Saxo Bank Review 2024 – Pros & Cons

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Since reducing their fees in 2024, SAXO Bank has become a very competitive broker for Swiss investors. SAXO has a lot of features, and this package now comes at a low price.

But is that enough? We find out in this review.

In this review, I cover Saxo Bank in detail, including its advantages and disadvantages. By the end of this review, you will know whether SAXO is a good broker for you or not!

| Custody Fees | 0.22% per year (max 10 CHF per month) |

|---|---|

| Inactivity Fees | 0 CHF |

| Buy Swiss ETF | 0.08%, min 3 CHF |

| Buy American Stock | 0.08%, min 1 USD |

| Currency Exchange Fee | 0.25% |

| Languages | English, French, German |

| Mobile Application | Yes |

| Web Application | Yes |

| Custodian Bank | Saxo |

| Established | 1992 |

| Swiss Headquarters | Zürich |

| Global Headquarters | Copenhagen, Denmark |

Saxo Bank

Start investing with a Swiss broker at incredible fees! Start trading with Saxo Bank and get 200 CHF in trading credits.

- Low currency conversion fee

- Swiss broker

Saxo Bank is an investment bank from Denmark. It was founded in 1992. It is a large institution with over one million clients and operates in 28 countries.

Saxo Bank is a private company. The three principal shareholders are the Geely Holding Group (a Chinese group), the founder and CEO Kim Fournais, and Sampo Plc.

In Switzerland, investors deal with Saxo Bank (Switzerland) Ltd, a fully licensed Swiss bank. Some people will argue that Saxo Bank is still a foreign broker, but a Swiss investor will only deal with the Swiss entity, subject to the same rules as any Swiss broker.

So, there is little difference between dealing with a Swiss broker and a foreign broker that is domestically regulated. Therefore, I will sometimes refer to it as a Swiss broker, but it is more a Swiss-regulated broker.

In 2019, Saxo Bank acquired BinckBank, significantly increasing its size. Thanks to scale, Saxo Bank was able to reduce fees later and grow faster.

Indeed, in January 2024, Saxo Bank drastically reduced its fees in Switzerland (and other countries). Some of the prices were reduced by an order of magnitude.

I was really surprised by these changes because Saxo used to be an expensive broker. But this is excellent news for Swiss investors. And I hope that other Swiss brokers follow this trend and reduce their costs.

Saxo Features

We can start by looking at Saxo features. With Saxo, you can trade many different products:

- Stocks and ETFs

- Bonds

- Mutual Funds

- Options

- Futures

- CFDs

- and more…

So, you should have more instruments than you need. Most people will only need stocks, bonds, and ETFs for their investment journey.

Saxo has a full Swiss banking license from FINMA. This is a good point because many Swiss brokers are not banks but only securities dealers and use a third-party bank as an intermediary.

It is worth noting that Saxo follows FINSA requirements for all ETFs. Therefore, they will only offer US ETFs with a Swiss Key Investor Document (KID). Since there are no such US ETFs, the conclusion is that Saxo does not provide access to US ETFs for Swiss investors. The only way around that is to be eligible as a professional investor, which has some significant conditions.

You could also trade CFDs on US ETFs, but CFDs are generally horrible investments. So, I would prefer European ETFs over CFDs on US ETFs.

Saxo is available in German, French, English and Italian. However, the Italian support is partial only because the website and the onboarding are not available in Italian.

Another limitation of Saxo is that you cannot register your shares in the share register. This means you will not be able to get some shareholder perks if you want to (for instance, getting Lindt chocolates).

Saxo will not lend your shares by default. However, in some countries, you can opt-in for share lending and receive 50% of the profits. Currently, this feature is not available in Switzerland.

So, with the basics covered, we should delve into the details of Saxo Bank for a Swiss investor.

Saxo account tiers

Saxo has three different account tiers:

- Classic, without any minimum

- Platinum, with a minimum initial funding of 250’000 CHF

- Same as Classic, but lower prices

- Priority support

- VIP, with a minimum initial funding of 1’000’000 CHF

- Same as VIP, but even lower prices

- Access to trading experts and events

In this review, I focus on the Classic account. However, it is important to know that you can get even better conditions if you have more initial funding.

Even if you start with a Classic account, you can switch to a higher tier once you reach the necessary threshold.

Saxo Fees

When investing long-term, it is important to limit your fees. You want your money, not to give it to your broker. So, we must look at Saxo’s fees in detail.

First, you will pay a 0.22% custody fee per year. While this is an expensive base fee, it is capped at 10 CHF per month or 120 CHF per year. As far as Swiss brokers go, this is a fair custody fee.

On top of trading fees, the custody fee is the only fee you will pay. Saxo does not have any extra account management fees or inactivity fees.

For all the stock exchanges I have checked, the trading fees are the same for stocks and ETFs. So, here are the fees for some of the major stock exchanges:

- SIX Swiss Stock Exchange: 0.08% with a minimum of 3 CHF

- Euronext Paris: 0.08% with a minimum of 2 EUR

- London Stock Exchange: 0.08% with a minimum of 3 GBP

- NYSE: 0.08% with a minimum of 1 USD

- NASDAQ: 0.08% with a minimum of 1 USD

These fees are good for Switzerland. The percentages are relatively low, and the minimums are excellent.

As a Swiss investor, you must often trade in foreign currencies because few suitable ETFs are priced in CHF. When this happens, you will need to pay a currency conversion fee.

Fortunately, Saxo has an excellent currency conversion fee of 0.25%, the best among Swiss brokers.

Finally, we must also look at the Swiss Stamp Tax Duty fee. Being regulated by FINMA as a Swiss entity means paying this fee for each stock market operation. You will pay 0.075% for Swiss shares and 0.15% for foreign shares. This fee is the same for each Swiss broker.

Overall, these fees are outstanding. Saxo seems much cheaper than most Swiss brokers. The currency conversion fee is especially nice compared to other brokers, where the average is more than 1%.

Opening an account at Saxo

Opening an account with Saxo is simple. Everything happens online from their website, which should not take more than 15 minutes.

The online application is fairly straightforward and similar to most brokers these days. It consists of three main steps:

- Filling all your data.

- Approval of your account (proof of identity and residency).

- Funding.

I will not bore you with the details of each step because they are easy to go through.

The only thing that can take time is the funding, which can only be done through a wire transfer. The funds may take time to arrive in Saxo.

There is no minimum for opening an account. This is good news because you can start trading with little money. This is great if you want to test a service. And since there is no minimum custody fee (only a maximum), you can test the service with little fees.

So, overall, opening an account at Saxo will be very simple.

Trading with Saxo

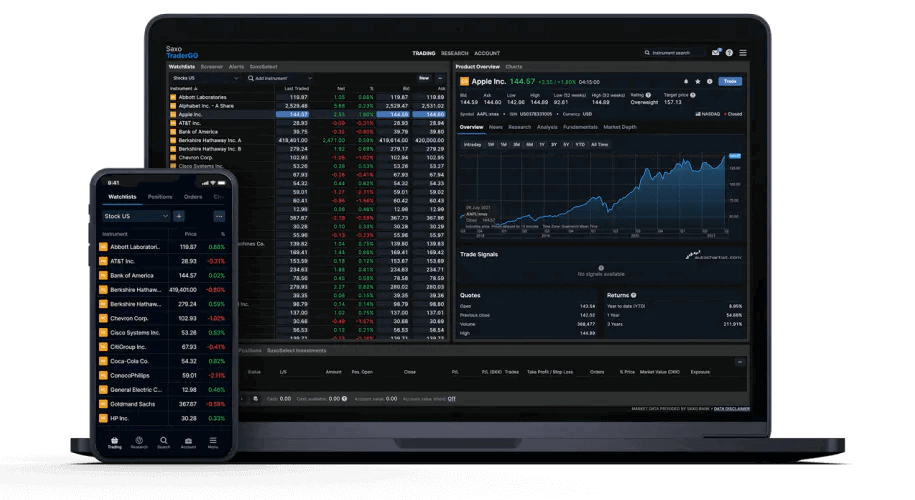

To trade with Saxo, you have two main options:

- The SaxoTraderGO platform, supported on mobile and desktop

- This is the default interface for most clients, allowing you to do all your trade operations and get access to data.

- The SaxoTraderPRO platform supports only PC and Mac

- This platform is made for professional investors, supporting up to 6 monitors.

In most cases, simple investors will have more than enough features with the SaxoTraderGO platform. But it is good to have advanced options for investors that need them.

Overall, everybody should find what they need to trade with Saxo.

Is Saxo safe?

Before using a broker, you must ensure it is as safe as possible.

Saxo is regulated in Switzerland by FINMA. And all its other entities are also well-regulated in different countries. As they have to obey many regulations (by being in many countries), they have to run a tight ship.

Saxo has been well-established since 1992. It has also been profitable for several years. Financial security is a good sign because the risks of going bankrupt are slim.

Saxo is a bank and does not have to use another custody bank. However, like any Swiss bank, your cash will be protected by Esisuisse. This protection guarantees up to 100’000 CHF per person.

The securities should be safe in the event of bankruptcy because they are held in segregated accounts in your name.

You can use a second-factor authentication (2FA) to protect your account further. 2FA is very important for your online personal finances! Currently, they only offer SMS 2FA. While it is much better than nothing, I prefer a more robust 2FA option.

You can also choose to trust a device on which you log in. You only have to enter your second factor once, not at every login. While this is convenient, it reduces security and should be avoided, in my opinion.

Investing with Saxo is safe, like investing with any other Swiss broker.

Saxo Reputation

We should also look at a broker’s reputation before using it to invest in the stock market.

I generally use TrustPilot as a source of reviews. So, we can start by looking at the reviews of Saxo Group on TrustPilot. It is essential to mention that this includes reviews for all parts of Saxo, not only the Swiss entity. Overall, Saxo gets a 3.7 score out of 5, which is not great but also not horrible for brokers.

We can also find reviews for Saxo Switzerland on Trustpilot. Here, Saxo gets a score of 4.4 out of 5, which is great. However, this is only out of 75 reviews, which is a very low number.

Looking at the negative reviews, we can find a few common themes:

- Difficult to reach customer support.

- Fees are too high (before the changes from 2024).

- Difficult to fund the account because of KYC procedures.

- There are a few technical and speed issues on the platform.

On the positive side, we can find the common themes:

- Good customer service.

- Easy to use platform.

- Good execution of trades.

After reading through many of these reviews, I am not worried about the negative comments or the global score. First, many people complain about the fees, but I would guess that most did not read all the fees carefully before. This happens in almost all brokers I have reviewed.

As for customer service issue, this is also the same in almost every broker. Sometimes, it is difficult to resolve some issues, and people get heated and post negative comments. But reading into the positive reviews, it looks like there are also some positive reviews of the customer service.

I also looked at the Google reviews of Saxo Switzerland. They got 4.3 stars out of 5. The negative and positive reviews are very similar to those on TrustPilot, with more positive reviews than before. Again, this also includes people using a broker without reading their pricing structure.

Overall, I think Saxo’s reputation is good but not impeccable.

Alternatives to Saxo

It is always important to compare a broker with its alternatives. We should compare Saxo with at least Interactive Brokers (a foreign broker) and Swissquote (a Swiss broker).

Saxo Bank vs Swissquote

Everything you need to start investing in the stock market! Open an account with Swissquote and get 100 CHF in trading credits with my code MKT_THEPOORSWISS.

- Swiss broker

- Easy to use

Swissquote is my favorite Swiss broker. It has many features, and its prices are pretty fair, as far as Swiss brokers.

Both brokers have a good reputation and have been established in Switzerland for a long time. They are both regulated in Switzerland and will provide the same level of security. They both offer access to many stock exchanges. And since they are both in Switzerland, they must levy Swiss Stamp Tax Duty.

We start with the custody fees. The maximum is 120 CHF per year at Saxo, while 200 CHF per year at Swissquote, a slight advantage for Saxo. Also, Swissquote charges an extra 0.03% fee (without maximum) on assets above one million CHF.

Fortunately, neither of these brokers has any extra inactivity or management fee.

We need to compare the trading fees of these two brokers. On the SIX Stock Exchange, here are some examples of costs for these brokers:

- 500 CHF: 3 CHF at Saxo and 5 CHF at Swissquote.

- 2000 CHF: 3 CHF at Saxo and 20 CHF at Swissquote.

- 5000 CHF: 4 CHF at Saxo and 30 CHF at Swissquote.

- 10000 CHF: 8 CHF at Saxo and 30 CHF at Swissquote.

The differences are pretty significant. Saxo can be several times cheaper than Swissquote!

Here are a few examples of trading fees for a stock on the NYSE:

- 500 USD: 1 USD at Saxo and 5 USD at Swissquote.

- 2000 USD: 1.60 USD at Saxo and 20 USD at Swissquote.

- 5000 USD: 4 USD at Saxo and 30 USD at Swissquote.

- 10000 USD: 8 USD at Saxo and 30 USD at Swissquote.

Again, the differences are significant. Saxo is, again, much cheaper than Swissquote.

Another significant advantage of Saxo is its currency conversion fee. Indeed, at 0.25%, Saxo is almost four times cheaper to convert currency than Swissquote at 0.95%.

On the other hand, a significant advantage of Swissquote is that they let you invest in US-domiciled ETFs. These ETFs are more tax-efficient and usually cheaper than European ETFs. This can make a significant difference in the long term.

Overall, Saxo appears to be significantly cheaper than Swissquote. This is excellent news because we have few affordable brokers in Switzerland.

I plan to do a complete comparison of Saxo and Swissquote soon. These two appear to be the two best Swiss brokers available. I will also do some simulations to see whether Saxo’s fees compensate for the lack of US ETFs.

Saxo Bank vs Interactive Brokers

The broker you need to buy stocks and ETFs reliably and at extremely affordable prices. Trade U.S. stocks for as little as 0.5 USD!

- Extremely affordable

- Wide range of investing instruments

Finally, we should also compare Saxo Bank with a foreign broker, Interactive Brokers.

Both brokers are well-regulated and have a good reputation. Saxo Bank is regulated in Switzerland, while Interactive Brokers is regulated in the UK and US. From a safety point of view, both brokers are on the same level.

We can start with the custody fees. Saxo Bank charges a maximum of 120 CHF per year for custody. IB, on the other hand, has no custody fees. Neither of these brokers has inactivity fees or any other account management fees.

For trading fees, I will use the Interactive Brokers Tiered pricing system. This system is generally cheaper for small operations but not always for large operations.

On the SIX stock exchange, here are the fees for both brokers:

- 500 CHF: 3 CHF at Saxo and 4.45 CHF at IB.

- 2000 CHF: 3 CHF at Saxo and 4.68 CHF at IB.

- 5000 CHF: 4 CHF at Saxo and 6.13 CHF at IB.

- 10000 CHF: 8 CHF at Saxo and 9.38 CHF at IB.

Interestingly, Saxo is cheaper than IB for operations on the Swiss Stock Exchange. This is precisely what I would expect of a Swiss broker. However, many Swiss brokers are more expensive than Interactive Brokers.

Here are a few examples of trading fees for a stock on the NYSE:

- 500 USD: 1 USD at Saxo and 0.36 USD at IB.

- 2000 USD: 1.60 USD at Saxo and 0.41 USD at IB.

- 5000 USD: 4 USD at Saxo and 0.51 USD at IB.

- 10000 USD: 8 USD at Saxo and 0.67 USD at IB.

IB can be significantly cheaper on US stocks. However, I am still impressed by how Saxo comes close to IB. Other Swiss brokers are much more expensive than IB.

Another advantage of IB is that you will save on stamp tax duty since this tax is only due to Swiss brokers.

Also, Interactive Brokers has the significant advantage of offering access to US ETFs, while Saxo does not. This can make a very important difference in long-term returns.

Finally, currency conversion is 0.25% at Saxo Bank, while IB charges 2 USD for each conversion. So, Saxo will be cheaper for conversions below 800 USD, and IB will be cheaper after that.

If you have a portfolio that uses US ETFs or stocks, Interactive Brokers will be significantly cheaper than Saxo. But Saxo is quite competitive.

If you are interested, I could do a complete comparison of these two brokers in the future.

FAQ

How much is the currency conversion fee at Saxo?

You will pay 0.25% currency conversion fee for each currency conversion.

Can you buy US ETFs with Saxo Bank?

No. Saxo Bank follows FINSA requirements, which means that any ETF must have a Swiss KID. And US ETFs have no Swiss KIDs, so you cannot trade them as a Swiss private investor with Saxo.

Who is Saxo Bank good for?

Saxo bank is good for Swiss investors that look for a very affordable Swiss-regulated broker with many features.

Who is Saxo Bank not good for?

Saxo Bank is not great if you want to trade US ETFs.

Saxo Summary

Saxo has significantly reduced its fees, is it good now? This in-depth review covers this broker in detail to see whether we should use it.

Product Brand: Saxo

4.5

Saxo Bank Pros

Let's summarize the main advantages of Saxo Bank:

- Excellent prices

- Excellent currency conversion fee

- Many investments available

- Well-established company

- Good security

Saxo Bank Cons

Let's summarize the main disadvantages of Saxo Bank:

- No access to US ETFs

- Onboarding not available Italian

Conclusion

Start investing with a Swiss broker at incredible fees! Start trading with Saxo Bank and get 200 CHF in trading credits.

- Low currency conversion fee

- Swiss broker

Saxo is a good, well-established, and very affordable Swiss broker. This service offers access to all the stock exchanges you need and many investment products. When compared with other Swiss brokers, they are consistently among the cheapest.

I appreciate that Saxo reduced its fees significantly. I hope this will start a good trend in Switzerland, where many services are overpriced.

The only major downside, in my opinion, is the lack of US ETFs. If you want to optimize to the maximum, US ETFs are essential. That being said, this is partly compensated by Saxo’s low fees.

I plan to compare Swissquote and Saxo in the coming months to see whether US ETFs and higher fees are better than EU ETFs and lower fees.

What about you? What do you think of Saxo?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Best Brokers

- More articles about Investing

- IBKR Global Trader Review 2024 – Simple stock trading

- Should you use IB Fixed or Tiered pricing in 2024?

- Swissquote vs Interactive Brokers 2024

Just for reference. I opened the account in Saxo and then I realised that I cannot buy US ETFs as private investor.

There is a provision for “professional client” and it needs certain waivers to be signed. Also you need to have made certain size transactions to show that you know you are well aware of financial markets.

I closed my account.

Thanks, Abhiney, that confirms what I thought!

I would love to have an in dept comparison of IB and Saxo. Also, could you tell me what a US ETF is?

Hi Tamino

Thanks for your feedback, I will bump this item on my list.

A US ETF is an ETF with a domicile in the United States. I have an article about them: What makes U.S. ETFs so great?

I don’t know if I’m wrong, but I think I could buy the mentioned Vanguard Total World, which you mentioned in the article you referred me to. This one should be a U.S ETF and is on the list of SAXO ETF: https://www.home.saxo/de-ch/rates-and-conditions/etf/etfs-available

Interesting; thanks for sharing. I actually got the information from my contacts at SAXO, who mentioned that it was not possible for private investors. I will double check with them and update the article if necessary. It will definitely makes Saxo more interesting if we can buy US ETFs.

Did you manage to buy it or do you only see it in search?

Hi Baptiste

I only was able to see it in search since I’m still in the process of deciding which of the Brokers (IB & Saxo) I should choose to invest.

Thanks for the info!

Hi Babptiste,

Thanks for the review! I would be definitely interested in another deep dive of Saxo vs. Interactive Brokers.

Especially becauce Saxo seems to be pushed by some other Swiss bloggers, but at the moment I cannot see a rational reason why. US ETFs seem more promising to me than the Swiss ETFs and therefore the winner is clearly IB…

Hi Peter

The winner is definitely IB IF you want to use a foreign broker. Many Swiss people are not comfortable with a foreign broker.

I think the most interesting comparison would be Swissquote vs SAXO.

Hi Baptiste

Does Saxo lend the shares out?

Is ist possible to register as owner in the share register?

Thanks

Greetings Aare

As far as I know, registration as owner in the share register is currently only possible for large deposits of CHF 1’000’000.- or more. In a comment on a YouTube video by “Finanzfabio”, I read something about Saxo possibly changing this. However, it is unclear if and when this will be implemented.

Hi Aare

Excellent questions.

For share lending, they don’t do it by default, but you can enable it. In this case, the profits are shared 50/50 with Saxo, the same as IB.

For the share register, I don’t know. I have asked Saxo and I will update here.

I got an answer from Saxo:

1) Share lending is not yet available in Switzerland but is planned.

2) It’s currently not possible to register shares.

why invest with a bank with a privately held chinese company? Geely is a car builder, why could be they be interested in a european bank? Consider your personal information fully disclosed to the chinese communist party, if not now, then whenever it can be of interest to them; Chinese companies are obliged by law to surrender any data requested by their government.

I abstain on that ground alone.

Admittedly, Swissquote can use some competition.

For me, one of the reasons to look into Swiss broker was to have a backup broker.

Saxo ticked most boxes except two

1. No US ETFs. This can technically be okay because i also dont want 100% of my wealth in US domicile ETFs.

2. 49.9% holding from Geely China. This kind of make me wonder that can i even consider them Swiss broker at all…..

Thanks for your review. I also like that there is finally one that can compete with Swissquote. I haven’t used Swissquote anymore since moving back from the US to Switzerland and right away went with IBKR.

If I understood correctly, overall even if Saxo has lower fees for trades on SIX, with the additional Stamp duty fees, they end up being more expensive than IBKR. And the custody fee needs to be considered as well. Still love using IBKR despite their ugly UI :-)

Hi Ralph

I agree that IBKR remains cheaper than Saxo. But Saxo does not really compete with IBKR I think, but there are definitely becoming very interesting against Swissquote.