Yuh Review 2024: One app to pay, save and invest

| Updated: |(Disclosure: Some of the links below may be affiliate links)

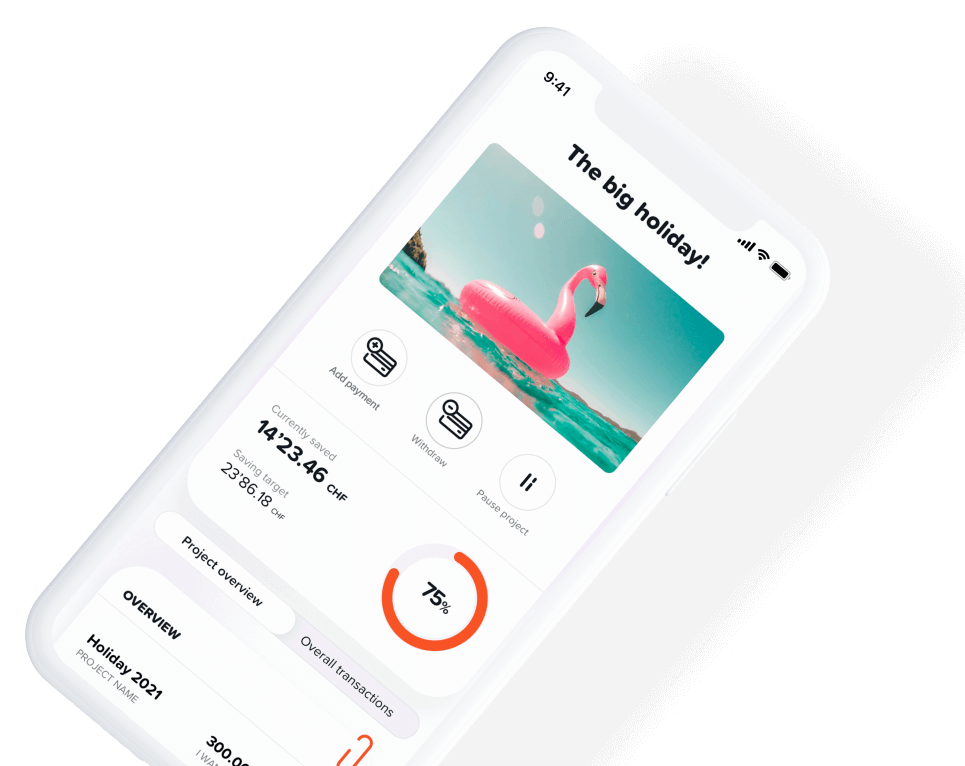

PostFinance and Swissquote started a joint venture: The Yuh banking application. With Yuh, you can save money on your account, pay in Switzerland and abroad, and invest in the stock market and cryptocurrencies.

Yuh is an entirely digital offer. They have no offices. You can manage all your money directly from your phone. So, you will pay your bills and invest your money in your smartphone.

So, should you use Yuh? What features does it have? And how much does Yuh cost? We will find out!

In this article, I will review Yuh’s features, fees, advantages, and disadvantages.

| Custody Fees | 0 CHF |

|---|---|

| Inactivity Fees | 0 CHF |

| Buy Swiss ETF | 0.50% |

| Buy American Stock | 0.50% |

| Currency Exchange Fee | 0.95% |

| Users | 160’000n |

| Languages | English, French, German, and Italian |

| Mobile Application | Yes |

| Web Application | No |

| Custodian Bank | Swissquote |

| Established | 2021 |

| Headquarters | Gland, Vaud |

Yuh

Yuh is an easy and affordable way to invest in the stock market and spend money abroad.

Use my code YUHTHEPOORSWISS to get 25 CHF in trading credits!

- Low fees for small operations

- Fractiona trading in stocks

In May 2021, PostFinance and Swissquote launched the Yuh service. They are trying to unify banking and trading services together. In addition, they want to unify paying, saving, and investing (both in the stock market and in cryptocurrencies) in a single app.

An interesting fact about Yuh is that they will share some of their profits with their cryptocurrency: the Swissqoins.

Yuh’s main selling point is making it easy to do your everyday banking operations and invest in the stock market. Many people do not invest because it is complicated or too expensive when starting with small amounts. Yuh tries to fight that situation.

It is important to note that Yuh is not a bank itself. However, for the customers, it does not make much difference. Indeed, your money will be held by Swissquote, which is a bank. It means your money will be insured for up to 100’000 CHF, the basic deposit protection as other Swiss banks.

Since its creation, Yuh has grown very quickly. In about two years, it reached 160.000 customers, which is impressive growth.

So, overall, Yuh is trying to bring many new things! But does that make them any good? We should look at the details to find out.

Banking Features

For banking features, Yuh has all the basic features you can expect: you can pay your bills with the app and transfer money to and from your account. Currently, you can do wire transfers in many currencies.

You will get a Debit Mastercard to make payments and withdraw money in Switzerland and abroad. You can also pay online with a card with CHF, USD, and EUR (and a long list of other currencies).

The interesting thing about Yuh is that you have a multi-currency account. It means you can receive and keep other currencies in your account. For instance, you could receive EUR and keep it in your account. So, when you have to pay in EUR, it will directly use that balance instead of converting from CHF to EUR.

You can also do peer-to-peer transfers to other users of the application, which is good if you know other users of the app. They also have the usual features, like savings goals, which I do not see any use for. These things are present in most digital banks.

They also have integrated ebills in their app.

Yuh supports Google Pay, Apple Pay, and Samsung Pay if you want to pay with your phone. Since May 2023, they have also provided support for TWINT with their Yuh TWINT app. So, Yuh has complete mobile payment support.

Several new features are planned, like virtual debit cards and teen accounts. You can consult their roadmap to follow their progress.

Overall, Yuh has all the banking features we need (and more) and is very transparent about future features.

Trading Features

Yuh is quite different from a standard broker. Indeed, they are trying to keep it simple. As such, they limit the list of stocks and ETFs we can trade. They try hard to make this list representative of what the users would need.

For an advanced investor, this is a disadvantage. But for a beginner investor, this is a good feature because it will help to choose. This makes Yuh easier for beginners.

Another limitation is that we can only use market orders at this time. Other orders, like limit orders, are planned in the feature. I think this makes sense because having multiple order types can confuse users. And market orders are working well.

It is also important to mention that the app is made to be easy to trade. It is really easy to get started with Yuh.

Yuh also offers savings plans on ETFs and shares, an interesting feature that many investors are looking for. Very few Swiss brokers offer this feature.

On top of stocks and ETFs, Yuh also allows investing in so-called themes. These themes represent trends such as the metaverse or recycling. They allow to invest in companies that represent these themes. On paper, this is great. However, these themes are implemented with structured products.

Structured products are among the most complicated investments available. They are not transparent and are often expensive. Some of the structured products offered by Yuh have a 1% fee. I recommend avoiding these products.

Unfortunately, Yuh does not offer any US ETFs. Since US ETFs are currently the best available to Swiss investors, not having them is a big disadvantage for Yuh.

For more information, you can look at the list of available ETFs (you may have to disable your adblocker to see them). They have a long list of available ETFs, from many providers like Vanguard, ishares and Invesco.

Another disadvantage of Yuh is that you cannot transfer your shares to another broker. So, if you want to switch brokers, you will need to sell all your positions and then transfer the cash.

Finally, Yuh also gives you access to some cryptocurrencies, like Bitcoin and Ethereum. You can access 34 cryptocurrencies, which should be enough for most people. It is unclear whether you can have proper wallet security, but I expect not. And generally, if you cannot have your cryptos in your wallet, you should not use a platform. However, since I am not a crypto expert, I will not detail their crypto features.

Overall, Yuh has great trading features for beginners. However, it is not an app for advanced investors.

Yuh Banking fees

We start with Yuh’s banking fees.

The basic operations are all free:

- Paying for your bills

- Transfer money to and from your account in CHF

- Paying in Switzerland with the Debit Mastercard

- Paying abroad is fee-free, but you will pay high currency exchange fees

- Free transfers in EUR in the EEA zone

- Peer-to-peer payment in the application

You will get one free withdrawal per week in Switzerland. Subsequent withdrawals will cost 1.90 CHF. If you withdraw money abroad, you will pay 4.90 CHF.

However, you can withdraw only 1000 CHF per day and, at most, 10’000 CHF per month. This limit should be good per month, but it could be an issue daily.

There is no limit on wire transfers. However, there is a limit on paying with a card, which you can configure between 500 CHF and 25,000 CHF.

Yuh has positive interest rates, which is extremely rare. Indeed, you can get 1.00% on CHF and 0.75% on EUR and USD. And this is paid for up to 100’00 CHF balances. It is still a great feature if you often hold cash. Some people would like to use this for their emergency fund.

Now comes the expensive part: currency exchange! Yuh is charging 0.95% per currency exchange. All your operations in a foreign currency will cost you 0.95%. This fee is funny because they claim transaction fees are free in 12 currencies, but you have to pay the currency exchange, so it is not free. And if you work with currencies not included in the app, you must pay 1.50%!

For me, the currency exchange fee makes Yuh highly unattractive. Currently, there are several interesting alternatives with free payments in foreign currencies and comparable features for the banking side.

Yuh Trading fees

We then look at Yuh’s trading fees.

First, there are no custody fees. So, you will not pay anything to keep your account open without doing anything. This is a good advantage!

Then, the transaction fees are straightforward:

- 0.5% fee for the stock market with a minimum fee of 1 CHF

- 1.0% fee for cryptocurrencies without a minimum

Compared with other Swiss brokers, these fees are relatively cheap for small operations on the stock market. But they are expensive for large operations. For instance:

- A 1000 CHF investment will cost you 5 CHF, which is cheap

- A 10’000 CHF investment will cost you 50 CHF, which is expensive

On top of that, you will also pay currency exchange fees of 0.95% for your operations with currencies you do not have. For instance, if you have only CHF and want to buy something in USD, you will pay a 0.95% fee. This fee is quite expensive.

Fortunately, the dividends will stay in their original currency. So you will not lose 0.95% of all your dividends in USD.

Of course, you will have to pay the management fees of the ETFs. This is logical, and it is the same for each broker.

Overall, these fees are good for beginners investing small amounts. But they are quickly expensive for advanced investors investing large amounts. This shows once again that Yuh is great for beginners. But you have to be careful about currency conversion fees.

Swissqoins

A unique feature of Yuh is its Swissqoin (SWQ). Swissqoin is a new cryptocurrency token that only exists within Yuh.

There are several ways of earning SWQ:

- By depositing 500 CHF in your account when you open it, you will get 250 SWQ

- By referring another user, you will get 500 SWQ

- By making a trade on Yuh, you will get 5 SWQ

- By paying with your Mastercard, you will get 1 SWQ

You can either redeem them for cash, send them to other Yuh users or keep them in your account.

Currently, one SWQ is worth 0.01 CHF (1 cent). There are 200 million Swissqoins, backed by a 2 million CHF reserve account. But this reserve account is expected to grow with time. Indeed, Yuh will reinvest 10% of its revenues into Swissqoin every month. Now, they say it is only 10% of the subscription revenues. However, there are currently no subscriptions, and there will not be any until 2022. So, I am reading that they will not reinvest anything before 2022, at least.

In 2023, they have added 100 million Swissquoins, with another million CHF in reserve. This was made because the supply of Swissquoins was running out faster than they had expected.

I do not see any value in that cryptocurrency thing. I would rather have a hard cashback or fee reduction on the operations than this gimmick.

Alternatives

There are many alternatives available in both banking and investment services. So, we should compare these services a bit.

One of the selling points of Yuh is to be a multi-currency account that you should be able to use in many countries. If you want to pay abroad for free, we can compare it with Neon (my review).

Yuh has a 0.95% currency conversion fee against 0% for Neon (but about 0.4% for the MasterCard rate). So, Neon is already better than Yuh on this selling point. And if you want to hold multiple currencies, both Revolut and Wise will be cheaper.

We can also compare with Swissquote (my review of Swissquote), the company behind Yuh and a broker. Yuh would be significantly cheaper for small operations. On the other hand, it would become more expensive for large operations.

Yuh has a very limited set of investments compared to the extensive set of instruments available with Swissquote. So, I would rather use Swissquote directly. For more information, you can read my article about Yuh vs Swissquote.

Finally, if we compare it with an international broker like Interactive Brokers, Yuh falls quickly behind. Most transactions (except tiny transactions on SIX) are cheaper (and sometimes very significantly) at IB. And IB has many more features than Yuh. You can read my review of Interactive Brokers for more information.

Since Neon introduced investing features in 2023, Yuh and Neon are now very similar services. You can read my comparison of Yuh and Neon for more information.

Overall, I would only recommend Yuh for trading for beginners. I would not recommend Yuh as the primary bank. There are better alternatives. And for advanced investors, there are better alternatives as well.

FAQ

How many ETFs can you trade with Yuh?

With Yuh, you can trade more than 50 different ETFs.

How much does a currency exchange cost with Yuh?

Yuh is charging 0.95% per currency exchange.

Is money deposited with Yuh insured?

Yes, your money will be held by Swissquote, which is a bank. It means your money will be insured for up to 100’000 CHF, the basic deposit protection as other Swiss banks.

Can you use Limit orders with Yuh?

Not yet, but they plan adding this feature in the future. In the meantime, trading in market orders works perfectly well for most investments in reputable stocks.

Can you trade in fractions with Yuh?

Yes! Yuh is among the very few Swiss brokers that allow fractional trading!

Who is Yuh good for?

Yuh is good for beginner investors that do not want to invest too much money, especially in foreign currencies. Yuh is also decent if you want to group (at a cost) many services together instead of using multiple services.

Who is Yuh not good for?

Yuh is not great for medium to advanced investors. Yuh is also not great if you want a joint account. Finally, Yuh is not great if you do many transactions in foreign currencies. For all these cases, there are better alternatives.

Yuh Summary

Yuh is an easy and affordable way to invest in the stock market and spend money abroad.

Product Brand: Yuh

4

Yuh Pros

Let's summarize the main advantages of Yuh:

- Very easy to invest in the stock market

- Fractional trading

- Free EUR bank account

- Multi-currency account

- No custody fees

- Cheap fees for small trading operations

- The money is kept safe by Swissquote

- Backed by two large institutions

- Savings plans

Yuh Cons

Let's summarize the main disadvantages of Yuh:

- Expensive currency exchange fees

- No access to U.S. ETFs

- Not great for advanced investors

- Use of structured products for trending themes

- Cannot transfer shares to another broker

Conclusion

Yuh is an easy and affordable way to invest in the stock market and spend money abroad.

Use my code YUHTHEPOORSWISS to get 25 CHF in trading credits!

- Low fees for small operations

- Fractiona trading in stocks

Overall, Yuh is a good trading platform for beginners. The app is very easy to use, and the fees are low for small transactions. If you want to start to invest and want something simple, Yuh will be great for you.

The main issue with the banking package is the currency conversion fee. Their currency exchange rates are very high compared to other actors in the market, which is disappointing for a multi-currency app. So, if you want a digital bank to pay abroad, you should use another bank.

To conclude, Yuh is good for beginner investors who want to start investing without trouble. However, if you want an excellent digital bank, you can use Neon and save on fees abroad. And if you are an experienced investor, you can use Swissquote with many more features.

What about you? What do you think of Yuh?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Best Brokers

- More articles about Investing

- Swissquote Review 2024 – A great Swiss Broker

- DEGIRO Review 2024: Pros and Cons

- Trading 212 Review 2024 – Pros & Cons

Hi,

So I opened a yuh account recently and honestly, I really like it so far. I know they are lacking some offers but they are still new and improving it. For example, they didn’t say when but you will soon be able to pay with apple/Google pay. And I also like the fact that it is protected by Swiss banks because with Revolut I already lost a fair amount of money because it was lost during a transaction and they never paid me back because they don’t have too. Therefore, I don’t really mind the fees since the security is behind it.

Hi Leo,

Thanks for sharing your experience!

I agree that’s it’s better than revolut. But I believe Neon is even better and cheaper and also protected by Swiss banks.

I wouldn’t trust revolut with much money.

Thank you for your review!

I just wanted to add a few negative experiences or realizations I’ve recently had with regards to Yuh:

– According to the customer service, they assume that Yuh will never get hacked and have “currently no plan what to do” in case people’s accounts are hacked and assets stolen. In contrast to Neon, for example, they also use the same access code for the app and for payments, making it seem even more insecure.

– Shockingly you CANNOT transfer your Cryptocurrency to an external wallet, currency exchange etc. So you can’t use them to pay either and you can’t stake them to earn interest. In comparison, Revolut offers all these features for free or at low cost. Complaints to Yuh about this are dismissed. The descriptions of the currencies on the app make it sound like you will be able to export/use them, thus misleading Yuh customers in my opinion.

– The customer service is terrible. They try to sound hip and friendly, but a different person will respond to your request each time, without giving a name. The result: Your problems aren’t solved and they provide little to no help. I’ve had a much better experience with the “classic” customer service at my house bank (Kantonalbank), which, for example, on several occasions has a agreed to waive fees as a show of good will, when recent changes to the account were confusing.

All in all, I would not recommend the account in its current shape.

Hi Anton,

Thanks a lot for sharing your experience.

*) It’s a bit crazy that they say they have no plans…

*) I am not surprised, most cheap services don’t give proper cryptocurrency wallets. It’s just a way to invest and sell back, not a way to spend and they do not want to implement all the necessary features.

*) Most digital services are quite bad for customer service to be honest. Revolut for instance is absolutely nightmarish. But with the prices of Yuh, I would have expected better :(

I would not recommend it either!

To me, YUH, is at first glance a direct alternative to Revolut!

Coming from Revolut this seemed very appealing to me, especially since after Brexit I’m stuck with the Revolut UAB entity which has fees for CHF transfers, and I’m divided whether I should open a YUH or Neon account.

Key feature that I like in YUH that Neon does not have is the ability to hold multiple currencies.

On the other hand, Neon has such low exchange rates and the ability to do free international payments that it is really important for me since I ‘m doing many payments in EUR from my Swiss salary account which is in CHF

Adding to my trouble of deciding, YUH, claims to have the lowest exchange rates!! But it is contradictive because here: https://www.yuh.com/en/pricing#pricing-list it seems like the exchange rate is 0,95% which is huge! While here: https://library.yuh.com/shared-images/currency-exchange-comparison-chart-en it seems like the exchange rate is 0,02% which is indeed 3 times lower than Revolut and Neon! So, which is it ???

Finally, I’ve also found this document from their online library which has some extra stats around fees and features: https://library.yuh.com/shared-images/yuh-pricing-more-information-en

Hi

For me, this is extremely unclear. The way I read it is that they have a 0.95% fee which is more than most of their competitors.

I do not know how they can claim that. It’s possible that they are only comparing the spread without other fees, but that does not make sense.

Or, it’s possible that the currency conversion fee is only for investments?

I opened a Yuh account out of curiosity. It is ok for investing small amounts.

And, as of October, you will be able to trade fractions of financial instruments. They will also get rid of the ridiculous order grouping, which means your order will be executed in real time instead of being grouped and executed between 16h00 and 18h00.

Hopefully they will add more investing options in the future (since I opened the account, they already added a bunch of new cryptos and a couple of new themes).

Hi Cris,

That’s interesting. I will have to update this article. It’s indeed better if they have some real-time trading. That makes it more serious.

Thanks for sharing your experience!

A friend at work has shown me this app today at work. He is kind of clueless about invsting but is excited about all the charts there etc. Crypto to buy/sell etc, but also stocks. I have searched for one blue chip from the US, just to see if they offer this, yes, they do. 100 x shares potential trade, about 16 500 USD trade, guess what are the transaction fees? 107 CHF! I do not know if this is final real fee or expected fee, it would be about ca. 0.7 % cost of the purchase? To me this is insane, expensive like hell! What would IBKR charge for such a trade? 8 USD ? To buy US stock for 16 000, any idea? 107 CHF is sick, simply sick.

Plus, I didnt like the overall feel for this, it looks like casino, all these crypto-crap, it looks like an application to buy vegetable or order a pizza but in fact you deal with dangerous things, if you have 18 or 20 years and have no idea about investments. Then these kids telling you things like “if you invested in Bitcoin at 20k look what would you have today!” This will not end well, I do not undestand why regulator allows for such things.

Hi small_potato,

Thanks for the feedback, this is very interesting.

The fees are indeed high, no doubt about that. about 16’500 USD in one US stock or ETF would cost less than 1 USD on IBKR. 100 times less than on yuh, not surprisingly.

It could be even higher than 0.7% because you pay 0.5% fee on the transaction and 0.95% on the currency exchange.

I agree with you on the casino feel. These new apps are really aimed at young people. And they try to make it too easy to invest honestly. I also agree that cryptos need way more regulations.

Hi, is there a way of sending EUR directly from another account to Yuh? Do we have to use the same IBAN as for CHF transfers? I know this is not a support page, but you seem to have had some experience with the app which is why I’m asking. Thank you

Hi aurea,

I do not know. Their documentation is really not clear on the subject. But since they are not a mlti currency account, I think that this not possible. And if possible, the EUR will be automatically converted the CHF with their heavy fees of 0.95%.

Thanks for the reply. It’s just that I am confused because in the article you write “The interesting thing about Yuh is that you get access to a multi-currency account”. Anyway I created an account because I thought they were cheaper than Revolut when using the card and paying in EUR, but it does not seem to be the case. The exchange fee in app is also high as you point out. Then I thought maybe as a EUR account it might be interesting. But there again it seems not to be possible if you don’t exchange on their own platform. So yeah… I think the app is gonna be unused for now which is a shame. For EUR account I use N26 which is great, it’s just a shame they use Wise for the currency exchange because it is more expensive than Revolut. And for large amount nothing beats IBKR exchange fee.

I actually confused myself, sorry!

You should indeed be able to keep the multiple currencies, my bad. But I am not sure you will be able to receive EUR directly into your account.

As for the price, it’s considerably cheaper than Revolut and TW. If you are looking for price, Yuh is not for you, there are better and cheaper alternatives.

And I agree with your strategy, N26 is great for EUR, Wise is great in general, but not always very cheap. Revolut is good for small amounts (<1250 CHF per month) and IBRK is top-notch for large amounts.

Hi again, I have tried it and it is in fact possible to deposit other currencies than CHF directly to the account. I have sent EUR via bank transfer to Yuh and it was credited as EUR. I have not tried it with USD, but I think it should work as well. Same for the other currencies available in the app. So this part is actually quite good; if someone needs a EUR or USD account.

One other thing that is quite interesting for me is that when I pay something in EUR I am used to using Revolut. But free Revolut does not have any cashback whatsoever. Whereas Yuh has this small 2 SWQ cashback. So I think now I will be converting to EUR in Revolut, sending that to Yuh, and using Yuh for the payments.

Hi aurea,

Thanks for sharing. It’s good to know that it’s indeed possible to directly transfer EUR directly. This could make it a good EUR account as long as it’s not used for converting.

I did not think about the cashback. It’s true that for foreign currencies you would get some cashback with them but not with Revolut, Neon or Wise. It’s less convenient, but could be interesting if you do many of these payments. Interesting strategy, did not think of that :)

Great review. Would definitely not be interested in opening an account with them, so many negatives.

Hi Daniel,

Thanks :)

Yes, I agree. At this point, they do worse than a bank and worse than a broker, not much interest in opening an account.

I was happy to find your very complete review, thanks for your work!

Personally, what made me open my account (today) is the Swissqoins. It might be worth nothing for a year or two, but who knows, maybe the value of these 500 Swissquoins will explode in a few years… And I don’t mind moving a little bit of my savings to do the experiment. It’s also not very risky, it’s not like it’s a random new bank. It’s backed by two very well known and reputable banks in Switzerland.

In my case, I’m quite new to investing so that might be a good platform to start.

And I am happy to try something new and innovative, instead of sticking entirely with these boring big banks who only start caring about their customers when they have 10M+ in their accounts, if you see what I mean :)

Like all coins, there is a small probability that it goes nuts, but that’s more akin to gambling than investing ;) Although I would argue that the risks are lower but generally lower risks means lower upsides as well.

These “investments” are not low risk – they are extremely risky. The chance for capital destuction is extreme (most of these crypto-things will not exist later in the future) and the only reason why you do not FEEL it is risky because you put tiny amount of your money there. Would you put your lifetime or your family savings into this? Start reading about value investing, there are million videos and books, do not put even 100 USD to this madness, speculation and gambling. This is, most likely, lost money. And paradoxically, I wish you… that you lose that small money now – same like I lost 1/3rd of my salary many years ago when I started having fun on future contracts, highly leverages instruments (wiped 1/3 of my salary in 1 day). I am grateful to God that this happened – had I earned money there, I would put much more into action and lose all of it next day or next week, because of the nature of the thing. Futures, options, crypto, day-trading etc, this is all fad, very very tiny % of people really makes money on this. ANd even if so, they have more luck than knowledge, because you can not, by any means, evaluate what crypto is worth. It is only a game, a fad, when next monkey buys for a higher price., hoping to sell it to yet another sucket. The richest people on this planet have never invested in crypto etc. They buy good businesses at discounted price. I am not your dad or a coach and not trying to tell you how to live your life, but really, read, and do not do things you do not understand (and I say this to myself, after many years , I still do not udnerstand many things in the market). Cheers.

I agree maybe it’s not the cheapest product at the moment but for me the free EUR account is what I was missing with Neon. I’m also interested how the Swissqoin will perform in the future :)

Yes, the EUR account can be useful to many people. I hope other services (Neon?) will start offering EUR bank accounts.

I was exited to get a Yuh account, and read your review the day I got my card. Excellent review in a very small time window, bravo! As for the product, it have the potential to be what most people need in a single app / account but never fully succeed, that’s a shame. It will be interesting to see what the next year pricing will be. Personally I wouldn’t mind paying 5.- per month to have the ultimate Swiss army knife of banking and trading operation in my pocket, but that seems like a long way to go. As the saying goes: Jack of all trades, master of none