FlowBank Review 2024 – Pros and Cons

| Updated: |(Disclosure: Some of the links below may be affiliate links)

FlowBank is a new Swiss digital finance service that was launched publicly in late 2020. It plans to be both a bank and a fully-fledged broker, so you can have your money and stocks in the same place.

FlowBank is an innovative digital bank platform that would bring cheaper trading to Switzerland. On paper, it sounds exciting. Currently, the investing features are ready, while the banking features are not yet all ready.

So, we will see how good it is in this in-depth review.

| Custody Fees | 0.10% per year |

|---|---|

| Inactivity Fees | 0 CHF |

| Buy Swiss ETF | Free |

| Buy American Stock | 0.15%, minimum 6.50 USD |

| Currency Exchange Fee | 0.50% |

| Languages | English, French, and German |

| Mobile Application | Yes |

| Web Application | Yes |

| Custodian Bank | Credit Suisse |

| Established | 2020 |

| Headquarters | Genève |

FlowBank

FlowBank was started in 2020 by Charles-Henri Sabet. They officially started their public service in November 2020.

FlowBank is an officially licensed bank from Switzerland. This license is excellent since it means we get Swiss banking protection. And it is interesting to note that they are the first bank to be licensed since 2009. They already employ 90 people in Geneva.

In 2021, Coinshares (a sizeable digital asset management company) acquired a 9% stake in FlowBank. And then again, in 2022, they acquired a second 20% stake in the company. This investment gave a significant boost to FlowBank’s continued growth.

FlowBank is trying to make online banking and trading simpler and more accessible. They are offering a multi-currency bank account and a broker account.

Their vision is to be seriously simple, seriously banking, and seriously Swiss. I am not sure exactly what it means, but it is interesting.

FlowBank offers customer service 24 hours a day and five days a week. It is worth noting that this customer service is based in Switzerland. I have contacted their support several times to get information, and they have been very responsive.

Banking with FlowBank

At this time, the information about banking with them is not yet complete.

Indeed, the offer itself is not yet ready. Here is what we can find about the banking features. You can hold several currencies and pay online with a virtual card. However, the banking fees are very unclear. My interpretation of the fees is such:

- Transferring money to your account is free

- Transferring money out of the account is not free

- Transferring CHF or EUR in Switzerland or Lichtenstein costs 2 CHF

- Transferring CHF outside of Switzerland costs at least 10 CHF

- Transferring EUR outside of Switzerland costs at least 10 CHF

These are costly fees for a bank. If you cannot get money from the account for free, it is not an acceptable bank account. These fees make it only valid as a trading account since you do not want to get money out of it very often.

Currently, they have no physical card. But one physical card is planned for later. The website has no details on the fees for the physical card when it comes. So we will have to wait and see for that part.

I have talked to the FlowBank team about that, and they told me that they want to focus on their trading system currently. This is why the banking information on the website is not complete, nor is the pricing. So, we should expect prices for the banking features to change.

However, the website contains a lot of information about their trading system. So, I will primarily focus on this aspect in this review.

Trading with FlowBank

As mentioned before, FlowBank offers many trading features. They have two different products:

- FlowBank App

- FlowBank Pro

FlowBank App is for simple investors and beginner investors. It is only available on mobile. You can get an idea of the FlowBank app from their video.

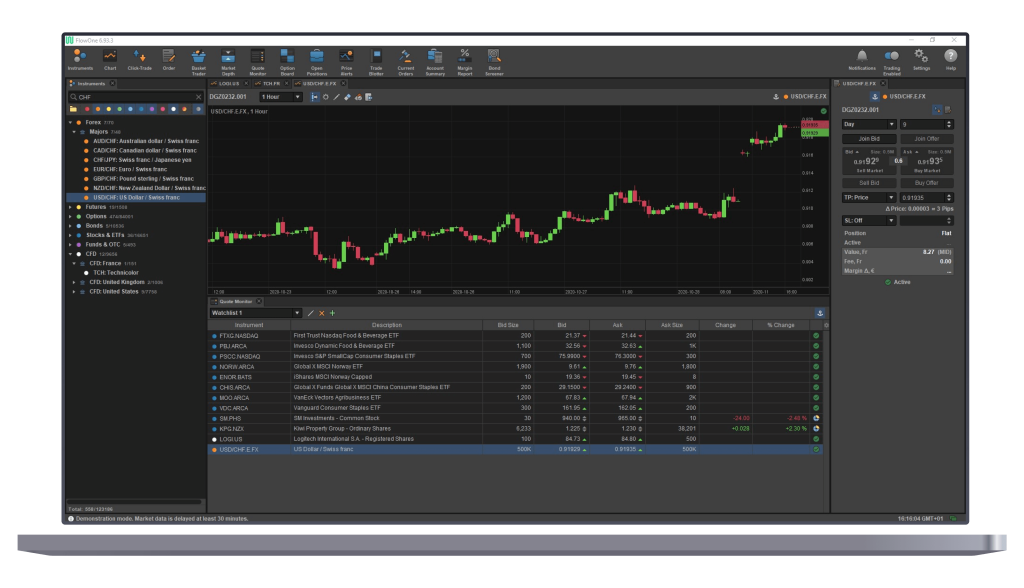

Flow BankPro focuses on expert investors. FlowBank Pro is available in many flavors:

- Desktop application for Windows, Mac, and Linux

- Mobile application for Android and iOS

- Web application

It is excellent that we can trade from so many platforms with a single application.

You can trade in many instruments:

- Stocks, bonds, and Exchange Traded Funds (ETFs)

- Options and futures

- Forex

- Commodities

- Contracts for Differences (CFDs)

That is a lot of instruments, but good passive investors will ignore everything that is not Stocks, Bonds, or ETFs. I would especially advise against using CFDs.

Also, it is essential to remember that some features are very limited. For instance, you can trade options, but not of every stock. And you are limited in the options dates.

You can buy and sell shares with the standard market, limit, and loss orders for the basic instruments. These orders are all we need to trade!

One interesting feature is the ability to trade in fractional shares. Most Swiss brokers do not allow this, which could be interesting if you want to buy shares of costly stocks. However, this is not common for ETFs.

The application has many advanced features:

- Price alerts

- Advanced Reporting

- Screeners for bonds

- Margin monitors

Overall, FlowBank has more than enough features for trading. They have apps for both simple investors and active investors. It is great that they are trying to be easy to use for beginners.

FlowBank Fees

For passive investors, investing fees are very important. Therefore, we need to look at their fees.

There is no account management fee. However, there is a yearly custody fee of 0.10%. This fee is paid each quarter (0.025% per quarter). The minimum is 10 CHF per quarter (40 CHF minimum per year), and the maximum is 50 CHF per quarter (200 CHF maximum per year).

While 0.10% may seem like a lot, 40 CHF per year is not unreasonable for small portfolios. And with a maximum of 200 CHF per year, it will also be very little for large portfolios. This is a reasonable custody fee compared to some Swiss brokers. Therefore, I do not believe this custody fee will be an issue for most users.

Note that the custody fee will not apply to your banking assets, only to your trading assets (once they start their bank services).

They have two account types:

- Classic, the default account

- Platinum, once you reach 100’000 CHF in your account

The fees for stocks and ETFs are the same. These fees are different for each stock exchange and account type; for instance:

- SIX (Switzerland): Free!

- Euronext (Europe)

- Classic: 0.15% with a minimum of 6.50 EUR

- Platinum: 0.10% with a minimum of 6.50 EUR

- NYSE (USA)

- Classic: 0.15% with a minimum of 6.50 USD

- Platinum: 0.10% with a minimum of 6.50 USD

The great thing here is that the minimums are low! These minimums mean you can trade in many ETFs with less than 7 CHF! If you reach the platinum level, the base price will be low.

On the other hand, there is no maximum. But even if you buy 20’000 CHF worth of shares, you will only pay 20 CHF with the platinum account. This is very low compared to other Swiss brokers.

FlowBank supports many more stock exchanges with similar prices. You can read more on their pricing page.

The commission will be 0.20% for bonds with a minimum of 50 CHF. It is not great. But most investors do not buy bonds directly anyway. Instead, they use bond ETFs, which are cheaper.

I will not detail other instruments since I do not recommend you use them anyway. But we are also interested in Forex conversions.

Forex is also relatively expensive, with a 0.5% conversion fee. If you want to buy an ETF in USD, you will have to pay 0.5% for the conversion and then the commission fee on top of this fee. For a Swiss broker, this is relatively cheap.

Overall, these fees are great. For small operations, the small minimums make them very cheap. And large transactions should be OK with small percentages as well. And having free transactions on the Swiss stock exchanges is excellent as well!

Security

We can take a look at FlowBank’s security.

First, FlowBank is a licensed bank from FINMA and is a member of esisuisse (the Swiss deposit protection scheme). So, in case of bankruptcy, your cash is safe for up to 100’000 CHF.

Your stocks and investments are segregated from FlowBank’s primary entity. Every broker does this segregation. And FlowBank support confirmed that all assets are segregated, and they use Credit Suisse as a custodian bank.

FlowBank’s applications seem technically secure. Creating an account requires uploading some official documents to verify your identity.

I have not found any information about data leaks or security breaches with FlowBank. But given that they are new, this does not weigh much in the balance.

Overall, FlowBank’s security seems good. However, I wish they would discuss it more on the website.

Alternatives

In the future, Flowbank will be both a bank and a broker. For now, we do not know enough about bank accounts, so we will focus on brokerage services. We can quickly compare FlowBank with some alternative brokers.

FlowBank vs Swissquote

Everything you need to start investing in the stock market! Open an account with Swissquote and get 100 CHF in trading credits with my code MKT_THEPOORSWISS.

- Swiss broker

- Easy to use

If we compare it against a Swiss broker like Swissquote, FlowBank is interesting in terms of fees. For both trading fees and currency conversion fees, FlowBank is significantly cheaper than Swissquote. They have the same custody fees.

For large operations, both brokers charge the same fees. But FlowBank can be significantly cheaper for small operations.

Both brokers have the same features, which is enough for passive investors.

The advantage of Swissquote is that they are well-established and have a good reputation. So, you must choose between the price and the trust of a well-known company.

If you want more information, you can read my review of Swissquote.

FlowBank vs Interactive Brokers

The broker you need to buy stocks and ETFs reliably and at extremely affordable prices. Trade U.S. stocks for as little as 0.5 USD!

- Extremely affordable

- Wide range of investing instruments

But if you want the cheapest broker, you could use a foreign broker. For instance, I am using Interactive Brokers. The fees of Interactive Brokers are significantly lower than those of FlowBank, especially for US markets and currency exchanges.

The only disadvantage of Interactive Brokers is that they are not Swiss brokers. But for many people, this does not matter.

If you want more info, read my Interactive Brokers review.

FlowBank FAQ

What is the minimum deposit for FlowBank?

There is no minimum deposit at FlowBank!

Does FlowBank have custody fees?

There is a yearly custody fee of 0.10%. This fee is paid quarterly, with a minimum of 10 CHF and a maximum of 50 CHF.

Does FlowBank have inactivity fees?

No, FlowBank does not have any inactivity fee.

What is FlowBank good for?

FlowBank is good as a broker, with cheap fees, especially for Swiss securities.

What is FlowBank not good for?

FlowBank is not good as a bank since it is still missing many banking features that it may have in the future. FlowBank is also pretty new, so it is not a great option if you want a well-established broker.

FlowBank Summary

FlowBank is a Swiss bank that wants to make trading and banking simpler for everybody, at a low-cost.

Product Brand: FlowBank

4

FlowBank Pros

Let's summarize the main advantages of FlowBank:

- Free transactions on the Swiss stock exchange

- Very cheap transactions costs

- Relatively cheap currency conversion fees

- They are a licensed bank, so your money is secured for up to 100'000 CHF

- Reasonable custody fees for all portfolios

- Allow trading in fractional shares

- Simple to get started with

- Can trade on many platforms

- They have a demo account to test the system

- Very responsive customer support

FlowBank Cons

Let's summarize the main disadvantages of FlowBank:

- They are very new to the market

- We currently do not know anything about their bank offering

Conclusion

It is good to see new digital banks and products aiming to make the Swiss market cheaper. And I believe it is also good to try to make investing more straightforward for people. Most Swiss people are not investing, but they could profit from a simple investing app.

FlowBank is interesting as a broker account. They have simple trading applications that should simplify investors’ lives. They also have very low minimums that should allow starting trading without too high fees. You can even invest in Swiss stocks and ETFs without fees! On top of that, they have very reasonable custody fees.

I have not yet compared FlowBank to all other Swiss brokers, but I will soon. It seems to me that FlowBank is a very serious contender against these other Swiss brokers. It would be good to have some movement in this field.

If you want to start investing with a Swiss broker, FlowBank may be an interesting choice. If you need more options, you can look at my articles about the best Swiss Brokers. I will soon update it to include FlowBank.

In the future, FlowBank will offer banking features in addition to its investing features, but it currently only provides investing features. Once it does, I will review it again for its banking features and compare it with other banks.

If you do not mind using a foreign broker, I would still recommend using Interactive Brokers, as I do.

If you have tried FlowBank, I would be glad to hear your thoughts about them.

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Best Robo-Advisors

- More articles about Investing

- Simplewealth Review 2024 – Pros & Cons

- True Wealth Review 2024 – Pros & Cons

- Raiffeisen Rio Review 2024: Pros & Cons

Thanks for the review, very usefull.

About the custody fees, you don’t mention that the amounts are per position (i.e. 10bp and max 200CHF). They usually are. Not in this case? is it for the whole account regardless of the number of positions?

Hi Sam

I have never heard of any custody fee per position, do you have an example?

At least for FlowBank (and all the brokers I have reviewed so far), the custody fee is for the entire portfolio, not for each position.

Thanks for the detailed review! Do you know if Flowbank has minimum capital restrictions on day trading stocks? In the US, they call it pattern day trading rule (PDT), where day trading is limited to 3 trades in a 5 day period, if account is under $25k.

Hi Son,

I am not aware of any such rule. I think you can trade as actively as you can.

thanks to your blog, I have heard about flowbank and opened an account. This was very easy and even got 1 stock as present from them, which I could sell with profit. But as soon as you want to close your account, the pain starts. I had to print and scan a form 3 times because my signature did not match the one on my ID. At the end I traced it (put the ID below the paper). Then I had to transfer 15.- for closure and then I never heard back from them. Not even after my 7th reminder by Email, they did not come back to me and confirm that the account was closed. Now I tried it with Twitter, lets see what this brings. I can still login, no cash there but still works. So not sure what they do, if they do anything at all. Clearly not going back to them and absolutely disappointment. I would rather recommend Cornertrader, when I cancelled my account there I got support and friendly service until the very last second.

Hi Thierry,

Thanks for sharing! Sorry to hear about your experience closing your account.

It’s indeed disappointing that they stop serving you the minute you close your account (and they don’t even seem to close it :( ).

well, after 12 reminders, they finally acted. I started to copy the whole world I found in LinkedIn and posted a review on TrustPilot, and suddenly a call. we are missing this and that: “I have already sent that. you can write no? then why dont you reply to my emails?”. then I sent it again and finally they confirmed the closure. if the email got lost or not, they could have at least sent me an email saying what was missing after my second reminder. so definitely not a recommendation, despite the savings. and also that the stocks are not registered under your name, so no chocolate from lindt if you have their stock ;-)

Thanks for sharing your example. It does not sound great indeed :(

It should not be difficult to close an account!

This confort me in that this bank is not mature enough for most people. This is sad.

Yes, indeed disappointing. I am facing the same issues now as I am closing my account with them. They simply went into non-action and claimed that the closure was delayed as it has to go through many departments. I am seriously doubting them on their “Seriously Simple Swiss Banking” slogan.

Thanks for sharing, this is weird indeed that it takes so long to close an account if all the money is where it’s supposed to be…

How can flowbank still have Credit Suisse as custodian bank? Does it mean that they have UBS now? I am missing something? Thank you.

Yes, you are missing something. Credit Suisse still exists, there are still Credit Suisse accounts and funds. It’s just a subsidiary of UBS, it won’t disappear in a few months.

Dear All,

can confirm that the max custody fees are CHF 50.- per quarter. Not only as per pricing list, but also based on actual charges.

Hope this helps

Kind regards, Lorenz

Thanks for the confirmation, Lorenz!

Been doing some research on this entity, as I wish to move a notable portion of my portfolio to a better priced broker (SwissQuote is just killing me with their fees).

However, I am seeing some red flags here:

1. Reviews from former employees?

https://www.glassdoor.com/Overview/Working-at-FlowBank-EI_IE3624869.11,19.htm

2. Is this a re-packaged LCG as suggested by a former employee in the above thread?

https://uk.trustpilot.com/review/lcg.com

3. Their Facebook page – I don’t see any comments on any of their posts. Zero comments on every post I’ve seen. Is no one posting – or are comments being deleted?

Like every one here – I’d LOVE to see a trustworthy, reliable, Swiss brokerage that can offer us even remotely competitive pricing – but, the red flags above leave me cautiously on the sidelines for now.

Hi,

Thanks for sharing these points, it’s indeed concerning. However, it’s probably the same for most startups that “search themselves”.

For Facebook, I think it’s difficult to get traction (I have tried myself). So, I would not put that on the cons list, they may just be failing their social media strategy.

Trading is Switzerland is quite expensive and will maybe remain that way. If I were to use a Swiss broker I would still use Swissquote myself and just pay the fees, they are still much cheaper than something like SAXO.

If you really want to cut fees, go with IB.

Flowbank Custody fees is 0.10% (+ VAT) per quarter (i.e. 0.40% annually).

Important : Min 10 CHF and max 50 CHF, debited per quarter (i.e 40 CHF MIN and 200 CHF Max Per annum)

Hi Mohit,

I am not sure that’s correct. If we look at the official fees (very unclear), they do a calculation of 0.10% * 0.25 per quarter, so that would still be 0.10% per year.

Hi Baptiste,

I have open account with flow bank last year in Dec and In jan I have seen the change of 10CHF on my account as Fees.

I have called the flowbank and this what they told me : 0.1% per quarter with min 10 CHF per quarter.

Additionally, please see the page 14 of their pricing sheet https://www.flowbank.com/hubfs/Pricing/Pricing-April-2022/EN_Flowbank_Pricinglist_13_04_2022.pdf

Custody fees

0.10% (+ VAT)

Min 10 CHF and max 50 CHF, debited per quarter

Regards

Mohit

10 CHF is the minimum per quarter, but I still believe 0.10% is the total per year. I will contact them directly to be sure and come back.