What is the best Swiss broker in 2024?

| Updated: |(Disclosure: Some of the links below may be affiliate links)

You need a broker account to invest in the stock market. Many Swiss investors only feel comfortable having a broker from Switzerland or at least a broker with an office in Switzerland.

So, we need to compare these Swiss brokers and see which is best for a Swiss investor to invest in the stock market.

In this article, I compare seven Swiss brokers in different scenarios and see the best (the cheapest!).

What makes the best Swiss broker?

Swiss brokers are extremely similar. They are all regulated similarly, and most have the same features. What matters most in choosing the best Swiss broker is the price!

Some people will argue that we must look at their tools and reporting capability. However, this is not a good criterion for most investors. For a passive investor, you need to be able to buy shares of ETFs. That is it.

It does not matter how shiny your net worth graphs are or how many possible algorithms you can use for active trading. What matters is minimizing the price you will pay for your transactions.

I spend less than 10 minutes a month on my broker account, no matter how beautiful or easy it is. I want to be able to buy the ETFs from my portfolio at a low cost, and I want my money to be safe.

The other thing that matters is that the broker gives you access to the stock exchanges we need. In the case of a Swiss broker, we need at least access to the Swiss stock exchange. We also need access to the major European Stock Exchanges. Ideally, we want access to U.S. ETFs as well. Unfortunately, not all Swiss brokers still give you this access.

Even without U.S. ETFs, it would be great to have access to the major U.S. stock exchanges. Although passive investing is the way for most people, many investors still want access to American companies.

So, I compare some Swiss brokers over different scenarios. And for each scenario, we see which one is the cheapest. This article is not meant to be a review of these brokers. However, I have written reviews of most of these brokers.

Some Swiss Brokers

I have selected eight Swiss brokers for this comparison:

- Swissquote, an online broker. You can read my complete Swissquote review for more information.

- PostFinance, the Swiss Post Bank. My complete review of PostFinance E-trading is also available.

- Saxo Bank is an investment company with a branch in Switzerland. My review of Saxo bank is available as well.

- Cornèrtrader, an online broker. I have a complete Cornèrtrader review for more information.

- Migros Bank, the bank from Migros.

- FlowBank, a new online broker. You can read my full review of FlowBank for more info.

- Yuh, an online broker from PostFinance and Swissquote, is made for beginners. I also have a full review of Yuh.

- Neon Invest, the broker of the digital bank, Neon. You can read my full review of Neon Invest.

These are brokers that many people are using in Switzerland. And they are the cheapest brokers that I have found.

Cornèrtrader has two accounts useful for passive investors: Private and Capital. Capital is cheaper than Private and only requires you to have 75’000 CHF on your account. So, I will compare the fees for these two accounts.

Saxo also has several account types depending on the initial funding. Starting at 250’000 CHF, you can get lower prices with the Platinum account. Since the entry point is very high, I will assume we are using the default account, Saxo Classic.

All of these brokers give you access to many stocks and ETFs. You will have to pay the Swiss Stamp Tax Duty with all Swiss brokers, so we will ignore it in our comparisons because it would be the same anyway.

In this comparison, I will ignore dividends. Indeed, in some cases, dividends may incur an extra fee. For instance, if you get a dividend in a foreign currency with Neon, you will have to pay a currency conversion fee. However, these dividends highly depend on which stocks and ETFs you choose, so they are too variable to include in this comparison.

I will start by comparing each broker’s individual fees. Then, I will run through some scenarios to see which is best in more detail.

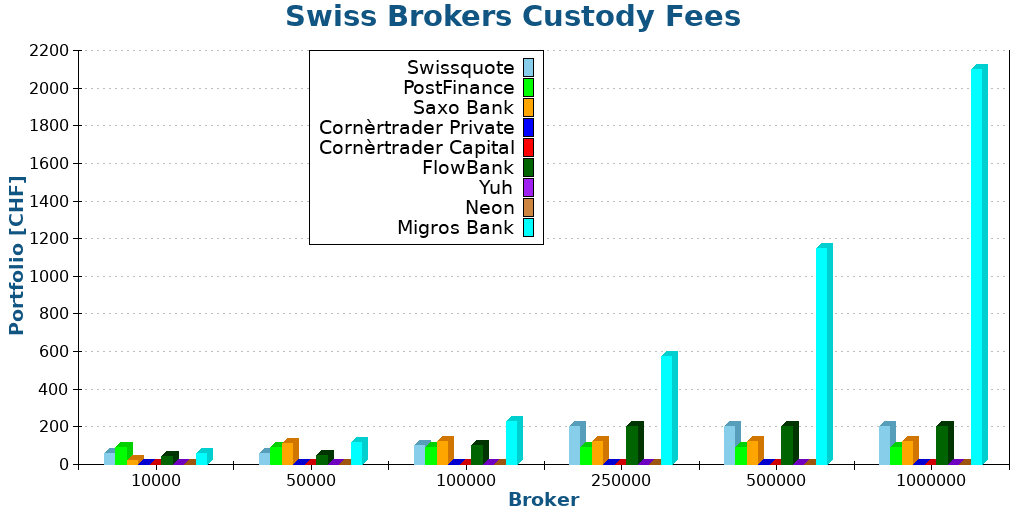

Custody Fees of Swiss brokers

First, we look at the custody fees of these brokers.

A custody fee is something you pay just to keep your account open. The custody fee is often expressed as a percentage of the value of your portfolio. Also, these fees often have a minimum and sometimes a maximum.

The custody fee is significant because you will pay it if you have an account. If you plan to retire on your portfolio, a large custody fee will make it more difficult during the accumulation and withdrawal phases.

Here are the custody fees of our seven brokers:

- Swissquote has a 0.025% quarterly fee, with a min of 15 CHF and a maximum of 50 CHF. They also have an extra 0.03% per year for assets over a million CHF.

- PostFinance has a 90 CHF per year custody fee. However, users can use this as trading credits, which is both an inactivity fee and a custody fee.

- Saxo Bank has a 0.22% yearly custody fee, with a monthly maximum of 10 CHF.

- Cornèrtrader has no custody fees.

- Migros has a 0.23% custody fee below 750K, 0.21% until 1.5M, and 0.19% after that, and a yearly minimum of 50 CHF.

- FlowBank has a 0.10% custody fee with a minimum of 10 CHF per quarter and a maximum of 50 CHF per quarter.

- Yuh has no custody fees.

- Neon has no custody fees.

Here are the custody fees you would pay with these brokers:

From this chart, the conclusion should be pretty obvious. Migros Bank does not look to be a good fit for a Swiss investor. To manage a one million CHF portfolio with Migros Bank, you would pay 2100 CHF per year! This is bad.

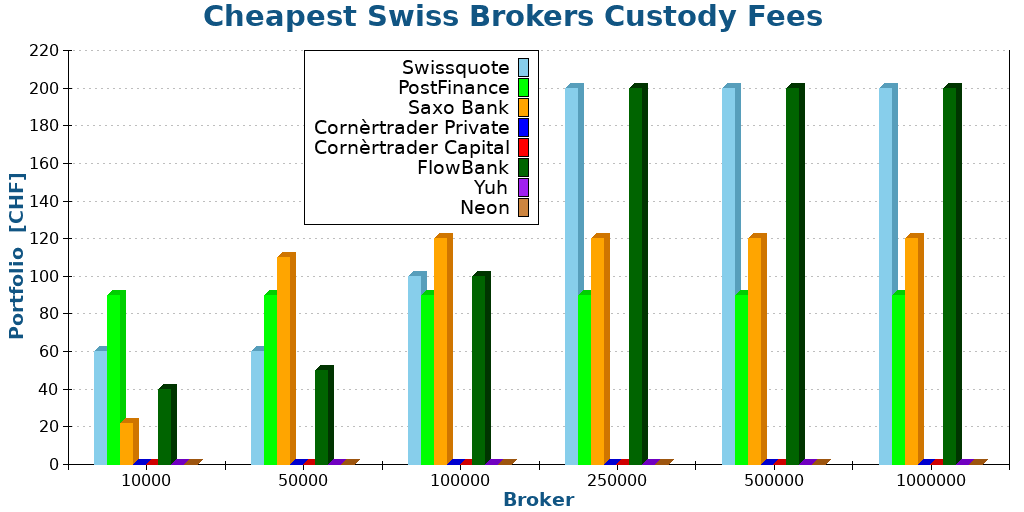

In comparison, all the other brokers are pretty good on that note. To see better, here is the same graph without Migros Bank:

The best brokers are Cornèrtrader, Yuh, and Neon since they have no custody fees. Swissquote and FlowBank are the most expensive brokers because they have the highest maximum. But to me, they all look acceptable. For small portfolios, FlowBank can sometimes be cheap as well since they have a small minimum.

You should not worry too much about a 200 CHF custody fee for large portfolios.

However, the 0.03% Swissquote fee on large portfolios (more than a million) can make a significant difference if you have to pay it during retirement. However, this will likely only matter for people wanting to retire early in Switzerland.

Inactivity Fee

The second fee we need to look at is the inactivity fee.

Some brokers charge a fee when you do not do any action on your account during a specific period. It is very close to a custody fee, but it is only charged when you do not use your account.

This fee is not as crucial as the custody fee since you will not pay it during the accumulation phase. But it is still essential if you plan to retire on your portfolio because you will pay it during your entire retirement.

Out of the seven brokers, only Cornèrtrader has inactivity fees. Cornèrtrader charges 35 CHF per quarter without a trade, which is 140 CHF per year if you do not trade.

Cornèrtrader had no custody fees, but their inactivity fees are significant. This is why it is essential always to consider everything. All the other brokers have no inactivity fee.

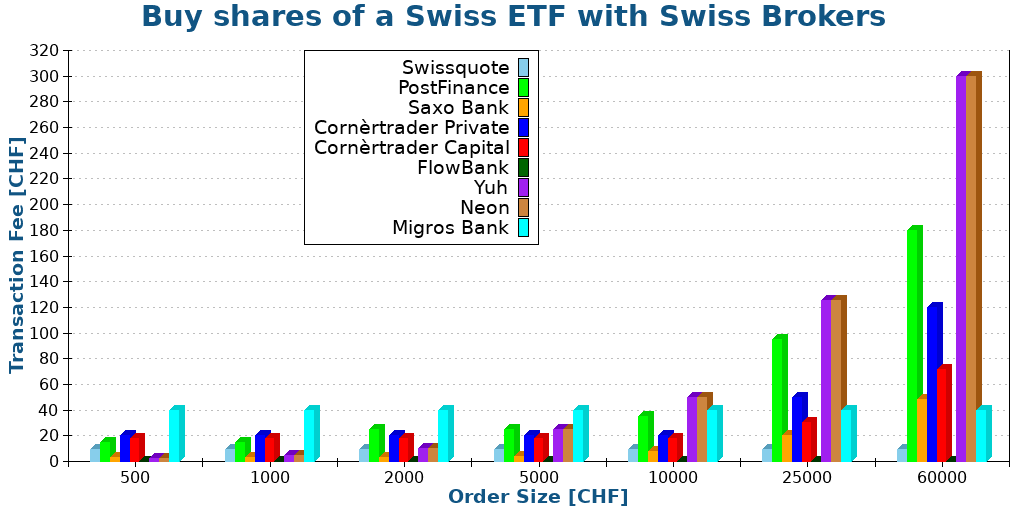

Buy shares of Swiss ETF with a Swiss broker

The next fee we will examine is the fee to buy shares of a Swiss ETF. A Swiss investor is likely to make several such transactions per year.

Here are the fees for ETFs on the Swiss Stock Exchange:

- Swissquote: 9 CHF

- PostFinance: From 15 CHF to 350 CHF based on the order size

- Saxo Bank: 0.08% with a minimum of 3 CHF

- Cornèrtrader Private: 0.20% with a minimum of 20 CHF

- Cornèrtrader Capital: 0.12% with a minimum of 18 CHF

- Migros Bank: 40 CHF

- FlowBank: free!

- Yuh: 0.50% with a minimum of 1 CHF

- Neon: 0.50%

Here are fees for one buy operation of a Swiss ETF with different order sizes:

Since these ETFs are free, FlowBank is the cheapest broker to buy Swiss ETFs. After FlowBank, Saxo, Yuh, and Neon are the most reasonable brokers for small operations, while Swissquote is the most affordable broker for large operations. FlowBank, Saxo, Neon, Yuh, and FlowBank can be significantly cheaper than the other brokers.

The other ones are relatively comparable. Migros Bank is quite expensive for operations up to 25’000 CHF. After this, it is becoming relatively okay. PostFinance is not bad for small operations but pretty bad for large operations. It is also worth mentioning that Yuh and Neon are bad for large operations since they have no maximum.

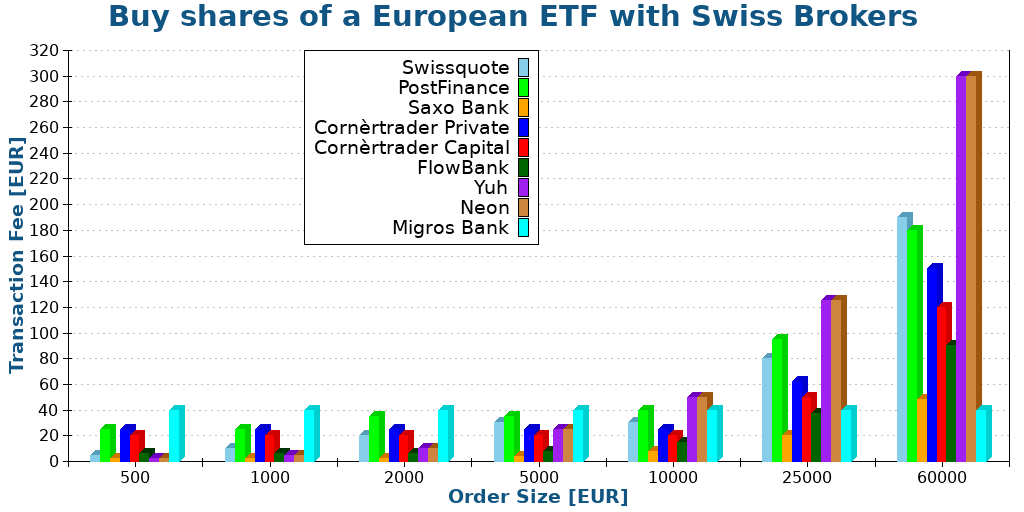

Buy shares of European ETFs with a Swiss broker

We can do the same exercise with European ETFs.

A Swiss investor who wants to diversify globally must invest in European ETFs. There are much more ETFs on the European Stock Exchange than on the Swiss Stock Exchange.

For this example, I take Euronext Paris as an example. Some brokers’ fees differ slightly based on which European Stock Exchange is being used.

Here are the fees for ETFs on the Euronext Stock Exchange:

- Swissquote: From 5 EUR to 190 EUR based on the order size

- PostFinance: From 25 EUR to 350 EUR based on the order size

- Saxo Bank: 0.08% with a minimum of 2 EUR

- Cornèrtrader Private: 0.25% with a minimum of 25 EUR

- Cornèrtrader Capital: 0.20% with a minimum of 20 EUR

- Migros Bank: 40 EUR

- FlowBank: 0.15% with a minimum of 6.50 EUR

- Yuh: 0.50% with a minimum of 1 CHF

- Neon: 0.50% (ETFs on BX Swiss)

Here are fees for one buy operation of a European ETF with different order sizes:

These results are pretty interesting. For small operations (below 2000 EUR), Saxo, Yuh, and Neon are the cheapest, with a good margin. Then, for medium operations, FlowBank is the most affordable. Then, for large operations, Saxo is significantly better than the others. With a minimum of only 2 EUR and a low percentage fee, Saxo Bank is quite interesting for trading European ETFs.

All the others are more expensive in this case. After Saxo Bank and FlowBank, the third cheapest Swiss broker is Cornèrtrader with its Capital account. Finally, Yuh and Neon become bad for large operations.

Buy shares of U.S. companies with a Swiss broker

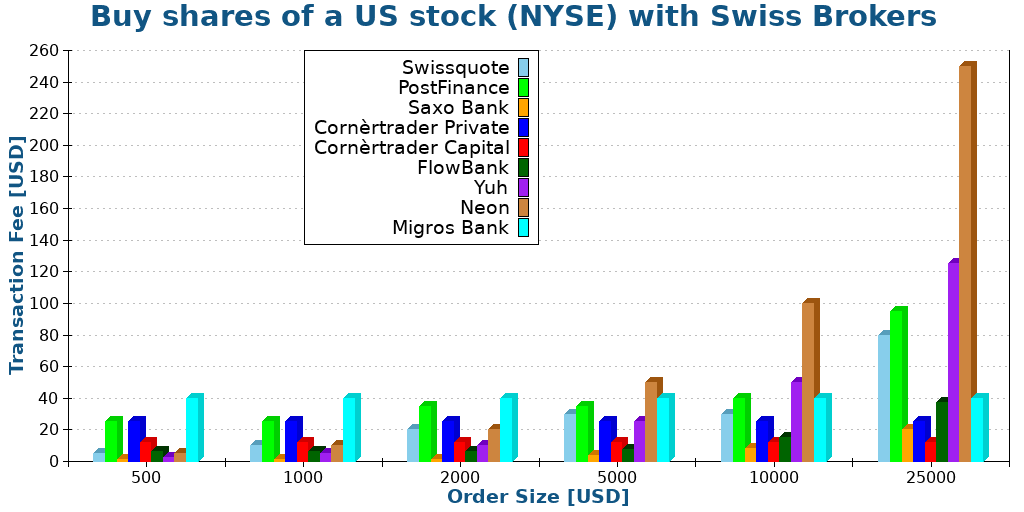

The last fee we will look at is the fee to buy shares of U.S. companies.

Even though this is not passive investing, it is interesting because many passive investors still buy some shares of companies. In general, they buy shares of American companies. This will be the same fee for brokers that allow buying U.S. ETFs.

Here are the fees for stocks on the NYSE:

- Swissquote: From 5 USD to 190 USD based on the order size

- PostFinance: From 25 USD to 350 USD based on the order size

- Saxo Bank: 0.08% with a minimum of 1 USD

- Cornèrtrader Private: 4 cents per share with a minimum of 25 USD

- Cornèrtrader Capital: 2 cents per share with a minimum of 12 USD

- Migros Bank: 40 USD

- FlowBank 0.15% with a minimum of 6.50 USD

- Yuh: 0.50% with a minimum of 1 CHF

- Neon: 1.0% (On BX Swiss)

Here are fees for one buy operation of a U.S. stock with different order sizes:

For small to medium operations, Saxo Bank is the cheapest broker. Starting from 10’000 USD, Cornèrtrader becomes the cheapest broker. Yuh, Saxo, FlowBank, and Cornèrtrader have small minimums, making them significantly cheaper than the others.

Swissquote and PostFinance are pretty bad for large operations in this situation. And Yuh and Neon are bad for large operations as well.

For these three stock operations, we can draw some conclusions:

- Saxo is great for small to medium operations

- FlowBank is good for medium operations

- Swissquote is good on average

- Cornèrtrader and Saxo can be pretty good on some large operations

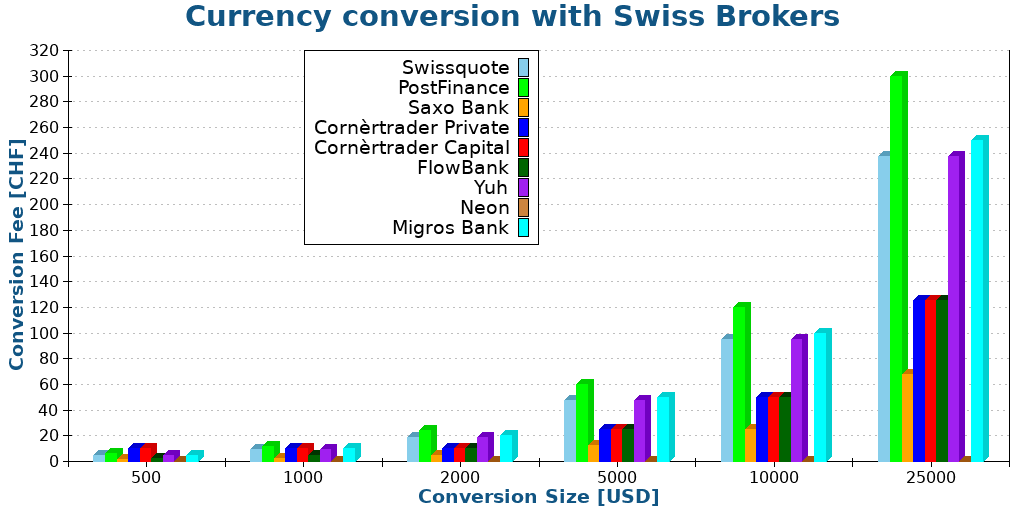

Currency Exchange Fees

Finally, before moving into the different scenarios, we need to consider the currency exchange fees. You must convert your CHF to EUR if you want to buy an ETF in EUR.

Here are the currency conversion fees of these seven brokers:

- Swissquote: 0.95%

- PostFinance: 1.20%

- Saxo Bank: 0.25%

- Cornèrtrader: 0.50% with a minimum of 10 CHF

- Migros Bank: 1%

- FlowBank: 0.50%

- Yuh: 0.95%

- Neon: 0% (Trade everything in CHF at BX Swiss)

These fees are the same for CHF to USD and CHF to EUR. You may have to pay higher fees if you use more minor currencies. But these fees are all significant already!

Here are the fees for one conversion from CHF to USD for different order sizes:

Neon has a significant advantage if you can trade the stock on the BX Swiss stock exchange. If you cannot trade it on BX Swiss, you will need to find an equivalent or use another broker.

For other brokers: Saxo is much cheaper than the others, and all the others are much more expensive. Even with a minimum of 10 CHF, the 0.25% fee compared to the average 1% of the other Swiss brokers makes Saxo the only good Swiss broker for currency conversion. After that, Cornèrtrader is reasonably priced as well. But Neon is better if you can find your stock or ETF on the BX Swiss stock exchange.

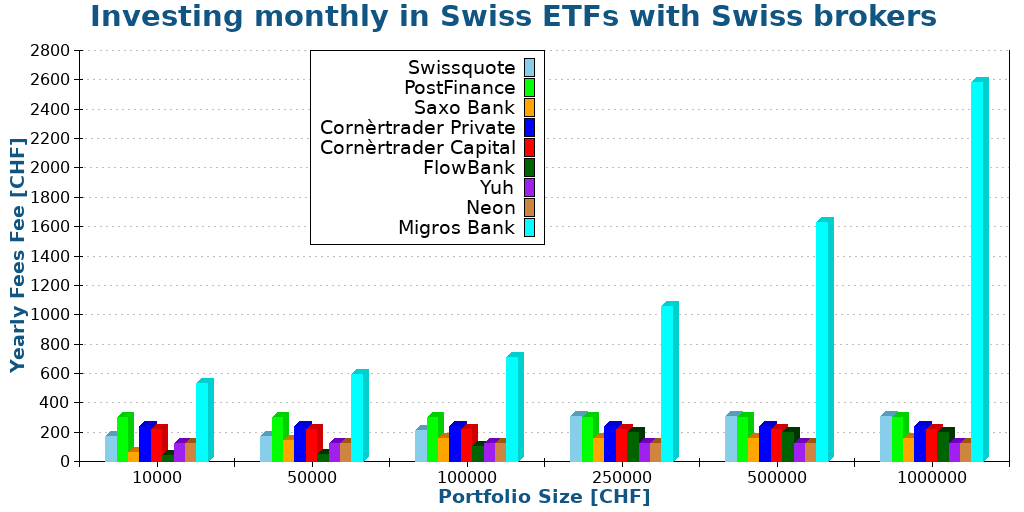

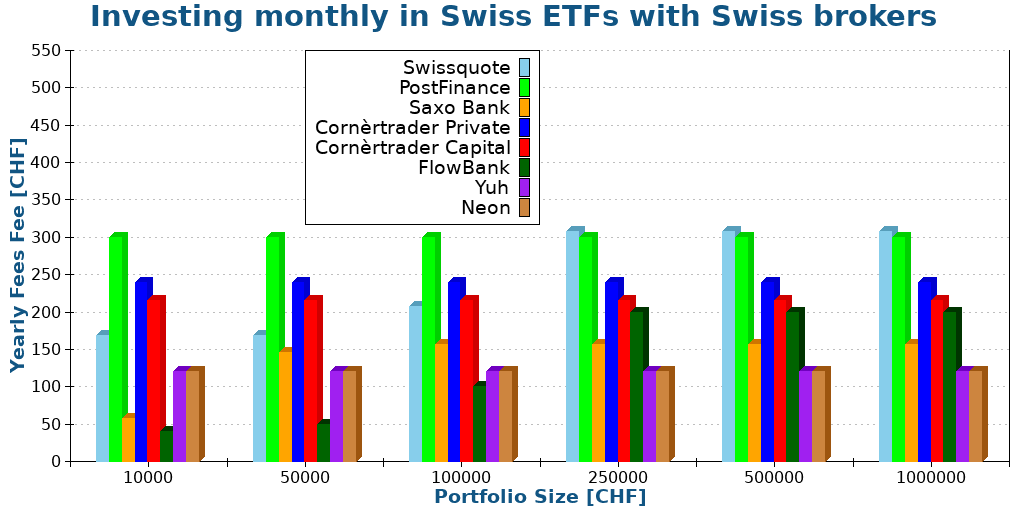

Scenario 1: One Swiss ETF per month

Until now, we have only considered a single operation in isolation. But it is much more interesting to look at everything together. We must look at a year of trading together with transaction and custody fees.

One first scenario is for an investor who buys shares of one Swiss ETF (in CHF) per month. Many Swiss investors only use the Swiss Stock Exchange. Since we must consider the custody fee, we must run the scenario with several portfolio sizes.

Also, since the prices change based on the order size, we must choose an order size. For this scenario, the investor is buying 2000 CHF worth of shares every month. 2000 CHF is a good average for monthly investing.

So, without further ado, we take a look at the fees of each of these brokers for one year for this scenario:

We can see that Swiss Investors should entirely ignore Migros Bank. Their custody fees are too high for any serious investor. So, we can see this graph again with the reasonable brokers:

Interestingly, Neon and Yuh are great for large portfolios (having no custody fees), while FlowBank is excellent for small portfolios.

Then, Saxo is excellent all around with a very good average. After this, Swissquote is excellent for small portfolios, while Cornèrtrader is great for larger ones, but the differences are insignificant.

So, overall, in this scenario, I would use either Neon, Saxo or Swissquote.

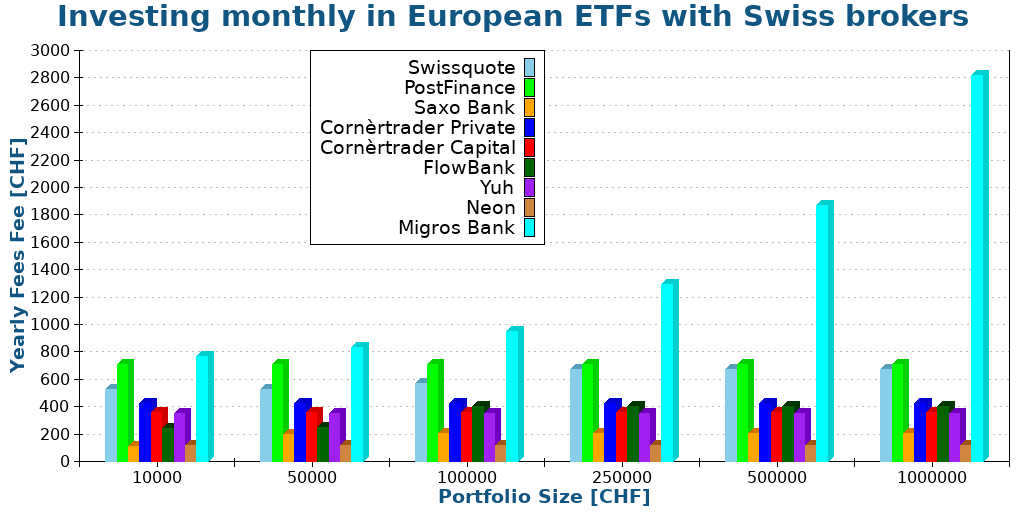

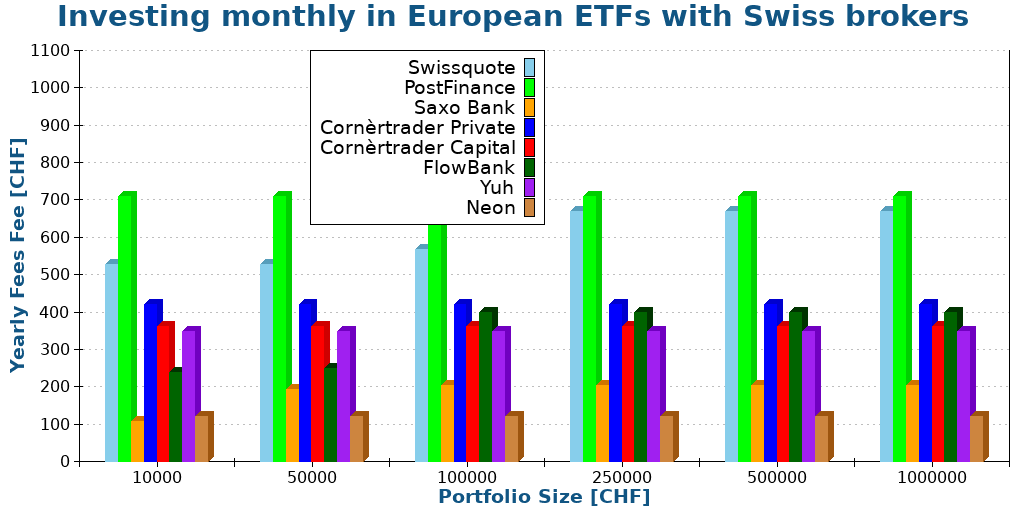

Scenario 2: One European ETF per month

A more interesting scenario would be to invest in ETFs on the European Stock Exchanges. Again, we look at one entire year of trading.

For this scenario, we will use a monthly investment of 2000 EUR in European ETFs. Again, since custody fees exist, we will use different portfolio sizes.

As expected, the broker with bad custody fees must be ignored again. So, here is the graph again without it:

When adding currency conversion fees into the scenario, we can see that the results are quite different, and everything is more expensive. With this, I would not recommend PostFinance anymore because of its bad currency conversion fee.

In this case, since we avoid currency conversion fees, Neon is the cheapest Swiss broker. After Neon, Saxo Bank is significantly cheaper than the other brokers and has a good margin, especially with large portfolios.

The differences between the other brokers (Cornèrtrader, FlowBank, and Yuh) are not very significant. FlowBank is good for small portfolios, while Yuh is best for large ones. Swissquote is okay for small but not necessarily good for large portfolios.

In this scenario, I would personally use Neon or Saxo.

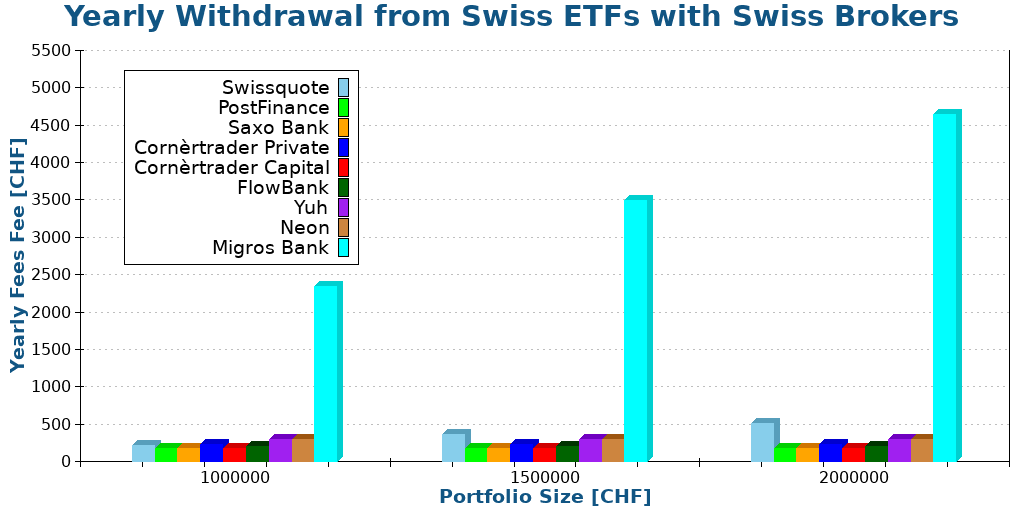

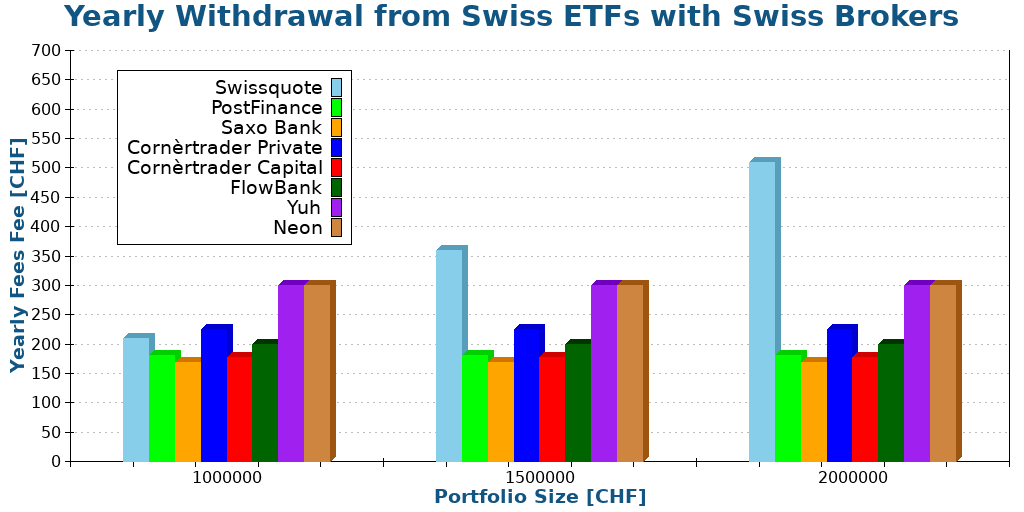

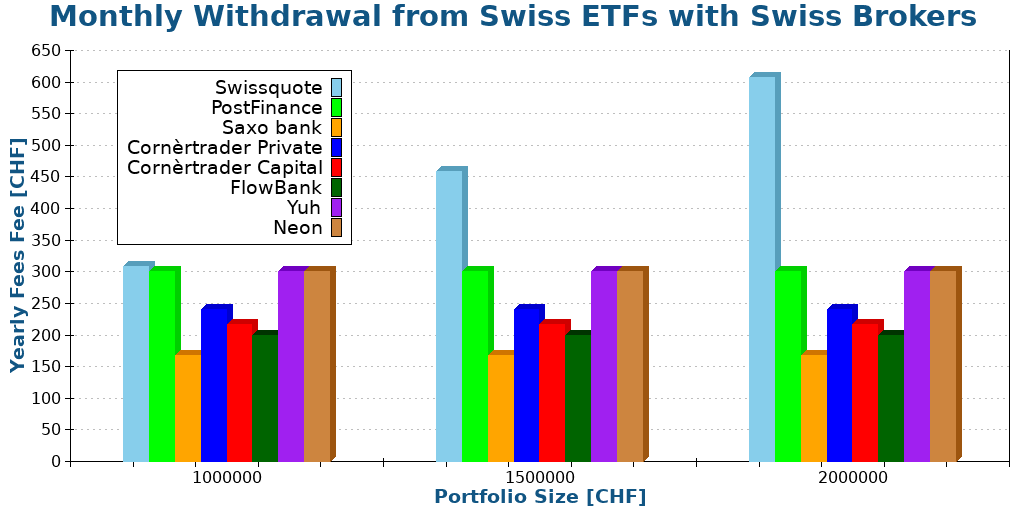

Scenario 3: Withdraw once a year

For our last scenario, we take something different.

The other two scenarios would represent an investor during the accumulation phase. Now, we can take a scenario that would represent the retirement phase.

If you want to retire based on your portfolio, you must sell shares to live from it. So, our scenario investor is selling for 60’000 CHF every year to live from his portfolio. We need different portfolio sizes since custody fees will play into this scenario.

First, we start with an investor selling for 60’000 CHF of a Swiss ETF at the beginning of the year:

This is where we can see the impact of high custody fees. You have no income in retirement, and you could give your broker several thousand Swiss francs yearly! I would not recommend anyone to invest with such a broker! You need to find a broker with which the custody fee has a maximum.

Here are the other choices:

In this scenario, Saxo is the cheapest broker. After this, there is barely any difference between the brokers. There is a 100 CHF per year difference between the cheapest and the most expensive. This difference does not matter.

To avoid inactivity fees, we can also withdraw money each month. Withdrawing every month also has the advantage of keeping your money invested longer. I have run simulations, and historically, it is better to withdraw more frequently.

If the money is withdrawn each month instead, the results are still very similar:

The differences are about the same here. 100 CHF per year is not a huge difference. Nevertheless, Saxo is once again the cheapest option, and Swissquote is significantly more expensive, given its extra fee.

Some people will argue that selling each quarter would be optimal to avoid the inactivity and large transaction fees. But this is a meaningless optimization. It will make very little difference whatsoever. You should withdraw either once a year or once a month. Ideally, once a month, you will have better returns in the long term since you keep the money in the market for as long as possible. But of course, there are other things to take into account.

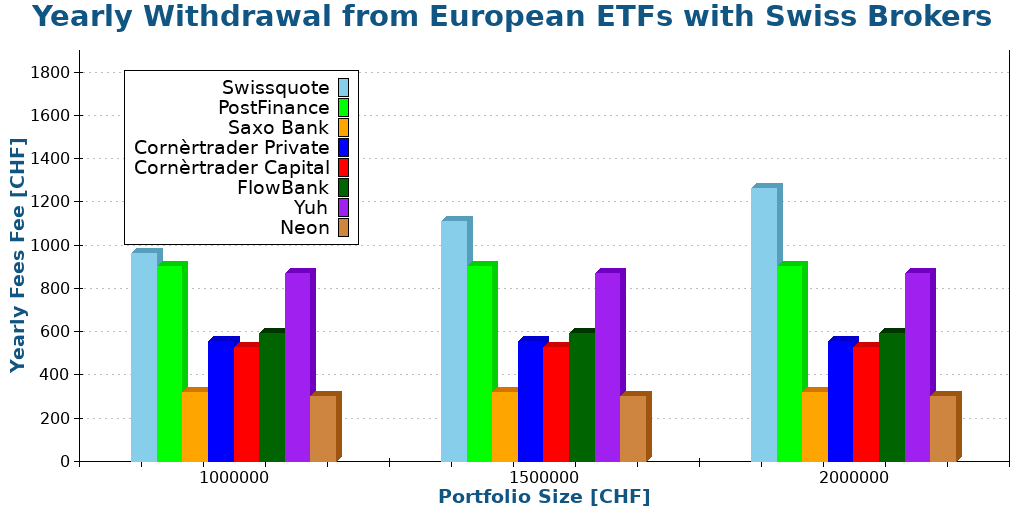

Finally, we can see what happens when we sell ETF shares on the European stock exchange instead of the Swiss Stock Exchange. Here are the results with our affordable Swiss brokers:

This time, the difference is more significant due to currency conversion fees. Neon is the cheapest since you can avoid currency conversion. However, it is interesting to note that despite its currency conversion fee, Saxo has almost the same fees as Neon!

After these two, FlowBank and Cornèrtrader get better than the others due to being twice as cheap at converting currencies.

In that scenario, I would use Neon or Saxo.

Conclusion

Everything you need to start investing in the stock market! Open an account with Swissquote and get 100 CHF in trading credits with my code MKT_THEPOORSWISS.

- Swiss broker

- Easy to use

Swiss brokers are expensive, but you can find some brokers cheaper than others if you search well. If you want a Swiss broker, I recommend either Saxo, Swissquote, or Neon.

Neon is great for beginners, given its low costs on small operations. Swissquote and Saxo are excellent for more advanced investors, with good average fees overall. Also, Swissquote has a good reputation and is well-established. You can avoid most currency conversion fees with Neon by trading on BX Swiss, which is a very transparent service.

I would use Saxo or Swissquote myself if I were to use a Swiss broker.

Cornèrtrader also has some interesting facts, but I do not feel confident about this broker. It has a mixed reputation at best.

Another important conclusion from this article is that serious investors should not use a broker with a custody fee without a maximum. This becomes very quickly too expensive. For this reason, I would not recommend using Migros Bank. They are way too expensive and will drag your returns down. And some Swiss brokers are even more expensive than these two. So, Swiss investors should be careful.

If you are ready to use a foreign broker, I recommend investing with Interactive Brokers, which is cheaper. However, if you are afraid of having your money outside of Switzerland, it is much better to use a Swiss broker than not to invest at all! Since many of my readers have requested this from me so often, I feel like I had to write this article. I hope that cheaper brokers will come in the future.

If you want more details on the winners, you can read their reviews:

If you think investing fees can be taken lightly, you should read my article about investing fees and their impact.

What is your favorite Swiss broker?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Best Brokers

- More articles about Investing

- Neon vs Yuh: Best digital bank in 2024?

- IBKR Desktop Review 2024

- Yuh vs Swissquote 2024 – Best Broker in 2024

Quick comment on your graphs:

In several of them the explanatory box overlaps the columns so you can’t properly see if they end there or are higher. And in the last one, Neon is missing in the explanation of colors, I am guessing it is still the brown one?

Also, generally, colors for the same thing should stay the same, however they change once you start removing Migros Bank from consideration at all. Maybe just leave out the dark green instead of reassigning it and all the following colors? For example, Neon is first turquoise, later brown. Makes it harder to compare graphs at a glance.

Thanks for your feedback! I will try to address this once I get some time.

Dear Baptiste,

I have a US broker account with Etrade (now morgan stanley).

I have bought Vanguard ETFs via them.

I am still not clear if I get another broker, could I do this without getting into currency exchange? The USD fluctuates so much that I am not sure how to evaluate the gain “easily”. I have no use for USD so to say (only CHF and SEK as I am of Swedish nationality but living in Switzerland).

Would you suggest that I am all set with an etrade trading account and rather transfer money from CH to US? or to get a swiss brokarage account?

Hi Maria

You cannot really avoid all currency risk. Just buyin in another currency is not enough.

The only tool against that is currency hedging: Should you use currency hedging in your portfolio?

Thanks for the great review. Saxo bank also seems to have updated their fees – e.g no inactivity fees and max 10CHF custody fees per month. It would be great to see the results with the updated conditions.

Thanks for sharing. I am aware of the changes, but I have not had time to update this article yet. I plan a full article on Saxo with the new fees, in the coming months.

Looks like Saxo bank with new fees is ticking some critical boxes to compete with Swissquote

– Swiss banking license

– capped custody fees

– reasonable (not as low as IB) commissions

– Availability of VT, VTI, CHCORP etc

I couldn’t find a review from you, but it seems like you are rating Saxo with 4.5 .

I always thought Saxo is a danish bank. But it seems it’s also a Swiss bank.

As a second brokerage in addition to IB, I am contemplating to have a Swiss broker. Seems Saxo bank could be a good option. I was a bit bummed with the trading fees of SQ for US ETFs.

Yes, they do look like a great candidate. It won’t be on the same level as IB, but great for a Swiss broker and likely a very good candidate for a second account.

I hope to have the time to do a full review in February.

Hi could you please make the examples redembling an “typical swiss investors” portfolio, lets say if you invest 50k diversified into the most common blue-chips like nestle, some swiss-pharma like roche & novartis & U.S. tech stocks like MSFT, Amazon, Nvdia etc, some gold and bitcoin. thank you

Hi Tom,

The problem is that there is no typical investor portfolio in stocks, they vary too much for me to cover them in this article, I would never be done.

You can use the Swiss stocks and US stocks graphs and combine them based on your percentage of each.

Hi thanks for this article. Could you please add Neon bank to the list?

I read only bad reviews about the apps of FlowBank.

Yuh does only offer very popular stocks. You cant find companies like i.e. UiPath

I had a bad experience with SwissQuote in 2020 when everyone started investing, they happily took all new customers but couldnt deliver any customer service anymore, no excuses from their side. Tried to buy crypto and sell them on all-time-high and suddendly the halted all trading on bitcoin to keep profits to themselves.

Hi Tom,

Good idea, I will add Neon to the list in the future.

Neon also has a limited list of stocks and ETFs, so some companies will be missing.

Unfortunately, many companies had issues like the one you mention. They took a huge influx of clients during the pandemic, but they could not handle them :(

Hello Baptiste,

Thanks for the article. Useful and well written like all of your articles.

I have a question: how difficult it is to move from a broker to another one? Do you incur in extra charges?

Thanks and best regards,

Hi Domenico,

You can take at look at this article: How to Change Broker and Transfer Your Portfolio

It’s not very difficult, but it’s easier if both brokers support automated transfers. And it also depends on the size of your portfolio.

Hey Baptiste,

Great article as always!

Did you check get a chance to look at Yuh, founded by post finance and swissquote? Yet, they can’t beat IB in terms of pricing.

Thanks a lot

I did look at them : Yuh Review 2023: A new mobile banking service

Hey Baptiste,

In the Currency Exchange Fees section you compare the fees of the different brokers. How about instead converting CHF to EUR first with Revolut or Wise and then send the EUR to the broker? Isn’t this cheaper?

Thanks for your great content!

Hi,

Yes, you could use Revolut to save a little money. However, it would be interesting only up to 1250 CHF per month. But for these amounts, you won’t save much money.

Is it really worth your time?

Thanks for the review. You might need to update the part with Flowbank as they now have no commissions on shares bought on the Swiss excange.

Hi Ian,

Thanks for letting me know, I will update this article once I get a chance.

I had terrible experience with InteractiveBrokers, ending up losing -huge- amount of money because of some technical problems with their software (finally acknowledged by them but, according to their agreement, they take no responsibility for what is displayed on they trading software and subsequent damages).

I also had stocks disappearing from my account ..

In addition, as they are an US broker with some kind of presence in UK, you are almost out of luck trying a legal action against them.

I strongly suggest to use CH brokers only.

Sorry to hear about your bad experience.

P.S. Please do not post the same comment multiple times.