Swissquote Erfahrungen 2024 – Ein toller Schweizer Broker

| Aktualisiert: |(Offenlegung: Einige der unten aufgeführten Links können Affiliate-Links sein)

Sie fragen sich, ob Swissquote etwas taugt?

Swissquote ist einer der bekanntesten Schweizer Broker, der von vielen Anlegern genutzt wird. Es verfügt über zahlreiche Merkmale, die es für Personen, die in den Aktienmarkt investieren möchten, attraktiv machen.

Aber taugt Swissquote überhaupt etwas? Viele Menschen stellen sich diese Frage, und wir haben die Antwort. Wir vergleichen Swissquote mit einigen seiner Konkurrenten, um zu sehen, wie es abschneidet.

Dieser ausführliche Bericht beantwortet genau diese Frage. Wir sehen, was Swissquote ist, was Sie damit machen können, wie viel es kostet und vieles mehr!

Am Ende dieses Berichts werden Sie wissen, ob Swissquote ein guter Broker für Sie ist!

| Gebühren für die Verwahrung | 0,10% pro Jahr |

|---|---|

| Gebühren für Inaktivität | 0 CHF |

| Schweizer ETF kaufen | 5-190 CHF |

| Amerikanische Aktien kaufen | 5-190 USD |

| Gebühr für den Währungsumtausch | 0.95% |

| Sprachen | Englisch, Französisch, Deutsch und Italienisch |

| Mobile Anwendung | Ja |

| Web-Anwendung | Ja |

| Depotbank | Swissquote |

| Gegründet | 1996 |

| Hauptsitz | Zürich |

Swissquote

Alles, was Sie brauchen, um in den Aktienmarkt zu investieren! Eröffnen Sie ein Konto bei Swissquote und erhalten Sie 100 CHF an Handelsguthaben mit meinem Code MKT_THEPOORSWISS.

- Schweizer Broker

- Einfach zu bedienen

Der Broker Swissquote ist Teil der Swissquote Group Holding SA. Sie ist eine Schweizer Bankengruppe, die in vielen Ländern tätig ist. Der Broker Swissquote wurde 1996 gegründet und ist damit ein etabliertes Unternehmen. Zum Zeitpunkt der Erstellung dieses Dokuments sind dort 722 Mitarbeiter beschäftigt.

Die Gruppe bietet ihre Dienstleistungen zwar in vielen Ländern an, doch dieser Bericht konzentriert sich auf die Dienstleistungen in der Schweiz. Dieser Dienst wird von der Eidgenössischen Finanzmarktaufsicht (FINMA) reguliert.

Swissquote verfügt über eine Banklizenz und ist börsennotiert. Diese Notierung macht Swissquote sehr transparent, da sie detaillierte Finanzberichte offenlegen muss.

Zum Zeitpunkt der Erstellung dieses Artikels hat Swissquote mehr als 400’000 Nutzer. Es bietet Zugang zu Aktien, Anleihen, Fonds, Contracts For Difference (CFDs) und mehr. Sie haben Zugang zu 60 Börsenplätzen in der ganzen Welt. Wenn Sie wie ich ein passiver Anleger sind, haben sie mehr Funktionen, als Sie jemals brauchen werden.

Sie bieten auch einige Dienstleistungen außerhalb des Aktienmarktes an, wie etwa Kryptowährungen. Aber diesen Teil behandle ich in dieser Rezension nicht. Stattdessen möchte ich mich auf ihre Handelsfunktionen konzentrieren. Sie haben die beiden Funktionen auch in ihren Tools getrennt.

Wir werden uns also genauer ansehen, was Swissquote als Broker bietet.

Swissquote Kontotypen

Swissquote bietet vier verschiedene Kontotypen an:

- Handel. Dieses Konto ist dasjenige, das uns für diese Überprüfung interessiert, da es den Zugang zum Handel an der Börse bietet.

- Devisen. Ein Konto für Devisenhändler.

- Robo-Advisory. Sie können Swissquote auch als Robo-Advisor nutzen.

- Krypto-Assets. Ein spezielles Konto, auf dem Sie viele Kryptowährungen handeln können.

Dieser Bericht konzentriert sich ausschließlich auf den Kontotyp Handelskonto. Als passiver Anleger in den Aktienmarkt ist dies das einzige Konto, das Sie brauchen.

Swissquote-Gebühren

Langfristig müssen Sie Ihre Gebühren senken. Anlagegebühren sind extrem wichtig. Deshalb müssen wir uns die Gebühren für das Handelskonto bei Swissquote ansehen.

Sie zahlen 0,025 % Depotgebühren für das Konto. Diese Gebühr wird vierteljährlich erhoben, wobei die Mindestgebühr 20 CHF beträgt. Zum Glück gibt es einen Höchstbetrag von 50 CHF pro Quartal. Die maximale Gebühr, die Sie zahlen, beträgt also 200 CHF pro Jahr.

Bei einem Vermögen von über einer Million CHF zahlen Sie eine zusätzliche Verwaltungsgebühr von 0,03% pro Jahr. Diese zusätzliche Gebühr ist nicht zu vernachlässigen, wenn Sie planen, sich mit Ihren Investitionen zur Ruhe zu setzen, aber sie ist immer noch deutlich niedriger als bei den großen Schweizer Brokern.

Im Vergleich zu Schweizer Brokern ist diese Gebühr zwar angemessen, aber dennoch nicht zu vernachlässigen. Diese Verwahrungsgebühr ist die einzige Gebühr, die Sie neben den Handelsgebühren zahlen. Es fallen keine zusätzlichen Kontoführungsgebühren oder Inaktivitätsgebühren an.

Wir beginnen mit Exchange Traded Funds (ETFs), da sie das beste Instrument für passive Anleger in der Schweiz sind. Bei den meisten Brokern fallen für ETFs die gleichen Handelsgebühren an wie für Aktien, da sie in ähnlicher Weise gehandelt werden.

Bei Swissquote gibt es jedoch einen kleinen Unterschied. Für einige ETFs, die sogenannten ETF Leaders, zahlen Sie an der Schweizer Börse eine Pauschalgebühr von 9 CHF pro Handel. Wenn der börsengehandelte Fonds in USD notiert ist, zahlen Sie 9 USD (und das Gleiche gilt für GBP und EUR).

In den ETF-Führern finden Sie viele gute ETFs von Vanguard, iShares, UBS, etc. Solange Sie also Ihren ETF an der Schweizer Börse kaufen, sollten Sie mit der Pauschalgebühr kein Problem haben. Für ETFs an anderen Börsen sind die Gebühren dieselben wie für Aktien.

Anschließend zahlen Sie für jede Börse eine Gebühr, die sich nach dem Transaktionswert richtet. Die Gebühren sind für Kauf- und Verkaufstransaktionen gleich hoch. Hier sind zum Beispiel die Gebühren für die Schweizer Börse (SWX):

- 0 – 500: 5 CHF

- 500.01 – 1000: 10 CHF

- 1000.01 – 2000: 20 CHF

- 2000.01 – 10’000: 30 CHF

- 10’000.01 – 15’000: 55 CHF

- 15’000.01 – 25’000: 80 CHF

- 25’000.01 – 50’000: 135 CHF

- Ab 50’000.01: 190 CHF

Und hier sind die Gebühren für amerikanische Börsen (NYSE oder Nasdaq):

- 0 – 500: 5 USD

- 500,01 – 1000: 10 USD

- 1000,01 – 2000: 20 USD

- 2000.01 – 10’000: 30 USD

- 10’000.01 – 15’000: 55 USD

- 15’000.01 – 25’000: 80 USD

- 25’000.01 – 50’000: 135 USD

- Von 50’000.01: 190 USD

Diese Gebühren sind nicht billig, vor allem bei kleinen Transaktionen. Wenn Sie zum Beispiel 1000 CHF-Aktien kaufen, zahlen Sie eine Gebühr von 2%! 2 % ist eine hohe Gebühr, und Sie müssen vorsichtig sein. Wenn Sie jedoch für 10’000 CHF kaufen, zahlen Sie 0,3 % an Gebühren. 0,3 % ist zwar immer noch eine beträchtliche Gebühr, aber sie ist akzeptabel.

Und wenn wir Swissquote mit anderen Schweizer Brokern vergleichen, sind diese Gebühren niedrig.

Wir müssen auch die Währungsumrechnungsgebühr berücksichtigen. Bei Swissquote zahlen Sie 0,95 % des Umrechnungswertes, wenn Sie CHF in eine andere gängige Währung wie EUR oder USD umtauschen. Die Gebühren können sich ändern, wenn Sie andere, exotischere Währungen verwenden.

Auch hier handelt es sich um eine erhebliche Gebühr. Bei dieser Gebühr müssen Sie vorsichtig sein. Sie zahlen diese Gebühr, wenn Sie einen ETF in EUR oder USD kaufen oder verkaufen. Im Laufe der Zeit kann sich dies schnell zu einem beträchtlichen Geldbetrag summieren , der durch Gebühren verloren geht.

Die letzte Gebühr, die wir untersuchen werden, ist die schweizerische Stempelsteuergebühr. Da Swissquote ein Schweizer Broker ist, müssen Sie diese Gebühr für jede Börsenoperation bezahlen. Die Gebühr beträgt 0,075 % für Schweizer Aktien und 0,15 % für ausländische Aktien und ist für jeden Schweizer Broker gleich hoch.

Swissquote stellt eine Steuerbescheinigung und ein E-Tax-Zertifikat aus. Diese Zertifikate kosten jedoch 100 CHF pro Jahr. Ich bin mir nicht sicher, ob Sie Ihre Steuern ohne sie einreichen können, also ist es sozusagen eine Pflichtgebühr.

Insgesamt ist Swissquote nicht billig. Einige der Gebühren sind relativ hoch, vor allem die Gebühren für den Währungsumtausch und den Handel bei kleinen Transaktionen. Im Vergleich zu anderen Schweizer Brokern sind diese Gebühren jedoch erschwinglich. In der Tat sind die meisten Schweizer Broker noch teurer als Swissquote.

Für Transaktionen an der Schweizer Börse gehört Swissquote sogar zu den günstigsten Schweizer Brokern. Der einzige Bereich, in dem er nicht glänzt, ist der Devisenhandel.

Eröffnung eines Kontos bei Swissquote

Wir werden sehen, was es braucht, um ein Konto bei Swissquote zu eröffnen.

Die Eröffnung eines Kontos bei Swissquote kann vollständig online erfolgen. Je nachdem, wann Sie anrufen, müssen Sie jedoch möglicherweise warten, bis jemand für die Videoidentifizierung bereitsteht, was eine Weile dauern kann (mehr als 10 Minuten).

Ansonsten ist der Prozess der Kontoeröffnung sehr einfach. Sie müssen Ihre persönlichen Daten angeben und Fragen zu Ihren finanziellen Kenntnissen beantworten. Dies sind die gleichen Fragen, die Ihnen jeder Makler stellen wird – nichts Überraschendes.

Für die Eröffnung eines Kontos gibt es keinen Mindestbetrag. Sie können also mit sehr wenig Geld in den Handel einsteigen. Es ist gut, aber seien Sie vorsichtig wegen der Mindestverwahrungsgebühr von 60 CHF pro Jahr. Wenn Sie mit sehr wenig Geld investieren, kann das teuer werden.

Wenn Sie ein Konto eröffnen, vergessen Sie nicht, meinen Code MKT_THEPOORSWISS zu verwenden, um 100 CHF an Handelsguthaben zu erhalten (nur für Schweizer Bürger).

Insgesamt sollte die Eröffnung eines Kontos bei Swissquote also recht einfach sein.

Handeln mit Swissquote

Swissquote bietet mehrere Optionen für den Aktienhandel an:

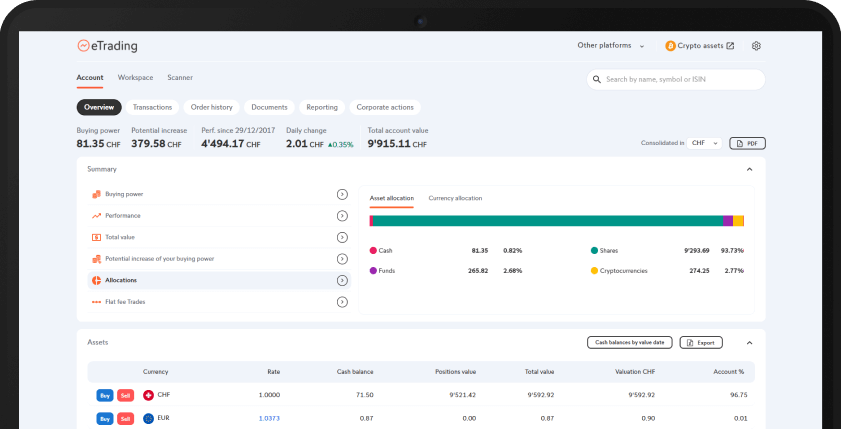

- Das Webinterface kann direkt genutzt werden und verfügt über alle notwendigen Funktionen.

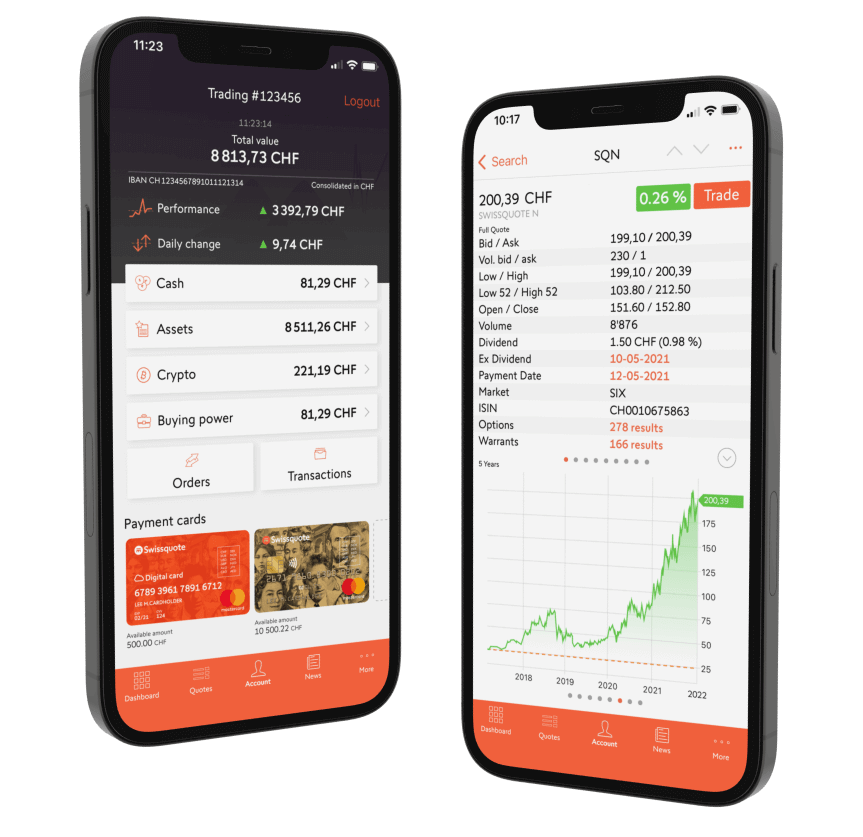

- Eine mobile Anwendung für iOS und Android.

- Eine Desktop-Anwendung, die hauptsächlich für den Devisenhandel gedacht ist.

Insgesamt gibt es genug Möglichkeiten für alle. Die Weboberfläche sollte für die meisten Menschen funktionieren. Viele Menschen werden auch mobile Anwendungen zu schätzen wissen, mit denen sie alles tun können, was sie brauchen.

Der einzige Nachteil ist, dass die Weboberfläche aufgrund der vielen Funktionen ein wenig kompliziert ist . Aber wenn Sie erst einmal die Funktionen gefunden haben, die Sie brauchen, sollten Sie mit ihnen zurechtkommen. Wenn Sie passiv investieren wollen, benötigen Sie nur einen kleinen Teil der verfügbaren Funktionen.

Ist Swissquote sicher?

Wenn Sie einen erheblichen Geldbetrag bei einem Makler anlegen, müssen Sie dafür sorgen, dass er sicher ist.

Swissquote wird in der Schweiz von der FINMA reguliert. Ihre anderen Unternehmen werden auch in anderen Ländern reguliert.

Swissquote ist seit 1996 gut etabliert und seit mehreren Jahren profitabel, so dass das Risiko eines Konkurses gering ist. Dennoch ist es wichtig zu wissen, was passiert, wenn Ihr Makler in Konkurs geht.

Da Swissquote über eine Banklizenz verfügt, ist Ihr Bargeld bis zu einem Betrag von 100’000 CHF durch Esisuisse geschützt. Ihre Wertpapiere sollten in vollem Umfang garantiert sein, da sie auf einem Bankkonto in Ihrem Namen verwahrt werden sollen. Das ist ein gutes Schutzniveau.

Was die technische Sicherheit anbelangt, so können Sie sich für eine Zwei-Faktor-Authentifizierung (2FA ) für Ihr Konto entscheiden. Ich empfehle jedem, dies zu tun, um die Sicherheit seines Kontos zu verbessern. Ich habe von keinen Sicherheitsproblemen bei Swissquote gehört, was ein gutes Zeichen ist.

Insgesamt ist eine Anlage bei Swissquote also sicher. Was Investitionen im Allgemeinen betrifft, so sollten Sie bedenken, dass sie unabhängig von der Plattform mit einem Verlustrisiko verbunden sind.

Swissquote Reputation

Es ist wichtig, den Ruf eines Brokers zu prüfen, bevor man in den Aktienmarkt investiert.

Als Quelle für Bewertungen verwende ich immer TrustPilot. Also schauen wir uns die Bewertungen von SQ auf TrustPilot an. Im Durchschnitt bewerten die Nutzer SQ mit 3,2 Sternen, was kein gutes Ergebnis ist. Hier ist, was die Leute über diesen Broker sagen.

Zunächst sollten wir einen Blick auf die Leute werfen, die sich über den Broker beschweren. Wir können die Beschwerden in mehrere Kategorien einteilen:

- Sehr lange Kontoeröffnung. Mehrere Personen mussten mehrere Tage warten, bis ihre Konten eröffnet wurden.

- Es fallen sehr hohe Gebühren an. Das ist in gewisser Weise richtig, aber die Menschen sollten dies bedenken, bevor sie ihre Konten eröffnen. Die Gebühren sind im Vergleich zu anderen Schweizer Brokern angemessen.

- Schlechte Kundenbetreuung. Viele Menschen hatten Probleme, ihre Probleme mit dem Kundendienst zu lösen.

- Schlechte Investitionsplattform. Einige Anleger sind mit den von der Plattform angebotenen Funktionen nicht zufrieden, vor allem im Bereich der Kryptowährungen.

Insgesamt bin ich ein wenig besorgt über die Bewertungen des Kundendienstes und der Kontoeröffnung. Die anderen Beschwerden beunruhigen mich nicht, da sie von Leuten kommen, die sich vor der Eröffnung eines Kontos bei Swissquote nicht richtig informiert haben. Und wir dürfen nicht vergessen, dass die meisten Kommentare im Internet von unzufriedenen Menschen stammen. Negative Kommentare sind also mit Vorsicht zu genießen, auch wenn sie der Wahrheit entsprechen.

Erfreulich ist, dass die meisten Bewertungen (36 %) mit fünf Sternen bewertet werden. Insgesamt sind die Kritiken positiv:

- Einfacher Handel über die Plattform

- Eine sehr stabile Plattform und Firma

Interessanterweise konzentrieren sich die positiven Bewertungen stark auf die Plattform selbst und ihre Benutzerfreundlichkeit. Es ist gut, dass viele Menschen berichten, dass die Plattform einfach zu bedienen ist.

Insgesamt würde ich sagen, dass die Nutzerbewertungen von Swissquote gut, aber nicht großartig sind.

Alternativen zu Swissquote

Es ist wichtig, einen Makler mit seinen Alternativen zu vergleichen. Den Schweizer Anlegern stehen zahlreiche Broker zur Verfügung. Ich denke, es ist wichtig, Interactive Brokers als die beste Alternative zu Swissquote zu erwähnen.

Swissquote vs. Interactive Brokers

Aus Gründen der Transparenz ist es wichtig zu erwähnen, dass ich keine Swissquote verwende.

Meiner Meinung nach ist Swissquote der beste Schweizer Broker auf dem Markt. Wenn Sie einen Schweizer Broker suchen, würde ich ihn empfehlen.

Ich benutze jedoch Interactive Brokers, einen Broker aus den Vereinigten Staaten. Wir können also beide Plattformen vergleichen.

Beide Makler sind sehr gut etabliert und reguliert. Der Schutz ist auf beiden Seiten gut, mit einem leichten Vorteil für Interactive Brokers, das durch die U.S. SIPC geschützt ist.

Bei den Gebühren fängt es an, sich sehr stark zu unterscheiden.

Wir können mit den Sorgerechtsgebühren beginnen. Swissquote erhebt eine jährliche Depotgebühr von 200 CHF für ein umfangreiches Portfolio. Bei IB zahlen Sie 0 CHF an Depotgebühren! Mit IB können Sie 200 CHF pro Jahr sparen. Und Swissquote erhebt eine zusätzliche Verwahrungsgebühr auf Vermögen über 1’000’000 CHF, was bei IB nicht der Fall ist.

Für den Handel an den Schweizer Börsen ist Interactive Brokers etwas günstiger als Swissquote, aber nicht sehr viel. Die IB glänzt an den amerikanischen Börsen. Wenn ich zum Beispiel Microsoft-Aktien im Wert von 10’000 USD kaufe, zahle ich bei IB etwa 0,40 USD (ja, 40 Cent!). Bei Swissquote würde dies 30 USD kosten. In diesem Beispiel ist IB 75 Mal billiger als Swissquote!

Da IB ein ausländischer Broker ist, zahlen Sie außerdem keine Schweizer Stempelsteuer. Mit IB sparen Sie 0,075% auf jede Schweizer Operation und 0,15% auf jede ausländische Operation.

Schliesslich kostet der Währungsumtausch bei IB etwa 2 USD, während er bei Swissquote 0,95% kostet. Wenn Sie also nicht weniger als 200 USD umtauschen, ist IB viel billiger für den Geldumtausch.

Wenn Sie also bereit sind, einen Broker zu nutzen, der nicht aus der Schweiz stammt, sollten Sie Interactive Brokers in Betracht ziehen. Sie können meinen Bericht über IB lesen, um mehr zu erfahren. Aber was die Schweizer Broker angeht, ist Swissquote hervorragend.

Für weitere Details lesen Sie bitte meinen vollständigen Vergleich von Swissquote und Interactive Brokers.

FAQ

Ist Swissquote sicher?

Swissquote ist ein etablierter Broker, der von der FINMA reguliert wird. Im Falle eines Konkurses wird Ihr Vermögen ausgesondert und steht Ihnen zur Verfügung.

Können Sie mit Swissquote Währungen umrechnen?

Ja, Sie können zwischen vielen verschiedenen Währungspaaren umrechnen.

Für wen ist Swissquote geeignet?

Swissquote ist gut für Leute, die einen gut etablierten Schweizer Broker mit guten Gebühren und vielen Funktionen suchen.

Für wen ist Swissquote nicht geeignet?

Swissquote eignet sich aufgrund der hohen Umrechnungsgebühren nicht für Personen, die häufig in Fremdwährungen handeln.

Swissquote Zusammenfassung

Swissquote ist ein guter Schweizer Broker. Sie hat ausgezeichnete Gebühren und einen guten Ruf. Es bietet Ihnen alle Funktionen, die Sie für Ihre ersten Investitionen benötigen.

Pruduktmarke: Swissquote

4.5

Swissquote Vorteile

- Günstig im Vergleich zu anderen Schweizer Brokern

- Relativ schnelle Kontoeröffnung

- Eine sehr breite Palette von Investitionen

- Langjährige Erfahrung

- Gut eingeführtes Unternehmen

- Gute Sicherheit

- Einfach zu bedienen

Swissquote Nachteile

- Teure Umtauschgebühren

- Teuer im Vergleich zu ausländischen Brokern

- Die Videoidentifizierung kann eine Weile dauern

Schlussfolgerung

Alles, was Sie brauchen, um in den Aktienmarkt zu investieren! Eröffnen Sie ein Konto bei Swissquote und erhalten Sie 100 CHF an Handelsguthaben mit meinem Code MKT_THEPOORSWISS.

- Schweizer Broker

- Einfach zu bedienen

Insgesamt ist Swissquote ein guter, etablierter und günstiger Schweizer Broker. Sie bieten Zugang zu vielen Börsenplätzen und zahlreichen Anlageinstrumenten. Und sie vergleichen sich gut mit anderen Schweizer Brokern.

Swissquote ist also der beste Schweizer Broker. Wenn Sie bei einem Schweizer Broker investieren wollen, empfehle ich Ihnen Swissquote. Swissquote ist eine hervorragende Plattform, um Ihr Geld an der Börse zu vermehren.

Wenn Sie bei der Eröffnung eines Kontos meinen Code MKT_THEPOORSWISS verwenden, erhalten Sie 100 CHF an Handelsguthaben. Sie sparen also 100 CHF an Gebühren! Dieser Code ist jedoch nur für Personen mit Wohnsitz in der Schweiz gültig.

Wenn Sie sich insbesondere für Schweizer Broker interessieren, habe ich die besten Broker verglichen. Dieser Artikel soll Ihnen die Wahl erleichtern, aber Sie müssen die Kostenunterschiede zwischen Schweizer und ausländischen Brokern kennen.

Wenn Sie auch ausländische Broker in Betracht ziehen, empfehle ich Interactive Brokers als den besten Broker für Schweizer Anleger.

Was ist mit Ihnen? Was halten Sie von Swissquote?

Laden Sie dieses E-Book herunter und optimieren Sie Ihre Finanzen und sparen Sie Geld, indem Sie die besten in der Schweiz verfügbaren Finanzdienstleistungen nutzen!

Das KOSTENLOSE E-Book herunterladen