How to start investing in the stock market in 2024?

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Do you feel overwhelmed with investing? And you do not know where to start with investing? Do you want a simple guide on how to get started with investing?

Then, this guide is exactly what you need! This article is a step-by-step guide to investing in the stock market.

First, I cover the things you should know before you start investing. And then, I cover how you could get started with investing.

Know why you want to invest

First, you need to understand why you want to start investing. Your reasons for investing will matter a lot in how you will invest.

There are many reasons to invest in the stock market. But we can group them into two categories:

- Investing in the short-term to buy something. It could be to buy a new house, for instance.

- Investing in the long-term for your future. It could be to pay for your retirement. Or you could invest in the long-term for the education of your child.

Now, it is essential to know that investing is a long-term game. If you want to buy a house next year, it is probably not a good idea to invest now. Why is that? As we will see in the next section, the stock market is volatile. It will provide good returns, but only on average. What will you do if you invest now and the market drops 20%?

So, I would only recommend investing if you are investing for the medium or long term. You need to answer a simple question: Can you wait until the market recovers if it goes down?

For instance, if the market goes down 20% next year, will you be able to wait one year or more until it recovers?

If you cannot answer yes to this question, you are probably better off investing. If you sell because you fear the losses, you will be in trouble. There will be some negative years in your investing journey. And you will need to wait until it recovers. Selling in a downturn is the worst thing you can do!

Know why you should invest

You already know why you want to invest. But do you know why you should invest? Could you not save money and let it rest in a savings account and achieve the same goals?

There is one big problem with cash: inflation! The value of your money will decrease over time. Inflation increases the prices of goods over time. On average, inflation goes up.

Inflation means the money you acquire through hard work will have less value. With the same amount of money, you can afford fewer goods.

And the problem with bank accounts is that they do not follow inflation. By leaving money in your bank account, it is losing value over time.

On the other hand, investing in the stock market has higher historical returns than inflation. Investing means that you will generate more value from your money. And inflation will not eat up all your gains.

And since the returns will be higher, your money will grow without you having to do anything. You want your hard-earned money to work for you!

Know the stock market

Then, you also need to know the stock market. Do not worry. You do not need to know everything about it! You do not even need to know the details!

But there are several things you need to know before you even consider investing in the stock market.

First, there is no such thing as an investment without risk! All investments have some risks. It is up to you to decide on the level of risk you are willing to take.

Even low-risk investments will have negative returns sometimes! If you pick a low-risk instrument such as government bonds, you will still experience some downturns. There have been some years where bonds have performed very poorly. We are talking minus 20% in a single year!

You only lose money if you sell in a downturn. You should mix up paper losses and realized losses. If you check your account one day and see you are ten percent down, this is only a paper loss. If you sell, it will become a realized loss. It is essential to understand this.

Finally, you should not time the market. Timing the market means you buy or sell at a particular time in the hope of making a profit. For many people, this means waiting to buy or selling early. But on average, you will lose this bet with the market. People are not able to beat or time the market.

Know the difference between stocks and bonds

In the stock market, there are two main instruments: bonds and stocks. There are others as well. But these two are more than enough to get started.

A bond is a debt that an entity issues. This entity could be a government, a municipality, or a corporation. To keep it simple, you should only focus on government bonds. They are the safest and most straightforward. A bond has a time to maturity and interest rate.

When it needs money, the government will issue bonds people can buy. In return for their money, the bond buyer will receive interest payments regularly. Once the bond reaches maturity, the buyer will receive its money back.

The stock of a company is the set of all the shares of this company. You do not buy stocks directly, but you buy shares of stocks. By purchasing a share of a company’s stock, you will own a part of the company.

People investing in stocks are expecting the share price to grow. Generally, as the company grows, so does its share price. Another advantage of some shares is that the company pays a dividend to its shareowners.

Once a company has some money, it has several choices. It can invest in itself to grow. Or the company can give the money back to the shareowners as a dividend. This dividend will be given in cash to you into your broker account.

In practice, there is one significant difference between these two instruments: bonds have smaller risks and smaller returns, while stocks have higher risks and more profits.

In short, it means that stocks are great for the long term. And bonds are better for the shorter term. But bonds will reduce the volatility of a portfolio. They are good for your risk tolerance.

Know what are index funds

Now that you know what stocks and bonds are, you may think that the next step is to choose companies to invest in (picking stocks). But this is not the case! Investing in individual stocks is not a good thing for most people.

Historically, picking stocks had lower returns than the average market itself. Picking stocks is called active investing because people choose which companies to invest in. On the other hand, with passive investing, you invest in a collection of stocks representing the market. These collections of stocks are called indices.

An index fund is a fund that contains all the shares of the index. Instead of buying shares of the stocks, you purchase shares of the index. And by doing so, you do the equivalent of buying shares of every stock in the index. If the market does well, your shares will do well.

There are many advantages of passive investing:

- It outperforms active funds on average.

- It is simpler since you do not have to pick stocks.

- It is cheaper since fees on index funds are generally lower than on active funds.

- It has greater diversification.

Therefore, I would recommend that if you are getting started, you start with passive investing!

Decide between mutual funds and ETFs

As we have just discussed, index funds are the best instruments to start investing. However, index funds come in two flavors:

- Index Mutual Funds. They are funds directly managed by a financial institution.

- Index Exchange-Traded Funds (ETFs). They are funds traded on the stock market.

There are also active mutual funds and ETFs, so ensure you focus on index mutual funds and index ETFs.

Both of these alternatives are index funds. They both invest in many shares and replicate the index itself. You must decide whether you want to invest in mutual funds or ETFs.

The only notable difference is how you invest in these instruments.

- To invest in a mutual fund, you will not need to access the stock market. You can invest in mutual funds through a financial institution like Vanguard or BlackRock. Your big national banks (UBS, for instance, in Switzerland) will also offer access to some mutual funds.

- On the contrary, to invest in an ETF, you will need access to the stock market. You will use a broker as the intermediary. And then, you will purchase shares of an ETF as it was a stock.

Mutual funds are simple to invest in. However, there is a big issue with them in many countries. Most of us do not have access to good mutual funds. For instance, one of the best mutual fund providers, Vanguard, does not offer mutual funds in Europe. We have access to many funds from our banks. But these funds are significantly more expensive and smaller. So, they are inferior alternatives.

It is why most European people invest (or should be) through Exchange Traded Funds (ETFs). Like me, if you are in Switzerland, you have no choice but to invest in ETFs unless you want to waste your money on fees!

If you have access to good mutual funds, for instance, in the United States, you can start to invest directly with them.

If you do not have access to good mutual funds, you will invest in ETFs through a broker account (more on that later).

Choose your asset allocation

Whether you decide on mutual funds or ETFs, you must choose an asset allocation.

Asset allocation is a fancy term that simply means how much bonds, stocks, and cash you have in your investment portfolio. For most people, cash is not part of their portfolio. So you can focus solely on bonds and stocks. Your cash will stay separated from your investment portfolio.

Now, there are no good or bad asset allocations. You need to know the difference between different asset allocations and choose one that suits you personally!

We have already seen that stocks are more volatile and have higher returns. On the other hand, bonds are more stable but will bring lower returns.

Based on that, you should choose your asset allocation based on these factors:

- Your risk tolerance. How much risk are you capable of handling? If your portfolio is down 30%, what will you do?

- Your investing term. How long will you be investing before you will need this money?

Having a good risk tolerance means the ability to take on more stocks. And a long investing term also means you can have more stocks in your portfolio. But do not take these two factors independently. You need to consider them both.

For instance, if you need the money in 20 years (very long-term) but have a low risk tolerance, you should have a significant amount of stocks regardless.

You should not even consider having less than 40% of stocks. You need stocks to have good returns. Here are the most popular asset allocations:

- 100% of Stocks: Investing for the long-term and excellent risk tolerance.

- 80% of Stocks: Investing for the long-term and good risk tolerance.

- 60% of Stocks: Investing for the medium-term or average risk tolerance.

- 40% of Stocks: Investing for the medium-term or low risk tolerance.

These are only rules of thumb, of course. Nothing prevents you from a 75/25 portfolio. It would be a perfectly fine portfolio.

And one last thing on asset allocation: It does not need to be set in stone. You should not change it often. But you can change it. First, as you age, your risk tolerance may change. And as you get closer to your term, you may want to increase the bonds to avoid a big surprise.

If you want to see the difference between asset allocations, you can check these retirement simulations. And if you need more details on this subject, I have an entire guide about asset allocation.

Choose a portfolio

Now, you know the allocation to stocks and bonds in your portfolio. It remains for you to decide on what indexes you will invest in. You do not have to pick stocks. But you still need to pick indexes.

Choosing a portfolio is essential. You should not rush this decision. You must choose a portfolio that will suit your needs.

To simplify your search, you should avoid index funds that are too specific. For instance, you should not invest in sector index funds. These funds are investing in only one sector, such as Technology. They introduce a bias towards an industry. Keep it simple and invest in whole countries.

The same is true for funds that only invest in companies of some sizes. For instance, some funds are invested only in small companies. This is also a bet on which companies are doing to do best. And you should avoid bets! You need to bet on the entire market. It is the safest bet.

You will need to decide in which countries you want to invest. If you live in a vast country like the United States, you can invest only in your country. But if you live in a tiny country like Switzerland, it is best to diversify across many countries.

If you have bonds in your portfolio, I recommend only investing in bonds from your country in your currency. The idea of bonds is that they will reduce the volatility of your portfolio. If you add currency risks to that, you lose some of the advantages of bonds.

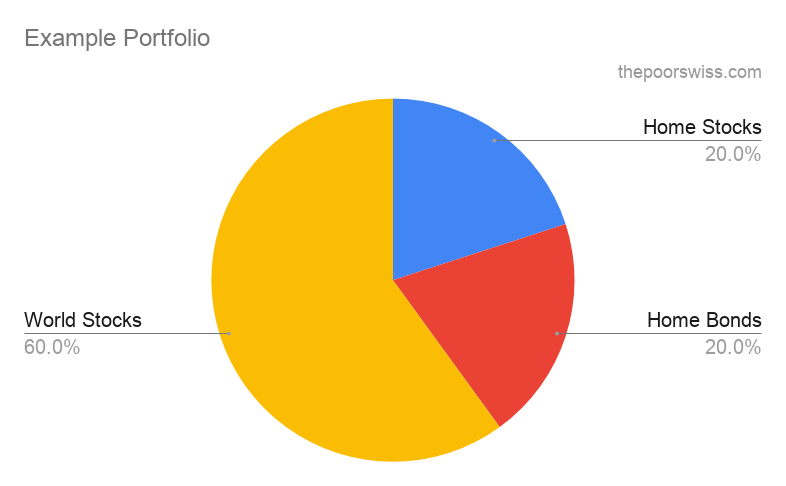

A good portfolio could be 80% of World Stocks and 20% of Swiss Stocks for Switzerland. If you want bonds, you could do 60% of World Stocks, 20% of Swiss Stocks, and 20% of Swiss Bonds.

For me, the best funds are the ones covering the entire world. For instance, Vanguard Total World (VT) is an excellent ETF. It is the one I am investing 80% of our portfolio with. But there are others. I would recommend you consider a world portfolio as your base index fund.

Once you have decided which countries you want to invest in, you can pick the best index fund for each country. There are many tools to compare ETFs. My favorite tool for this is justETF.

If you want more information on this step, I have a complete guide on designing an ETF portfolio from scratch. This guide will help you choose an index, select a fund for this index and finally put your funds together to form your portfolio.

Decide how much you want to invest

Now, it is time to decide how much you will invest.

First, do you already have some money that you want to invest? If you already have a lot of cash, you can consider investing part of it.

Then, how much do you invest to invest regularly? Investing part of your monthly salary in the stock market is a good idea.

Of course, it is also a matter of how much you can invest. You must remember that this money will not always be available. You need to invest money that you do not need right now. If the market is down and you need the money, you will realize significant losses. So if you know you will need the money, do not invest it!

You should also keep some money in the form of an emergency fund. And you should not invest your emergency fund since you want it to be available.

An excellent way to get started is to start with lower amounts. You can decide to invest 100 CHF each month. Or it could a 1000 CHF. It will depend on your budget and means.

It is much better to get started now with 100 CHF per month than never to invest. Starting with little money will help you break your investing paralysis.

As for the frequency, I recommend investing every month. But some people prefer to invest quarterly. I think it is good to invest as soon as you have money available for it.

Decide how you want to invest

There is one more thing you need to decide. You have three main options to invest in the stock market:

- Invest through a bank

- Invest through a Robo-advisor

- Invest yourself

I would discourage you from trying option one. Banks are expensive to invest in and are the worst option. There remain two options, investing by yourself or through a Robo-advisor.

By investing by yourself, you will maximize the efficiency of your portfolio and minimize the fees. However, this means more complexity and time necessary to invest. And you also have more margin for errors and personal decisions.

On the other hand, a Robo-advisor will add substantial fees to manage your portfolio. This is easier. Since the platform will manage your portfolio, you will have few things to do.

I invest myself and recommend most people do that. However, if you do not feel ready, investing with a Robo-advisor is much better than not investing.

For more information, you can read about how much time investing by yourself takes and the different levels of investing.

Choose a broker

You know enough things and have decided on what to invest in. It is time to get started with the actual investing.

You will not need a broker if you use mutual funds instead of ETFs. You just need to create an account with the chosen fund provider.

For investing in the stock market, you must use a brokerage company (a broker for short). Your broker is the intermediary between you and the stock exchange. Against a small fee (more on that later), the broker will place orders for you on the stock exchange. Without a broker account, you will not be able to buy shares of your funds on the stock market.

Each country has many brokers. Most big banks will be brokers themselves. However, banks are not the best option for a brokerage account. They are way too expensive. We are talking about an order of magnitude more expensive.

As a small example, we would buy 2000 dollars of shares on the New York Stock Exchange (NYSE). In PostFinance, this would cost us 35 USD. With Interactive Brokers (IB), this would cost us 0.5 USD! PostFinance is 70 times more expensive than IB.

The broker you need to buy stocks and ETFs reliably and at extremely affordable prices. Trade U.S. stocks for as little as 0.5 USD!

- Extremely affordable

- Wide range of investing instruments

For Europe, there are two great brokers:

- Interactive Brokers. It is a U.S. broker with a U.K. branch for European people. They have very low prices and offer a wide range of investments.

- DEGIRO. It is a European broker from the Netherlands. They also offer a good range of investments at low prices.

I recommend IB over DEGIRO because they have lower prices and a better offer of investments. They are also more professional, and I trust them more than DEGIRO.

I would recommend you start investing with IB. If you are still hesitant, I wrote a comparison of Interactive Brokers and DEGIRO.

If you want to avoid foreign brokers, you can opt for a Swiss Broker.

Choose a Robo-advisor

If you decide to invest through a Robo-advisor, you must choose which. There are many Robo-advisors in Switzerland.

There are very significant differences between Robo-advisors:

- Some are much more expensive than others

- Some are investing differently

- Some are much more complicated than others

|

4.5

|

4.0

|

|

Great Robo-Advisor

|

Very affordable

|

|

|

|

|

|

Good

|

Good

|

- Beginner-Friendly

- Degressive Fees

- Great diversification

- A good strategy with ETF

- Little customization

- Outstanding fees

- Very customizable

- Great diversification

- A good strategy with ETF

- High minimums

- Not always easy to use

For Robo-advisors, I recommend going with either:

- True Wealth for their excellent fees

- Selma for their simplicity

You can also try both if you want and decide later which one you want.

Make your first investment!

You have now made all the necessary decisions. You can make your first investment in the stock market!

If you are using a mutual fund, transfer your funds to the mutual fund provider and invest the funds in your choice’s mutual fund.

If you are using an ETF, transfer money to your broker account and purchase shares of the ETF of your choice.

Congratulations, you are now invested in the stock market!

Keep it going

Getting started with investing is a great thing. But you need to keep it going. From now on, you should invest regularly.

I recommend investing every month. Even if it is small amounts, it will pile up quickly. It is how I am investing. After receiving my salary and paying all the bills every month, I transfer the remaining amount to my broker account. And from there, I buy the shares of my portfolio.

To limit your costs, I recommend buying only one ETF shares each month. The best way to invest is to purchase shares of the ETF that is the most out of balance.

For instance, you want 60% of the VT ETF and 40% of the CHSPI ETF. If you only have 30% CHSPI, you buy shares of CHSPI this month. On the other hand, if you have 55% of VT, you buy VT this month. It is a great simple way to keep your portfolio balanced.

Conclusion

Following all these steps will help you start investing in the stock market. Investing is a great way to make your money work for you. And it will help you beat inflation.

I realize these are many steps. But these are all small steps. You do not have to rush through them. Even if this takes you one month to decide on everything, this is fine. You do not want to rush any decision.

Once you start developing a routine of investing, it will get simpler. And as soon as you begin to get the investing going, you will start to see the benefits of investing. It feels great when your portfolio grows without you doing anything.

I hope this will help you get started. If there is still something unclear, let me know in the comments below.

To get started, you can read more about the best brokers in Switzerland. Or, if you want to get started with IB, find out how to buy your first ETF with IB.

If you want more reading about the stock market, you can read about the myths surrounding the stock market.

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Investing Fundamentals

- More articles about Investing

- How to Change Broker and Transfer Your Portfolio

- Should Swiss investors worry about the U.S. Estate Tax in 2024?

- What makes U.S. ETFs so great?

Hi, I’m just a beginner here and your article is very inspiring and helpful, thanks! I understand your strategy is to invest as much as possible in stocks to make your money “work for you” and that the way the stock market has been behaving historically shows that it seems quite safe in the long-term. But for a cautious investor interested in long-term investment, how would you compare the risk of investing in stock to letting your money “sleep” in a bank account in case the whole economy crashes (kind of like in the 30s)?

Hi,

Over the long-term, I think there are more risks with cash considering inflation than with stocks.

Now, it’s true that the 1929 recession was extreme and it took many years to recover from the top. And at this time, there was deflation, so the money in your bank account was actually gaining value. But at this time, most people did not have money in their bank account anyway.

And the stock market was bad when you consider from its top. But if you had started investing several years before the great crash, you would have recovered much faster. And if you could have bought (suggesting a good job) during the crash, you would have recovered even faster.

While not impossible, I do not think we are going to see another crash as strong as this one.

Thanks for stopping by!

Hi, thanks a lot for the detailed answer!

Hi, thanks for the article!

Looking at the current USD/CHF exchange rate situation, how are you buying VT ETFs that are essentially denominated in USD? Are you borrowing USD from IB on margin (quite expensive) or do you always convert CHF into USD on IB and then buy VT? Thanks!

Hi Filipo,

I am not buying anything on margin. I always convert the currency myself before I buy the shares. Margin lets you invest with IB’s money and as such you could increase your gains. However, it also multiplies your losses if you have them.

For me, it’s just too risky. I prefer buying things for which I have the money, in the correct currency.

Thanks for stopping by!

Hello! very interesting post!

I would like to invest 80% VT and 20% in a Swiss ETF as you do.

For the Swiss ETF, wouldn’t it be better to invest in UBS ETF (CH) – SMI® (CHF) A-dis instead of the iShares ETF that you mentioned?, it follows the SMIM (the 30 medium sized Swiss companies). With the iShares CHSPI ETF you are buying shares that are already contained in VT.

Thank you!

Hi Edu,

I guess you wanted to say the UBS ETF(CH) SMIM (and not SMI) since you mentioned the SMIM later. There is also a SMIM one that follows the SMI, not SMIM.

You are right that with SPI, you are buying all shares of SPI (this includes, SMIM, but in a much lower proportion). Do not forget that only 2.5% of VT is Switzerland. This means that you have very little of even the big companies.

The goal of the home bias is to have some funds in a stable currency and easy to withdraw. SMIM will be more volatile than SPI and SMI. It could return more and it will indeed increase your allocation to smaller stocks.

I would not recommend investing 20% in SMIM. Now, you could do 10% SPI and 10% SMIM to make an edge to smaller companies. But you need to realize that are you are betting that medium companies will be better than larger companies.

And remember that this is only the way I invest, you do not have to copy it verbatim :)

Thanks for stopping by!

Hello, this was very informative!

Have you seen Charles Schwab International? I’m in the opening process as they have a $0 commission fee policy as well, while having $0 account management fee, the only limitation seems to be the minimum investment of $25000. I wonder if you have spotted any problem with them I may have overlooked.

Cheers,

Renato

Hi Renato,

I just took a quick look at their offering, it seems interesting. Just note that the commission-free only for U.S. stocks and ETFs, it seems very expensive for other stock markets.

I have not been able to find if you can transfer CHF to them, but I would guess no. So this is only interesting if you have USD that you can transfer to them.

I would check that point to make sure that you can transfer CHF for free to their account and how much they will charge for transforming in USD. And I would also check how much they charge in foreign currency exchanges if you want to buy shares in EUR or CHF.

Thanks for stopping by!

Hello, thank you for your articles! Been reading them for a while now and I am ready to start investing in this bear market.

You mentioned that your portfolio is 80% Vanguard Total World (VT). In another article, you said US ETF won’t be available to swiss investors anymore starting 2020. What is your porfolio now ? how are you investing ? Thanks :)

Hi Lain,

So for now, U.S. ETFs are still available. It seems that this could change in 2022. But I was not able to find a definite answer to this question :s

For now, my portfolio is still 80% VT.

Thanks for stopping by!

Thank you for this, very helpful!

Great article… I guess many people, including myself, are less familiarize with this and may feel more comfortable using some sort of help. I heard about True Wealth – what do you think about it?

Hi Eder,

Yes, I have heard about True Wealth. There are several Robo-advisors in Switzerland.

I think they are good alternatives to DIY Investing. But of course, you will pay the price of not doing it yourself.

I need to do more research. But I plan to do an article about robo-advisors in the coming months.

Thanks for stopping by!

What is the guarantee in case of bankrupt of IB or Degiro ? How safe would be the money ?

Hi Ilvalesco,

Very good question.

Your shares and cash are insured based on where the broker is depositing the money. For instance, at IB, it has SIPC Coverage of up to 500’000 coverage in case of bankruptcy (of which, 250K can be cash).

IB has another program that allows you to insure more than that. Also, in general, your shares are held in your name and not in the name of the broker. In that case, you should be able to recover all your shares if it fails. But it could take time.

Thanks for stopping by!

Hey mate, just a question – if you load 100 000 cash in IB and they go down (which, is next to impossible now given their fame and market position) – is this some way covered? Or you must be packed in stocks/bonds = invested.

Second question on fees – if you keep 100 000 in cash and didn’t buy anything yet as investment – do you still pay 10 USD fees per month or this fee is gone for account balance of 100 000 and over?

Hi Hubert,

If they go down, you will be protected by SIPC (protection for brokers). This protects for up to 500K USD (of which 250K USD can be cash). So 250K USD of your cash should be covered. Now, this could take a long time before it comes back to you!

That’s a good question. I am not entirely sure. But I think only the full value matters. So even if you only have uninvested cash on your IB account, you should not pay the fee. But do not cite me on that one ;)

Great Article, I’ve been following those exact steps and started investing a lump sum of money beginning of January in VT when the share prices where at it’s highest ever. I’m investing long term (10-15 years) and hopefully the market will be higher at that point.

Hi John,

Yes, the markets are currently at very high prices. But nothing says that they cannot go even higher.

I think that it will crash in the coming years but then go even higher. But it’s only a guess.

We can only keep trusting in the market.

Thanks for stopping by and good luck with your investing.

Hi Mr. The Poor Swiss! Great article! Like you I have concentrated my portfolio on the Vanguard world ETF (accumulating for tax purposes). I am thinking about balancing fluctuations out with some other instrument and was considering bond ETFs, like the ones following the Barclays World Government Inflation-Linked Bond Index but I am still unsure. Do you think bond ETFs are a good idea or would you prefer real government bonds for that issue? My base/local currency is the Euro.

@Conman I thought distributing was better for tax purposes compared to accumulating if you were based in Switzerland? Am I missing something or are you not based in Switzerland?

Hi John,

In Switzerland, both are exactly the same for tax purposes. But since Conman mentioned his base currency as Euros, I would say he’s not from Switzerland. Some countries in Europe have better taxes for accumulating than distributing funds.

Hi @John Woods, yes Mr. The Poor Swiss got it right, I live in Cyprus, not Switzerland. Physical persons only get taxed on dividends received there (at least that’s what my research says) and not on any capital gains from shares or the likes.

Hi Conman,

I think it is reasonable to add bonds to balance fluctuations indeed.

This index seems interesting but it seems the weightings are really weird. I do not like the fact that the UK has about 30% of allocation. For me, this does not make sense. It’s only 5% of VT.

If I wanted bonds, I would go with a bond ETFs, either a local one or a full global one like the one you mentioned.

Keep in mind that if you get a USD ETF, you will still get fluctuation of the dollar towards the EUR.

Thanks for stopping by!

Hi Mr. The Poor Swiss,

Many thanks for your reply and advice. Yes that’s correct, the weightings are not proportional to VT but it seems to be closely following the index unlike some other world bond ETFs I have looked at – and that includes Euro hedged ones. I prefer not to invest in local bonds anymore and bond ETFs seem to be tricky but I’ll keep searching. Thanks again and keep up the great work!

This is my favorite sentence in this post, “It feels great when your portfolio grows without you doing anything.” That’s passive strategy at its finest :)

You also mentioned that there isn’t any financial institutions (like Vanguard) that offers a broad-based index fund in the form of a mutual fund option in Switzerland. This sounds to me like there’s a HUGE opportunity to be uncovered by anyone who is up for creating a low cost mutual fund (or a set of funds) that mimics the performance of an index! Unless the banks have a strong lobby here in Switzerland to prevent such competition?

Hi MBF :)

I completely agree with the huge opportunity fact. But, yes, there is a huge lobby from banks in Switzerland. And people are really not well educated on how much they are paying and how they should invest. Banks are profiting from this situation and have no interest to improve the current system.

I honestly do not see that changing in the coming years :(

For now, the better option is simply to avoid Swiss options. Pretty sad, but we have to make due.

Thanks for stopping by!