Dollar Cost Averaging is more risky than you think

| Updated: |(Disclosure: Some of the links below may be affiliate links)

When you have a large sum of money to invest, you have two choices. Either you invest it at once or cut it in smaller sums and you invest it over a longer period. The latter option is called Dollar Cost Averaging (DCA).

Most people will tell you you should always use Dollar Cost Averaging for your investments. But, in practice, investing in a lump sum is better than using DCA.

In this article, we will see what DCA is and its advantages and downsides. By the end of the article, you will know how to invest a lump sum.

We will also talk about Continuous Investing. Continuous Investing is when you invest your monthly savings as soon as it is available. Some people call this DCA, but it is not accurate. These are two different things. One is excellent, but the other is not.

Dollar Cost Averaging (DCA)

Dollar Cost Averaging (DCA) invests much money over an extended period. DCA will effectively average the price of what you buy over a longer period. Hence the name of dollar cost averaging your purchase.

We can take an example where you got 60’000 USD to invest. You want to invest it in the Vanguard Total World ETF (VT).

You could invest it at once today in the stock market. But you are afraid that the market will suddenly drop. And indeed, the market can quickly lose a few percent in one day. And can drop up to 50% in a few months (or even weeks). Such a significant drop does not happen often, but it can happen. And you are afraid that just after you invested your big sum, the market will drop a lot.

So, instead of investing it at once, you decide to Dollar Cost Average your VT purchase. You cut your lump sum into 12 parts of 5000 USD. And you choose to invest one part every month for one year.

So if the price of VT goes down significantly shortly after you made your first investment, you will have saved a lot of money since the average price of your investments will be lower than it would have been.

So, the main advantage of DCA is to protect you against a drop shortly after your investment.

DCA introduces another risk

You have eliminated one significant risk. However, you have just introduced a new significant risk. If the market is going up during the time you are dollar cost averaging, the average price will significantly increase. You have traded one risk for another.

It remains to see which risk is more significant.

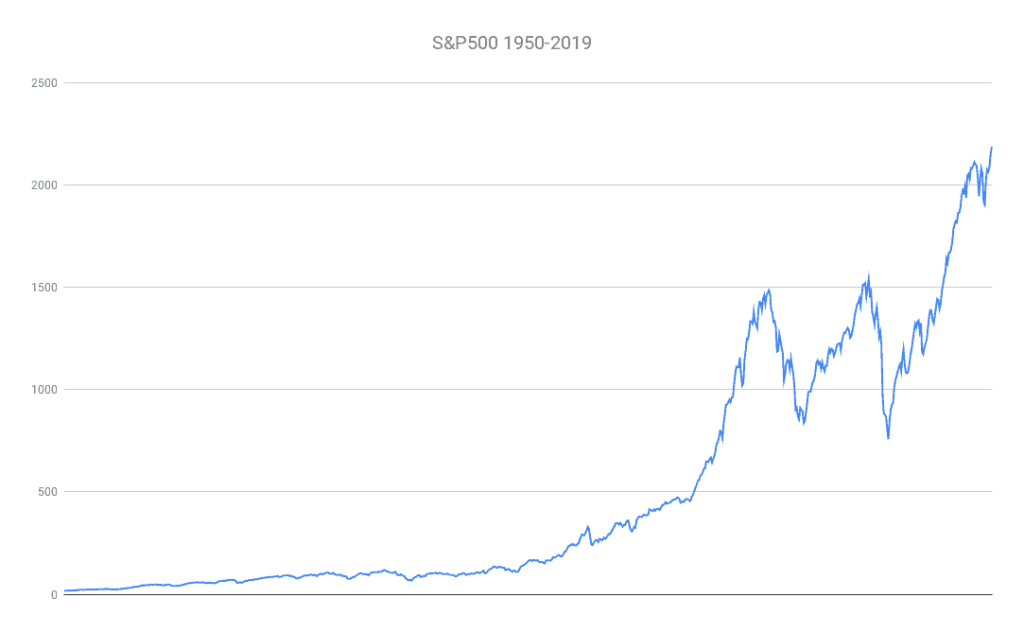

In practice, the second risk is greater. The stock market, on average, is going up. You can easily see that on the graph of the S&P 500 over more than half a decade. So, every year the stock market has more chances to go up than down. From a probability point of view, the risk introduced by DCA has more effect than the risk it fixes.

For instance, in the last 100 years, the Dow Jones Industrial Average (DJIA) was up 70% of the last 100 years. So, the DJIA is twice more likely to go up than to go down. Thus you are increasing the risks in your portfolio by using DCA.

Indeed, it is better to protect against a risk of 70% rather than a risk of 30%.

Downsides of DCA

Here is a summary of the multiple downsides of DCA.

First, when you dollar-cost average your purchase, you are betting against the market. However, there is a higher probability that the market will go up rather than down. By dollar cost averaging, you are increasing your risks.

All the cash waiting to be invested is incurring some opportunity costs. First of all, it will not generate any dividends. On average, a good stock market index will have a dividend yield of about 2%. You are missing the dividends. And you are also increasing the risk of inflation.

One small disadvantage of DCA is that you will likely increase the transaction fees for your investment. Generally, most brokers have a small flat fee and a percentage fee. If you invest twelve times instead of once, you will pay 12 times the transaction fees. These fees should not be a lot of money, but this is still some wasted money.

DCA will only protect you from the risk of the stock going down during the period of DCA. Nothing prevents the market from plunging the day after you have finished your DCA investment. So, it is short-term protection.

DCA is a short-term strategy! If you want to invest for the long term, it is not a good strategy. Most of the time, it will not work.

And talking about the investing period, you still have to choose the period during which you want to dollar cost average your investment. A typical time frame is one year. But you could choose to invest for two years or only six months. Choosing the optimal period for DCA is impossible. Trying to do so is market timing.

The entire idea of DCA is very close to market timing. If you doubt whether the market will increase, you are already timing the market. And we have discussed market timing previously. Timing the market is a loser’s game. There is no way to predict the market. We can only base our decisions on the facts that we already have. These facts are more than one hundred years of stock market data. And these have shown that generally, the stock market is going up. Therefore, you should bet on the market going up, not down.

Finally, by holding a lot of cash, you are also messing with your asset allocation. When you started investing, you decided on an asset allocation that suited you. For instance, you may have decided to invest 80% in stocks and 20% in bonds. But now, you have a large amount of cash. Maybe you have 40% in stocks, 10% in bonds, and 50% in cash now. And your asset allocation will only be balanced once you are done investing it.

Value Averaging

Value Averaging is an alternative to dollar-cost averaging. Instead of investing the same monthly amount, you will invest based on your shares’ current value.

We can take the same example as before. You want to invest 60’000 USD in 12 months. In the first month, you will invest 5000 USD as with DCA. However, in the second month, you will invest an amount so that the value of your shares reaches 10’000 USD. For example, if the shares went down in value to 4500, you will buy 5500 USD to bring it back to 10’000. If the shares increase the next month and reach 11’000 USD, you must invest 4000 USD.

So instead of having a fixed investment each month, you have a fixed goal.

Some people like Value Averaging because it avoids investing too much when the market is going up and more when it is going down.

However, it has some important downsides. If the market drops significantly during the year, you must invest more than planned. If you invested during the financial crisis of 2008, you would have had to invest more than 80’000 USD in bringing back the value to 60’000 USD. So where will you find the extra 20’000 USD?

And on the contrary, if the market is going very well, you may have to invest less than you wanted. Then, what will you do with the extra money?

Value Averaging is strictly worse than DCA. It has fewer advantages and more disadvantages. It is too complicated and incurs too many risks.

How to invest a Lump Sum?

Now that we have seen that DCA is mostly a bad idea, it is straightforward to know how to invest a lump sum.

You should invest a lump as soon as possible and at once. You need to know your target allocation and use the lump sum to ensure your portfolio is balanced. If you need bonds, buy bonds. If you need stocks, buy stocks. And if you need both, buy both! It is an excellent time to balance your portfolio correctly.

Continuous Investing is not DCA

Now, you may be thinking: what am I supposed to do with my savings every month?

You need to invest it as soon as you get it! Investing your monthly savings could be considered some form of Dollar Cost Averaging. However, it is unavoidable. And there are a lot of posts talking about that and saying this is Dollar Cost Averaging. Both concepts should be separated. We can call this Continuous Investing.

If you do not invest it directly but wait, for instance, until you have one year or even one-quarter of savings, you will increase your risks significantly and have zero advantages.

You cannot reduce the risks of your monthly investing. Once a month, you should invest your savings. You should do that regardless of the price. Over a very long period, this will save you money to invest frequently since you will buy when the price is high and you will also buy when the price is low, giving you a better average than if you invest only once a year.

This form of DCA is unavoidable and is the recommended way of investing! It is great to invest your savings each month. You need to invest continuously.

I have actually simulated how often you should be investing. It turns out that monthly investing is the best frequency. You should not try to delay your investments.

Why are people recommending DCA?

All over the internet, almost everybody is recommending Dollar-Cost-Averaging over Lump Sum Investing.

The main reason is that DCA makes people feel better. If you invest over several months and the market is going down, you will feel better that you did not invest too much the first time. Moreover, you will also feel better about buying shares at a discount.

It all comes down to the fact that people are much more afraid of a loss than they are happy with a return. Most people will feel a bigger impact with a loss of 10% than a profit of 10%. This fact has been shown many times already.

People prefer avoiding a small loss than staying for the long term and taking a more significant return. Therefore, people recommend DCA not feel bad about investments.

But I think this is wrong. Most people are investing for the long term. And therefore, it is better to maximize long-term gains. Even if you feel bad for one year or two years, you should be able to weather it. And people advocating for DCA should also point out the disadvantages!

FAQ

What is Dollar-Cost Averaging (DCA)?

Dollar-Cost Averaging (DCA) is an investing technique where you invest a sum of money over a longer period. The larger sum is split into smaller portions and invested as such.

What is Value Averaging?

Value Averaging is an alternative to Dollar-Cost Averaging (DCA). Instead of investing the same amount every time, you invest based on the current value of your shares.

What are the downsides of Dollar-Cost Averaging (DCA)?

When you dollar-cost average an investment, you are betting against the market. But on average, the market is going up. This means you are likely making the wrong bet.

What are the advantages of Dollar-Cost Averaging (DCA)?

Dollar-Cost Averaging (DCA) protects you against a drop in the market happening shortly after you start investing.

Conclusion

I do not advise Dollar Cost Averaging for any of your investments. You should stick to your asset allocation and invest money when you have it. It is part of my Investor Policy Statement not to use DCA.

If you invest for the long term and have a large sum of money, the best course of action is to invest it now. Dollar Cost Averaging the investment will increase your risk of losing out on returns. And do not forget to invest according to your asset allocation.

Now, if you want to invest using DCA, do it if it makes you feel more comfortable. It is an excellent technique to cut some emotions out of investing. But do not let your emotions choose your investing strategy.

But you should still invest your savings monthly. Continuous Investing is not the same as Dollar Cost Averaging. There are too many articles on the internet that mix the two concepts. Continuous Investing is great, DCA is not great!

While it is not a very popular opinion, I am not the only one who thinks like this. For instance, JL Collins talked about why he does not like DCA.

What about you? What do you think of DCA? Do you use it?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Investing Fundamentals

- More articles about Investing

- Dividends – Develop Passive Income

- The Little Glossary of Investing: Every term you need to know

- Investing Instruments: Cash, Bonds and Stocks

When investing a lump sum, there’s the risk of the market reacting to it: If you want to invest it in a single ETF, the price could rise if you invest 100000 Swiss Francs at once. Especially if you use a “market order” (see https://en.wikipedia.org/wiki/Order_(exchange) ), and if the ETF is not very liquid, other people (who want to sell at a high price) might profit extraordinarily from the lump investment, wouldn’t they?

How would you deal with this problem?

Unless you are investing in a tiny ETF, investing 100’000 CHF at once will make no difference. Even 1 million will make no difference when we talk about ETFs with billions.

But yes, if you are investing in a tiny ETF (maybe you shouldn’t) a large amount (at least 1% of the amount of the ETF I would say), it will make a difference.

But I would not think that it is an issue for 99.9% of investors investing a lump sum.

Many thanks for your reasonable and helpful reply, Baptiste.

Finally it depends on the daily trading volume of the ETF at the relevant stock market, doesn’t it? If the daily volume is not much higher than the amount I want to invest at once, it’s difficult.

Example: Vanguard FTSE 100 UCITS ETF (IE00B810Q511) currently has 5’328’804’256.93 of investment volume. But the trading volume at SIX seems to have been zero yesterday (see https://www.six-group.com/de/products-services/the-swiss-stock-exchange/market-data/etf/etf-explorer/etf-detail.IE00B810Q511CHF4.html#/ ). What’s the problem here?

Yes, it also depends on the trading volume, not only on the size of the asset, you are right.

I don’t know why it was zero at SIX, but I would never trade a Vanguard ETF at SIX anyway. And I try not to trade illiquid ETFs either.

If you trade the Vanguard ETF you mentioned for 100K CHF, it will not make any difference given the volume. So I would not worry about it.