Should you pay your bills early in 2024?

| Updated: |(Disclosure: Some of the links below may be affiliate links)

A widespread question I hear is whether we should pay some bills early to get a rebate. Some people always pay their bills, and others never pay them early.

So, we will delve deep into this subject and answer this important question in this article.

What can you pay early?

First, we see what we can pay early.

In Switzerland, there are a few things you can pay early to get a reduction:

- Your health insurance bills. Many insurance companies give a small deduction if you pay annually or quarterly instead of monthly.

- Your taxes. In some cantons (depending on the time), you can get a small rebate if you pay all your taxes at once at the beginning of the year instead of using the monthly bills.

There are probably other bills of which I am not aware, but these are the big ones. These are also very significant bills that people must pay, so it makes sense that they are the most interested in paying early.

It is essential to mention that when you pay bills early, you should never use your emergency fund. Paying your bills early is not an emergency; it is an optimization, and your emergency fund is only here for emergencies!

How much reduction can we get?

So, how much of a reduction can you get by paying early?

For health insurance, it will depend on each provider. For instance, several providers give 2% if you pay once yearly: Assura, Visana, Atupri, or Sympany. Others, like CSS, give you a much lower deduction of 0.25%. Finally, some companies like Groupe Mutuel will not even give you a deduction.

For taxes, it will depend on each canton. In the past (in the time of high interest rates), it was a significant reduction. The best I could find these days is Appenzell Innerrhoden and Zurich with a 1% reduction. Schwytz has an interesting deduction of 0.50% as well. But most other cantons are around 0.25%, like Uri. And finally, some cantons have entirely removed the deduction, like Fribourg or Zug.

So, we can save money on these bills by paying them early. Therefore, if we have the money, we should always pay them early, right? It depends.

Opportunity cost

You can invest your money if you are in an excellent financial situation. This means that all your available money will yield some expected returns.

In these cases, we have an opportunity cost for everything we pay. For instance, if we expect 5% returns, paying 1000 CHF now means an extra cost of 50 CHF because this 1000 CHF is not invested. This cost is called the opportunity cost.

You have an opportunity cost even if your money is in an interest-yielding bank account. Indeed, the money you get out of your bank account will not yield any money.

So, whenever we think about paying things early, we should be careful about the opportunity cost.

Examples

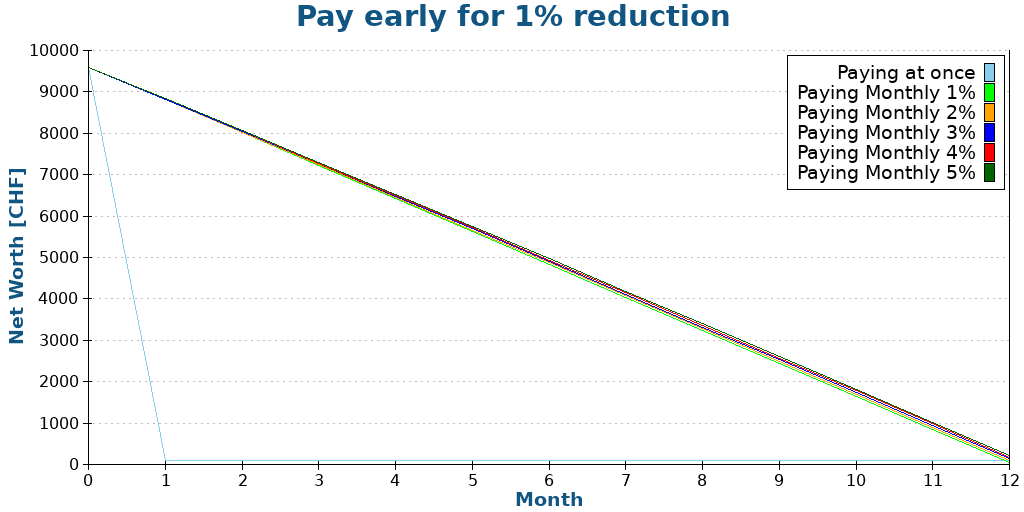

We can run through a few examples to get an idea of how much could be saved with opportunity cost.

First, we can assume a monthly health insurance bill of 800 CHF. If paid annually, this would be a 1% reduction (9504 CHF instead of 9600 CHF). We assume you have 9’600 CHF at the beginning of the year. And we use different yearly returns to see different opportunity costs.

Unfortunately, the graph is unclear on the differences between the different strategies. So, here are the terminal values for each of the scenarios:

- Paying at once: 96 CHF

- Paying monthly with 1% annual returns: 44 CHF

- Paying monthly with 2% annual returns: 89 CHF

- Paying monthly with 3% annual returns: 134 CHF

- Paying monthly with 4% annual returns: 180 CHF

- Paying monthly with 5% annual returns: 227 CHF

Some people will find these results confusing. Indeed, many would expect 1% yearly returns and 1% immediate rebate to be the same. But they are very different for two different reasons.

First, the 1% returns do not apply to the entire 9600 CHF. Indeed, we have invested less each month, so there are lower returns. Then, if you reduce something by 1%, you need more than 1% to increase it back to where it was before. This explains why you need more than 2% returns to be as good as a 1% instant reduction.

If you get a 2% reduction, you would save 192 CHF at the end. So, you would need 5% returns to get better returns with investing.

So, overall, you should pay your bills early only if you get an excellent deduction or if you get low returns on your investments.

Since getting more than a 2% reduction on yearly bills is rare, most people should not pay their bills early.

Should you pay bills late?

Should you pay bills late if you do not pay them early?

No. There are too many disadvantages to paying bills late even to consider it. If you delay a bill once, you will generally pay a fee for late payment. This is typically a small amount, but added to the original payment, this penalty may make a significant difference.

For instance, consider a dentist bill of 200 CHF. If you delay it by 30 days, you may get a 20 CHF fee. This is a 10% increase in a month! You would need your investments to return around 120% annually to justify this against the opportunity cost.

If you delay even further, you will generally be charged a second late payment fee, which may be more expensive.

Finally, you must deal with the debt collection register if you do not pay after the two general reminders. This means that the other party will ask the debt collection office to get back the money from you. There are many ways for them to do that, but this will enter the debt into your personal information.

You need a clean debt bill to rent an apartment. If you need a job in some companies, this may also come up. Finally, this may compromise your chances of getting a good mortgage.

So, paying your bills on time is very important.

Conclusion

Paying your bills early is rarely worth it if you invest your money. Indeed, paying your bills early means your money is invested for a shorter time, yielding less returns.

If you do not invest your money, paying your bills early is interesting because it is an easy way to save money.

Of course, you have no choice if you do not have the money to pay your bills upfront. In this case, it is more important to improve your financial situation to reach a point where this choice matters to you.

In the past, I used to pay most things early (especially taxes and health insurance), but these days, I have stopped doing that. Since we invest money aggressively, I do not want to forego investing to pay my health insurance at once. Also, we now pay a large amount of taxes, and paying it at once is too much.

What about you? Do you pay your bills early?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Manage your money

- More articles about Save

- Frugality is personal – Spend based on your needs

- How to Tackle and Pay Off Various Forms of Debt

- My 7 Biggest Budgeting Mistakes – How to fix them!

If I have understood correctly, you propose to not pay the invoices early to get these discounts.

I don’t understand this, especially your example. There you would have to invest the money with at least 2.2% return to be slightly better than paying at the beginning of the year. Where do you invest this money to get 2.2% return while having 1) the money available every month and 2) enough security, i.e. no volatility?

Investing money (and by that I don’t mean a savings account) that is needed in the short term doesn’t really make sense to me.

So for me: I pay health insurance premium in advance (have 1% – 2% discount) and only have to check the bill once a year. I pay all other bills on the due date. Paying taxes in advance is not attractive for me at the moment, as the bank interest rate is significantly higher than the prepayment interest rate in my canton (and i don’t invest this money either!).

And another thing: you don’t have to pay tax on this 1% – 2% discount, but you do have to pay tax on the return on your investment – but it probably doesn’t matter (much) :-)

And something else: craftsman’s invoices sometimes have a discount (skonto), this makes sense to take advantage of this.

Yes, I propose it’s not useful if you invest aggressively.

But I think you may have misunderstood the example. It’s not about short-term investing, it’s about long-term investing. It’s not about investing the money to pay the bill, it’s about keeping the money invested. If you need to pay a large sum in cash in advance, this sum must not be invested and this is where it becomes expensive to keep it in cash instead of keeping it in stocks and pay the bills each month out of the salary.

In the past in Switzerland one could pay the bills right away deducing a couple of % “Skonto” (was a common practice). See -> https://de.wikipedia.org/wiki/Skonto

I don’t think there are many cases left (other than the few I have mentioned) where you can a premium, unfortunately.

Very good article thanks !

With taxes, you can have a double optimization when you pay in advance. Let’s imagine you pay in advance your 2024 taxes in December 2023 :

1) You have a reduction for in advance payment

2) The amount paid in advance will not be in your fortune at the end of the year, so less taxes.

My 2 cents.

Hi Tux

That’s a good point. If you pay wealth tax, it good to limit your wealth at the 31.12 mark.

I always pay in time. When I pay the bill I set the date to the date it is due. I know it is not a lot a save. But since you get interest in your account you can make a few CHF a year by not paying instantly you receive the bill.

I also pay my health insurance monthly since interests have returned.

I was thinking about paying bills by credit card with cashback. But the costs are higher than the return.

Hi Daniel,

Interesting, I never thought of that. I always set the data to the earliest possible :)

If we could pay by credit card without fees, it would be great indeed.

Thanks for sharing your strategy!

I also put in the due date usually. Not so much regarding the additional interest (which is nice though), but regarding the increased liquidity I have during the month.

If for some reason an emergency happens, it’s for sure better if the money is still on my account.

Regarding emergency, I am not sure this is a fair point, because paying your bills should not come out of your emergency fund, so it should not change.

But I agree that money is better in your hands as long as possible compared to putting it in the hands of others too early.