FlowBank Review 2024 – Pros and Cons

| Updated: |(Disclosure: Some of the links below may be affiliate links)

FlowBank is a new Swiss digital finance service that was launched publicly in late 2020. It plans to be both a bank and a fully-fledged broker, so you can have your money and stocks in the same place.

FlowBank is an innovative digital bank platform that would bring cheaper trading to Switzerland. On paper, it sounds exciting. Currently, the investing features are ready, while the banking features are not yet all ready.

So, we will see how good it is in this in-depth review.

| Custody Fees | 0.10% per year |

|---|---|

| Inactivity Fees | 0 CHF |

| Buy Swiss ETF | Free |

| Buy American Stock | 0.15%, minimum 6.50 USD |

| Currency Exchange Fee | 0.50% |

| Languages | English, French, and German |

| Mobile Application | Yes |

| Web Application | Yes |

| Custodian Bank | Credit Suisse |

| Established | 2020 |

| Headquarters | Genève |

FlowBank

FlowBank was started in 2020 by Charles-Henri Sabet. They officially started their public service in November 2020.

FlowBank is an officially licensed bank from Switzerland. This license is excellent since it means we get Swiss banking protection. And it is interesting to note that they are the first bank to be licensed since 2009. They already employ 90 people in Geneva.

In 2021, Coinshares (a sizeable digital asset management company) acquired a 9% stake in FlowBank. And then again, in 2022, they acquired a second 20% stake in the company. This investment gave a significant boost to FlowBank’s continued growth.

FlowBank is trying to make online banking and trading simpler and more accessible. They are offering a multi-currency bank account and a broker account.

Their vision is to be seriously simple, seriously banking, and seriously Swiss. I am not sure exactly what it means, but it is interesting.

FlowBank offers customer service 24 hours a day and five days a week. It is worth noting that this customer service is based in Switzerland. I have contacted their support several times to get information, and they have been very responsive.

Banking with FlowBank

At this time, the information about banking with them is not yet complete.

Indeed, the offer itself is not yet ready. Here is what we can find about the banking features. You can hold several currencies and pay online with a virtual card. However, the banking fees are very unclear. My interpretation of the fees is such:

- Transferring money to your account is free

- Transferring money out of the account is not free

- Transferring CHF or EUR in Switzerland or Lichtenstein costs 2 CHF

- Transferring CHF outside of Switzerland costs at least 10 CHF

- Transferring EUR outside of Switzerland costs at least 10 CHF

These are costly fees for a bank. If you cannot get money from the account for free, it is not an acceptable bank account. These fees make it only valid as a trading account since you do not want to get money out of it very often.

Currently, they have no physical card. But one physical card is planned for later. The website has no details on the fees for the physical card when it comes. So we will have to wait and see for that part.

I have talked to the FlowBank team about that, and they told me that they want to focus on their trading system currently. This is why the banking information on the website is not complete, nor is the pricing. So, we should expect prices for the banking features to change.

However, the website contains a lot of information about their trading system. So, I will primarily focus on this aspect in this review.

Trading with FlowBank

As mentioned before, FlowBank offers many trading features. They have two different products:

- FlowBank App

- FlowBank Pro

FlowBank App is for simple investors and beginner investors. It is only available on mobile. You can get an idea of the FlowBank app from their video.

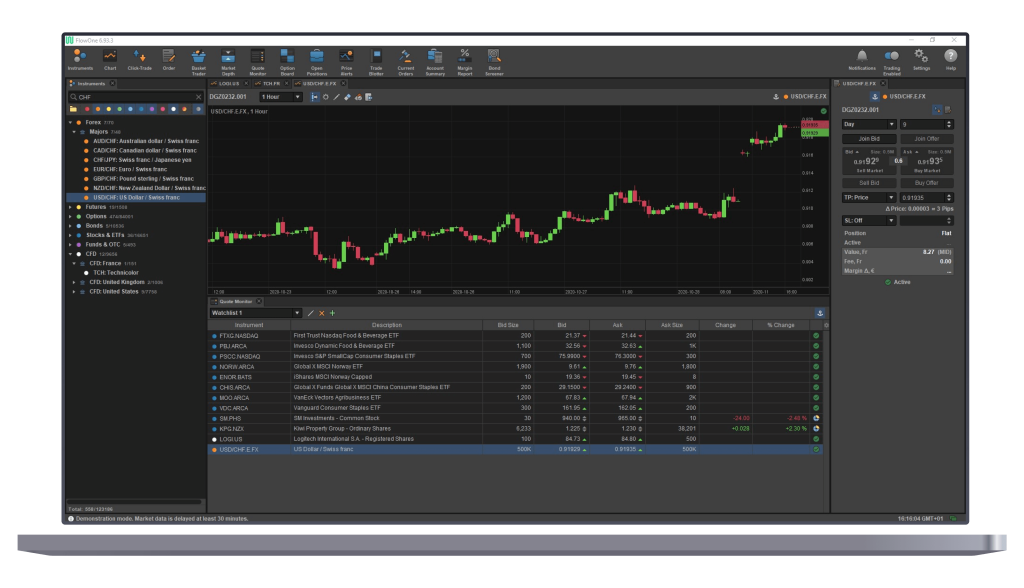

Flow BankPro focuses on expert investors. FlowBank Pro is available in many flavors:

- Desktop application for Windows, Mac, and Linux

- Mobile application for Android and iOS

- Web application

It is excellent that we can trade from so many platforms with a single application.

You can trade in many instruments:

- Stocks, bonds, and Exchange Traded Funds (ETFs)

- Options and futures

- Forex

- Commodities

- Contracts for Differences (CFDs)

That is a lot of instruments, but good passive investors will ignore everything that is not Stocks, Bonds, or ETFs. I would especially advise against using CFDs.

Also, it is essential to remember that some features are very limited. For instance, you can trade options, but not of every stock. And you are limited in the options dates.

You can buy and sell shares with the standard market, limit, and loss orders for the basic instruments. These orders are all we need to trade!

One interesting feature is the ability to trade in fractional shares. Most Swiss brokers do not allow this, which could be interesting if you want to buy shares of costly stocks. However, this is not common for ETFs.

The application has many advanced features:

- Price alerts

- Advanced Reporting

- Screeners for bonds

- Margin monitors

Overall, FlowBank has more than enough features for trading. They have apps for both simple investors and active investors. It is great that they are trying to be easy to use for beginners.

FlowBank Fees

For passive investors, investing fees are very important. Therefore, we need to look at their fees.

There is no account management fee. However, there is a yearly custody fee of 0.10%. This fee is paid each quarter (0.025% per quarter). The minimum is 10 CHF per quarter (40 CHF minimum per year), and the maximum is 50 CHF per quarter (200 CHF maximum per year).

While 0.10% may seem like a lot, 40 CHF per year is not unreasonable for small portfolios. And with a maximum of 200 CHF per year, it will also be very little for large portfolios. This is a reasonable custody fee compared to some Swiss brokers. Therefore, I do not believe this custody fee will be an issue for most users.

Note that the custody fee will not apply to your banking assets, only to your trading assets (once they start their bank services).

They have two account types:

- Classic, the default account

- Platinum, once you reach 100’000 CHF in your account

The fees for stocks and ETFs are the same. These fees are different for each stock exchange and account type; for instance:

- SIX (Switzerland): Free!

- Euronext (Europe)

- Classic: 0.15% with a minimum of 6.50 EUR

- Platinum: 0.10% with a minimum of 6.50 EUR

- NYSE (USA)

- Classic: 0.15% with a minimum of 6.50 USD

- Platinum: 0.10% with a minimum of 6.50 USD

The great thing here is that the minimums are low! These minimums mean you can trade in many ETFs with less than 7 CHF! If you reach the platinum level, the base price will be low.

On the other hand, there is no maximum. But even if you buy 20’000 CHF worth of shares, you will only pay 20 CHF with the platinum account. This is very low compared to other Swiss brokers.

FlowBank supports many more stock exchanges with similar prices. You can read more on their pricing page.

The commission will be 0.20% for bonds with a minimum of 50 CHF. It is not great. But most investors do not buy bonds directly anyway. Instead, they use bond ETFs, which are cheaper.

I will not detail other instruments since I do not recommend you use them anyway. But we are also interested in Forex conversions.

Forex is also relatively expensive, with a 0.5% conversion fee. If you want to buy an ETF in USD, you will have to pay 0.5% for the conversion and then the commission fee on top of this fee. For a Swiss broker, this is relatively cheap.

Overall, these fees are great. For small operations, the small minimums make them very cheap. And large transactions should be OK with small percentages as well. And having free transactions on the Swiss stock exchanges is excellent as well!

Security

We can take a look at FlowBank’s security.

First, FlowBank is a licensed bank from FINMA and is a member of esisuisse (the Swiss deposit protection scheme). So, in case of bankruptcy, your cash is safe for up to 100’000 CHF.

Your stocks and investments are segregated from FlowBank’s primary entity. Every broker does this segregation. And FlowBank support confirmed that all assets are segregated, and they use Credit Suisse as a custodian bank.

FlowBank’s applications seem technically secure. Creating an account requires uploading some official documents to verify your identity.

I have not found any information about data leaks or security breaches with FlowBank. But given that they are new, this does not weigh much in the balance.

Overall, FlowBank’s security seems good. However, I wish they would discuss it more on the website.

Alternatives

In the future, Flowbank will be both a bank and a broker. For now, we do not know enough about bank accounts, so we will focus on brokerage services. We can quickly compare FlowBank with some alternative brokers.

FlowBank vs Swissquote

Everything you need to start investing in the stock market! Open an account with Swissquote and get 100 CHF in trading credits with my code MKT_THEPOORSWISS.

- Swiss broker

- Easy to use

If we compare it against a Swiss broker like Swissquote, FlowBank is interesting in terms of fees. For both trading fees and currency conversion fees, FlowBank is significantly cheaper than Swissquote. They have the same custody fees.

For large operations, both brokers charge the same fees. But FlowBank can be significantly cheaper for small operations.

Both brokers have the same features, which is enough for passive investors.

The advantage of Swissquote is that they are well-established and have a good reputation. So, you must choose between the price and the trust of a well-known company.

If you want more information, you can read my review of Swissquote.

FlowBank vs Interactive Brokers

The broker you need to buy stocks and ETFs reliably and at extremely affordable prices. Trade U.S. stocks for as little as 0.5 USD!

- Extremely affordable

- Wide range of investing instruments

But if you want the cheapest broker, you could use a foreign broker. For instance, I am using Interactive Brokers. The fees of Interactive Brokers are significantly lower than those of FlowBank, especially for US markets and currency exchanges.

The only disadvantage of Interactive Brokers is that they are not Swiss brokers. But for many people, this does not matter.

If you want more info, read my Interactive Brokers review.

FlowBank FAQ

What is the minimum deposit for FlowBank?

There is no minimum deposit at FlowBank!

Does FlowBank have custody fees?

There is a yearly custody fee of 0.10%. This fee is paid quarterly, with a minimum of 10 CHF and a maximum of 50 CHF.

Does FlowBank have inactivity fees?

No, FlowBank does not have any inactivity fee.

What is FlowBank good for?

FlowBank is good as a broker, with cheap fees, especially for Swiss securities.

What is FlowBank not good for?

FlowBank is not good as a bank since it is still missing many banking features that it may have in the future. FlowBank is also pretty new, so it is not a great option if you want a well-established broker.

FlowBank Summary

FlowBank is a Swiss bank that wants to make trading and banking simpler for everybody, at a low-cost.

Product Brand: FlowBank

4

FlowBank Pros

Let's summarize the main advantages of FlowBank:

- Free transactions on the Swiss stock exchange

- Very cheap transactions costs

- Relatively cheap currency conversion fees

- They are a licensed bank, so your money is secured for up to 100'000 CHF

- Reasonable custody fees for all portfolios

- Allow trading in fractional shares

- Simple to get started with

- Can trade on many platforms

- They have a demo account to test the system

- Very responsive customer support

FlowBank Cons

Let's summarize the main disadvantages of FlowBank:

- They are very new to the market

- We currently do not know anything about their bank offering

Conclusion

It is good to see new digital banks and products aiming to make the Swiss market cheaper. And I believe it is also good to try to make investing more straightforward for people. Most Swiss people are not investing, but they could profit from a simple investing app.

FlowBank is interesting as a broker account. They have simple trading applications that should simplify investors’ lives. They also have very low minimums that should allow starting trading without too high fees. You can even invest in Swiss stocks and ETFs without fees! On top of that, they have very reasonable custody fees.

I have not yet compared FlowBank to all other Swiss brokers, but I will soon. It seems to me that FlowBank is a very serious contender against these other Swiss brokers. It would be good to have some movement in this field.

If you want to start investing with a Swiss broker, FlowBank may be an interesting choice. If you need more options, you can look at my articles about the best Swiss Brokers. I will soon update it to include FlowBank.

In the future, FlowBank will offer banking features in addition to its investing features, but it currently only provides investing features. Once it does, I will review it again for its banking features and compare it with other banks.

If you do not mind using a foreign broker, I would still recommend using Interactive Brokers, as I do.

If you have tried FlowBank, I would be glad to hear your thoughts about them.

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Best Robo-Advisors

- More articles about Investing

- Selma vs True Wealth 2024 – Best Swiss Robo Advisor?

- Interview of Richard Toolen – CEO of Investart

- Findependent Review 2024 – Pros & Cons

Great review as usual, thank you TPS.

I’ve seen that they currently have a promotion where they gift 500 chf worth shares for opening an account with at least 2000 chf. Anybody experienced with it?

Hello,

do you know if you can trade USA ETFs with flowbank?

If not, it is still far away to be compared with IBKR

Hi Nick,

I do not know that, I have asked them that a few weeks ago and did not get an answer, I will ping them again.

I do not think FlowBank should be compared to IB. It should be compared to other Swiss brokers and they are starting to look good in that regard.

Hi Nick,

I use Flowbank extensively and yes you can. You can also ask their support team to add any instruments you like.

Big fan of Flowbank!

Thanks for the confirmation Alfonso :)

With the maximum, they now look quite good!

Hi, thanks for the detailed review!

I actually came across FlowBank on Instagram and found it interesting since I just started using IBKR and wondering why there’s no Swiss Robinhood here. The only con that I think is a bit worrying here is the custody fee, but actually according to their website, they updated it the maximum to be 50 per quarter. I think that’s pretty reasonable?

Hi J,

Thanks for pointing out that change. They seem to have changed the minimum into a maximum. I will have to update this article, but this makes FlowBank very interesting!

Yes, for large portfolios this would make it significantly better. And actually, for small portfolios, having no minimum seems to be great!

The minimum is 10chf per quarter

Yes, this is what is indicated in my article.

Hi there,

Very good review! I have heard about this bank some months ago and was doing some due-diligence as it seems to be really brand new.

For me it looks very interesting to diversify a bit of the portfolio, they even have a promotion right now for buying some Swiss stocks commission-free.

Do you by any chance know any details about transfers? Do they work like IB that only allows withdrawals to own bank accounts, or it’s possible to use it like a normal bank account and pay services and send transfers to third parties?

Thanks!

HI Mazzeti,

For transfers, I believe you can do both (not entirely sure) since they also provide accounts, you could move the money directly from your account into the broker.

They are interesting, but for me, they have to add a cap on the custody fees. If they do not do that, I would not recommend this service.

Thanks for the review. I would not compare any bank to IB, simply because IB is not a bank. It is a US broker with US laws in place.

Unlike Zak and Neon, Flowbank is not restricted to CH residents, same like SwissQuote. I agree that no maximum on custody fees make it less attractive than SQ for higher than CHF/EUR 200.000 portfolios.

Hi Seb,

I would not compare Neon with IB, but Flowbank is not only a bank it’s mainly a broker. So it makes sense to compare the brokerage capacity of FlowBank with IB. IB is currently the best broker for Swiss investors.

It’s good to know that it’s not restricted to CH residents.

Thanks for stopping by!

Btw. I’ve just noticed you can play with the platform online without even creating an account (in a limited way, ofc): https://exante.eu/trade/

Hi there,

Thanks for the review, that’s very helpful.

If I see correctly, they use ExAnte as a service provider (https://exante.eu/). The platform seems familiar :).

It’s a broker with very low fees if you’re not afraid of storing your capital outside of the Switzerland.

Hi,

I actually did not know this platform. It looks interesting at first sight.

Have you ever used them?

Only the demo version, but it looks very solid and simple in use. Quite similar to the one offered by Saxo.

I don’t have an account with ExAnte, but a friend of mine strongly recommends them.

Thanks for sharing this, I will check them out in the future.

Thank you Mr. Poor Swiss :)

I could not continue reading the article, because I saw similar service before offered by “Dukascopy”. I opened an account with them (because it was the easiest once I arrived to Switzerland), but never used it due to their (similar) expensive fees.

Thank you!

I was waiting for a review about this new challenger, although I’ve already made my opinion about them.

As you said, the fact that there is no maximum fee for the custody is clearly a shame from them. They are going to be really expensive once you have more thant 200’000 CHF invested with them compared to Swissquote.

For the transaction fee, at least their fee (0.10%) is a all-in-fee (broker fee + stamp duty) but they are interesting only if you can invest at least the minimum fee, so at least 20’000 CHF.

Thanks for your review !

Hi,

Thanks for sharing your opinion on the matter!

I agree that they should review their minimums and maximums if they want to be interesting. Currently, I do not see any edge they would have compared to the alternatives.

Thanks for stopping by!

Thanks for the review! What do you think about reviewing the Trading212 broker. It is somewhat similar to Degiro and has been picking up assets under management.

Hi,

Here are my thoughts on Trading 212, the last time I checked:

I never did any research about them. They look interesting. It seems the fees are good but the spread could be tighter.

It also seems that you can only use the mobile app. For me, this is definitely a blocker. And I do not like their focus on cryptocurrencies.

It also seems like they do not give you access to the Swiss stock exchange and that you cannot wire CHF for free on your account.

Reviews look positive and it looks legit. But it’s a bit young and too shiny for me.

For me, they do not look interesting enough from a Swiss perspective to make a review. But I may be wrong.

Thanks for stopping by!

I have started using them recently mostly as a diversification option, I also have an IB account. I wanted to test out some broker without inactivity fee, which I can hopefully recommend to friends and family. Some things may have changed since you last considered them:

* I only use the Desktop app, I also do not like mobile apps.

* You may be right about crypto, still I did not consider it, bought some ETFs from them, the trade got executed on German stock exchange.

* They are zero fee, however the way they make money is that they execute your order on worse rate than IB would. I am not super sure about this, but tried to compare rates real time and theirs was always worse. Still this can be acceptable for investor with small amounts for who no inactivity fee would be a big plus.

* Their UI is somewhat simplistic, some say it is not professional enough, but I think it is fine for DIY investors.

* They use IB as backend, they do not have own access to stock exchanges.

* The good thing about them is that they are still offering the UK fund protection schema up to 85K pounds.

Anyways I get that you may not be interested, if they are not relative to Swiss audience. Still wanted to check out with you. Regards! :)

Hi Yordan,

Thanks a lot for sharing :)

Indeed, it seems my research is quite outdated. It seems better than I thought.

But I’d rather not recommend a broker without Swiss Stock Exchange access, for Swiss investors.

Thanks for stopping by!

I’d love a review on Trading 212! Not only for Swiss Investors but for any investor in Europe

I’ll put this on my list then :)

But I have no idea when I will do it, so no promises!