Yuh Review 2024: One app to pay, save and invest

| Updated: |(Disclosure: Some of the links below may be affiliate links)

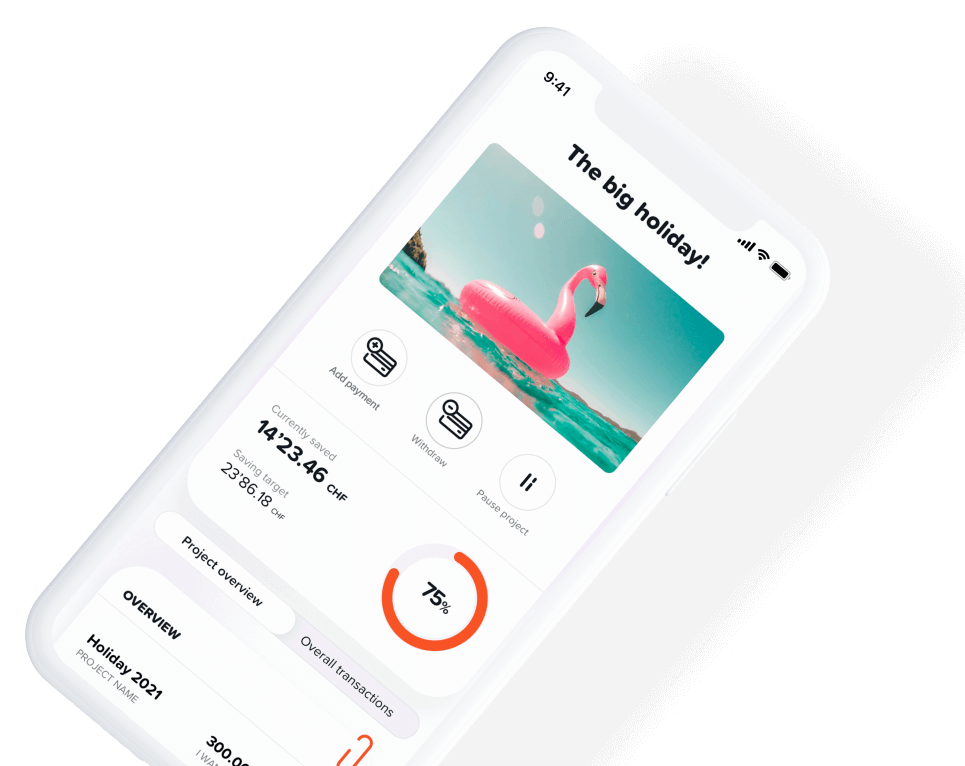

PostFinance and Swissquote started a joint venture: The Yuh banking application. With Yuh, you can save money on your account, pay in Switzerland and abroad, and invest in the stock market and cryptocurrencies.

Yuh is an entirely digital offer. They have no offices. You can manage all your money directly from your phone. So, you will pay your bills and invest your money in your smartphone.

So, should you use Yuh? What features does it have? And how much does Yuh cost? We will find out!

In this article, I will review Yuh’s features, fees, advantages, and disadvantages.

| Custody Fees | 0 CHF |

|---|---|

| Inactivity Fees | 0 CHF |

| Buy Swiss ETF | 0.50% |

| Buy American Stock | 0.50% |

| Currency Exchange Fee | 0.95% |

| Users | 160’000n |

| Languages | English, French, German, and Italian |

| Mobile Application | Yes |

| Web Application | No |

| Custodian Bank | Swissquote |

| Established | 2021 |

| Headquarters | Gland, Vaud |

Yuh

Yuh is an easy and affordable way to invest in the stock market and spend money abroad.

Use my code YUHTHEPOORSWISS to get 25 CHF in trading credits!

- Low fees for small operations

- Fractiona trading in stocks

In May 2021, PostFinance and Swissquote launched the Yuh service. They are trying to unify banking and trading services together. In addition, they want to unify paying, saving, and investing (both in the stock market and in cryptocurrencies) in a single app.

An interesting fact about Yuh is that they will share some of their profits with their cryptocurrency: the Swissqoins.

Yuh’s main selling point is making it easy to do your everyday banking operations and invest in the stock market. Many people do not invest because it is complicated or too expensive when starting with small amounts. Yuh tries to fight that situation.

It is important to note that Yuh is not a bank itself. However, for the customers, it does not make much difference. Indeed, your money will be held by Swissquote, which is a bank. It means your money will be insured for up to 100’000 CHF, the basic deposit protection as other Swiss banks.

Since its creation, Yuh has grown very quickly. In about two years, it reached 160.000 customers, which is impressive growth.

So, overall, Yuh is trying to bring many new things! But does that make them any good? We should look at the details to find out.

Banking Features

For banking features, Yuh has all the basic features you can expect: you can pay your bills with the app and transfer money to and from your account. Currently, you can do wire transfers in many currencies.

You will get a Debit Mastercard to make payments and withdraw money in Switzerland and abroad. You can also pay online with a card with CHF, USD, and EUR (and a long list of other currencies).

The interesting thing about Yuh is that you have a multi-currency account. It means you can receive and keep other currencies in your account. For instance, you could receive EUR and keep it in your account. So, when you have to pay in EUR, it will directly use that balance instead of converting from CHF to EUR.

You can also do peer-to-peer transfers to other users of the application, which is good if you know other users of the app. They also have the usual features, like savings goals, which I do not see any use for. These things are present in most digital banks.

They also have integrated ebills in their app.

Yuh supports Google Pay, Apple Pay, and Samsung Pay if you want to pay with your phone. Since May 2023, they have also provided support for TWINT with their Yuh TWINT app. So, Yuh has complete mobile payment support.

Several new features are planned, like virtual debit cards and teen accounts. You can consult their roadmap to follow their progress.

Overall, Yuh has all the banking features we need (and more) and is very transparent about future features.

Trading Features

Yuh is quite different from a standard broker. Indeed, they are trying to keep it simple. As such, they limit the list of stocks and ETFs we can trade. They try hard to make this list representative of what the users would need.

For an advanced investor, this is a disadvantage. But for a beginner investor, this is a good feature because it will help to choose. This makes Yuh easier for beginners.

Another limitation is that we can only use market orders at this time. Other orders, like limit orders, are planned in the feature. I think this makes sense because having multiple order types can confuse users. And market orders are working well.

It is also important to mention that the app is made to be easy to trade. It is really easy to get started with Yuh.

Yuh also offers savings plans on ETFs and shares, an interesting feature that many investors are looking for. Very few Swiss brokers offer this feature.

On top of stocks and ETFs, Yuh also allows investing in so-called themes. These themes represent trends such as the metaverse or recycling. They allow to invest in companies that represent these themes. On paper, this is great. However, these themes are implemented with structured products.

Structured products are among the most complicated investments available. They are not transparent and are often expensive. Some of the structured products offered by Yuh have a 1% fee. I recommend avoiding these products.

Unfortunately, Yuh does not offer any US ETFs. Since US ETFs are currently the best available to Swiss investors, not having them is a big disadvantage for Yuh.

For more information, you can look at the list of available ETFs (you may have to disable your adblocker to see them). They have a long list of available ETFs, from many providers like Vanguard, ishares and Invesco.

Another disadvantage of Yuh is that you cannot transfer your shares to another broker. So, if you want to switch brokers, you will need to sell all your positions and then transfer the cash.

Finally, Yuh also gives you access to some cryptocurrencies, like Bitcoin and Ethereum. You can access 34 cryptocurrencies, which should be enough for most people. It is unclear whether you can have proper wallet security, but I expect not. And generally, if you cannot have your cryptos in your wallet, you should not use a platform. However, since I am not a crypto expert, I will not detail their crypto features.

Overall, Yuh has great trading features for beginners. However, it is not an app for advanced investors.

Yuh Banking fees

We start with Yuh’s banking fees.

The basic operations are all free:

- Paying for your bills

- Transfer money to and from your account in CHF

- Paying in Switzerland with the Debit Mastercard

- Paying abroad is fee-free, but you will pay high currency exchange fees

- Free transfers in EUR in the EEA zone

- Peer-to-peer payment in the application

You will get one free withdrawal per week in Switzerland. Subsequent withdrawals will cost 1.90 CHF. If you withdraw money abroad, you will pay 4.90 CHF.

However, you can withdraw only 1000 CHF per day and, at most, 10’000 CHF per month. This limit should be good per month, but it could be an issue daily.

There is no limit on wire transfers. However, there is a limit on paying with a card, which you can configure between 500 CHF and 25,000 CHF.

Yuh has positive interest rates, which is extremely rare. Indeed, you can get 1.00% on CHF and 0.75% on EUR and USD. And this is paid for up to 100’00 CHF balances. It is still a great feature if you often hold cash. Some people would like to use this for their emergency fund.

Now comes the expensive part: currency exchange! Yuh is charging 0.95% per currency exchange. All your operations in a foreign currency will cost you 0.95%. This fee is funny because they claim transaction fees are free in 12 currencies, but you have to pay the currency exchange, so it is not free. And if you work with currencies not included in the app, you must pay 1.50%!

For me, the currency exchange fee makes Yuh highly unattractive. Currently, there are several interesting alternatives with free payments in foreign currencies and comparable features for the banking side.

Yuh Trading fees

We then look at Yuh’s trading fees.

First, there are no custody fees. So, you will not pay anything to keep your account open without doing anything. This is a good advantage!

Then, the transaction fees are straightforward:

- 0.5% fee for the stock market with a minimum fee of 1 CHF

- 1.0% fee for cryptocurrencies without a minimum

Compared with other Swiss brokers, these fees are relatively cheap for small operations on the stock market. But they are expensive for large operations. For instance:

- A 1000 CHF investment will cost you 5 CHF, which is cheap

- A 10’000 CHF investment will cost you 50 CHF, which is expensive

On top of that, you will also pay currency exchange fees of 0.95% for your operations with currencies you do not have. For instance, if you have only CHF and want to buy something in USD, you will pay a 0.95% fee. This fee is quite expensive.

Fortunately, the dividends will stay in their original currency. So you will not lose 0.95% of all your dividends in USD.

Of course, you will have to pay the management fees of the ETFs. This is logical, and it is the same for each broker.

Overall, these fees are good for beginners investing small amounts. But they are quickly expensive for advanced investors investing large amounts. This shows once again that Yuh is great for beginners. But you have to be careful about currency conversion fees.

Swissqoins

A unique feature of Yuh is its Swissqoin (SWQ). Swissqoin is a new cryptocurrency token that only exists within Yuh.

There are several ways of earning SWQ:

- By depositing 500 CHF in your account when you open it, you will get 250 SWQ

- By referring another user, you will get 500 SWQ

- By making a trade on Yuh, you will get 5 SWQ

- By paying with your Mastercard, you will get 1 SWQ

You can either redeem them for cash, send them to other Yuh users or keep them in your account.

Currently, one SWQ is worth 0.01 CHF (1 cent). There are 200 million Swissqoins, backed by a 2 million CHF reserve account. But this reserve account is expected to grow with time. Indeed, Yuh will reinvest 10% of its revenues into Swissqoin every month. Now, they say it is only 10% of the subscription revenues. However, there are currently no subscriptions, and there will not be any until 2022. So, I am reading that they will not reinvest anything before 2022, at least.

In 2023, they have added 100 million Swissquoins, with another million CHF in reserve. This was made because the supply of Swissquoins was running out faster than they had expected.

I do not see any value in that cryptocurrency thing. I would rather have a hard cashback or fee reduction on the operations than this gimmick.

Alternatives

There are many alternatives available in both banking and investment services. So, we should compare these services a bit.

One of the selling points of Yuh is to be a multi-currency account that you should be able to use in many countries. If you want to pay abroad for free, we can compare it with Neon (my review).

Yuh has a 0.95% currency conversion fee against 0% for Neon (but about 0.4% for the MasterCard rate). So, Neon is already better than Yuh on this selling point. And if you want to hold multiple currencies, both Revolut and Wise will be cheaper.

We can also compare with Swissquote (my review of Swissquote), the company behind Yuh and a broker. Yuh would be significantly cheaper for small operations. On the other hand, it would become more expensive for large operations.

Yuh has a very limited set of investments compared to the extensive set of instruments available with Swissquote. So, I would rather use Swissquote directly. For more information, you can read my article about Yuh vs Swissquote.

Finally, if we compare it with an international broker like Interactive Brokers, Yuh falls quickly behind. Most transactions (except tiny transactions on SIX) are cheaper (and sometimes very significantly) at IB. And IB has many more features than Yuh. You can read my review of Interactive Brokers for more information.

Since Neon introduced investing features in 2023, Yuh and Neon are now very similar services. You can read my comparison of Yuh and Neon for more information.

Overall, I would only recommend Yuh for trading for beginners. I would not recommend Yuh as the primary bank. There are better alternatives. And for advanced investors, there are better alternatives as well.

FAQ

How many ETFs can you trade with Yuh?

With Yuh, you can trade more than 50 different ETFs.

How much does a currency exchange cost with Yuh?

Yuh is charging 0.95% per currency exchange.

Is money deposited with Yuh insured?

Yes, your money will be held by Swissquote, which is a bank. It means your money will be insured for up to 100’000 CHF, the basic deposit protection as other Swiss banks.

Can you use Limit orders with Yuh?

Not yet, but they plan adding this feature in the future. In the meantime, trading in market orders works perfectly well for most investments in reputable stocks.

Can you trade in fractions with Yuh?

Yes! Yuh is among the very few Swiss brokers that allow fractional trading!

Who is Yuh good for?

Yuh is good for beginner investors that do not want to invest too much money, especially in foreign currencies. Yuh is also decent if you want to group (at a cost) many services together instead of using multiple services.

Who is Yuh not good for?

Yuh is not great for medium to advanced investors. Yuh is also not great if you want a joint account. Finally, Yuh is not great if you do many transactions in foreign currencies. For all these cases, there are better alternatives.

Yuh Summary

Yuh is an easy and affordable way to invest in the stock market and spend money abroad.

Product Brand: Yuh

4

Yuh Pros

Let's summarize the main advantages of Yuh:

- Very easy to invest in the stock market

- Fractional trading

- Free EUR bank account

- Multi-currency account

- No custody fees

- Cheap fees for small trading operations

- The money is kept safe by Swissquote

- Backed by two large institutions

- Savings plans

Yuh Cons

Let's summarize the main disadvantages of Yuh:

- Expensive currency exchange fees

- No access to U.S. ETFs

- Not great for advanced investors

- Use of structured products for trending themes

- Cannot transfer shares to another broker

Conclusion

Yuh is an easy and affordable way to invest in the stock market and spend money abroad.

Use my code YUHTHEPOORSWISS to get 25 CHF in trading credits!

- Low fees for small operations

- Fractiona trading in stocks

Overall, Yuh is a good trading platform for beginners. The app is very easy to use, and the fees are low for small transactions. If you want to start to invest and want something simple, Yuh will be great for you.

The main issue with the banking package is the currency conversion fee. Their currency exchange rates are very high compared to other actors in the market, which is disappointing for a multi-currency app. So, if you want a digital bank to pay abroad, you should use another bank.

To conclude, Yuh is good for beginner investors who want to start investing without trouble. However, if you want an excellent digital bank, you can use Neon and save on fees abroad. And if you are an experienced investor, you can use Swissquote with many more features.

What about you? What do you think of Yuh?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Best Brokers

- More articles about Investing

- eToro Review for Swiss investors in 2024

- DEGIRO Review 2024: Pros and Cons

- Cornèrtrader Review 2024 – Cheapest Swiss broker

Hi,

Can you open joint account as a married couple at Yuh?

Hi,

So far, Yuh does not offer joint accounts.

I would have used your referral code but it does not seem to be accepted any longer.

What does the app say when you use my code? It’s supposed to be valid.

Thanks for your review. I have opened an account with Yuh somme months ago, mainly for their multi-currency features. Satisfied so far.

Concerning the interest rates served on deposits, please note that they have announced that they will increase them to 0.5% for CHF and EUR on October 1st. And it will apply to a balance of up to 100’000 for each of the currencies concerned (CHF, EUR, USD).

So you get 0.5% for up to 100’000 CHF, 0.5% for up to 100’000 EUR, 0.5% for up to 100’000 USD. It is for the time being quite competitive compared to many other Swiss banks, and can be interesting if one holds some cash savings or an emergency fund in cash with a Swiss Bank.

It is interesting and good to see that they have been so far quick to adapt their offering to the interest rates hikes of central banks.

Keep up the good work on the website. It is a great resource !

Hi,

Thanks for the update, that’s indeed becoming interesting.

I don’t have much cash, so I don’t really care, but if you had a significant amount of cash, this could become interesting.

I will update the article soon.

It’s indeed great that they are so quick in raising interest rates!

Hi there, have you experienced SEPA payment with them from you EURO account? In or out. Have you been hit by exchange fees or any other fee? They seem to give you only one common IBAN for all your currency accounts. TA

Hi and thanks for such an informative article. I live in Switzerland now and at 42, just starting to learn about investing (post-divorce). I have downloaded Yuh (as well as Selma and Volt). I understand that I better play it safe now so I want to invest in ETFs – with Yuh, I guess. But there are so many of them! Should I just choose Global Blue Chips (VT) and that’s it? If so – should I buy more than 1 share – and if so, how many? CHF 500 of these ETFs a month – would that be wise? Apologies – I know this blog is not for personal financial advice, but it would be super helpful. And maybe will also be of use to other readers of your helpful blog! Thanks in advice! Liska

Hi Liska,

The amount of money you are going to invest will depend on many personal factors:

* For when are you investing

* For what are you investing

* Your overall personal financial situation.

That’s not something I can answer for you.

I personally invest as much as I can but this strategy would not work for everybody.

As for which ETF, I have an article on choosing an index ETF portfolio.

Hi,

I like your review, it’s very helpfull. I use Yuh a lot and have been seeing their development here are some updates regarding Yuh. You can now schedule a payment and have standing orders. Also Yuh removed all negative interest rates and it’s now offering 0.25% for cash until 25’000CHF, this is super interesting if if you want to use it as your main account.

Hi CN,

Thanks for letting me know. I have removed the information about the negative interest rates. I will update the interest on cash later. I am not sure it makes a big difference. I generally keep less than 10’000 CHF on my main account. This would save me the currency conversion price of 2500 CHF, which is not great. I think their currency conversion fee is the main disadvantage they have.

Can you use Yuh bank as a salary account ? I would like to use it as my salary account as I live in germany and work in Zurich. Traditional banks are expensive.

Hi AKK,

I don’t see why not since they give you a personal IBAN. It’s not the best, but acceptable and better than many traditional banks.

I think they only accept Swiss residents. Unfortunately, non-residents are generally left with poor choice of banks.

Does Yuh give you a swiss IBAN number?

Yuh gives you a bank account, so they should indeed give you a private CH IBAN.

Overall good write-up but it seems a few things have changed since this was originally written.

First though, “I have no idea how to pronounce…” I’d say this is just a different spelling of “you”, simple. But maybe I have missed a deeper meaning here.

Also, USD are part of the fee-free currencies (now): CHF – USD – EUR – GBP – JPY – AUD – CAD – SEK – HKD – NOK – DKK – AED – SGD

So buying online in USD should be less of a problem for you now. And the currency exchange fee only applies when converting – this is a bit confusing in the text. Admittedly, I did also think almost a percent is a bit high. But if I transfer CHF, EUR, GBP or USD into the account before needing it (i.e. if no conversion needs to be done when using it), then there is technically no fee.

I just opened the account a few days ago (which was the best process I’ve experienced anywhere so far) and quite happy, since I usually don’t need fancy features. Speaking of those, Apple and Google Pay are supported as well. eBill and virtual cards coming soon apparently.

Like most if not all neobanks, this is all still work in progress. Surprisingly, this is the first site I read something about different pricing models coming but presuming they will also follow the “usual” neobank model with some kind of a metal card.

Regular/irregular visitor of your site.

Hi AG,

In my head, it’s still pronounced yew or yeuh, I don’t know why, no deep meaning :)

I have updated the articles for USD and Google Pay / Apple Pay, thanks for letting me know.

It’s true that if you have the currency then it’s free. But the immense majority of people won’t get USD directly, they will need to convert it and pay a large fee. Or, they will have to use Revolut/Wise, but a service that requires another service to be useful is useless in my opinion.

They announced the new pricing model once they started, but they may have changed their minds, I will have to check again about that.

Thanks for sharing your experience, I am glad you enjoy it :)

Great summary. Indeed, to me the main problem is the currency fee. Can’t understand how banks can still get away with this, especially in 2022. Apart from neon which doesn’t have a multi currency account, I still haven’t found a cheap way to trade currencies…

Hi John,

Yes, it also bothers me that it’s so damn expensive to convert currency in Switzerland.

You can trade them for cheap in Interactive Brokers, but it’s not a bank.

I don’t know any Swiss bank with a good currency fee and a multi-currency account.

Can’t you just convert them on revolut and send them back to one of your accounts in the new currency ? (like send from your CHF account to revolut, convert to EUR on revolut for free and then send the EUR back to your EUR account on yuh)

Thats the thing i was thinking about with Yuh, that you can hold EUR in a real bank account for free and make SEPA transfers for free, as long as you exchange your CHF into EUR on revolut for free then it should be ok

Yes, you can but then it makes Yuh entirely useless since you could only use Revolut, no? I don’t like a service that’s bad enough that you need a second service to complement it.

I’m using Yuh since the beginning.

The application is well done, the multi-currency is great and all investing orders are now sent immediately.

There just on big problem for me and I don’t think this is rocket science : you can’t schedule a payment…

When I manage my payments, I like to do it once a month and plan them to match the deadline (professional distortion). I also like to scan directly the paper invoices (some intuitions are still very old school…) and schedule the payment for the next month.

With Yuh, this is not possible ! You can’t also create some recurrent payments…

That’s why I also opened a Neon account where this is possible and also for e-bill.

Hi Torvi

Thanks for sharing!

That’s good to know. And it’s indeed disappointing. Especially recurring payments should be possible. I don’t like automation, but even I use that to pay for my heating bill.

Do you have a referral code?