TradeDirect Review 2024 – Pros & Cons

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Trade Direct is an online broker owned by the BCV, the cantonal bank from Vaud. It has a reputation for being a very affordable broker with many features.

In this review, we look at the features and fees of Trade Direct, as well as its advantages and disadvantages. By the end of the review, you will know whether you should use Trade Direct to trade on the stock market.

| Custody Fees | 0.10% per year |

|---|---|

| Inactivity Fees | 0 CHF |

| Buy Swiss ETF | 6.90-199.90 CHF |

| Buy American Stock | 9.90-199.90 USD |

| Currency Exchange Fee | 2.50% |

| Languages | English, French, German |

| Mobile Application | Yes |

| Web Application | Yes |

| Custodian Bank | BCV |

| Established | 1999 |

| Headquarters | Lausanne, Switzerland |

TradeDirect

TradeDirect was launched in 1999 by the Banque Cantonale Vaudoise (BCV). In the beginning, it was only available for the BCV customers, but it was extended to become a separate service.

To this day, they serve more than 10,000 investors in Switzerland, making them one of the five biggest brokers in the country.

Features

Let’s start with the features offered by TradeDirect for Swiss investors.

TradeDirect offers access to 35 stock exchanges in the world. They also give access to stocks, ETFs, funds, and bonds. They even provide access to derivatives such as warrants.

With TradeDirect, you can invest on your smartphone or your computer. For investing, you can use the standard stock market order types such as market orders or limit orders.

You can have your account in CHF, USD, or EUR.

They do not offer any leverage. So, you cannot invest with margin or sell short. For most investors, this is not an issue.

Overall, TradeDirect has enough investing features for most investors.

Fees

It is also essential to look at the broker’s fees.

With TradeDirect, you pay a quarterly custody fee of 0.025% per quarter. There is a maximum of 25 CHF and a minimum of 10 CHF. In yearly terms, this is a custody fee between 40 CHF and 100 CHF. We should note that these numbers do not include VAT. This is a reasonable custody fee for a Swiss broker.

The fees are divided into 5 five different categories:

- Fees for SIX stocks.

- Fees for SIX structured products.

- Fees for Europe 1 (Xetra, Euronext Paris, Amsterdam, London SETS).

- Fees for Europe 2 (other European stock exchanges, such as Helsinki or Milan).

- Fees for USA and Canada (such as NYSE and NASDAQ).

Let’s look at the three most interesting categories in detail.

Here are the fees for buying and selling stocks on SIX:

- Below 750 CHF: 6.90 CHF (0.92% – N/A)

- From 750 to 2’000: 17.90 CHF (0.89% – 2.38%)

- From 2’000 to 10’000: 29.90 CHF (0.3% – 1.49%)

- From 10’000 to 15’000: 44.90 CHF (0.3% – 0.45%)

- From 15’000 to 25’000: 69.90 CHF (0.28% – 0.46%)

- From 25’000 to 50’000: 114.90 CHF (0.23% – 0.46%)

- From 50’000 to 75’000: 164.90 CHF (0.22% – 0.33%)

- Above 75’000 CHF: 199.90 CHF (N/A – 0.26%)

Here are the fees for buying and selling stocks in Europe 1 category:

- Below 2’000: 19.90 EUR (0.99% – N/A)

- From 2’000 to 10’000: 29.90 EUR (0.3% – 1.49%)

- From 10’000 to 15’000: 44.90 EUR (0.3% – 0.45%)

- From 15’000 to 25’000: 69.90 EUR (0.28% – 0.46%)

- From 25’000 to 50’000: 114.90 EUR (0.23% – 0.46%)

- From 50’000 to 75’000: 164.90 EUR (0.22% – 0.33%)

- Above 75’000 EUR: 199.90 EUR (N/A – 0.26%)

Finally, here are the detailed fees for buying and selling on US and Canadian stock exchanges:

- Below 750 CHF: 9.90 USD (1.32% – N/A)

- From 750 to 2’000: 21.90 USD (1.095% – 2.92%)

- From 2’000 to 10’000: 32.90 USD (0.33% – 1.64%)

- From 10’000 to 15’000: 44.90 USD (0.3% – 0.45%)

- From 15’000 to 25’000: 69.90 USD (0.28% – 0.46%)

- From 25’000 to 50’000: 119.90 USD (0.24% – 0.48%)

- From 50’000 to 75’000: 169.90 USD (0.22% – 0.34%)

- Above 75’000 CHF: 199.90 USD(N/A – 0.26%)

Overall, the fees for the Swiss stock exchange are relatively good. However, I think the US and Canadian stock exchange fees are too expensive, especially when compared with a foreign broker. However, these fees are very similar to what we are used to for most Swiss brokers.

In addition, there is also a currency conversion fee if you do not have the currency to buy the stocks or if you want to sell foreign stocks back to your currency.

For the main currencies (CHF, EUR, USD, GBP, JPY, AUD, CAD, NOK, SEK, and DKK), you will pay a 2.50% fee. If you convert more than 150’000, you will pay 1%. And you will pay 0.60% if you convert more than a million at once.

For other currencies (SGD, HKD, CZK, ZAR, PLN, BRL, HUF, MXN, and others), you will pay 4% for operations below 150’000, 2.5% below one million and 0.8% for anything higher than one million.

While the main fees are pretty transparent, the fees for currency conversion are well hidden inside two layers of factsheets. This is probably because these fees are very expensive.

Since most people will convert less than 150’000 CHF at a time, we can assume a 2.50% currency conversion fee on most currencies (4% if you need to use a secondary currency). This is a very bad fee. I would never recommend paying such a high fee to convert currencies for your investments.

Overall, the fees for buying and selling are average within Switzerland. However, the currency conversion fees are costly, even prohibitive.

Reputation

Ideally, we should look at the reputation of any broker before investing any money.

I usually look at TrustPilot for reviews, but there were none for TradeDirect. There were 22 reviews for its parent company, Banque Cantonale Vaudoise (BCV), with a 1.9 out of 5 score.

If we look at the Play Store, we can see that the TradeDirect app has 3.2 stars out of 5, with 84 reviews. On the negative side, users cite many bugs with the app. On the positive side, users mention that the app is straightforward to use.

On the App Store, the app gets a 3.7 stars out of 5. The comments are more or less on the same idea.

So overall, it looks like the reviews from the app users are pretty mixed but not catastrophic, either.

Is TradeDirect safe?

We must also look at the safety of the broker.

TradeDirect uses BCV as the custody bank, which means that your cash and securities are held by BCV.

Since BCV is a Swiss bank, your CHF deposits are insured up to 100’000 CHF by the Swiss Deposit Insurance scheme. This insurance is the same for each Swiss bank.

Your stocks should be held in separate custody accounts in your name. Therefore, in case of bankruptcy of either BCV or TradeDirect, your stocks should be safe.

BCV itself has a good credit rating. However, most Swiss banks have good credit cards, which is not a significant advantage.

So, overall, your money is safe as TradeDirect as with other reputable Swiss brokers.

Alternatives

We must compare TradeDirect with a few alternatives to see whether it is good.

TradeDirect vs Swissquote

Everything you need to start investing in the stock market! Open an account with Swissquote and get 100 CHF in trading credits with my code MKT_THEPOORSWISS.

- Swiss broker

- Easy to use

Swissquote is the most used Swiss broker. So, it is an excellent candidate to compare against TradeDirect.

Both brokers have more or less the same features. They will allow you to invest in stocks, bonds, and other instruments. They both provide the main stock market order types and have multiple interfaces to trade with.

They are both Swiss brokers and are well-established. So, overall, they should offer the same security.

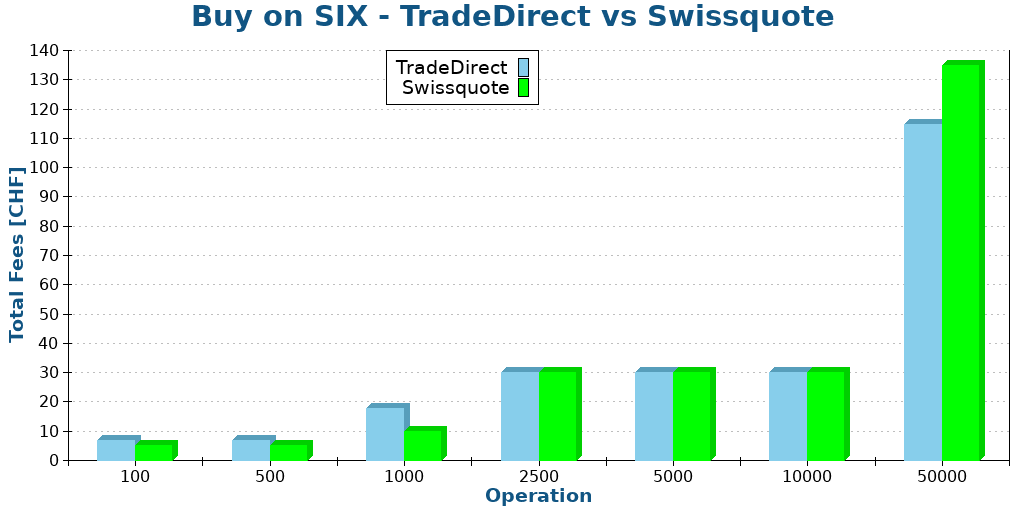

What is more interesting to compare are their fees. First, we can compare their fees on some operations on the SIX stock exchange.

On small operations, Swissquote is slightly cheaper. On large operations, it depends on which brackets. But overall, these fees are relatively the same.

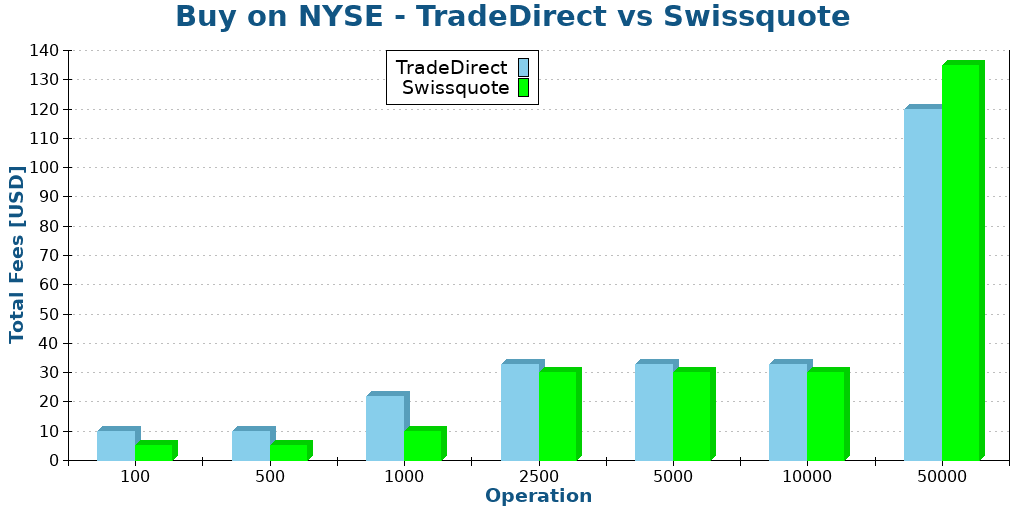

We can redo the same with the NYSE.

In this case, Swissquote is generally cheaper, but the differences are not huge. However, this example assumes you have the currency to trade. If you do not have the currency, you need to convert it, and this can make a big difference.

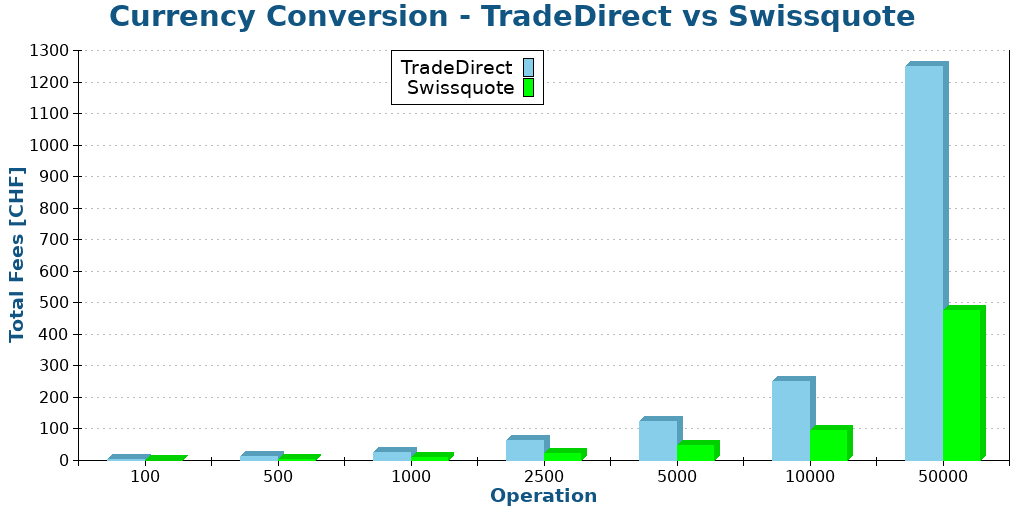

So, let’s compare currency conversion fees.

With a currency conversion fee of 0.95%, Swissquote is much cheaper than TradeDirect. This is a massive difference.

Since they have roughly the same features and transaction fees, I recommend Swissquote because of its much cheaper currency conversion fee.

TradeDirect vs. Neon Invest

All the services you need to pay, save and invest, in a neat package, with extremely good prices!

Use the poorswiss code to receive 10CHF!

- Pay abroad for free

- Invest with great fees

Next, we can compare TradeDirect with Neon Invest. Neon Invest is a relatively new service proposed by Neon, a great digital bank.

In terms of features, TradeDirect has more than Neon. Indeed, Neon Invest only offers access to the BX Swiss stock exchange and only in CHF. On top of that, Neon Invest currently only offers market orders.

As for security, they both offer the same security since they are both in the custody of a Swiss bank. However, the likelihood of Neon failing is higher since it is a small bank compared to the BCV.

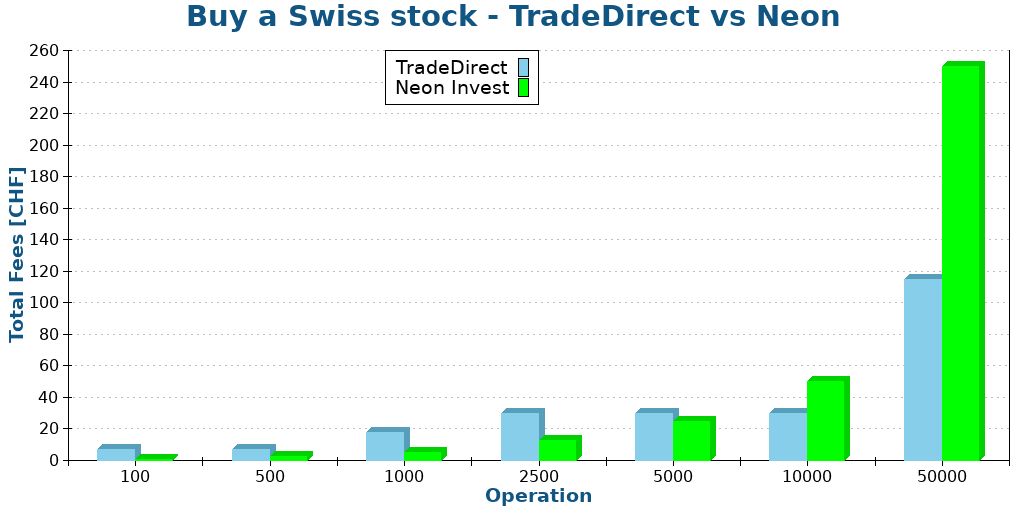

Let’s look at the fees for Swiss stocks.

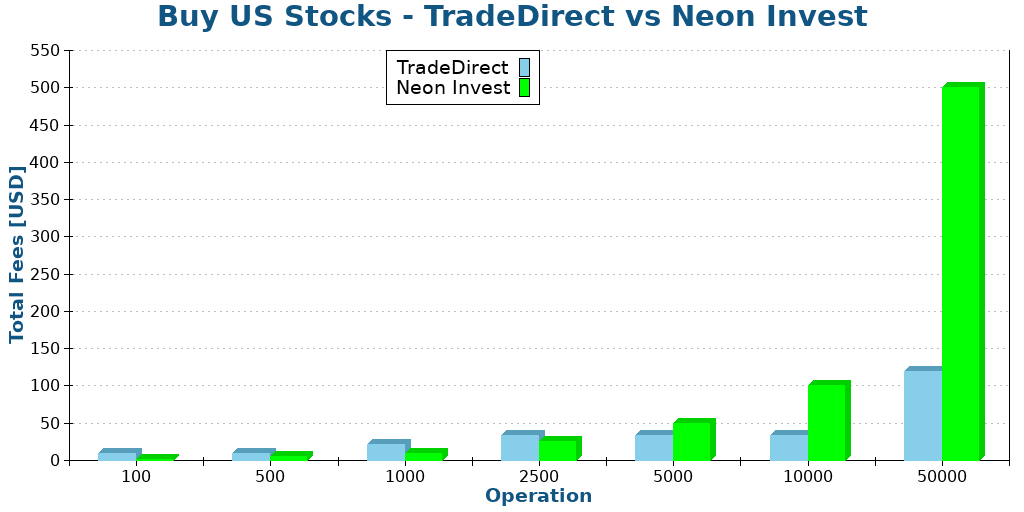

Neon Invest can be much cheaper than TradeDirect on small to medium operations. However, for large operations (more than 10’000), Neon Invest becomes significantly more expensive than TradeDirect.

We can see what happens for US stocks:

Again, Neon Invest is much cheaper than TradeDirect for small and medium operations. However, starting at around 5000 USD, Neon Invest will become significantly more expensive.

Another advantage of Neon Invest is that you will not pay currency conversion fees. Indeed, everything is traded as CHF.

On the other hand, if you receive foreign dividends, you will pay a 1.50% currency conversion. But that is still much better than the 2.50% of TradeDirect.

Overall, Neon Invest is a better choice if you are fine with trading only on BX Swiss and want to do small to medium operations. If you wish to trade on more exchanges or want to do large operations,

TradeDirect vs Interactive Brokers

The broker you need to buy stocks and ETFs reliably and at extremely affordable prices. Trade U.S. stocks for as little as 0.5 USD!

- Extremely affordable

- Wide range of investing instruments

Finally, let’s compare TradeDirect with my favorite broker, Interactive Brokers, a broker from the US with a branch in the UK.

In terms of features, IB has many more than TradeDirect, with multiple applications, many stock market order types, and access to more exchanges.

They are very different in terms of security. Thanks to US SIPC, you have more protection at IB. However, many believe having a Swiss broker is a sign of security, so you will have to weigh that for yourself.

We should also compare the fees of both brokers. I will use IB Fixed fees for simplicity.

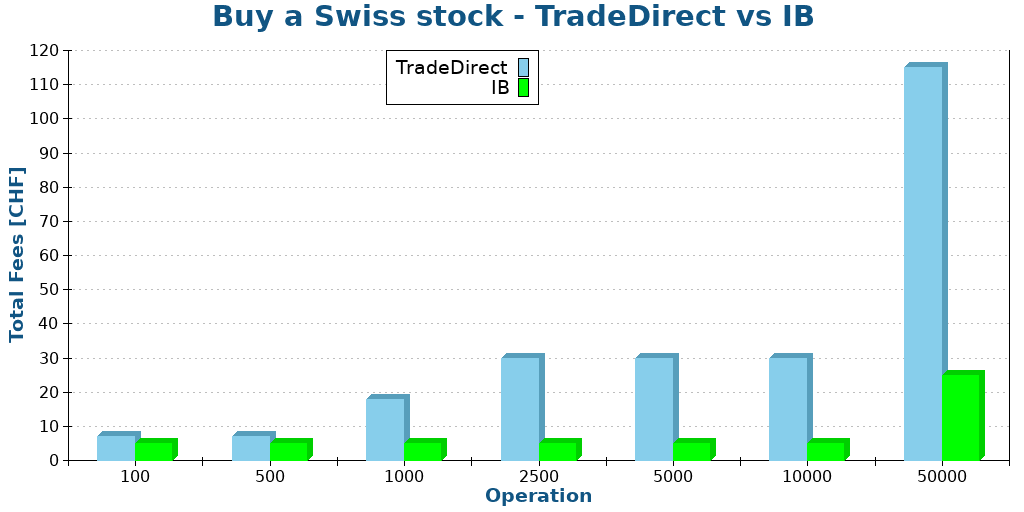

Let’s look at the fees for Swiss stocks:

Interactive Brokers is much cheaper than a Swiss broker even on the Swiss stock exchange. This is something I find sad. A foreign broker should not be much cheaper than a Swiss on a Swiss stock exchange.

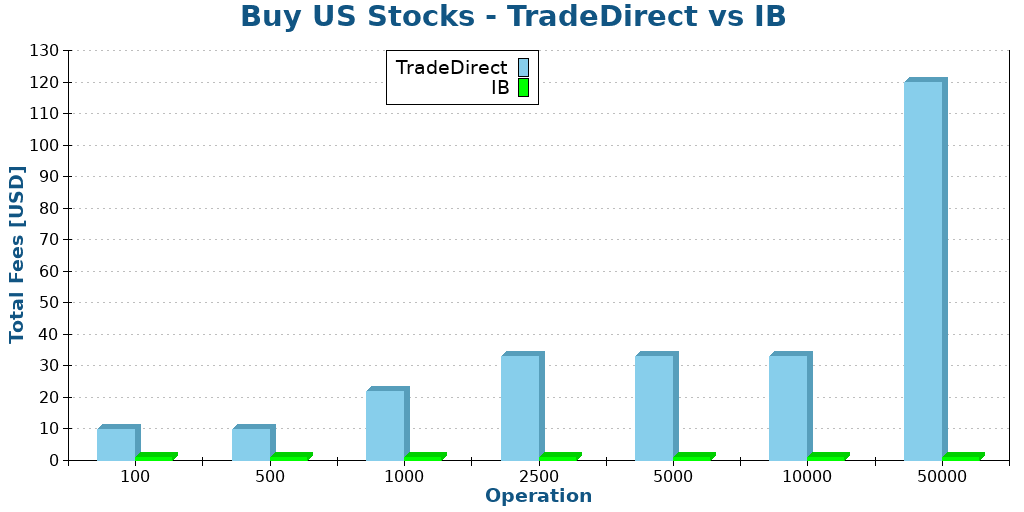

Let’s also look at the fees for US stocks:

We can see that the difference is even greater. So, overall, IB is much cheaper on all stock market operations.

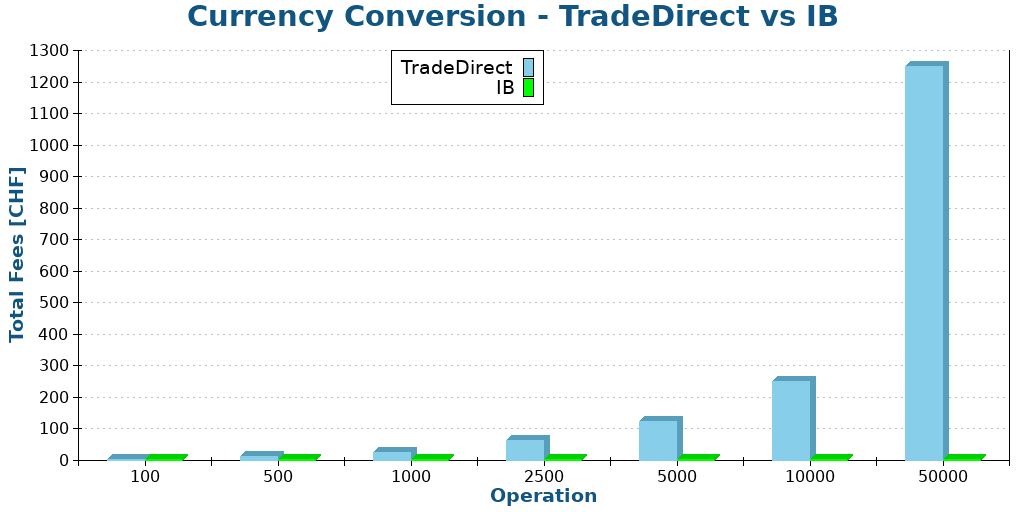

Finally, let’s look at the currency conversion fees.

With only a 2 USD fee per trade, IB is much cheaper than TradeDirect on another level.

Simply put, if you are ready to use a foreign broker, you should use Interactive Brokers. It is better on all counts.

TradeDirect FAQ

Do you need a BCV account to use TradeDirect?

No, the two services are separated.

Who is TradeDirect good for?

TradeDirect is decent if you only trade in Swiss francs.

Who is TradeDirect not good for?

TradeDirect is not good if you trade in foreign currencies since it has very high currency conversion fees.

TradeDirect Summary

Review of the TradeDirect broker, introduced by the BCV. Learn all you need to know about this broker to decide whether you need it or not.

2.5

TradeDirect Pros

Let's summarize the main advantages of TradeDirect:

- Access to many stock exchanges

- Average transaction fees

- Your assets are safe in the custody bank

- Trade on mobile and computer

TradeDirect Cons

Let's summarize the main disadvantages of TradeDirect:

- Very expensive currency conversion fees

- No access to US ETFs

Conclusion

Overall, TradeDirect is a decent Swiss broker. It has enough features for most investors. And its transaction fees are acceptable.

However, its currency conversion fees are very expensive. This makes it quite undesirable unless you are only trading Swiss stocks. There are simply some better alternatives out there. You should look at the best brokers available for Swiss investors.

What about you? What do you think about TradeDirect?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Best Brokers

- More articles about Investing

- IBKR Desktop Review 2024

- Neon Invest Review 2024: Pros & Cons

- The best broker for Swiss investors in 2024

you can have other foreign currency accounts with tradedirect as well. They explicitly ask if you want USD, EUR when opening account, but more foreign currency accounts can be added later. I just opened CAD and AUD.

Yes, but if you want to convert between those, you will pay a very high fee.

Thank you very much Baptiste. I now have a good reason to open an account with IB.

Thank you very much for the suggestion Alex.

Dear Baptiste, Thank you very much for the clear comparaison. If i understand it correctly, to change any amount of US$ with IB cost US$2 vs. 0.95% with SQ. I need to change a rather large amount of US$ in CHF and try to find the most economical way to do it. With kind regards.

Open IB account. Send CHF there. Exchange. Send to your USD account.

PS: Not a financial advice :)

Hi gilles,

Yes, you understand correctly. Put differently, any conversion above 200-ish USD will be cheaper with IB.

Shows one more time how detached are local brokers from reality even in 2024. Though they still have their audience, probably.

Yeah, they have decent fees, but they really need to do something about their currency conversion fees to be usable.