You should invest every month not every quarter

| Updated: |(Disclosure: Some of the links below may be affiliate links)

I have recently read a recommendation to invest only once a quarter instead of more frequently. Investing every quarter is bad advice, and I want to explain why in this article.

As I have a lot of data, I figured the best way to provide it would be to run simulations. And so I did!

In this article, I will show you why you should invest every month and not less frequently than that.

Investing Every Month

Every month, I transfer the money left to my broker account after I pay my monthly bills. And as soon as the money reaches my broker account, I invest it in the stock market. I only invest in a single Exchange Traded Fund (ETF) every month.

This strategy is straightforward, but it works quite well. And contrary to what people believe, it takes me very little time. It does not take me more than 10 minutes per month.

I have always recommended that my readers invest every month and not less frequently.

But there are other advantages to this than just being simple and easy. By investing the money that you have, you are always invested in the market. You do not have to wait several months for this money to be invested. It means your money does not wait with a zero interest rate in your bank account. Instead, it can get returns from the stock market earlier. And it is much better to build a habit when you build it more frequently.

For me, it is clear that people will lose money when they invest every quarter instead of every month. But until now, I have never done the simulations. It is time to change that!

We will find out exactly how much quarterly investors lose compared to monthly investors!

Differences in investing frequencies

The best way to know whether investing every month or every quarter makes any difference is by running simulations! And it turns out I have a wealth of historical data available!

I have collected a lot of data for my simulations of the Trinity Study. I have the monthly returns of the U.S. stock market from 1871 to 2019. So, I can use this data to see the difference between different investing frequencies.

We start with the average portfolio after ten years of investing. The investor is investing 1000 USD per month. If the investing frequency is two months, the investor will wait two months and invest 2000 USD. And if the frequency is six months, the investor will wait six months and invest 6000 USD. At the end of the simulation period, I will take the average portfolio value into account.

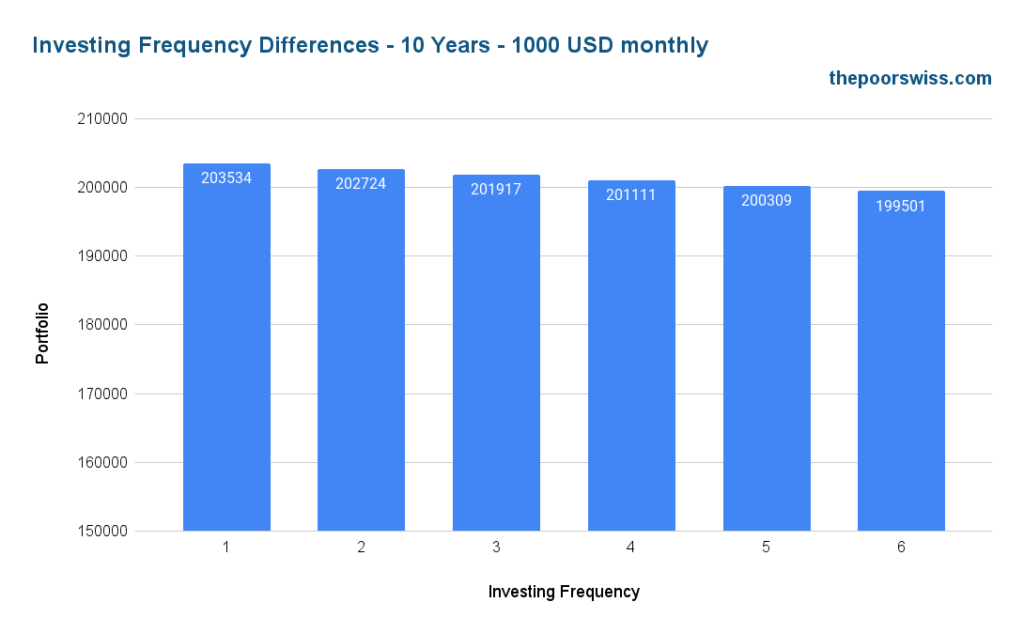

So, here is the difference after ten years of investing:

After ten years, if you invest once per quarter, you have already lost 1617 USD. And if you invest even less frequently every six months, you have lost 4033 USD! And it is only by investing 1000 USD every month.

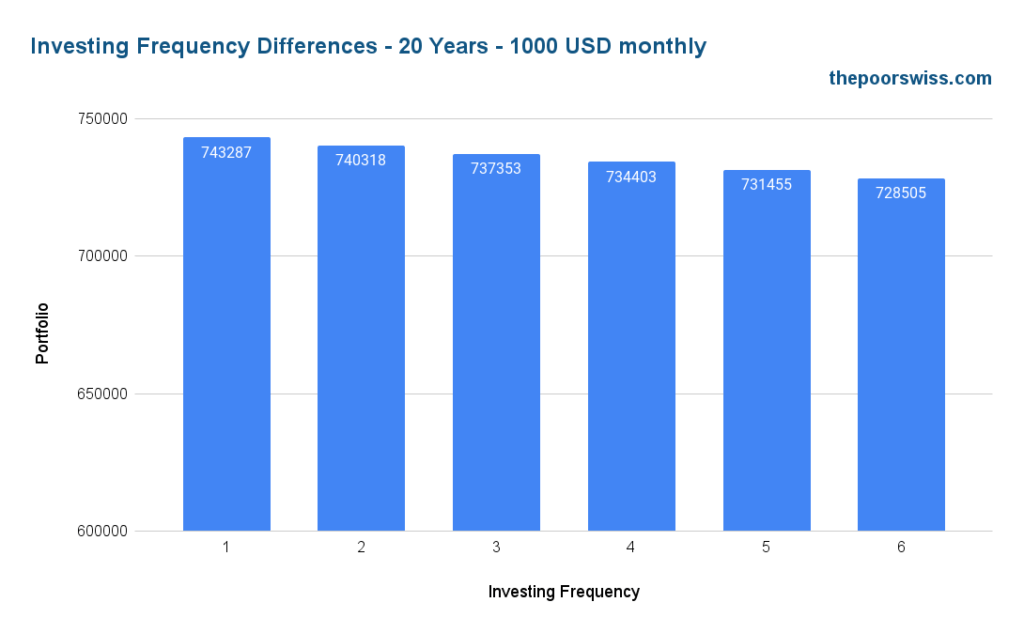

Here is what happens after 20 years.

After 20 years, the quarterly investor lost 5934 USD compared to the monthly investor. For most people, this is more than one month of monthly expenses. So, the quarterly investor wasted one month already!

What if we invest more?

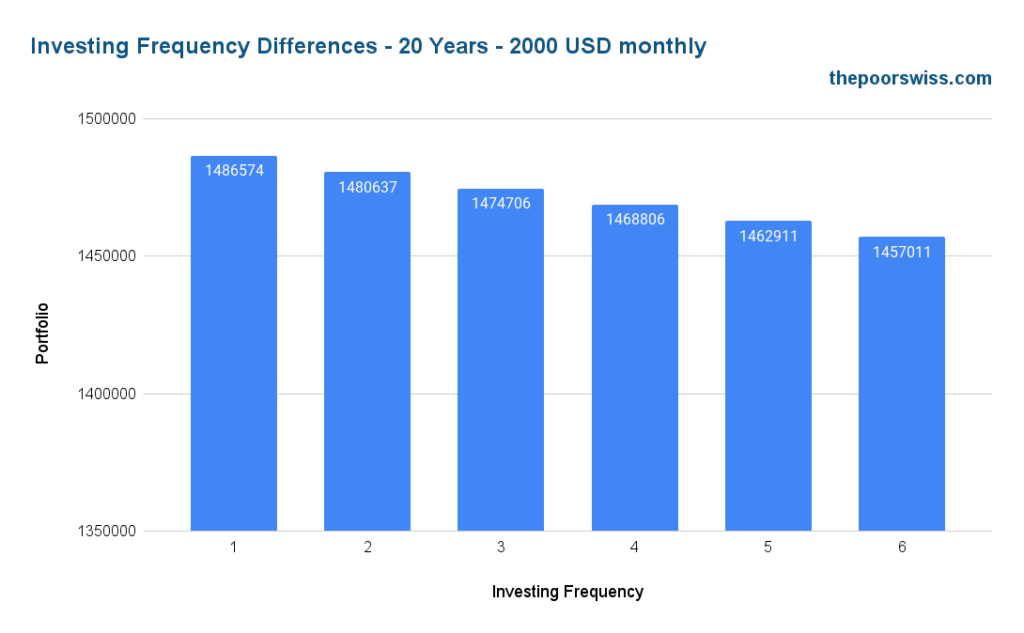

Until now, our scenarios only invested 1000 USD per month. Here is what happens if our investors invest 2000 USD every month.

When we invest more every month, the differences are higher between each investing frequency. By investing every quarter instead of every month, our investor is losing 11868 USD! This is at least two months of monthly expenses wasted!

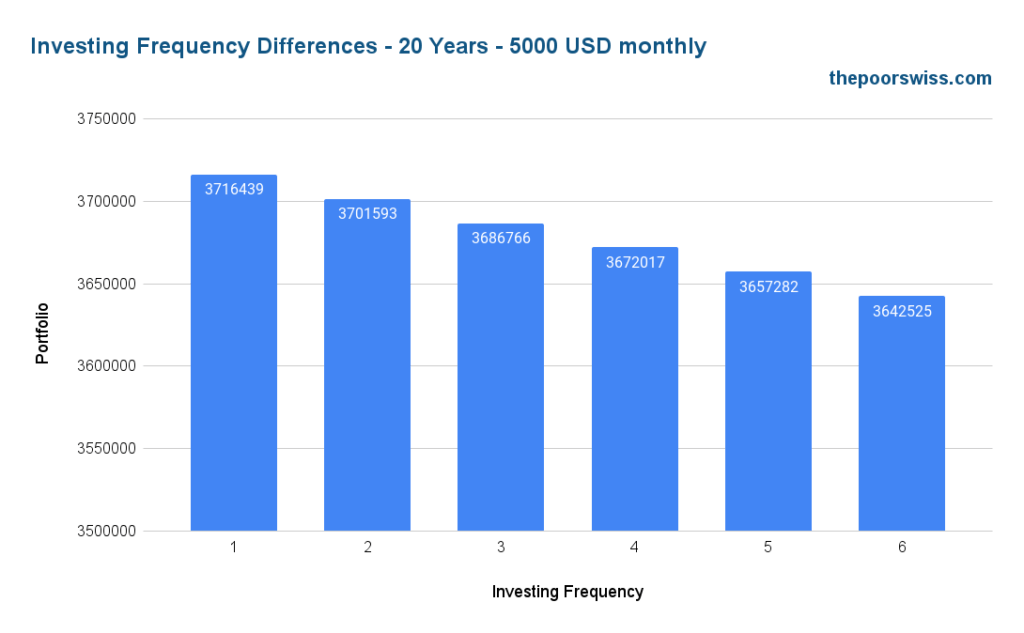

Finally, we increase that to 5000 USD per month.

Over 20 years, by investing quarterly instead of every month, our investor has lost 29673 USD! For most people, this is half a year of monthly expenses. I am sure this is not worth the few minutes saved each quarter!

What about the worst case?

Until now, we have seen the average portfolio value and, thus, the average loss of each investing frequency compared to investing every month. But we can also take a look at the worst case. By the worst case, I mean the worst possible loss an investing frequency different from every month could be.

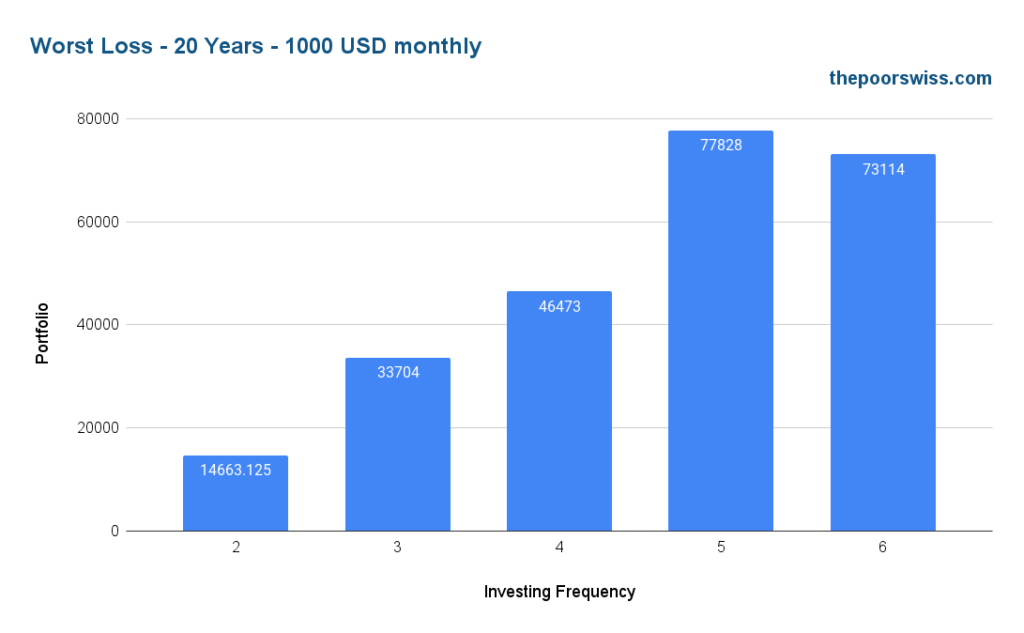

Here is the worst possible loss after 20 years and 1000 USD monthly investing.

By investing quarterly, the worst loss you could have is 33704 USD. With only investing 1000 USD per month, this is already a significant loss.

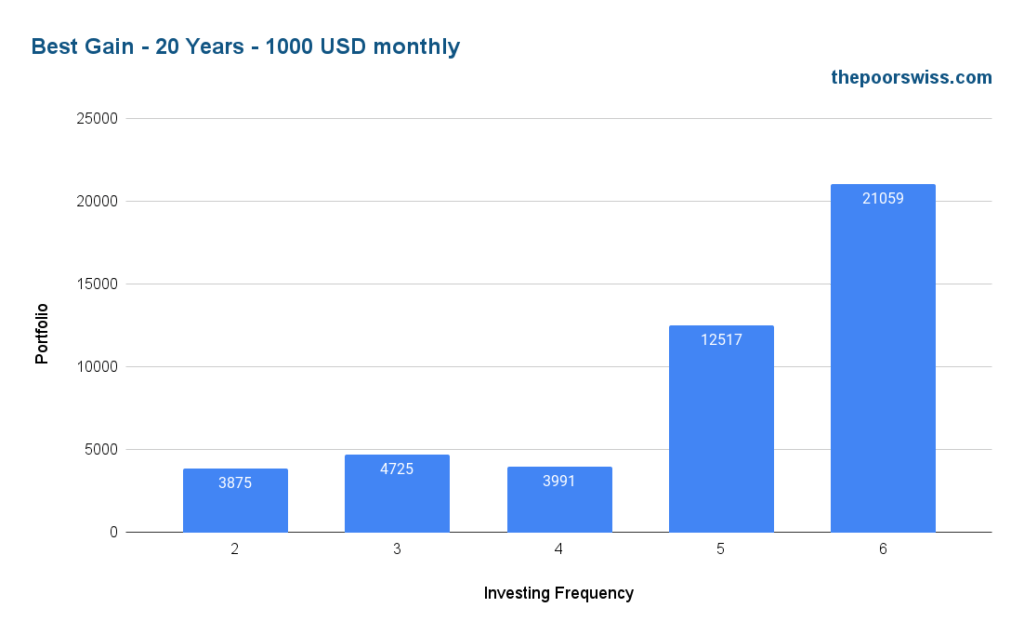

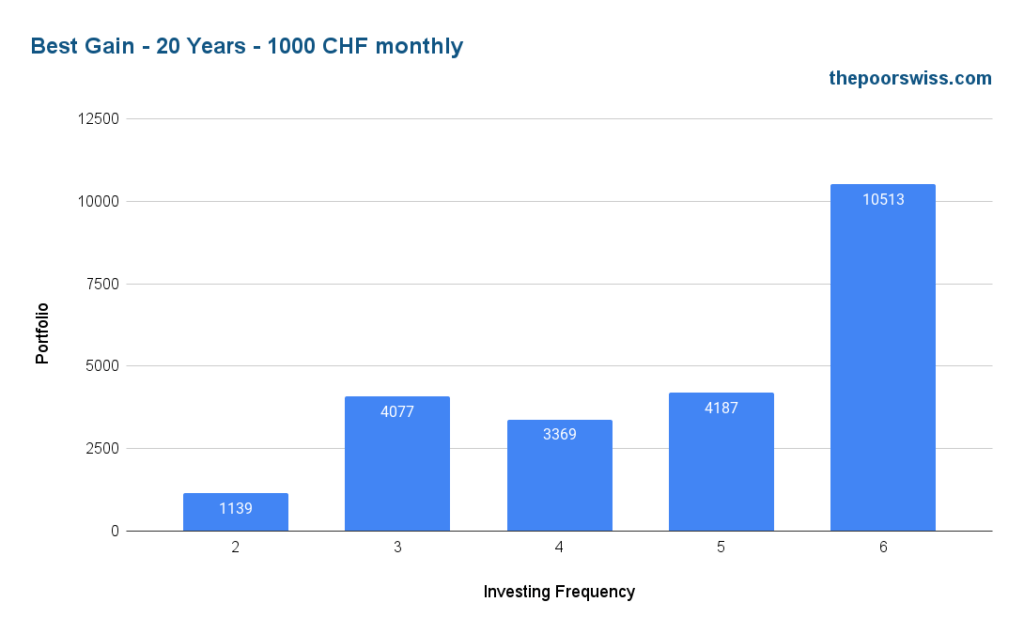

Of course, we have to look at the best case. There are some years when it is better to invest less frequently.

So, here are the best possible gains after 20 years with 1000 USD per month.

By investing quarterly, the best case would be to gain 4725 USD after 20 years.

So, we can summarize this scenario. After 20 years and 1000 USD invested per month, by investing quarterly:

- On average, you would lose 5’934 USD

- In the worst case, you would lose 33’704 USD

- In the best case, you would gain 4’725 USD

I do not know about you, but seeing that we lose money on average and that the worst is seven times more significant than the best case, I can easily say that investing every month has significant advantages over investing each quarter. And the same is true of any less frequent investing strategy.

What about the Swiss Stock Market?

Until now, we have talked bout the U.S. Stock market. We can run the same simulations on the Swiss Stocks Market. I also have the data for the Swiss Stock Market from 1924 to 2019.

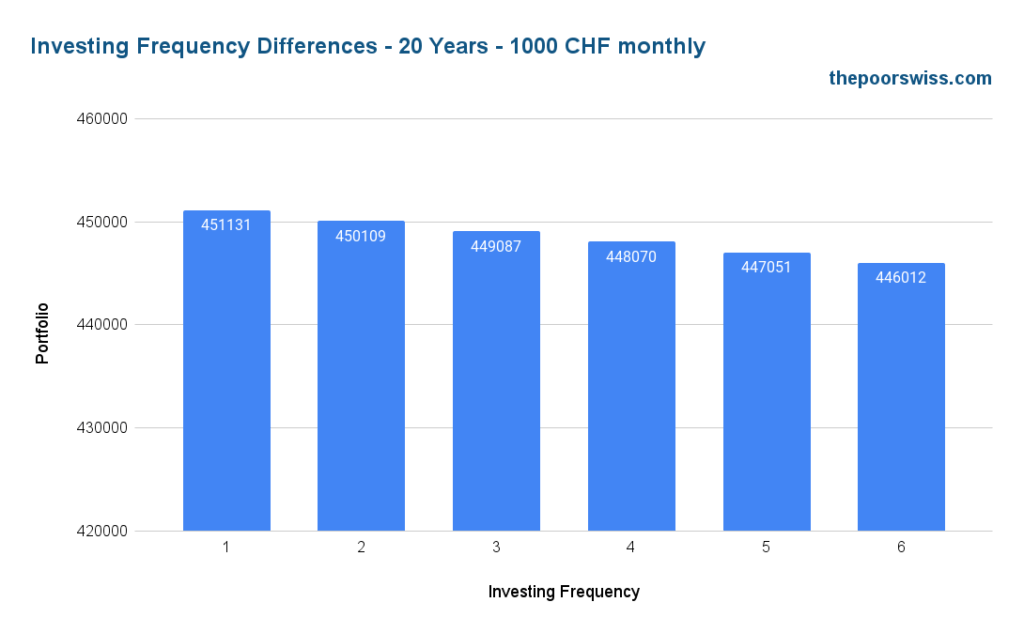

So, we run the same simulation for 20 years with 1000 CHF monthly investing in the Swiss Stock market.

On average, an investor on the Swiss Stock Market would lose 2044 CHF after 20 years. It is less important than the U.S. Stock Market. The reason is that the Swiss stock market returns less than the U.S. Stock Market.

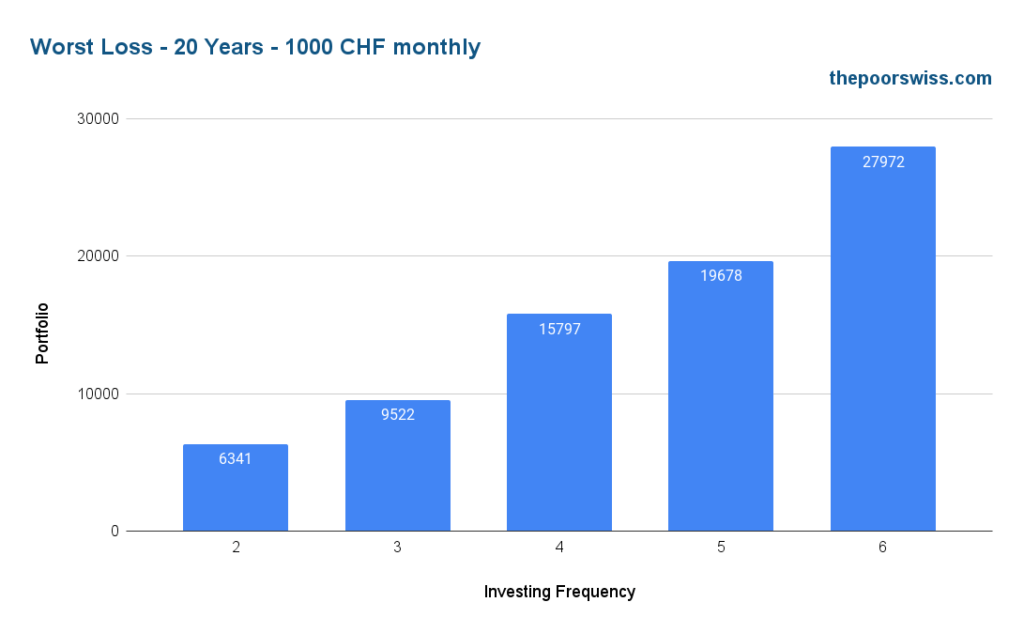

Here is the worst case for the same scenario:

The worst loss for investing quarterly would be 9522 CHF after 20 years. Again, this is less significant than for the U.S. But it remains a significant amount of money.

Finally, we look at the best case for the same scenario:

So, the best gain would be 4077 CHF after 20 years.

We now have all the numbers to summarize the differences in investing 3000 CHF quarterly in the Swiss Stock Market compared to investing 1000 CHF every month after 20 years:

- On average, you would lose 2’044 CHF

- In the worst case, you would lose 9’522 CHF

- In the best case, you would gain 4’077 CHF

Again, on average, we lose money, and the worst case is more significant than the best case, so investing every month in the Swiss Stock Market is better than investing quarterly.

What about fees?

One of the points the quarterly investors are making is that they want to reduce fees. So, we can see the difference in fees between different investing frequencies.

I already have a calculator for DEGIRO and Interactive Brokers, so I can also use it. For this comparison, I will only use the DEGIRO Basic and Interactive Brokers Tiered accounts since they are the cheapest. I will take the ETF fees into account for both markets (we ignore the fact that DEGIRO cut us out of the U.S. ETF market). And the last recommendation I saw about quarterly investing was using Interactive Brokers, the cheapest broker available to Swiss Investors.

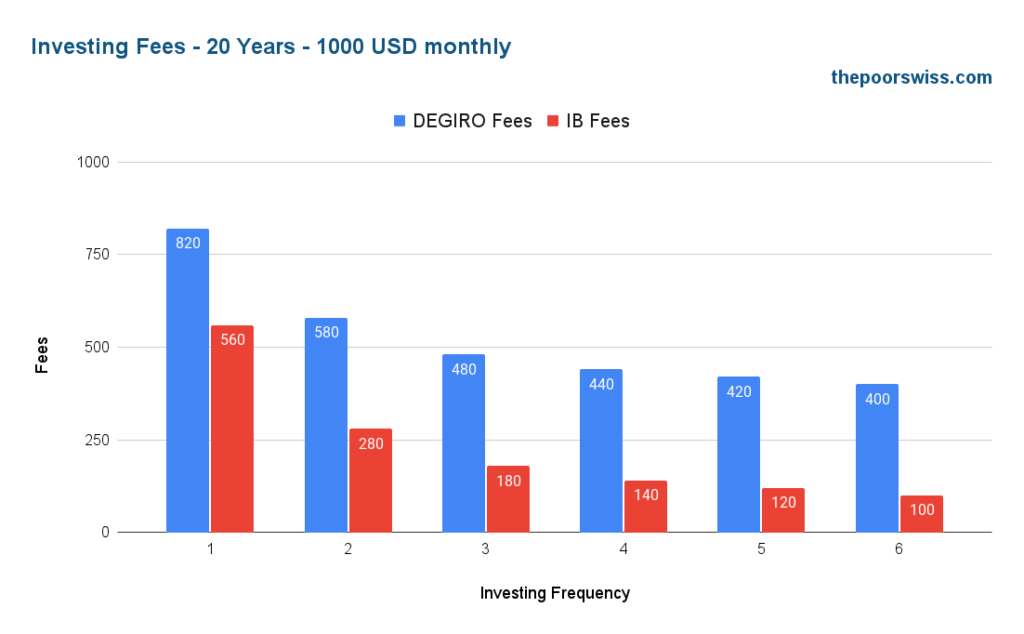

We start with the U.S. Stock Market. We can look at the fees for 20 years with these two brokers and 1000 monthly investing:

There are several interesting facts with these results. First, we can confirm that investing less frequently results in lower fees. But this is logical since most brokers have some flat fees. What is also interesting is that there is almost no reduction after the fourth month. So reducing the frequency to anything less frequent than quarterly does not make sense.

By investing in the U.S. stock market quarterly instead of every month, an investor can save 340 CHF over 20 years with DEGIRO and 380 CHF with Interactive Brokers. These savings represent less than 20 CHF per year.

We should put that in perspective with the average loss of 5’934 USD after 20 years. To save a maximum of 380 CHF, you are sacrificing 5934 USD! I hope you realize that it does not make sense. And keep in mind that this is only for 1000 USD invested monthly. The difference is even larger for more investing!

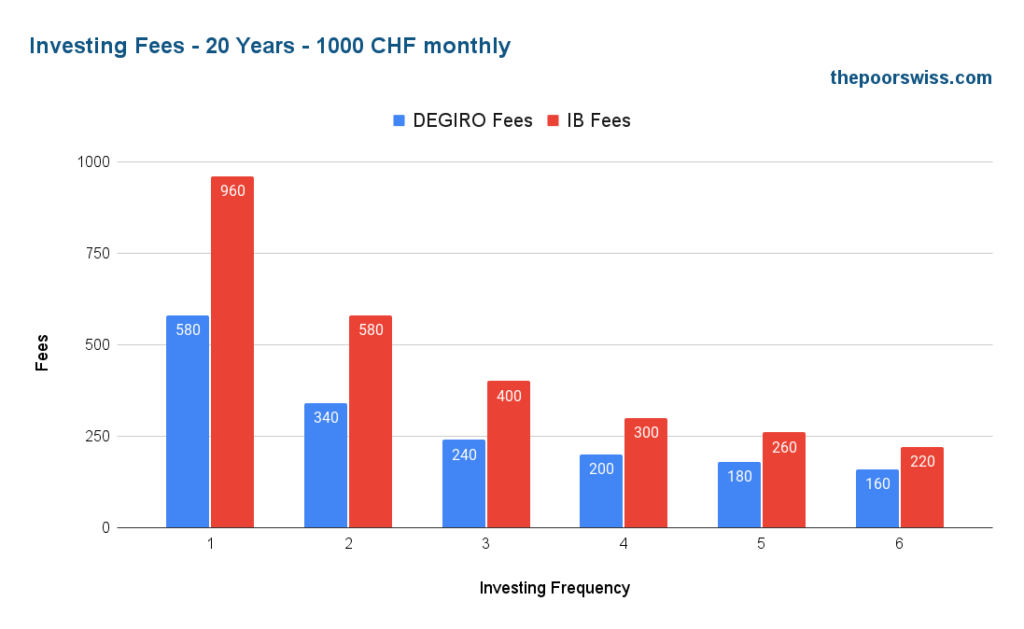

But maybe the Swiss Stock market is different. Here are the fees for 20 years of investing in the Swiss Stock Market.

For the Swiss Stock Market, we can see that DEGIRO is cheaper than Interactive Brokers. This does not make DEGIRO cheaper for a Swiss investor since we invest more in the U.S. than in Switzerland. But it is still interesting to note.

By investing in the U.S. stock market quarterly instead of every month, an investor can save 340 CHF over 20 years with DEGIRO and 560 CHF with Interactive Brokers. These savings represent less than 30 CHF per year. But we can see that we can save a little more on the Swiss Stock market than in the U.S. Stock Market.

Once again, we put that in perspective with the average loss of 2’044 CHF after 20 years. To save a maximum of 560 CHF, you are sacrificing 2044 CHF! Once again, it does not make sense to invest quarterly!

Conclusion

As you can see, you will not save any money by not investing every month. Investing every month is the most efficient strategy!

Some people will tell you to invest every quarter instead of every month. But you will lose money by investing quarterly. Indeed, by letting your money in a bank account, you are losing on the returns from the stock market. And the broker fees you are saving are not insignificant compared to the loss.

Some people will argue that you will save some time by investing quarterly. But honestly, if you are not willing to invest a quarter of an hour per month to buy an ETF (much less than that generally), you are not motivated enough! It is entirely worth your time (and your money) to spend a few hours per year investing in the stock market properly.

And if you think this is taking too long, you should consider automating your investments.

How often do you invest?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Investing Fundamentals

- More articles about Investing

- Value Investing: What is it? And should you do it?

- How to Choose an ETF or an Index Fund

- What Makes Vanguard Unique?

Hi,

I think this article might be incorrect. It all depends WHEN you invest quarterly. In your calculation, you assume we invest at the end of every quarter (e.g. wait a few months and then invest). However, if you invest in the beginning of each quarter, it should be more profitable than investing every month. If I were to invest 1000/month, and distribute that over Jan/Feb/Mar/Apr, the money will have less time to grow than if that 4000 was already in the account since Jan. Or am I missing something? What are your thoughts on this? Many thanks for your reply.

Hi Niels,

I don’t think this goes against the article. The conclusion of the article is that you should invest as soon as you have it.

But you can’t invest UNTIL you have the money. That’s why I wait until the end of the quarter, because at the beginning of the quarter, you only have the savings of a single month, not of 3.