How to start investing in the stock market in 2024?

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Do you feel overwhelmed with investing? And you do not know where to start with investing? Do you want a simple guide on how to get started with investing?

Then, this guide is exactly what you need! This article is a step-by-step guide to investing in the stock market.

First, I cover the things you should know before you start investing. And then, I cover how you could get started with investing.

Know why you want to invest

First, you need to understand why you want to start investing. Your reasons for investing will matter a lot in how you will invest.

There are many reasons to invest in the stock market. But we can group them into two categories:

- Investing in the short-term to buy something. It could be to buy a new house, for instance.

- Investing in the long-term for your future. It could be to pay for your retirement. Or you could invest in the long-term for the education of your child.

Now, it is essential to know that investing is a long-term game. If you want to buy a house next year, it is probably not a good idea to invest now. Why is that? As we will see in the next section, the stock market is volatile. It will provide good returns, but only on average. What will you do if you invest now and the market drops 20%?

So, I would only recommend investing if you are investing for the medium or long term. You need to answer a simple question: Can you wait until the market recovers if it goes down?

For instance, if the market goes down 20% next year, will you be able to wait one year or more until it recovers?

If you cannot answer yes to this question, you are probably better off investing. If you sell because you fear the losses, you will be in trouble. There will be some negative years in your investing journey. And you will need to wait until it recovers. Selling in a downturn is the worst thing you can do!

Know why you should invest

You already know why you want to invest. But do you know why you should invest? Could you not save money and let it rest in a savings account and achieve the same goals?

There is one big problem with cash: inflation! The value of your money will decrease over time. Inflation increases the prices of goods over time. On average, inflation goes up.

Inflation means the money you acquire through hard work will have less value. With the same amount of money, you can afford fewer goods.

And the problem with bank accounts is that they do not follow inflation. By leaving money in your bank account, it is losing value over time.

On the other hand, investing in the stock market has higher historical returns than inflation. Investing means that you will generate more value from your money. And inflation will not eat up all your gains.

And since the returns will be higher, your money will grow without you having to do anything. You want your hard-earned money to work for you!

Know the stock market

Then, you also need to know the stock market. Do not worry. You do not need to know everything about it! You do not even need to know the details!

But there are several things you need to know before you even consider investing in the stock market.

First, there is no such thing as an investment without risk! All investments have some risks. It is up to you to decide on the level of risk you are willing to take.

Even low-risk investments will have negative returns sometimes! If you pick a low-risk instrument such as government bonds, you will still experience some downturns. There have been some years where bonds have performed very poorly. We are talking minus 20% in a single year!

You only lose money if you sell in a downturn. You should mix up paper losses and realized losses. If you check your account one day and see you are ten percent down, this is only a paper loss. If you sell, it will become a realized loss. It is essential to understand this.

Finally, you should not time the market. Timing the market means you buy or sell at a particular time in the hope of making a profit. For many people, this means waiting to buy or selling early. But on average, you will lose this bet with the market. People are not able to beat or time the market.

Know the difference between stocks and bonds

In the stock market, there are two main instruments: bonds and stocks. There are others as well. But these two are more than enough to get started.

A bond is a debt that an entity issues. This entity could be a government, a municipality, or a corporation. To keep it simple, you should only focus on government bonds. They are the safest and most straightforward. A bond has a time to maturity and interest rate.

When it needs money, the government will issue bonds people can buy. In return for their money, the bond buyer will receive interest payments regularly. Once the bond reaches maturity, the buyer will receive its money back.

The stock of a company is the set of all the shares of this company. You do not buy stocks directly, but you buy shares of stocks. By purchasing a share of a company’s stock, you will own a part of the company.

People investing in stocks are expecting the share price to grow. Generally, as the company grows, so does its share price. Another advantage of some shares is that the company pays a dividend to its shareowners.

Once a company has some money, it has several choices. It can invest in itself to grow. Or the company can give the money back to the shareowners as a dividend. This dividend will be given in cash to you into your broker account.

In practice, there is one significant difference between these two instruments: bonds have smaller risks and smaller returns, while stocks have higher risks and more profits.

In short, it means that stocks are great for the long term. And bonds are better for the shorter term. But bonds will reduce the volatility of a portfolio. They are good for your risk tolerance.

Know what are index funds

Now that you know what stocks and bonds are, you may think that the next step is to choose companies to invest in (picking stocks). But this is not the case! Investing in individual stocks is not a good thing for most people.

Historically, picking stocks had lower returns than the average market itself. Picking stocks is called active investing because people choose which companies to invest in. On the other hand, with passive investing, you invest in a collection of stocks representing the market. These collections of stocks are called indices.

An index fund is a fund that contains all the shares of the index. Instead of buying shares of the stocks, you purchase shares of the index. And by doing so, you do the equivalent of buying shares of every stock in the index. If the market does well, your shares will do well.

There are many advantages of passive investing:

- It outperforms active funds on average.

- It is simpler since you do not have to pick stocks.

- It is cheaper since fees on index funds are generally lower than on active funds.

- It has greater diversification.

Therefore, I would recommend that if you are getting started, you start with passive investing!

Decide between mutual funds and ETFs

As we have just discussed, index funds are the best instruments to start investing. However, index funds come in two flavors:

- Index Mutual Funds. They are funds directly managed by a financial institution.

- Index Exchange-Traded Funds (ETFs). They are funds traded on the stock market.

There are also active mutual funds and ETFs, so ensure you focus on index mutual funds and index ETFs.

Both of these alternatives are index funds. They both invest in many shares and replicate the index itself. You must decide whether you want to invest in mutual funds or ETFs.

The only notable difference is how you invest in these instruments.

- To invest in a mutual fund, you will not need to access the stock market. You can invest in mutual funds through a financial institution like Vanguard or BlackRock. Your big national banks (UBS, for instance, in Switzerland) will also offer access to some mutual funds.

- On the contrary, to invest in an ETF, you will need access to the stock market. You will use a broker as the intermediary. And then, you will purchase shares of an ETF as it was a stock.

Mutual funds are simple to invest in. However, there is a big issue with them in many countries. Most of us do not have access to good mutual funds. For instance, one of the best mutual fund providers, Vanguard, does not offer mutual funds in Europe. We have access to many funds from our banks. But these funds are significantly more expensive and smaller. So, they are inferior alternatives.

It is why most European people invest (or should be) through Exchange Traded Funds (ETFs). Like me, if you are in Switzerland, you have no choice but to invest in ETFs unless you want to waste your money on fees!

If you have access to good mutual funds, for instance, in the United States, you can start to invest directly with them.

If you do not have access to good mutual funds, you will invest in ETFs through a broker account (more on that later).

Choose your asset allocation

Whether you decide on mutual funds or ETFs, you must choose an asset allocation.

Asset allocation is a fancy term that simply means how much bonds, stocks, and cash you have in your investment portfolio. For most people, cash is not part of their portfolio. So you can focus solely on bonds and stocks. Your cash will stay separated from your investment portfolio.

Now, there are no good or bad asset allocations. You need to know the difference between different asset allocations and choose one that suits you personally!

We have already seen that stocks are more volatile and have higher returns. On the other hand, bonds are more stable but will bring lower returns.

Based on that, you should choose your asset allocation based on these factors:

- Your risk tolerance. How much risk are you capable of handling? If your portfolio is down 30%, what will you do?

- Your investing term. How long will you be investing before you will need this money?

Having a good risk tolerance means the ability to take on more stocks. And a long investing term also means you can have more stocks in your portfolio. But do not take these two factors independently. You need to consider them both.

For instance, if you need the money in 20 years (very long-term) but have a low risk tolerance, you should have a significant amount of stocks regardless.

You should not even consider having less than 40% of stocks. You need stocks to have good returns. Here are the most popular asset allocations:

- 100% of Stocks: Investing for the long-term and excellent risk tolerance.

- 80% of Stocks: Investing for the long-term and good risk tolerance.

- 60% of Stocks: Investing for the medium-term or average risk tolerance.

- 40% of Stocks: Investing for the medium-term or low risk tolerance.

These are only rules of thumb, of course. Nothing prevents you from a 75/25 portfolio. It would be a perfectly fine portfolio.

And one last thing on asset allocation: It does not need to be set in stone. You should not change it often. But you can change it. First, as you age, your risk tolerance may change. And as you get closer to your term, you may want to increase the bonds to avoid a big surprise.

If you want to see the difference between asset allocations, you can check these retirement simulations. And if you need more details on this subject, I have an entire guide about asset allocation.

Choose a portfolio

Now, you know the allocation to stocks and bonds in your portfolio. It remains for you to decide on what indexes you will invest in. You do not have to pick stocks. But you still need to pick indexes.

Choosing a portfolio is essential. You should not rush this decision. You must choose a portfolio that will suit your needs.

To simplify your search, you should avoid index funds that are too specific. For instance, you should not invest in sector index funds. These funds are investing in only one sector, such as Technology. They introduce a bias towards an industry. Keep it simple and invest in whole countries.

The same is true for funds that only invest in companies of some sizes. For instance, some funds are invested only in small companies. This is also a bet on which companies are doing to do best. And you should avoid bets! You need to bet on the entire market. It is the safest bet.

You will need to decide in which countries you want to invest. If you live in a vast country like the United States, you can invest only in your country. But if you live in a tiny country like Switzerland, it is best to diversify across many countries.

If you have bonds in your portfolio, I recommend only investing in bonds from your country in your currency. The idea of bonds is that they will reduce the volatility of your portfolio. If you add currency risks to that, you lose some of the advantages of bonds.

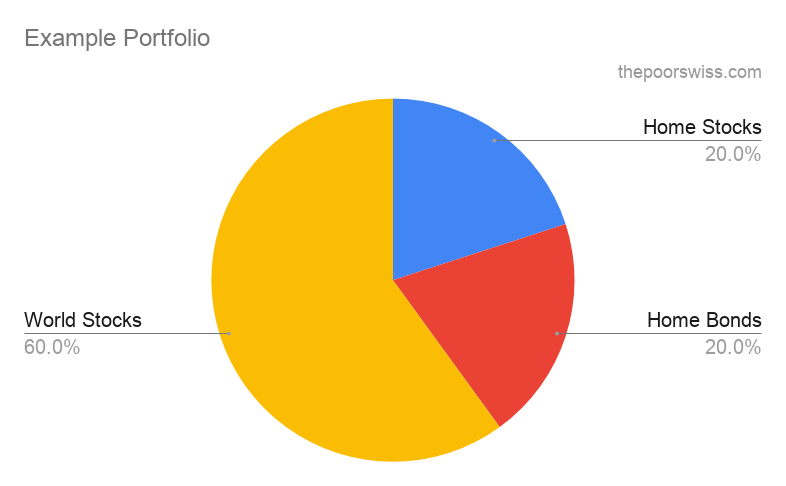

A good portfolio could be 80% of World Stocks and 20% of Swiss Stocks for Switzerland. If you want bonds, you could do 60% of World Stocks, 20% of Swiss Stocks, and 20% of Swiss Bonds.

For me, the best funds are the ones covering the entire world. For instance, Vanguard Total World (VT) is an excellent ETF. It is the one I am investing 80% of our portfolio with. But there are others. I would recommend you consider a world portfolio as your base index fund.

Once you have decided which countries you want to invest in, you can pick the best index fund for each country. There are many tools to compare ETFs. My favorite tool for this is justETF.

If you want more information on this step, I have a complete guide on designing an ETF portfolio from scratch. This guide will help you choose an index, select a fund for this index and finally put your funds together to form your portfolio.

Decide how much you want to invest

Now, it is time to decide how much you will invest.

First, do you already have some money that you want to invest? If you already have a lot of cash, you can consider investing part of it.

Then, how much do you invest to invest regularly? Investing part of your monthly salary in the stock market is a good idea.

Of course, it is also a matter of how much you can invest. You must remember that this money will not always be available. You need to invest money that you do not need right now. If the market is down and you need the money, you will realize significant losses. So if you know you will need the money, do not invest it!

You should also keep some money in the form of an emergency fund. And you should not invest your emergency fund since you want it to be available.

An excellent way to get started is to start with lower amounts. You can decide to invest 100 CHF each month. Or it could a 1000 CHF. It will depend on your budget and means.

It is much better to get started now with 100 CHF per month than never to invest. Starting with little money will help you break your investing paralysis.

As for the frequency, I recommend investing every month. But some people prefer to invest quarterly. I think it is good to invest as soon as you have money available for it.

Decide how you want to invest

There is one more thing you need to decide. You have three main options to invest in the stock market:

- Invest through a bank

- Invest through a Robo-advisor

- Invest yourself

I would discourage you from trying option one. Banks are expensive to invest in and are the worst option. There remain two options, investing by yourself or through a Robo-advisor.

By investing by yourself, you will maximize the efficiency of your portfolio and minimize the fees. However, this means more complexity and time necessary to invest. And you also have more margin for errors and personal decisions.

On the other hand, a Robo-advisor will add substantial fees to manage your portfolio. This is easier. Since the platform will manage your portfolio, you will have few things to do.

I invest myself and recommend most people do that. However, if you do not feel ready, investing with a Robo-advisor is much better than not investing.

For more information, you can read about how much time investing by yourself takes and the different levels of investing.

Choose a broker

You know enough things and have decided on what to invest in. It is time to get started with the actual investing.

You will not need a broker if you use mutual funds instead of ETFs. You just need to create an account with the chosen fund provider.

For investing in the stock market, you must use a brokerage company (a broker for short). Your broker is the intermediary between you and the stock exchange. Against a small fee (more on that later), the broker will place orders for you on the stock exchange. Without a broker account, you will not be able to buy shares of your funds on the stock market.

Each country has many brokers. Most big banks will be brokers themselves. However, banks are not the best option for a brokerage account. They are way too expensive. We are talking about an order of magnitude more expensive.

As a small example, we would buy 2000 dollars of shares on the New York Stock Exchange (NYSE). In PostFinance, this would cost us 35 USD. With Interactive Brokers (IB), this would cost us 0.5 USD! PostFinance is 70 times more expensive than IB.

The broker you need to buy stocks and ETFs reliably and at extremely affordable prices. Trade U.S. stocks for as little as 0.5 USD!

- Extremely affordable

- Wide range of investing instruments

For Europe, there are two great brokers:

- Interactive Brokers. It is a U.S. broker with a U.K. branch for European people. They have very low prices and offer a wide range of investments.

- DEGIRO. It is a European broker from the Netherlands. They also offer a good range of investments at low prices.

I recommend IB over DEGIRO because they have lower prices and a better offer of investments. They are also more professional, and I trust them more than DEGIRO.

I would recommend you start investing with IB. If you are still hesitant, I wrote a comparison of Interactive Brokers and DEGIRO.

If you want to avoid foreign brokers, you can opt for a Swiss Broker.

Choose a Robo-advisor

If you decide to invest through a Robo-advisor, you must choose which. There are many Robo-advisors in Switzerland.

There are very significant differences between Robo-advisors:

- Some are much more expensive than others

- Some are investing differently

- Some are much more complicated than others

|

4.5

|

4.0

|

|

Great Robo-Advisor

|

Very affordable

|

|

|

|

|

|

Good

|

Good

|

- Beginner-Friendly

- Degressive Fees

- Great diversification

- A good strategy with ETF

- Little customization

- Outstanding fees

- Very customizable

- Great diversification

- A good strategy with ETF

- High minimums

- Not always easy to use

For Robo-advisors, I recommend going with either:

- True Wealth for their excellent fees

- Selma for their simplicity

You can also try both if you want and decide later which one you want.

Make your first investment!

You have now made all the necessary decisions. You can make your first investment in the stock market!

If you are using a mutual fund, transfer your funds to the mutual fund provider and invest the funds in your choice’s mutual fund.

If you are using an ETF, transfer money to your broker account and purchase shares of the ETF of your choice.

Congratulations, you are now invested in the stock market!

Keep it going

Getting started with investing is a great thing. But you need to keep it going. From now on, you should invest regularly.

I recommend investing every month. Even if it is small amounts, it will pile up quickly. It is how I am investing. After receiving my salary and paying all the bills every month, I transfer the remaining amount to my broker account. And from there, I buy the shares of my portfolio.

To limit your costs, I recommend buying only one ETF shares each month. The best way to invest is to purchase shares of the ETF that is the most out of balance.

For instance, you want 60% of the VT ETF and 40% of the CHSPI ETF. If you only have 30% CHSPI, you buy shares of CHSPI this month. On the other hand, if you have 55% of VT, you buy VT this month. It is a great simple way to keep your portfolio balanced.

Conclusion

Following all these steps will help you start investing in the stock market. Investing is a great way to make your money work for you. And it will help you beat inflation.

I realize these are many steps. But these are all small steps. You do not have to rush through them. Even if this takes you one month to decide on everything, this is fine. You do not want to rush any decision.

Once you start developing a routine of investing, it will get simpler. And as soon as you begin to get the investing going, you will start to see the benefits of investing. It feels great when your portfolio grows without you doing anything.

I hope this will help you get started. If there is still something unclear, let me know in the comments below.

To get started, you can read more about the best brokers in Switzerland. Or, if you want to get started with IB, find out how to buy your first ETF with IB.

If you want more reading about the stock market, you can read about the myths surrounding the stock market.

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-book

Thank you for this article. It is certainly well suited for “beginners” and helpful. Just a technical note which is a bit confusing to more “knowledgeable investors”; you use the term duration (within the section stocks vs bonds) and contextually refer to the time to maturity (or similar) where duration would actually be a first order risk metric (bond price sensitivity to interest rate delta).

Hi SB

Thanks for the feedback! I should indeed improve that part!

Great article (as usual!).

Just a thought, but what about an article on theme trading, maybe? Those opportunities seem to pop up left and right and, sometimes, they sound too good to be true … especially when it comes down to fees!

Thanks!

Hi Cris,

For me, themes trading can be done with targeted ETFs, like Green Energy ETFs or Pharma ETFs, no?

Where did you find great fees for themes trading?

Since I don’t invest myself in any of that, I don’t think I will write an entire article on the subject.

Great article… I have a question though I am relatively young and dont have a big capital. Next year I will earn 1500/month and i have saved around 15 thousand. But some of this money will be needed for a car. Is it even worth for me to invest in a fund, considering that for IB I have to pay 10 CHF every month?

Thanks for your great content.

Kind regards

Hi Timon,

Regarding the fees, I think it’s worth it, yes. But you could consider using DEGIRO if you want something a little cheaper.

On the other hand, if you need the money in the near future, you should probably not invest it.

Thanks a lot for the fast answer.

I just read your post about Investar (https://thepoorswiss.com/investart-review/#Investart_vs_a_broker) if I understood correctly Investar does not have any fees and they even recently added VT, the etf i plan to invest in, is there any reason why I would choose IB over investar, since the fees at IB (especially the 10 CHF/month fee) would be relatively expensive for someone who cant invest a lot of money.

DEGIRO has the same problem as IB even tho the fees seem to be lower for me, but DEGIRO also doesnt offer VT or other american etf’s, which is very inconvenient, especially for someone like me who is very very new to this whole investing thing.

That’s correct, now they even cheaper than IB, and they just gained a good advantage with U.S. ETFs.

If you are serious with investing and in the long-term, I believe that IB is significantly superior to DEGIRO.

IB still has the advantage that you can do what you want (may not be an advantage depending on you). So, if you want to invest in another ETF that is not at investart, you can do it. If you want to invest in a company directly (not an ETF), you can also do so. It’s basically more flexibility. But Investart will have the advantage of being free and being simpler.

Thanks for the answer!

I am going to open an Investar account, no fees at all sounds incredible and I am perfectly content with their offering because i do not plan to invest in specific stocks (I do not believe i am capable of outperforming the market, index funds or similar things are good enough).

If you have a referral link I will happily use it, you were incredible helpful and informative. (I already searched this article https://thepoorswiss.com/investart-review/ for a referral link but couldn’t find one, only a link to the homepage of Investar)

I will wait until tomorrow evening so that I can use your referral if you have one.

Keep up the good work! And thank you.

Good luck with your investing!

Unfortunately, I do not have any referral links, thanks for asking!

Hi there,

First of all thanks for all the articles you write. They have been of massive help as most of the investing and financial resources that I have studied are entirely US or CAN focused.

One thing I just can’t figure out and perhaps you’ve dealt with:

My investing account is in CHF and when buying US stocks I can buy on USD or CHF. Not sure what the best option is (I know that if I buy in USD I’m basically borrowing money from the broker…but the accumulation of buying power in USD might not be a bad idea in the long run).

What’s your strategy in that case?

Thanks again for all the amazing work!

Hi Rodrigo,

Do you have a margin account? If so, you can indeed invest with USD that you do not have.

Investing with leverage is a good way to multiply your profits. However, it also means you have some fort of debt, are paying interest on that debt and need to fulfill margin requirements. If you do a lot of margin and your shares are going down very sharply, your broker may do a margin call and ask you to either put more money into the account or liquidate your positions.

There are risks with margin that I do not want to take. But many people are doing so.

I always convert my CHF into USD before buying.

Thanks for stopping by!

Hello,

thank you so much for your article, and for the whole blog, it is simply amazing how much high-quality information you are sharing, and I do not think that I found anything such comprehensive and well explained elsewhere on the web. This is really precious for a beginner like me!

To quote a comment made by someone else previously, “You mentioned that your portfolio is 80% Vanguard Total World (VT). In another article, you said US ETFs won’t be available to swiss investors anymore” in the future (if I understood things could change in January 2022).

My question is: what does this exactly mean: if you have an investment in US ETFs on IB for instance, does that mean that you will not able to buy anymore shares from 2022? Does this imply that you will also have to sell all your shares or can you at least keep invested the money invested until that point in time?

Thanks for your reply, and keep up with the fantastic work!

Another fella from Canton of Fribourg like you :-)

Hi Maven,

I am really glad this is valuable to you!

Yes, it could change in 2022, still not sure of that. Normally, you won’t be forced to sell, but you won’t be able to buy anymore indeed. That’s what happened when European investors lost the right to get access to these ETFs.

So, for now, I am still investing in VT :)

Hi, thanks for all information. It is really interesting!

I have a question. I’d like to buy Netflix, Tesla, Pinterest and perhaps Alphabet shares. I use swissquote. I’m not sure, if I should by shares directly over SIX or invest in an EFT that contains all this companies?

Is there a problem to buy stocks form companies from the US?

Thank you in advance.

Hi Charlotte,

If you want to buy U.S. Stocks, you should not buy them on SIX, but on their respective stock exchanges like NYSE.

I recommend investing in index funds, but you are free to invest in single stocks, if you are aware of the risks and the downsides.

There is no problem buying shares of U.S. companies.

Thanks for stopping by!

Hello,

Are the U.S. ETFs still available via Interactive Brokers from Switzerland in 2021 ? If yes is there any news when this availability will expire as in other European countries ?

Thank you in advance.

They still are available so far yes. And no, I still do not know if or when they will stop being available.

Hi Mr. TPS. Thanks for this fantastic blog.

I’m a beginner investor and I’m considering Trading212 over Degiro as my online broker.

Apparently it’s better in terms of general fees, usability of the interface and you can get fraction stocks.

I wonder if you had any experience with T212?

Thanks a lot in advance!

Roberto

Hi,

I never did any research about Trading212. They look interesting. It seems the fees are good but the spread could be tighter.

It also seems that you can only use the mobile app. For me, this is definitely a blocker. And I do not like their focus on cryptocurrencies.

It also seems like they do not give you access to the Swiss stock exchange and that you cannot wire CHF for free on your account.

Reviews look positive and it looks legit. But it’s a bit young and too shiny for me.

Thanks for stopping by!

Thanks a lot for your comment!

> It also seems that you can only use the mobile app

They do have a full website experience, you can check it out here: https://demo.trading212.com/

> And I do not like their focus on cryptocurrencies.

Actually I don’t believe they offer crypto at all. Perhaps you were referring to CDF? I personally dislike CDF as well.

> you cannot wire CHF for free on your account.

Based on their T&C I think you actually can. Stocks and indices are traded in GBP, EUR or USD depending on their origin. But you can wire CHF for free on your account and the conversion fee from CHF to EUR or USD is 0.

> It also seems like they do not give you access to the Swiss stock exchange

Unfortunately, this is true so far. And it might be a deal breaker for me as well.

Thanks a lot for your comment!

Thanks for sharing. I did my analysis a while back, they seem to have improved things so far!

You are right, I meant CFD and not crypto, which are instruments that should not be permitted in Europe in my opinion.

On their trading Terms, they only mention USD and EUR. But I have seen on the forum that people with Neon card were able to send CHF for free. So it’s becoming an interesting alternative now.

Thank you for the great article. Really helpful.

I like your suggestion about VT ETF but not sure about – what is the currency risk ? as at the end i need my money in CHF and you also mentioned about converting money yourself (CHF to USD) – what is best option here.

Hi AP,

There is a risk indeed since VT is investing in USD. But the risk is actually global. Almost all global companies are invested in the United States. So even if you invest only in Swiss companies, you have a risk if the dollar moves too high or too low.

If you want to reduce that risk, you can invest in currency-hedged ETFs. I have an article about currency hedging.

But there is no way to fully eliminate that risk.

Thanks for stopping by!

Thank you for the information. I follow consistently your blog, and started investing in VT ETF on IB. This is actually the only investment I have there, would this be considered “enough” diversification? is a re-balancing required considering that this is the only ETF I have in my portfolio?

Hi ZugerGirl,

I think this is enough diversification. You have thousands of stocks in multiple countries. My portfolio consists of only 80% VT and 20% CHSPI for my home bias. So, it’s very close to yours.

And indeed, if you have a single ETF, there is no need to ever rebalance anything :) Which is another advantage of simplicity!

Thanks for stopping by!