Health Insurance in Switzerland: The Complete Guide!

| Updated: |(Disclosure: Some of the links below may be affiliate links)

The health insurance system in Switzerland is complicated. And since it is mandatory to have health insurance, it is imperative to understand it correctly. So, I wrote a complete health insurance guide to help you!

In these last few years, health insurance has become very expensive. But many people are paying much more than they ought to. You need to know that there are a few things we can do to pay less! So, we will see how to save money on your health insurance in Switzerland.

In this guide, I cover the details of the health insurance system in Switzerland. I cover mostly the base health insurance in great detail. You must choose wisely, and there are many options. I also cover supplemental health insurance, but it is too varied to be covered in detail.

So, here is the complete Health Insurance Guide! This guide contains all you need to know about Health Insurance in Switzerland!

The Health Insurance system

We start this health insurance guide by describing the health insurance system. In Switzerland, everyone must have health insurance coverage. It has been the law for many years.

There are two levels of insurance:

- The base insurance is mandatory. It covers standard health costs, such as visits to the doctor and hospital. It is compulsory for everyone, regardless of age. Even babies need health insurance.

- Supplemental insurances are not mandatory. There are many different supplemental insurances available. For instance, private hospital insurance, dental insurance, eye insurance, and so on.

Regardless of the provider, the base insurance is the same. Unfortunately, there are many different providers and many different options. It makes it more complicated than it ought to be. For instance, you can choose between different models and different deductibles. You need to know the differences between these things. We all this in detail in this guide.

The supplemental insurances are entirely different from one provider to the other. Even two dental insurance policies can differ from one provider to the other. It makes it very difficult to compare such insurances.

The LAMal law governs the base insurance. You often see this term on medical bills. And many people use the term LAMal to describe base insurance. But you do not need to know the details of this law.

Changing Insurances

You can switch to a new base health insurance provider every year. You must cancel your health insurance by the end of November if you want to change. Your letter must reach them before the end of November. So, you should not send it on the last day of the month.

Being able to change often is good for us since we can optimize costs. But, it is also a curse. Because at the end of the year, you will receive calls from insurance clerks that want you to change insurance. As a rule, you should completely ignore them. They are not doing that for you!

But, you must cancel supplemental insurance up to six months in advance. It makes it so that most people rarely change supplemental insurance.

You must know that an insurance provider cannot refuse your base insurance coverage! An insurance provider cannot refuse someone because it would be too expensive to cover! But they can refuse to cover you for supplemental insurance.

What is covered by the base insurance?

There are many things covered by compulsory base insurance. But, many of these things are subject to conditions that are sometimes complex. So, I cover the basics here.

Here are the main things that are covered.

- Visits to the hospital, interventions, and emergency treatments. However, you still must pay 15 CHF per day in the hospital. This coverage also includes care after serious treatments.

- General treatments by doctors. But many specialist treatments are excluded.

- Prescriptions from the doctor.

- Childbirth expenses and abortions

- Mammograms and colon cancer screenings for people over 50.

- Gynecological examinations

- Glasses and contact lenses for children up to 18. Insurance only covers up to 180 CHF per year.

- Emergency dental care. Dental care coverage is limited to severe issues.

- Psychotherapy under some conditions.

- Most common vaccinations

- Some alternative therapies, such as acupuncture and homeopathy.

However, this is only covered if an accredited specialist does it. And even then, there are some conditions. Therefore, for alternative medicine, it is better to take supplemental insurance.

These are the most important things that the base health insurance cover. If you want to know all the details, I would recommend reading the information from the Federal Office of Public Health.

How is it covered?

First of all, each insurance has a deductible. All the expenses below the deductible are not covered. For instance, if your deductible is 300 CHF (the smallest), you must pay the first 300 CHF of medical expenses before the insurance covers anything. The deductible will not apply to maternity fees after the third month of maternity.

But even after the deductible, there is still a part that you have to cover. This fee is called the retention fee. For everything that is reimbursed by the insurance, you will have to pay 10% of it. The retention fee is a yearly maximum of 700 CHF for adults and 350 CHF for children. This retention fee does not apply to maternity fees. The retention fee is 20% on medicine you could replace with a lower-cost drug.

Another important thing is who pays the bills. There are two models for that:

- Indirect Claim Settlement (Tiers Garant): Your doctor sends you its bills. You pay all your bills yourself. Then, you send your invoices to the insurance that will reimburse you for what is covered by your policy.

- Direct Claim Settlement (Tiers Payant): Your doctor will send the bills to your insurance. The insurance will pay what is covered. It will then send you an invoice for the deductible or the retention fee.

If you do not think you can handle the upfront fees, you should choose an insurance provider with Direct Claim Settlement. However, if you are in that case, you should improve your financial situation. Also, these insurance providers are generally more expensive.

Hospital fees generally fall in the Direct Claim Settlement regardless of your insurance. Indeed, they can be costly, and your insurance will generally reimburse these fees.

What is not covered?

Accidents are not covered by health insurance but by accident insurance. I will talk about this in more detail below.

Generally, you will need to be treated in your canton. However, if you are injured in another canton, you must be moved to your canton for treatment. That is, of course, if it is possible to move you. Supplemental insurance can cover treatments in other cantons.

Health insurance abroad

If you are often traveling abroad, it is important to know how health insurance works in other countries.

If you are traveling to the European Union (EU) or the United Kingdom (UK), health insurance will cover in case you need medical assistance in case of illness, accident, or maternity. What will be reimbursed is based on the country you are traveling to. In most cases, everything will be reimbursed in these countries.

If you travel to a country outside of the EU and UK, your health insurance will cover up to twice the costs that would have been paid in Switzerland. Outside of hospitalization, this should be good enough. However, in the case of hospital coverage, the insurance only has to cover 90% of the costs that would have been paid in Switzerland.

If traveling to a very expensive country like the US, Canada, Australia, or Japan, complementary health insurance is generally recommended. Indeed, the coverage from the Swiss health insurance will likely be insufficient, and the remainder could be very expensive.

Which insurance deductible should you take?

Choosing the best health insurance deductible is important.

The deductible is the amount you will pay before the insurance covers anything. The deductible is per year. For instance, if your deductible is 2000 CHF and you spend 1900 CHF on health expenses, the insurance will not cover anything.

As I mentioned before, there are several deductibles that you can choose from:

- 300 CHF

- 500 CHF

- 1000 CHF

- 1500 CHF

- 2000 CHF

- 2500 CHF

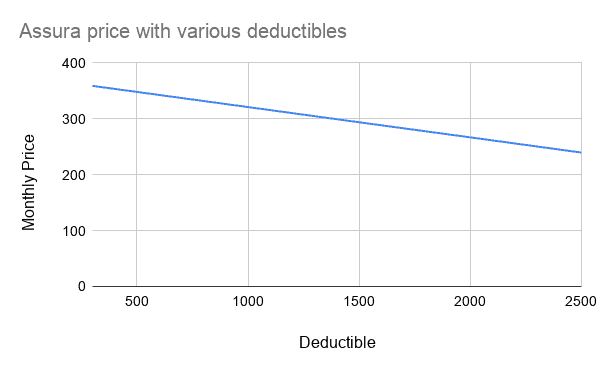

With a higher deductible, you get a lower monthly fee for your health insurance. For instance, here are the monthly prices for Assura for my specific case with various deductibles.

Now, to choose, you have to estimate how much you will have in health costs. With so many deductible options, it sounds complicated to select the best one.

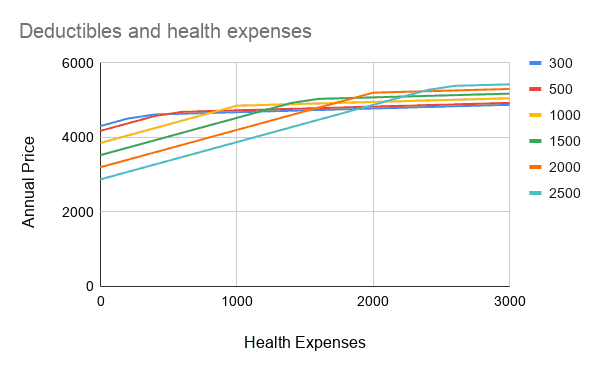

However, it is simpler than that because only 300 CHF and 2500 CHF make any sense. All the other deductibles are useless. Here is a simulation with the same Assura case and various levels of health expenses.

We can see on the graph that only two deductibles are interesting: 300 CHF and 2500 CHF. If you spend below 1900 CHF, the 2500 CHF deductible is the best. If you spend more than that, the 300 CHF deductible is the best. It is pretty simple, right?

If you want the exact threshold number, it is relatively simple. Take the yearly price of the 300 CHF deductible (A) and subtract the cost of the 2500 CHF deductible (B). Then you need to multiply this by 1.1 to account for the retention fee. Finally, you can add 300 CHF to it.

So, if A = 4308 CHF and B = 2874.76 CHF, the threshold is 1904.76 CHF (1.1*(A -B + 300)). With less than that, you should take the highest deductible. With more than that, you should take the smallest deductible.

Now, if you take the highest deductible, you must be ready to pay these fees. You could depend on an emergency fund for that. If you do not have one, you may consider starting an emergency fund.

Which insurance model should you choose?

This health insurance guide mentioned before that there are several insurance models that you can choose. Now, not all insurances offer them all. But there are four principal families of insurance models:

- Standard Model.

- Family Doctor Model.

- Telmed Model

- HMO Model.

These models will have the same coverage. The difference is what you must do when you have a health issue.

Now, of course, you can still directly go to a doctor or the hospital in emergencies. It is only in the case of usual health issues that these restrictions will apply.

The Standard Health Insurance Model

With the standard model, you can go to any doctor directly. You can change doctors anytime, and you do not need to inform your insurance about that.

This model is the most expensive because the insurance has no choice on which doctor you choose.

The Family Doctor Health Insurance Model

With the family doctor model, you have an assigned doctor. You have to go to this doctor, and he will send you to specialists if need be. But you cannot go to another doctor even if you want unless there is an emergency. And some insurances are limiting which family doctors they accept.

This model is between 10% and 20% cheaper than the standard model.

The Telmed Health Insurance Model

With the Telmed model, you must call a health call center before seeing any doctor. They will then choose the doctor you must go to, either a specialist or a generalist, based on your issue. Once you have been there, you do not need the call center anymore for this issue.

This model is also between 10% and 20% cheaper than the standard model.

The HMO Health Insurance Model

Finally, with the HMO model, you have to go to a particular health center. You do not have an assigned doctor but a designated health center. So, likely, you will always see different doctors. Since there are few health centers, you may have to go farther to see a doctor.

This model is generally the cheapest. But not all insurance providers offer it. For instance, Assura, the most affordable health insurance in Switzerland, does not offer this model.

How to choose a model?

There is no definite rule on which model to choose. You should select the cheapest model that is still convenient for you.

For instance, if you have an HMO center close to your house, it may be great to choose an HMO model. But if the next HMO center is 40 minutes away, you may want to avoid this.

Most people should avoid the Standard model. It is simply too expensive. Between the other three models, you should choose the cheapest one you are ready to accept.

Do you need accident insurance?

The base health insurance and accident insurance are closely tied together. Accident insurance is also mandatory in Switzerland. And you need to take your accident insurance with your health insurance.

But, if you work more than 8 hours a week, your employer is responsible for your accident insurance. So, only people working less than 8 hours a week need to get accident insurance.

If you need one, you should ask for accident insurance when you take a base health insurance. It is not very costly, and the coverage is the same for each insurance provider.

Save money on your health insurance

There is no denying that health insurance in Switzerland is costly. For us, it is about 12% of our budget. And some people spend up to 20% of their budget on health insurance coverage. And every year, the prices are increasing! So, we should do our best to spend as little as possible on it.

In this health insurance guide, I cover how to save money on the base insurance. All insurance providers have the same coverage since the law decides on the coverage. And you do not have to use the same provider for the base and the complementary insurance.

1. Do not hesitate to change insurance

The first thing you need to do is compare and change often. There is no reason to stay with an insurance provider if it is significantly more expensive than another.

Yes, some insurances are a bit less convenient than others. But if you can save several hundreds of francs each year, there is no reason not to change. Every year, you should check if your base insurance is still the cheapest!

Unfortunately, the premiums increase each year. Since some insurances increase more than others, it is challenging to keep the cheapest insurance.

Insurances are in for the money! There is no reason not to compare!

2. Choose the best model and deductible for you

We have already talked about deductibles. But I will repeat it: You need to take the best deductible for your case! If you spend less than around 1900 CHF, you want the 2500 CHF deductible. Otherwise, you want the 300 CHF deductible. There is no reason to use any other deductible!

We have already talked about the insurance model. Most people should take the model that is the cheapest. If you have access to a family doctor recognized by your insurance, choosing a family doctor model is an excellent way to save money. And if you do not mind, you can save a lot by using a call center.

3. Pay your fees upfront

Also, you can pay all your monthly fees at the beginning of the year at once. Some insurance providers will give you a small reduction if you do that. Some also will offer you a discount if you pay per quarter. For instance, Assura gives you a 2% reduction if you pay annually.

That is not a lot, but that could be a way to cut your expenses more. Do not forget to consider that you could have invested this money instead. I do not do that. But, if you do not invest aggressively, you can get 2% returns. It is a good investment without risks.

4. Ask for health insurance subsidies

Finally, if your income is low, you may be eligible for help from your municipality or the canton. If your income is below a certain threshold, they can pay a part or even all your insurance bills. This can be very helpful if you have several children and medium incomes. When we were young, we got support for part of my family’s health insurance.

I cannot tell you the threshold since it differs from one canton to another. For example, you can request it from the municipality administration in my canton. But in some cantons, you must request it from the state administration. If you think you would be eligible, contact your canton or municipality administration, and they will help you ask for it.

5. Be aware of possible reductions

Some insurance providers also have some possible extra reductions. It is not always easy to find them, but they could be interesting.

For instance, when I was with Helsana, I could save money each month if I only went to one pharmacy in particular. I did not take this offer since this pharmacy was not in my village. But if I lived in a city, I would have taken it.

With most insurance providers, you can also save money if you have several family members with the same provider. Grouping together can save a significant amount with some insurance. For instance, saving 5% to 10% is not uncommon.

You should do some research and check what your insurance can offer you!

6. Suspend base insurance during military service

This tip is very specific. If you serve in the army for over 60 days, military insurance will cover your health insurance. Since most men do a military service of about four months, this could mean a nice saving.

Unfortunately, this is not possible for annual repetition courses since they last less than 60 days.

Which health insurance should you choose?

Now that you know which model you want and which deductible is best, this health insurance guide will help you choose an insurance provider.

The base insurance is a legal matter, so each provider has to cover the same things. So, for me, you should simply choose the cheapest base insurance you can find. And you should change as soon as it is not the cheapest anymore.

There are a few cases where you may want not to choose the cheapest insurance. First, unless you take the Standard model, some insurance will restrict you to some doctors. And they may not accept your current doctor.

If you have been with the same doctor for a very long time, you may not want to change. So, you may have to choose a provider that accepts him even though it is not the cheapest. Or you can take the most affordable Standard model.

There is another case where you would not want to take the cheapest option. If you have a condition and often go to a hospital not accepted by the most affordable option. You may want to keep it with your current hospital.

Otherwise, I recommend that you take the cheapest insurance that you can find.

Careful about Health Insurance Comparators

A health insurance guide would not be complete without discussing health insurance comparators. Some comparators can help a lot in choosing health insurance in Switzerland.

You have to be very careful about these comparators. Many of these comparators have issues:

- Some comparators are incomplete and only show insurance they have deals with, often not the cheapest.

- Some comparators are run by insurance brokers.

- Some comparators are full of ads, showing up before the comparisons themselves without enough transparency.

The prices of insurance vary significantly by age and also by canton. Therefore, for all comparators, you must enter this information to get accurate results.

The best one is the official Health Insurance comparator from the Swiss administration.

It comes directly from the government. It is very fast and very complete. This comparator is the one that I would trust the most. It is also straightforward to use. Unfortunately, it is not available in English. It is available in the three national languages of Switzerland (French, Italian, and German).

The prices of insurance vary significantly by age and also by canton. Therefore, for all comparators, you must enter this information to get accurate results.

If you want a comparator in English, you should use the health insurance comparator from moneyland. Another one in English, the one from comparis, is highly biased and poorly intransparent about ads.

The comparator from moneyland is straightforward to use, and it has a lot of information. However, you need to be a bit careful about some details. Sometimes, it will propose insurance with select options such as limited pharmacy choice. In addition, it will sometimes offer you models tied to a health center that is too far for you.

Comparison for my case

For instance, in my case, here are the five cheapest insurances:

- Assura with 244.60 CHF per month and HMO model (Delta Network)

- Assura with 257.70 per month and Pharmed model (family doctor)

- Sanitas with 259.70 per month and Mix Model (several choices for the first contact)

- CSS with 260.75 CHF per month and HMO Model (Medix Bern)

- Helsana with 262.70 CHF per month and Family Doctor model

It is essential to look at the details here. The first one is low price, but you have a limited number of pharmacies and doctors. This is perfectly acceptable for me since my family doctor is on the list, and the pharmacy from my village is too. This is the insurance I currently have now, and I am satisfied.

The third one does not have any good options near me. The fourth choice looks interesting, but I must visit Bern to see a doctor. That is bad since it is a 40 minutes drive to go there. So these are also unacceptable to me.

The fifth would be my second choice, but I would spend more than 200 CHF extra per year.

So look at the details to make sure that is something you can use.

Should you take any supplemental insurance?

Finally, we finish this guide with the main types of supplemental insurance. There are many more, of course. But these are the ones that people use the most.

There are two groups of supplemental insurance:

- supplemental hospital insurance.

- supplemental outpatient insurance.

It is very important to mention that you generally need to fill up a health questionnaire, sometimes with your doctor, to get supplemental insurance. For instance, dental insurance will require information from your dentist.

Indeed, insurance providers are free to refuse you or change the conditions for supplemental insurance. If you are in bad health, it will be complicated (or very expensive) to get supplemental health insurance.

Supplemental Hospital Insurance

Base health insurance will pay for your hospital fees. However, it will only cover your expenses in the general ward, and some insurance will limit which hospital you can go to. Supplemental hospital insurance, also called supplemental inpatient insurance, can help improve the quality of your stay in the hospital.

Instead of general care, you can decide on semi-private care. Such insurance guarantees you will only end up in a room with two beds. It also means that a senior physician will take care of you. It can be expensive, but many people take this insurance.

You can also use private care supplemental insurance. These insurances will cover your expenses for a private room in a hospital. Also, you will generally have a chief physician for your treatment. But this can be very expensive, so very few people use this kind of supplemental insurance.

Finally, you can also opt for the free choice of hospital supplemental insurance. It will let you choose any hospital in Switzerland and cover your expenses there.

For most people, these insurances would not be necessary. However, semi-private care is a good option. Private care is simply too expensive and not worth it. But having a two-bedroom when trying to recover can be quite enjoyable. But of course, it is pure comfort. A free choice of hospital can also be a good deal.

For women who plan to have children, it is good to have semi-private care insurance. This insurance will let you choose a clinic instead of a hospital and your doctor. And you will be in a two-bedroom. So, it could make a significant difference in childbirth and the first days after giving birth. Nevertheless, some hospitals only have rooms with two beds for mothers, so semi-private will not be very interesting.

Now, for young people in good health, it is fine not to have any supplemental Hospital insurance.

Supplemental Outpatient Insurances

Outpatient insurances are a bit more complicated since there are many different options. These insurances cover things outside of the hospital.

The most used ones cover some treatments not covered by the base insurance. For instance, there are dental, supplemental insurance, and glasses supplemental insurance.

There are also some supplemental insurances for travel. For example, one that many people use can cover accidents in other countries, hospital coverage in other countries, and vaccinations for traveling abroad.

There are also some more special insurances. For example, there are supplemental insurances that will pay back your costs of traveling to the doctor. And some insurances will pay for improving your health. Such insurance includes things such as medical checkups and gym memberships.

These insurances are dependent on the situation of each person. If you travel a lot outside of the EU, it is great to have some travel insurance. In my case, this is even mandatory for my job.

Some supplemental insurances can also make sense if you know that you will use them a lot. For instance, dental insurances can be great if you know that you have many dental care expenses. But you must do the math to see if it is worth it. You should only take such insurance if this makes you save money.

One supplemental insurance that can also be great is preventive care insurance. For instance, this could cover checkups every few years. They can also include a gym membership, for example.

And some of these insurances come in packages. So you need to consider them entirely and not per single item.

FAQ

Who needs health insurance in Switzerland?

Everybody. Health insurance is mandatory in Switzerland for every resident, including children and infants.

Who needs accident insurance in Switzerland?

Everybody. Accident insurance is mandatory in Switzerland. But, if you are working, your company will cover your accident insurance. If you are not working, you must apply for accident insurance.

How many deductibles are available for health insurance in Switzerland?

There are six possible deductibles: 300, 500, 1000, 1500, 2000, and 2500. As a rule of thumb, you should choose a 300 CHF deductible if you spend more than 1900 CHF a year on health expenses. Otherwise, you should choose the 2500 CHF deductible.

Are supplemental insurances mandatory in Switzerland?

No. All supplemental insurances are entirely optional. Some of them will help you save a significant amount of money, while others are very rarely useful.

How often can I change health insurance in Switzerland?

You can change your base insurance every year. You need to send a letter to your insurance. Your letter must arrive at least one month before the end of the year. As for supplemental insurance, they all have different rules for cancelation, so you will need to check your contract. Generally, you will need to cancel them six months in advance.

Conclusion

If you have read this health insurance guide entirely, you should have an excellent understanding of how the health insurance system works in Switzerland. And you should know how to save money on your Swiss insurance.

It is essential to choose the insurance policy that works best for you. Since base insurance is the same for all providers, you can generally pick the cheapest one. But make sure you pick one that is convenient. You do not want to drive 40 minutes to a doctor’s!

Unfortunately, even if you take the cheapest health insurance, it is still costly. And you will always have to pay for many things yourself. If you have a large deductible, it would be great to have at least this amount in your emergency fund.

The quality of healthcare in Switzerland is excellent. However, I do not like the health insurance system. Since each health insurance covers the same thing, it should be federal insurance instead. And the price should be fixed by law. Instead, every year it increases, and every year we need to compare them. It does not make sense! For me, the base insurance should be much cheaper and cover fewer things.

Since health insurance is so expensive, you may want to find some ways to save money in Switzerland.

Do you have any more questions? What health insurance do you have? Do you have any tips for lower health insurance coverage? Is something missing from my health insurance guide?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Personal Finance in Switzerland

- More articles about Save

- 5 Traps to avoid when moving to Switzerland

- Is inflation in Switzerland really that low?

- Should you buy or rent a house in Switzerland?

Hi – Great website. I work for an International company in the UK, but am resident in Switzerland as I spend more than 180 days in CH. The Company provides me with a global international medical insurance that covers all medical costs in switzerland, for myself and my dependants (my student children that are at university in UK and my wife) – Everyone is resident in switzerland with a permit C. I was told I didnt need to have the compulsory insurance in Switzerland as I work abroad and am covered. When we use doctors here, we pay the full amount and then get reinbursed by Cigna International. Is that correct? is this a valid exemption in your view? Many thanks

Hi Ben

I am definitely not an expert here. But I would say it’s a valid exemption. I believe that health insurance from the EU/UK is valid in Switzerland. But, if you want to make sure, you will have to ask an expert.

Thank you very much for the informative article and for maintaining such an exceptional website, which I thoroughly enjoy!

While I find myself in agreement with the majority of the content across your blog, I feel compelled to express a slight reservation regarding a particular statement made in this piece:

“Now, for young people in good health, it is fine not to have any supplemental hospital insurance.”

Upon reflection, I question the advisability of this recommendation. Although it may seem unnecessary to secure supplemental hospital insurance at a young age, acquiring it early ensures its availability during older age, when it’s more likely to be needed. Foregoing this insurance can make it significantly more challenging to obtain later on. Given the unpredictable nature of our health’s future trajectory, it’s difficult to ascertain the absolute financial prudence of such a decision. Nonetheless, I believe it’s an important consideration worth mentioning in the discussion. :)

Hi

It’s a good point. It’s a stupid conundrum of this health insurance system. You don’t need insurance when you are healthy but you can’t get insurance when you are not healthy :(

For this particular paragraph, I was talking about private and semi-private insurance and I still believe that it is not necessary for the vast majority of people, it’s a luxury. However, some of the supplemental outpatient insurance may be more interesting even when we are young.

I will try to make this more clear in the article.

This is a very useful overview. Another useful article I could picture you doing is on how to save money on prescription drugs. Having just started on my first “forever drug,” I realise that saving CHF 5/month would add up to 60/year for many years. A comparison of bricks-and-morter pharmacies, online pharmacies and (if feasible) purchase from neighboring countries could be interesting.

Hi Scott,

That’s an interesting idea. I have never really thought about that. I don’t know what I would do to save money in that case.

I will try to think about it.

Thanks for the suggestion!

Thanks for your great website!

Is there a risk in taking a complementary insurance with a different company than the mandatory insurance? I try every year to switch to the cheapest company, but this year I worry that there might incompatabilities if I have mandatory insurance in one company and complementary in the other.

Hi wedge,

There is no risk that I know of. having a single provider is easier, but there is no problem with having multiple providers. Unfortunately, this is often the case because complementary insurance are often 3 years long while the base insurance can be changed every year.