Does the 4% rule work with low yield bonds?

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Many people are using bonds in their portfolios to make them less volatile. And many people are basing their retirement on the 4% rule. But bond yields have never been so low. So how does the 4% rule work when yields are lower?

I try to answer this question in this article. I simulate the chances of success with the 4% rule with different bond returns. The idea is to lower the historical interest rate to see what would have happened.

This is only a simulation, of course. But given that the recent average bond returns are much lower than historical returns, it is interesting.

This is something that many people suggested. If you have bonds in your portfolio, this is an interesting question.

Historical Bond Yields

First, are bond yields so low these days? We know they are low. But compared to the historical average, is it that bad?

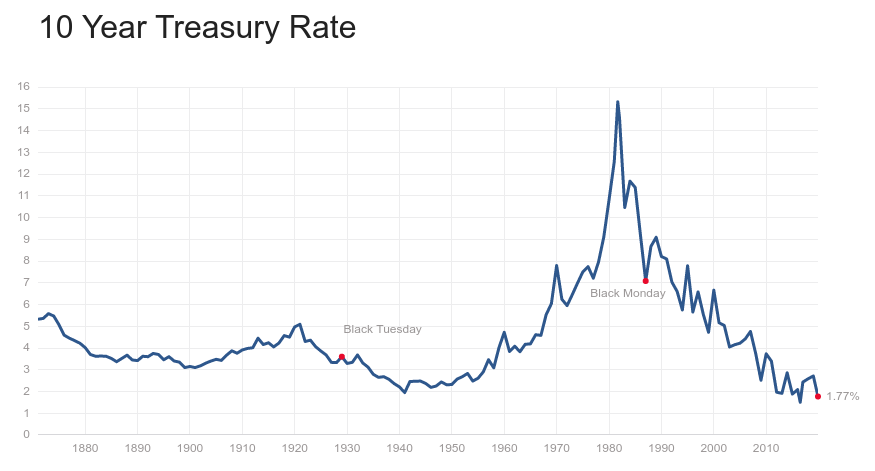

For reference, here are the historical yields of United States 10-Year Treasury Bonds:

Since 1860, the average yield has been 4.55%. Currently, the yields are 1.77%. And the lowest ever recorded yield was only three years ago, at 1.55%. So, yes, the current rates are historically very low.

That is not to say that the rates will not go lower or will not go back to a higher point. But it is important to note that current yields are much lower than the average historical yield.

In historical simulations of retirement withdrawals, the rates are much higher than the current rates. So it is a good concern about what would have happened if the rates were lower.

The 4% Rule

By now, most people should be familiar with the 4% Rule from The Trinity Study.

The study showed that by withdrawing 4% of your initial portfolio every year, a portfolio could be sustained for up to 30 years. They tested many different portfolios and many different portfolios.

I have recently published updated results for the Trinity Study. These new results take more recent data into account. And I also tested for more than 30 years of retirement.

For this, I have gathered historical data about the stock market. And I have written a program to simulate the success rate of a withdrawal rate based on historical data.

So, today, I use the same data and code for these experiments. I use the data from 1871 to 2018. And I simulate the success rates for various withdrawal rates. I simulate for 30 years of retirement. It is the most used simulation period for most people.

I use yearly rebalancing in all my scenarios. I have already evaluated different rebalancing methods in retirement if you are interested in more details.

Reference Results

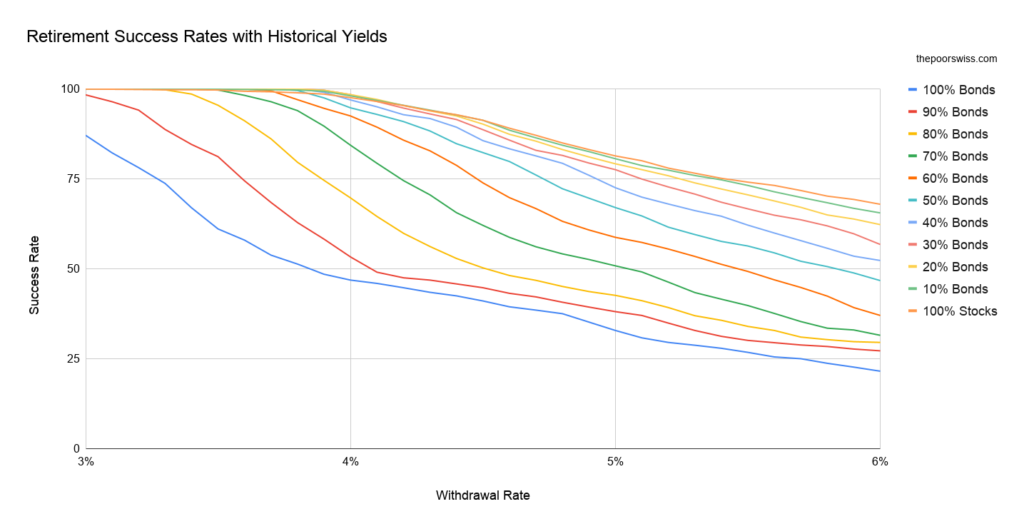

For reference, here are the results with the historical yields:

These results are the standard success rates that we are used to for basic withdrawal rates. Since there is a 25% chance of failing for more than 5%, I will remove this from future graphs. Withdrawal rates between 3% and 5% are the most reasonable.

There are already a few things we can learn from this graph:

- You need at least 40% of stocks if you want a good chance of returns with a 4% withdrawal rate.

- The more stocks you have, the higher the chances of success you will have with a 4% withdrawal rate.

- Below 4%, bonds slightly increase the chances of success compared to 100% stocks.

- If you want to use a withdrawal rate higher than 4%, you will need a higher allocation to stocks.

If we change the yields, the portfolio with 100% stocks will not change. But it remains a good indicator of the maximum returns. And it is also the highest chance of success.

Yields fall 10%

For our first simulation, we see what happens if yields fall 10%. Since bonds are less risky, their negative returns are lowered by 10%. For instance, a 2% return becomes 1.8%. And a -3% return becomes -2.7%.

In this scenario, the average yield would be about 4%. It is still significantly higher than the rates of the last decade.

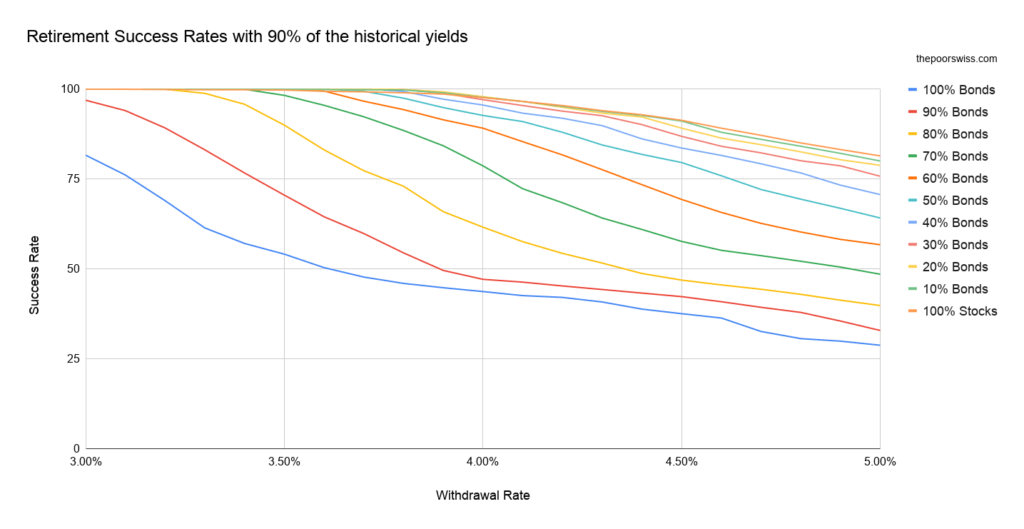

Here is what would happen in that scenario:

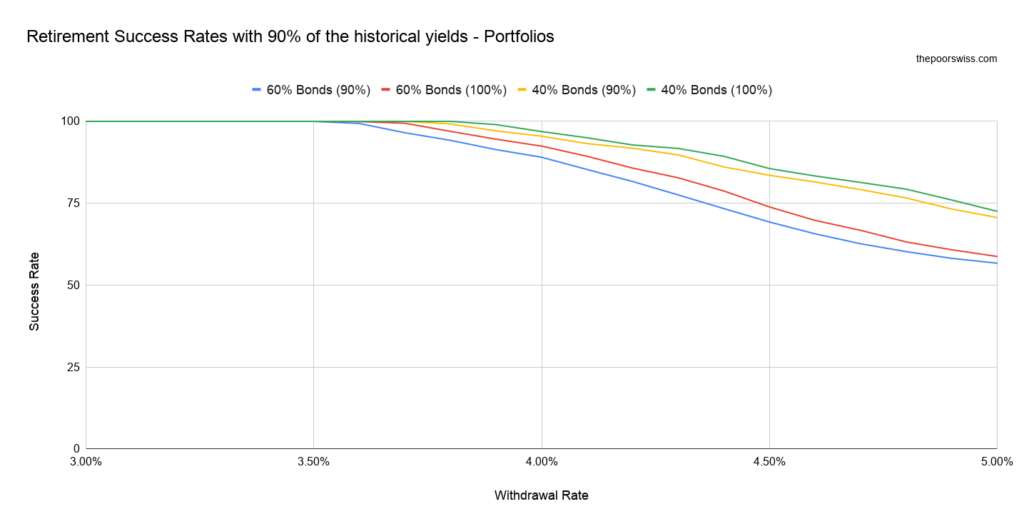

It is difficult to see the differences here. But all the portfolios with bonds did slightly worse. We compare the results with the most popular portfolios with bonds:

- 40% Bonds / 60% Stocks

- 60% Bonds / 40% Stocks

Depending on the withdrawal rate, your success rate can decrease slightly. But it will not be too bad. The 60% bonds portfolio success rate only fell by 3.4%. And the success rate of the more popular 40% bonds portfolio only fell by 1.4%. It is quite reasonable.

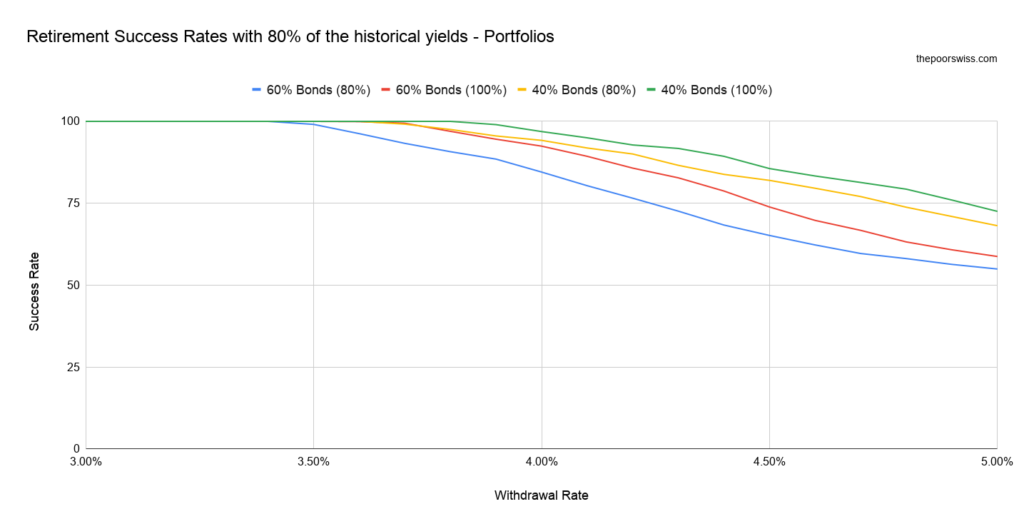

Yields fall 20%

We now see what happens if yields fall by 20%. In this scenario, the average yield would be about 3.6%. It is still higher than the yields of the last decade.

Here is what would happen in that scenario:

This time we can see that the success rates are decreasing significantly. Here are the differences between the two big portfolios:

This time, we can more clearly see the difference if the bond yields were to fall 20%. The 60% bonds portfolio is already falling 8% in that scenario. It is becoming a significant risk for that portfolio. But the 40% bonds portfolio is only falling by 2.6%. It is still something that most people should be able to handle.

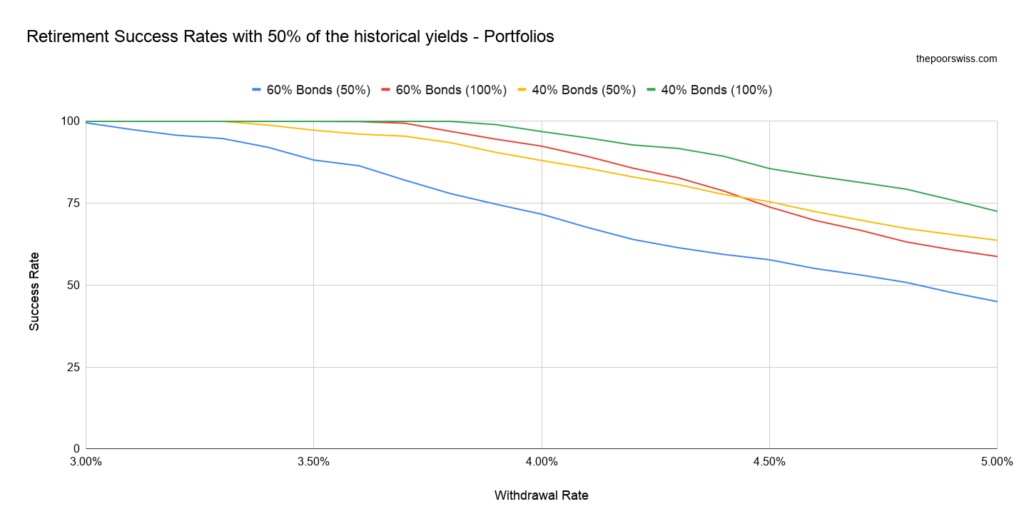

Yields fall 50%

We can also take a more drastic situation. What would happen if yields declined by 50%? In this scenario, the average rate would be about 2.25%.

You may think that a 50% reduction in rates is an extreme situation. But the yields of the last decade have been even lower than this. So I do not think this is such an unreasonable scenario.

Without further ado, here is what happens in this scenario:

There are some significant changes in this scenario. Some of the portfolios are not safe anymore. Here are our two portfolios in detail:

The 60% bonds portfolio has now lost a 20% chance of success. But the 40% bonds portfolio only lost an 8% chance of success. It is better than I would have thought. The loss of an 8% chance of success is not something we can ignore. But it is still something that can be handled. Reducing the withdrawal rate is one way to make it better.

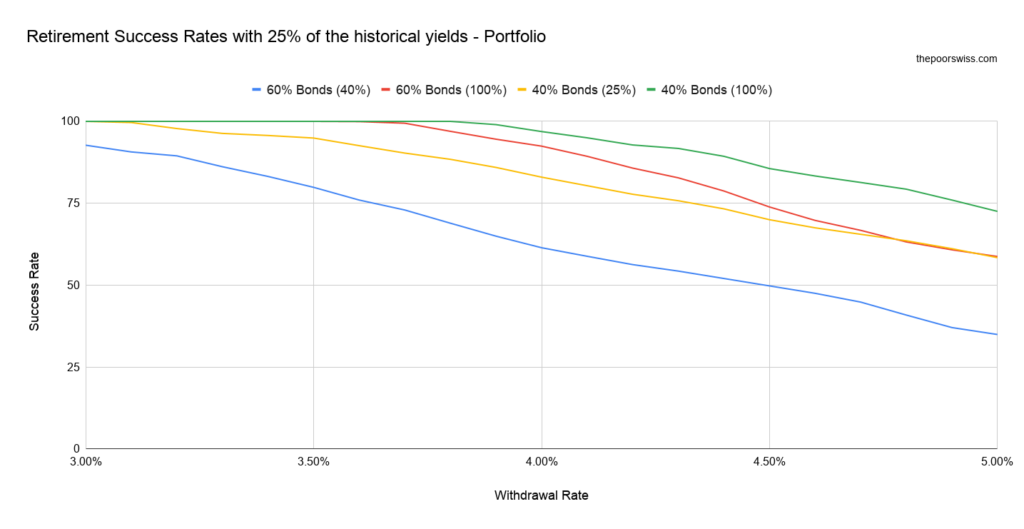

Yields fall 75%

We can take an even more drastic situation. What would happen if yields fall by 75%? In this scenario, the average rate would be about 1.13%. This is finally lower than current yields.

Now, I do not think this is a scenario that will happen. But this is still interesting to see. While I think a 50% loss is realistic, a 75% loss is too much to worry about. But we never know!

So, here is what happens:

Portfolios with a lot of bonds are taking a very serious hit. With a 75% loss in returns, they are rarely returning more than the withdrawal rate.

Here are the details:

The 60% bonds portfolio lost a 30% chance of success with a 4% withdrawal rate. It is now around a 60% chance of success. It is very low. The 40% bonds portfolio lost only a 14% chance of success. It is significant, but with a reduced withdrawal rate, this is still working.

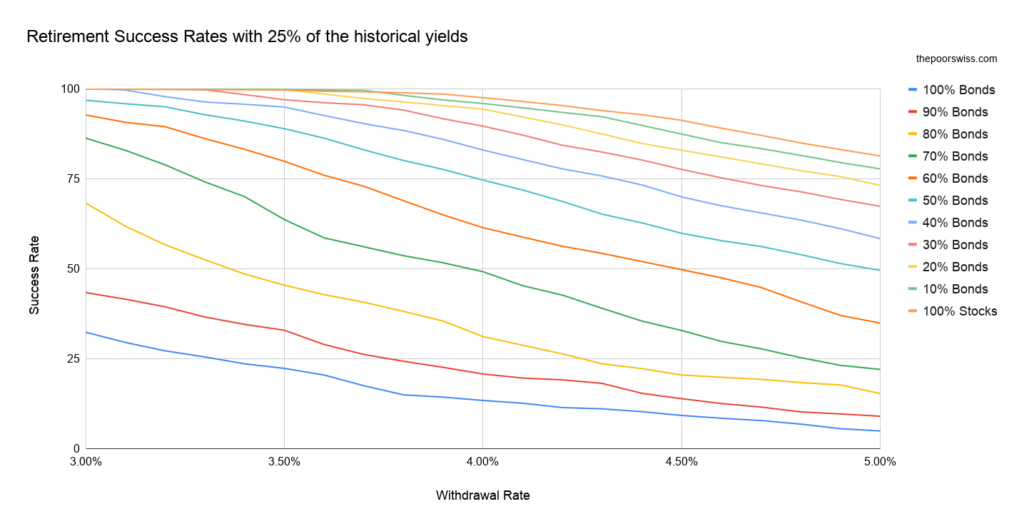

Yields fall 90%

We can also take a final scenario. What would happen if the bonds returned 90% less than their historical average?

We are now looking at an average of 0.455% returns. Since interest rates were never that low, this is not a realistic scenario. It could happen. But it would take a long time for this to happen. And rates are unlikely to stay at that level for a long time.

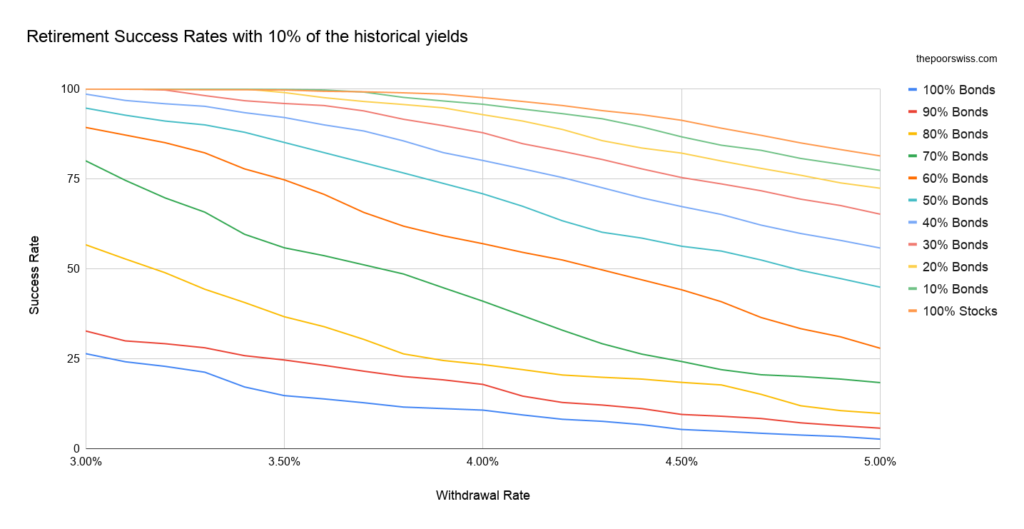

So, here is what happens to the portfolios:

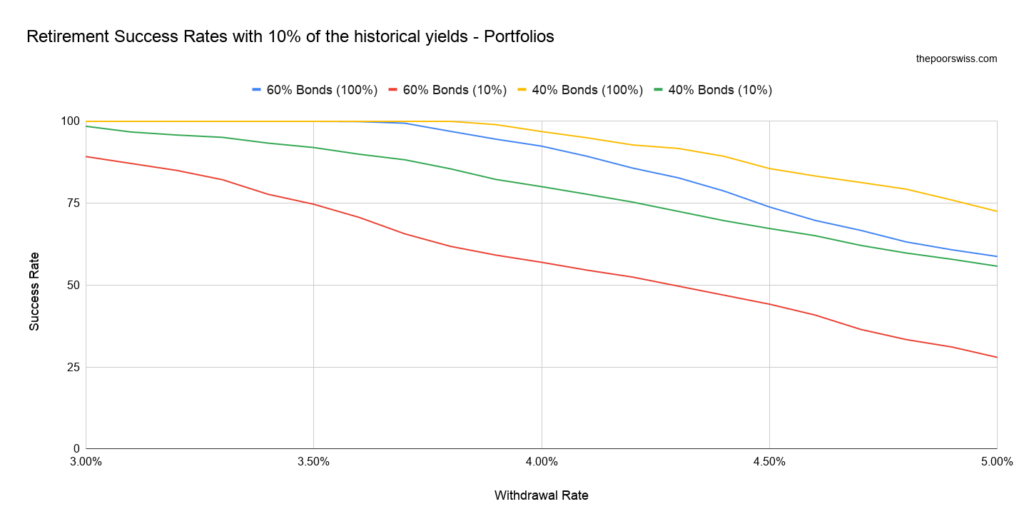

I am still surprised that the portfolio with 100% bonds still has a few chances of success. It is a huge gamble. But I would have thought it would be worse. Portfolios with a large bond allocation are not expected to work with such low bond returns. However, since I also reduced the negative returns, they are very stable.

The 60% Bonds portfolio is now very dangerous, even with a 3.5% withdrawal rate. And the portfolio with 40% bonds is getting closer to a 75% chance of success with a 4% withdrawal rate. But this is still not so bad. And this is an extreme case.

Conclusion

Historical bond returns are much higher than current returns! This is the most important conclusion of this study. So, when we do historical simulations, we do it on an average significantly higher than the recent average.

It is important to realize this. I am not saying that the historical simulations have no value! Maybe the current returns will go much higher again, and the average will rise. But I am saying that we need to know that fact.

For people using a portfolio with bonds, this is important. For instance, many people are using a portfolio with 40% Bonds. If returns fell by 50% (bringing the average to 2.2%), the success rate would drop by about 14%. These people would probably have to lower their withdrawal rates to be on the safe side.

Now, I realize this is just a synthetic benchmark. Just cutting the returns is not realistic. Since the bond yields are correlated to inflation, if bond returns go down, inflation would probably be down as well. But I wanted to see what would happen if inflation stayed the same and bond returns fell.

And I think this simulation has some value. Many people do not realize that bond returns were historically much higher.

If you are worried about bond yields, you may want to retire with cash instead of bonds.

I also did a simulation to check our chances of early retirement in recent years. And if you are in Switzerland, I have checked the retirement success rate of Swiss Stocks!

If you like simulations, you should also read about whether you should rebalance in retirement. You may be surprised by the results!

I hope you found this simulation interesting! Let me know if you have ideas for other simulations!

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-book

I personally wouldn’t consider gold or commodities as a good way to allocate money (if you have a look at their historical returns they are basically on par with inflation, just as it should be).

I’d be curious to backtest a portfolio made of stocks, bonds and P2P lending and REITS, say at a 25% allocation each, I think it would probably improve risk-adjusted returns A LOT compared with other options…

Of course it’s impossible to backtest it :/

Hi The Efficient Millenial,

They are basically on par with inflation indeed. However, gold is not directly correlated to stocks. So it could help while stocks are not doing well. But obviously you are going to lower your average returns.

As for P2P lending, it would be interesting indeed. It’s just way too young to backtest as you said it :(

Thanks for stopping by!

Hi TPS,

Thank you again for a very interesting and well-made article on this subject.

This is another proof of the fact that when bond yields are low, investors are pushed into taking higher risks. Essentially, there is no today no alternative to stocks. (TINA as they call it).

Then of course, should the yields suddenly increase, then we will likely see a massive pull from stocks into bonds because a lot of investors are eager to reduce their risk-level.

But I believe that it is important to have something to balance the stock portfolio with, the question is with what?

Rare earth metals (gold, silver, platina etc) are the only things that comes to mind… Unless of course, one is drawn towards far more riskier assets like other commodities, P2P lending and even cryptocurrencies.

Any chance that you would be able to run the same simulations but with gold allocations added to see what happens?

Thanks again and looking forward to further post from you!

Hi Kalle,

That’s a good point. As soon as stocks fall and bonds rise a bit, a lot of people are going to sell and go to bonds (with a loss!). And many people will start advocating bonds again :)

I completely agree that a good balance is necessary. I would not consider P2P lending or crypto-currencies here since they are really too much gambling. However, gold (and rate earth metals) is a good candidate. And real estate is another good one. In Switzerland, real estate is not that great, but it can help you generate income and the property can appreciate.

I am thinking of adding gold and doing an article about it. I just added it to my TODO list. I have no idea when I would do it but it is definitely interesting!

Thanks for stopping by!

Interesting article! I have wondered about this question, and I appreciate you simulating it for us. I’m pretty heavy in equities, and it looks like that’s a good allocation for a low interest rate environment.

Hi, She’s FIRE’D,

I was also wondering about this for a long time. And the simulation seems to agree with my positions of a large allocation to equities as well. And given the current bonds in Europe, I would not want to invest in bonds.

I am glad you liked the article. Good luck with your equities!

Thanks for stopping by!