Updated Trinity Study for 2024 – More Withdrawal Rates!

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Would you like to know precisely which withdrawal rate is safe and will sustain your lifestyle for a long time?

You will find the answer in this article with updated results from the Trinity Study! This study researched different withdrawal rates for retirement. Although the original research was not about early retirement, it is often referred to in the Financial Independence and Retire Early (FIRE) movement!

However, there are two caveats to the original study. First, they are only covering the period until 1995. And then, they are not covering more than thirty years of retirement. Thirty years is not enough for some people wanting to retire early.

Therefore, I reproduce the original study’s results with recent data all the way to 2023! And I extended the data back to 1871. This makes for much more data than the original study.

I have also considered periods as long as 50 years. It means many more withdrawal simulations than the original study.

In this article, you will find how I did it and all the results I have gathered from this data!

The Trinity Study

I have already talked at great length about the Trinity Study. It is an excellent research paper done by three professors from Trinity University.

Their research paper’s goal was to see which withdrawal rates people should use to sustain a particular lifestyle for up to 30 years. It is important to note that the original research was not about early retirement but official retirement.

It is important to emphasize that we are talking about sustaining a lifestyle (expenses), not capital. So, if you end up with 1 USD at the end of the retirement period, this is a success. If you want to sustain your capital in retirement, it is a different success criterion not treated by the original Trinity study.

They tested the success rates of withdrawal rates from 3% to 12%. Also, they tested portfolios with between 0% and 100% stocks by jumps of 25%.

The authors also took inflation into account in the results. Indeed, it is interesting to compare the results with and without inflation. Finally, they also provided the terminal values of the portfolio.

I wrote a detailed article about the Trinity Study if you want more information.

The 4% Rule (of Thumb)

The Trinity Study is the source of the 4% Rule. This rule states that if you only withdraw 4% of your initial portfolio yearly, you can sustain your lifestyle for a very long period. And your withdrawal is adjusted for inflation every year.

Some people believe that the original study shows that this will sustain forever. But this is not what the original research was about. They only tested simulations for up to 30 years.

It is better to call it The 4% Rule of Thumb. Because if you plan to retire very early, you will probably need a lower withdrawal rate. Moreover, your withdrawal rate will depend on your portfolio and asset allocation to stocks and bonds.

Why did I do it again?

If the study is excellent, why did I want to redo it? I have several reasons for that.

First, I wanted to see how this worked with recent stock market returns. The original study was only covering years up to 1995. I wanted to have more recent data. I wanted to ensure the results were holding with more recent stock market behavior. So this simulation will cover returns until the end of 2023!

Secondly, the original study only covered up to thirty years of retirement. I wanted to ensure that the portfolio could sustain withdrawals for extended periods. For people retiring early, I think that 50 years is not unreasonable.

Finally, I have to admit that I like to write code. So it was cool to write code related to this blog. And being a big geek, now I can run many simulations with the data I want. Overall, it was a lot of fun preparing the data for this article.

Ultimately, I want to extend the Trinity Study to the European markets. It will be challenging to obtain the data. But I will try to find it for as many years as possible.

How I redid the Trinity Study

My simulation uses monthly withdrawals. Most people in retirement will withdraw money monthly. It is also possible to withdraw money at the end of the year instead. But I believe that it is not common.

I have calculated all the returns monthly. Doing that makes the results much more accurate than doing it yearly. And the monthly withdrawal is updated with inflation every month as well. Every possible starting month in the available data is tested.

For this simulation, I have not done any rebalancing. For more information, I have compared different rebalancing methodologies for retirement.

Withdrawals are based on the current allocation. For instance, if your base allocation to stocks is 60%, but your current allocation is 80%, 80% of the withdrawal will be taken from stocks. I may use different withdrawal techniques in the future.

Based on this simulation, I collected the same results as the original study: success rates without inflation, success rates with inflation, and terminal values.

Success Rates of the Trinity Study

I start the simulation with the entire data from 1871 to 2023.

In this simulation, success is when your portfolio does not run out of money before the end of the simulation. For instance, if we simulate for 20 years and end up with one dollar after 20 years, it is a success. This is a failure if the portfolio runs out of money before that (it could be in the first year or the nineteenth year).

So, the success rate is the percentage of the months that end up with success. The higher the success rate, the better the results are.

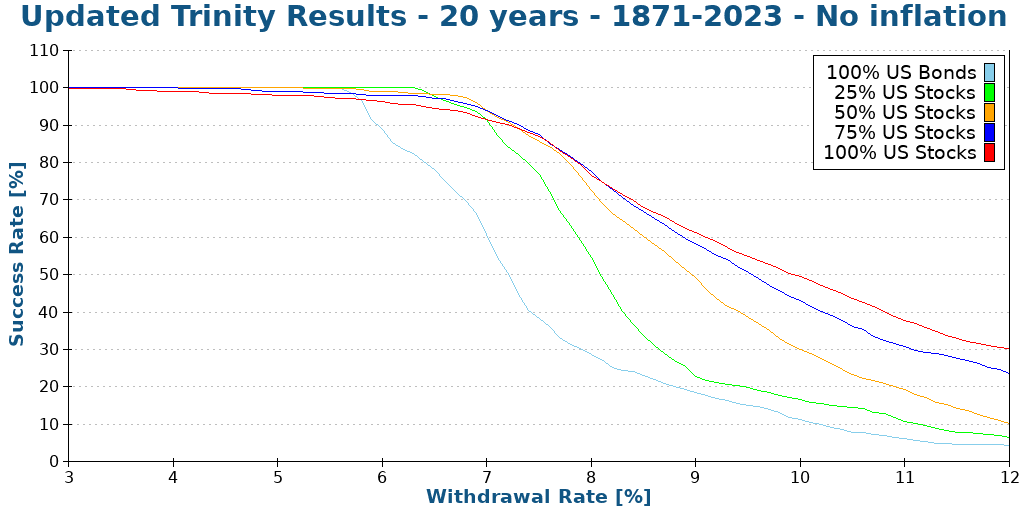

We will see what success rates we have when we ignore inflation. We start with 20 years since I do not think anybody will care about a ten-year-long simulation. I will begin at a 3% withdrawal rate and go up to 12%, increasing by 1% at a time.

We can see what we already expect:

- Increasing the withdrawal rate decreases the chances of success

- Any withdrawal rate higher than 8% does not make sense long-term, even without inflation.

- A small allocation of bonds can help with lower withdrawal rates

- Generally, a 100% stock portfolio will perform better than the other portfolios.

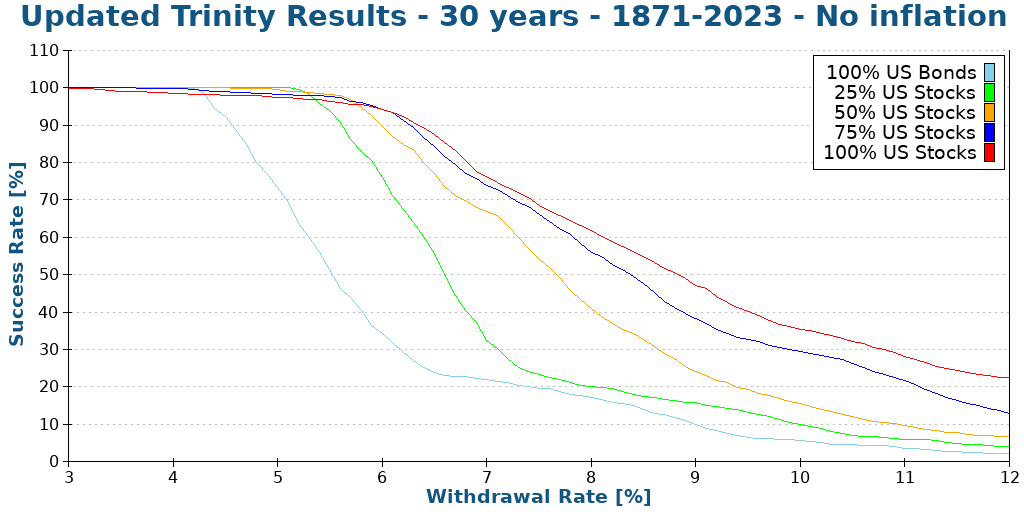

Here is what happens when we push the simulation to 30 years.

We can see that increasing the number of years decreases the likelihood of success. It is logical since you are more likely to run out of money.

With 30 years of retirement without inflation, a 6% withdrawal rate with a significant allocation to stocks still makes a lot of sense!

Taking Inflation into Account for retirement

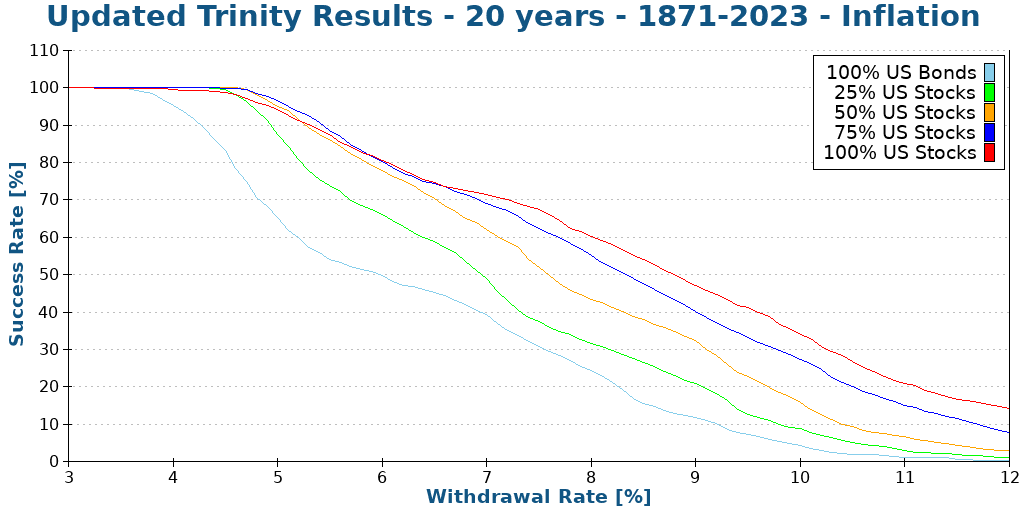

However, it is much better to consider inflation in our simulation! We see again with 20 years to compare the results:

As we can see, inflation causes a significant hit to our chances of success! Before inflation, an 8% withdrawal rate made some sense. Now 6% is the limit. And even 6% has a barely over 75% chance of success!

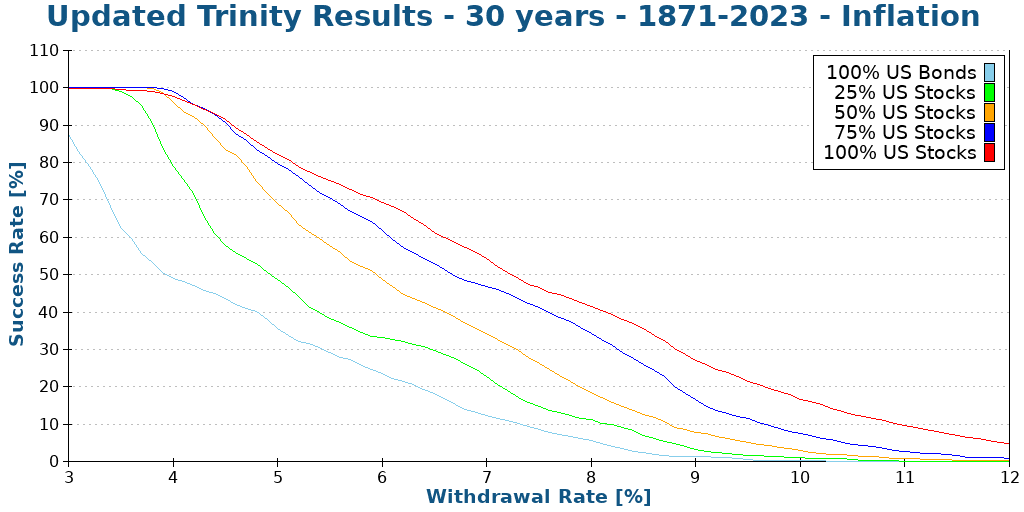

Here is what happens in 30 years.

We can now see that anything higher than a 6% withdrawal rate is hazardous, with a less than 75% chance to succeed even with 100% stocks.

More withdrawal rates

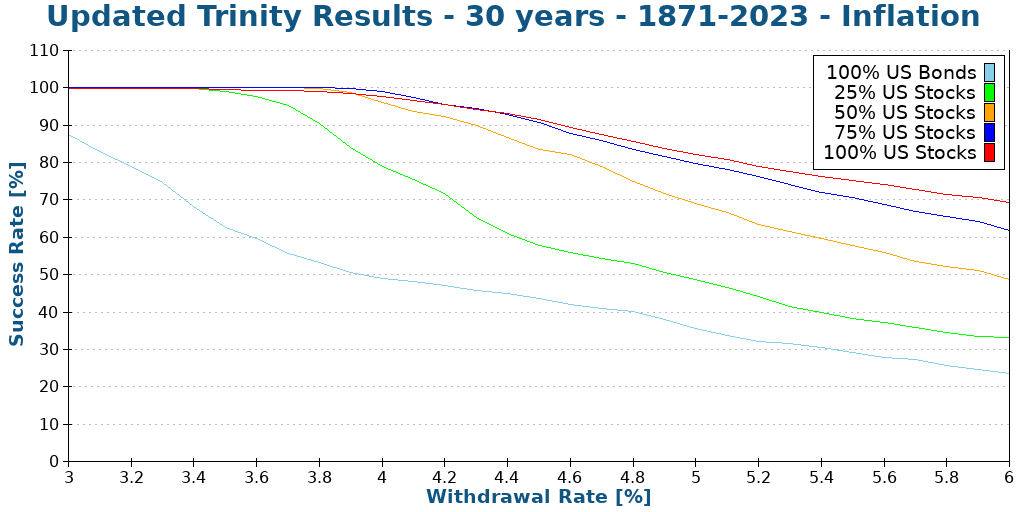

Since we see that reasonable withdrawal rates are in the range of 3% to 6%, we try more withdrawal rates. I have simulated increments of 0.1% of withdrawal rates.

With a large stock allocation, withdrawal rates between 3% and 4% are very safe. Some people would even dare use withdrawal rates of about 4.5%. But even a portfolio with 100% stocks has only an 85% chance of success after 30 years with 4.5%.

Longer retirement time

One of the caveats of the original study is that they stopped at 30 years. We run the same simulation again but with 40 years this time.

After 40 years, we are starting to see lower success rates, even for most people’s 4% withdrawal rate. Unless you have 100% of stocks, your success rate will be less than 90%.

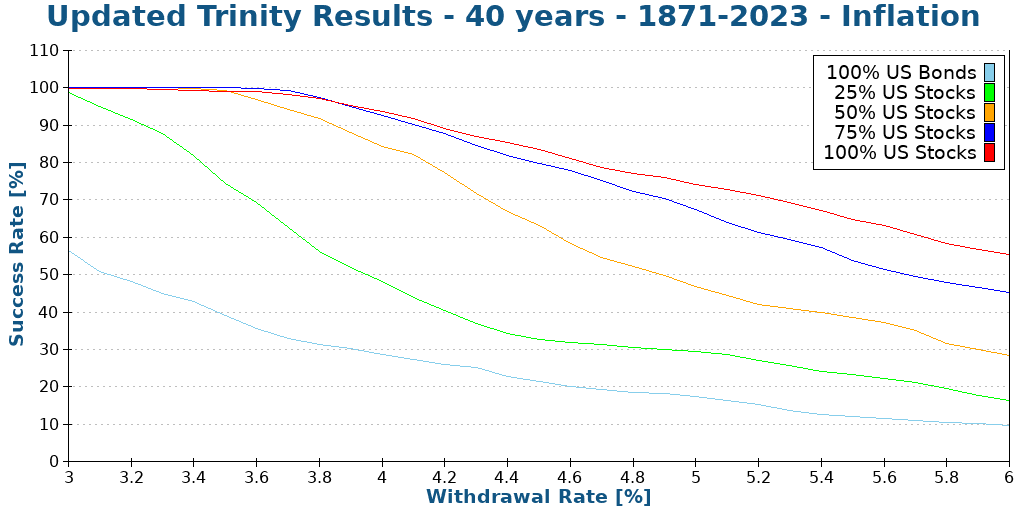

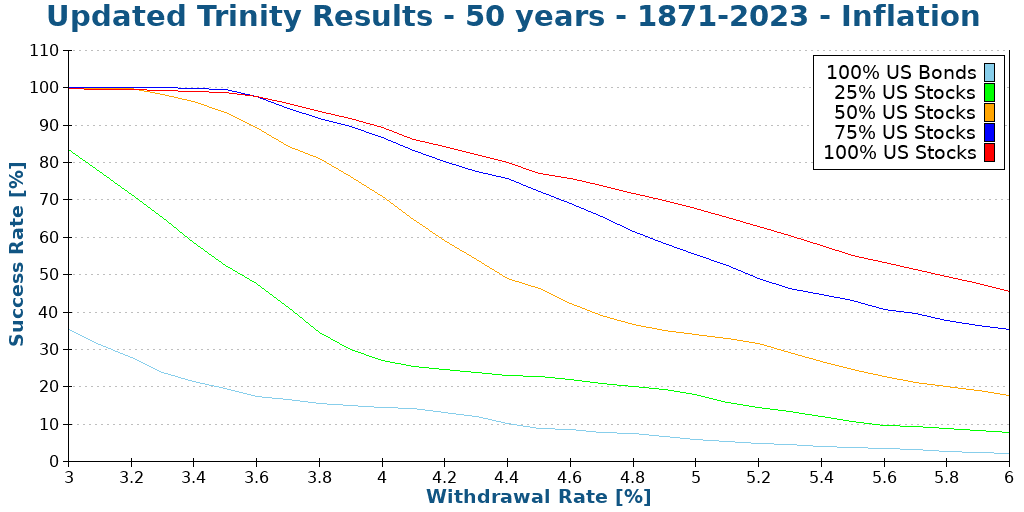

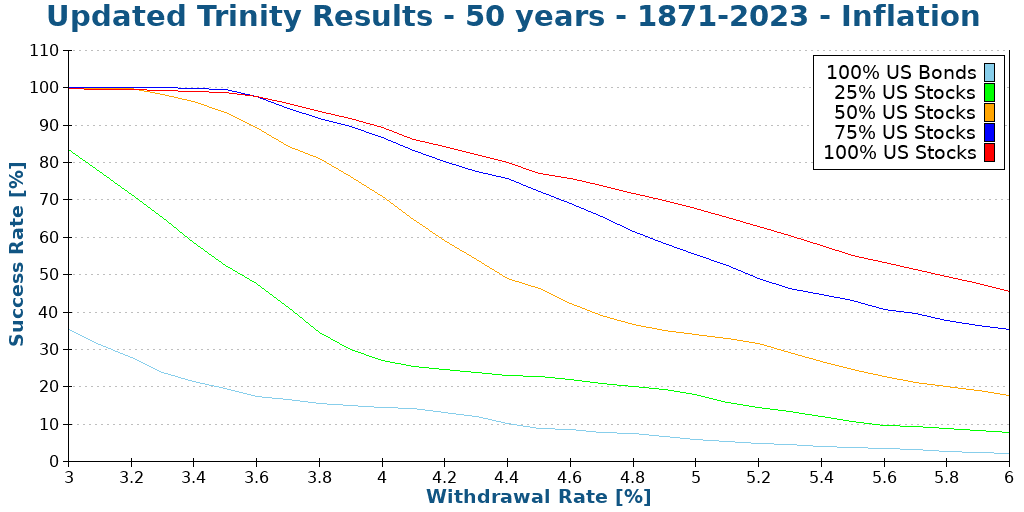

Here is what happens with 50 years.

As expected, we see lower success rates. But it is still not bad at all with reasonable withdrawal rates. A 100% allocation to stocks and a 3.5% withdrawal rate still have more than a 98% success rate. This is significantly more than I expected.

It shows that the study’s original conclusion can still hold for over 30 years. It is excellent news!

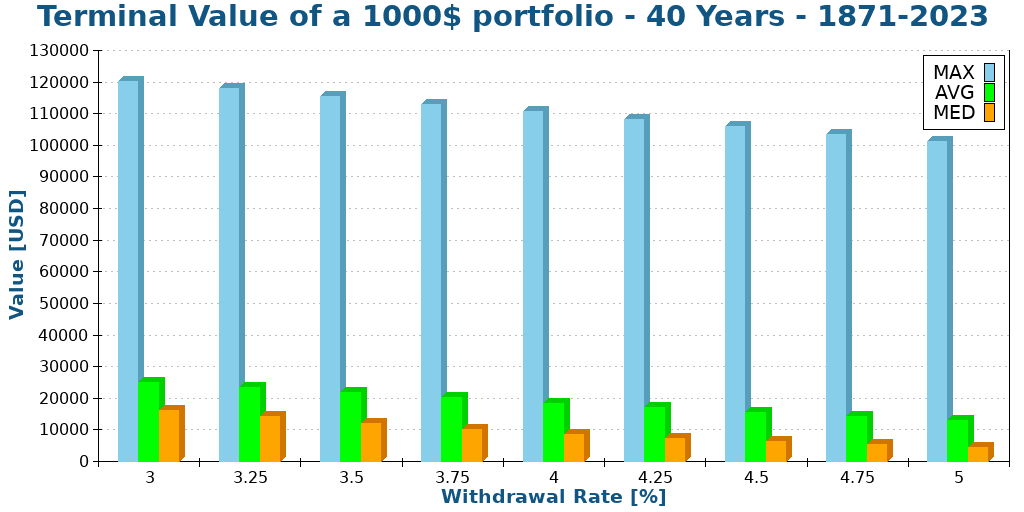

Updated Terminal Values

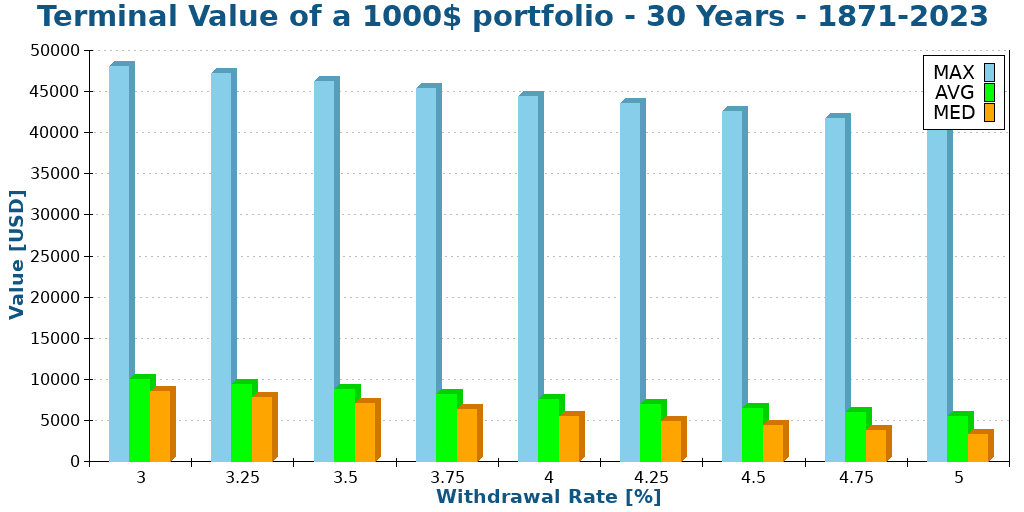

Another interesting thing from the study was that they also compared the terminal values of the different withdrawal rates and portfolios.

So we will see the terminal values of a 1000$ portfolio after 30 years. I did the simulation for a portfolio of 100% Stocks. For the sake of display, I have reduced the number of withdrawal rates.

I did not show the minimum values. Indeed, they are always zero. If the chance of failure exceeds zero, the minimum value will be zero.

However, the average and median values are quite remarkable. We will focus on the median since it is generally more representative than the average.

For a withdrawal rate of 3.5%, my current target, the median terminal value after 30 years, is about 6700 dollars! Not only did your portfolio sustain your lifestyle, but it also increased six-fold! Let me repeat this. After 30 years of doing nothing but withdrawing money, you have six times more money than when you started!

The maximum values do not mean a lot. But it is crazy to see that after 30 years, you could have about 30 times more money than when you started! And this is with a 3.5% withdrawal rate!

Here is what happens when we extend it to 40 years.

We can see that the results are comparable. However, all the values are significantly higher. The numbers are all about twice higher. On average, your retirement money will double during the ten additional years. So, even though you are not contributing more money and living from it, your portfolio will double in 10 years. How cool does that sound?

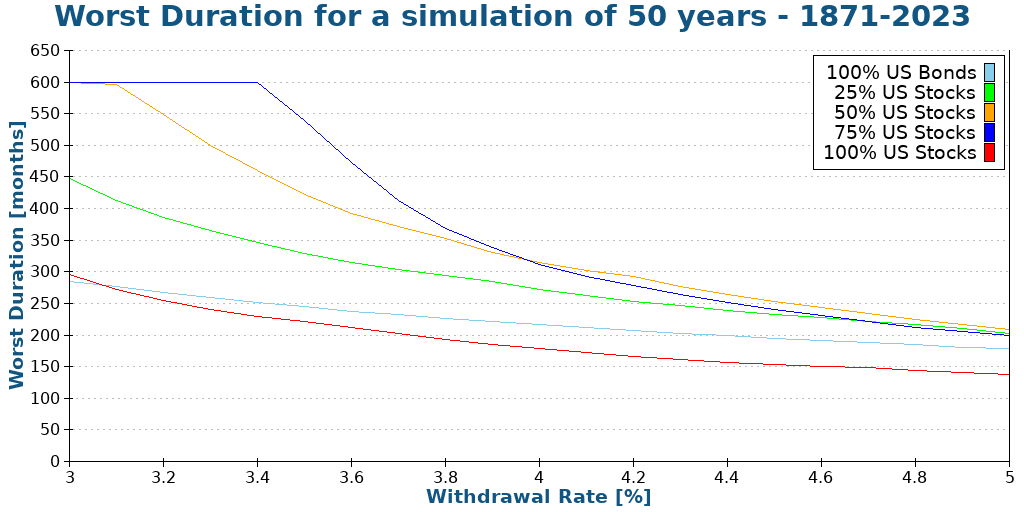

The success rate is not everything

There is something important with these measurements: the success rate does not tell the entire story. For instance, for you, which of these two scenarios is better:

- 98% to last 50 years, but a chance of running out after ten years

- 96% to last 50 years, but a chance of running out after 48 years

For me, the second scenario is better. You do not want to have a chance of failing after only ten years if you are planning for 50 years. But if it fails after 48 years, you have many years to make some adaptations.

So, another quite important metric is the worst duration of a scenario. This means after how many months, the first failure can happen.

For reference, here are the success rates of each portfolio for 50 years and different withdrawal rates:

And now, here are the worst durations for each of these portfolios:

If we only look at the first graph, the conclusion is that higher allocation to stocks is always better. But if we look at the second graph, 100% stocks is the worst one!

So what does this mean: you need a balance in your portfolio. Bonds will significantly reduce the chances of your portfolio failing too early. This does not mean that you should optimize for the highest worst duration either. Because if your highest duration is 40 years, but you have only a 50% chance of reaching 50 years, this is gambling, not planning.

So balance is essential. While stocks will increase your success, stocks are more subject to sequences of return risks.

How to implement the Trinity Study?

Now that we have seen that the results of the Trinity Study are encouraging and would let people retire early, how should we implement it?

Theoretically, the Trinity Study is based on a simple concept: you can retire based on a large principal by withdrawing with a fixed withdrawal rate.

However, in practice, this means you need to accumulate money, more than most people accumulate during their lifetime. And you need to accumulate this earlier than retirement age.

To accumulate this money is not easy, but it is also not complicated. First, you need to save money (as much as possible). For this, you will need to focus on your expenses and earnings.

Then, you will need to invest that money until you can retire. Once you have accumulated the proper amount through capital gains and savings, you will be financially free.

If you are interested, I have many articles on my blog about financial independence.

How did I do it?

You can find my code and my data on Github. Everything is available to share as much as possible!

I wrote the entire program in C++. I used this programming language because it is my favorite! And it is blazing fast! I have not especially optimized my code, and it takes less than a second to generate thousands of simulations.

If you are not a coder, I also have an online FIRE calculator to do most of the calculations presented here.

My U.S. and international data is based on the data made available by Big ERN in its Safe Withdrawal Rate series. It is a good dataset that has been tested several times already. Big ERN made all this available for free. I am very thankful for his work! I have completed its data with the missing years using the same methodology.

If you want to use the graphs in this article, please cite this article as the source of the image!

Future of the series

It was fascinating to reproduce these results. And it was very insightful as well. I have learned many things from the results. It is great to see the confirmation that the original conclusions hold for more than 50 years.

And it also shows that my withdrawal rate (3.5%) is a safe bet. I may switch to 3.75% in the future. I will have to run more simulations. It is important to choose a proper safe withdrawal rate.

Talking of simulations, I have run a few more simulations with the same idea:

- Trinity Study Results with Swiss Stocks

- Withdrawal rates and low-yield bonds

- When should you rebalance your portfolio?

- Does the Trinity Study work in recent years?

- How often should you withdraw money?

Since I plan to make more articles like these with more simulations, I would like to get your point of view on this article! Please let me know what you think in the comments below! What should I improve?

What do you think of these results? Would you like me to run more simulations like this? Do you have ideas on what kind of simulations I should run next?

Conclusions

With all these results, we can have several important conclusions.

First, the paper’s original conclusions still hold even with much more data being considered. And it still stands accurate up to 2024! It is excellent since it shows that the 4% rule of thumb still works!

If you increase the simulation time to more than 30 years, a 4% withdrawal rate is no longer safe. With 50 years of retirement, you have a 90% chance of success with a 4% withdrawal rate at most. A withdrawal rate of around 3.5% would be safer for most people.

If you want real chances of success, you will need more than 50% of your portfolio allocated to stocks. The stocks allow us to fight inflation and cover the withdrawal rate year after year.

If you choose a reasonable withdrawal rate, you will likely have much more money than when you started! For instance, a 3.5% withdrawal rate over 30 years with 100% stocks would leave you about six times more money than when you started!

For information about the original study, read my detailed article about the Trinity Study. If you are extremely conservative, you will also be interested in learning how to choose a failsafe withdrawal rate.

If you want to start investing to become Financially Independent, you will be interested in my guide on how to get started in the stock market.

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-book

Love the article. Speaking from a “always balance your Portfolio” how does guaranteed income products affect (I.e. annuities and life insurance) your studies? With many retiring young the push for guaranteed income products is on the rise and understandably so. However, while income may be protected it seems total net worth suffers if this is your end all. Having that said, with market volatility and mortality rate increasing having a portion in a guaranteed income product seems to be out performing the bond investment theory with the protection of principal? i am leaning more to balancing a portfolio including a portion in products from the life insurance industry as a result.

Also, it would be interesting to see simulations with the impact of taxes as well. I look forward to your thoughts.

Thank you

Carolee Dasher

Hi,

I am not sure that early retirement push the need for guaranteed income. Very early retirees are generally very high on stocks, not on bonds. I think people can retire on 100% stocks if they can handle the volatility.

It’s true that some other sources of guaranteed income could replace the bond part of the portfolio. But I have never run any such simulation.

I have made a simulation with different amount of fees, but taxes are too different from one place to the other do simulation with.

My coding is. Far inferior but I have run “similar” analysis using 20 year DJIA, 20 year VTI and 30 year S&P data analysis calculating every month. 1 observation from the analysis – never retire right before a crash (more practically don’t appreciate up to your # then retire, depreciate down to it so you increase your safety) I’m still working on how to figure out (roughly) how to do this prospectively and the best I’ve done is wait to retire until there have been two monthly 5% drops in a six month period (assuming you still have your number) then retire in the next up month. This isn’t perfect and there are too many 5 year periods when you don’t have this condition, so need a better heuristic. 2. If you drop withdrawal rates to 0 in any month where there has been a 5% or greater drop (don’t sell Low – duh) and even better if you can buy those months (in any amount) it’s a game changer. It averages about once per year over any tine period (10x for 10 years, 15 for 15, etc) and never exceeds 6 months in a11 month period. Keeping this cash on hand before retirement saves you selling in Low months. I’ll have to rerun with the longer/bigger data set you use, but this allows for much higher withdrawal rates for a given time period.

Hi JT,

I am not sure my coding is any superior :P

Thanks for sharing your own results!

1. You are entirely right. Right before a crash is the worst possible time to retire. To avoid this, I would simply bump up my target or reduce my safe withdrawal rate. If you reduce your WR to 3.5%, you can easily avoid several of these bad situations. And if you only retire when you have 120% of your target, you have a large margin of safety.

2. You can definitely use a large cash buffer as long as you only use it on down years. Now, this is a pessimistic view and incurs a large opportunity cost and means it will take you longer to retire. I would prefer a simple approach of a lower withdrawal rate or a higher target number. But indeed, if you have a way to avoid your effective withdrawal rate being higher than your target withdrawal rate, you can greatly reduce your chance of failing!

Thanks for stopping by!

Great post, as always, TPS!

Something I have often wondered about is how the timing of *when* you retire influences the results.

By simply counting the number of months in history in which you could have successfully retired with a particular withdrawal rate, the Trinity study implicitly assumes that people are equally likely to start retirement in any of those months.

However, given that most FIREes intend to retire as soon as they reach a certain net worth, they’re much more likely to retire during a stock market hype than during a crash. And as we all know, after a hype comes a crash. Could that mean that actually a much higher percentage of FIREes fail than the success rate would let them believe?

Without wanting to give you more work ;-) but it should actually be possible to measure this effect by including including the wealth accumulation phase in the simulation. Namely, for a given savings rate S, withdrawal rate W, and target retirement duration D, first compute by when you would have accumulated your target net worth of 1/w, and then compute whether you would have survived D years from that point while withdrawing w per year.

I’m slightly simplifying here, implicitly assuming that you’re planning to spend the same amount in retirement as before; you could adjust for different amounts too, of course.

But the point is that, by counting the number of historically successful starting months in this way, you’re assuming that people *start saving* in a random month, rather than assuming that they *start retirement* in a random month. I think the former is a much more reasonable assumption than the latter.

Hi George,

That’s a very good point!

Indeed, you have a much better change of success if you retire during a crash than at the top of a bull market.

You are right, people starting saving at a random point but they do not retire at a random point. Few people retire during a bear market (even though the chances of success would be better, had they had the money).

I will try to run some simulations on the different chances of success based on when you start retiring. I will probably do a simpler simulation by testing retirement during down years and up years. That could be an interesting test!

Thanks for the suggestion!

Great post TPS, one of the best Ive seen actually.

Talking about calculators, I think this is too utopic and does not factor in things that are very likely to happen in everyone’s life. Personally, I miss two important things: 1) what about moves to other countries? I may want to stay in Switzerland, which is probably going to mitigate a huge source in inflation, but I may decide Im too bored and I decide to move somewhere where the inflation is higher, or the currencies I will be living on are appreciating from the ones Im invested in, or both. 2) what about durable family changes/challenges? For example, if in the next 10 years I estimate I will have additional expenses due to a need to support my parents, or children, and afterwards there will be a return to a lower need of income, how can this be captured?

Hi Luis,

Thanks :)

That’s a good point about calculators. They are a good tool, but they are only a rough estimate. There is no way to make a calculator that could take into account all the possible changes of all the possible people. Everybody is different, so a calculator won’t be able to work for most of them. But should work for the average case and then people need to take care of their differences.

1) A move to another country would warrant an entirely new simulation I think.

2) Additional expenses in the future could be estimated into a simulation, but estimation are mostly inaccurate when they are much in advance.

I think for the case of 2), the best course of action is to get a higher target or a lower withdrawal rate to be safer.

Thanks for stopping by!

10 year data would be interesting and helpful to adjust throughout retirement. I have 90 year old grandparents. Would be interesting to know with the money they have left now what safe withdrawal rates would be over 10 years and different allocations.

Hi Jamie,

That’s a good point, I did not think of that.

I have a calculator that may help you though. You can run 10 years simulation with that calculator :)

Thanks for stopping by!

Hi

How did you stock allocation look like? US and Europe?

Thx

Hi Andi,

Do you mean my stock allocation for this simulation? Then, it’s fully U.S., as the original Trinity Study.

If you mean my own stock allocation, it’s diversified with the VT World ETF and some Swiss Shares.

Thanks for stopping by!

Hey.

Great post.

And what will be the results if you use not the SP500, but the global indices of stocks and bonds?

Hi Mikhail,

That’s a good question.

I did a Trinity Simulation with Swiss stocks.

The problem is getting all the data.

If I can get my hands on the data for the global stock market, I would love to do the simulation. I would also like to do on European indices.

I need to spend more time looking for data.

Thanks for stopping by!

I readed, that you have 80% vanguard world. What% withdrawal are you planning for this portfolio?

Hi Mikhail,

I am currently working with a 3.5% withdrawal rate. I am still considering whether I will go a little higher for computing my FI Number.

Thanks for stopping by!

Interestingly enough Ben Felix from PWL Capital just published a video (https://youtu.be/3BScK-QyWIo) mentioning that a 4% rule might be overrated. He’s suggesting more around a 2.5% for a 60yrs horizon.

Any thoughts?

Hi Alex,

I will try to take a look at this video entirely later.

I agree that 4% is overrated. But I would think that 2.5% is over-conservative. I did not put results for 60 years in this article, but they are not that different from 50 years. I will include up to 60 years on my next update.

If you want a 100% historical success rate, 2.5% will be good. But you do not need that. And even a 100% historical success will not protect you from failing if the future is too different.

The only reason to go so low would be if you go 100% bonds, but why would you do that?

Thanks for stopping by!

Hi,

really interesting calculations. It’s really nice to see some more up to date numbers on this topic.

I would have two questions/suggestions:

– my general understanding why more stocks oriented strategies work better is because you have a higher return on average but a somewhat larger risk due to higher volatility.

-> Is there any case where a portfolio including bonds does actually perform better? e.g. very short time scales?

-> Could it therefore make sense to gradually shift your portfolio from purely stocks to a mix? e.g. you start 100% stocks and at the end of 50 years you are at 50-50 by shifting 10% / year?

– please correct me if I am wrong, a case of failure means one runs out of money before the end of the time period is reached, even if you’d only fall 1 year short

-> Wouldn’t it make sense to also include how ‘hard’ one fails? i.e. how many years do I run out before my goal? If you aim for 50y but you do make it till 49y, it’s not that bad…

=> one could for example do a histogram for each strategy and withdrawal rates showing how likely it is to reach how many years. If this is somewhat close to a normal distribution a simple summary as an errorbar plot showing different strategies with withdrawal rates on the x-axis and ‘years till dry’ on the y-axis, with the errorbars showing the standard deviation. In that way maybe different options are more viable. E.g. what if you have a 97% success rate, but the 3% imply a miserable failure as e.g. only reaching 25 instead of your goal of 50 years because you have to withdraw during a big crisis. On the other hand a strategy with a 80% success rate for reaching 50 years and maybe 100% for reaching 40 years because of a less volatile investment becomes more viable.

I think it is utterly important to include the impact of these ‘unlikely’ events for such a ‘risk-analysis’.

There is a very pragmatic but convincing example for this – Letting your child play on a somewhat busy street . The chances of it being involved in a car accident could be rather low, lets say 1%. But the results could be absolutely fatal – death. Would anyone take such risks under these circumstances? Probably not! So I think putting a weight to ‘events’ is an absolute necessity.

What do you think? If you’d need a hand for looking at the numbers feel free to contact me.

Bests

Hi,

Your understanding is correct, the stocks help because on average they have more than enough returns so that we cannot run out of money. But they are much more prone to sequence of returns risk since they will also fall sharply. They can be dangerous if you retire at the wrong time.

This is where bonds will perform better. If you have a portfolio of 100% Stocks that falls 50% the first year you retire, you could have a better chance if you had some bonds.

This strategy could make sense indeed. I have not simulated anything like that but I can see it working for very long retirements. On the other hand, with stocks, you could end up with twice more money than when you start even when withdrawing. So this means you can easily weather a 50% drop long in your retirement. The problem is more at the beginning.

You are entirely right about my failure rate. If you end up with 1 dollar after N years, this is a success. This is something not a lot of people realize and I should emphasize more on that. This is somehow visible on the final values of the simulation. But I could indeed show when is the earliest fail of each scenario. As you said, failing after 49 years is much better than after 9years.

That’s a good idea. I could definitely show the success rate of each scenario (portfolio and rate) for different periods. This would be an interesting statistics. I will try to add this on my next update.

Thanks for your great suggestions :)

Hi,

Super useful article, thanks!

I too have dedicated quite a bit of time to reading the research (no coding for me though! :) and I have to say I was sold on the method and results: 4% felt safe.

…Then I retired 😅

And I realised that using a ‘safe’ withdrawal rate doesn’t mean it will *feel* safe!

But your research is another proof that the maths is likely to be right in the long term, and that give me some additional confidence, so thanks for that!

Hi ,

Thanks for sharing!

Congratulations on your retirement!

Yes, I can imagine that the feeling of withdrawing that money for real is different than on paper with a calculator!

Many people do not feel safe with 4%. If they can afford to wait until they can retire with 3%, it’s fine as well.

Good luck for your retirement!