Neon Invest Review 2024: Pros & Cons

| Updated: |(Disclosure: Some of the links below may be affiliate links)

I have talked a lot about Neon, a top-notch digital bank, on this blog, and they have recently launched Neon Invest, their new investment service. So, we must take an in-depth look at this new service.

This review will examine Neon Invest, its fees, security, and features. By the end, you will know whether to use Neon Invest.

| Custody Fees | 0% per year |

|---|---|

| Inactivity Fees | 0 CHF |

| Buy Swiss ETF | 0.5% |

| Buy American Stock | 1% |

| Currency Exchange Fee | 0% |

| Languages | English, French, German, and Italian |

| Mobile Application | Yes |

| Web Application | No |

| Custodian Bank | Hypothekarbank Lenzburg |

| Established | 2023 |

| Headquarters | Zürich |

Neon Invest

All the services you need to pay, save and invest, in a neat package, with extremely good prices!

Use the poorswiss code to receive 10CHF!

- Pay abroad for free

- Invest with great fees

Neon is my favorite digital bank in Switzerland. They offer an excellent bank account with outstanding fees and the best card to shop internationally and in foreign currencies.

Until recently, Neon had no investment service. They offered some partnerships with other investment services, but that was all.

Things are now changing for Neon with the introduction of Neon Invest! Neon Invest is a new feature from within Neon that lets you invest in the stock market. You can use Neon Invest directly inside the Neon app.

With this new investment feature, Neon aims to be an app to do it all. You can now pay with Neon, save with Neon, and invest with Neon. This is also obviously an extension of their business model.

In May 2023, Neon Invest started in beta for app users in German. The beta lasted for about two months. On July 11th, 2023, the feature was released to all users of Neon, out of beta!

Investing features

The goal of Neon Invest is to make investing easy for everybody. Therefore, we should not expect this service to have all the services of a standard broker.

It is essential to know that Neon Invest does not give you access to the entire stock market. They currently give you access to about 220 stocks and 70 ETFs, and they plan to increase this list in the future. There is currently no plan to add bonds, but for most investors, this is fine. There are bond ETFs that can work well for most people.

It is also essential to know that they only offer access to the BX Swiss Stock Exchange (previously the Bern Stock Exchange). All these stocks and ETFs will be traded on BX Swiss.

I have looked at the list of the actions and ETFs, and they have a good list of European ETFs. Unfortunately, since they trade on BX Swiss only, they do not offer US ETFs, only European and Swiss ETFs. However, they have a good list of ETFs, allowing one to make a good diversified portfolio.

It is important to note that one disadvantage of using BX Swiss is that this exchange is rather small. This means the volume of trading is also low. As a result, the spread will be higher than on other exchanges. If you invest once a month, this should not make a big difference. But if you want to invest more actively, this can be detrimental.

You can place orders on the stock exchange even when it is closed. When you do so, the order will be placed automatically when the stock exchange opens. You can cancel the order while the market is closed. You must also ensure you have enough money to execute the order when it opens.

Since Neon is a fully digital bank, it is only logical that Neon Invest also only works from your phone. You can access all these features directly from your Neon account.

Finally, Neon Invest currently only offers market orders. Limit orders would be great, but it is not as necessary as people think. If you are investing long-term, you want to buy now, not when you think it is a good price. When buying stocks and ETFs, I only use market orders.

It is very interesting to note that Neon lets you transfer your shares to another broker. This is a great news because most affordable brokers do not have this feature.

So, overall, Neon Invest’s features are limited, but these features should be enough for most people starting to invest. It should even be enough for most long-term passive investors.

However, it must be said that the lack of US ETFs makes it sub-optimal.

Investing fees

When investing in the stock, investing fees are very important. So, we must look into Neon Invest fees in detail.

First, Neon Invest has no custody fees. This is great because many services have hefty custody fees.

For trading, Neon Invest fees are really simple:

- You will pay 0.50% of the trade value for all ETFs and Swiss stocks.

- You will pay 1.00% of the trade value for all international stocks.

There is no minimum or maximum on these fees. This makes it very cheap to trade small operations and expensive for large operations. Here are some examples:

- A 200 CHF trade in a Swiss stock would cost 1.00 CHF in fees

- A 500 CHF trade in a Swiss stock would cost 2.50 CHF in fees

- A 1000 CHF trade in a Swiss stock would cost 5.00 CHF in fees

- A 5000 CHF trade in a Swiss stock would cost 25.00 CHF in fees

- A 200 CHF trade in a foreign stock would cost 2.00 CHF in fees

- A 500 CHF trade in a foreign stock would cost 5.00 CHF in fees

- A 1000 CHF trade in a foreign stock would cost 10.00 CHF in fees

- A 5000 CHF trade in a foreign stock would cost 50.00 CHF in fees

On top of that, you will have to pay the stamp tax duty. This fee is 0.075% on all Swiss shares and 0.15% on all international shares.

One unique feature of Neon Invest is that everything is traded in CHF. This is a feature of the BX Swiss exchange. One significant advantage is that there is no additional currency conversion fee.

You might think this is simply a way to hide the currency exchange of BX Swiss, but BX Swiss has no markup on the currency exchange. This makes trading foreign actions and ETFs very affordable.

There is one particular case where a currency conversion will happen. When you receive dividends in another currency, this dividend will be converted to CHF. For instance, if you hold Microsoft shares, you may receive USD dividends. In that case, the partner bank will convert the dividends with about a 1.5% currency conversion fee. This is a significant fee!

You need to consider that the dividend conversion fee will apply in the long term. The transaction fees will be paid twice usually (buying and selling) but the dividends will be paid each year, and every time, you will pay this 1.50%.

For ETFs, this may make accumulating ETFs more attractive than distributing ETFs. But there are also other factors to deciding between accumulating and distributing ETFs.

Overall, fees are pretty good for starting investors. Having no minimum on trades makes it very easy to get started investing. Also, having no currency conversion fee on international shares is excellent. However, having no maximum means expensive fees for large operations.

On the other hand, the fee on international dividends is significant.

How to use Neon Invest?

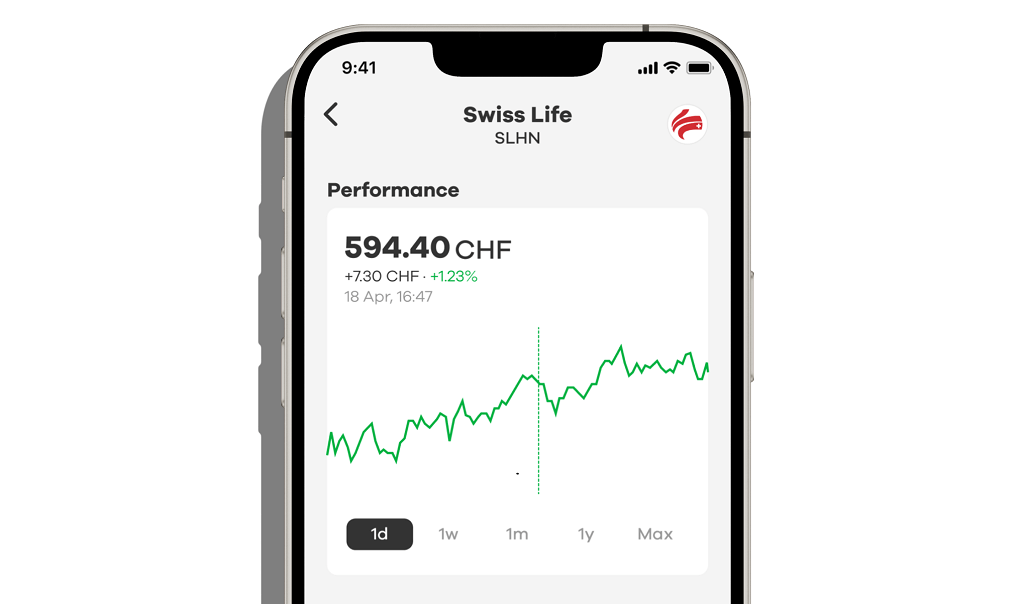

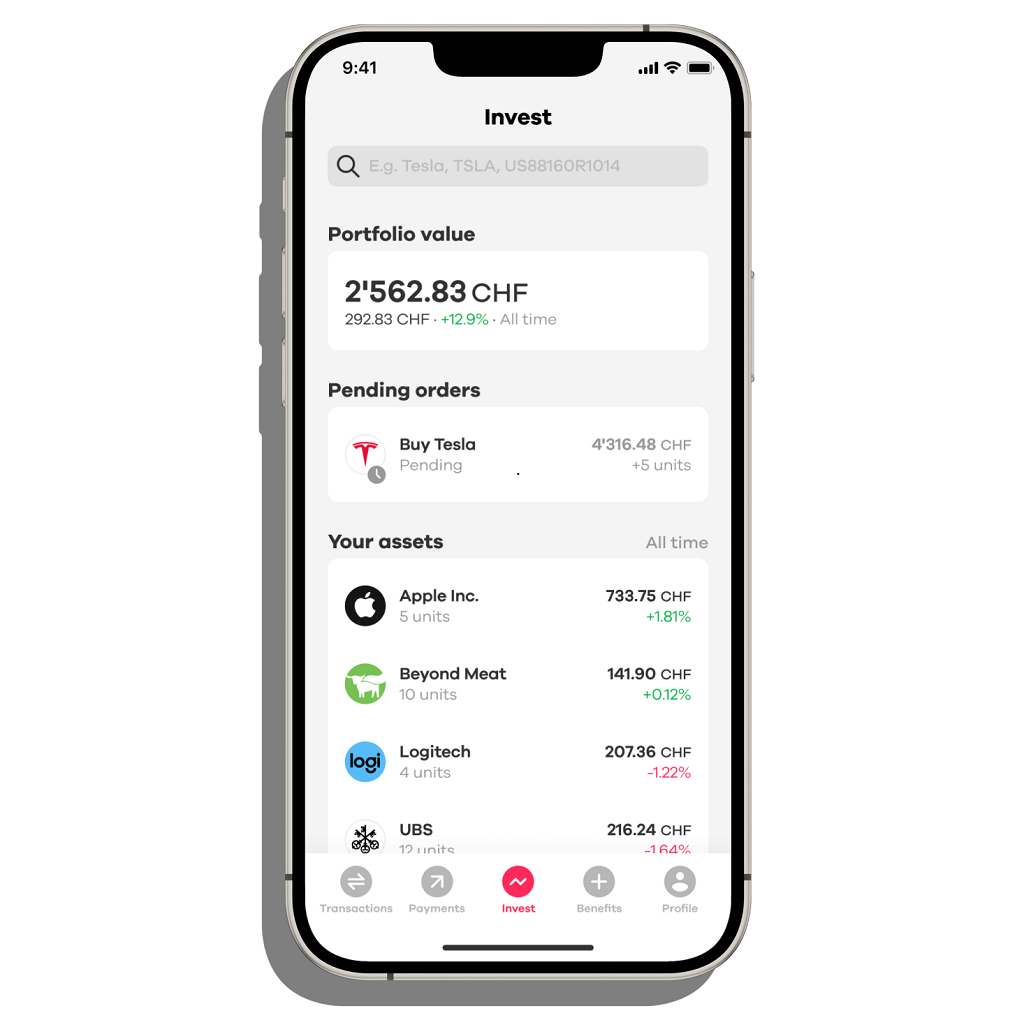

You can access Neon Invest directly from Neon application. You can use the Invest tab at the bottom of the app to access Neon Invest.

The first time you invest, you will have to accept the conditions. After that, it will be very seamless.

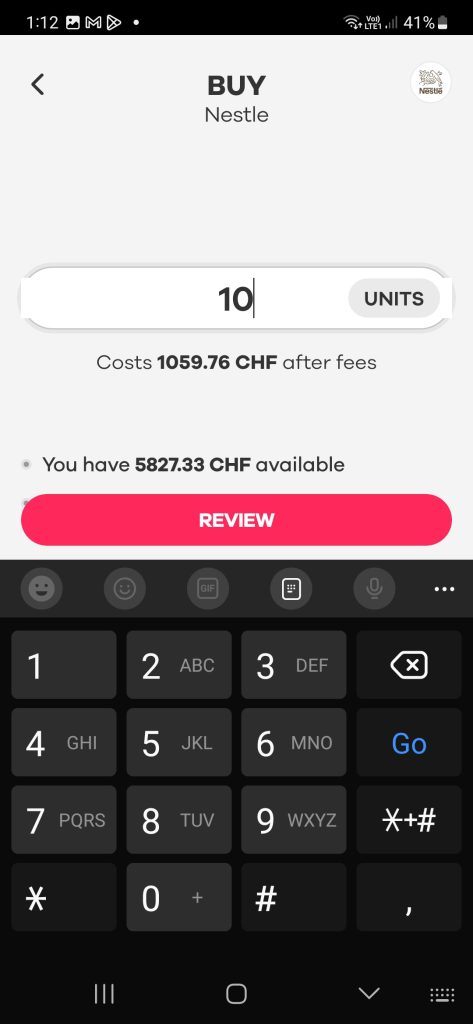

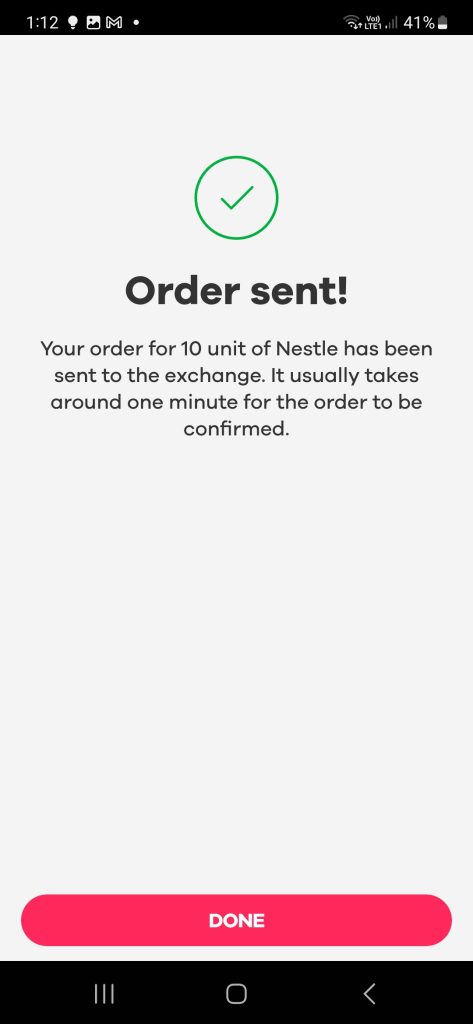

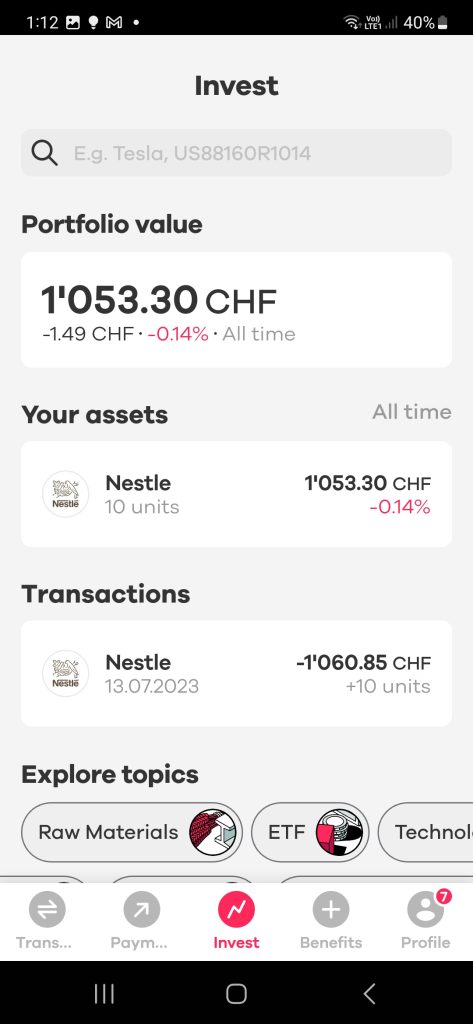

I have tested Neon Invest by buying a few shares of Nestlé (a single example, not a recommendation). Once you select Nestlé, you can either buy or sell shares. In that case, if you click on buy, you should see this very simple screen:

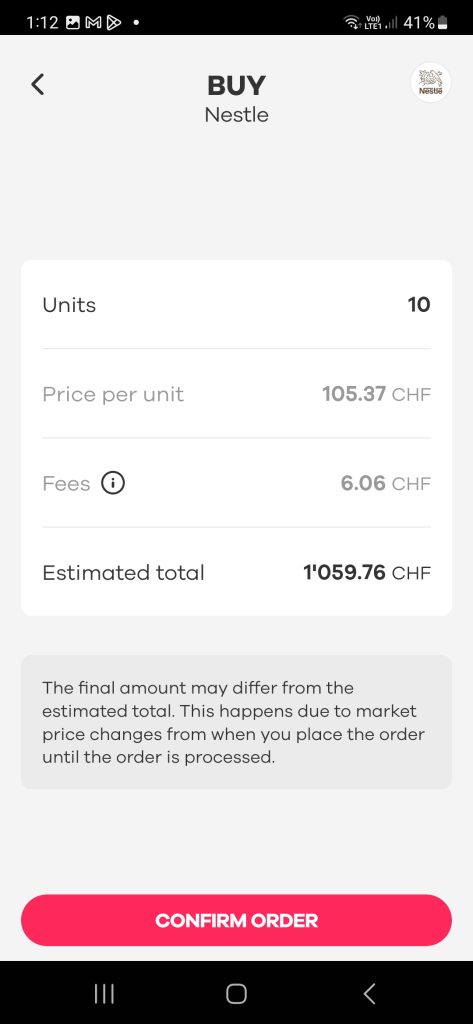

Once you click on Review, you get a summary of the operation before confirmation.

You can see here the estimated total and the amount of fees. It is really good that they are displaying the amount of fees on this screen. This is the 0.5% fee from Neon and the 0.075% stamp duty fee. Once you are done reviewing the order, you can confirm the order (or cancel it).

Once the order has been executed, you can see your shares in the portfolio view (the default view).

Overall, the process is extremely simple. Anybody can invest with Neon Invest.

Looking at an ETF, you can directly see the TER, which is great information. And they do not try to change the names misleadingly. You can also access the fact sheet, which is also good.

So, overall, investing with Neon Invest is very straightforward, efficient, and transparent.

Is investing with Neon safe?

When you are investing, you must consider the safety of your assets.

Neon itself is not a bank. As a bank account, they use Hypothekarbank Lenzburg (HBL) as a partner bank. And for trading, it is the same. Neon uses HBL as a custody bank for trading.

Your assets will be held in their custody bank in an account in your name. So, Neon could go bankrupt, and your assets would be safe since they are not on their balance sheet. On top of that, this custody bank has a good reputation.

Investing with Neon is as safe as investing with any other good Swiss broker.

Salary day issues

Something I should mention is that Neon often has issues on the 25th of the month. This day is the day most people get their salary. And when people get their salary, they pay their bills. This means that this day is the most active of the month.

Today, we often observe difficulty connecting to the application and delays in the app.

Sometimes, it can be very frustrating to come into these issues.

Future features

It is worth mentioning a few future features that Neon Invest has planned.

Soon, Neon Invest plans to add more shares and ETFs to the list and provide more information about these shares, such as sustainability ratings, in the app.

Neon also wants to support limit orders and pending orders. That means you can create an order during the weekend, which will be executed when the stock exchange opens. You will also be able to set the price at which you want to buy or sell a stock.

Finally, they aim to allow users to register their shares in the share register. This is an excellent feature because very few modern brokers allow this. However, this feature is likely to take a while to be implemented.

Alternatives

We should look at some alternatives and compare them with Neon Invest.

Neon Invest vs Yuh

Yuh is an easy and affordable way to invest in the stock market and spend money abroad.

Use my code YUHTHEPOORSWISS to get 25 CHF in trading credits!

- Low fees for small operations

- Fractiona trading in stocks

I have not yet compared Neon and Yuh in detail because Yuh offered some investment services while Neon did not (until now!). So, now that Neon offers investment services, we must compare these two digital banks. I will soon make a complete comparison because these two accounts are now fairly similar.

In terms of trading features, both services offer relatively similar features. They both only allow market orders. Yuh allows you to trade in foreign currencies. Also, Yuh allows fractional trading. So, Yuh has a slight advantage if you want to trade in fractions. Neither of them offers access to US ETFs.

In terms of fees, Yuh charges a single 0.5% fee for each trade on the stock market, with a minimum of 1 CHF. Neon Invest charges a 0.5% fee for Swiss stocks and ETFs and a 1.0% fee for international stocks. However, a significant difference is that Neon charges a 0% currency conversion fee while Yuh charges a 0.95% fee.

So, both brokers have the same price for Swiss stocks and Swiss ETFs, but Neon is much cheaper for foreign ETFs (0.5% against 1.45%) and foreign stocks (1.0% against 1.45%).

On the other hand, Neon Invest has a 1.50% fee on foreign dividends. In the long term, with a significant portfolio (more than 100’000 CHF), this may start to become significant.

Another significant advantage of Neon that I should mention is that it uses transparent names for the ETFs they offer. On the hand, Yuh uses misleading names for the ETFs. For instance, they use blue chips (implying safety) for several ETFs that are simply large indexes. So, we much appreciate transparency here.

Overall, I much prefer Neon’s pricing over Yuh’s. And I do not think the extra feature of fractional trading is enough to tilt the balance in favor of Yuh. So, Neon Invest is a better product than Yuh.

If you want more detail, I have a full comparison of Yuh vs Neon.

Neon Invest vs Interactive Brokers

The broker you need to buy stocks and ETFs reliably and at extremely affordable prices. Trade U.S. stocks for as little as 0.5 USD!

- Extremely affordable

- Wide range of investing instruments

Neon and Interactive Brokers (IB) are very different services. Nevertheless, I think it is interesting to compare them both to see two extremes. Neon is a Swiss service, while IB is a US service (with a branch in the UK).

In terms of features, IB has all the features you can think of for the stock market. Neon Invest is much more limited but has all the features a beginner needs. An advantage of that is that Neon Invest is easier to start with since you are not confused by the number of features available.

That said, several features of IB would also interest beginners, such as limit orders and submitting orders outside of exchange hours. However, these features should be coming to Neon soon. However, market orders work just fine most of the time.

In terms of fees, IB is almost always significantly cheaper. On medium to large trades, IB has the potential to be several times cheaper.

Finally, IB also has the advantage of offering access to US ETFs, the optimal ETFs for Swiss investors. If you have the goal of building a substantial portfolio, this can make a difference.

Overall, it is difficult to compare these two services since they are very different. Overall, IB is a better broker, and I still think IB is the best fit for people ready to use a foreign broker. But for beginners and people that want a Swiss broker, Neon Invest offers a terrific new alternative.

FAQ

On which stock exchange can you trade with Neon?

You can only trade on the BX Swiss stock exchange. But it contains both domestic and international shares.

Where do you get Neon Invest?

Neon Invest is simply a feature inside the Neon app. So you can access directly from within the app of your Neon account.

Is Neon Invest currency conversion fee really 0%?

Yes! Neon Invest only trades in CHF on BX Swiss. And BX Swiss itselfs converts foreign currencies to CHF without a markup.

Who is Neon Invest good for?

Neon Invest is good if you want to start investing in the stock market with low to medium amounts, with great fees.

Who is Neon Invest not good for?

Neon Invest is not great if you want to invest in US ETFs or if you want to access multiple stock exchanges. I also can start to become expensive for large transactions.

Can you transfer shares from Neon to another broker?

Yes, you can transfer positions (for 100 CHF per position) to another broker.

Can you transfer shares from another broker to Neon?

No. Currently, it is not possible to transfer shares from another broker to Neon.

Summary

The great digital bank Neon, started an investment feature: Neon Invest! Is it any good? We find out in this in-depth analysis.

Product Brand: Neon

4

Neon Invest Pros

Let's summarize the main advantages of Neon Invest:

- No currency exchange fee

- Very fair prices

- Access to many ETFs

- Your assets are safe in the custody bank

- Transparent

- Very easy to use

- Can transfer shares to another broker

Neon Invest Cons

Let's summarize the main disadvantages of Neon Invest:

- No access to US ETFs

- Expensive for large stock market operations

- Only support market orders

- Some issues accessing the app on the 25th of the month

Conclusion

All the services you need to pay, save and invest, in a neat package, with extremely good prices!

Use the poorswiss code to receive 10CHF!

- Pay abroad for free

- Invest with great fees

Neon Invest is a very interesting product. It provides an excellent investment solution for customers who want to easily invest in the stock market.

Neon Invest charges very attractive fees. It has all the essential features one needs to start investing in the stock market, and when added to a great digital bank, this makes Neon even more interesting.

While it is a great product, I should mention that it is not perfect. It can become expensive for large operations, and the lack of US ETFs makes any portfolio sub-optimal. That is why I am still using Interactive Brokers as my main broker. Nevertheless, Neon Invest is much easier to use than Interactive Brokers.

It is also worth mentioning that Neon offers 10 CHF for each new user using my code “poorswiss”.

If you want to learn more about Neon, you can read my review of Neon bank.

What do you think about this new product?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Best Brokers

- More articles about Investing

- Swissquote vs Interactive Brokers 2024

- Charles Schwab International Review 2024 – Pros & Cons

- How to Buy an ETF on Interactive Brokers the Easy Way

Hi Baptiste,

I enjoyed your review. As a Dutch person, moving to Zurich per february I’m familiar with De Giro. How would you compare the two?

BR, Bas

Hi Bas,

It’s very difficult to compare the two because they are two very different products.

Neon will be cheaper for foreign stocks because you buy them in CHF and for small operations. DEGIRO will be better for large operations. DEGIRO also give you access to more stock exchange, more stocks and more ETFs.

Hi Baptiste,

Thanks for your explanation. That is very helpful for me since I’m more into ETFs and passive investments/all weather.

Hi Baptiste,

I really enjoy the content you post.

For someone starting to invest in a global ETF (100.- to 200.- per month) for long term growth would you suggest something like Neon or another broker/bank ?

I found Swissquote too expensive for small investments.

Hi Julia,

Yes, Neon will be great to start investing small sums monthly in ETFs!

Swissquote will be too expensive for large operations. And IB is not ideal either until you reach 500 CHF (rough estimate).

Would SELMA be an valid alternative?

Yes, Selma is fine to invest with small amounts but you need a 2000 CHF minimum.

Thanks for your answer :)

This might be a stupid question, but fact that Neon uses the BX Swiss stock exchange, are there consequences if you buy once a month and hold stock? If you compare it to Yuh where you can trade in multiple currencies/bigger stock exchanges ?

I guess my question is does it matter if you buy and hold stock in a smaller stock exchange for long term growth – taking into account that you are investing in the same ETF?

If you are investing in the long term, it should not matter. There will be small variations compared to using another exchange and another currency, but in the broad picture, it should make no difference in my opinion.

Hi ThePoorSwiss,

Thanks for your reviews. I really appreciate all the posts you make here.

For someone who is still a beginner (but who understands already a little bit about investments), is it more cost efficient to use Neon Invest or a cheap robo-advisor such as Findependend?

Thanks in advance!

Hi Gabriel,

It highly depends on the amounts you are going to invest and on each ETF you are going to use. The main difference will be that Neon Invest will have transaction fees, so the price will be based on your activity while Findependent will have mangement fees will be based on your invested amount.

Hi Baptiste, I had a similar question. Supposing the person can start with the minimum for true wealth of 8500 CHF, and then invest 500-1000 CHF each month would you advise Neon or True Wealth?

(The person in question is new to personal finance, does not want to spend time on it, and already has a Neon bank account)

If Neon Invest, which ETF on Neon Invest is the one you would advice?

It depends. From a purely fee point of view, the fees of True Wealth will quickly outweighs of Neon since they are based on the total. However, you will have to pay at least 0.5% when you sell your portfolio to use the money with Neon while it won’t be the case with True Wealth. So, the exact numbers will depend on how long you keep the money invested.

True Wealth may be simpler since you don’t have to choose the ETFs. It’s up to you to decide whether you want to manage your ETF portfolio yourself or not.

There are now two ETFs where you don’t have to pay investing fees:

https://www.neon-free.ch/de/0-gebuehren-etfs

Sadly it seems to be a limited offer.

Thanks for mentioning it, I have also received the information.

It’s good they do that, but it’s a very limited time offer indeed.

Is this free ETF any good or would you recommend buying Vanguard World ETF?

It’s good. The TER is only 0.15%. It’s sligthly small in my opinion at 16M USD, but also not tiny either. It’s an accumulating ETF but that is fine with Neon since USD dividends are not efficient.

I appreciate this comparison review and to be honest, as a newbie, IB is a bit daunting.

Can you explain the drawdown or return of investment a bit further .

Secondly, do you think Neon will move ahead and offer US ETFs in (near) future?

Lastly,with its current offering, is there any ETFs at Neon Invest we should look at/consider? Not asking for your direct investment recommendation.

Thanks again

Hi Marcus,

I am not sure I get your first question. Given the same ETFs, both Neon Invest and IB will have the same returns on investment. Only the choice of ETFs matters.

No, I don’t think Neon Invest will ever offer US ETFs. They want to keep it simple.

There are plenty of good ETFs with Neon Invest, such Vanguard World UCITS ETFs.

Thank you for the response. Apologies, I meant about the fees /costs to drawdown any earnings . Going by some other commenters – the fees seem high if you wish to take the money .

Any extra info is great

Yes, that’s a good point. You will indeed lose 0.5% of your portfolio when withdrawing. This is definitely not cheap, but on par with similar services like Yuh.

But comparing with IBKR makes any Swiss broker look bad.

Hi ThePoorSwiss

Thanks for your review on neon invest, I really enjoyed reading it!

I know these two services are very different, but can you do a quick comparison between neon invest and TrueWealth – especially in terms of fees. Say I want to invest CHF 10k with either service, where do I pay less in fees? In case of neon invest, I would put my investment mainly in 2 or 3 ETFs.

Hi Louis,

Indeed, these two services are very different.

It mostly depends on whether you are investing 10k once or 10k per year and how many years you invest.

With 10k once, you will pay 0.5% only with Neon. With TW, you will 0.5% per year. So, over 10 years, TW will be much more expensive.

Then, you will pay 0.5% again for withdrawing (selling) with Neon while it should be free with TW.

But generally speaking, a broker is almost always cheaper than a robo-advisor.

That makes sense to me, thanks for sharing your thoughts!

Do you know, if the shares are registered to the name? Companies as Swatch or Calida give out gifts to shareholders when they are correctly registered.

Registering is not yet possible, no. However, they plan to do that, which is one of the reasons they do not support fractional tradding.

Yuh does offer US ETFs.

Like which one?

I have checked their list and it seems like it’s only European ETFs. They have ETF with US shares, but no ETF with US domicile (very different).

This sounds like a terrible choice. Honestly, I really like your blog but this sounds like an advertisement for Neon instead of an impartial review.

How can you come to the conclusion that “Neon Invest managed to make very attractive fees”? They are not attractive at all. Why not show a graph comparing a 1000 / 5,000, 10,000 and 25,000 “trade” with Neon vs IBKR UK ?

Clearly the fees at Neon will be a HUGE drag on the portfolio returns.

I think a beginner would be wasting there time learning how to use Neon invest, IKBR UK is very simple to use especially via the app.

Also not having the ability to use limit orders is VERY risky on illiquid stocks. Another reason it is better to just use a broker that isn’t in “beta” mode that they rushed out.

I have no affiliation with IBKR other than my own personal account. I would even consider using DEGIRO instead of Neon.

Hi,

As I mentioned in the article, Neon fees are great for small operations but bad for large operations. Neon is great if you invest small amounts every month, but terrible if you invest 10K per month.

I agree that most people should use IB directly. But the truth of the matter is that most people are too afraid to use a foreign broker. Neon will never compete with IB, it’s not possible for a Swiss financial service to do so.

But it’s much better to invest with Neon than not to invest and it’s much better to invest with Neon than with several Swiss brokers.

If you have read my article entirely, you have seen that the conclusion still recommends IB.

I am sorry you feel like this is advertisement. I feel there is a place for such services, next to services like IB.

I did read the article fully, and I appreciate that you mentioned you still use IB as your main broker.

And I agree with you there is a place for these services (in limited cases), but I just don’t like the idea of paying a percentage fee (unless it’s to the taxman). And 0.5% to 1% will end up being expensive.

Let’s say you are investing a small amount for a long period of time, and manage to get 100’000 CHF in investments, if you ever need the money in the future to withdraw you get dinged again another 0.5% to 1% to close (sell) the positions. So at minimum you’ve paid 500CHF to 1000CHF to close the positions, even if it’s just 1 ETF ticker!

Anyways I appreciate your blog in general, and in this particular case I think the fees are just too high.

That’s a good point. If you ever have to withdraw everything from these accounts, this will be very expensive. For retirement, for instance, paying 0.5% on your withdrawals will add some significant expenses to your retirement.

Neon plans to support share transfers in the future, but this may take a long time.

It’s definitely an interesting step. While it is limited in choices, it may be useful for those with neon to balance their portfolio with more local type of investments without having to go through the hassle of yet another app, registration and documentation.

That’s a good way to put it :)