IBKR Global Trader Review 2024 – Simple stock trading

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Many people believe that Interactive Brokers is too complicated for them to trade on, so they choose an inferior platform instead.

Well, Interactive Brokers is not that complicated, and it just became even simpler! Interactive Brokers recently introduced a new mobile app, IBKR Global Trader.

Interactive Brokers designed the IBKR Global Trader to simplify trading and reduce friction. In this review, we examine this new app and determine whether it lives up to its promises.

| Custody Fees | 0% per year |

|---|---|

| Inactivity Fees | 0 CHF |

| Buy Swiss ETF | 5-15 CHF |

| Buy American Stock | 0.50 – 1 USD |

| Currency Exchange Fee | 2 USD |

| Languages | English, French, German, and Italian |

| Mobile Application | Yes |

| Web Application | No |

| Custodian Bank | 8 different US banks |

| Established | 1978 (IB), 2020 (Global Trader) |

| Headquarters | United States |

IBKR Global Trader

IBKR Global Trader is the latest mobile application from Interactive Brokers for easy and affordable trading!

IBRK Global Trader is a mobile application from Interactive Brokers. It is important to note that this is not a broker by itself, only a different way to trade with IB. If you have an IB account, you can use IBKR Global Trader.

However, this application differs from the previous IB, IBRK Mobile application. Indeed, IBKR Global Trader was built from the ground up to be easy to use and to help global trading.

This application’s goal is to be easier for every IB user. Many people think that IB is difficult to use, so IB is acknowledging this fact and creating an application specifically to ease the difficulties of using it.

Interactive Brokers is currently the best broker for Swiss investors. This app makes it even better. If you want to learn more, you can read my Interactive Brokers review.

The mobile application

To get the application, you can search for it on your local app store or go to IBRK Global Trader and follow the Android or Apple Store links.

Once you have the app, you can connect to it or use the paper trading account to start without a complete account.

There are five main views on the account:

- The home page

- The portfolio

- The watchlist

- The explore view

- The Trade view

You can also access your account details, transaction history, and account settings from different perspectives.

We now get into the details of some of the interfaces. We will also see the operations you can do from the mobile app.

The home page

The home page gives you access to your portfolio graph and shortcuts to the essential actions:

- Trading

- Account settings

- Withdraw money

- Transaction history

- Support

The home also provides recent news on the stock market. Many people will appreciate the news, while passive investors like me think it is irrelevant. I wish we could remove them, but they are not very invasive.

On the other hand, you can filter the news by news that relates to your portfolio contents. For instance, you will get news about Apple if you have Apple stock. This feature could be good if you have a few stocks in your portfolio.

Overall, this is a good home page, with the critical information visible and the noise is mostly hidden.

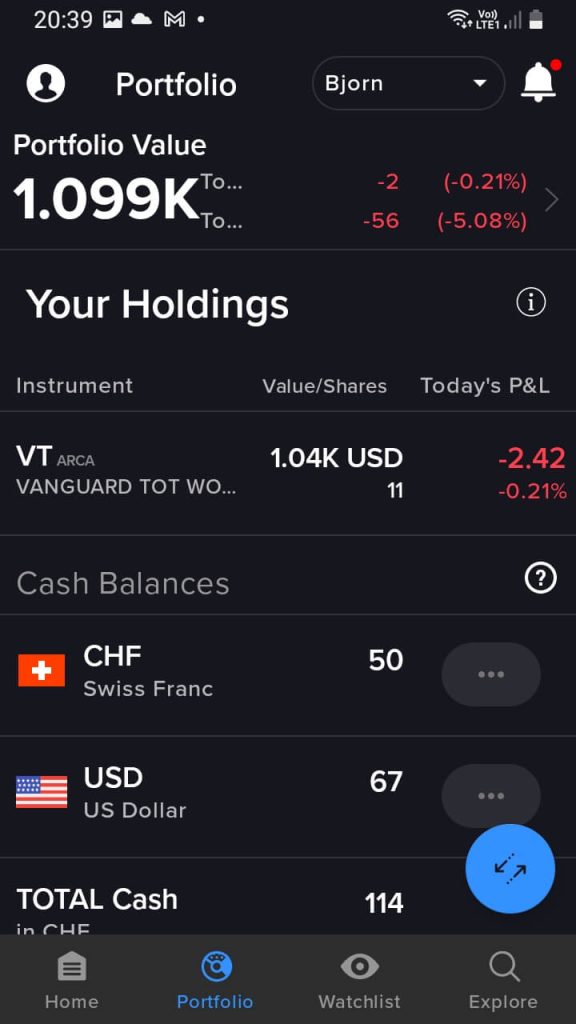

The portfolio page

The portfolio view is very simple. It shows all your positions, their values, and performances. It also shows your cash balances. From the cash balance, you can easily convert currencies directly.

This view is nice and simple.

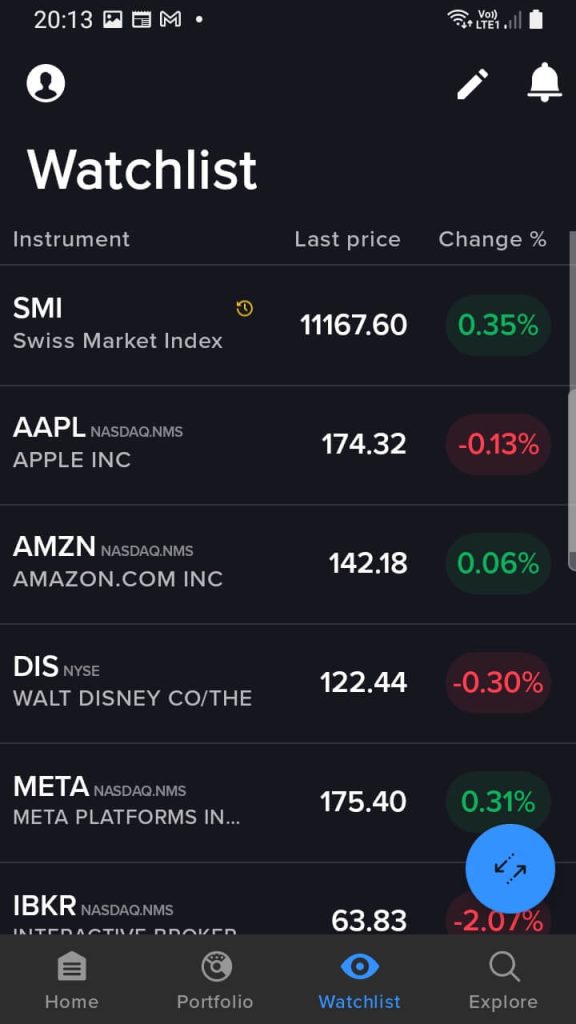

The watchlist view

As its name indicates, the watchlist views let you see your watchlist easily. If you are watching some single stocks or ETFs, using a watch list is an excellent way to have access to them easily.

The view gets the job done. There is not much to share about this view.

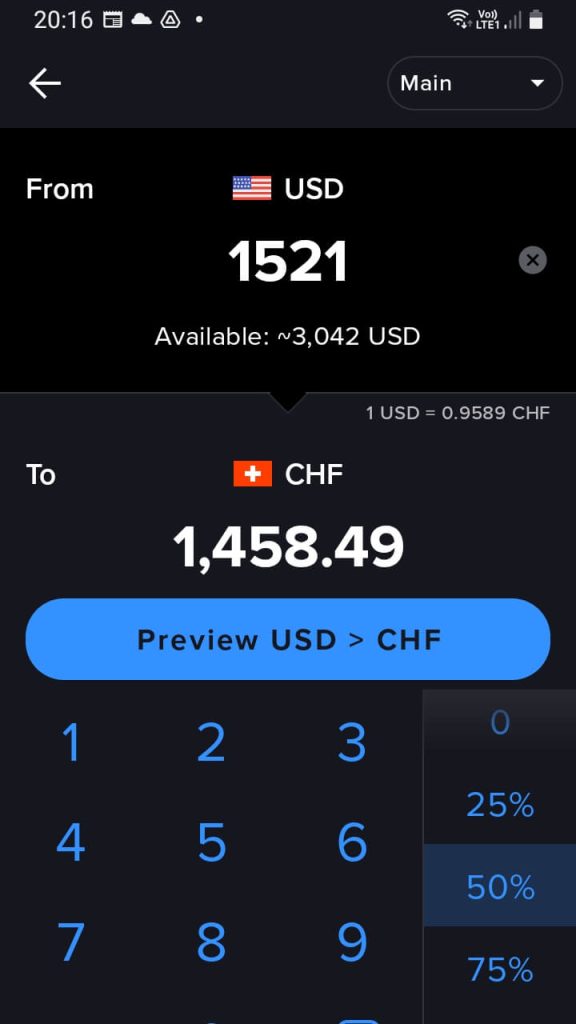

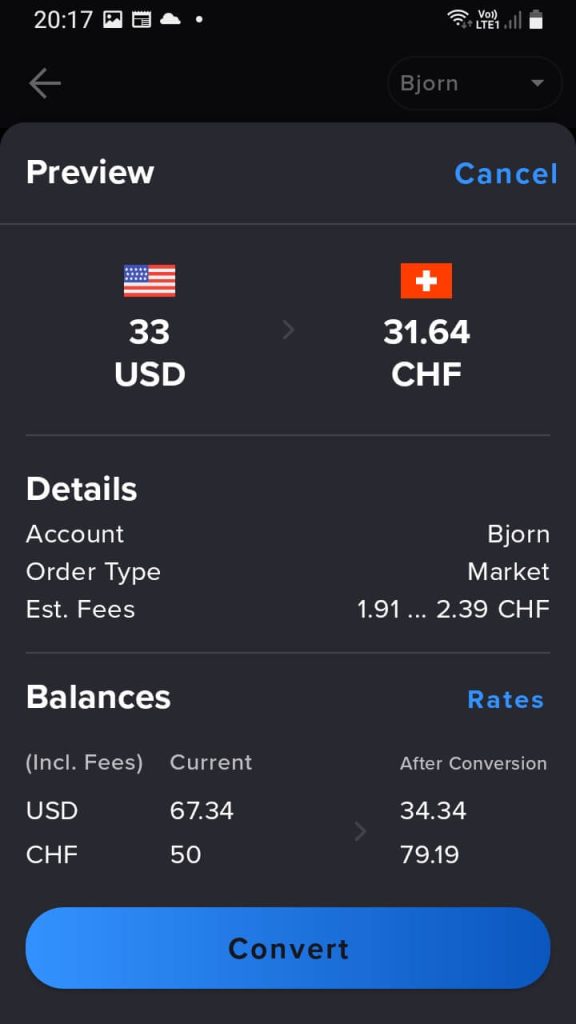

Convert currencies with IBRK Global Trader

One operation you may have to do often is to convert currencies. You can access this view from your portfolio.

It is extremely simple to convert currencies with IBKR Global Trader. You can select the currency you have and the currency you want. Then you can choose how much you want to convert. You can enter the amount directly or convert a percentage of your cash, which is interesting.

Once you are ready, you can preview your order. In my opinion, the preview is excellent. I always preview my orders to make sure they are what I want. This also previews the fees you will pay.

As you can see on this screenshot, I will pay about 2 CHF for my conversion. You should not convert tiny amounts with IB since they use a fixed fee of 2 USD. But it becomes very cheap to convert more significant amounts.

Overall, it is straightforward to convert currencies with IBKR Global Trader. What is remarkable is that the potential for error is minimal.

Trade with IBRK Global Trader

If you are investing regularly, the most helpful action is to trade stocks, whether to buy or sell. We can take a look at this view in detail. You can access it from the blue button at the bottom right of each interface.

From this interface, you can search for the ETF (or stock) you want. You can also access this view from your portfolio by clicking on any of your position in case you want to buy more (or sell).

Here, you can see that I searched for the Vanguard Total World ETF (VT), my favorite ETF. From there, you can choose to buy or sell.

There is also a unique feature, Swap. Swap allows exchanging stocks for other stocks. Swapping means selling some of your shares in one position and buying a similar amount in another. This feature is convenient if you change ETF, but I do not see people using it often.

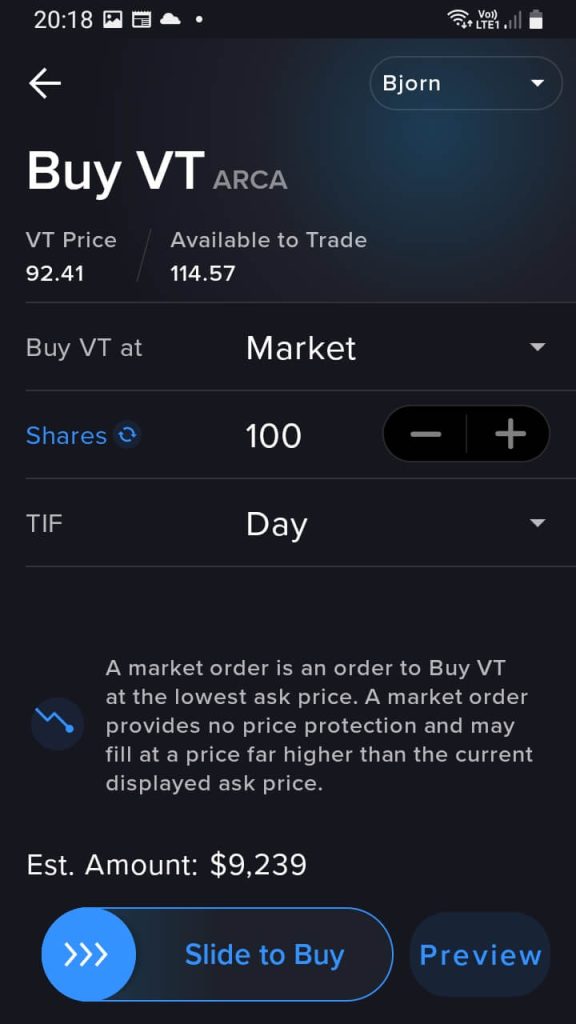

So, here is how to buy VT with IBRK Global Trader.

From this view, you can choose between the different stock market order types, the number of shares, and the valid time for this order. I generally only trade with market orders. That is so much simpler. And market orders are not nearly as dangerous as people believe.

Once you have set up your order, you can either slide to buy directly or preview your order. I recommend previewing your order to make sure everything is correct before you send the order.

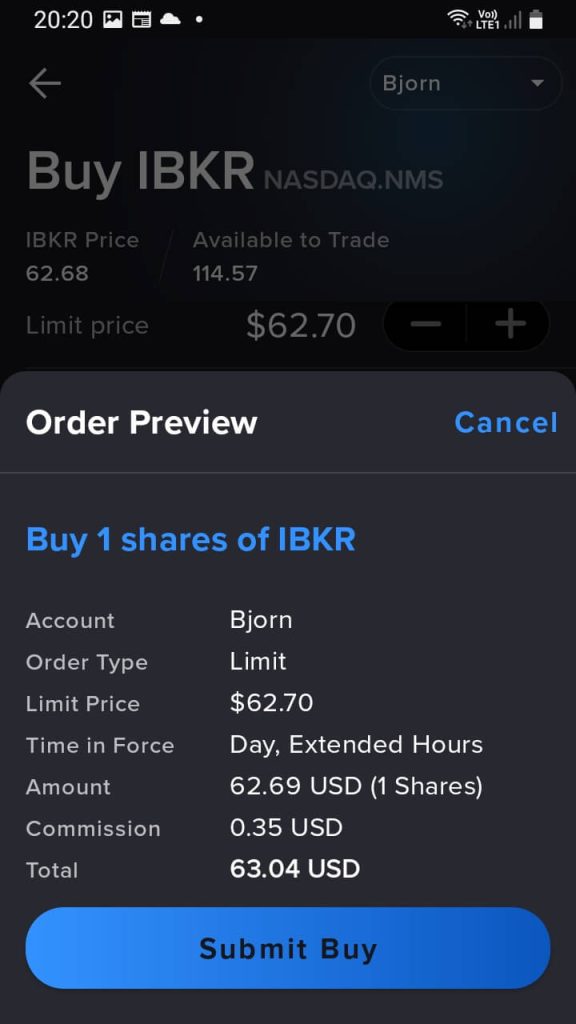

From the preview, you can see what will happen, for instance, with a limit price on IBRK stock (just an example, I do not own this stock). You can see the total and the fees you will pay. This example shows that IB is extremely cheap since you would pay 0.35 dollars for this transaction!

Overall, buying and selling from IBRK Global is extremely simple. They did an excellent job integrating only the necessary features to simplify trading.

IBKR Global Trader and other interfaces

We should also quickly compare IBKR Global Trader and the other interfaces.

IBKR Mobile is the previous mobile application from Interactive Brokers. Overall, IBKR Global Trader is a better version of IBKR Mobile. The new interface is significantly easier and less bloated than the previous one. If you want to trade on mobile and have something simple, IBRK Global Trader is better than IBKR Mobile.

If we compare it against the web interface (account management), both interfaces are really easy to use. The account management interface is significantly more practical if you want to deposit or withdraw money. Indeed, the mobile application will load the mobile-unfriendly web interface into a mobile browser.

Finally, we must say a few words about Trading Workstation (TWS). TWS is the desktop interface. Most people should avoid TWS. The IBKR Global Trader is ten times easier to use and much better looking.

Overall, IBKR Global Trader offers the best way to trade on mobile for Interactive Brokers accounts.

FAQ

Can you trade in fractions with IBKR Global Trader?

Yes, you can trade in fractions with many stocks.

Is IBKR Global Trader a different IB account?

No, it is a mobile interface to your IB account, you do not need a new account.

What is IBKR Global Trader?

IBKR Global Trader is a new mobile interface by Interactive Brokers, to make it easier to trade globally from your phone.

Who is IBKR Global Trader good for?

IBKR Global Trader is good for people who want to use IB with a different mobile interface.

Who is IBKR Global Trader not good for?

IBKR Global Trader does not provide much over the existing mobile apps. So, if you are content with the current mobile application or only trade on your computer, you do not need IBKR Global Trader.

IBKR Global Trader Summary

IBKR Global Trader is the latest mobile application from Interactive Brokers for easy and affordable trading!

Product Brand: Interactive Brokers

4

IBKR Global Trader Pros

Let's summarize the main advantages of IBKR Global Trader:

- It is very easy to trade

- Can trade on many stock exchanges

- Very user friendly

- Easy to start with

- The best mobile app from IB

IBKR Global Trader Cons

Let's summarize the main disadvantages of IBKR Global Trader:

- Not practical to deposit or withdraw money from the application

- Lack of customization

- Too many news

Conclusion

IBKR Global Trader est la nouvelle application mobile d'Interactive Brokers pour investir facilement et à bas coût!

Overall, the IBKR Global Trader mobile application is an excellent mobile application. It allows you to trade easily from the phone and is significantly easier to use than the IBKR Mobile application.

On the other hand, it is not a revolution. There is nothing fundamentally new with this application. It allows simpler trading with your IB account.

Overall, it is an excellent mobile application and a promising new addition to the IB universe. I have replaced my IBRK Mobile application with this new mobile application.

I wish we could turn off the news on this app. For a simple passive investor like myself, they do not help much. But nowadays, every mobile trading app has this kind of information.

However, I am not an ardent user of mobile phones. I will continue trading and checking my portfolio on the account management interface from my computer. The default web interface remains the best interface for most users.

But it is true that most people now prefer using a mobile phone rather than a desktop. So having a simple mobile application is essential.

To learn more about Interactive Brokers, you should read my IB Review.

What about you? What do you think about IBKR Global Trader?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Best Brokers

- More articles about Investing

- Neon vs Yuh: Best digital bank in 2024?

- Should you use IB Fixed or Tiered pricing in 2024?

- How to buy an ETF from IBKR Mobile

I may have missed it, but I can’t find a way to configure the generation of IB Keys for 2FA on this new smartphone app. That’s a big CON for me, as it requires that I keep the IBKR Mobile app just for that purpose.

Otherwise, it is a very convenient and more user friendly app, I agree.

Hi,

That’s a good point. I think it should be possible, but I don’t know how either. I think we should be able to change that from the web interface.

I know we can use the new app for Authenticate, so it should be possible to do 2FA directly as well.

Hi, Baptiste,

Would you say it is better to transfer funds from another account like Revolut or Wise, having them previously converted from CHF to USD/other?

Or are the rates from IBKR similar to those from Revolut and is simply not worth the struggle?

Thanks!

Hi

IB will charge you 2 USD per conversion, with interbank exchange rates (sometimes a little worse on small conversions).

I don’t think it’s worth trying to optimize. Unless you are doing small conversions, Wise will cost you more, and Revolut will quickly hit the monthly limit.

I would like to try this app but I can’t access it..

It asks for a PIN and I am almost certain that when I opened the account I didn’t create one.

Is anyone having the same problem? With the standard app I always used the 2fa without problems. Thanks!

Could this be the PIN from the other mobile application?

hi,

so if i understand correctly, the swap is like selling the current position and buying the new position without holding the cash on your account?

is it any cheaper or is it just this advantage of not having this extra step in it?

thank you

Hi Michael,

Yes, it does the two steps together. I don’t think it’s any cheaper, it is just “simpler” if you want to change from one share to another.

ok, thank you.

what if i got one etf in chf and want to swap it with one that’s in dollar?

I suppose that would work, but I suppose IB would charge you the forex fee as well.

You are missing an amazing opportunity to tell your readers about the bear market we’re in and the potential scenarios. Really. You are in VT and Swiss stocks, how are you gonna play this? I expect VT to drop 15-20% in the next months. Do you too?

Hi Alex,

I will play it simply by not changing anything: keep buying monthly shares of my portfolio.

There are many possible scenarios from now on. VT may drop 15-20 lower, or we could have already reached the bottom, … I don’t know the future, so I don’t try to guess it.

Long-term investors should not have to read about current market conditions, so I try to avoid speaking about them.

Do you know if there is any accumulating total stock market ETF instead of VT or VTI which pay dividend?

Paying 40% tax on the dividends is quite painful if I put 80% of my savings into VT(I).

I’m wondering about alternatives.

I don’t know, but it does not matter. You will pay the same taxes on accumulating and distributing ETFs.

Hi Baptise,

Thanks for your article.

Note that this new app (and the web interface) still doesn’t authorize to place “advanced” buy/sell orders, like “trailing stop limit” orders (e.g. to sell/buy his shares if the current price increases/decreases by XX%).

For me it’s an essential feature to protect my investment (even long term), by taking my profits/stopping my loses in the event of a real crash (e.g. -20%).

I don’t understand why this feature (and many others) has only been integrated by Interactive Brokers in the IBKR mobile app.

Hi Anthony,

I actually think it’s great to limit the number of order types available. Most people don’t need them. And most people that think they need them actually don’t need them.

If a real crash happens, what are you going to do? And when are you going to buy again? 99% of people will lose money with this strategy and will lose time in the market.

I’d much rather keep my money invested and not try to be smarter than the market. At least, I will get dividends.

Hi Baptiste,

It depends on your strategy.

For example, I invested in the “XLE” ETF (SPDR Energy Select Sector / S&P 500) at the beginning of the year (very cyclical and risky).

Its value rose by 68% before its “crash” by 30% in mid-June.

By setting up a 20% stop loss, I was able to take my profits during its crash without monitoring its performance on a daily basis.

For long-term investments, I prefer to set up a larger stop loss (for example 30-35%).

It is not possible to know if an ETF/index will return to its original value and when (think Nikkei 225).

So, in this case, I prefer to get my money back, and invest it on another index/sector and/or on the same after its crash.

Setting up a “trailing stop limit” prevents you from staying behind your screen and moving your stop loss/take profit manually.

I don’t believe in the “not sold, not lost” theory.

But you’re right, keeping your money invested will get you dividends.

And for very long-term investments (20-30-40 years), on an index on which you have a strong conviction (e.g. MSCI World, FTSE Global All Cap, S&P 500 etc.), setting up a stop loss (and follow the financial news) may not be necessary :)

Hi,

Yes, it does depend on your strategy. For me, even picking a cyclical ETF comes down to active investing. And when you are actively investing, you can indeed profit with more complex algorithms. But that’s not really what I preach or do :)

As you said it, for very long-term investments on broad indexes, keeping yourself in the market is generally best.

Thanks for sharing your strategy and the good example!

Hi Baptiste,

Looking at the screenshots, this is exactly the same app as “IMPACT by Interactive Brokers”, but on blue.

Hi Teslo,

I did not try the Impact App. But looking at it, it seems based on the same foundation. One difference would be that the IMPACT puts sustainability first, while Global Trader does not. But it looks quite similar in terms of buttons and displays.

Thank you Baptiste for this summary.

You always keep us informed of what’s new.

I have been using IBKR for years. It’s true that the interface is not the easiest. But in the end, as a passive investor, it doesn’t matter to me.

I rarely go there, and when I do I go through the PC.

In my most active period, I placed 2 to 3 orders per week.

Finally, a passive investor who seeks financial independence needs very little function from his broker.

Hi Dror,

That’s a good point, I don’t use any of the mobile apps much either.

I usually place 1-2 orders per month and I place them all on my computer.

Just looking at the screenshots you provide I already don’t like it :) The trend for oversize everything is just plain wrong. I can fit 16 lines of portfolio items on my iPhone Mini screen in the classic app. It is 8 in Global Trader.

Hi Alex,

I don’t even have 8 items in my portfolio :)

On the other hand, I agree that I don’t like the trend to oversize either. But I almost never look at mobile apps, so I don’t really case. For seeing many things at once, I use my big 4K monitors anyway.

Thanks for sharing!

Hi Baptiste, thanks for the article. I’ve noticed the new app doesn’t allow to use the Mid Price method to buy stocks. Do you know if the mid price is better than the market order?

Hi Luca,

I have never used the mid-price algo to buy stocks. Unless you buy a ton of stocks and you do active trading, it won’t make any significant difference with a market order.

Thanks for your reply Baptiste!