Yuh Review 2024: One app to pay, save and invest

| Updated: |(Disclosure: Some of the links below may be affiliate links)

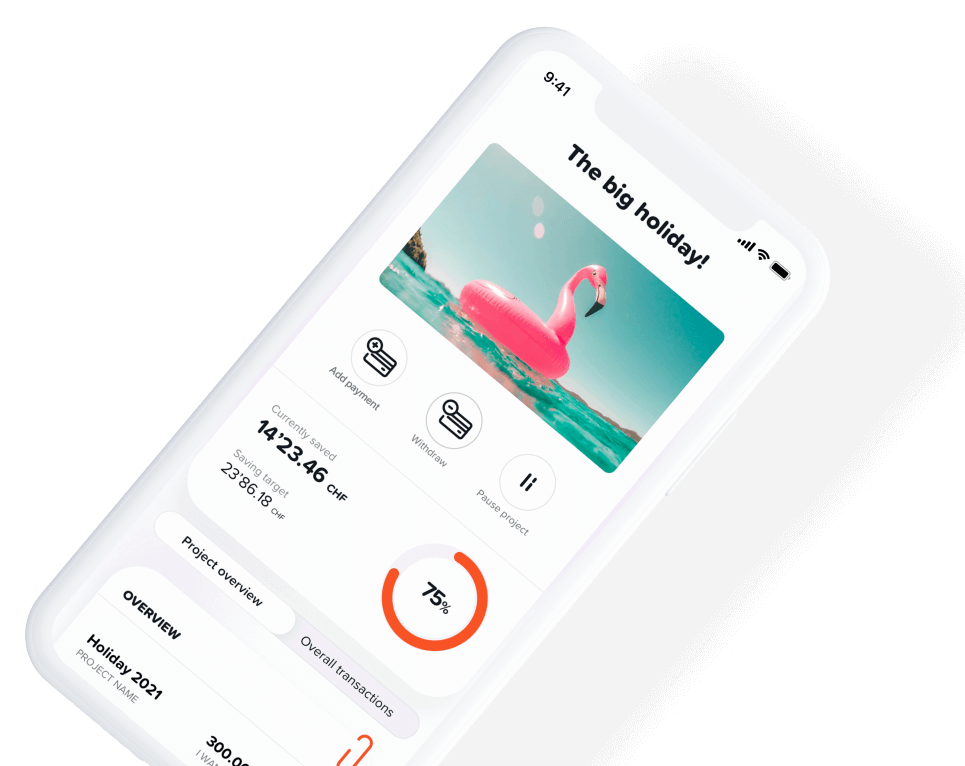

PostFinance and Swissquote started a joint venture: The Yuh banking application. With Yuh, you can save money on your account, pay in Switzerland and abroad, and invest in the stock market and cryptocurrencies.

Yuh is an entirely digital offer. They have no offices. You can manage all your money directly from your phone. So, you will pay your bills and invest your money in your smartphone.

So, should you use Yuh? What features does it have? And how much does Yuh cost? We will find out!

In this article, I will review Yuh’s features, fees, advantages, and disadvantages.

| Custody Fees | 0 CHF |

|---|---|

| Inactivity Fees | 0 CHF |

| Buy Swiss ETF | 0.50% |

| Buy American Stock | 0.50% |

| Currency Exchange Fee | 0.95% |

| Users | 160’000n |

| Languages | English, French, German, and Italian |

| Mobile Application | Yes |

| Web Application | No |

| Custodian Bank | Swissquote |

| Established | 2021 |

| Headquarters | Gland, Vaud |

Yuh

Yuh is an easy and affordable way to invest in the stock market and spend money abroad.

Use my code YUHTHEPOORSWISS to get 25 CHF in trading credits!

- Low fees for small operations

- Fractiona trading in stocks

In May 2021, PostFinance and Swissquote launched the Yuh service. They are trying to unify banking and trading services together. In addition, they want to unify paying, saving, and investing (both in the stock market and in cryptocurrencies) in a single app.

An interesting fact about Yuh is that they will share some of their profits with their cryptocurrency: the Swissqoins.

Yuh’s main selling point is making it easy to do your everyday banking operations and invest in the stock market. Many people do not invest because it is complicated or too expensive when starting with small amounts. Yuh tries to fight that situation.

It is important to note that Yuh is not a bank itself. However, for the customers, it does not make much difference. Indeed, your money will be held by Swissquote, which is a bank. It means your money will be insured for up to 100’000 CHF, the basic deposit protection as other Swiss banks.

Since its creation, Yuh has grown very quickly. In about two years, it reached 160.000 customers, which is impressive growth.

So, overall, Yuh is trying to bring many new things! But does that make them any good? We should look at the details to find out.

Banking Features

For banking features, Yuh has all the basic features you can expect: you can pay your bills with the app and transfer money to and from your account. Currently, you can do wire transfers in many currencies.

You will get a Debit Mastercard to make payments and withdraw money in Switzerland and abroad. You can also pay online with a card with CHF, USD, and EUR (and a long list of other currencies).

The interesting thing about Yuh is that you have a multi-currency account. It means you can receive and keep other currencies in your account. For instance, you could receive EUR and keep it in your account. So, when you have to pay in EUR, it will directly use that balance instead of converting from CHF to EUR.

You can also do peer-to-peer transfers to other users of the application, which is good if you know other users of the app. They also have the usual features, like savings goals, which I do not see any use for. These things are present in most digital banks.

They also have integrated ebills in their app.

Yuh supports Google Pay, Apple Pay, and Samsung Pay if you want to pay with your phone. Since May 2023, they have also provided support for TWINT with their Yuh TWINT app. So, Yuh has complete mobile payment support.

Several new features are planned, like virtual debit cards and teen accounts. You can consult their roadmap to follow their progress.

Overall, Yuh has all the banking features we need (and more) and is very transparent about future features.

Trading Features

Yuh is quite different from a standard broker. Indeed, they are trying to keep it simple. As such, they limit the list of stocks and ETFs we can trade. They try hard to make this list representative of what the users would need.

For an advanced investor, this is a disadvantage. But for a beginner investor, this is a good feature because it will help to choose. This makes Yuh easier for beginners.

Another limitation is that we can only use market orders at this time. Other orders, like limit orders, are planned in the feature. I think this makes sense because having multiple order types can confuse users. And market orders are working well.

It is also important to mention that the app is made to be easy to trade. It is really easy to get started with Yuh.

Yuh also offers savings plans on ETFs and shares, an interesting feature that many investors are looking for. Very few Swiss brokers offer this feature.

On top of stocks and ETFs, Yuh also allows investing in so-called themes. These themes represent trends such as the metaverse or recycling. They allow to invest in companies that represent these themes. On paper, this is great. However, these themes are implemented with structured products.

Structured products are among the most complicated investments available. They are not transparent and are often expensive. Some of the structured products offered by Yuh have a 1% fee. I recommend avoiding these products.

Unfortunately, Yuh does not offer any US ETFs. Since US ETFs are currently the best available to Swiss investors, not having them is a big disadvantage for Yuh.

For more information, you can look at the list of available ETFs (you may have to disable your adblocker to see them). They have a long list of available ETFs, from many providers like Vanguard, ishares and Invesco.

Another disadvantage of Yuh is that you cannot transfer your shares to another broker. So, if you want to switch brokers, you will need to sell all your positions and then transfer the cash.

Finally, Yuh also gives you access to some cryptocurrencies, like Bitcoin and Ethereum. You can access 34 cryptocurrencies, which should be enough for most people. It is unclear whether you can have proper wallet security, but I expect not. And generally, if you cannot have your cryptos in your wallet, you should not use a platform. However, since I am not a crypto expert, I will not detail their crypto features.

Overall, Yuh has great trading features for beginners. However, it is not an app for advanced investors.

Yuh Banking fees

We start with Yuh’s banking fees.

The basic operations are all free:

- Paying for your bills

- Transfer money to and from your account in CHF

- Paying in Switzerland with the Debit Mastercard

- Paying abroad is fee-free, but you will pay high currency exchange fees

- Free transfers in EUR in the EEA zone

- Peer-to-peer payment in the application

You will get one free withdrawal per week in Switzerland. Subsequent withdrawals will cost 1.90 CHF. If you withdraw money abroad, you will pay 4.90 CHF.

However, you can withdraw only 1000 CHF per day and, at most, 10’000 CHF per month. This limit should be good per month, but it could be an issue daily.

There is no limit on wire transfers. However, there is a limit on paying with a card, which you can configure between 500 CHF and 25,000 CHF.

Yuh has positive interest rates, which is extremely rare. Indeed, you can get 1.00% on CHF and 0.75% on EUR and USD. And this is paid for up to 100’00 CHF balances. It is still a great feature if you often hold cash. Some people would like to use this for their emergency fund.

Now comes the expensive part: currency exchange! Yuh is charging 0.95% per currency exchange. All your operations in a foreign currency will cost you 0.95%. This fee is funny because they claim transaction fees are free in 12 currencies, but you have to pay the currency exchange, so it is not free. And if you work with currencies not included in the app, you must pay 1.50%!

For me, the currency exchange fee makes Yuh highly unattractive. Currently, there are several interesting alternatives with free payments in foreign currencies and comparable features for the banking side.

Yuh Trading fees

We then look at Yuh’s trading fees.

First, there are no custody fees. So, you will not pay anything to keep your account open without doing anything. This is a good advantage!

Then, the transaction fees are straightforward:

- 0.5% fee for the stock market with a minimum fee of 1 CHF

- 1.0% fee for cryptocurrencies without a minimum

Compared with other Swiss brokers, these fees are relatively cheap for small operations on the stock market. But they are expensive for large operations. For instance:

- A 1000 CHF investment will cost you 5 CHF, which is cheap

- A 10’000 CHF investment will cost you 50 CHF, which is expensive

On top of that, you will also pay currency exchange fees of 0.95% for your operations with currencies you do not have. For instance, if you have only CHF and want to buy something in USD, you will pay a 0.95% fee. This fee is quite expensive.

Fortunately, the dividends will stay in their original currency. So you will not lose 0.95% of all your dividends in USD.

Of course, you will have to pay the management fees of the ETFs. This is logical, and it is the same for each broker.

Overall, these fees are good for beginners investing small amounts. But they are quickly expensive for advanced investors investing large amounts. This shows once again that Yuh is great for beginners. But you have to be careful about currency conversion fees.

Swissqoins

A unique feature of Yuh is its Swissqoin (SWQ). Swissqoin is a new cryptocurrency token that only exists within Yuh.

There are several ways of earning SWQ:

- By depositing 500 CHF in your account when you open it, you will get 250 SWQ

- By referring another user, you will get 500 SWQ

- By making a trade on Yuh, you will get 5 SWQ

- By paying with your Mastercard, you will get 1 SWQ

You can either redeem them for cash, send them to other Yuh users or keep them in your account.

Currently, one SWQ is worth 0.01 CHF (1 cent). There are 200 million Swissqoins, backed by a 2 million CHF reserve account. But this reserve account is expected to grow with time. Indeed, Yuh will reinvest 10% of its revenues into Swissqoin every month. Now, they say it is only 10% of the subscription revenues. However, there are currently no subscriptions, and there will not be any until 2022. So, I am reading that they will not reinvest anything before 2022, at least.

In 2023, they have added 100 million Swissquoins, with another million CHF in reserve. This was made because the supply of Swissquoins was running out faster than they had expected.

I do not see any value in that cryptocurrency thing. I would rather have a hard cashback or fee reduction on the operations than this gimmick.

Alternatives

There are many alternatives available in both banking and investment services. So, we should compare these services a bit.

One of the selling points of Yuh is to be a multi-currency account that you should be able to use in many countries. If you want to pay abroad for free, we can compare it with Neon (my review).

Yuh has a 0.95% currency conversion fee against 0% for Neon (but about 0.4% for the MasterCard rate). So, Neon is already better than Yuh on this selling point. And if you want to hold multiple currencies, both Revolut and Wise will be cheaper.

We can also compare with Swissquote (my review of Swissquote), the company behind Yuh and a broker. Yuh would be significantly cheaper for small operations. On the other hand, it would become more expensive for large operations.

Yuh has a very limited set of investments compared to the extensive set of instruments available with Swissquote. So, I would rather use Swissquote directly. For more information, you can read my article about Yuh vs Swissquote.

Finally, if we compare it with an international broker like Interactive Brokers, Yuh falls quickly behind. Most transactions (except tiny transactions on SIX) are cheaper (and sometimes very significantly) at IB. And IB has many more features than Yuh. You can read my review of Interactive Brokers for more information.

Since Neon introduced investing features in 2023, Yuh and Neon are now very similar services. You can read my comparison of Yuh and Neon for more information.

Overall, I would only recommend Yuh for trading for beginners. I would not recommend Yuh as the primary bank. There are better alternatives. And for advanced investors, there are better alternatives as well.

FAQ

How many ETFs can you trade with Yuh?

With Yuh, you can trade more than 50 different ETFs.

How much does a currency exchange cost with Yuh?

Yuh is charging 0.95% per currency exchange.

Is money deposited with Yuh insured?

Yes, your money will be held by Swissquote, which is a bank. It means your money will be insured for up to 100’000 CHF, the basic deposit protection as other Swiss banks.

Can you use Limit orders with Yuh?

Not yet, but they plan adding this feature in the future. In the meantime, trading in market orders works perfectly well for most investments in reputable stocks.

Can you trade in fractions with Yuh?

Yes! Yuh is among the very few Swiss brokers that allow fractional trading!

Who is Yuh good for?

Yuh is good for beginner investors that do not want to invest too much money, especially in foreign currencies. Yuh is also decent if you want to group (at a cost) many services together instead of using multiple services.

Who is Yuh not good for?

Yuh is not great for medium to advanced investors. Yuh is also not great if you want a joint account. Finally, Yuh is not great if you do many transactions in foreign currencies. For all these cases, there are better alternatives.

Yuh Summary

Yuh is an easy and affordable way to invest in the stock market and spend money abroad.

Product Brand: Yuh

4

Yuh Pros

Let's summarize the main advantages of Yuh:

- Very easy to invest in the stock market

- Fractional trading

- Free EUR bank account

- Multi-currency account

- No custody fees

- Cheap fees for small trading operations

- The money is kept safe by Swissquote

- Backed by two large institutions

- Savings plans

Yuh Cons

Let's summarize the main disadvantages of Yuh:

- Expensive currency exchange fees

- No access to U.S. ETFs

- Not great for advanced investors

- Use of structured products for trending themes

- Cannot transfer shares to another broker

Conclusion

Yuh is an easy and affordable way to invest in the stock market and spend money abroad.

Use my code YUHTHEPOORSWISS to get 25 CHF in trading credits!

- Low fees for small operations

- Fractiona trading in stocks

Overall, Yuh is a good trading platform for beginners. The app is very easy to use, and the fees are low for small transactions. If you want to start to invest and want something simple, Yuh will be great for you.

The main issue with the banking package is the currency conversion fee. Their currency exchange rates are very high compared to other actors in the market, which is disappointing for a multi-currency app. So, if you want a digital bank to pay abroad, you should use another bank.

To conclude, Yuh is good for beginner investors who want to start investing without trouble. However, if you want an excellent digital bank, you can use Neon and save on fees abroad. And if you are an experienced investor, you can use Swissquote with many more features.

What about you? What do you think of Yuh?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Best Brokers

- More articles about Investing

- DEGIRO Review 2024: Pros and Cons

- Neon Invest Review 2024: Pros & Cons

- Automate your investments with Interactive Brokers in 2024

Hi Baptiste!

Thank you for gathering this amazing content.

I will start investing and after reading some information ( most of it yours :) i think i’ll start with yuh.

I feel that i would be overwhelmed with ‘IB’…

My main question concerns the absence US ETFs in which i’m interested in. After looking at the list provided by yuh, i can find a ‘VUSD U.S Blue ships’ isn’t it a Vanguard S&P 500?

Thank you in advance!!

Best

Hi André

Thanks, I am happy you like my content.

By US ETF, I meant ETF from the United States (the domicile of the ETF), not ETF with US stocks. This ETF is a European ETF with US stocks inside, which is less efficient as mentioned.

Also, keep in mind that despite its (stupid) name in Yuh, this is not a blue chips ETF, only the 500 bigger companies in the US.

Just curious on how the interest payment are taxed.

If I understand correctly Swiss Government will take 35% of the interest as withholding tax. We can then add this interest to our income in our tax filing and get some money back.

Is my understanding correct?

I am not sure this is the same you are saying but here is what happens with Swiss dividends:

* 35% of the dividends are taxed in advanced (withholding tax).

* You add 100% of the dividends to your taxable income.

* You declare the 35% withholding tax in your tax declaration.

* This 35% tax is removed from the taxes you are due (If you taxes is 1000 and you have paid 30 CHF in withholding tax, you will only pay 970 CHF).

Thank you for your detailed reply. This means Interest on Yuh account and Dividends on market instruments are taxed the same way.

In high level if we could get a good deal in the money market (SNB 1 year is trading at about 1.4% yields), choosing that might be a wiser option (although there are some interest rate risk).

Yes, in theory you could get higher yields outside of the bank account. But they are often expensive with Swiss banks or locked for more years.

Not 100% sure, but I think one difference is that dividends are always taxed with the 35% withholding tax, while interests on accounts are only subject to this tax if the amount is greater than 200 CHF.

Some companies also give you “capital gain”, which are not taxed at all.

You are correct, in that there is a minimum since a few years for the interest on account to be withhold. It makes no difference in the end since we pay the same tax, but it’s of course easier to not have withholding since you don’t have to claim it back later.

Thank you for this fantastic website! Thanks to you I have avoided a life insurance trap and got myself a 3a on Viac.

Would you trust Yuh as a main savings account? I am thinking of security of the app against theft and fraud compared with a more traditional bank.

Hi Alessandro

Glad you were able to avoid this trap!

I think it’s a safe savings account. It’s backed by both PostFinance and Swissquote and is insured as a bank by esisuisse.

I don’t think there is any reason to fear that their app is less secure than others. They have more than 150K customers, if their app had security issues, we’d have heart about it now.

Nevertheless, I’d recommend:

Swiss laws guarantee deposit up to 100K. So don’t save more on your Yuh, or any other, account ! 😉

Save the monthly statement you receive every month in the app. It could help if one morning you find your account empty, and traces of transactions have been deleted !

Note: It’s a young company and they do mistakes. For example, they blocked the account of my mother, without reason, without warning, and without telling her ! Because the account was used for long term saving, it’s only when she tried to make a payment, months later, that she found the payment section had been disabled… !

I have been using Yuh for over a year and find the basic platform/app to be very good. I dont use them for investments but paying interest on balances (CHF/USD/EUR) is good.

In the last few days, I opened an account with “Alpian” which is very like YuH but targeted at larger balances. One needs to have CHF 50k to avoid fees (after initial 6 months free) Less than CHF50k then you are looking at CHF90 per quarter. But I am impressed and their FX conversions are very close to Revolut. Alpian pays 1.0% on balances to CHF50k and 1.5% excess of this. Also is a bank hence guaranteed up to CHF100k. Great app in a multicurrency account with a visa metal card. You have a individual IBAN (multi currency CHF/USD/GBP/EUR).

Alpian seems to want to be almost a Private Bank and offers tailored investment strategies (for an anual management fee of 0.75%).

IMHO, worth a look.

Hi Pat,

Thanks for sharing your experience on Yuh, this is great!

And thanks for sharing your experience on Alpian, very interesting. I have a review of Alpian: Alpian Review 2023 – Pros & Cons

Do you see anything I could add to my review?

Hi Baptiste,

Thanks a lot for the content you publish, I moved last May from Paris to Zurich and all your articles have helped a lot !

I chose Yuh as my Swiss primary bank for 2 reasons:

1. I wanted a very cheap digital bank with simple UX

2. I needed a CHF IBAN (my upcoming Swiss employer required one) even if at the time I was still a French resident. Yuh was the only digital bank providing a CHF IBAN to non Swiss-resident. They sent the card to my house in France, and after arriving in Switzerland I just declared to the bank the change of residence.

I think it is a key differentiator for EU expats planning to move to Switzerland and looking for a convenient (and free) daily banking solution

Hi Charlotte,

Thanks for sharing!

That’s a very good point. If you a CHF account before you move to Switzerland, there are very few accounts available. Yuh has a great advantage there!

Yuh support was good at the beginning, but not anymore! They are probably completely overloaded by the number of customers and requests.

This is a serious issue because the app does not work from time to time. Example I have a sell order which is pending for no reason! Trying to cancel it and I get “operation cannot be canceled”. Trying to submit another trade and I get “Similar order exists. Cancel it and try again” ! Contacting support with the online form is useless, they haven’t answered any of my requests through this channel for months! Contacting phone support and you’re sure to wait 15 mins on the phone…

In summary, the App sometimes does not work and there is no support!

Thanks for sharing your experience!

It seems to be the case for most startups. They start with a good support, but they can’t scale when they have many users. This is sad.

It would be important to mention that Yuh is not a reliable App for investments.

If for some reason they delist a crypto, as it happened for example with “Augur” your funds will be blocked for months.

A lot of customers are affected by this unfair activity, funds blocked since 29th March and no solution from Yuh (Only repeating “it will be available as soon as possible”).

So my personal suggestion is not to invest with them, otherwise you are taking a big risk.

Hi David,

Thanks for sharing. This is interesting, I was not aware of this issue.

Are you saying that you cannot even sell the crypto they have delisted? This is quite bad indeed.

Thank you very much of this objective review Baptist.

After reading the recent comments I see YUH as a confused product.

The positive point being that you can hold €UR or USD with interest, secured in CH if you get paid in said currencies. Additionally you can make free SEPA & card payments but foreign withdrawals are a total no-no at fr. 4.90.

Not sure if withdrawing €UR in CH is even possible.

Hi Trish,

It’s a little confusing because they don’t offer anything really particular in my mind.

I am not sure either if it’s possible, but likely.

First of all, thanks for your reviews and blog. I have followed you for a while now and am moving back to Switzerland from the US next year.

I need to get a good new bank account next year. It’s not easy to open one with the new digital banks

– Neon is a bit annoying as they don’t let you open an account even if you reside in Switzerland if you are still considered a US resident for tax purposes.

– Zak requires you to already have an account with your Swiss address. Pretty annoying

– Yuh language is a bit more open there.

I totally agree with your point of fees with Yuh. But if I only use it as a bank, it’s not that bad. Here is my view

1) I won’t use them for trading as there are many better options

2) High currency exchange fees only true if you really need to exchange the money. Agree it’s not as slick as doing it directly within the bank like Neon.

3) eBills is now available

4) Twint on roadmap. Hope it comes soon

Unfortunately none of the digital banks have the option for a joint account from what I read. I don’t understand why that is so complicated.

I don’t like Migros bank due to the complicated login/authentication and fee (I know just 20 cents) for incoming transfers. That is really nonsense. App also seems to be bad. Raifeissen might be an alternative

Hi Ralph,

Indeed, if you only use it as a bank, it’s not that bad. And as a US citizen, you are quite stuck with your options, as you saw. If you use it properly, Yuh will be interesting and you even have interest on your cash.

I don’ mind the 20 cents fee too much at Migros, but it’s true that their apps are quite bad and the fact that you need two machines to do payments is a huge pain in the ass.

I know many US citizens simply use UBS. They have great English support, relatively good apps and their latest accounts are not that expensive.

I am not a US citizen. I am Swiss citizen living in the US at the moment. Planning my move back home. While opening an account ahead (before living again in Switzerland) is impossible I am checking my best options once back home.

What annoys me is that Neon only allows you to open an account when your tax liability is exclusively in Switzerland. This is not the case for me in 2023 as I will still have to fill a tax return for 2023 (for the few months I am still living and working in the US).

I still have a few months before I am back. Thanks for your blog and all your hard work you are putting into it.

If I were you, I would wait until I was in Switzerland for opening an account. Everything is simpler, but you will indeed have to settle for limited options.