You should invest every month not every quarter

| Updated: |(Disclosure: Some of the links below may be affiliate links)

I have recently read a recommendation to invest only once a quarter instead of more frequently. Investing every quarter is bad advice, and I want to explain why in this article.

As I have a lot of data, I figured the best way to provide it would be to run simulations. And so I did!

In this article, I will show you why you should invest every month and not less frequently than that.

Investing Every Month

Every month, I transfer the money left to my broker account after I pay my monthly bills. And as soon as the money reaches my broker account, I invest it in the stock market. I only invest in a single Exchange Traded Fund (ETF) every month.

This strategy is straightforward, but it works quite well. And contrary to what people believe, it takes me very little time. It does not take me more than 10 minutes per month.

I have always recommended that my readers invest every month and not less frequently.

But there are other advantages to this than just being simple and easy. By investing the money that you have, you are always invested in the market. You do not have to wait several months for this money to be invested. It means your money does not wait with a zero interest rate in your bank account. Instead, it can get returns from the stock market earlier. And it is much better to build a habit when you build it more frequently.

For me, it is clear that people will lose money when they invest every quarter instead of every month. But until now, I have never done the simulations. It is time to change that!

We will find out exactly how much quarterly investors lose compared to monthly investors!

Differences in investing frequencies

The best way to know whether investing every month or every quarter makes any difference is by running simulations! And it turns out I have a wealth of historical data available!

I have collected a lot of data for my simulations of the Trinity Study. I have the monthly returns of the U.S. stock market from 1871 to 2019. So, I can use this data to see the difference between different investing frequencies.

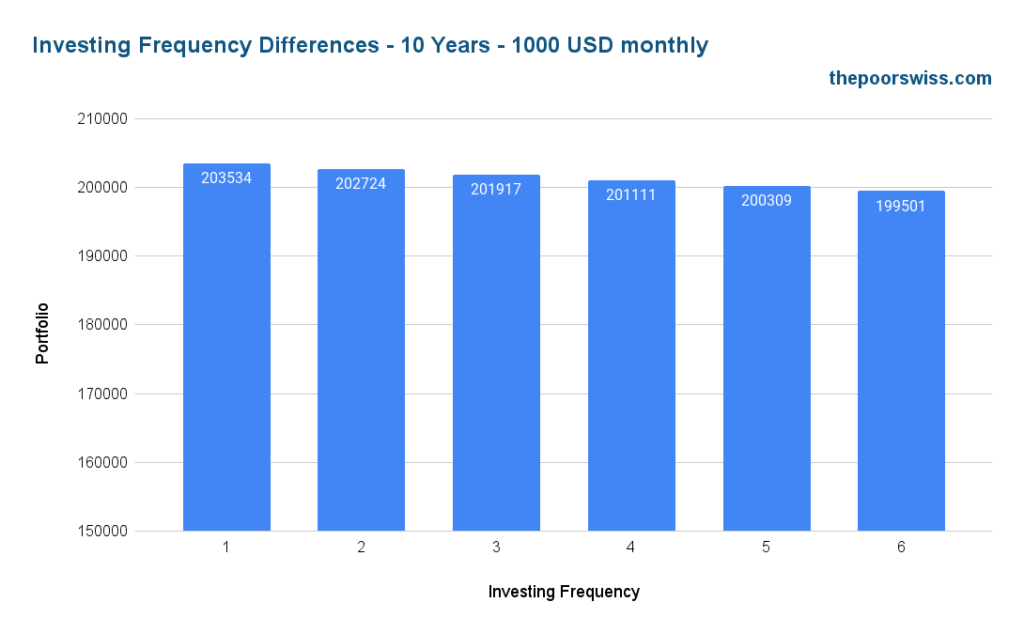

We start with the average portfolio after ten years of investing. The investor is investing 1000 USD per month. If the investing frequency is two months, the investor will wait two months and invest 2000 USD. And if the frequency is six months, the investor will wait six months and invest 6000 USD. At the end of the simulation period, I will take the average portfolio value into account.

So, here is the difference after ten years of investing:

After ten years, if you invest once per quarter, you have already lost 1617 USD. And if you invest even less frequently every six months, you have lost 4033 USD! And it is only by investing 1000 USD every month.

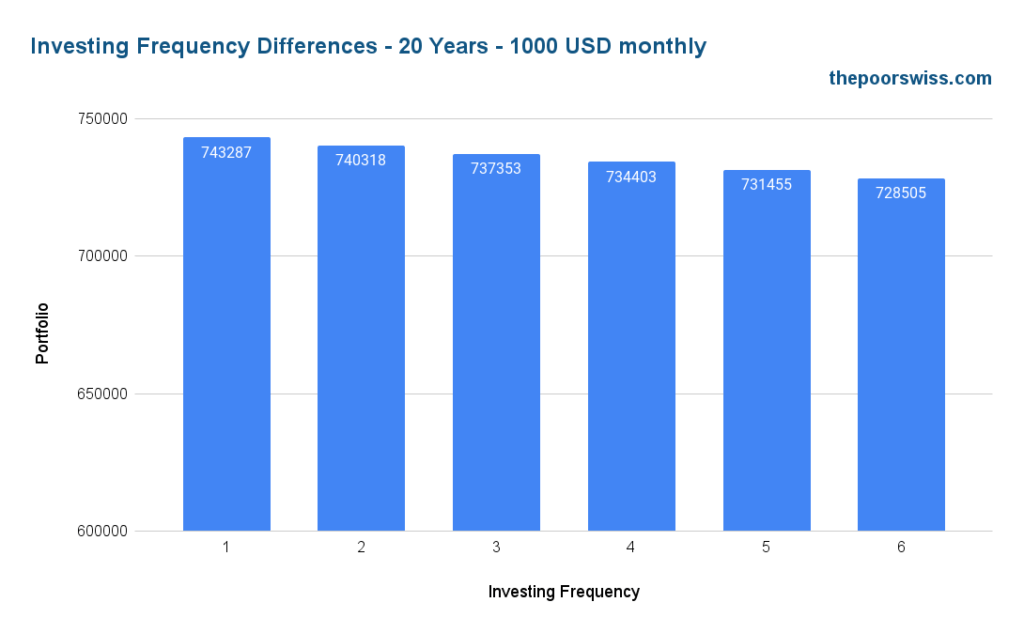

Here is what happens after 20 years.

After 20 years, the quarterly investor lost 5934 USD compared to the monthly investor. For most people, this is more than one month of monthly expenses. So, the quarterly investor wasted one month already!

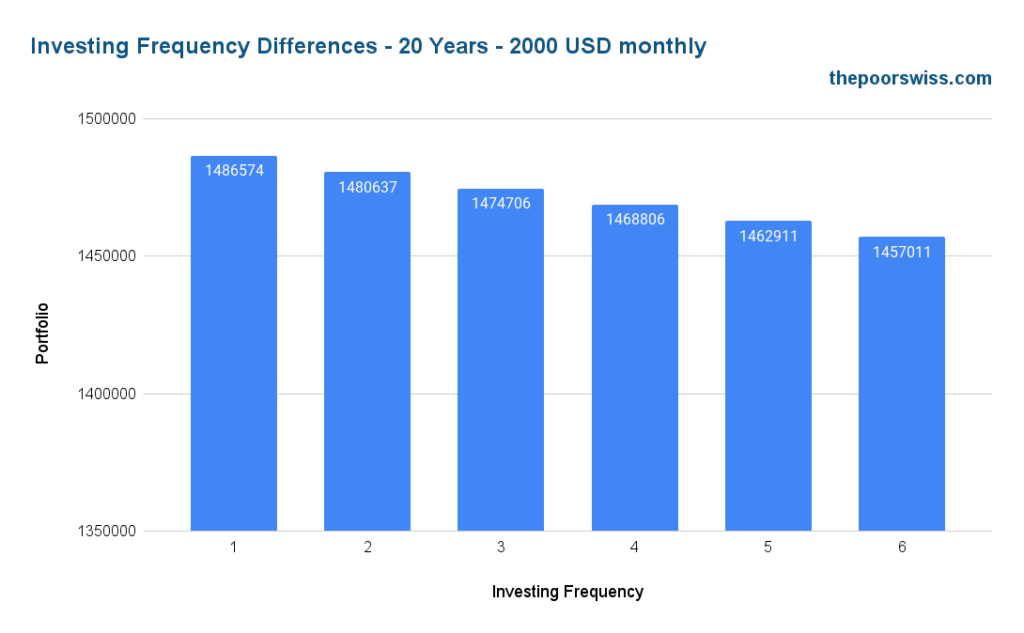

What if we invest more?

Until now, our scenarios only invested 1000 USD per month. Here is what happens if our investors invest 2000 USD every month.

When we invest more every month, the differences are higher between each investing frequency. By investing every quarter instead of every month, our investor is losing 11868 USD! This is at least two months of monthly expenses wasted!

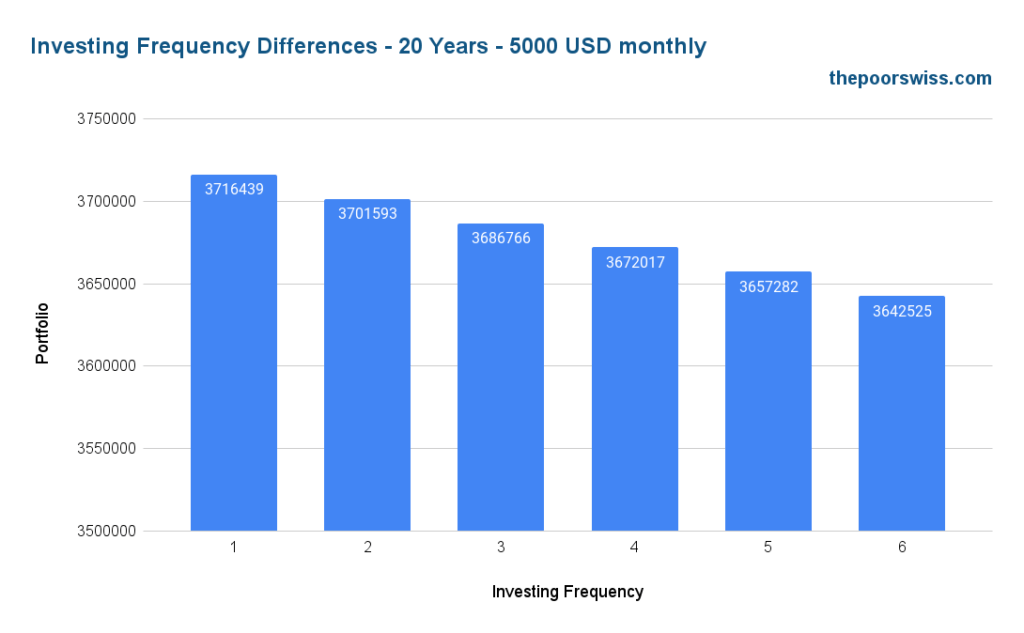

Finally, we increase that to 5000 USD per month.

Over 20 years, by investing quarterly instead of every month, our investor has lost 29673 USD! For most people, this is half a year of monthly expenses. I am sure this is not worth the few minutes saved each quarter!

What about the worst case?

Until now, we have seen the average portfolio value and, thus, the average loss of each investing frequency compared to investing every month. But we can also take a look at the worst case. By the worst case, I mean the worst possible loss an investing frequency different from every month could be.

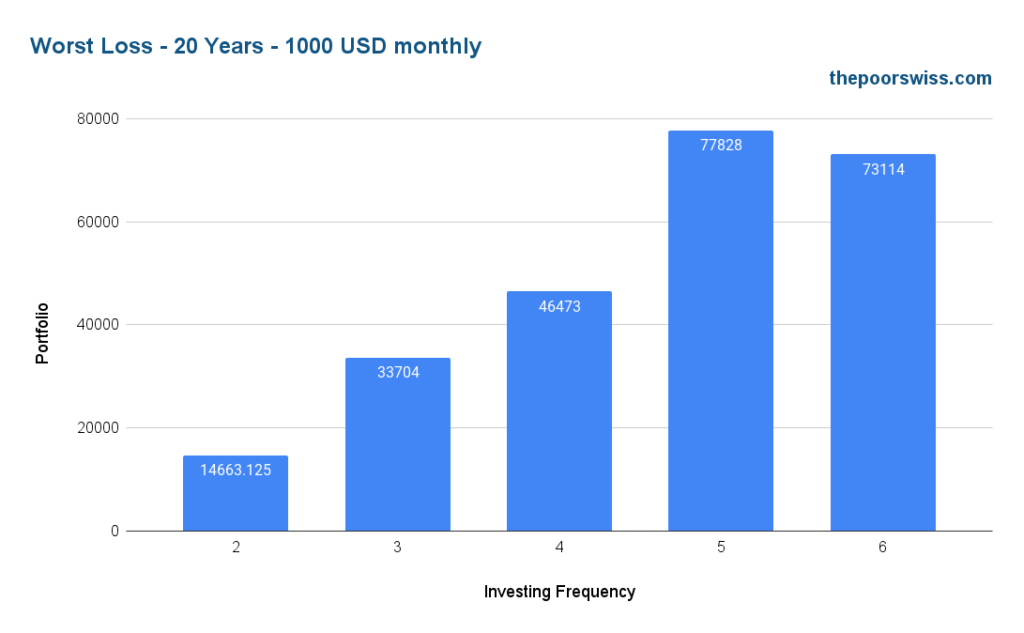

Here is the worst possible loss after 20 years and 1000 USD monthly investing.

By investing quarterly, the worst loss you could have is 33704 USD. With only investing 1000 USD per month, this is already a significant loss.

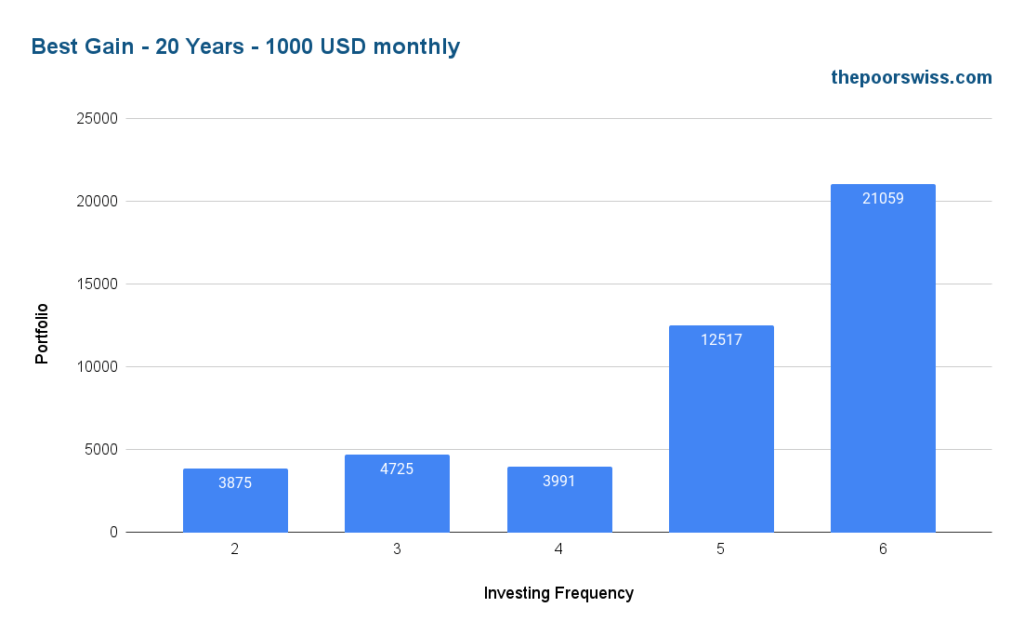

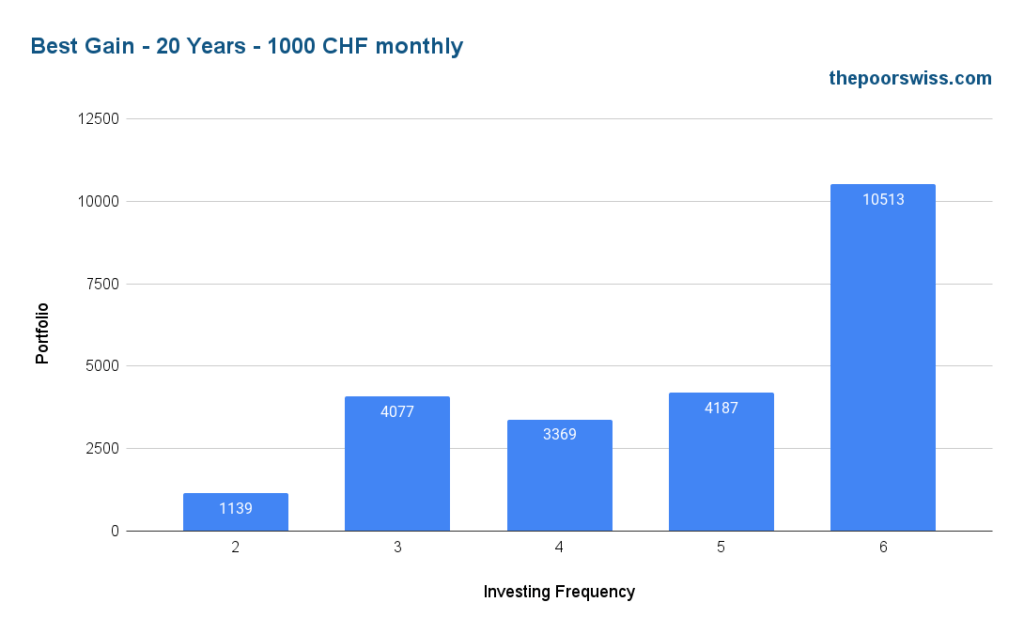

Of course, we have to look at the best case. There are some years when it is better to invest less frequently.

So, here are the best possible gains after 20 years with 1000 USD per month.

By investing quarterly, the best case would be to gain 4725 USD after 20 years.

So, we can summarize this scenario. After 20 years and 1000 USD invested per month, by investing quarterly:

- On average, you would lose 5’934 USD

- In the worst case, you would lose 33’704 USD

- In the best case, you would gain 4’725 USD

I do not know about you, but seeing that we lose money on average and that the worst is seven times more significant than the best case, I can easily say that investing every month has significant advantages over investing each quarter. And the same is true of any less frequent investing strategy.

What about the Swiss Stock Market?

Until now, we have talked bout the U.S. Stock market. We can run the same simulations on the Swiss Stocks Market. I also have the data for the Swiss Stock Market from 1924 to 2019.

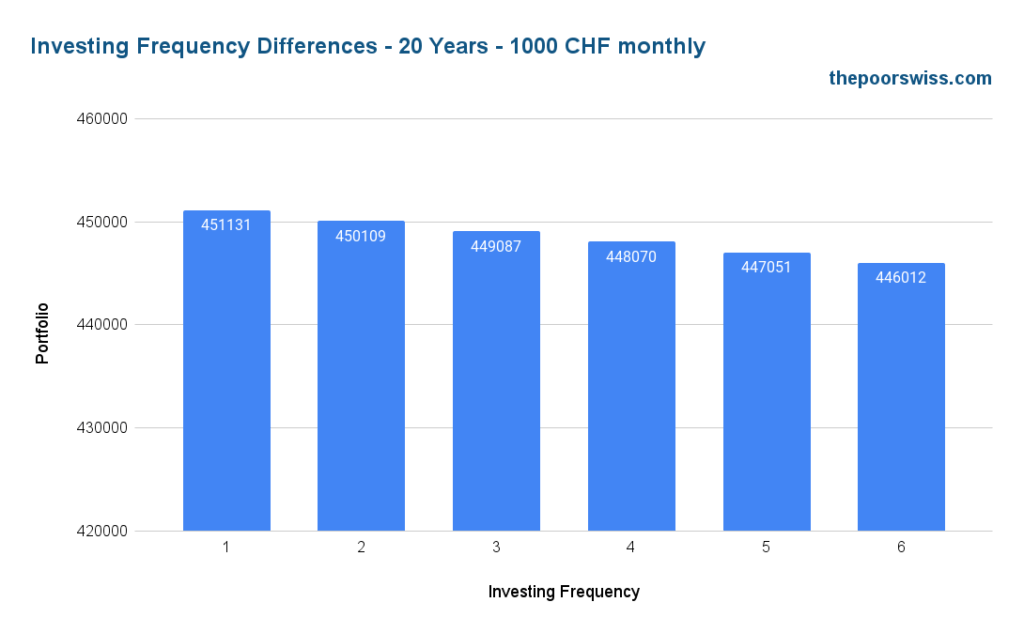

So, we run the same simulation for 20 years with 1000 CHF monthly investing in the Swiss Stock market.

On average, an investor on the Swiss Stock Market would lose 2044 CHF after 20 years. It is less important than the U.S. Stock Market. The reason is that the Swiss stock market returns less than the U.S. Stock Market.

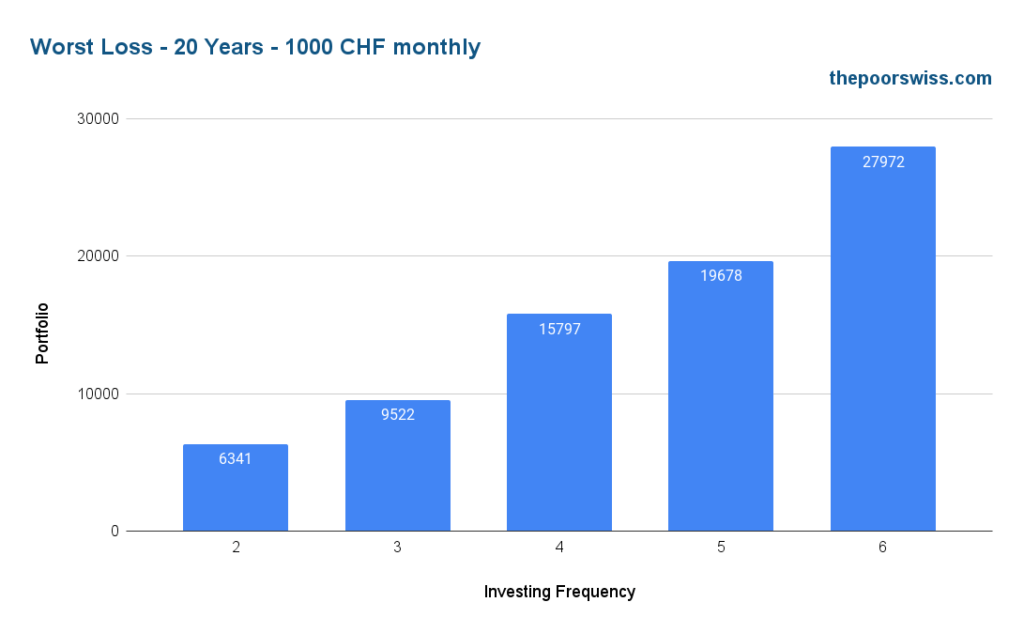

Here is the worst case for the same scenario:

The worst loss for investing quarterly would be 9522 CHF after 20 years. Again, this is less significant than for the U.S. But it remains a significant amount of money.

Finally, we look at the best case for the same scenario:

So, the best gain would be 4077 CHF after 20 years.

We now have all the numbers to summarize the differences in investing 3000 CHF quarterly in the Swiss Stock Market compared to investing 1000 CHF every month after 20 years:

- On average, you would lose 2’044 CHF

- In the worst case, you would lose 9’522 CHF

- In the best case, you would gain 4’077 CHF

Again, on average, we lose money, and the worst case is more significant than the best case, so investing every month in the Swiss Stock Market is better than investing quarterly.

What about fees?

One of the points the quarterly investors are making is that they want to reduce fees. So, we can see the difference in fees between different investing frequencies.

I already have a calculator for DEGIRO and Interactive Brokers, so I can also use it. For this comparison, I will only use the DEGIRO Basic and Interactive Brokers Tiered accounts since they are the cheapest. I will take the ETF fees into account for both markets (we ignore the fact that DEGIRO cut us out of the U.S. ETF market). And the last recommendation I saw about quarterly investing was using Interactive Brokers, the cheapest broker available to Swiss Investors.

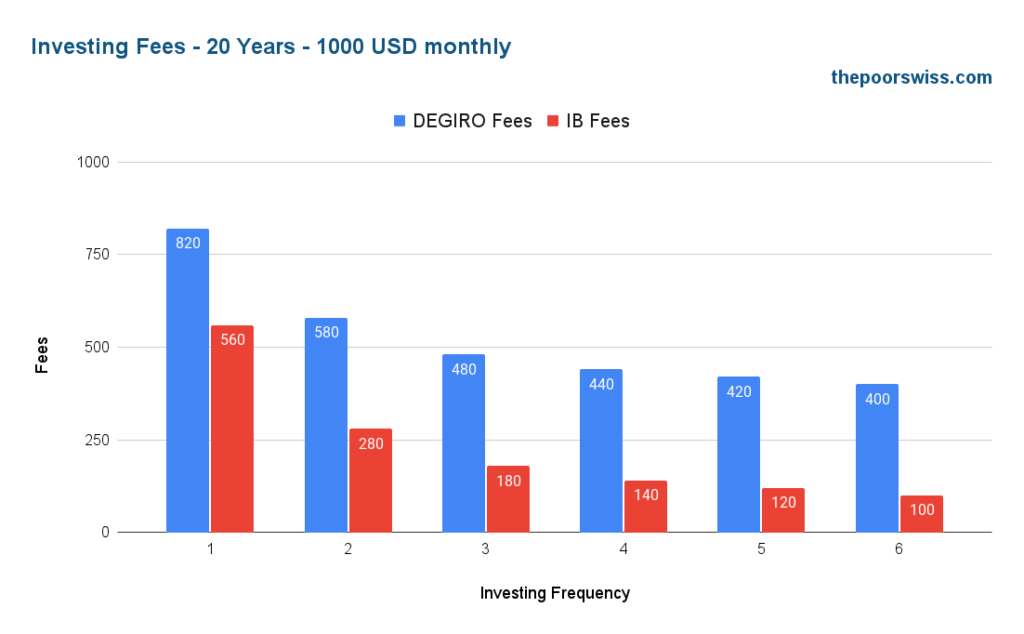

We start with the U.S. Stock Market. We can look at the fees for 20 years with these two brokers and 1000 monthly investing:

There are several interesting facts with these results. First, we can confirm that investing less frequently results in lower fees. But this is logical since most brokers have some flat fees. What is also interesting is that there is almost no reduction after the fourth month. So reducing the frequency to anything less frequent than quarterly does not make sense.

By investing in the U.S. stock market quarterly instead of every month, an investor can save 340 CHF over 20 years with DEGIRO and 380 CHF with Interactive Brokers. These savings represent less than 20 CHF per year.

We should put that in perspective with the average loss of 5’934 USD after 20 years. To save a maximum of 380 CHF, you are sacrificing 5934 USD! I hope you realize that it does not make sense. And keep in mind that this is only for 1000 USD invested monthly. The difference is even larger for more investing!

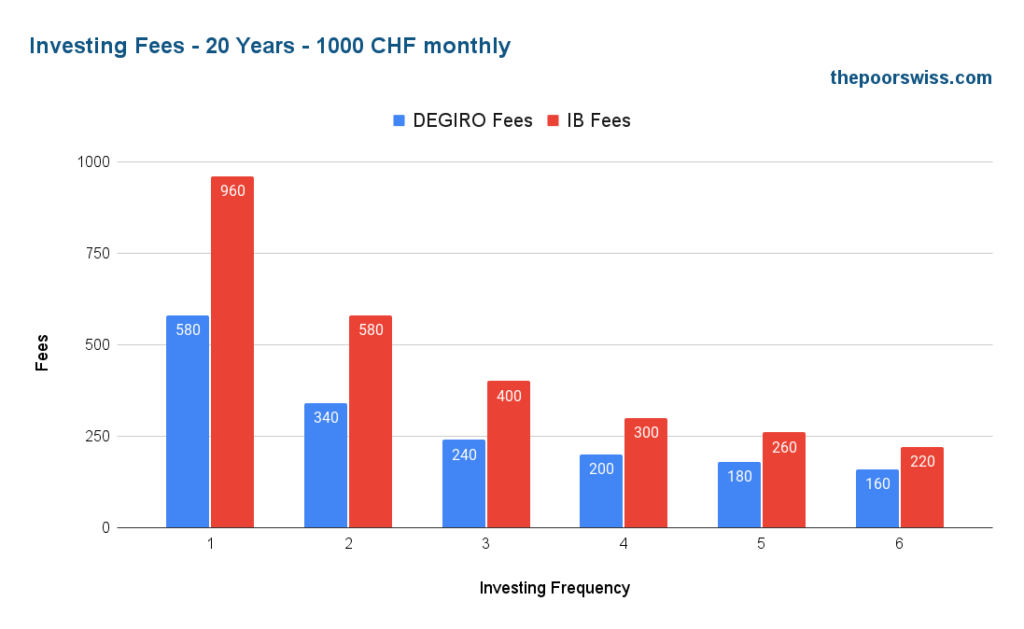

But maybe the Swiss Stock market is different. Here are the fees for 20 years of investing in the Swiss Stock Market.

For the Swiss Stock Market, we can see that DEGIRO is cheaper than Interactive Brokers. This does not make DEGIRO cheaper for a Swiss investor since we invest more in the U.S. than in Switzerland. But it is still interesting to note.

By investing in the U.S. stock market quarterly instead of every month, an investor can save 340 CHF over 20 years with DEGIRO and 560 CHF with Interactive Brokers. These savings represent less than 30 CHF per year. But we can see that we can save a little more on the Swiss Stock market than in the U.S. Stock Market.

Once again, we put that in perspective with the average loss of 2’044 CHF after 20 years. To save a maximum of 560 CHF, you are sacrificing 2044 CHF! Once again, it does not make sense to invest quarterly!

Conclusion

As you can see, you will not save any money by not investing every month. Investing every month is the most efficient strategy!

Some people will tell you to invest every quarter instead of every month. But you will lose money by investing quarterly. Indeed, by letting your money in a bank account, you are losing on the returns from the stock market. And the broker fees you are saving are not insignificant compared to the loss.

Some people will argue that you will save some time by investing quarterly. But honestly, if you are not willing to invest a quarter of an hour per month to buy an ETF (much less than that generally), you are not motivated enough! It is entirely worth your time (and your money) to spend a few hours per year investing in the stock market properly.

And if you think this is taking too long, you should consider automating your investments.

How often do you invest?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Investing Fundamentals

- More articles about Investing

- The Little Glossary of Investing: Every term you need to know

- How much time does investing take?

- The Millionaire Next Door – Book Review

Great article as usual 😀

What’s better for a 3A contribution?

Contribute first thing in the year (and get your investment working tax free asap) or make monthly contributions?

I would say it depends on whether you invest on the side or not.

If you only invest in your 3a, it’s better to invest at once at the beginning of the year. If you also invest in another product, you should invest first in the product with the lowest fees / highest returns.

However, I don’t think it matters much. I personally max my 3a out as early as possible just so I don’t have to think about it for the rest of the year.

Hi the poor Swiss,

I opened an account at IB and I would like to automate my investment in the ETF VC . I am not sure yet if i would like to make a daily/weekly/monthly invest, but what i know is that i need a tool to automate these invests, as i don’t want to do it manualy, this for different reasons. Do you know any tool which would fit my needs? Is there any?

This is what i get with truewealth (as soon as I send money there , it gets invested) and would like to replicate this for myself.

Best Regards, Christophe

Hi Christophe,

I am afraid I don’t know. A broker is not meant to be automated. Automation is the role of a robo-advisor as you pointed out.

I feel that monthly investing is more than enough and is little enough work that it does not to be automated.

IB has started supporting recurring investment in the last few months, which allows custom repetition and automatic currency conversion when buying ETF. With standing order that transfers money to IB, everything can be automated.

Correct :) https://thepoorswiss.com/automate-your-investments-interactive-brokers/

Hello,

I totally agree with you that investing monthly is better especially to build a habit of Investing.

but I have an issue that money transfer fees is so much 25-50 $ per month

so if I calculated the fees it will be 300-600$

if I investing 1500$ monthly

Monthly = 600$/18000$ % = 3%

Quarterly = 200$/18000$ % = 1.1%

so is this means for my case it will be better to invest quarterly to save the transfer fees ?

spite, I tend to invest monthly because I will lose some of the money just because it is cash on my account.

Why do you pay so high money transfer fees? You should try to optimize that first before optimizing your investing frequency.

Hello,

I plan to start with USD 1000, with 50% allocation to emerging market fund and 25% each in world stock and S&P500 Does this make sense? The cost shows as USD 4 per transaction ie USD 12 each month. Plus I incur USD 25 on bank transfer.

Is USD 1000 too low investment to incur above cost p.m.

Hi Poornima,

If you invest each month 1000 USD, I would recommend investing in only one ETF each month:

* Month 1 in your 50% allocation EM

* Month 2 in your 50% allocation EM

* Month 3 in your 25% World

* Month 4 in your 25% S&P 500

That way, it will balance over time.

Now, I would be careful about having 50% in emerging markets, that’s a lot. This could work if you are yourself living in an emerging market, in which case this would also be your home bias. Otherwise, I would recommend 50% world, 25% us, and 25% EM. But that’s just what I would do :)

Hi Mr. Poor Swiss,

Thanks for this great content. I’m a bit confused. If you are to invest $1000 per month in only one EFT, then what is the point of the percentages?

Sorry if it’s a silly question.

Thanks,

Akolade

Sorry for the confusion :)

I was just giving an example with this portfolio of three ETFs:

A) 50% allocation Emerging Markets

B) 25% World

C) 25% S&P500

You would invest:

* Month 1 in A

* Month 2 in A

* Month 3 in B

* Month 4 in C

Since A has double the weight of B and C, you invest twice in A and then in B and then in C to keep the allocations.

Does that make more sense?

Hello Mr Poor Swiss, firstly what a pleasure to come across your blog.very informative,

! I live in Switzerland and just started my investing journey both exited and nervous at the same time. :)

To the above question you explain,I am also abit confused as was AKolade above. I thought the percentage % of one’s portfolio is determined by how much you allocate your monthly invested amount for example in my case i started investing 1000 Francs in my portfolio that I have monthly:

Vanguard FTSE All-World UCITS ETF- invest chf 500 of the 1000 I.e 50%

Vanguard S&P 500 UCITS ETF (the “Fund”) – invest chf 500 of the 1000 I.e 50%

So if I was to invest in one ETF per month I would then be investing 1000 I.e 100% in Vanguard FTSE All-World UCITS ETF In month 1 and the next I invest 100% of the 1000 in the next month in the S&P 500 and repeat the process? Is that right or I am mistaken?

Thank you for clarifying yours truly

Newbie investor

Jay

Thanks, Jay!

Both choices are possible. But if you invest “only” 1000 CHF, it’s easier and slightly cheaper to buy only one ETF per month.

As you say in your case, you would invest 1000 in World in month 1 and 1000 in S&P500 in month and then repeat again for month 3 with world and month 4 with 500.

Over time, if one of them become really out of balance, you will have to balance with your investments. So, if S&P 500 grows much faster than world, you could invest a few months in a row in the world etf.

Hello Mr. Poor Swiss,

very informative article, like most articles of your blog :-)

I have a question about the first investment when opening an Interactive Brokers Tiered account.

Let’s say I want to buy ~100K CHF worth of ETFs:

1) To optimise fees and ROI, should I invest all the 100K CHF at once or spread them over multiple months (e.g. investing 10K every month for 10 months)? Or there is not much difference?

2) Does IB still applies different fees when holding more or less 100K CHF? (I remember reading that they dropped activity fees)

Hi Gianni,

1) For your first question, I would recommend reading my article about Dollar Cost Averaging. It should answer your question.

2) No, that’s gone :) There are no more custody fees below 100K :)

Do you have an article of an example on how to go about investing a lumpsum on the trading platform practically to some ETFS that you can direct me to please?

Hi Jay,

I am not sure I get your question. Investing any amount is the same on a platform. I have an article about buying ETFs on IBRK.

On the 1st of the year I usually transfer my whole 3d Pillar (invested). Would you recommend changing this habit into monthly payments, too?

Hi Paul,

No, it’s fine to invest at once in the third pillar. The important point is to invest as regularly as possible, so investing it at once is better than spreading it over several months.

Even if it means accumulating the cash over the previous year?

So you would recommend doing a lump sum on the 1st day of the year (having accumulated the cash the previous year in cash) over just investing monthly over the course of the year?

This seems consistent with your stance against DCA, yet you would have to factor in the money sitting idle out of the market in the previous year for up to 12 months.

No!

I only recommend doing that if you are able to have the cash directly. If you have to accumulate during the year, you should invest as you get it.

That’s a good point because most people will not have the necessary income to invest in one or two months, but 500 CHF per month should be better!

The original question was whether it’s better to invest every month instead of investing once like he was doing. So, I assume he is not accumulating money every month until the end of year. But if he is, then, it’s better to invest cash as it comes available.

Hi, I love this article and I am using it as reference a lot. However, what I have not realised, is the monthly amount. And thanks for the above question, where it is addressed. For a beginner (18-30 year), it can be challenging and/or impossible to invest 1000 USD (or CHF) monthly. In the Czech Republic it is usual to start somewhere between 25-50 USD monthly (25 USD is usually the minimum you can invest in some bank fund). So the amount one can monthly invest changes the results quite a lot.

Hi Michala,

The amount will indeed change the absolute result. But not the conclusion. On average, you will be better off if you invest monthly rather than less frequently.

Now, if you have an expensive broker and invest very little money, you may be better off invest less frequently, but then you would also profit from using a better broker :)

Thanks for stopping by!

Hello,

Thank you for this post – very much appreciate your insight and knowledge sharing! Thanks to you (and a few others!) I started an IB account last year and have begun investing, mostly for my daughters.

In relation to this post my questions is – is there a minimum amount below which it DOESN’T makes sense to invest monthly? Eg at the moment I have been transferring 200frs per month to a savings account and then transferring it every once in a while to IB. So even with 200frs does it still make sense to invest monthly rather than quarterly? I would ideally like to be investing more and hope to be able to do so soon :)

Best wishes,

Alison

Hi Alison,

You are welcome :)

That’s a good question.

On IB, it will depend on two things:

* Are you buying U.S. ETFs? Then, invest every month, buying them is incredibly cheap on IB

* Are you below 100K USD? Then, invest every month since you are going to pay 10 USD per month anyway and transaction costs are removed from that 10 USD

* Otherwise, it’s a bit more difficult. I would not pay 10 CHF in fees each month to invest 200 CHF, that would be too much of a fee for me. In that case, it could make sense to wait for a quarter, but maybe not more.

I hope this helps.

Thank you so much!

So for the moment it’s yes and yes to the first two questions – so I will start to invest that directly every month – thank you! I hope soon to both be able to invest over 100k and be able to invest more each month in any case :)

I really appreciate your answer and the time you take to share all this information, so thank you :)

Best wishes,

Alison

Good luck with your investing and I am glad to be helpful :)

Nice to see, once again, the results of using a scientific approach vs the “intuition”. Thanks for running those simulations.

It would be nice to do the same but with selling instead of buying ETF. What I would like to know is: once I am retired, is it better to sell monthly, quarterly, or annually? Assuming a withdrawal rate of 4 % or less.

Hi Greg,

Thanks :)

That’s a good question! I will put ths in my list of future simulations. Intuitively, you should sell as late as possible given the higher probability of the market to go up than down, so I am thinking monthly. We’ll see later if the simulations show the same thing.

Thanks for stopping by!

Awesome! looking forward to it.

Have a nice day.