How to choose a Safe Withdrawal Rate?

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Your Safe Withdrawal Rate is an essential component of your retirement planning if you plan to retire based on your investment portfolio. We have already talked at length about this method of retirement, the essence of the Financial Independence and Retire Early (FIRE) movement.

But we have not discussed how to choose a Safe Withdrawal Rate for your situation. No safe withdrawal rate would fit every situation. And while there are some rules of thumb, it is still something you have to decide for yourself.

So, by the end of this step-by-step guide, you will know how to choose your Safe Withdrawal Rate.

Safe Withdrawal Rate

A Safe Withdrawal Rate is a withdrawal rate that is safe enough for you to have a successful retirement. And a successful retirement means you will not run out of money before the end of the retirement period you have chosen.

The withdrawal rate defines the amount you will spend each year in the percentage of your portfolio. So, if you retire with 1’000’000 CHF and have a withdrawal rate of 4%, you will be able to spend 40’000 CHF per year. And each year, you will adjust this number for inflation. It is essential that the withdrawal rate is relative to your initial portfolio, not the current portfolio.

So, with a higher withdrawal rate, you can spend more money each year for the same initial portfolio. But spending more means increasing your risks of running out of money. So, a high withdrawal rate is riskier than a low withdrawal rate.

If you want more information and examples, I have done many simulations of withdrawal rates.

In this article, I will guide you through my six-step method of choosing your safe withdrawal rate, but this is not the only one. However, I believe it should work well for the majority of people.

1. Decide when you want to retire

Choosing your safe withdrawal rate starts with deciding when you want to retire. Of course, this does not mean you will retire precisely then. In the end, you may retire earlier or later than that goal. But having a goal in mind will let you plan from now to your goal.

For instance, I would like to be financially independent at 50 years old. So, have to plan my journey from now to the point I am 50 years old. Currently, I am mostly on track to reach that goal. But things can change in the future.

2. Estimate how long you will live

Now that you have your starting point, you need an endpoint. You need an upper estimate of how long your retirement will last. There are several ways to approach this problem.

The simple way is to assume you will reach 120 years old. I take 120 because the oldest verified person was 122 when she died. If you plan to retire at 40, you will need your portfolio to live for 80 years. These 80 years will be your financing period.

However, the issue with this technique is that you are extremely unlikely to reach this old age. For example, if you plan for 80 years of retirement and only live through half of it, you will have spent too many years working to fund your retirement plan. So, being too conservative will make it harder to reach your goal.

So, a better technique is to rely on statistics. Each developed country publishes life expectancy statistics. For instance, as of 2019, the life expectancy at birth for a man is 81.9 years old. So, should I expect to live until I am 82 years? Not really. There are three important concerns.

First, life expectancy at birth is not the most relevant statistic. What is more relevant is the life expectancy at your age. For instance, the life expectancy at age 30 in Switzerland is 52.6 years, totaling 82.6 years. And at age 50, it is 33.3, for a total of 83.3 years. So, it is more important to take the estimate based on your age.

Second, if you plan precisely for your life expectancy, what will happen if you live longer? Your plan may fail. So, while you should not plan for anything shorter than your life expectancy, you should add a margin of safety to live longer.

Third, life expectancy depends on your current health. For example, a heavy drinker or smoker has a significantly lower life expectancy. On the other hand, a non-smoker with frequent exercise has a significantly higher life expectancy. So, this is something you should take into account as well.

For instance, my life expectancy at my current age is about 83 years old. So, I will plan my financing period to 90 years old. Seven years sounds like enough margin of safety for me. Therefore, I should plan for a financing period of 40 years at least.

Of course, if your plan concerns several people (you and your partner, for instance), you should consider that. For instance, my wife is younger than me, and women live younger than men, so I should add 5 years to my estimation.

3. Choose your asset allocation

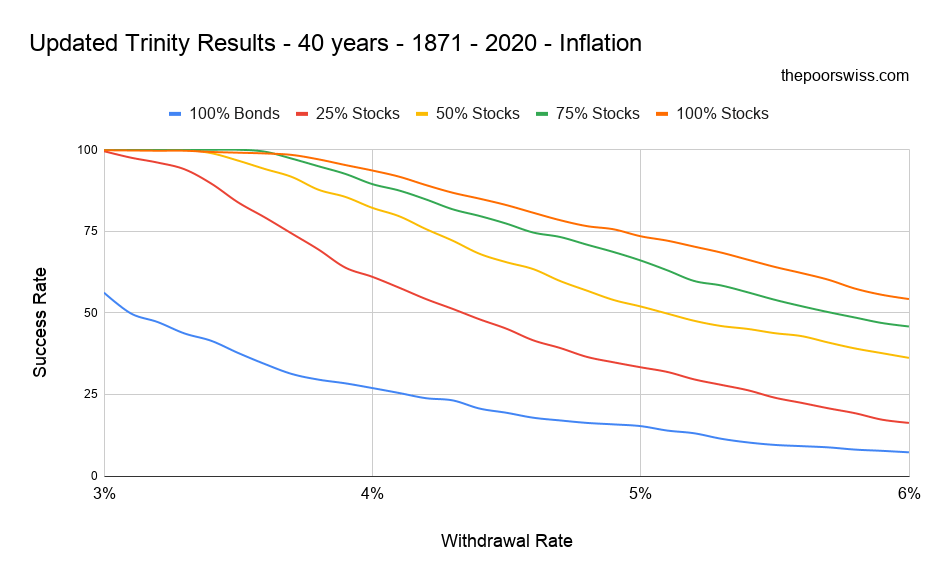

To estimate the success rate of a safe withdrawal rate, we need to know the asset allocation of the portfolio. Indeed, a safe withdrawal rate will have different results if you have a 100% stock portfolio or 40% in bonds, and 60% in stocks.

Now, here comes the tricky part. The asset allocation will play a role in the safety of your retirement plan. So, it will impact the success rate and the worst duration of your retirement scenario. Indeed, asset allocation and safe withdrawal rates are highly related.

If you have already decided on your asset allocation, go to the next step. Otherwise, keep reading.

We are talking about your asset allocation at retirement, not the asset allocation of your current accumulation portfolio. For instance, I plan to keep 100% in stocks before retirement, and then I may switch 20% in bonds during my retirement. So, I should consider 20% in bonds as my asset allocation to choose my Safe Withdrawal Rate.

What bonds will do is reduce your chances of failing early. Put another way. They will increase the worst duration of your portfolio. The worst duration is the earliest time a portfolio can fail during retirement. So, you want it to be as high as possible.

On the other hand, adding a high allocation of bonds to a portfolio will reduce your chances of a successful retirement. Indeed, the low returns of bonds have historically been too low to sustain retirement. You can see this in action on this graph from my Trinity Study updated results.

Here are a few examples with different safe withdrawal rates and asset allocations (with my FIRE calculator):

- 4% withdrawal over 40 years

- 100% stocks: 93.67% success rate, can fail after 174 months

- 80% stocks: 90.20% success rate, can fail after 270 months

- 60% stocks: 86.03% success rate, can fail after 302 months

- 3.5% withdrawal rate over 60 years

- 100% stocks: 98.58% success rate, can fail after 222 months

- 80% stocks: 98.58% success rate, can fail after 402 months

- 60% stocks: 95.17% success rate, can fail after 437 months

If you want to be aggressive, having 100% in stocks is the allocation with the highest chance of success. However, it is also the one that can fail the earliest. Adding 20% bonds is generally a good bet since it would not hurt too much the success rate much, and it would significantly improve the worst duration.

If you want more information, I have a guide on asset allocation.

4. Choose a Safe Withdrawal Rate

You now have all the information you need to choose your safe withdrawal rate:

- Your financing period

- Your asset allocation

With this information, you can use my FIRE calculator to get information about success rates and worst durations for several withdrawal rates. For instance, I have plugged my own situation into (40 years and 80% stocks) to get the following information:

| Withdrawal Rate | Success Rate | Worst duration |

|---|---|---|

| 3% | 100% | 480 months |

| 3.25% | 100% | 480 months |

| 3.5% | 99.85% | 402 months |

| 3.75% | 97.15% | 318 months |

| 4% | 90.20% | 270 months |

| 4.25% | 84.57% | 246 months |

| 4.50% | 78.86% | 231 months |

With this information, I would use a 3.75% withdrawal rate. Some people prefer to have the 3.5% if they are more conservative. And some people would even go with the 4% if they are aggressive enough. One chance out of ten to run out of money is already too much for me, but not for everybody.

Since I am still hesitating with my asset allocation, I have also done the work with 100% in stocks and 40 years:

| Withdrawal Rate | Success Rate | Worst duration |

|---|---|---|

| 3% | 99.85% | 306 months |

| 3.25% | 99.69% | 246 months |

| 3.5% | 99.23% | 222 months |

| 3.75% | 97.99% | 198 months |

| 4% | 93.67% | 174 months |

| 4.25% | 88.19% | 162 months |

| 4.50% | 82.87% | 150 months |

If I went with 100% stocks, I would also go with 3.75%. But I would be careful about the worst duration during my retirement. So I would keep some flexibility to reduce it to 3.5% if necessary.

Some people may also want to only take a failsafe withdrawal rate. Such a withdrawal rate has never failed for a given retirement configuration.

5. Think of the margin of safety

This step is optional, but it may make sense for some people to have a margin of safety in their plan. There are several reasons to introduce some more safety.

First, you may live much longer than expected. This is not a bad thing, of course. But if you have planned for 40 years and live 60 years, your plan may fail.

Second, we must remember that this data is based on historical results. These simulations have worked for 150 years. And I am confident they will work in the future. But maybe they will perform slightly worse?

Third, your expenses may change. If you have not planned for your expenses and they increase after retirement, your effective withdrawal rate may be higher than you thought.

So, adding a little margin of safety to your retirement plan may not be a bad thing. There are several ways to add a margin of safety:

- Lower your withdrawal rate at the end

- Plan for more years for your retirement

- Increase your target success rate and worst durations

Of course, you should not go over the top with your margin of safety. Ultimately, most early retirees will have significantly more money than they started with. So, if you lower your withdrawal rate from 3.5% to 2.5%, you will have to accumulate significantly more money, and you will probably end up with a ton of money at the end of your retirement.

6. Revise your plan yearly

If you plan to retire soon, you are good to go. But if you retire in years or decades, you will want to update your retirement plan and your safe withdrawal rate every year or so.

I would encourage you to redo the first five steps quickly every year to make sure your plan is still working for your current situation. And this is also an excellent time to see where you are from your retirement.

Conclusion

With these six steps, you should have a good idea of choosing a Safe Withdrawal Rate for your situation. It is an essential decision since it will shape your journey to financial independence.

As long as you are not retired, you have plenty of time to think about this. However, once you retire, you cannot change your withdrawal rate without changing your expenses, which may not be possible. Therefore, it is worth taking the time to think about your withdrawal rate.

I have already changed my own Safe Withdrawal Rate several times. While writing this guide and doing the six steps myself, I increased my withdrawal rate from 3.6% to 3.75%. I believe I will be safe enough with 3.75%. But I probably will not retire before 15 years. So, I expect my Safe Withdrawal Rate to change again.

The best way to play with these numbers is to use my Safe Withdrawal Rate Calculator.

What about you? What is your own Safe Withdrawal Rate?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-book

Gerd Kommer (German best-selling author on ETF investing) advises against using the 4% Rule, first introduced by William Bengen in 1994, and the method it was calculated. In his opinion, a Monte Carlo Simulation is a better (and obviously more conservative) method for assessing the safe withdrawal rate. He recommends, among others, the online Retirement Nest Egg Calculator by Vanguard, which e.g. calculates 96% success probability at 3% withdrawal rate and 40 years of retirement (50/50 portfolio).

I think that 3% is too extreme. But something in the middle, like 3.5% is indeed much more reasonable than 4%.

Thanks for your blog, love it !

One thing I’d love to see is that rather than rates, some sort of evaluation of *how much* does one (or say a small family) need to retire early in Switzerland.

Say we are a couple with one or two kids and want to retire by 50. How much do we need to have accumulated to retire with say 100 or 200k/year of retirement revenue ? This would dive into wealth tax, AVS (if one is not employed it’s based on one’s wealth !), cost of living, … to describe how one can optimize and plan.

Hi Stephen,

The most important thing to find out is how much you are going to spend per year (including taxes and everything) in retirement. After that, it gets simpler.

I have an article talking about estimating expenses in retirement

And another one related to retiring early in Switzerland.

Is something missing?

The part which I think is missing is the deep dive into what I would call ‘fixed costs’ in early retirement, that is, costs independent of someone’s lifestyle.

For example wealth tax in Switzerland varies significantly depending on where you live, but then you may not want, or may not afford, to live in the cheapest places tax-wise. Also the AVS tax is still to be paid and wealth-based when retiring before retirement age, the wealth tax does not need to be paid on the 2nd pillar but then taxes when taking the money there’s specific taxation, etc… You also already mentioned health insurance.

I feel it would be valuable to readers to get a detailed view on all these and what can be optimized and how. I spent myself a ton of time trying to figure out where the best place for me to live is based on wealth tax rates & my interest in the location, and I then learned that keeping a part-time job (> 50%) allows me to pay a salary-based AVS tax rather than a wealth tax, which could work just fine for people who are afraid of being bored in retirement.

Thanks for the details :)

You are right, I should expand on these subjects. I never thought that having a part time would change to pay a salary-based AVS. That’s interesting.

Dear MTPS,

Thanks again for your blog. Do I understand correctly that by withdrawing SWR your base is just the portfolio, not Networth? In any case do you factor in the house value and 2 and 3 Pillars and how?

Hi Evgeny,

Yes, that’s correct, only your portfolio is there. I have written an article about what I call the FI net worth.

In my own net worth, I factor everything. But for the part that I would withdraw from, my house is not taken into account. My second and third pillars yes because at some point I will be able to withdraw from them. But if you are too far from retirement age, this may be dangerous.

Hi Mr. The Poor Swiss,

Yes, I read your blog on the calculation of the Networth – it is clear. So it means when you add 2 and 3 pillars to the base to calculate your SWR – 3.5-3.75% before you reach the retirment age, your actual SWR only to your portfolio will be higher. I do not know the proportions that you expect to have between the portfolio and the pillars, but potentially you can be withdrawing more money from the portfolio and decreasing its value, before you get the 2nd and 3rd pillars released and added back to your portfolio (if taken as a lumpsum, not monthly payments). Correct?

Hi Evgeny,

keep in mind that I am about 15 years away from any retirement. So, I will have to update my plan in the future.

You are entirely correct that in the meantime between early retirement and official retirement, my effective withdrawal rate on the portfolio will be higher than it would be on the entire portfolio.

Currently, we have more than 90% in the portfolio, not in second and third pillar. So it’s fine. If I had 50% only, I would have to lower my withdrawal rate significantly before official retirement.

To be safe, I may also ignore second and third pillars to know when I can retire.

Hi!

In the discussion whether 4% is safe enough, or one should rather go down to 3 something per cent, the state pension (AHV/AVS in CH) may be an argument in favour of a higher SWR.

The pension would split the 40-year-long retirement into two roughly equal 20-year periods, where the second period has additional income. One could therefore start the retirement with a higher WR and reduce it in 20 years (constant monthly expenditures assumed).

Hi max,

Yes, if you are going to get a pension, this will definitely help your planning. But this will highly depend on when you plan to retire. And if you retire 20 years before the retirement age, there is a big risk that the official retirement changes before you reach it. Or that you pension gets lower before you get it. So, it’s also very difficult to account for it. You could start with 4% for 20 years and then lower it to 3% and use your pension to cover the missing 1%. That would work but that relies heavily on receiving your pension when you planned it, not later.

You are absolutely right: there is uncertainty about the future official retirement age and the monthly payment sum.

The uncertainty about the future official retirement age is expressed in “two roughly equal 20-year periods”, i.e. I assumed the official retirement age to go up to 70 (currently 65 in CH).

The monthly pension sum might change as well, however I wouldn’t expect a change like halving, because AHV/AVS is the basic pension which is most important for the socially weak, and halving it would be a big step away from the social state.

“if you are going to get a pension” – Are you not?

In theory, yes, but currently I am assuming in my plans that I am not going to get one since I am extremely far from the official retirement age. That makes my plans safer.

Once I grow closer to retirement and if there is still a pension system in place, I will adapt my plans :)

I completely agree that nothing is absolutely certain.

Nevertheless, I would like to point out a common error in thinking about SWRs: Any SWR with a historical chance of success lower than 100%, is dependent on when it is applied. For example, a SWR with 4% had a 0% chance of success at the time of the Great Depression, not 90% or more. This is because the markets are not a perfect random walk – valuations matter! (see earlyretirementnow for a much deeper and better explanation than mine). Unfortunately one does not know where we are in the market cycle, however it should be clear that a 4% (S)WR late in the bull market probably has a lower chance of success than at the beginning.

CAPE based SWRs adress this problem to a certain degree, although it‘s not perfect.

Again, I don‘t say that there is any method that provides perfect safety, even a SWR with historic success rate of 100% might fail in the future. I‘m just pointing out that SWR probabilities are depending on the point in time and are therefore not constant.

That’s a good point, it’s an average over many periods. We could compute the average success for each year and indeed some periods would have extremely low chances of success even with 4% while other periods would have extremely high chances even with 5%. But we just can’t know where we are.

Hi MTPS,

do you plan to have any cash in your asset allocation once retired? I never tried yet but I know that it could take some time to release the cash on the broker account after a sell. If some cash is needed and is to be treated as the emergency fund during the accumulation phase, how much would you consider?

What would you sell each month/year? I guess if stocks are down a lot you would prefer to sell bonds, right? How would the rebalance work then? Just selling stocks again until the target allocation is back to desired?

Have you ever considered large cash allocation instead of bonds? Like 5 to 10 years expenses (it should be around or even less then 20%)?

Do you think it could make sense to create a personal rule like: if the avarage return from when retired to now is less then 3,5% * number of years then sell bonds or use the eventual cash reserve until it lasts (i’m probably missing compounding and inflation here but it’s just to give an idea)?

Hi Azz,

I currently do not plan to have a cash allocation. I will keep my emergency fund, which is currently 10K CHF (2 months of expenses).

I already had to sell some securities and get the money out from IB and it took only 2 days. I am not very worried about that.

That being said, I will probably have a larger emergency buffer while in retirement.

I would personally sell based on the rebalancing needs. So, if stocks are too much out of balance (positively), I would sell stocks, otherwise bonds. The idea is to keep the balance correct.

No, I have not considered a large cash allocation. The problem is that this will return 0% (likely lower) after inflation. So, this will require saving for many more years, for little benefits.

So ideas like that make sense, but they have many drawbacks and it’s extremely difficult to get a proper cash cushion. Big ERN talked about this on many of his articles, for instance: https://earlyretirementnow.com/2017/03/29/the-ultimate-guide-to-safe-withdrawal-rates-part-12-cash-cushion/

But it’s still a good idea. I have to run simulations about that. I will try to write an article about the results in the coming months.

You are deluding yourself if you think you can estimate how long or if your money will be enough

1. What do you do if you live 100+ instead of 83?

2. What do you do if inflation and market crashes eat your money at 72?

3. What do you do if your broker goes bankrupt at 67?

Look, yesterday my little garden was destroyed by hail. I’ve never seen such hail in my whole life until now, I didn’t think that such devastation was possible. But it did happen. Do you really think that your FIRE will hold? I can survive without my garden, but what are you going to do if your money is spent and you cannot work anymore or find another way to replace it?

1. He has extensively documented his thoughts on the probability of running out of money. At age 70 or 80, the capital will most likely have compounded to a far larger amount than what he would ever need. Of course, there future is uncertain. But working until age 70 does not change that. Neither does contributing to ponzi retirement schemes.

2. Inflation benefits business owners. Market crashes are an opportunity to deploy reserves. Inflation and market crashes do not eat capital. Think about the difference between capital and what you call money.

3. Shares are not held by the broker but by a custodian. The custodian holds the shares in the name of the owner rather than the broker. For this reason, the bankruptcy of a broker does not affect the shareowner. To mitigate operational risks, you can maintain relationships with several brokers.

1. The fact that he documented his thoughts won’t decrease the probability that he runs out of money. Paper can take everything, the internet even more. And yes working until later changes the issue a lot. If you retire at 60 instead of 40, the forecast is much safer. Instead of let’s say 50 years you need to predict 30. This is quite a difference don’t you think? Additionally you would have more money and decrease the chance that you run out of money.

2. Market crashes which never recover do eat your capital. Inflation can eat your capital too if the price of the asset class where you are not invested rises compared to the asset class where you are invested.

3. It’s not so simple. You can still lose your money or at least the money after a certain amount which is not protected It happened and it will happen again. Blind trust without knowledge is dangerous.

You have a quite simplistic view of how things work. Life tends to punish such plain attitudes and being broke when you are old is no fun, I can assure you of it.

Even if the disaster happens earlier and you can still earn money, you’ll end up wasting your best years and having to work in your 60s or 70s to make up for the missing money. Again not much fun here. Good luck.

Hi,

It’s an estimation, it means it’s not correct. It’s a matter of probability. I have talked at length about margin of safety and risk capacity. If you want your plan to last until you are 100+ or 200+, you can simply use that number.

You could not retire early and have your bank bankrupts and you would end broke all the way. There is no way to plan for everything.

My little garden was also destroyed by hail this weekend, this does not make reconsider my life :)

“My little garden was also destroyed by hail this weekend, this does not make reconsider my life :)”

It should, rare events do happen and we have no idea how often.

“You could not retire early and have your bank bankrupts and you would end broke all the way. There is no way to plan for everything.”

You would have a pension as a safety net, you would have investments where you wouldn’t fret about 3.5% or 4%. In fact you won’t care about return. You would keep part of your investment in cash (sure, negative return because of inflation). You would own your house (not the Swiss away) and have a couple of other houses (again, not the Swiss way) you own and collect rent, etc. You would have the FU Money.

The biggest issue with FIRE is that it doesn’t take in account rare events, making the whole thing a joke. Realistically you need a couple of times what fire spits out in order to really “retire”. You know you can retire when you have enough money so you don’t have to count it.

Thomas – Pension schemes can also go bust, who do you think pays for the state pensions? Young people. What happens when there aren’t enough young people to pay the pensions of increasing number of old people due to falling birth rates?

Where do you think the company pension funds invest the contributions? The financial markets.

A failing pension scheme would also be a rare event.

Unless you get paid in cash and store all the coins physically under your bed we are all subject to the similar risks FIRE or no FIRE. And in fact the value of that cash would be eroded away to nothing by inflation.

A failing pension scheme would also be a rare event.

No retirement plan is immune from rare events. This article simply presents an option and planning method which one can adjust according to one’s risk apetite and specific financial situation.

Clearly working until your 60 is safer, but if like many you don’t want to work all your life and are willing to take a bit of calculated and anticipated risk these kind of calculations above are the way to go.

Thank you for another great article. I’m an actuary so I’ve seen many of these types of articles but this is one of the best.

Hi James,

Thanks for your kind words!

And you make great points. It is true that pension schemes can go bust. It’s unlikely but not impossible to happen. And what will likely happen is that they will reduce significantly the benefits by the time we can touch these benefits.

So, it makes even more sense to try to have an alternative.

For sure a pension plan can go bust. What I said is you should own stock exchange investments, cash, physical assets and a pension plan. All of them For a rough estimation take the FIRE amount you think that’s enough and multiply in by 4 or 5 and don’t forget to spread the risk.

I’ve seen a lot of people who miscalculated their retirement cost by a lot. Increasing health cost, bad luck, you name it. Not funny.

Tnx for the good Article. Regarding the life expectancy one probably will want to calculate considering his/her partner. In my case, my wife is 5 years younger than I (and women in general live longer).

That’s an excellent point! It was implicit for me, but I should make that clear! Obviously, you want your plan to sustain all the people it concerns! And take the maximum duration :)