Happily Back to work after 1 year of retirement – Dror’s Story

| Updated: |(Disclosure: Some of the links below may be affiliate links)

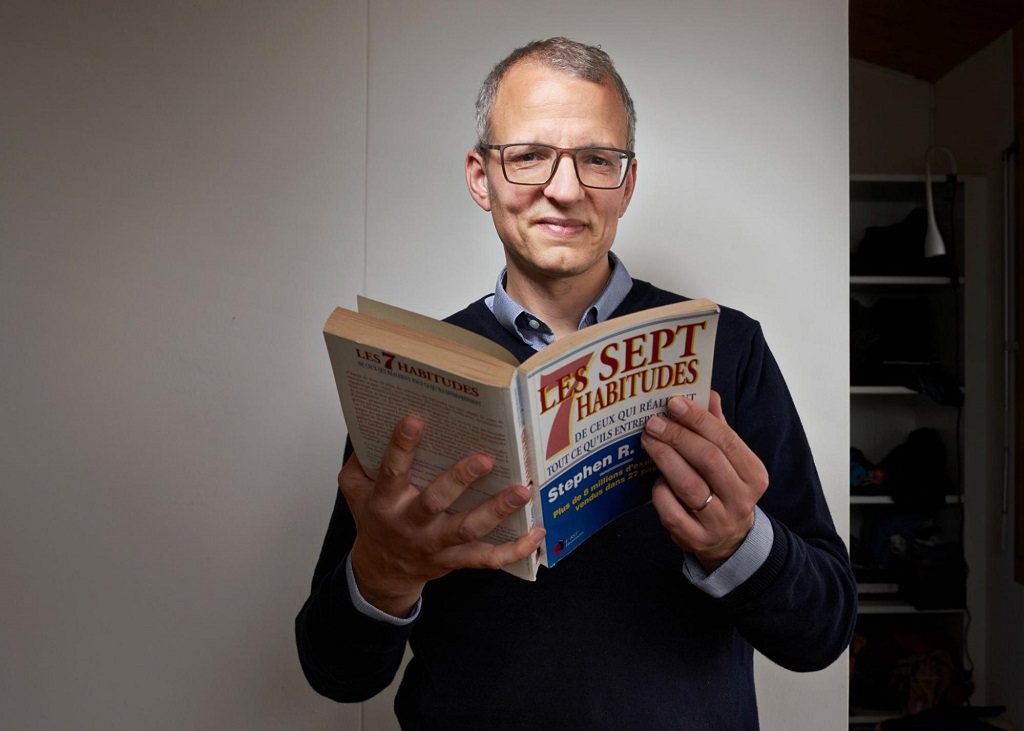

About a year ago, I interviewed Dror Allouche about his early retirement at 46. He had just left his career to focus on his hobbies. And it turns out one of his hobbies is turning into a coaching business now.

So, I figured it would be interesting for us to touch point again with Dror so that we know what is going on after early retirement. So, I interviewed him again.

Dror also agreed to give a special offer to the readers of this blog for his coaching business (more on that at the end).

So, we will see what Dror shares after this year of early retirement.

1. How is retirement going?

Thank you for asking Baptiste…

As a reminder, I stopped my operational work activity in November 2021.

The contractual part ended in April 2022.

So today, it’s been 1 year since I’m not dependent on a salary anymore! But I don’t consider myself a retiree.

I discovered the FIRE terminology late in life. But what has always resonated with me are the first two letters, “Financial Independence.” I was curious about the “Retire Early” part, but the further I get into my new life, the less interested I become.

I even have a pendulum swinging the other way. The more activities I do that I enjoy, with people I choose, and with constraints I impose on myself, the longer I hope to do it.

And that’s the case today. I’m learning and writing, and I’ve discovered a career and a passion for coaching.

2. Why did you go back to work?

I don’t feel like I’m going back to work. 🙂

I’m just pursuing my passions.

And that’s the greatest gift of financial independence: Having the time to find and do what you want.

I enjoyed my first career in corporate. This career took me from salesman to executive C-Level. I met brilliant people, traveled the world, and lived well.

But after 22 years, I wanted something else. And I couldn’t see myself continuing for another 25 years.

I didn’t know what I was going to do. I just took time to ponder.

And that gentle reflection (thanks to FI) helped me find my way.

I started writing on my blog optionstogrow.com. The blog resulted in a new community. I got specific requests for coaching on career projects, leadership behaviors, personal development, finding financial independence…

I enjoyed doing these coaching sessions. I dug around and found some notes in my journal from 2016. I already had plans to become a personal coach. This triggered me to launch my coaching practice.

There is a common thread between my previous career and the one I am starting. In the corporate world, I liked the leadership part (helping people to develop) and the business development part.

I’m lucky enough to be able to combine the two in my new career.

But with a big difference. I manage my time constraints as I wish.

I work an average of 6 hours a day between writing, learning, and coaching.

And it’s hard for me to say work because even if I didn’t make money at coaching, I surely continue doing it. 🙂

3. Is FIRE not working? Are you still financially independent?

I built my FI mainly with one ETF.

I invested regularly until July 2022 to exhaust my available cash.

I kept about 2 years of security in advance.

I’ve hardly touched my investments, including the dividends.

In 2023, I should cover “all” my expenses thanks to my new activities.

Now, when I look at the evolution of the markets on my main ETF.

2022 was very bad (around -17%), and 2021 was very good.

It’s too early for me to say if FIRE is practically working!

But to be FIRE, you have to believe in the concept. And for my part, in the long run, I strongly believe in the FIRE concept.

Finpension Vested Benefits is the best account in Switzerland.

Use the FEYKV5 code to get 25 CHF in your account!

- Invest 99% in stocks

Thanks to Baptiste’s advice, I even invest my second pillar directly in the markets through Finpension with a 60% stocks/40% bonds split.

So, yes, in the long term, I believe in FIRE.

I can also share that it is easier to live your FIRE when you are still creating income than when you are totally passive, especially in years when the markets are wobbling.

When I was in corporate, FI gave me a sense of freedom. I can say what I think. I wasn’t 100% dependent on my job.

My passion for coaching gives me that same freedom from my FI. I believe strongly in the system but am not 100% dependent on it.

4. Can people stop working?

I think it depends on each person.

But for me, I believe in the vital importance of having a rewarding intellectual activity.

I am inspired by older people who age well. And often, they have a rich and exciting professional activity. It has to do with the ability to do what you love, with the people you love, and where you want.

The danger is to do only that.

Hence the importance of knowing how to set constraints. “I don’t work more than X hours a day. ”

That allows you to accomplish all the other things you want.

5. Do you always recommend FIRE to people or FI?

I don’t recommend anything! Everyone finds their way.

I’ve always been drawn to financial independence. In a fast-paced world where the script is ingrained. (Study, work, retirement…)

Financial freedom offers something unique. The freedom to do what you want.

That, to me, is its greatest value.

So, if you can live this experience, live it.

For the retire early part, I believe more in pursuing one’s dreams and passions until one’s last day.

And for me, that also includes a career path I enjoy, where I learn every day, and where I can help others.

I aim to become the best version of myself and help others achieve what they want.

6. What does a day in your life look like?

There is a concept in psychology called “The Focus Illusion.” We tend to imagine that when we have achieved an important goal, all our other difficulties disappear.

Experts agree that this is not true. And this is my experience as well. Becoming financially independent doesn’t take away all the little and big difficulties in your life:

- the morning stress of making sure the kids are ready on time

- the extra pounds

- your relationship problems with your loved ones

- the teenage crisis of your first child

- your parents’ health problems

So when you become financially independent, not all your days are perfect. But creating perfect ones is easier because you have more control over your time.

So here’s what my days look like when everything goes right…(which isn’t always the case)

- Early morning wake-up call. Between 5 am and 6:15 am but no later than 6:45 am to help the kids get ready for school.

- I take time for myself in the morning when everyone else sleeps. Quiet time, breathing exercises, and physical activity

- We have breakfast as a family.

- When the kids leave, I spend quality time with my wife, often between 8:00 and 9:00 am.

- Between 9:00 and 11:00 am: creative time for the blog and my newsletter. Every Wednesday morning, I send out my weekly newsletter. The newsletter contains 3 minutes of reading and at least one self-growth idea. This is an example of a constraint that I force upon myself. This forces me to write with a deadline. And writing helps me clarify my thinking (one great example of Dror’s thinking)

- 11H00- 13H00 – Preparation and lunch with the family.

- 13H00 – Light nap, jogging, or walking in nature.

- 14H30- 17H30 : coaching activities.

- > 17 H 30: family time and fun.

- > 9:00 PM Bedtime with a book. Reading time.

7. Your best advice for beginning solopreneurs

I would say find something you love and learn to market yourself.

I love this idea of a solopreneur. We live in a unique time where technology allows you to do much with little investment.

- Dispatch your content on social networks automatically

- Define your availability slots and let your customers make appointments when it suits them

- Launch a blog, a newsletter…

A solopreneur can now have a lot of impact with little investment in money. And Baptiste, with this blog, is a perfect example.

8. How is coaching going?

I read somewhere that 80% of business coaches do not earn a good living. And I want to believe it. The barrier to entry is very low. Therefore, everybody can get started. And it’s hard to stand out.

But then again, financial independence is a huge asset for me. Unlike most coaches, I am not pressured to make this new passion lucrative.

So I take my time training myself by carefully selecting the people I want to work with. This brings me a lot of pleasure, and my clients must notice because my first quarter of 2023 suggests that I’m going to go straight into the 20% of coaches who make a good living 🙂

While it wasn’t my primary motivation, I’m confident this passion will become much more financially rewarding in the next few years than my executive career.

And if it doesn’t, that’s okay. My financial stability does not depend on my coaching practice.

9. Who can benefit from coaching?

I would say anyone who wants to progress.

Coaching offers a unique space for reflection that cannot be found anywhere else. Few people around you can give you the quality of listening and self-reflection a good coach offers. And it’s in this space that the magic of coaching is created. The client discovers new perspectives and gains clarity and confidence.

Coaching is hard to explain and easy to experience, which is why I offered a full 1.5-hour session for the first 10 readers. (see below)

10. Would you like to add anything else?

Congratulations, Baptiste, for your blog. Besides a busy job, you show us that it is possible to develop an interesting project.

Thanks to this, you help thousands of people better understand and manage their finances. And you offer a path to something priceless: financial independence and all the freedom it offers. Thank you!

Special offer from Dror

Dror is offering the first ten readers a special offer on his coaching.

The first ten responses will get a full 90-minute 1:1 coaching session with Dror.

Here is how to proceed: Email Dror at dror@optionstogrow.com with the title “I’m interested TPS” and a short presentation of yourself. Dror will send you a link to his calendar for the first 10 readers.

I tested one of his 90-minute coaching sessions. And I already got much more than I thought possible over such a short period. So, I think there is a lot of value in coaching.

Afterwords

Thanks a lot, Dror, for answering my questions, and thanks for the special offer for my readers.

This interview offers a great perspective that Financial Independence can bring the freedom to do new things. And these new things can be different than early retirement.

For instance, many financially independent choose to work in another field. But most people would not have chosen this path without being FI. So, financial independence offers new freedom of choice.

We should also mention that many people need intellectual challenges. And most people need at least some significant activities. So, if you do not plan well your retirement, you may end up burned out.

What do you think about the story of Dror Allouche?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Financial Independence and Retire Early

- More articles about Retirement

- Add some margin of safety to your FIRE plan

- Financial Freedom – Book Review

- Does the 4% rule work with low yield bonds?

“But to be FIRE, you have to believe in the concept.” – believing usually doesn’t work long term. What happens when you stop believing and eventually run out of money?

“Coaching is hard to explain” – actually it’s easy. It all comes down to find a way to take their money. This might sound easy, but think about the competition: psychologists, shamans, life coaches, you name it. As a corporate mensch with no entrepreneurial achievements this might be a bit challenging. Or not?

Cynicism is a normal emotion but it is would destroying. Instead of being so critical, look for things which may resonate with you. And if nothing resonates, move on because it is not for you.