The Three Pillars of Retirement in Switzerland

| Updated: |(Disclosure: Some of the links below may be affiliate links)

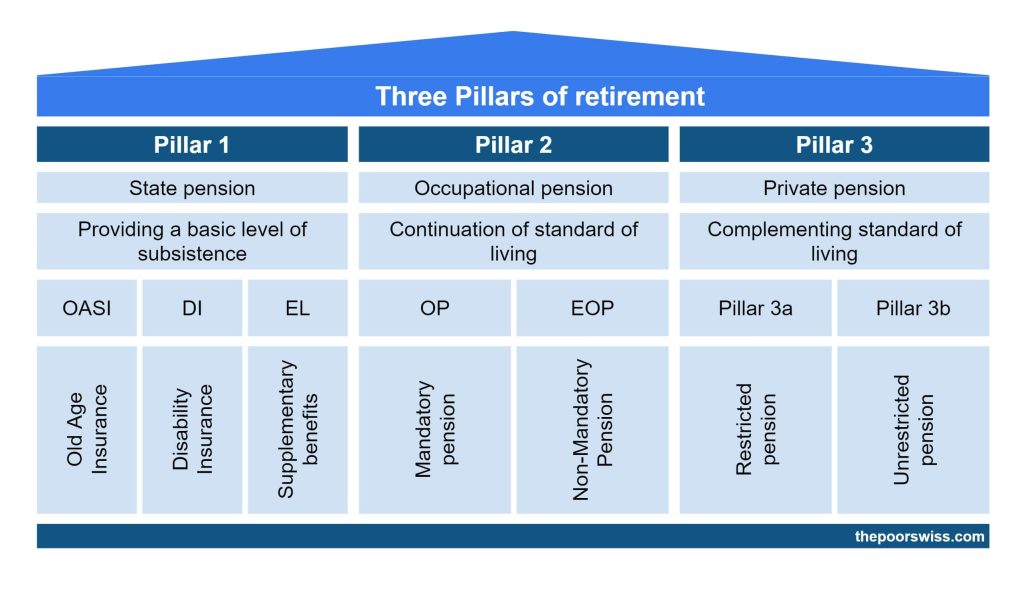

I have already covered in detail each of Switzerland’s three pillars of retirement. In this article, I summarize the entire system. I also talk about how early retirement works in this system.

Knowing about the three pillars is essential if you want to retire in Switzerland.

Three Pillars System

First, we summarize the system of the three pillars.

1. The first pillar

The first pillar is a mandatory state pension.

Everybody pays this directly from their salary or with a bill if they do not work. And everybody in Switzerland is entitled to get a pension from the first pillar. What you will receive from the first pillar will depend on your salary and how many years you contributed. However, it will only cover the fundamental needs of your life in retirement. And there is very little you can do to optimize your first pillar. That is why the other pillars are essential.

2. The second pillar

The second pillar is an occupational pension for workers.

Only people who work contribute to the second pillar. And consequently, only people who contributed to it will receive a pension (or a lump sum) once they reach retirement age. The second pillar is more complicated than the first one because it will depend on the company you are working for.

Moreover, you can also contribute voluntarily to it. There are some tax advantages to doing so. Find out whether you should contribute to your second pillar.

3. The third pillar

The third and last pillar of Switzerland’s retirement system is a private pension.

The third pillar is entirely optional. It is also reserved for people who are contributing to their second pillar. You can have your third pillar in a bank or as life insurance. There is a nice tax advantage in contributing to the third pillar. And you can choose where you want to invest your third pillar. That gives it a lot of opportunities for optimization.

Choosing a third pillar account is not an easy task. Currently, Finpension 3a is the best third pillar in Switzerland.

Early retirement

If you are interested in early retirement, you have seen that none of the three pillars covers it.

You can withdraw the second and third pillars five years before retirement. Currently, this means that you can withdraw money at 60 years old. But early retirement means retiring earlier than 50. Some people even retire before 40. If you plan to retire significantly earlier than Switzerland’s legal retirement age, these three pillars will not help you a lot.

But, the current system is still helping with early retirement. While the three pillars may not cover your expenses after retirement, they will cover most of them. You should be covered if you have invested enough in the second and third pillars. That means you only need to save for the years between early and official retirement. I say only, but it is not easy. But after official retirement, you will have new income (first and second pillar) and savings (third pillar). Also, since you get tax advantages with three pillars, you will save more before you retire.

But you will have to pay the first pillar for these middle years. Indeed, you are entitled to pay it until your official retirement age. If you do not work, the amount you have to pay is based on your net worth. So, if you accumulate a lot of money, you may have to pay significant first pillar fees each year. However, I do not think this is a large problem. But it is something that you have to take into account.

If you are not interested in early retirement, you can focus mainly on the three pillars. If you want to retire early, you should focus on each of the three pillars and on saving money to cover your expenses for several years. You will need an investment portfolio to cover expenses for many years.

The three pillars system

Personally, I kind of like the retirement system in Switzerland. Of course, it is not perfect. But I do not think any retirement system is perfect. Overall, it is okay.

We can start with the advantages. It is somewhat flexible. You have many choices for the third pillar and some choices for the second pillar. It is relatively fair.

The first pillar is socially fair. Indeed, the rich will pay significantly more than what the poor will receive. And they will not receive considerably more. It forces you to save for retirement. The first and second pillars are forced savings. This means that everybody will save at least something. With this, everybody will have at least something. This is a good thing, in my opinion.

Only the basic part is mandatory. Those that want complete coverage can use second pillar buy-ins and a third pillar. There are tax advantages. Contributions to both the first and second pillars are tax-advantaged. This encourages people to save money for retirement. Your employer is contributing. This is also excellent. Your employer will match your contributions. Moreover, your employer could also offer you an excellent pension plan.

Areas of improvement

Now, we should also see what could be improved. As I said, it is a sound system. But it is far from being a perfect system, in my opinion.

First, the system is too complex. It took me over 7000 words to cover all the details in the first three articles. And I did not cover several things, such as divorce, death, foreigners, or self-employment.

While doing my research, I learned a lot. I had to gather information from many sources. In my opinion, it could be simplified. Or, at least, there should be a complete source of information. Moreover, the biggest issue is that it depends on each canton. There are significant differences from one canton to another.

One missing thing is the ability to invest this money how you wish. I am talking here about the second and the third pillars. For the third pillar, you have the choice of retirement funds.

However, we should be able to choose index funds ourselves for both these pillars. This would lower the expense ratios, especially for the third pillar. This would also improve the returns, especially for the second pillar. Good funds should be an option for the second pillar. Currently, the returns on the second pillar are laughable.

Finally, another issue is that you contribute more and more as you age. This makes it less interesting for early retirement. Moreover, the first years should be the ones with the biggest interest compounding. And therefore, it would be interesting to contribute more in the first years. This would also force young people to spend less, which would be good.

Strategy for the Three Pillars

Finally, we can recap the main things about the three pillars to get the most out of them.

For the first pillar, there is not a lot you can do. You could choose to take it early or late, depending on your life expectancy. This could significantly change the pension you will receive. But of course, nobody knows its life expectancy. So this is only an educated guess.

As for the second pillar, you can do a few things. You can talk to your company about increasing your contributions if you are still working. This could be interesting to reduce your taxes and increase your safe allocation in your portfolio. You can also contribute voluntarily to your second pillar for the same reasons. When you are not working, you need to make sure that your second pillar is with the best second pillar provider.

It is a bit dumb that there is no incentive to contribute to the second pillar after buying a house with the second pillar’s money. Indeed, you must first put the money back into the second pillar without any tax advantages. Since the interest rate on the cash is bad, there is no reason to contribute without tax advantages.

Finally, for the third pillar, you have a bit more freedom. You need to make sure that you are contributing the maximum every year. This is very important. Then, you must ensure you are using the best third pillar provider. This is very important if you want your third pillar to be invested. For most people, the best way to invest in a third pillar is to invest in a bank, not life insurance.

That should cover the basics of each three pillars. If you want the details, you can read the other parts of the series again!

Finally, here is my current strategy regarding the three pillars:

- First pillar: Nothing to do, continue to pay for it.

- Second pillar: I contribute the default amount that my company matches. We will start making voluntary contributions soon.

- Third pillar: I have five accounts at Finpension 3a. I will continue contributing to one of them per year in January.

Conclusion

I think I have covered everything important about the three pillars system. I hope this will be helpful! If you live in Switzerland, it is essential to know these things.

You need to use these three pillars best to retire properly in Switzerland. They are even more important if you do not plan to retire early. They will be the pillars of your retirement!

If you do not know where to start, learning about contributions to the third pillar is the best way.

What about you? What do you think about this retirement system? Do you have any questions about this system? Do you have any tips to optimize your retirement?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Retire in Switzerland

- More articles about Retirement

- What is the Substitute Occupational Benefit Institution?

- Should you contribute to your third pillar in 2024?

- The truth about 3b pillar accounts

I want to move to Swiss and all this info in you blog is gold for me, thank you!

Hi Mr Poor Swiss,

I extremely enjoy the content of your blog. I’m a newcomer to Switzerland and I learned a lot of important things by reading your articles.

However, I can’t tolerate what you’ve done with the visuals. Completely frustrating. The recent change rendered the site almost useless to me – the navigation doesn’t exist anymore, I can’t find the article I’m looking for, pictures look all the same now (in fact they’re not pictures anymore – a HUGE text on a colored rectangle). I hope you do collect some kind of metrics that would allow you do realize that the change was for the worst!

— Your frustrated reader.

Hi Frustrated Reader,

Sorry to hear that!

What do you mean about the navigation? I have not done many changes to navigation.

Are you having issues on mobile or on desktop?

Yes, I am collecting plenty of metrics and none of them show any difference after the changes in design.

Thanks for stopping by!

You did an awesome job researching and then presenting all the info.

I have 3 remarks:

1) The Canton of Solothurn (Soleurs) wanted to limit the number of 3a accounts. There was a court decision (in Soleurs) saying this is not permissible. This led to a general liberalization (e.g. my Canton Zurich stopped creating problems).

2) Is the deduction of 1500.– not fully eaten up by the premiums for health insurance?

3) Postfinance 3a 75 has a TER (~running costs for admin) of 1% – VIAC with 100% equity only of 0.56%. Are you sure you want to pool with Postfinance?

Thank you for your quality blogging!

Hello Martin,

Thanks :) I’m doing my best!

1) Oh, very good to know. That is really great.

2) That is a very good question. I suppose you meant life insurance. I don’t know. I’ll have to see the offers we got. I’m still not sure.

3) I opened the Postfinance account before I knew of VIAC and even before I knew of checking TER. It’s not a bad 3a, but it’s definitely not the best. Now that I’ve got it, I plan to continue with it for the time being. Today, I would not open a new one with them.

Thanks

2) Just to clarify: If I am not mistaken (I may be, though!), the deduction for health premiums competes with the one for other personal insurance for the 1.5k deduction. As manatory health premiums are easily 3k, they often fill the deduction out entirely.

3) I made the remark because I was in the exact same situation as you! Opened Postfinance 3a 75 before knowing about Viac (I am not payed by or affiliated with them!!). I hesitated, but changed because

– that ~0.5% difference really adds up over time

– changing costs nothing in fees and means getting out and back into the market (you may gain or loose by this)

– Postfinance has a bit of a weird (=nonstandard) geographical equity distribution if I remember correctly: mostly swiss shares and ~ 15% US Shares.

– When changing, I opened a viac account and chose my strategy, got the transfer form, sold the Postfinance shares myself, sent in the form to Postfinance and waited about 2-3 weeks before the money arrived at Viac. Viac invests on the first or second trading day of every month (index funds execute up to a week later).

I am just describing my reasons and experiences here, as the topic of changing a 3a provider might be of importance for fire.

Good luck.

Oh, now I get what you are saying :) It depends from state to state. In my state (Fribourg), they have 1500 deduction only for the third pillar 3b life insurance. So this does not compete with health deductions.

I agree that the fee does add up over time. Even a small difference such a 0.5% makes a big difference over a large time horizon.

It seems they have 26% in foreign currencies, but I didn’t find the exact details.

I didn’t even consider moving the funds actually… I maybe considered creating my second third pillar account in VIAC. I don’t know why I didn’t even think of transferring :P

I have one problem with VIAC is the fact that it is mobile only. I much prefer to check my funds on my computer rather than on my phone. I don’t like phones… I’m going to contact them and see if it’s something they plan in the future or not.

Thanks for the discussion. It is of importance :)

Haha, they already answered me! They plan to add web interface to their tools in Fall 2018. I will reconsider using them at this point. Thanks again for the idea :)

Thanks a lot for your posts…I only just found this site, but there’s a wealth (sorry…) of good information here…especially as a non-Swiss living in Canton Vaud (Lausanne) finding this info summarised in an easy to understand format is perfect. Keep up the great work!!

Hi Simon,

Haha, good one ;)

I’m very glad this information helps!

I tried to make it as complete as possible, don’t hesitate to tell me if some information is missing.

Best