quantitative Easing (QE). It sounds complicated. But it is a fairly straightforward technique. But it is unconventional.

First, the central bank issues bank reserves. It is the same as printing new money electronically. Then, with this money, they will buy bonds and securities from banks. Usually, since the banks have more cash, they will lend more money to consumers. It should result in increased spending from these consumers. And finally, since they are buying bonds, this will lower their interest rates as well.

Even though it can prevent a recession or lower its effect, Quantitative Easing has disadvantages.

The first problem with Quantitative Easing is that creating a large money supply can cause inflation. If not handled correctly, this inflation could become out of control.

The second problem is that even though banks will receive cash, Central Banks cannot force them into spending it. Also, if nobody wants new loans, central banks cannot force them either. So, QE may have much weaker effects than expected. It could merely enrich the banks.

Finally, increasing the money supply can devaluate a currency. It could have good effects since exports will be cheaper for the countries. But if it gets out of control, imports will become too expensive, slowing the economy.

So, while QE could prevent or slow down a recession, it is also a dangerous tool.

Can you predict recessions?

No! Nobody can predict a recession. Some people have been lucky in predicting some recessions. However, for every person that predicts it correctly, thousands mispredict it.

If you could predict precisely a recession, you would be rich. You could sell your investments at the top and buy at the bottom.

Now, some possible signals could help you predict it. But none of them will be accurate.

One signal many believe leads to a recession is an inversion of the yield curve. It is when a yield curve is inverting. The yield curve is the curve of the yield of a bond regarding its maturity. When it inverts, it is better to borrow money for the long rather than the short term.

Since the GDP is used to know when recessions start, if the GDP of a country begins to decline, it could indicate the coming of a recession.

The employment statistics are also good indicators. For example, if the number of new jobs created is going down or unemployment is going up, these could be essential signs.

When will the next recession be?

I cannot tell you when the next recession will be. And you need to remember that nobody can!

Now, we are at the top of a raging bull market lasting for about ten years. It is also the longest we have gone without a recession for a long time! And recessions are known to occur every eight to ten years.

Of course, just because this happened in the past does not mean it will happen again soon.

But you can also factor in that several global economies are slowing down. And the United States and China are fighting their trade wars. Moreover, Hong Kong is in a bad place right now, and it is a stronghold for banks. Finally, in 2019, several of the important yield curves inverted.

Now, on top of that, the coronavirus has hugely perturbed the supply chains. Also, many people cannot work and do not go home. Once this happens, people do not spend as much money. All this is bad for the economy.

What can you do to protect yourself?

First, do not panic! You need to be prepared, but there is no need to panic!

There are a few things you can do to be better prepared for a recession.

1. Prepare your emergency fund

If you are worried about losing your job during a recession, it may be a good time to increase the size of your emergency fund. If you can save about six months of expenses, this could greatly help you during troubled times.

Once it is over, you could reduce it again and invest the surplus in the stock market. If you do not have an emergency fund, this could be an excellent time to start one.

2. Improve your budget

If you have not done so in a while, you should check your budget to ensure you are not overspending. It could be a great time to lower your expenses. It is always a good time to reduce your spending if you can.

Also, you could prepare a list of expenses that are not strictly necessary. If things get bad, you can use that list to lower your expenses even more during the crisis.

A good thing to do is to hold off on any big purchases you have planned. For instance, it may not be a great idea to buy a new car before a recession.

3. Reduce your debts

Also, it is always better to be debt-free in times of crisis. Try to lower your debts before the bad times. But, of course, do not push it too far. If you are confident you will weather the crisis, you do not need to change too many things.

You should focus on bad debts. These are debts with high interest rates. It would probably be credit card debts and car loans, for instance. But you can live with a low-interest mortgage during a recession.

There are a few things to improve your budget to become debt-free.

4. Make yourself more valuable at work

Finally, if you are worried about your company cutting some jobs, you should try to make yourself less expendable. You need to bring your A-game to the company. Take on more responsibilities, for instance.

You could try to do the same things if you were to increase your career income.

5. Review your investments

During a recession, you need to be ready to take on significant losses. For example, if the stock market drops 30%, you must withstand it. The worst thing you can do in a bear market is sell!

It may be a good time to revisit your portfolio. For instance, if you hold more stocks than you are comfortable with, it could be an excellent time to switch to bonds or cash. In any case, it is always good to revisit your portfolio occasionally.

6. Reduce your withdrawals (FI people)

If you planned it well and are already financially independent, you should be well protected from a recession. However, if you just started withdrawing from your portfolio, it could be the wrong time. For this, you may want to consider limiting your withdrawals as well.

Bad returns in the first years of early retirement are among the worst things that can happen during Financial Independence. It is because of the Sequence of Returns risk. However, you still have a high chance of success, according to the Trinity Study.

FAQ

What is a recession?

A recession is a period of economic decline. It is generally defined as two consecutive quarters of declining Gross Domestic Product (GDP).

What is a depression?

A depression is stronger than a normal recession. It is generally used when the GDP declined by at least 10% from its peak or when a recession lasts at least two years.

What are the consequences of a recession?

Many companies will cut jobs during a recession. They will also cut their spending. And the stock market will generally fall sharply.

What can a government do against recessions?

The government can lower interest rates or buy many bonds from banks to increase their lending capacity. They need people to increase spending to stimulate the economy. Another way is for the governments to increase their spending to stimulate the economy.

Conclusion

By now, you should know everything you need to know about recessions. You need to be prepared for the next one. But there is no reason to panic. Panic only leads to bad decisions.

The next recession will come eventually. But we do not know when and there is no way to know it!

However, it has been more than ten years since the last one. And we have seen several signals that could indicate the next one. So, I do not think it will take long before the next one.

It never hurts to be prepared. And most of the things you can do to protect yourself from a recession will also improve your financial life now!

Once the next bear market hits us, you may want to check a few tips on how to invest during a bear market. And after a bear market you may want to know what to do after a bear market.

When do you think the next recession will start? And how are you planning to protect yourself?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Investing Fundamentals

- More articles about Investing

- The stock market and the economy: They are not the same

- Target Retirement Funds – Too Much Simplicity?

- Yield Curve Inversion: Should we Panic?

Hi – good article as always very well structured.

My strategy for a recession is to be as diversified as possible regarding income streams, and be able to reduce costs as much as possible not to eat the emergency fund up unless I have to.

The biggest difference between a depression and a recession in my view is the unemployment rate which you didn’t mention at all. Depressions have a unemployment rate of +30% whilst recessions typically ‘only’ double from their healthy 5-6% levels.

Thanks for the kind words!

As you said, there will be more unemployment during a depression. I mentioned unemployment a few times in my article. But practically speaking, you could have a depression without high unemployment. But this is highly unlikely.

Diversification is really important indeed! And multiple income streams could help a lot! Reducing the costs to a minimum (or being flexible with them) can help as well of course.

Thanks for stopping by!

Hi there. Thanks for another good post!

I have to say that I don’t agree with point 3:” Reduce your debts” in the form you wrote it.

While it’s generally good to get rid of bad debt, when a recession comes, it’s espacially good to have good debt. What I mean is that, with a very low interest rate loan you can be in a very good position when the stockmarket is down. You then have the money to buy your ETFs at a low price.

Hi Rob,

I still think that my point holds as it is. Reducing your debts will reduce your costs and will increase your chances of going through a recession. If you lose your job, you will not have anything to invest in the stock regardless of the low prices.

But you are entirely right that bad debts should be focused on first. Actually, regardless of recessions, people should not have bad debts. On the other hand, a 0.8% mortgage should not impact you too much.

Thanks for stopping by!

Fantastic post!

I also wrote about this topic a while ago “How I’m preparing for the recession as an investor”..

My strategy is to not overreact if the stock market dips. I will continue buying the same amount of ETF’s and mutual funds as before. And I’m happy that everything is on sale! :)

– Financial Nordic

Hi Financial Nordic,

Nice to know that we think alike!

It’s a good strategy if your situation is safe. Just invest through the market! And profit from some sales!

Thanks for stopping by!

Great post.

Personally, if you wanted to start investing long term (20+ years) now from scratch, would you still choose 100% stocks?

How would you handle to save up for a down payment for a house (within 3-5 years)?

Would really appreciate your input.

Hi Peter Pan,

Thanks for the kind words!

For the long-term, yes, I would still use 100% stocks. That is for my current situation of having a first and second pillar very conservative. If I did not have this, I would maybe invest in some bonds. But Swiss bonds are a terrible investment right now. Cash is actually better than Swiss bonds.

As for a house, it’s more difficult to say. I would probably still invest 100% in stocks and know that it could be delayed by a bear market. In the current state of the stock market, I would be very careful about having my down payment in stocks right now.

Thanks for stopping by!

Please review the article… There are multiple mistakes and errors… Frases not finished or miss translated… For example “This recession lasted from December 2017 to June 2009. It ended about six years of economic growth.“ But I like the article and how it is structured, simple easy to understand paragraphs.

HI W,

Thanks for letting me know. I am sorry, it seems that this one was pretty bad :(

I made updates to all the mistakes I could quickly find. I will do another pass over the weekend.

Thanks for your kind words!