Can you withdraw 4% of your current portfolio?

| Updated: |(Disclosure: Some of the links below may be affiliate links)

A widespread misconception about the Trinity Study is that people believe they will withdraw 4% of the current portfolio. If the portfolio is worth 1’000’000 USD this year, they can withdraw 4% of it, 40’000 USD.

But in reality, the withdrawal is based on the initial portfolio at the time of retirement. If you start with 800’000 USD, you can withdraw 32’000 USD. And then, you adjust the withdrawal every year for inflation. During the first year, this is the same thing, but these two methods are widely different in the following years.

But what would happen if you were to withdraw based on your current portfolio and not the initial portfolio?

Withdraw from current portfolio

I will assume you are familiar with the Trinity Study and how to retire based on your portfolio. Otherwise, you should read the previous article and come back here.

The basic idea of the Trinity Study is that if you withdraw X% (X being your withdrawal rate) of your initial portfolio every year, you should be able to sustain your lifestyle for a long time (30 years in the original study). The withdrawal is set once and then only adjusted for inflation. It means that you need to know in advance how much you will spend in retirement.

Many believe they can withdraw X% of the current portfolio, not of the initial portfolio. So, if the portfolio is 1’000’000 in the first year, they can withdraw 40’000. And if the portfolio is worth 1’100’000 in the second year, they can withdraw 44’000.

Even though this is not what the Trinity Study or the 4 percent rule is about, I think it is important to see what would happen if we do simulations when we withdraw based on the current portfolio instead.

Simulations

I will run simulations based on the Trinity Study with different withdrawal rates. The only thing I do differently is that the withdrawal amounts will be based on the current portfolio, not the initial portfolio.

For this, I use data from the U.S. Stock market from 1871 to 2020. I use different portfolios with stocks and treasury bonds. In all my simulations, I assume a TER of 0.1% per year.

I am using my tool to do these simulations. If you are interested in the tool and the data, you can look at my Updated Trinity Study article.

The output of the simulation is the success rate. Success is defined as not running out of money before the end of the simulation. A simulation ending with 1 CHF is a success. And the success rate is the percentage of successful simulations in the set of simulations.

Retirement of 30 years

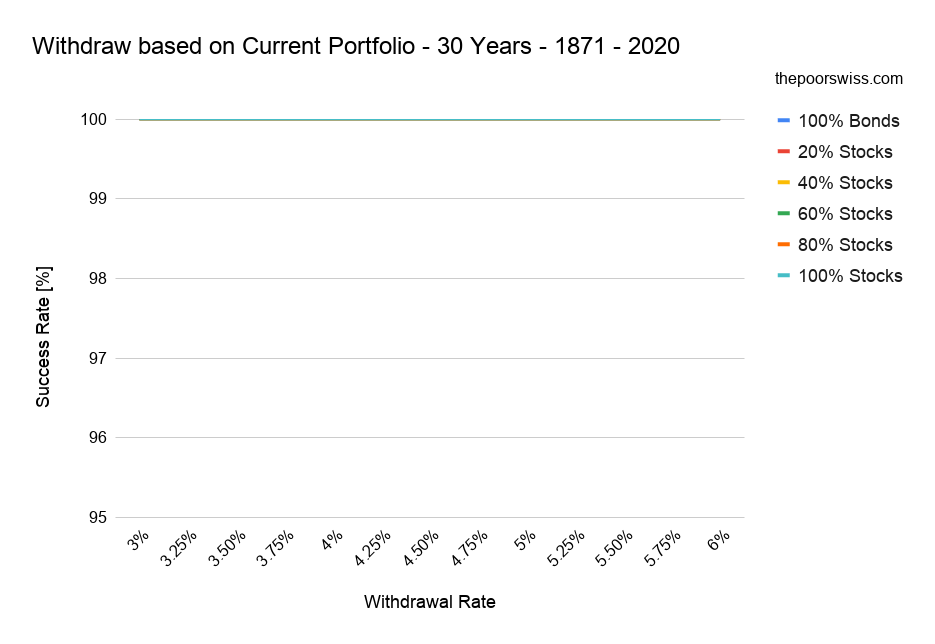

We directly start our simulations with a retirement of 30 years. This is a reasonable time frame for some retirement already. So, here are the results if you base your withdrawals on your current portfolio instead of the initial one:

As you can see, all the portfolios have a 100% chance of success! Even with a 6% withdrawal rate! This is significantly better than the standard rule of the Trinity Study!

Does that mean we just found an awesome way to sustain our lifestyle while withdrawing more money with a higher chance of success? No!

If you think about it, as long as you withdraw a percentage of your current portfolio, it can never reach zero. For instance, with a 4% withdrawal rate, even 100 USD can sustain for almost ever. You can withdraw 4 USD in the first year, then 3.84 USD, then 3.68 USD, and so on. At some point, you may reach zero since you will not be able to split a cent.

The main problem with this simulation is that it supposes we can live from any amount of money, including 1 cent. If you could live on 1 cent a year, you would not need to rely on the Trinity Study to retire.

So, we need to introduce a minimum of money to live. This will be the bare minimum to survive. It can be lower than your current planned expenses on retirement, but it still needs to be reasonable (because you will need to stick to it).

Retirement of 30 years with a minimum

We can rerun our simulation by introducing a minimum into the system. However, we still have to choose a minimum. What makes sense is to use a percentage of the original portfolio as the minimum for the simulation. So, if you use 4% and have a 1’000’000 CHF portfolio, your minimum will be 40’000 CHF to spend in any given year.

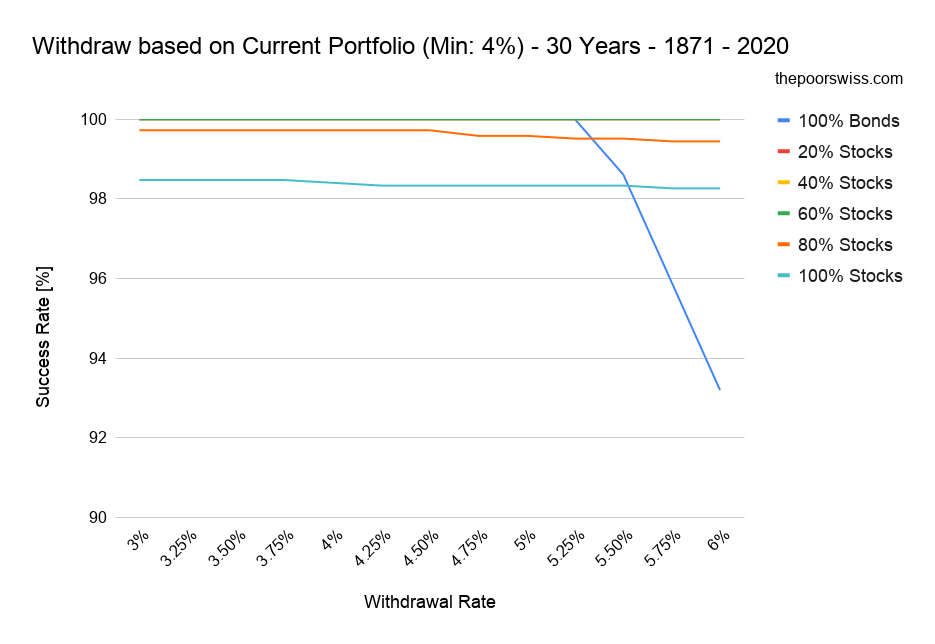

So, here are the results with withdrawals from the current portfolio and a minimum of 4%:

This time there is a little variation. But the performance is still excellent, significantly better than a 4% withdrawal rule. So, can you withdraw 6% of your portfolio yearly with a minimum of 4% of your initial portfolio?

Well, not really. There is still one important piece missing: inflation!

Bringing back inflation

A minimum is necessary for this method, but we need to account for inflation. After 30 years, it is unlikely that the minimum is still relevant. We only adjust the minimum for inflation, not the withdrawals, based on the withdrawal rate and current value.

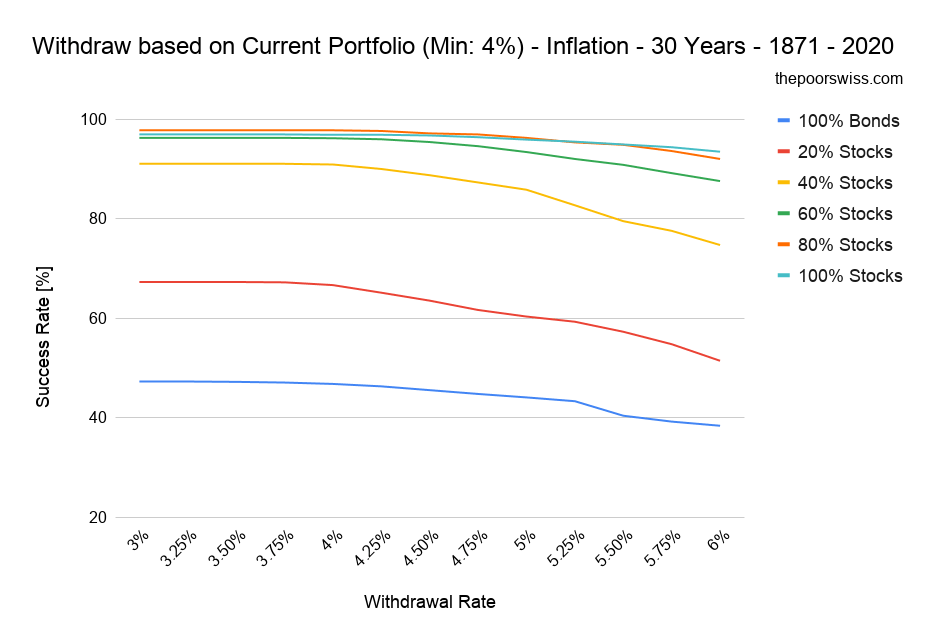

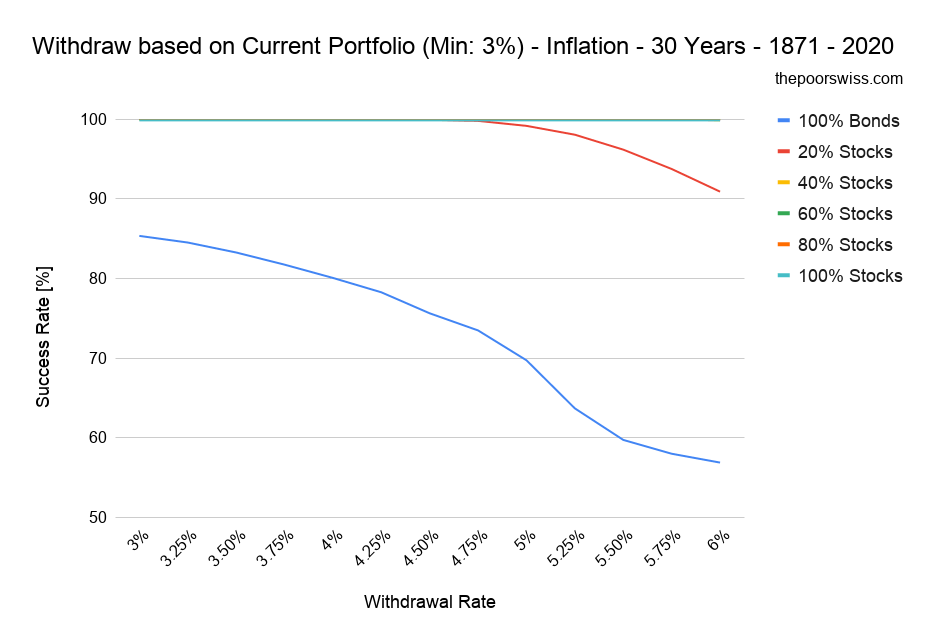

So, here are the results when we adjust the minimum for inflation, month after month, using Consumer Price Index (CPI) data from the United States:

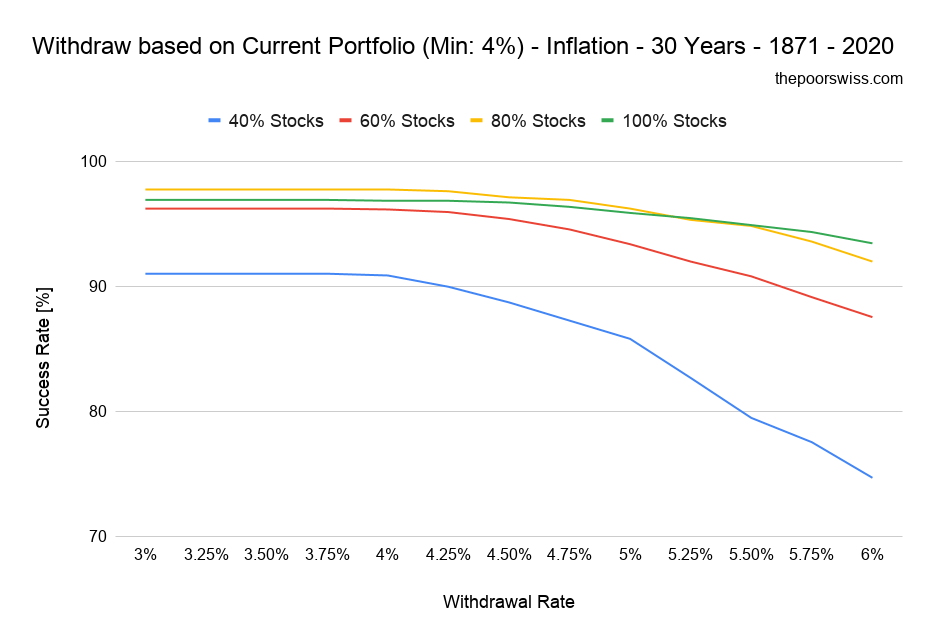

We can see that the results are already significantly more interesting. And we can also see that portfolios with less than 40% of stocks are not performing well. So, we can start by removing these portfolios:

We can already see better the different portfolios now. We can observe a few things on this graph.

First, there is a flat line between 3% and 4%. This is logical since the minimum we withdraw is 4% per year. So, we cannot be better than 4%. We will see what happens when accounting for a minimum of 3%.

The second interesting fact is that, past 4%, the loss of success rate is not extremely significant. Of course, the success rate is decreasing, but this makes sense since we withdraw more money from the portfolio every year, especially in the early years. But this also shows that we can withdraw significantly more than the minimum and not risk too much. For instance, we can withdraw 6% of our 100% stock portfolio every year and reach a 93.4% chance of success with a minimum of 4% withdrawal. This is still worse than a pure 4% withdrawal rate by a few percent. But it is not significantly worse.

This shows that we generally can withdraw more than people think without depleting the portfolio. This can show the value of a flexible withdrawal rate range. For instance, a 100% stock portfolio with a 5% dynamic withdrawal rate and a minimum 4% withdrawal will still give a 95.9% chance of success.

Here is what happens if we make the minimum 3% of the initial portfolio, adjusted each month for inflation:

Except for portfolios with 100% bonds, all portfolios are performing well in this situation. This is logical since we have reduced the minimum withdrawal to 3%. A 3% withdrawal rate is very conservative and has a high chance of success. This shows that the most important parameter is now the minimum, not the withdrawal rate.

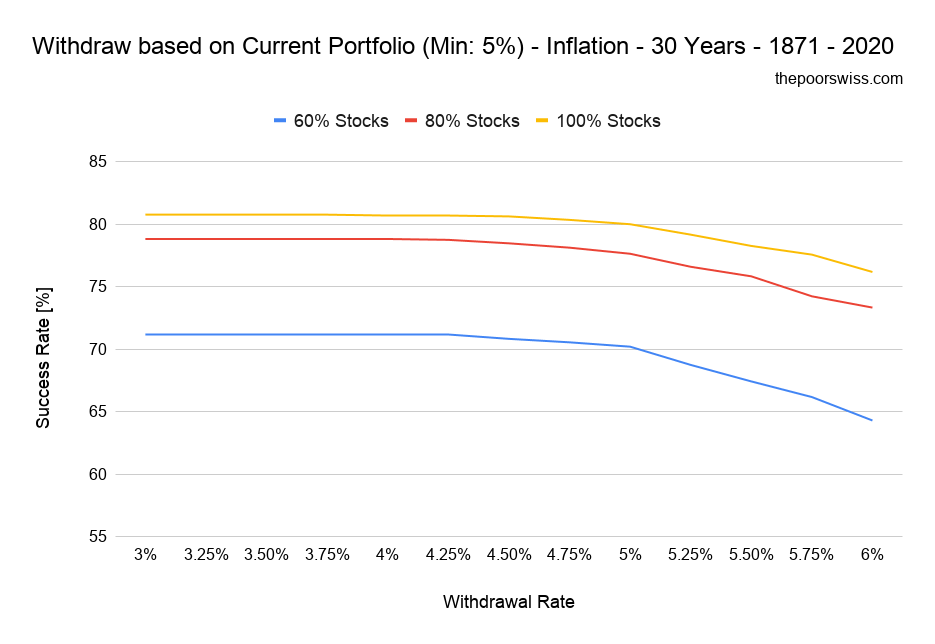

To make sure, here are see the results with a minimum of 5% of the initial portfolio:

We can see that a minimum of 5% withdrawal is too aggressive. Even with a portfolio fully invested in stocks, we would have barely more than an 80% chance of success.

Retirement of 40 years

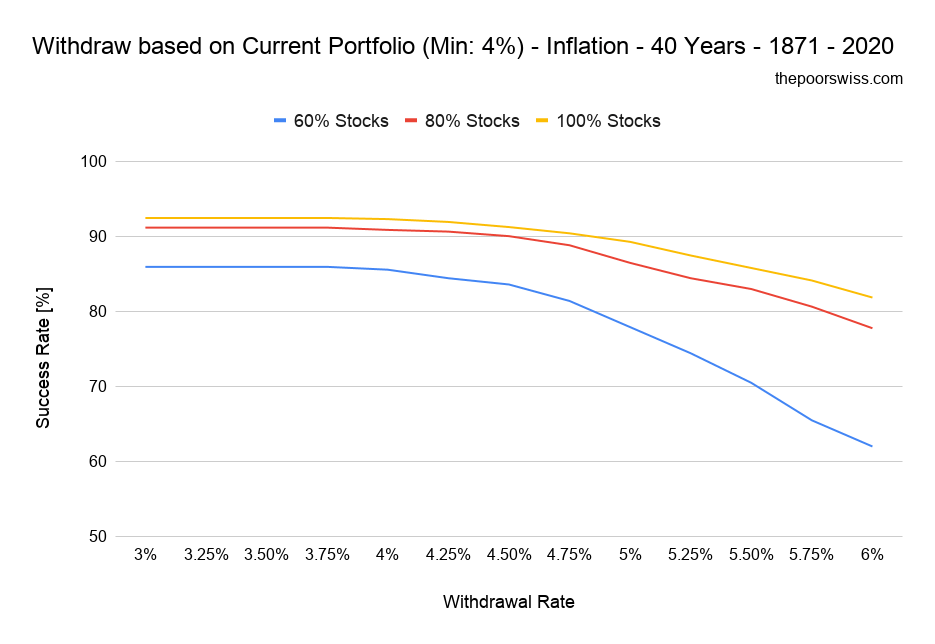

We continue our simulations with a retirement of 40 years. With the same parameters, here are the results for 40 years:

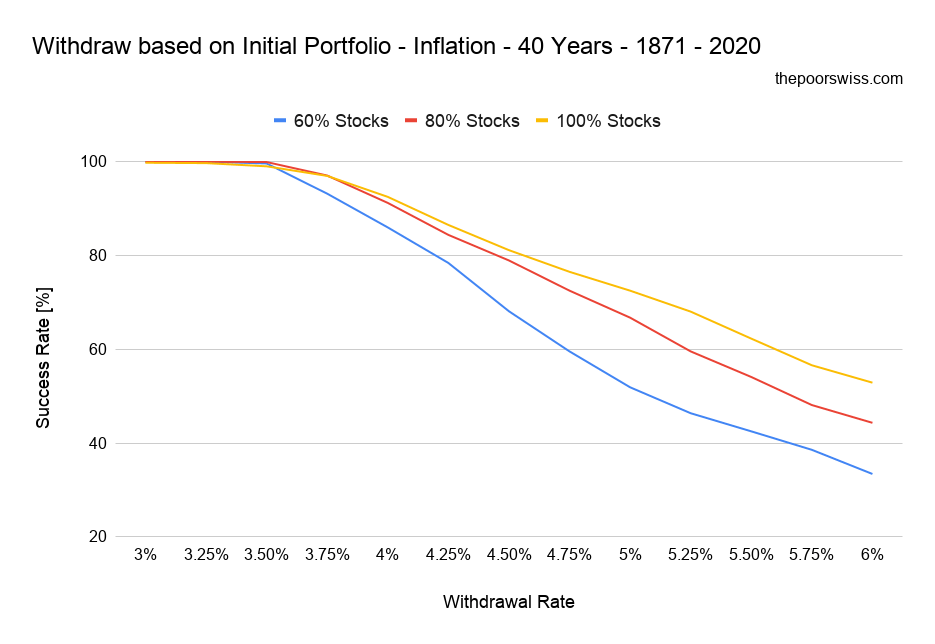

We can see that the method holds quite well even for 40 years. For reference, we can compare it to the standard rule of withdrawal of the Trinity Study with the same parameters:

We can observe several things when we compare both graphs. First, for low withdrawal rates, the standard withdrawal rule is significantly better. It is entirely normal since we are using a minimum of 4%. A withdrawal rate of 3% of the current portfolio does not make sense when the minimum is 4% of the initial portfolio.

The second point is that the success rates with higher withdrawal rates are better with this new method than the standard Trinity Study method. Why is that?

The reason is that in the early years of the simulation, we can take out a large percentage (the withdrawal rate) of the current portfolio. But as soon as this reaches a small point, we revert to 4% of the initial portfolio. So basically, we revert to the 4% rule! At high withdrawal rates, we will withdraw less than with the standard retirement method once we reach the minimum.

Are we withdrawing more?

Now, are we withdrawing more than with the standard withdrawal rule? We have seen that at higher withdrawal rates, at some point, we will withdraw only 4%, but what would be interesting is to see if we are withdrawing more money with this method.

So, I have recorded how much is being withdrawn on average for each year of the simulations. I have only counted successful simulations in this average. The simulation started with 1000 USD.

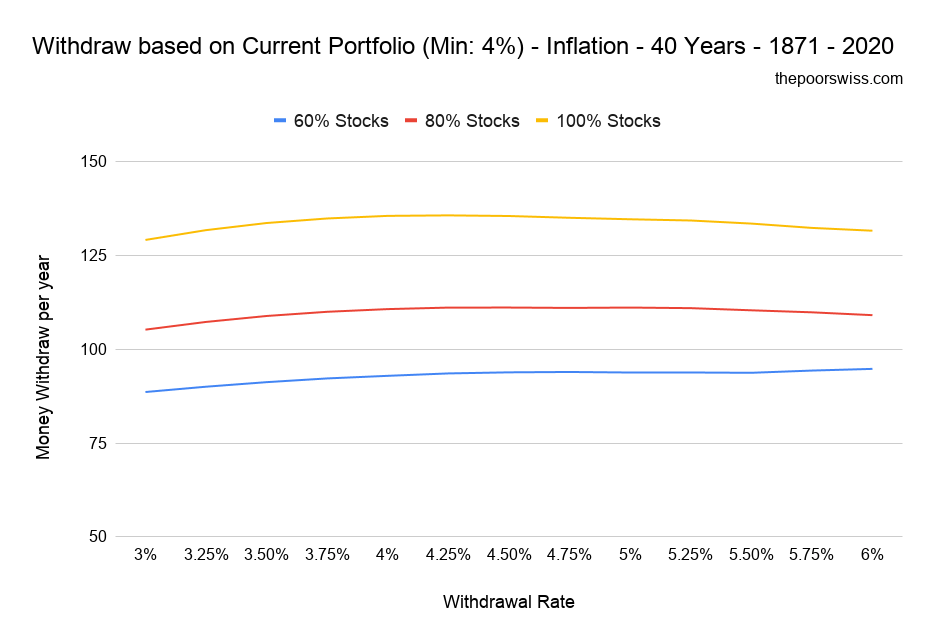

So, here are the results for the average money withdrawn per year with the new method of withdrawal and a 4% minimum withdrawal (based on the initial portfolio) and 40 years:

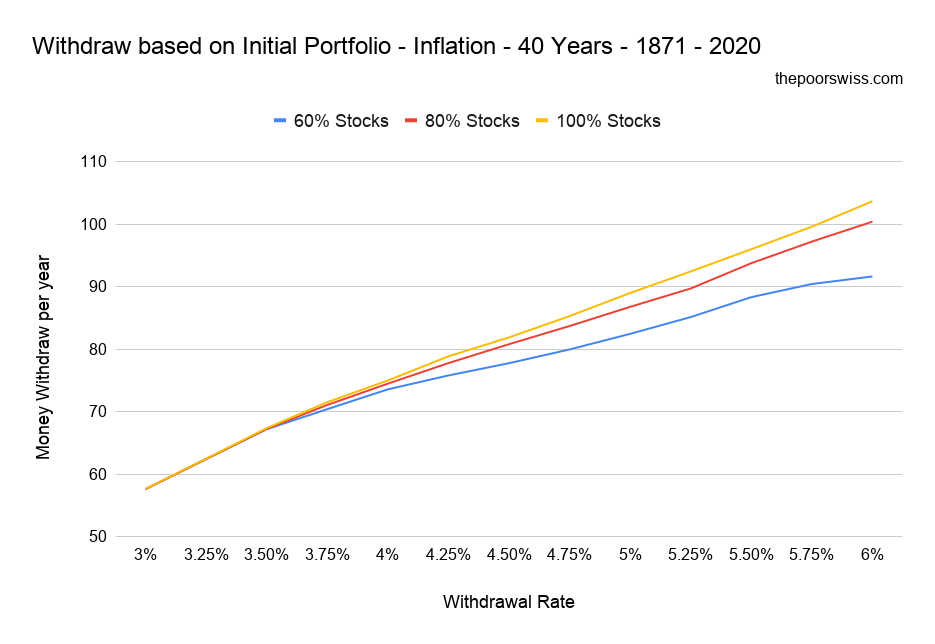

And here is the same information but for the standard method of withdrawal:

We can observe several things based on these two graphs. First, we are indeed withdrawing more money from the portfolio. In some cases, they are getting 50% more on average. This is the goal of this retirement method. But the withdrawal rate itself does not make much difference. What matters the most is the minimum. For the standard withdrawal method, the money we withdraw per year entirely depends on the withdrawal rate.

So, we can say that we can withdraw more money without impacting the success rate too much. However, this will entirely depend on the minimum that we use. And it means we will get some very different years. We are likely to have years when we can spend double what we will be able to spend in the following year. This could be an issue for people that are not flexible with their spending.

Worst duration

Finally, we also need to look at something else. Many people only take the success rates of each set of parameters into account. But we should also look at the worst duration of each set of parameters. Sometimes, it is better to retire with a lower success rate but a significantly higher worst duration. The worst duration is how early a simulation can fail.

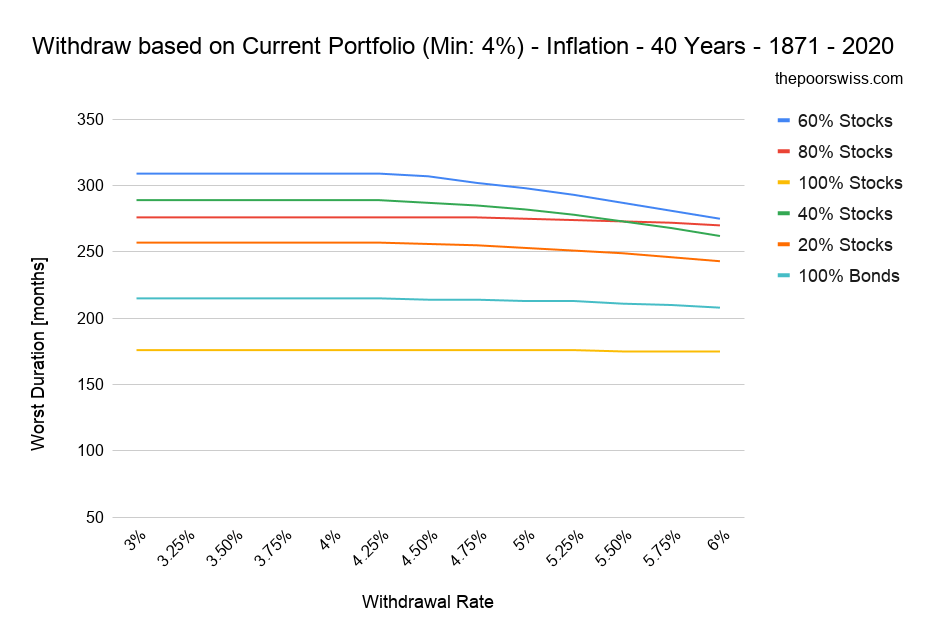

So, here is the worst duration with this new method for 40 years of retirement:

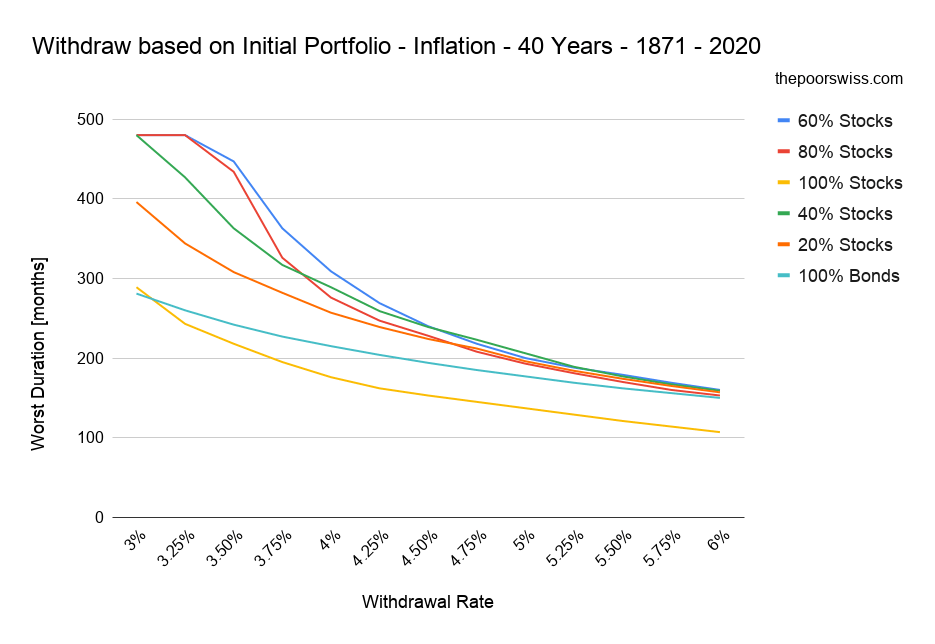

And we can compare against the standard method of withdrawal:

We can see that these two graphs are very different. The main difference is that the current portfolio withdrawal strategy depends almost entirely on the minimum you choose, while the standard method of retirement depends entirely on the withdrawal rate.

So, by using this method, you are moving the problem from choosing a withdrawal rate to choosing a minimum and sticking to it.

The dangers of flexibility

This method can work, but only if you stick to the minimum you have chosen.

Many people believe they can be very flexible in terms of spending. They could cut their vacations, eat less outside or stop spending on theater. And in some cases, this is true. But in most cases, people grossly overestimate their capacity to be flexible.

The main reason is that if you are used to spending more for several years, it will become difficult to reduce that level of expenses. The more good years you have, the more difficult it will be to spend less.

And flexibility is not always quick. If you have moved into a bigger house, you cannot move out once a bad month comes and you do not have enough money to pay the mortgage interest. It is an extreme example, of course, but not an impossible one.

People can probably handle a difference between 4.5% and 4% in withdrawal rate as flexibility goes. But most people would not be able to change their habits enough from 5% to 4%, even less from 6% to 4%. So, if you are planning a high flexibility level for your retirement, I would recommend being careful!

Conclusion

Since many people believe that they should withdraw based on their current portfolio instead of based on the initial portfolio like the initial Trinity Study results, I have simulated what would happen if we did withdraw based on the current portfolio.

I believe it is possible to retire by using this method. However, you need to set a minimum amount of money to withdraw. This will be defined by the bare minimum of money you need to survive. When the years are good, you can withdraw more, up to your withdrawal rate. But when the years are based, you will only withdraw a small amount to survive.

The advantage of this method would be to be flexible. You can withdraw more money and enjoy a higher lifestyle when times are good and go back to a smaller lifestyle when the times are rough. And this would not lower your chances of success too much.

The big problem with this method is to choose a minimum. It is even more complicated than choosing a withdrawal rate, and you still have to choose a withdrawal rate. And on top of that, you have to stick to the minimum. If you enjoy several years in a row where you can withdraw more money, you are unlikely to be able to go back to the previous level. And in that case, you will be in trouble. Because this method is only as good as the minimum you have chosen.

If you chose a conservative minimum and a slightly higher withdrawal rate, for instance, 3.5% and 4%, I think this method would make sense. But it would not make sense to go with something like 4% and 5%, especially in the long term.

If you have suggestions for simulations like this, let me know! And if you want to read more simulations like this, I suggest you read my simulations about low yield bonds.

What did you think of these results? How do you plan to retire?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-book

I’m enjoying your series of posts related to the Trinity Study and Withdraw Rates.

Say you were already at retirement age according to Swiss law and that your withdraw rate determines that for the following year you should withdraw CHF 100,000, would you deduct pension payments (AVS payments from pillar 1 and pension payments from pillar 2) from your required withdraw amount before you decide how much of your equity allocation to sell to fund the difference?

I guess in broader terms, given you’d likely include your AVS and pillar 2 in your bond allocation, payments from these investments should naturally be included within your withdrawal amount.

Also, if you had lump sum payments (from pillar 3 or from 1e) coming your upon retirement would you invest them according to your allocation, or keep them and withdraw less than your withdraw rate that year?

It’s likely that some people’s lump sum payments would be greater than the figure they would need to cover their expenses that year so they may want to invest some and use the rest for yearly expenses.

Hi Nick,

Thanks :)

Great questions!

* I indeed include the second pillar into my net worth since I intend to get the lump sum (if it’s still available when I retire). Same for my third pillar. I will invest all this money according to my asset allocation and then live from it. Of course, the first year, I will use some of this cash to live and invest the rest.

* I do not include AVS into my bond allocation since it’s impossible to get a value from the first pillar.

* If you intend to retire at legal age, you should definitely remove AVS pension from the expenses. For instance, if you spend 100K a year and get 40K a year in AVS, you only have to withdraw 60K a year.

* If you take the second pillar as a pension, remove it from the net worth and do the same as done for the AVS

Let me know if that does not make sense :)

Thanks for your reply. All makes perfect sense.

Apologies as some of my comments are relevant to several of your blog posts on pillar 2 vs cash, and tax considerations but I think they follow naturally from considering what your final net worth needs to be before beginning the withdrawal phase.

For those of us looking to reach financial independence prior to the legal retirement age I think that pillar 2 requires special consideration when accounting for their value towards “current” net worth. They are extremely illiquid (other than in special situations like home ownership, self-employment, emigrating) until retirement and so can’t be used to rebalance your portfolio and buy more stocks after market crashes, and then they become extremely liquid but subject to capital withdrawal tax. I don’t suggest to alter the accounting value rather it’s just good to be clear in our minds on the difference compared to more liquid cash or bonds.

It will be obvious to you and is now clear to me after some research but others should make sure that they factor in the capital withdrawal tax (which can be 2-30% depending on the size of the sum and your canton) when assessing how much of a lump sum will be left to invest after tax.

Also, given capital withdrawal tax is progressive it pays to be very strategic to stagger the payouts as much as possible to minimize taxes. With pillar 3a being allowed to be paid out up to 5 years early from swiss retirement and any vested benefit accounts being able to be deferred for up to 5 years. Of course tax laws can change in the future and the staggered benefit may not be possible.

Finally, on trying to reach a target net worth as fast as possible or reaching a larger pot by legal retirement I find the subject of buy backs very interesting. If someone is lucky enough to have a high enough salary to benefit from a 100% investable pillar 2-1e plan then it pays to contribute to this as early as possible to benefit from an immediate return close to your marginal tax rate from reduced income tax that year, and reduced wealth tax on this aspect of your equity exposure until retirement, but of course keeping in mind there will be a withdrawal tax at the end.

Then for pillar 2, buy backs should be as late as possible prior to requirement given the capital return will be close to zero anyway but you still get to benefit from reduced income tax that year.

Personally, I’m balancing my investments across pillar 2-1e buy backs in a 100% equity plan and personal equity investments in the Vanguard VT global equity ETF, and I have my pillar 3 setup in 5 accounts with VZ all with a 100% equity global allocation in passive index funds.

Sorry that was a lot but your post really got me thinking!

It’s entirely true that we should account for the withdrawal tax of the second pillar. And there is no rebalance opportunity for the second pillar, as compared to cash and bonds. Ideally, you should avoid withdrawing it at the same time as your third pillar for instance.

If you have a great second pillar, it is indeed more interesting to do buybacks. In my case, my second pillar totally sucks and I have withdrawn money from it already so I do not have tax advantages in filling it back.

I have been wondering this exact question recently, thank you for posting this analysis!

I am glad it was useful :)

I would like to see wha happens if I save the difference when I can withdraw more than the initial 4% and use the saved money in down years instead of withdrawing from my portfolio? In my head it seems that could be good, but i’m no able to simulate it ;-)

Oh, you mean if you could withdraw more than 4%, you withdraw it but only spend up to 4% and then use the leftovers during the down years?

I do not think it would work because you are going to have too much money out of the stock market. And this money out will not even match inflation.

If you have a great year with 8%, it means you are going to get 8% out of the portfolio instead of 4%. Sure you could use some of this money in down years if necessary.

Now, I have not simulated this, so maybe my expectation is wrong :)

But I think you would be better off with a large cash buffer (on top of the portfolio, not part of it) and use this during the down years in order reduce the effective withdrawal rate. But this is not perfect either since you have to accumulate more money to retire and have to keep the money out of the stock market.

In general, the best way to lower your risks is to lower your withdrawal rate.

I’ve always made my calculations based on the current Portfolio so thanks for your analysis, I’m having a hard time keeping track of the initial amount. I’m also one who can stick to the minimum I set per year (at least for now). Being in Switzerland, if you retire early and you don’t take into account the 2nd pillar, 3rd pillar, AVS into these calculations don’t you think these would largely compensate the withdrawal strategy based on a current Portfolio?

Once you get to your retirement age then you would get all these different income sources on top of your stock portfolio minus the taxes?

I think it’s still safe to base a strategy on current portfolio knowing one day you’ll get extra income when you reach 65.

Hi Fire flav,

That’s a very good point with the retirement accounts. I personally account for the second and third pillars into my net worth. But I do not account for AVS.

It’s true that once AVS kick in, your expenses will go down significantly. As such, this should greatly help your chances of success.

But it will depend on how early you want to retire. If you want to retire at 30, you should not count on the current portfolio. But if you want to retire at 50 and get AVS at 67 (estimated future age), you can afford a current portfolio strategy.

Does that make sense?

yes it does make sense. Thank you

What about taxes? With every withdrawal, you may have to pay taxes on it, right?

This means that we won’t be at 4% withdrawal unless I’m mistaken, but a bit more.

Depends on the country you are living in. In Switzland you pay no taxes on capital gains. You are only taxed on dividends.

Hi Seb,

I am assuming we are withdrawing from an investment portfolio here, not from pension accounts.

As mentioned by Zueritram, we should not pay capital gains taxes on these withdrawals.

That was the point.

But as your wealth is based on several 2nd and 3rd pillars, don’t you think that you should include taxes in your FI number ?

Oh, I get it now :)

Yes, you should probably account for taxes for your second and third pillars in your FI number. So, if you expect to pay 8% in taxes for your third pillar, you should only account for 92% of the value of your third pillar in your FI number.

Love your simulations, keep posting them.

Thanks Fred, I am glad you like them :)