Interactive Brokers Review 2024: Pros & Cons

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Are you looking for a great broker? Look no further!

Interactive Brokers (IB) has all the features you need as a passive investor. Plus, their fees are almost unbeatable in the industry.

I have been using IB for several years and could not be more satisfied. They offer a wide range of products at excellent prices.

In this review, you will find all you need to know about Interactive Brokers, what you can do with IB, how much IB will cost you, and much more!

By the end of this review, you will know whether IB is a good broker for you!

| Custody Fees | 0% per year |

|---|---|

| Inactivity Fees | 0 CHF |

| Buy Swiss ETF | 5-15 CHF |

| Buy American Stock | 0.50 – 1 USD |

| Currency Exchange Fee | 2 USD |

| Languages | English, French, German, and Italian |

| Mobile Application | Yes |

| Web Application | Yes |

| Custodian Bank | 8 different US banks |

| Established | 1978 |

| Headquarters | United States |

What is Interactive Brokers?

The broker you need to buy stocks and ETFs reliably and at extremely affordable prices. Trade U.S. stocks for as little as 0.5 USD!

- Extremely affordable

- Wide range of investing instruments

Interactive Brokers (IB) is a well-established brokerage firm (a broker) from the United States. IB was founded in 1978 already.

Today, Interactive Brokers is a huge brokerage company. They are the largest electronic brokerage firm in the United States. They are also leading the forex broker market. IB is also profitable, with over one billion US dollars in yearly revenue. IB employs more than 1500 employees worldwide.

IB offers access to stocks, bonds, options, futures, and other financial instruments on the leading stock exchange in the world. You will have access to all the investing instruments you will ever need.

If you are going to trade US bonds, it is worth mentioning that IB offers access to the US bond market 22 hours a day, 5 days a week. This makes it very available to buy US bonds during European hours.

So, here is precisely what IB offers as a broker.

Interactive Brokers Account Types

Interactive Brokers offers two types of accounts.

The default account type is the Cash account. With this account, you can only trade with the money you have in it. I am using this account type, which is good for most people.

The other account type is the Margin account. With this account, you can trade on margin, which means that you can buy stocks with money you do not have. So, IB will lend you money to trade on the stock market, and you will pay interest on the money loaned to you.

Generally, with margin, you have a certain level of margin. For instance, if you have 10K cash and a 4:1 margin, you will have 40K available.

If you are interested in margin accounts, you should first read IB’s page on Margin accounts. You should also be careful about the risks of trading on margin.

For most people, a Cash account will be the best choice. If you do not know about margin accounts, do not consider getting a Margin account. You could lose a lot of money if you do not know what you are doing. On the other hand, if you know what you are doing and want to use leverage, you can choose a Margin account.

Interactive Brokers Fees

In the long term, you need to reduce your fees. Investing fees are extremely important.

Interactive Brokers has two fee systems:

- Fixed Fee System

- Tiered Fee System

The fixed fee system is straightforward. You will pay a fixed fee for each exchange. For instance, you will pay 0.10% on transactions on the Swiss Stock Exchange (with a minimum of 10 CHF).

The tiered fee system is much more complicated. You pay individual fees, such as clearing fees, trade reporting fees, and transaction fees. The rules are different for each stock exchange.

The complexity of the tiered fee system turns many people away. However, for simple investors, the tiered system is often significantly cheaper. In most of my calculations, the tiered fee system was less expensive than the fixed system. So, if you want the lowest fees possible, you should generally opt for the tiered system.

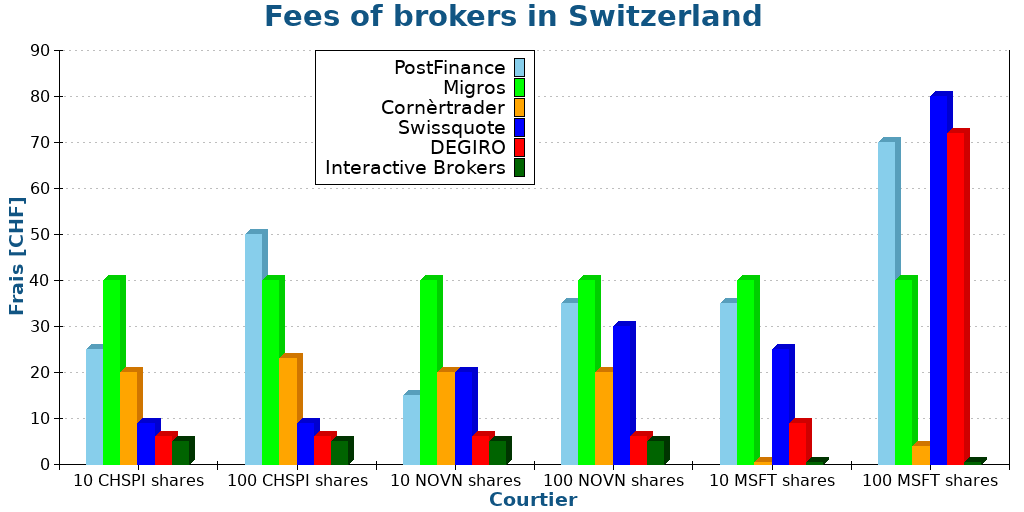

I will not go into details about all the fees of Interactive Brokers because they are complex. But overall, the fees of IB are really low. For instance, here is a comparison I did for the best brokers in Switzerland:

When you compare IB with other brokers available in Switzerland, we can see that the fees of Interactive Brokers are excellent. If you trade a few times per month, your costs will be really low!

If you want to register your Swiss shares in the share register, you will have to pay 150 CHF. This is relatively expensive, even compared to Swiss brokers. However, this is something not everybody needs and is not necessary for each position. But if you are planning to register your shares, it is important to know this fee.

Currency Conversion Fee

IB is doing currency conversion at the best rate available. However, conversions are not free.

If you are doing a manual conversion, you will pay 0.002% of the conversion, with a minimum of 2 USD. Unless you are doing huge conversions, you can assume you will pay 2 USD.

If you are letting IB do automated conversions (with a cash account only), you will pay 0.03% of the conversion size, without minimum.

The automated system is cheaper for conversions below 6500 CHF and manual conversions are cheaper after that.

Overall, these fees are incredibly cheap! This is among the best available fees for currency conversions. And this is orders of magnitude better than a Swiss broker.

Custody / Inactivity Fee

Fortunately, there are no custody fees or inactivity fees at IB!

IB’s no custody fee advantage over most other brokers is fantastic! Not only do they have outstanding transaction fees, but having no custody fees is fantastic!

Cash Interest Rates

The interest rate on CHF cash was negative in the past. However, it has been growing steadily since 2023.

In August 2023, the interest is now 0% up to 10’000 CHF and 0.726% on cash more than 10’000 CHF. This is a good interest rate. And the interest rate in USD is now 4.830% simultaneously. This is very high interest.

You can get the current interest rate on this page.

Opening an account with Interactive Brokers

Opening an account with Interactive Brokers is not complicated, but it will take some time. The procedure asks many questions and has many steps.

First, they will ask for general information about you (name, address, and such). You will also need to select the type of account you want. This choice is essential. This step is also where you will choose the base currency of your account.

The second step of the procedure is to provide financial information. IB will ask you how much money you have and how much experience you have with stocks. And you will have to choose which instruments you want to invest in. Do not worry too much since you can register for new investing instruments later.

The next step is about accepting the terms and conditions of Interactive Brokers. I would recommend at least skimming through them. After this, they will ask for proof of your identity and extra tax-related information.

Finally, you only need to fund your account for it to be complete. While this is not the most straightforward procedure, it is not too complicated.

If you want more information on the process, I have a guide on creating an Interactive Brokers account.

Subaccounts

It is worth mentioning that you can have subaccounts in your Interactive Brokers account. It means that you can manage several accounts in the same primary account.

The best usage of subaccounts is if you want to invest for your children and easily separate your stocks from theirs. Legally, the stocks are still yours since you cannot create accounts for minors. Nevertheless, it is good to see them separate. I have bought a share of VT every month for my son.

If you want further information, I have an article about investing in stocks for your children.

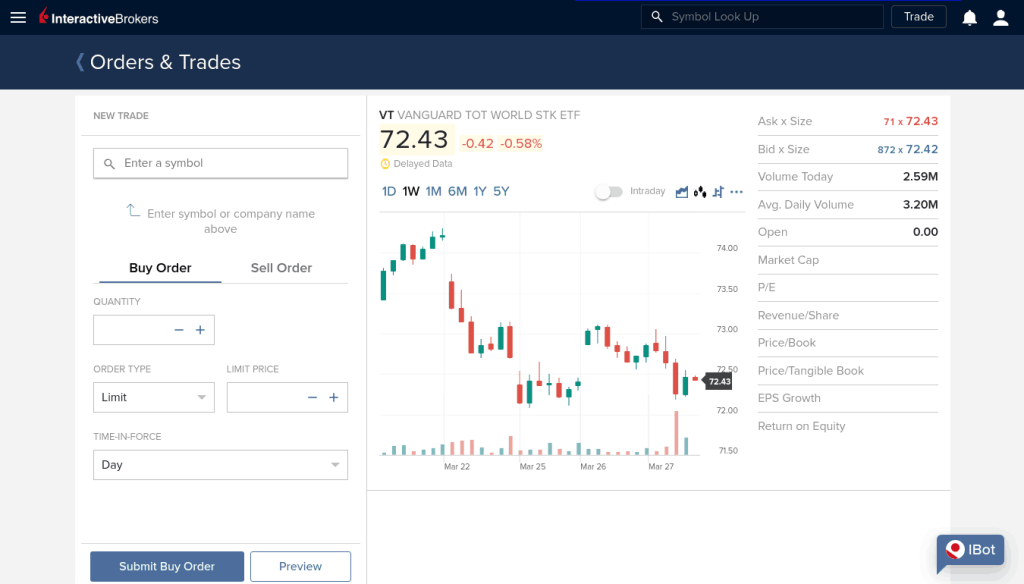

Using IB to trade

Interestingly, IB has many user interfaces:

- The standard web application

- The mobile application (IBKR Mobile)

- The WebTrader web interface

- The IBKR Desktop application, for Windows and Mac

- The Trading Workstation (TWS) desktop application

So, there should be an interface for everybody!

You can do most things from all interfaces. For instance, you can trade stocks from each of these interfaces. The problem with IB is that many people have been discussing the TWS interface. So, many beginners believe they should use it. However, the TWS interface is the most complicated of these interfaces by far.

I have never used the TWS application for trading. It is just too complicated for most investors. You only need the Account Management interface if you are a simple investor and invest in ETFs. If you prefer phones, you can also use the IBKR Mobile application to trade.

From account management, you can trade everything you want. And you can also transfer money to and from your account. All these operations are relatively simple.

You can fund your account for free with a bank transfer. First, you must declare your bank account in IB, and then you can make a deposit. Withdrawals work the same way. You can only send money to accounts in your name. I never had any issues with either deposits or withdrawals.

For currencies, you have multiple choices:

- You can do a forex trade directly. For instance, you could buy USD.CHF, which is buying USD with CHF.

- You can use the currency converter and let IB do the operation for you.

- Since April 2024, You can let IB do the currency conversion for you by buying shares in a currency you do not have. For instance, if you buy VT in USD and only have CHF, IB will do the conversion for you. This will only work on a cash account, since a margin account would go negative on the currency you do not have.

In any case, IB is outstanding at converting currencies. They use an excellent rate and have very low fees.

It is also worth noting that you can automate your investments with IB. You can set up standing orders starting weekly or monthly. If you use a recurring order for the transfer, you can entirely automate your investments. This feature is something some people are looking for.

If you want further instructions, I have a guide on how to fund your IB account and trade an ETF.

Other features

IBKR has some other interesting features.

I would especially like to mention the Stock Yield Enhancement Program. If you enable this option in the settings, IB can lend your shares to other investors.

I like that IB shares 50% of the profit with you if you use that option. This sharing starkly contrasts with other brokers that would lend your shares by default without giving you any profits.

I am not saying everybody should enable this option, but for me, this shows that IB is a great broker.

Another interesting feature is that you can trade fractional shares. This feature allows you to buy fractions of shares. This feature is helpful if you want to buy some expensive shares or if you want to purchase many different companies without having a large portfolio. You can read more about fractional trading at IB.

Is IB safe?

If you invest significant money, you want your broker to be safe. So, we must look at the safety and security of IB.

Regulations

First, we can take a look at regulations.

Interactive Brokers has seven legal entities depending on the customers’ country. For instance, Interactive Brokers LLC works in the US, while Interactive Brokers (UK) Limited works for European clients.

Each of these entities is regulated. For instance, the US Entity is regulated by the Security Exchange Commission (SEC), and the UK entity is regulated by the Financial Conduct Authority (FCA). So, overall, IB is extremely well-regulated.

Financial Strength

Currently, Interactive Brokers is considered very strong financially. They have a strong capital position and advanced risk controls.

The company manages over two million accounts and executes almost two million daily trades. These are substantial numbers showing that IB has many active users.

In April 2023, IB had over 7 billion USD above the regulatory capital they needed. The company invests mostly in the short term to ensure it has enough money to cover issues in the short term. So, IB’s money is not locked when it needs to be available.

Overall, Interactive Brokers’ financials are good. The company has not shown any signs of financial trouble.

Protections

On top of that, protection in case of bankruptcy is also critical. Even though IB is financially strong, we still want to know what would happen should it go bankrupt.

It is important to know that IB does not segregate each country. This means a Swiss investor using IB UK will use the same trading system as a US investor. This is great news for protection!

The SIPC will protect US Investors. It protects your assets up to 500K USD, but it will only protect your cash up to 250K USD. And since Swiss investors are protected like US customers, we also get SIPC protection!

Now, there is an exception for some instruments. For instance, Contracts for Difference (CFDs) are prohibited in the United States. But they are offered to other investors. If you use them, the protection for your CFDs will fall to the FCA protection, up to 85K GBP.

Again, you have excellent protection against bankruptcy with Interactive Brokers. We have higher protection with IB than with a Swiss broker.

It is important to note that since Brexit, European investors have been using other entities of IB. In that case, the protection is worse since you will not get SIPC protection on stocks, only FCA. But Swiss investors still have SIPC protection.

If you want to learn more, I have an entire article about broker bankruptcy.

Technical security

Finally, technical security is also essential.

With Interactive Brokers, you will have strong technical security. All communications with the server are encrypted, but all honest brokers use encrypted traffic.

Most importantly, you can use Two-Factor Authentication for your account. You will be able to use the IBKR Mobile Application for that. Every time you log in from the web interface, you must confirm the login and enter one more code on your phone. This second factor adds a great layer of security to your account.

So, Interactive Brokers has excellent security!

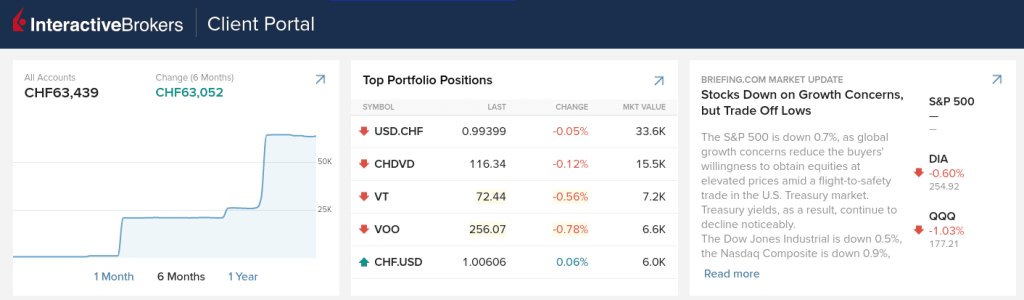

My Experience with IB

I started investing with Interactive Brokers when DEGIRO suddenly blocked access to US ETFs to Swiss Investors. Since then, I have been delighted with Interactive Brokers. I have been investing with IB for more than three years.

My entire stock portfolio is in my IB account. I buy new ETF shares every month from the default web interface, but I have also tried other interfaces. The IBKR Mobile application is very well done, but I generally prefer using my desktop computer rather than my phone.

I do everything from the Account Management interface, which suits all my needs. IB also fits my needs perfectly well. With time, I have learned to ignore most of the tool’s features. I only need a few features for my trading.

Since I sometimes get paid in USD, I can wire the money directly to my Interactive Brokers account. That way, I would not have to pay any currency exchange fees and could invest the money directly.

Overall, I am happy with my experience with IB. I never had an issue with the broker, and all my transfers reached IB very quickly. When I needed to withdraw money for the downpayment on our house, I had no problems. All my trades have been flawlessly executed. The reporting on the web interface is also precisely what I need. I can only recommend IB!

IB Reputation

It is essential to look at a broker’s reputation before using it to invest in the stock market.

As a source of review, I always use TrustPilot. So, we look at the reviews of IB on TrustPilot. On average, users rate IB at 3.3 stars. Before looking at this, I was expecting a higher score.

First, we look at what people do not like about IB. We can categorize most of the negative reviews into two categories:

- Poor user interfaces. It takes a while to get used to the IB user interface. But after some time, it is straightforward to use.

- Poor customer service. It seems that many people have issues getting help from customer service. I cannot comment on that since I have never used their customer service. But I know people in Switzerland who did and have never had issues with them.

Overall, I am not too worried about these negative comments. A lot of them do not seem serious. And many commenters seem pissed off at making mistakes with the platform. But of course, it would be better if they are fewer negative reviews.

One good thing is that most reviews (39%) rate IB at five stars. So, we should also look at what positive reviews are saying:

- Excellent customer service. It is interesting to note that there are both negative and positive reviews of IB’s customer service.

- Excellent fee system

- Excellent order execution

- Good platforms

So, we can see that overall the reviews are mixed for IB. I think it comes from the fact that it takes a while to get used to it. Once you get used to it and focus only on the things you need, IB is quite simple to use.

Interactive Brokers Awards

One way to see how a broker is doing is to check out the awards they got from external sources. Over the years, Interactive Brokers has received many awards.

They received seven awards only in the year 2022:

- Best Online Brokers of 2022, by Barron’s

- Three awards from Investopedia, including best broker for international investing

- Several award titles from stockbrokers.com

- Several award titles from forexbrokers.com

- Several award titles from brokerchooser

While this is not the only thing that matters, awards are a good sign for Interactive Brokers.

Alternatives to Interactive Brokers

There are many alternatives out there.

The one that is the most interesting for a Swiss investor is DEGIRO. However, we should also compare IB with Swiss brokers.

Interactive Brokers vs DEGIRO

|

5.0

|

4.0

|

|

No custody fees

|

Very affordable

|

|

|

|

|

- Great prices

- Many investing instruments

- Excellent execution

- Access to US ETFs

- A little intimidating at first

- Affordable

- Wide range of investing instruments

- Expensive currency conversions

- No access to US ETFs

- Lend your shares by default

For European investors, DEGIRO is another interesting alternative. So, it is interesting to compare these two brokers.

The first main difference between the two brokers is that only Interactive Brokers offers access to US ETFs to Swiss investors. This difference makes IB a much better choice than DEGIRO for Swiss investors. It will make a significant difference in the performance of your portfolio. If you invest with DEGIRO, you must invest in inferior European funds.

But we can also look at the fees of both brokers. There are a few differences between DEGIRO and IB:

- IB is much cheaper for the American Stock Market

- DEGIRO is very slightly cheaper for the European Stock Market

- IB is much cheaper for Foreign Exchange (FOREX)

There are a few differences in the features part as well. IB is also a FOREX broker, so you can hold many currencies in your account. And foreign currency exchanges are cheap. On the other hand, DEGIRO offers automatic currency exchanges when you buy and sell, but it is much more expensive than IB (unless you do small conversions).

You can also opt for manual currency conversions on DEGIRO, making currency conversions even more expensive. Overall, DEGIRO is not a great choice for trading currencies.

For the user interface, DEGIRO is slightly easier to use than IB. On the other hand, IB has many more features, but simple investors will likely not need many of these features.

Also, there is another difference in share lending. By default, DEGIRO will lend your shares to other investors. You, unfortunately, have no choice about that.

On the other hand, IB will not lend your shares by default. But with IB, you can choose to do that (it is called Stock Yield Enhancement Program), and then IB will give you some percentage of the profits. IB’s approach is much superior in that it does not lend your shares by default.

Finally, IB was established in 1978, while DEGIRO only started offering brokerage accounts to retail investors in 2013. So, IB has more extensive experience.

So, overall, Interactive Brokers is a much better broker than DEGIRO. You will be able to access US ETF if you are Swiss. And you will be able to get excellent service at very low prices.

If you want more details, you can read my DEGIRO Review.

Interactive Brokers vs Swissquote

|

5.0

|

4.5

|

|

Extremely cheap

|

Very affordable

|

|

|

|

|

- Outstanding prices

- Many investing instruments

- Excellent execution

- Access to US ETFs

- Good reputation

- A little intimidating at first

- Swiss broker

- Easy to use

- Many investing instruments

- Access to US ETFs

- Good reputation

- Expensive to trade US shares

- Expensive currency conversion

Many Swiss investors prefer to use a Swiss broker. So, we should compare Interactive Brokers vs Swissquote, a great Swiss broker.

Both brokers offer access to US ETFs and have roughly the same features. If you are a simple passive investor like me, both brokers will have more than enough features for you.

You can trade with both brokers from your computer and your mobile phone or tablet. Swissquote is slightly easier to use than Interactive Brokers, but not by a long shot.

The main difference between these two brokers is price. If you use a stock exchange other than the Swiss Stock Exchange, IB is much cheaper than Swissquote. In some cases, IB can be 100 times cheaper than SQ. This difference can be very significant.

In addition, SQ has some custody fees, while IB has zero account management fees. So, if you are looking to optimize the price, IB is the clear winner.

For many investors, Swissquote will have the advantage of being in Switzerland. It may make it easier to deal with them if you have issues, while it could be complicated with IB. So, if you are looking for an affordable (not cheap) Swiss broker, Swissquote is an interesting alternative.

For more information, read my review of Swissquote or my comparison of Swissquote vs Interactive Brokers.

Frequently Asked Questions

What is the minimum deposit for Interactive Brokers?

There is no minimum deposit at Interactive Brokers. You can open an account without any money inside. Since there are no inactivity fees, this is perfectly fine for a small amount.

Is Interactive Brokers safe?

Yes. Interactive Brokers has been around for more than 40 years and has a great reputation. On top of that, it is well regulated in several different countries. Finally, your money is insured at Interactive Brokers for up to 500’000 USD, thanks to SIPC.

Is Interactive Brokers good for beginners?

Yes. While it is not the simplest broker out there, IB allows you to get started with little money and very low fees. The basic interface is simple enough to use and will allow you to do everything you need to start investing in the stock market.

What Interactive Brokers entity should I use?

As a Swiss investor, I recommend using the Interactive Brokers UK entity that offers the best regulations, protection, and features.

Who is Interactive Brokers good for?

Interactive Brokers is great for all investors that want to trade themselves and do not mind a foreign broker.

Who is Interactive Brokers not good for?

Interactive Brokers is not the best if you want to keep it very simple. If you are afraid of using a foreign, there are some Swiss alternatives, but at higher fees.

Summary

Interactive Brokers is an excellent broker with everything you need to buy stocks and ETFs, reliably and at extremely affordable prices. With IB, you can trade U.S. stocks for as little as 0.5 USD!

Product Brand: Interactive Brokers

5

Interactive Brokers Pros

Let's summarize the main advantages of Interactive Brokers:

- A vast range of investments

- Very low fees

- No custody or inactivity fees

- Very professional service

- Offers US ETFs to Swiss Investors

- Good overall reputation

- Long experience

- Excellent security

Interactive Brokers Cons

Let's summarize the main disadvantages of Interactive Brokers:

- It can be intimidating at first

- Too many user interfaces

Conclusion

The broker you need to buy stocks and ETFs reliably and at extremely affordable prices. Trade U.S. stocks for as little as 0.5 USD!

- Extremely affordable

- Wide range of investing instruments

Overall, Interactive Brokers is an excellent broker. Their fees are incredible, and their service is top-notch. Interactive Brokers should be your choice if you want a professional broker at a very fair price.

Since they are still offering US ETFs to Swiss investors (why US ETFs are the best), Interactive Brokers is currently the best broker for Swiss investors. No other broker even comes close if you want to optimize your portfolio.

I have been using Interactive Brokers for more than two years now. IB is the broker I am currently recommending to Swiss investors. It is also an excellent choice for European investors. I am pleased about IB and plan to continue using it for a long time.

Many people argue that we should not pay fees for brokers since there are free brokers. However, you have to be careful. There are many downsides to commission-free brokers. I much prefer paying very little for a great broker than not paying for a bad broker.

If you are interested in IB, I have a guide on opening an IB account.

What about you? What do you think of Interactive Brokers?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Best Brokers

- More articles about Investing

- DEGIRO Review 2024: Pros and Cons

- TradeDirect Review 2024 – Pros & Cons

- DEGIRO vs eToro: Which Is Better For You in 2024?

Hi Baptiste, your blog is fantastic! I’m an EU citizen based in Asia looking to open my first broker account. Above you mention no inactivity fees with IB, however, I read in multiple places that no inactivity fees is only for IBKR LITE and this type of account is only for US-citizens. Non-US persons’ only option seems IBKR PRO, which charges 10 USD per month in case of inactivity. I’d trade infrequently, so it seems IB account would cost me 120 USD per year. Would you say it is still competitive compared to other online brokers? 120 USD does not seem much, but I’ve been reading your other posts and I understand over 40+ years and compounded interest it adds up…

Thanks, Luna!

The 10 USD per month custody fee has been removed some years ago, but it’s probably mentioned in several websites that are not upgrading their content.

Thanks Baptiste for such a quick reply! This is super helpful. Indeed, based on your comment I found out the fee was waved in 2021: https://finance.yahoo.com/news/interactive-brokers-makes-waves-inactivity-132135973.html

Hi Baptiste,

Thanks for your wonderful blog! I want to ask you a question: I read in other blogs that on IB there is a custody fee of 10 USD per month if you don’t have a balance on your account of at least 100k USD, is it true?

Thank you,

Faber

Hi Faber,

This fee does not exist anymore with IB, it was removed a few years ago. There is currently no custody fee at IB.

Oh, that’s great. Thank you so much!

Hi Baptiste

Thank you for the great blog.

Have anyone ever done a transfer of shares / assets from IBKR away?

As my portfolio grows i plan to transfer the swiss shares to Cornertrader to have my assets in two places.

Anyone done that? I did not found any infos or fees about that, only deliver shares to IBKR.

Thank you for advise.

Greetings Aare

I have never done it myself, but share transfer is currently free at IB.

I know several people transfer shares from IB to Swissquote at least.

You can aks on the forums to get more experience reports.

Hi Baptiste

Thanks for the reply, i have found the place now: Transfer & pay / in german “Ausgehend” / “Positionen übertragen”

I did not recognise the point before.

They should not charge any fees as long its an automatic transfer ACATS (free of payment (FoP) und Automated Customer Account Transfer Service ACATS).

Infos here FAQ https://www.interactivebrokers.com/lib/cstools/faq/#/content/52472818 and fees here https://www.interactivebrokers.com/en/index.php?f=14718#security-transfer-fees

Greetings

How does it work when you have to make the tax declaration?

It works exactly like a Swiss broker, you declare all your transactions on your tax software and you add the activity statement as proof in the tax declaration.

500k is not so safe…

In Europe or Switzerland securities like Stocks, ETFs are all held by a separate legal entity. It means there is complete asset segregation, which is unlimited, if the broker goes down.

So IB is not good for a high net worth.

It’s true that the segregation rules are stronger in Switzerland for instance.

But just because there is no such segregation at IB (they use omnibus accounts) does not mean it’s less safe.

There is a good reason why US stopped using segregated accounts and switched to omnibus accounts: efficiency. These accounts are much more efficient to deal with and will allow lower fees as well. This is one of the reasons IB is cheaper than other brokers.

IF IB was to fail, it does not mean the money above 500K would be lost. it’s actually likely that nothing would be lost as well. And fully segregated accounts don’t protect you from fraud. If a Swiss broker does not deposit your money in the segregated account but uses it for something else (like pay other investors), the money is lost as well.

Could you elaborate on the difference between segregated and omnibus accounts in terms of risks and protection. I thought IBKR (Irish branch at least as I’m currently an EU resident) accounts were also segregated. Thanks

A segregated account is a real account (in a custody bank) in your name. Each time you do operations, the broker will deposit (or take out) shares in this account. This is entirely separated from the broker.

An omnibus account is a brokerage account where assets of multiple users are held together.

In general, there is not much difference between both. However, segregated offer an extra security against fraud (but they are not perfect). Indeed, with omnibus accounts, the broker could in theory use some assets from A to cover the losses from B, resulting in a loss for B if this is not reverted later.

No, I don’t think so. If the swiss broker does not deposit your money in the segregated account but uses it for something else, the swiss state have to pay back ur money. It is your right. The state have to check if the broker don’t follows his rules.

But also I can’t understand the 500k of IB. First they write 500k and then 30 millions.

‘In addition, Interactive Brokers LLC carries an excess SIPC policy with certain underwriters at Lloyd’s of London, which extends the per account coverage by an additional $30 million (with a cash sublimit of $900,000), subject to an aggregate limit of $150 million.’

Are you sure that the regulations state that the government will pay back everything? I am not regulations include fraud. Of course, they will audit these companies and this will help having only legit companies, but they could still be doing something bad after the audit.

The LLoyds insurance is on top of SIPC. Basically, this insurance will cover up to 150 million for things that are not recovered through SIPC. It’s a good thing, but given the number of IB users, I am not sure it will cover a huge amount per person.

Hi again Baptiste,

I was looking through in detail the small print with regard to IBKR Ireland accounts (as an EU resident). There are some curious and worrying conditions, such as article C 3 c:

“Where we hold Client financial instruments as custodian in accordance with the

Client Assets Rules, we may use IBIE affiliates or an unaffiliated third party to act

as sub-custodian in respect of Client financial instruments. You agree that where

Client financial instruments are subject to the law or market practice of a third

country and where permitted by MiFID II, the sub-custodians may register or record

Client financial instruments in the sub-custodian’s name or in the name of a third

party.

(iii) You authorise us to arrange for Client financial instruments to be held with a

sub-custodian or other third party in one or more jurisdictions outside of Ireland

or the European Economic Area (“EEA”). In some cases, Client financial

instruments which are held overseas will be subject to different settlement, legal

and regulatory requirements than those that apply in Ireland or in the EEA. In

some jurisdictions, local law might not allow Client financial instruments to be

separately identifiable from IBIE’s financial instruments or those of the subcustodian.

You might be at greater risk of loss if the sub-custodian fails.”

Grateful for any feedback on this. Should we be particualrly worried in practical terms about this given IBKR’s reputation? Perhaps the conditions for IBRK with the UK branch are different but wanted to flag this issue. Thanks.

I would not be too worried about that, but it’s difficult to grasp the implications of these statements. IB IE and IB UK are indeed different, but they have relatively similar regulations.

I think it just means that they can use custody accounts for your money, not only store it themselves. But they already do that even in the US for cash.

Thanks Baptiste for your quick reply.

Would the risk still be less with say Swissquote? I mean might it be worth paying those extra fees (which are quite significant)?

I don’t think Swissquote is safer than IBKR, no. But it’s true that Swissquote has segregated accounts while IBKR has omnibus accounts. If this helps you sleep at night, this is a great deal :)

Dear Baptiste,

The day I move to Switzerland (from France), will I able to transfer my IBKR IE account to IBKR UK and this benefit from better asset protection? Is this automatic or would I have to make a request and how complicated would it be? Thanks

Hi max,

That’s really more a question for IB than for me :) I have only had an IB UK account in my life.

I have heard of people getting transferred without issues from UK to IE, but I don’t know about the contrary. I also know that in some cases, transfers won’t be fully automated, like between UK and US.

I think it should be doable in your case, but you will have to ask the support about it.

Hi Max,

I have been doing the same last year (from IE to UK IB).

If I would have known all the hustle around it, I would’ve probably just sell on IE and buy on UK at the same time :-D.

It took approx. 1,5 month to complete the transfer in my case, there were several verification and request documents needed from both sides.

The downside of selling and buying in contrast to transfer between the accounts is clearly the transaction fees on both sides, plus you might not buy it for the exactly same price as you are selling it. Not to mention you have to have available liquidity to do that.

However, this is not to discourage you from the transfer process, just sharing my experience so you can assess for yourself and eventually prepare for maybe a bit of a lenghtier process.

At the end of transfer process, I had all the positions in exactly same volume and prices on my UK account as previously held on my IE account.

Good luck!

Jana

Thanks a lot for sharing, Jana! This is extremely good to know. I would not have expected 1.5 months either, this is quite long…

Hi Baptiste

Do you participate yourself in Stock Yield Enhancement Program?

Would you consider it for some classical ETFs like VT or VOO?

What’s your general opinion about this option?

Kind regards

Maciej

Hi Maciej

I did in the past. It brought a little income.

I think it’s a good program and I like how IB is doing it, compared to other brokers.

What I don’t like is how the reporting works. In my activity statements, I easily had at least a 100 statements for SYEP in a single month, all with small increments. It made the report complicated to read. So, I opted out for simplification.

Hi Baptiste,

I’ve created an IB account but I cannot trade US ETFs. I got this answer from IB:

“Please note that our retail clients from Switzerland hold an IBUK account.

Therefore, since your account is under IBUK, the restriction applies. Please note that we do not have a separate entity in Switzerland.”

I guess new accounts have lost the option to trade US ETFs.

Do you suggest to trade EU ETFs equivalents or use a different broker (surely with higher fees) that would still allow trading US ETFs?

Thanks

Hi Paolo,

I would recommend you insist on the ticket that Switzerland is not subject to the UCITS limitation since it’s not part of the EU.

There has been many cases unfortunately where IB support is not aware of Switzerland being a special case.

Hi Baptiste,

thanks for your suggestion. I’ve got more info from IB customer care: they reinstated IBUK does not allow trading US ETF’s. However, Swiss residents can open an IB-LLC account: it’s enough to select Crypto as a product during the account creation process (if you do not, you will trigger IBUK). Unfortunately they cannot migrate an existing IBUK account to IB-LLC. Do you see any issues in having an IB-LLC account vs IB UK account?

Thanks

That’s really weird :(

I am not sure honestly what would be the differences between both for a Swiss resident.

@Paolo, did you find a workaround to this problem? It would be really important to us Swiss residents to be able to buy US ETFs. Otherwise, IB becomes sort of useless for me.

@Baptiste, are you able to buy US ETFs? Is this a new restriction that applies only to new accounts?

Thank you, both!

Yes, I am still able to buy US ETFs and I have not heard of other people being blocked so far.

I had this same issue a year ago when I opened my IBKR account actually, just had to explain to their customer support that the regulation does not Switzerland as it’s not in the EU and I’ve had no issues since then. Strange that so many people all have to do it one by one, but customer support should be able to fix it if you contact them.

To be able to trade US ETF’s I’ll open an IB US account and then close the UK one (that I opened less than a month ago).

Dear Baptiste, many thanks for this very useful and comprehensive article. I have a question regarding the US legal entity of IBKR. As I am considering investing a small amount in cryptocurrencies (I am aware that this is risky and highly speculative :-)), I asked IBKR if I could get the trading permissions to do so. The answer from IBKR was that cryptocurrency permissions are available under the IBLLC-US entity for Swiss residents. So I have the option to open a new IBKR account under IBLLC-US entity. In their reply, they also said that once my new account is opened under IBLLC-US entity, I may request for Full Internal Account Transfer from IB-UK account to my new IBLLC-US account by sending a webticket request.

So my question is: What would be the advantages/disadvantages of doing a Full Internal Account Transfer? One option would be to keep both accounts so that I can take advantage of both entities? Thank you in advance for your valuable advice!

Hi Willy,

Interesting, I was not sure we could open IB US accounts as Swiss citizens.

As you said, the advantage of having both is to have both advantages. On the other hand, transfering your IB UK to your IB US account would make it simpler since you would have everything at the same place, which is very convenient.

Hi Baptiste, so with the knowledge that you can now open an IB LLC account as a Swiss citizen, do you still recommend getting an IB UK account? Does IB UK offer more protection and options than IB LLC?

Hi Mina,

I think it makes little difference. IB UK and IB LLC have the same protection. IB LLC has access to crypto while IB UK does not have it, but for me this does not matter. And IB UK has access to CFDs while IB LLC does not have it, but again for me, it does not matter. So I think it’s a matter of personal preference.

Hi there, great review, many thanks. Do you have any guidance on filing the tax declaration in Switzerland when using IB?

I am a EU national in Zurich on a B Aufenthaltsgenehmigung earning above the threshold, so declaring is mandatory.

I am especially interested in the factors convenience (how difficult is it) and effort (how much time does it take) of the declaration with IB compared to, say, SQ. Does the difference amount to a full working day lost to the fact that one is using IB?

My investor profile in a nutshell: invested 100k, adding 25k per year, half of that in USD ETFs and the rest in stocks (80% USD, 20% EUR/CHF). I make maybe 3 transactions monthly for a total around 2k.

Much appreciated!

Hi

Generally, people grossly estimate the amount of time they need to fill their tax declaration with IB.

You only need to input all operations (about 36 in your case) with the amount of shares and the price. The dividends and net value should be calculated by the tax software.

At this point, it takes me about 15 minutes to enter this part of the tax declaration. The first year you start, it may take you about an hour, maybe two at most.

And the difference with SQ will be minimal.

Log on procedure is now more complicated than before and anywhere else.

Log on an the web:

You must confirm the authorization on your phone.

Until here, “normal” but now:

Back to the web, oh, there is a number?

You have to go back you your phone and enter this number.

Than you generate another number on your phone and you have to go back to the web and enter the number from the phone a the webpage.

This is kind of 4 factor authentication.

BUT Interactive Broker is still very very unsecured!!!

Until the customer/user is still able to log on, the system has a bug.

When NOBODY can log on anymore, THAN and only THAN the system is secure.

In my opinion: IB is far to complicated for a “normal” user who trade some times per week/month.

I still don’t understand why I have IB to inform for every money transfer to IB. My account is as remark on the transfer.

And you have to be carefully if you withdraw money from the IB account. The money has to be at your account at least 3 (or 5?) days otherwise you pay fees.

I don’t understand your point. I logged this morning and the procedure is still exactly the same: Login to the web, get a notification on my phone, enter a PIN or biometric and it’s done, no further steps.

Money needs to settle after a trade, this is not specific to IB but to most brokers. This is based on the historical banking system where things need to settle fully after at least one banking day to be fully processed.

Baptiste, Thanks for this great overview on Interactive Brokers. I found this when investigating more affordable brokers to trade US stocks for our son. He holds a Swiss and US passport, just graduated from college and will work in Spain. Not easy to get acct with an on line brokerage company as American living abroad. He has a SwissQuote acct but limited on what he can trade as an Amercan and its very expensive for his modest investment budget he has as recent college graduate. IB looks like a great option. Are you aware of any restrictions IB has on products and services for Americans living in Europe? Thanks!

Hi Ann,

I am not aware of any such limitation. They may force americans to use IB US rather than IB UK, but since your son holds a Swiss passport as well, it should be good.