Swissquote Review 2024 – A great Swiss Broker

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Are you wondering if Swissquote is any good?

Swissquote is one of the most well-known Swiss brokers, and many investors use it. It has many features that make it attractive for people looking to invest in the stock market.

But is Swissquote any good? Many people are asking this question, and we have the answer. We compare Swissquote to some of its competitors to see how it stacks up.

This in-depth review answers precisely that question. We see what Swissquote is, what you can do with it, how much it costs, and much more!

By the end of this review, you will know whether Swissquote is a good broker for you!

| Custody Fees | 0.10% per year |

|---|---|

| Inactivity Fees | 0 CHF |

| Buy Swiss ETF | 5-190 CHF |

| Buy American Stock | 5-190 USD |

| Currency Exchange Fee | 0.95% |

| Languages | English, French, German, and Italian |

| Mobile Application | Yes |

| Web Application | Yes |

| Custodian Bank | Swissquote |

| Established | 1996 |

| Headquarters | Zürich |

Swissquote

Everything you need to start investing in the stock market! Open an account with Swissquote and get 100 CHF in trading credits with my code MKT_THEPOORSWISS.

- Swiss broker

- Easy to use

The Swissquote broker is part of the Swissquote Group Holding SA company. It is a Swiss banking group operating in many countries. The Swissquote broker was founded in 1996, making it a well-established company. They have 722 employees at the time of this writing.

While the group offers services in many countries, this review will focus on its services in Switzerland. This service is regulated by the Swiss Financial Market Supervisory Authority (FINMA).

Swissquote has a banking license and is listed on the stock market. This listing makes Swissquote very transparent since it must reveal detailed financial reports.

At the time of this writing, Swissquote has more than 400’000 users. It offers access to stocks, bonds, funds, Contracts For Difference (CFDs), and more. They have access to 60 stock exchanges over the world. If you are a passive investor like me, they have more features than you would ever need.

They also offer some services outside of the stock market, like cryptocurrencies. But I do not cover this part in this review. Instead, I want to focus on their trading features. They have separated the two features on their tools too.

So, we will delve deeper into what Swissquote offers as a broker.

Swissquote Account Types

Swissquote has four different account types:

- Trading. This account is the one that interests us for this review since it offers access to trading in the stock market.

- Forex. An account for foreign exchange traders.

- Robo-Advisory. You can also use Swissquote as a Robo-Advisor.

- Crypto-Assets. A special account where you can trade many cryptocurrencies.

This review focuses solely on the Trading account type. As a passive investor in the stock market, this is the only account you need.

Swissquote Fees

In the long term, you need to reduce your fees. Investing fees are extremely important. Therefore, we must look at the fees of the Trading account at Swissquote.

You will pay 0.025% in custody fees for the account. This fee is charged each quarter, with a minimum fee of 20 CHF. Fortunately, there is a maximum of 50 CHF per quarter. So, the maximum fee you will pay is 200 CHF per year.

On assets above a million CHF, you will pay an extra 0.03% management fee per year. This extra fee is not negligible if you plan to retire on your investments, but it is still significantly lower than that of big Swiss brokers.

As far as Swiss brokers go, this is a reasonable fee, but it is still not negligible. This custody fee is the only fee you will pay outside of trading fees. There are no extra account management fees or inactivity fees.

We start with Exchange Traded Funds (ETFs) since they are the best instrument for passive investors in Switzerland. With most brokers, ETFs have the same trading fees as stocks since they are traded similarly.

However, with Swissquote, there is a slight difference. For some ETFs, called ETF Leaders, you will pay a flat fee of 9 CHF per trade on the Swiss Stock Exchange. If the ETF is listed in USD, you will pay 9 USD (and the same logic for GBP and EUR).

In the ETF leaders, you find many good ETFs by Vanguard, iShares, UBS, etc. So, as long as you buy your ETF on the Swiss Stock Exchange, you should be okay with the flat fee. For ETFs on other stock exchanges, the fees will be the same as for stocks.

Then, you pay a fee for each stock exchange based on the transaction value. The fees are the same for buy and sell operations. For instance, here are the fees for the Swiss Stock Exchange (SWX):

- 0 – 500: 5 CHF

- 500.01 – 1000: 10 CHF

- 1000.01 – 2000: 20 CHF

- 2000.01 – 10’000: 30 CHF

- 10’000.01 – 15’000: 55 CHF

- 15’000.01 – 25’000: 80 CHF

- 25’000.01 – 50’000: 135 CHF

- From 50’000.01: 190 CHF

And here are the fees for American stock exchanges (NYSE or Nasdaq):

- 0 – 500: 5 USD

- 500.01 – 1000: 10 USD

- 1000.01 – 2000: 20 USD

- 2000.01 – 10’000: 30 USD

- 10’000.01 – 15’000: 55 USD

- 15’000.01 – 25’000: 80 USD

- 25’000.01 – 50’000: 135 USD

- From 50’000.01: 190 USD

These fees are not cheap, especially for small transactions. For instance, if you buy 1000 CHF shares, you will pay a 2% fee! 2% is a huge fee, and you must be careful about it. But if you buy for 10’000 CHF, you will pay 0.3% in fees. 0.3%is still a considerable fee, but it is acceptable.

And when we compare Swissquote with other Swiss brokers, these fees are low.

We also have to consider the currency conversion fee. At Swissquote, you will pay 0.95% of the exchange value if you convert CHF to another common currency like EUR or USD. The fees may change if you use other, more exotic currencies.

Once again, this is a significant fee. You need to be careful about this fee. You pay this fee whenever you buy or sell an ETF in EUR or USD. Over time, this can quickly accumulate to a significant amount of money lost to fees.

Finally, the last fee we will examine is the Swiss Stamp Tax Duty fee. Since Swissquote is a Swiss broker, you must pay this fee for each stock market operation. The fee is 0.075% for Swiss shares and 0.15% for foreign shares, and it is the same for each Swiss broker.

Swissquote will provide a tax certificate and an e-tax certificate. However, these certificates will cost you 100 CHF each year. I am not sure you can file your taxes without them, so it is pretty much a mandatory fee.

Overall, Swissquote is not cheap. Several of its fees are relatively high, mainly currency exchange and trading fees for small transactions. However, compared with other Swiss brokers, these fees are affordable. Indeed, Most Swiss brokers are even more expensive than Swissquote.

In fact, for transactions on the Swiss Stock exchange, Swissquote is among the cheapest Swiss brokers. The only place where it does not shine is for foreign currency exchange.

Opening an account at Swissquote

We will see what it takes to open an account at Swissquote.

Opening an account at Swissquote can be done entirely online. However, depending on when you call, you may have to wait until you get someone on call for the video identification, which can take a while (more than 10 minutes).

Other than that, the account opening process is very straightforward. You must give your personal information and answer questions about your financial knowledge. These are the same questions every broker will ask you—nothing surprising.

There is no minimum for opening an account. So, you can start trading with very little money. It is good, but be careful about the 60 CHF per year minimum custody fee. If you invest with very little money, this could be expensive.

If you open an account, don’t forget to use my code MKT_THEPOORSWISS to get 100 CHF in trading credits (only for Swiss residents).

So, overall, opening an account at Swissquote should be pretty straightforward.

Trading with Swissquote

Swissquote offers several options to trade stocks:

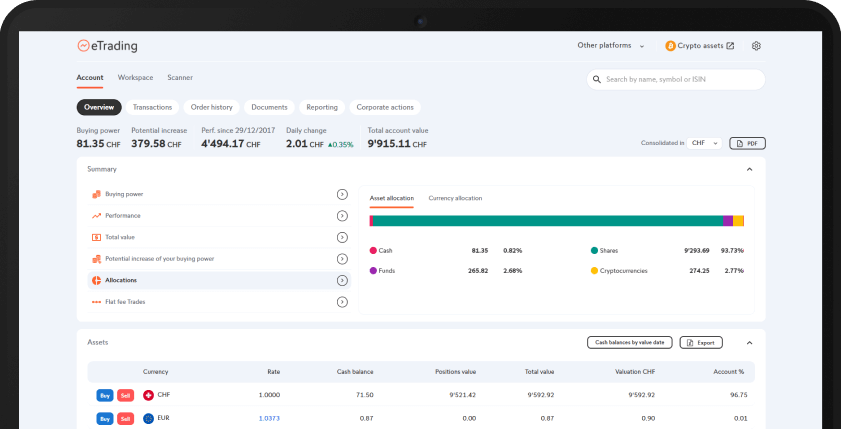

- The web interface can be directly used and has all the necessary functions.

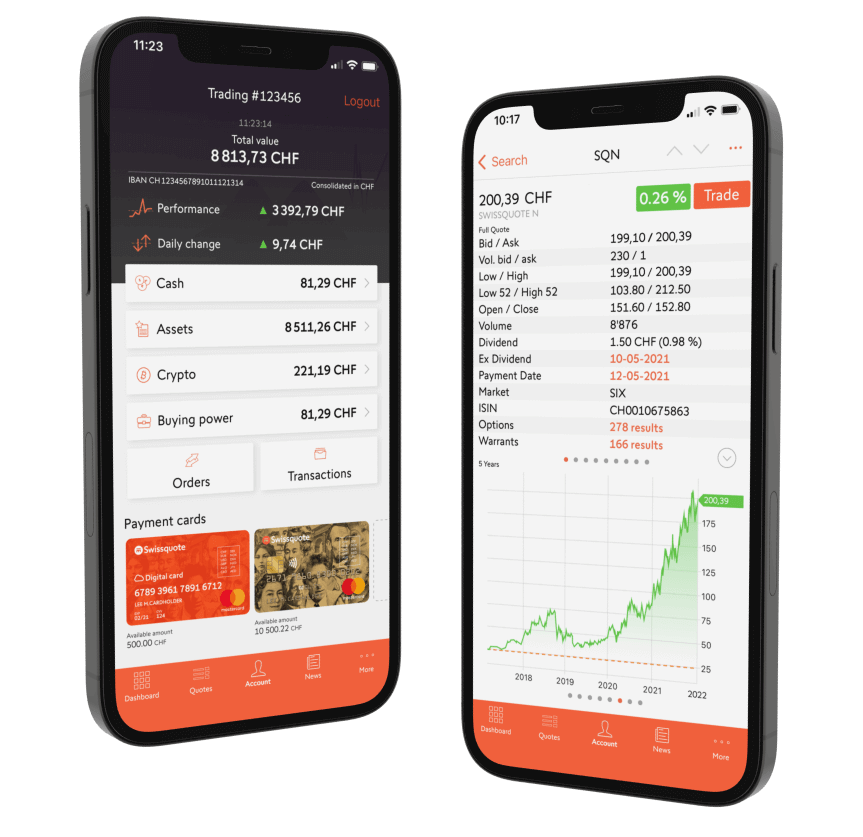

- A mobile application on iOS and Android.

- A desktop application primarily aimed at Forex trading.

Overall, there are enough options for everybody. The web interface should work for most people. Many people will also appreciate mobile applications that let you do everything you need.

The only downside is that the web interface is a little complicated because of all the crammed features. But once you find the features you need, you should be fine with using them. If you want to invest passively, you will only need a small fraction of the features available.

Is Swissquote safe?

If you invest a significant amount of money with a broker, you must ensure it is safe.

Swissquote is regulated in Switzerland by FINMA. Its other entities are also regulated in other countries.

Swissquote has been well-established since 1996 and profitable for several years, so its risks of going bankrupt are slim. But it is still important to know what would happen if your broker went bankrupt.

Since Swissquote has a banking license, your cash will be protected by Esisuisse for up to 100’000 CHF. Your securities should be fully guaranteed since they are supposed to be held in the custodian bank account in your name. It is a good level of protection.

As for technical security, you can opt for a second-factor authentication (2FA) for your account. I strongly recommend everybody to do that to improve the security of their account. I have not heard of any security issues within Swissquote, which is a good sign.

So, overall, investing with Swissquote is safe. As for investing in general, remember that investing involves risks of loss regardless of the platform.

Swissquote Reputation

Looking at a broker’s reputation before investing in the stock market is essential.

As a source of review, I always use TrustPilot. So, we look at the reviews of SQ on TrustPilot. On average, users are rating SQ at 3.2 stars, which is not a great result. So, here is what people are saying about this broker.

First, we should take a look at people complaining about the broker. We can group the complaints into several categories:

- Very long account opening. Several people had to wait several days to get their accounts opened.

- There are very high fees. This is somewhat true, but people should consider this before opening their accounts. The fees are reasonable compared with other Swiss brokers.

- Poor customer service. Many people had issues fixing their issues with customer service.

- Poor investing platform. Some investors are not satisfied with the features offered by the platform, especially on the cryptocurrency side.

Overall, I am a little worried about the reviews on the customer service and account opening. The other complaints do not worry me since they come from people who have not researched properly before opening an account at Swissquote. And we must remember that most internet comments come from unsatisfied people. So, negative comments have to be taken with a pinch of salt even though they still come from some truth.

The good point is that most reviews (36%) are rated five-star. Overall, positive reviews are saying:

- Simple to trade with the platform

- A very stable platform and company

Interestingly, positive reviews strongly focus on the platform itself and its usability. It is good that many people report that the platform is easy to use.

Overall, I would say that the user reviews of Swissquote are good but not great.

Alternatives to Swissquote

It is essential to compare a broker to its alternatives. Many brokers are available to Swiss investors. I think it is important to mention Interactive Brokers as the best alternative to Swissquote.

Swissquote vs Interactive Brokers

For transparency, it is important to mention that I do not use Swissquote.

I believe Swissquote is the best Swiss broker available. If you are looking for a Swiss broker, I would recommend them.

However, I use Interactive Brokers, a broker from the United States. So, we can compare both platforms.

Both brokers are very well-established and regulated. The protection is good on both sides, with a slight advantage for Interactive Brokers protected by U.S. SIPC.

Where everything starts to differ very strongly is in the fees.

We can start with the custody fees. Swissquote has a 200 CHF yearly custody fee for an extensive portfolio. At IB, you will pay 0 CHF in custody fees! You can save 200 CHF per year with IB. And Swissquote has an extra custody fee on assets above 1’000’000 CHF, which IB does not have.

For trading on the Swiss stock exchanges, Interactive Brokers is slightly cheaper than Swissquote, but not by a large margin. Where IB shines is in American stock exchanges. For instance, if I buy 10’000 USD of Microsoft shares, I will pay about 0.40 USD on IB (yes, 40 cents!). On Swissquote, this would cost 30 USD. In this example, IB is 75 times cheaper than Swissquote!

In addition, since IB is a foreign broker, you will not pay the Swiss Stamp tax. With IB, you save 0.075% on each Swiss operation and 0.15% on each foreign operation.

Finally, currency exchange at IB costs about 2 USD, while they cost 0.95% at Swissquote. So, unless you convert less than 200 USD, IB will be much cheaper for converting money.

So, if you are ready to use a broker that is not Swiss, you should consider Interactive Brokers. You can read my review of IB to know more. But as far as Swiss brokers go, Swissquote is excellent.

For more details, read my full comparison of Swissquote vs Interactive Brokers.

FAQ

Is Swissquote safe?

Swissquote is a well-established broker, regulated by the FINMA. In case of bankruptcy, your assets are segregated and will be available to you.

Can you convert currency with Swissquote?

Yes, you can convert between many different currency pairs.

Who is Swissquote good for?

Swissquote is good for people that want a well-established Swiss broker with good fees and many features.

Who is Swissquote not good for?

Swissquote is not great for people that often trade in foreign currencies, because of its high currency conversion fees.

Swissquote Summary

Swissquote is a great Swiss broker. It has excellent fees and a good reputation. It provides you with all the features you need to start investing.

Product Brand: Swissquote

4.5

Swissquote Pros

Let's summarize the main advantages of Swissquote:

- Cheap compared to other Swiss brokers

- Relatively fast account opening

- A very vast range of investments

- Long experience

- Well-established company

- Good security

- Easy to use

Swissquote Cons

Let's summarize the main disadvantages of Swissquote:

- Expensive currency exchange fees

- Expensive when compared to foreign brokers

- Video identification can take a while to complete

Conclusion

Everything you need to start investing in the stock market! Open an account with Swissquote and get 100 CHF in trading credits with my code MKT_THEPOORSWISS.

- Swiss broker

- Easy to use

Overall, Swissquote is a good, well-established, and affordable Swiss broker. They offer access to many stock exchanges and many investing instruments. And they compare well with other Swiss brokers.

So, Swissquote is the best Swiss broker. If you want to invest with a Swiss broker, I recommend going with Swissquote. Swissquote will be a great platform for growing your money with the stock market.

If you use my code MKT_THEPOORSWISS when you open an account, you will get 100 CHF in trading credits. So you are saving 100 CHF in fees! However, this code is only valid for Swiss residents.

If you are interested in Swiss brokers, in particular, I compared the best brokers. This article should help you choose, but you need to know the cost differences between Swiss and foreign brokers.

If you are also considering foreign brokers, I recommend Interactive Brokers as the best broker for Swiss investors.

What about you? What do you think of Swissquote?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Best Brokers

- More articles about Investing

- How to Buy an ETF on Interactive Brokers the Easy Way

- Yuh Review 2024: One app to pay, save and invest

- The best broker for Swiss investors in 2024

Hello, thanks for all the great articles in here. I would be very curious into a Swissquote vs Saxo comparison, especially since Saxo change their fees. Thanks!

Thanks, I will try to get this done in the coming months!

Hi Baptiste,

first of all, thank you very much for your articles and calculations! I just wanted to let you know that from the fiscal year of 2023 and onwards, Swissquote supports the “eSteuerauszug” standard. It still costs 100.- CHF to order the tax statement, but the “eSteuerauszug” is now included with no additional cost.

Thank you and till next time

Paul

Hi paul,

Thanks for letting me know. I still wish they would do that for free like many companies. But at least, it’s good that they added the e-tax certificate in the current free and not added another fee for it!

Hi Baptiste,

it’s true that investing in ETF leaders like

VUSA (Vanguard S&P 500 UCITS ETF) on SIX Swiss Exchange is cheap, but do you think it would be good enough in terms of ETF’s liquidity on this exchange compared to other exchanges?

Hi Paolo

It’s difficult to say. But I would think no. I would prefer using the proper exchange when possible to keep the spread low for the future when I need to sell. But this is mostly a gut feeling, I did not do the math. I just prefer buying ETFs on their “home exchange”.