FlowBank Review 2024 – Pros and Cons

| Updated: |(Disclosure: Some of the links below may be affiliate links)

FlowBank is a new Swiss digital finance service that was launched publicly in late 2020. It plans to be both a bank and a fully-fledged broker, so you can have your money and stocks in the same place.

FlowBank is an innovative digital bank platform that would bring cheaper trading to Switzerland. On paper, it sounds exciting. Currently, the investing features are ready, while the banking features are not yet all ready.

So, we will see how good it is in this in-depth review.

| Custody Fees | 0.10% per year |

|---|---|

| Inactivity Fees | 0 CHF |

| Buy Swiss ETF | Free |

| Buy American Stock | 0.15%, minimum 6.50 USD |

| Currency Exchange Fee | 0.50% |

| Languages | English, French, and German |

| Mobile Application | Yes |

| Web Application | Yes |

| Custodian Bank | Credit Suisse |

| Established | 2020 |

| Headquarters | Genève |

FlowBank

FlowBank was started in 2020 by Charles-Henri Sabet. They officially started their public service in November 2020.

FlowBank is an officially licensed bank from Switzerland. This license is excellent since it means we get Swiss banking protection. And it is interesting to note that they are the first bank to be licensed since 2009. They already employ 90 people in Geneva.

In 2021, Coinshares (a sizeable digital asset management company) acquired a 9% stake in FlowBank. And then again, in 2022, they acquired a second 20% stake in the company. This investment gave a significant boost to FlowBank’s continued growth.

FlowBank is trying to make online banking and trading simpler and more accessible. They are offering a multi-currency bank account and a broker account.

Their vision is to be seriously simple, seriously banking, and seriously Swiss. I am not sure exactly what it means, but it is interesting.

FlowBank offers customer service 24 hours a day and five days a week. It is worth noting that this customer service is based in Switzerland. I have contacted their support several times to get information, and they have been very responsive.

Banking with FlowBank

At this time, the information about banking with them is not yet complete.

Indeed, the offer itself is not yet ready. Here is what we can find about the banking features. You can hold several currencies and pay online with a virtual card. However, the banking fees are very unclear. My interpretation of the fees is such:

- Transferring money to your account is free

- Transferring money out of the account is not free

- Transferring CHF or EUR in Switzerland or Lichtenstein costs 2 CHF

- Transferring CHF outside of Switzerland costs at least 10 CHF

- Transferring EUR outside of Switzerland costs at least 10 CHF

These are costly fees for a bank. If you cannot get money from the account for free, it is not an acceptable bank account. These fees make it only valid as a trading account since you do not want to get money out of it very often.

Currently, they have no physical card. But one physical card is planned for later. The website has no details on the fees for the physical card when it comes. So we will have to wait and see for that part.

I have talked to the FlowBank team about that, and they told me that they want to focus on their trading system currently. This is why the banking information on the website is not complete, nor is the pricing. So, we should expect prices for the banking features to change.

However, the website contains a lot of information about their trading system. So, I will primarily focus on this aspect in this review.

Trading with FlowBank

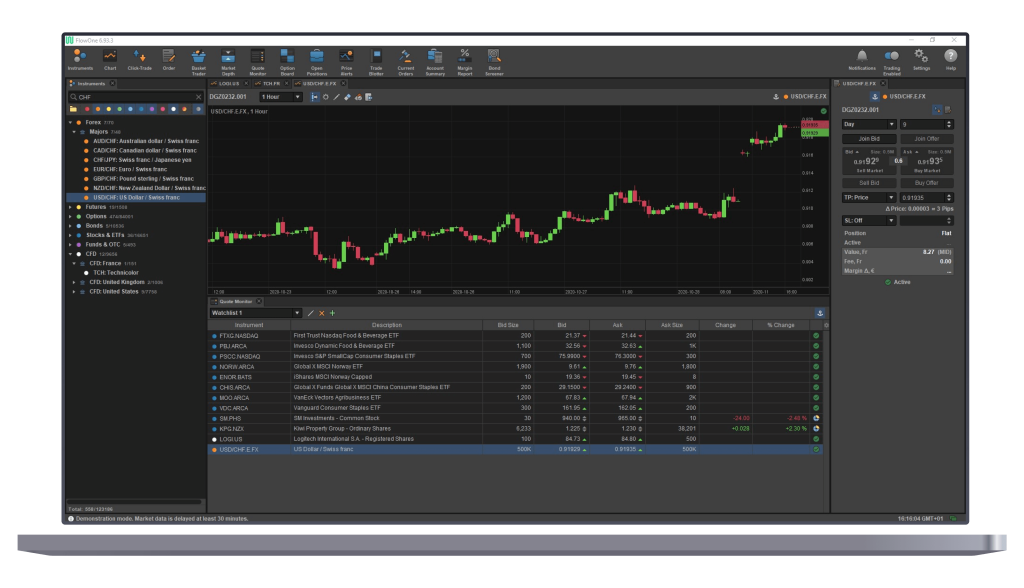

As mentioned before, FlowBank offers many trading features. They have two different products:

- FlowBank App

- FlowBank Pro

FlowBank App is for simple investors and beginner investors. It is only available on mobile. You can get an idea of the FlowBank app from their video.

Flow BankPro focuses on expert investors. FlowBank Pro is available in many flavors:

- Desktop application for Windows, Mac, and Linux

- Mobile application for Android and iOS

- Web application

It is excellent that we can trade from so many platforms with a single application.

You can trade in many instruments:

- Stocks, bonds, and Exchange Traded Funds (ETFs)

- Options and futures

- Forex

- Commodities

- Contracts for Differences (CFDs)

That is a lot of instruments, but good passive investors will ignore everything that is not Stocks, Bonds, or ETFs. I would especially advise against using CFDs.

Also, it is essential to remember that some features are very limited. For instance, you can trade options, but not of every stock. And you are limited in the options dates.

You can buy and sell shares with the standard market, limit, and loss orders for the basic instruments. These orders are all we need to trade!

One interesting feature is the ability to trade in fractional shares. Most Swiss brokers do not allow this, which could be interesting if you want to buy shares of costly stocks. However, this is not common for ETFs.

The application has many advanced features:

- Price alerts

- Advanced Reporting

- Screeners for bonds

- Margin monitors

Overall, FlowBank has more than enough features for trading. They have apps for both simple investors and active investors. It is great that they are trying to be easy to use for beginners.

FlowBank Fees

For passive investors, investing fees are very important. Therefore, we need to look at their fees.

There is no account management fee. However, there is a yearly custody fee of 0.10%. This fee is paid each quarter (0.025% per quarter). The minimum is 10 CHF per quarter (40 CHF minimum per year), and the maximum is 50 CHF per quarter (200 CHF maximum per year).

While 0.10% may seem like a lot, 40 CHF per year is not unreasonable for small portfolios. And with a maximum of 200 CHF per year, it will also be very little for large portfolios. This is a reasonable custody fee compared to some Swiss brokers. Therefore, I do not believe this custody fee will be an issue for most users.

Note that the custody fee will not apply to your banking assets, only to your trading assets (once they start their bank services).

They have two account types:

- Classic, the default account

- Platinum, once you reach 100’000 CHF in your account

The fees for stocks and ETFs are the same. These fees are different for each stock exchange and account type; for instance:

- SIX (Switzerland): Free!

- Euronext (Europe)

- Classic: 0.15% with a minimum of 6.50 EUR

- Platinum: 0.10% with a minimum of 6.50 EUR

- NYSE (USA)

- Classic: 0.15% with a minimum of 6.50 USD

- Platinum: 0.10% with a minimum of 6.50 USD

The great thing here is that the minimums are low! These minimums mean you can trade in many ETFs with less than 7 CHF! If you reach the platinum level, the base price will be low.

On the other hand, there is no maximum. But even if you buy 20’000 CHF worth of shares, you will only pay 20 CHF with the platinum account. This is very low compared to other Swiss brokers.

FlowBank supports many more stock exchanges with similar prices. You can read more on their pricing page.

The commission will be 0.20% for bonds with a minimum of 50 CHF. It is not great. But most investors do not buy bonds directly anyway. Instead, they use bond ETFs, which are cheaper.

I will not detail other instruments since I do not recommend you use them anyway. But we are also interested in Forex conversions.

Forex is also relatively expensive, with a 0.5% conversion fee. If you want to buy an ETF in USD, you will have to pay 0.5% for the conversion and then the commission fee on top of this fee. For a Swiss broker, this is relatively cheap.

Overall, these fees are great. For small operations, the small minimums make them very cheap. And large transactions should be OK with small percentages as well. And having free transactions on the Swiss stock exchanges is excellent as well!

Security

We can take a look at FlowBank’s security.

First, FlowBank is a licensed bank from FINMA and is a member of esisuisse (the Swiss deposit protection scheme). So, in case of bankruptcy, your cash is safe for up to 100’000 CHF.

Your stocks and investments are segregated from FlowBank’s primary entity. Every broker does this segregation. And FlowBank support confirmed that all assets are segregated, and they use Credit Suisse as a custodian bank.

FlowBank’s applications seem technically secure. Creating an account requires uploading some official documents to verify your identity.

I have not found any information about data leaks or security breaches with FlowBank. But given that they are new, this does not weigh much in the balance.

Overall, FlowBank’s security seems good. However, I wish they would discuss it more on the website.

Alternatives

In the future, Flowbank will be both a bank and a broker. For now, we do not know enough about bank accounts, so we will focus on brokerage services. We can quickly compare FlowBank with some alternative brokers.

FlowBank vs Swissquote

Everything you need to start investing in the stock market! Open an account with Swissquote and get 100 CHF in trading credits with my code MKT_THEPOORSWISS.

- Swiss broker

- Easy to use

If we compare it against a Swiss broker like Swissquote, FlowBank is interesting in terms of fees. For both trading fees and currency conversion fees, FlowBank is significantly cheaper than Swissquote. They have the same custody fees.

For large operations, both brokers charge the same fees. But FlowBank can be significantly cheaper for small operations.

Both brokers have the same features, which is enough for passive investors.

The advantage of Swissquote is that they are well-established and have a good reputation. So, you must choose between the price and the trust of a well-known company.

If you want more information, you can read my review of Swissquote.

FlowBank vs Interactive Brokers

The broker you need to buy stocks and ETFs reliably and at extremely affordable prices. Trade U.S. stocks for as little as 0.5 USD!

- Extremely affordable

- Wide range of investing instruments

But if you want the cheapest broker, you could use a foreign broker. For instance, I am using Interactive Brokers. The fees of Interactive Brokers are significantly lower than those of FlowBank, especially for US markets and currency exchanges.

The only disadvantage of Interactive Brokers is that they are not Swiss brokers. But for many people, this does not matter.

If you want more info, read my Interactive Brokers review.

FlowBank FAQ

What is the minimum deposit for FlowBank?

There is no minimum deposit at FlowBank!

Does FlowBank have custody fees?

There is a yearly custody fee of 0.10%. This fee is paid quarterly, with a minimum of 10 CHF and a maximum of 50 CHF.

Does FlowBank have inactivity fees?

No, FlowBank does not have any inactivity fee.

What is FlowBank good for?

FlowBank is good as a broker, with cheap fees, especially for Swiss securities.

What is FlowBank not good for?

FlowBank is not good as a bank since it is still missing many banking features that it may have in the future. FlowBank is also pretty new, so it is not a great option if you want a well-established broker.

FlowBank Summary

FlowBank is a Swiss bank that wants to make trading and banking simpler for everybody, at a low-cost.

Product Brand: FlowBank

4

FlowBank Pros

Let's summarize the main advantages of FlowBank:

- Free transactions on the Swiss stock exchange

- Very cheap transactions costs

- Relatively cheap currency conversion fees

- They are a licensed bank, so your money is secured for up to 100'000 CHF

- Reasonable custody fees for all portfolios

- Allow trading in fractional shares

- Simple to get started with

- Can trade on many platforms

- They have a demo account to test the system

- Very responsive customer support

FlowBank Cons

Let's summarize the main disadvantages of FlowBank:

- They are very new to the market

- We currently do not know anything about their bank offering

Conclusion

It is good to see new digital banks and products aiming to make the Swiss market cheaper. And I believe it is also good to try to make investing more straightforward for people. Most Swiss people are not investing, but they could profit from a simple investing app.

FlowBank is interesting as a broker account. They have simple trading applications that should simplify investors’ lives. They also have very low minimums that should allow starting trading without too high fees. You can even invest in Swiss stocks and ETFs without fees! On top of that, they have very reasonable custody fees.

I have not yet compared FlowBank to all other Swiss brokers, but I will soon. It seems to me that FlowBank is a very serious contender against these other Swiss brokers. It would be good to have some movement in this field.

If you want to start investing with a Swiss broker, FlowBank may be an interesting choice. If you need more options, you can look at my articles about the best Swiss Brokers. I will soon update it to include FlowBank.

In the future, FlowBank will offer banking features in addition to its investing features, but it currently only provides investing features. Once it does, I will review it again for its banking features and compare it with other banks.

If you do not mind using a foreign broker, I would still recommend using Interactive Brokers, as I do.

If you have tried FlowBank, I would be glad to hear your thoughts about them.

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Best Robo-Advisors

- More articles about Investing

- Interview of Felix Niederer, CEO of True Wealth Robo-Advisor

- Investart Review 2024 – Pros and Cons

- Swiss Robo-Advisors 2024: Invest without any hassle

Flow bank now has commission free trades on stocks on the SWiss exchange for both the classic and platinum accounts.

Hi Ian,

Thanks for letting me know, I will update this article once I get a chance.

Any new comments about Flowbank? I am opening an account but I hear a lot of negatives.

I have not got any information about them. They are very affordable, but I have heard of a few experiences that the services feel cheap as well…

I opened an account at Flowbank like 1.5 months ago.

Took like 2 weeks, and then I couldn’t login.

Lots of technical issues back and forth until they fixed it.

Even now certain functions of the App don’t work properly.

I start to loose trust in them because these are basic technical issues.

The account and the App should just work flawlessly from the start.

Hi EdMoInvesor,

Thanks a lot for sharing.

I agree indeed that having many technical issues even for simple features is worrying!

Hello and thank you for the great review!

A few questions:

1) Does Swissquote also use an omnibus account, like FlowBank?

2) In theory (and practice) are securities (stocks, bonds, etc.) equally as safe being at a broker like FlowBank or Swissquote, vs. in a private banking account at banks like UBS, CS, JB?

3) Do you think execution quality (price mostly) is the same at these brokers vs. big banks like UBS, CS?

4) Could you make a list or post about top brokerages that do not book your account in Switzerland or USA? More international options, for diversification purposes.

5) Is there anything you believe a swiss broker is better than IB at?

6) Did you open an IB account in the USA or the european entity?

Thank you!

Hi,

1) It’s not entirely clear from their website, but I believe so. I will ask them to get further info.

2) In theory, yes. If they do what they claim and the custodian bank does what they are supposed to do, the security is the same. But there are more counterparties and you have to trust all the parts of the chain.

3) Yes, I think so.

4) Not really in my plans no. If I find a good broker option, I will consider it, but currently, there is nothing on my list.

5) No, but people have more trust in them. I personally trust IB and Swissquote equally and IB is cheaper, so I go with IB. Swiss brokers are more tightly regulated though.

6) You don’t have a choice, you have to use the UK entity. The US entity is not open to Swiss investors.

I chatted with FlowBank again today and they confirmed that FlowBank is the custodian of the assets, not Credit Suisse. Securities would ONLY be transferred to Credit Suisse in the event of FlowBank bankruptcy, as I was told. Does this sound right? Does FlowBank even have authorization or capacity to custody securities?

Any other comments regarding the experience with this bank? I am considering it vs. Swissquote, but all the negative reviews are starting to worry me.

Hi,

This sounds possible, they are a licensed bank I believe. So they can hold securities. I would personally prefer having it in the hands of a more established bank, but both CS and FlowBank are regulated in the same way by the FINMA.

I would personally go with Swissquote for the established part, but it’s true that the fees of Flowbank are quite interesting.

Please be careful with this financial organisation!!!

They can suddenly at any time close your account administratively by management decision – without any explanation of the reason!

Do not trust them, try to avoid and chose other more reliable companies!

Arrogant service…

Most organizations have the right to close any account very quickly.

Was it your experience? Why did they close your account?

Thank you for the review and overall website. It is really helpful.

I just joined FlowBank. I will leave PostFinance due its very high fees.

I was quite exited with it in the begining but now I feel very disapointed.

One of my objectives was to sell options on stocks I own and eventually invest in stock options. The functionality is there but it is a bit problematic.

Not all tickers have options available, and the ones that have they only make few expiration dates available. This completely breaks any strategy as, if you decide to roll a position out, you will have no clue what which exiration dates they would be offered. In the end it is my fault that I didn’t pay enough attention when checking the demo.

For stocks only I believe it is fine so far, but I don’t like that they make market orders default instead of limit orders. Most of the time there will be no problems, even benefits, but when it goes wrong it can be really bad.

In the end, I will keep the account for at least a year (so, I can use their 500CHF gift in stocks) and then move my positions to interactive brokers.

Of course, if this issue is fixed I would keep at least my Swiss stocks with them. I’ve sent an email explaning the issue and asking if it is a bug or by design. Depending on their answer my final decision will be made.

Hi,

Thanks for sharing your experience, this is very interesting. It’s indeed disappointing that they don’t seem to offer proper options support.

Let us know once you get an answer regarding the options!

Good luck with your investing :)

Quick update on their answer:

For some stocks they (Flowbank) don’t have this instrument.

About some missing the expiration dates for the options, I was informed that I could request them and they would add them there when I needed.

After this I decided to stop engaging. It seems the people designing the options chain (or board like they call it) have never traded options. :)

That’s really weird indeed. I understand if they don’t have all the instruments. But having to request dates in advance for options does not make sense…

I would indeed avoid trading options with them!

I will mention this in the article, thanks for sharing!

One comment regarding security:

I was chatting with FlowBank customer services (very efficient at providing quick answers) and asked about the segregation of assets. I was told that there is segregation and that Credit Suisse is the bank holding the assets.

Hi,

Thanks for letting me know! I have updated the article with more info :)

Dear Mr. The Poor Swiss,

Many thanks for the excellent and insightful review. I think that Flowbank’s concept, platform and customer support are really top-notch. However, as you mentioned, Flowbank was launched recently (only a year ago). Given that the majority of startups fail within 5 years, is this something to worry about for the long-term investor who invests a significant amount of his savings in stocks, funds, etc. at Flowbank? Or is the regulatory (i.e. FINMA) oversight in Switzerland so robust and thorough that there is minimal risk of losing access to one’s investments even in the case of a bankruptcy (for whatever reason) of Flowbank? I found out that the investor doesn’t own the stocks/funds directly but rather an omnibus account is used. In theory, the investor would be able to transfer his/her investments to another broker in the case of the broker’s bankruptcy, but I am curious as to how well that would work in reality from a risk perspective (perhaps you know of a good example in the past?), or if there is a real possibility in some situations that assets could be lost.

Very best,

SwissInvestor001

Hi,

I would think indeed that regulations in Switzerland are strong enough to help in that case. However, I agree that Flowbank’s youth is playing against them. I would personally not invest everything with them. But if it was only a part of my investments, I would be okay with that.

In general, if Flowbank follows the regulations, the risk should be minimal to lose your securities. However, this may take a while. I do not know any example in the past, so I do not know how does the process works. But in theory, you should be able to find a new broker to handle these accounts. But then, of course, they need access to these omnibus accounts (or ideally custody accounts).

I am also curious on how that would work. I would not be surprised if investors lost access to their shares for more than a year, which could be highly detrimental to many people. If a broker is a scam, then there is a big risk of losing the shares, because you may not have them in the first place. I am not saying that could happen with FlowBank, but a more established broker is in general a little safer.

Thanks for the extensive review. I have opened an account with Flowbank recently and the customer service is responsive. However, their commissions on LSE (London Stock Exchange) are rather expensive that puts the likes of VWRA, IGLA out of reach if I want top invest in USD. There are no equivalents on SIX or EU exchanges in USD.

I may settle for the Vanguard Lifestrategry Funds on Xetra (V80A) in Euro as it is. good all in one option. However, there is no data at all on Flowbank for Xetra and you need to buy a real time data feed for EUR 20 a month. This is strange as all other stock exchanges around the world have at least delayed data, snapshot and ask/bid spreads available on Flowbank.

It is a solid start and certainly cheaper than Swissquote but I sincerely hope they iron out these strange issues that stick out at the moment.

Hi Michael,

Can you invest in U.S. ETFs on the U.S. stock exchange instead?

It’s indeed weird that they do not have XETRA data. Did you contact them about that? They should have delayed data for each exchange normally.

Just to let know everybody the fees are really expensiv if you compare to Degiro or ITBK,I really want to use,a swis trading app ,but I cant lose money on it .

Flow bank should work with a tax returning strategie,so maybe could be intresting to do so .

Yes, they are more expensive when compared to IB but they are now at a good level compared to other Swiss brokers. It’s always a tradeoff :)