6 Steps towards a Solid Budget can make you Debt-Free

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Today’s post is a guest post by Aiden White, a San Francisco Writer. She enjoys writing about debts and many other financial subjects. She is the author behind consolidatecreditcard.org (which does not exist anymore). I am happy to have her as a guest poster for the second time!

“Are you worried about your increasing weight? Did you already plan your daily gym routine and diet chart after consulting an expert?”

If I ask these questions to any normal people, most of them will answer me by saying Yes!

But what if I ask someone this – “How much debts you have?” or “are you making payments on your high-interest credit cards?” or “are you worried about your increasing debt load?”

The answers you might get would not be so encouraging, trust me. But it is also a fact that a maxed-out credit card or few unpaid payday loans may increase your debt weight more than you can imagine.

So what is the option you have? Just get out of debt and improve your financial status, that’s it! And in this case, a proper budgeting strategy will help you a lot to reduce the debt burden.

How? Read on to know more.

“Annual income twenty pounds, annual expenditure nineteen—result happiness. Annual income twenty pounds, annual expenditure twenty-one pounds—result misery.” – Charles Dickens

1. Recognize your situation

Believe me, nothing is scarier than confronting your bad financial decisions. It is quite difficult to admit any activity for which you are facing a financial crisis.

Fortunately, you may repay your debts.

But you can only do that when you know how much debt you have, you have formed a repayment plan, and have a clear idea about avoiding future debts.

So, you need to analyze your situation and measure the damage you have done. It is the first step and the hardest one too. Once you overcome this first challenge you will be more confident to solve your debt problems. Make a list about how much you owe and how much interest you are paying.

2. Prioritize your debts

You need to list all your debts as per your priority and start paying them off. Normally people pay off their debts in the 3 following priority:

a. Debt snowball

Target debts with the smallest amount and repay it first. Meanwhile, keep making minimum payments to all other debts.

b. Debt avalanche

Target debts based on the interest rate. Normally the highest interest rate debt is paid first. It will take longer to pay off the accounts than other debt repayment methods.

c. Debt Tsunami

Pay off the debt account based on emotional preferences.

On the other hand, you should focus on making payments on secured debts every month, such as mortgage and car loan payments.

3. Track your spending

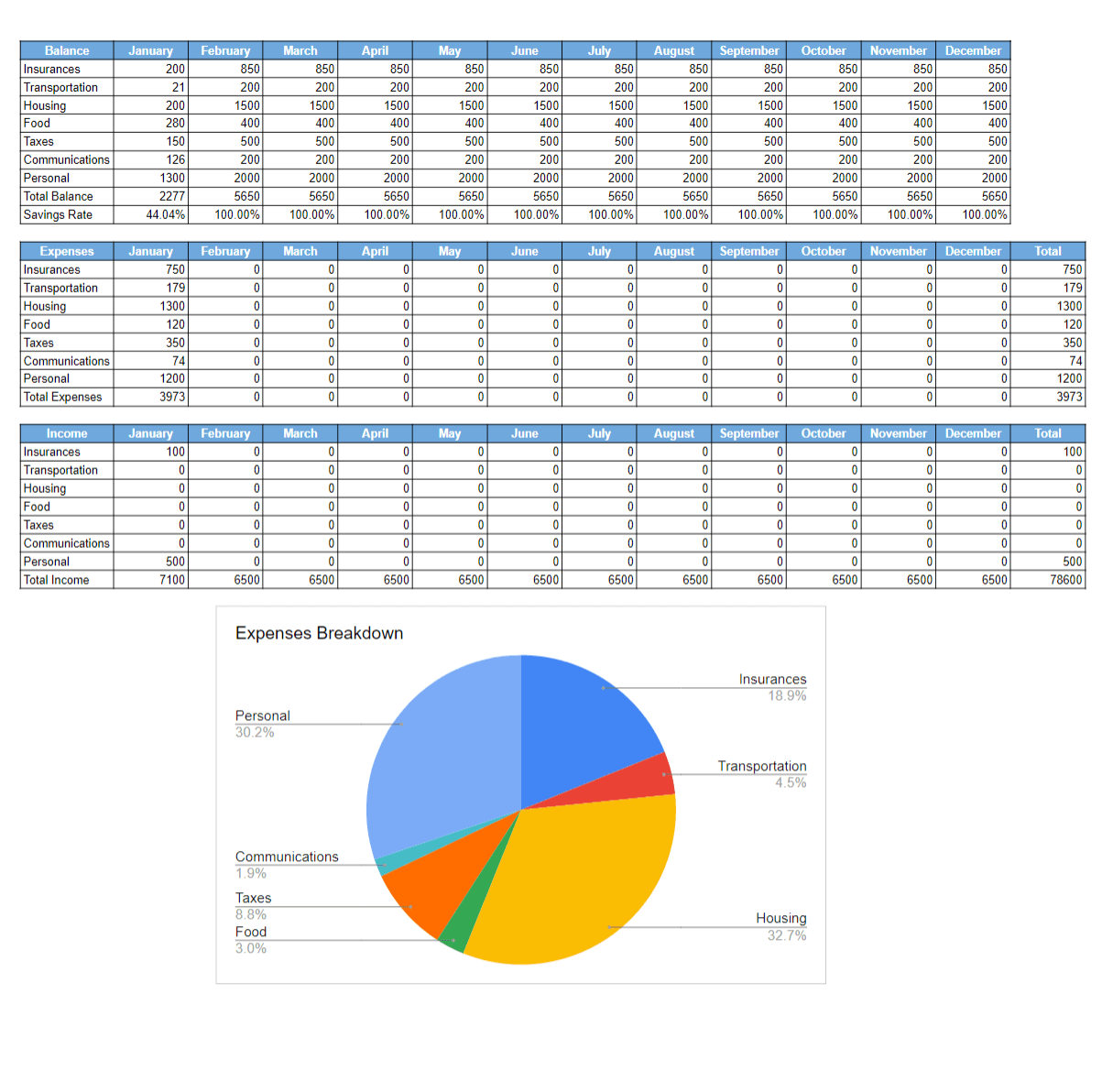

A simple Google Sheets template to start tracking your expenses and earnings and have an overview of your budget! Know your savings rate without effort!

You need to track your money every month so that you can identify the expenses you do not need. Once you start recognizing the expenses that can be optimized, you can find ways to reduce such costs and save money each month. This is one of the basic parts of successful budgeting.

In order to get a clear view of your monthly spending pattern, you will need to analyze the last few months of spending.

- Gather all the bills, records, and look at your last three months of spending. You may find out several useless expenses, such as a $150 bill for clothes or a $200 restaurant dinner bill during weekends. You will be shocked to find out how easily little expenses add up.

- Use some budgeting software like Mint.com to review your spending habits. It will help you to create goals for future spending habits

4. Follow a realistic budgeting strategy

Once you track your spending and identify your spending pattern, based on that data you may create a realistic budgeting strategy. Budgeting is nothing than putting enough money to its proper place and fulfilling your financial goals.

So, to plan a proper budget, you may need to set clear priorities for yourself and decide which expenses will get you closer to your financial goals.

Make sure that you are not overspending. For this, you should keep a balance on the budget to accommodate everything you need to pay for. You may use some free budget calculator and a spreadsheet to help you with this task.

You should spend it when you receive your income. Plan and decide each category of expenses before receiving the paycheck.

You should allocate funds for your necessities such as housing, food, utilities, transportation, groceries, etc. Secondly, you must focus on making debt payments every month, saving money for emergencies, and if you have some left…save for fun and entertainment.

This will protect you from going into further debt.

You may follow the 50/30/20 budgeting strategy at any point in time. Make all the essential expenses, using 50% of your income. Then you may allocate 30% for saving and debt payment purposes. The remaining 20% can be used for your special needs.

Since you are targeting to pay off your debts, you can use any surplus money from your special need category to make extra debt payments. This way you can reduce credit card debt, pay off payday loans, and make payments on your other debts easily and faster.

Once you start following the budget, track your progress. You can set automatic payments to reduce stress about bill payments.

After one month compare your spending and savings with the data from the last three months. If you are getting positive results, then carry on with the current strategy. You can always revise your budget later on if necessary.

5. Earn extra money through side hustles

Find out your hidden skills such as teaching, cooking, music, painting, web design or coding, web content writing, blogging, etc and earn extra money. Use that money for paying off credit card debts and make payments to your other bills every month.

There are also multiple side hustles you can pick up from home, like selling old clothes through online portals, e-commerce websites, or renting out a room on Airbnb.

Work hard to earn enough for a few extra payments toward your high-interest debts. The more you can contribute, the faster you will become debt-free.

6. Develop a realistic debt reduction plan

You first need to reduce your expenses through budgeting. Then you can generate some extra dollars through side hustles. Now what?

Your next move should be keeping a hold on your regular investment contributions if required.

Learn about debt consolidation options and how you can use those methods to consolidate your debts. You can use a 0% balance transfer credit card or take out a debt consolidation loan to consolidate multiple debts into one.

It will help you to lower your current interest rate and save a lot per month.

Use those savings to pay off your debt payments and get rid of your debts faster.

Endnotes

Think about your financial goals for the future. Apart from getting out of debt, you might want to buy a new house or save up for a car. Whatever you want to do, you will require a solid budgeting strategy to motivate you and help you to keep on the right track.

Thanks a lot to Aiden for this post! I am really glad to have worked with her for the second time already. If you are interested in credit card debt consolidation, you can consult her own website and blog at consolidatecreditcard.org (which does not exist anymore). If you like her style, you can read her other guest post about money-saving tips.

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Manage your money

- More articles about Save

- Emergency Fund – Do you Really Need One in 2024?

- How to manage your finances as a couple?

- Should you pay your bills early in 2024?

Thank you! Very insightful article.

Handling debt is crucial for healthy finances.